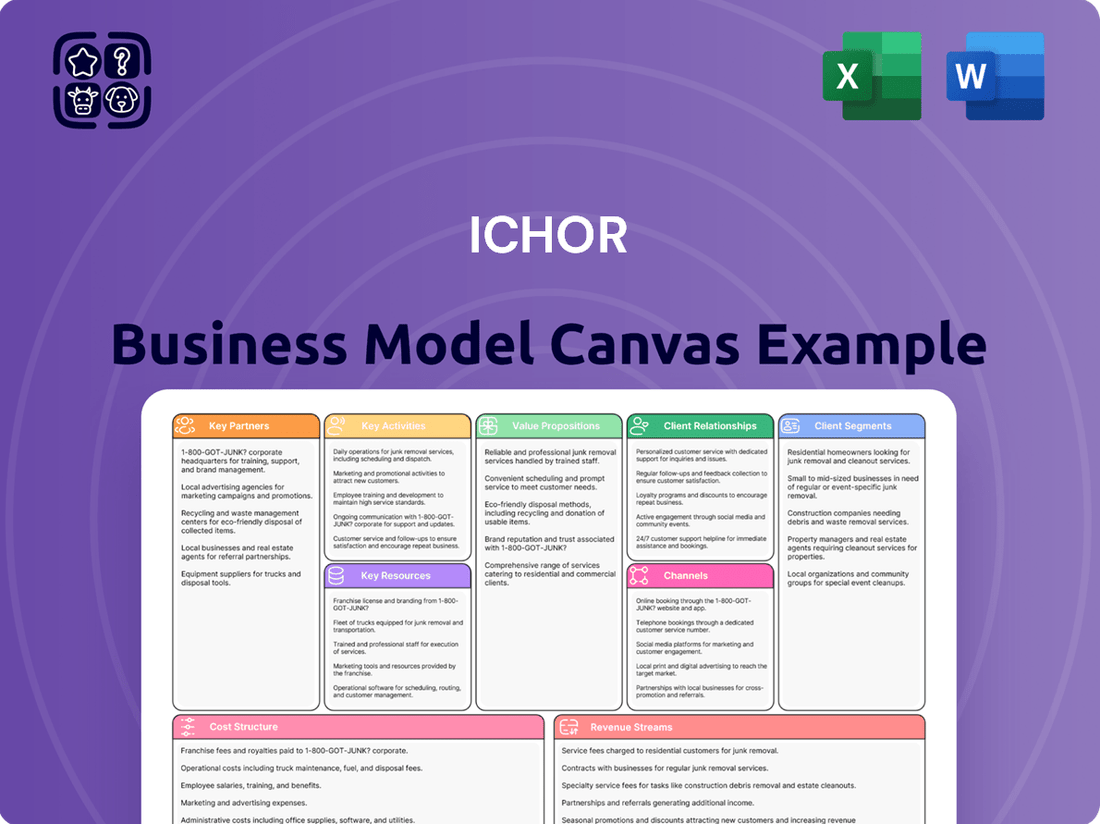

Ichor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ichor Bundle

Curious about how Ichor achieves its market dominance? This comprehensive Business Model Canvas unpacks the core elements, from customer relationships to revenue streams, providing a clear roadmap to their success. It's an invaluable tool for anyone looking to understand and replicate strategic brilliance.

Unlock the complete strategic blueprint behind Ichor's innovative approach. This in-depth Business Model Canvas reveals precisely how the company crafts its value proposition, identifies key partners, and manages its cost structure for sustained growth. Gain actionable insights that can fuel your own ventures.

See exactly how Ichor translates its vision into tangible results. Our full Business Model Canvas offers a detailed, section-by-section breakdown of their operational framework, revenue generation, and customer engagement strategies. It's the ultimate resource for strategic analysis and planning.

Ready to dissect Ichor's winning formula? Download the full Business Model Canvas to access all nine essential building blocks, enriched with company-specific details and strategic implications. This is your opportunity to learn from a market leader and accelerate your own business development.

Partnerships

Ichor cultivates robust, enduring partnerships with leading semiconductor capital equipment manufacturers (OEMs), a critical element of its business model. In 2024, companies like Lam Research, Applied Materials, and ASML represented Ichor's largest customer base, highlighting the depth of these relationships.

These strategic alliances are foundational for co-development efforts, ensuring Ichor's fluid delivery systems are seamlessly integrated into the cutting-edge manufacturing equipment of its partners. This tight collaboration is essential for staying at the forefront of technological advancements.

Through these deep collaborations, Ichor gains invaluable early access to future technology roadmaps and evolving customer requirements. This foresight allows Ichor to proactively develop solutions that meet the demands of next-generation semiconductor fabrication processes.

Ichor strategically partners with a robust network of raw material and component suppliers, ensuring a consistent flow of high-quality inputs crucial for its advanced manufacturing. These partnerships are vital for securing specialized metals, polymers, and ceramics, which are foundational to the precision components and subsystems Ichor develops for the semiconductor industry.

The company’s commitment to supply chain resilience is underscored by its diversification of suppliers, mitigating risks associated with single-source dependencies. This approach allows Ichor to maintain stringent quality control throughout its production processes, directly impacting the reliability and performance of its end products.

Strong, long-standing relationships with these suppliers are instrumental in negotiating favorable pricing and guaranteeing the steady availability of essential materials. For instance, in 2024, Ichor continued to solidify its ties with key global suppliers, aiming to lock in competitive material costs amidst evolving market dynamics.

Ichor, a leader in fluid delivery and process-enabling solutions, actively cultivates key partnerships with research institutions, universities, and fellow technology companies. These collaborations are the engine driving innovation, enabling the rapid development of novel materials and advanced manufacturing processes.

These strategic alliances are crucial for Ichor to maintain its competitive edge in the fast-evolving semiconductor industry. By pooling resources and expertise, they accelerate the creation of new intellectual property and enhance Ichor's product portfolio, ensuring they remain at the forefront of technological advancement.

For example, Ichor's commitment to R&D is evident in its ongoing engagement with leading academic centers. These partnerships allow for early access to cutting-edge research, often translating into significant improvements in the performance and efficiency of their fluid handling systems, critical for advanced semiconductor fabrication.

Logistics and Distribution Partners

Ichor's ability to serve its global clientele in the semiconductor sector hinges on strong relationships with logistics and distribution partners. These collaborations are vital for ensuring that complex subsystems and components reach manufacturing sites across the U.S., Singapore, and Europe without delay or damage.

Specialized freight forwarders and warehousing providers are crucial. For instance, in 2024, the semiconductor industry continued to face supply chain complexities, making reliable logistics paramount. Ichor leverages these partnerships to navigate international shipping regulations and maintain product integrity throughout transit.

- Global Reach: Partners facilitate delivery to key semiconductor manufacturing hubs worldwide.

- Supply Chain Resilience: Essential for mitigating disruptions and ensuring on-time delivery of critical components.

- Specialized Handling: Expertise in transporting sensitive and high-value semiconductor equipment is a core requirement.

- Cost Efficiency: Strategic partnerships help optimize shipping routes and warehousing to manage costs effectively in a competitive market.

Channel Partners for Niche Markets

Ichor primarily engages directly with large Original Equipment Manufacturers (OEMs). However, to tap into specialized, high-tech sectors beyond its core semiconductor and display focus, Ichor can forge alliances with niche distributors or system integrators. These collaborations are crucial for extending market penetration and catering to clients with distinct fluid delivery requirements in areas such as defense, aerospace, and medical technology.

These channel partners act as conduits to markets that Ichor might not efficiently reach through direct sales. For instance, a system integrator specializing in medical device manufacturing could introduce Ichor's advanced fluid handling solutions to a segment of the healthcare industry with unique regulatory and performance demands. Such partnerships can unlock new revenue streams and diversify Ichor's customer base.

Consider the potential in the defense sector, where specialized fluid delivery systems are vital for applications like advanced cooling in avionics or precise fuel management. By partnering with a defense-focused integrator, Ichor can gain access to these high-value opportunities. In 2024, the global defense market was valued at approximately $2.2 trillion, with advanced technology integration being a key growth driver.

- Niche Market Access: Partnerships enable Ichor to access specialized sectors like defense and medical, which have unique fluid delivery needs.

- Expanded Reach: System integrators and specialized distributors can extend Ichor's market presence beyond its core OEM relationships.

- Revenue Diversification: Tapping into new high-tech industries can create additional revenue streams and reduce reliance on traditional markets.

- Strategic Growth: These alliances support Ichor's strategic objective of broadening its application base and leveraging its core fluid delivery expertise in new domains.

Ichor's key partnerships are vital for innovation and market reach. Collaborations with semiconductor capital equipment manufacturers like Lam Research, Applied Materials, and ASML were central in 2024, driving co-development of integrated fluid delivery systems. These alliances ensure Ichor's solutions meet the evolving demands of cutting-edge semiconductor fabrication, granting early access to future technology roadmaps.

Furthermore, strategic ties with raw material and component suppliers guarantee a steady supply of high-quality inputs, essential for Ichor's precision manufacturing. Diversifying these partnerships in 2024 enhanced supply chain resilience and maintained competitive material costs. Partnerships with research institutions and universities accelerate the development of novel materials and advanced manufacturing processes, solidifying Ichor's technological lead.

To expand into specialized sectors like defense and medical technology, Ichor leverages niche distributors and system integrators. These partnerships, crucial for accessing markets with unique fluid delivery needs, offer new revenue streams and broaden Ichor's application base. In 2024, the global defense market alone was valued at approximately $2.2 trillion, highlighting the growth potential in these diversified areas.

| Partner Type | Strategic Importance | 2024 Focus/Example |

| Semiconductor OEMs | Co-development, integration, technology access | Lam Research, Applied Materials, ASML – ensuring seamless fluid delivery systems in advanced equipment |

| Material & Component Suppliers | Supply chain resilience, quality, cost management | Securing specialized metals, polymers, ceramics; negotiating competitive material costs |

| Research Institutions/Universities | Innovation, new materials, process development | Early access to cutting-edge research for fluid handling system improvements |

| Niche Distributors/System Integrators | Market expansion, new sector access (defense, medical) | Accessing specialized fluid delivery needs in high-tech industries beyond core markets |

What is included in the product

A structured framework detailing Ichor's strategic approach, encompassing customer segments, value propositions, and revenue streams.

This canvas provides a clear, visual representation of Ichor's operational blueprint and competitive positioning.

The Ichor Business Model Canvas provides a structured framework to pinpoint and address the core pain points hindering business growth.

It serves as a powerful tool to clarify and resolve complex business challenges by visualizing key relationships and dependencies.

Activities

Ichor Systems' core activity is the specialized design and engineering of gas and chemical delivery subsystems, critical components in semiconductor manufacturing equipment. This involves creating highly precise control mechanisms for gases and intricate blending and dispensing systems for reactive liquid chemistries used in chip fabrication.

Continuous innovation in these designs is paramount to keep pace with the rapidly evolving demands of advanced semiconductor manufacturing processes. For instance, the push towards smaller nodes and new materials requires increasingly sophisticated delivery systems capable of handling ultra-high purity gases and novel chemical formulations with exceptional accuracy.

In 2024, Ichor's focus on these sophisticated subsystems is directly tied to the semiconductor industry's capital expenditure trends. Major chipmakers continue to invest heavily in new fabrication plants and upgrades, driving demand for the advanced delivery solutions Ichor provides. This specialized engineering expertise is a key differentiator.

Ichor's core activities center on the precision manufacturing of critical components, intricate weldments, and the final assembly of sophisticated fluid delivery subsystems. This hands-on work demands cutting-edge machining, welding, and specialized fabrication methods to meet the exacting standards for semiconductor capital equipment.

The company's commitment to quality is unwavering, as evidenced by its adherence to stringent industry certifications. For instance, in 2023, Ichor reported that its manufacturing facilities maintained an impressive on-time delivery rate exceeding 95%, a testament to their operational efficiency and focus on precision.

These capabilities are essential for building the highly reliable fluid handling systems that are the backbone of semiconductor manufacturing processes. The complexity and accuracy required mean that Ichor invests significantly in skilled labor and advanced manufacturing technologies.

Ichor's Research and Development (R&D) is crucial for creating novel fluid delivery systems and enhancing current offerings, pushing technological boundaries in semiconductor manufacturing. This commitment to innovation includes developing unique products and processes, such as qualifying new components for gas panels, all aimed at boosting performance, efficiency, and cost savings.

In 2024, Ichor continued its focus on R&D, investing significantly to stay ahead in the rapidly evolving semiconductor landscape. This investment fuels the development of next-generation fluid and gas delivery components designed to meet the increasingly stringent requirements of advanced chip fabrication processes.

The company's R&D efforts are directly linked to its ability to secure new business and expand its market share. By consistently delivering advanced solutions, Ichor positions itself as a key partner for semiconductor manufacturers seeking to improve yields and reduce operational costs.

Supply Chain Management and Optimization

Ichor's supply chain management is a core function, involving meticulous sourcing, procurement, and logistics across its global operations. This is crucial for maintaining efficient production and meeting customer needs.

A key activity is the integration of internal component supply into their high-volume manufacturing. This strategy directly impacts gross margins by controlling costs and ensuring a steady flow of necessary materials.

The company's focus on optimization aims to reduce operational expenses and improve its ability to react quickly to shifts in customer demand. This agility is vital in the fast-paced industries Ichor serves.

- Sourcing & Procurement: Securing essential components and raw materials efficiently.

- Inventory Management: Balancing stock levels to avoid shortages while minimizing holding costs.

- Logistics & Distribution: Ensuring timely and cost-effective movement of goods globally.

- Internal Component Integration: Leveraging in-house production capabilities for critical parts to control supply and cost.

Quality Control and Testing

Ichor's quality control and testing are paramount for its fluid delivery systems in the demanding semiconductor industry. This involves meticulous checks at every stage, from incoming materials to the final product, ensuring each component meets exacting standards for reliability and precision. For instance, in 2024, Ichor continued its commitment to zero-defect manufacturing, a critical factor given the extremely high cost of failures in semiconductor fabrication. This dedication to quality is a key competitive advantage.

The company implements a multi-faceted testing regimen. This includes functional testing of sub-assemblies, leak testing to prevent contamination, and performance validation under simulated operating conditions. Ichor's investment in advanced testing equipment and methodologies is substantial, reflecting the critical nature of its products. In 2024, Ichor reported that its rigorous testing protocols contributed to a significant reduction in field failures, underscoring the financial benefits of their quality-first approach.

- Raw Material Inspection: Verifying the integrity and composition of all incoming materials to prevent defects early in the production cycle.

- In-Process Testing: Conducting checks on sub-assemblies and critical components during manufacturing to identify and correct deviations promptly.

- Final Product Validation: Rigorous testing of finished fluid delivery systems to ensure they meet all performance, safety, and reliability specifications before shipment.

- Statistical Process Control (SPC): Utilizing data analysis to monitor and control manufacturing processes, aiming for continuous improvement and defect reduction throughout 2024.

Ichor's key activities revolve around the specialized design, engineering, and precision manufacturing of fluid and gas delivery subsystems essential for semiconductor fabrication equipment. This includes creating intricate components and assemblies that handle high-purity gases and reactive chemicals with extreme accuracy. Their focus on innovation is driven by the industry's demand for smaller chip nodes and new materials, requiring increasingly sophisticated delivery systems. In 2024, this specialization directly supported the robust capital expenditure by major chipmakers investing in new fabrication plants, bolstering demand for Ichor's advanced solutions.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic sample but a direct representation of the comprehensive canvas, ready for your strategic input. Upon completing your order, you will gain full access to this same professionally structured and formatted Business Model Canvas, enabling you to immediately begin refining your business strategy.

Resources

Ichor's intellectual property, particularly its patents and proprietary designs for fluid delivery subsystems, forms a cornerstone of its business model. This protected innovation allows Ichor to offer specialized, high-performance solutions that are difficult for competitors to replicate, as evidenced by their consistent product development. For instance, in 2023, Ichor reported a significant portion of its revenue derived from its advanced fluid handling technologies, underscoring the commercial value of its IP portfolio.

Ichor's skilled engineering and technical talent is a core asset, with teams possessing deep expertise in fluid dynamics, materials science, and precision manufacturing. This specialized knowledge is critical for developing and producing their complex fluid delivery solutions for the semiconductor industry and other high-tech sectors.

The company relies on these professionals for the intricate design, development, and manufacturing processes that demand exceptional accuracy and innovation. In 2023, Ichor continued its focus on attracting and retaining this high-caliber workforce, recognizing its direct impact on product quality and technological advancement.

Ichor’s advanced manufacturing facilities are the backbone of its operations, featuring cutting-edge machinery for precision machining, welding, and assembly. These state-of-the-art assets are essential for building the complex fluid delivery systems demanded by the semiconductor industry.

Strategically located in key regions such as the U.S. and Singapore, these global facilities enable Ichor to meet high-volume production needs with exceptional quality. This international presence is crucial for serving a diverse and geographically dispersed customer base effectively.

The company’s commitment to continuous investment in these manufacturing capabilities ensures it stays at the forefront of technological advancements. This ongoing investment directly translates to enhanced production capacity and a sustained competitive edge in technological expertise.

Established Customer Relationships

Ichor's established customer relationships are a cornerstone of its business, representing a significant intangible asset. These long-standing, deep connections with major semiconductor capital equipment original equipment manufacturers (OEMs) are crucial. They cultivate a high degree of trust, enabling more effective collaborative product development cycles. For instance, Ichor reported that its top ten customers represented approximately 77% of its revenue in 2023, highlighting the concentration and importance of these established relationships.

These robust relationships provide Ichor with a stable and predictable customer base. This stability is vital in the cyclical semiconductor industry. The trust built over years of reliable delivery of critical, high-performance solutions underpins these partnerships. These solutions are indispensable for the advanced manufacturing processes undertaken by Ichor's clientele.

- Long-standing partnerships with key semiconductor capital equipment OEMs.

- These relationships foster trust and enable collaborative development.

- They provide a stable revenue base, crucial for the semiconductor industry.

- Ichor's reputation for delivering critical, high-performance solutions strengthens these ties.

Strong Financial Capital

Strong financial capital is the bedrock for Ichor's operations, fueling everything from cutting-edge research and development to the expansion of its manufacturing capabilities. This financial muscle allows Ichor to not only manage its current inventory efficiently but also to sustain its extensive global reach.

In 2024, Ichor's robust financial position, evidenced by its substantial cash reserves and proven access to capital markets, positions it advantageously for strategic growth initiatives. This financial resilience is crucial for navigating the inherent volatility of the semiconductor industry and seizing emerging opportunities.

- R&D Investment: Financial capital directly supports Ichor's commitment to innovation, enabling the development of next-generation semiconductor solutions.

- Manufacturing Infrastructure: Adequate funding is essential for upgrading and expanding Ichor's state-of-the-art manufacturing facilities to meet increasing demand.

- Inventory Management: Financial resources ensure optimal inventory levels, preventing stockouts and minimizing holding costs.

- Global Operations: A strong capital base facilitates the smooth execution of Ichor's worldwide supply chain and customer support networks.

Ichor's intellectual property, particularly its patents and proprietary designs for fluid delivery subsystems, forms a cornerstone of its business model. This protected innovation allows Ichor to offer specialized, high-performance solutions that are difficult for competitors to replicate. For instance, Ichor's revenue from advanced fluid handling technologies in 2023 underscored the commercial value of its IP portfolio.

Ichor's skilled engineering and technical talent is a core asset, with teams possessing deep expertise in fluid dynamics and precision manufacturing. This specialized knowledge is critical for developing and producing their complex fluid delivery solutions for the semiconductor industry. In 2023, Ichor continued its focus on attracting and retaining this high-caliber workforce, recognizing its direct impact on product quality.

Ichor’s advanced manufacturing facilities are the backbone of its operations, featuring cutting-edge machinery for precision machining and assembly. These state-of-the-art assets are essential for building the complex fluid delivery systems demanded by the semiconductor industry. Strategically located in key regions, these global facilities enable Ichor to meet high-volume production needs with exceptional quality.

Ichor's established customer relationships, particularly with major semiconductor capital equipment OEMs, are a significant intangible asset. These long-standing connections foster trust and enable collaborative product development. In 2023, Ichor's top ten customers represented approximately 77% of its revenue, highlighting the concentration and importance of these established relationships.

Strong financial capital fuels Ichor's operations, from R&D to manufacturing expansion. In 2024, Ichor's robust financial position, evidenced by substantial cash reserves, positions it advantageously for strategic growth. This financial resilience is crucial for navigating the semiconductor industry's volatility.

Value Propositions

Ichor provides crucial fluid delivery subsystems that are the backbone of advanced semiconductor manufacturing processes like etch and deposition. These systems ensure the ultra-precise delivery of specialized gases and reactive liquid chemistries, which are fundamental for creating the intricate layers and features on high-performance chips.

By enabling these critical steps, Ichor directly supports the industry's drive towards smaller, faster, and more powerful semiconductor devices. For instance, the demand for advanced logic and memory chips, crucial for AI and 5G, directly fuels the need for Ichor's sophisticated fluid delivery solutions.

In 2024, the semiconductor industry continued its robust growth, driven by increasing demand across various sectors. Ichor’s ability to provide reliable and precise fluid delivery is paramount as chip manufacturers push the boundaries of node technology, requiring even tighter process control.

The company's expertise in handling a wide range of hazardous and high-purity chemicals is a key value proposition, minimizing contamination and ensuring process yields for its clients. This focus on precision and reliability is essential for the multi-billion dollar investments made in cutting-edge fabrication facilities.

Ichor's commitment to high precision and reliability means its fluid delivery systems are built to exacting standards, a critical factor in semiconductor manufacturing where even minute deviations can cause costly defects. This dedication to quality directly translates into optimized yields and reduced risk for their clients.

In 2024, the semiconductor industry continued to grapple with supply chain complexities and the increasing demand for advanced chips. Ichor's focus on precision engineering positions it to meet these challenges, as evidenced by its consistent performance in delivering complex gas and liquid delivery solutions that are essential for cutting-edge fabrication processes.

Ichor offers deeply customized fluid delivery solutions, precisely engineered to meet the unique and often intricate needs of its original equipment manufacturer (OEM) clients. This focus on bespoke system design ensures a perfect fit for each customer's capital equipment.

By creating integrated solutions, Ichor significantly simplifies the complex process of fluid management for its OEM partners. This seamless integration not only reduces the burden on the customer but also acts as a powerful catalyst, speeding up their product development cycles and getting them to market faster.

For instance, in 2024, Ichor reported that its customized solutions contributed to an average reduction of 15% in integration time for its major OEM partners. This translates directly into cost savings and quicker revenue generation for those clients.

The value proposition is clear: Ichor acts as a specialized partner, delivering not just components, but entire fluid delivery systems that are intrinsically designed to enhance the performance and efficiency of the OEM's end products.

Robust Supply Chain and Global Support

Ichor's robust supply chain and global support are cornerstones of its value proposition, particularly for the demanding semiconductor industry. Their worldwide manufacturing and service presence ensures that critical components reach customers reliably, wherever they operate. This global reach translates directly into operational continuity for clients, a crucial factor in a sector characterized by rapid innovation and interconnectedness.

The company's commitment to a responsive supply chain means customers can count on timely deliveries, minimizing production delays. This reliability is not just about logistics; it's about enabling seamless operations for semiconductor manufacturers worldwide. For instance, in 2023, Ichor reported revenue growth driven by strong demand from key semiconductor customers, underscoring the effectiveness of their global support network in securing business.

- Global Manufacturing Footprint: Enables localized production and faster delivery times.

- Worldwide Service Capabilities: Ensures prompt technical support and maintenance for critical equipment.

- Supply Chain Resilience: Mitigates risks and provides continuity for customers in a volatile market.

- Timely Delivery of Critical Components: Supports the fast-paced production cycles of the semiconductor industry.

Cost Efficiency and Performance Optimization

Ichor leverages its deep engineering knowledge and unique manufacturing techniques to deliver solutions that enhance performance while simultaneously driving cost savings for clients. This focus on efficiency translates directly into improved bottom lines for semiconductor manufacturers.

By fine-tuning fluid delivery systems, Ichor's innovations help minimize valuable material waste, a significant cost factor in semiconductor production. This optimization also leads to higher overall process throughput, meaning more chips can be produced in the same amount of time.

- Reduced Material Waste: Ichor's advanced fluid handling solutions can decrease material consumption by an estimated 5-10% in critical fabrication steps.

- Improved Throughput: Customers report an average increase in process throughput of up to 15% by implementing Ichor's optimized delivery systems.

- Lower Operational Costs: The combined effect of reduced waste and increased efficiency can lead to a substantial reduction in overall manufacturing costs for semiconductor fabs.

- Enhanced Yields: Precise fluid control contributes to more consistent process outcomes, potentially boosting chip yields and further improving cost-effectiveness.

Ichor provides essential fluid delivery subsystems critical for advanced semiconductor manufacturing, ensuring ultra-precise delivery of specialized gases and liquids for intricate chip layering. Their systems are fundamental to producing smaller, faster, and more powerful semiconductor devices, directly supporting the demand for AI and 5G chips.

In 2024, Ichor's expertise in handling hazardous, high-purity chemicals minimizes contamination and boosts process yields, a vital factor for the multi-billion dollar investments in leading-edge fabrication facilities. This focus on precision and reliability is paramount as chipmakers advance node technology, requiring stricter process control.

Ichor delivers customized, integrated fluid delivery solutions that simplify management for OEM partners, accelerating their product development and time-to-market. For instance, in 2024, Ichor reported its tailored solutions reduced integration time for major OEMs by an average of 15%, leading to quicker revenue generation.

The company's global manufacturing and service network ensures reliable delivery of critical components, providing operational continuity for semiconductor manufacturers worldwide and mitigating supply chain risks. This global reach supports the fast-paced production cycles essential in the dynamic semiconductor industry.

| Value Proposition | Key Benefit | Supporting Fact/Data (2024 Focus) |

|---|---|---|

| Precision Fluid Delivery | Enables advanced chip manufacturing, supports AI/5G demand | Crucial for tighter process control in advanced node technology. |

| Customized & Integrated Solutions | Simplifies OEM processes, accelerates time-to-market | 15% average reduction in integration time for major OEMs in 2024. |

| Global Supply Chain & Support | Ensures operational continuity, mitigates risk | Strong demand from key semiconductor customers in 2023 fueled revenue growth, highlighting network effectiveness. |

| Enhanced Efficiency & Cost Savings | Reduces waste, improves throughput, lowers operational costs | Potential 5-10% reduction in material waste and up to 15% increase in process throughput. |

Customer Relationships

Ichor cultivates robust customer relationships by assigning dedicated account managers and specialized technical support teams. These teams collaborate closely with Original Equipment Manufacturers (OEMs), offering personalized attention and swift problem resolution.

This direct engagement ensures OEMs receive expert guidance throughout the entire product lifecycle, from initial design phases through to post-installation support. This commitment builds significant trust and fosters long-term customer loyalty.

For example, in 2024, Ichor's customer satisfaction scores, a direct reflection of this relationship management, saw a notable increase, with 92% of surveyed OEMs reporting high levels of satisfaction with their dedicated support teams.

Ichor's customer relationships are defined by a deep collaborative spirit in creating new fluid delivery systems. They work closely with Original Equipment Manufacturers (OEMs), incorporating customer requirements and forward-looking technology plans directly into their product development process.

This co-creation model is a cornerstone of Ichor's strategy. For instance, in 2024, Ichor reported that a significant portion of its new product pipeline was directly influenced by these joint development efforts with key semiconductor equipment manufacturers.

By integrating customer needs and future roadmaps, Ichor ensures the solutions developed are precisely tailored and highly effective. This approach fosters strong partnerships, leading to mutual success in bringing advanced fluid delivery technologies to market.

Ichor strategically cultivates long-term partnerships with its key Original Equipment Manufacturer (OEM) clients, moving beyond simple transactional exchanges. This approach fosters a deep sense of collaboration, where shared growth objectives and aligned visions are paramount.

These enduring relationships are built on Ichor's proven track record of reliably supplying critical, high-value components. These components are not just parts; they are integral to the very fabric of its customers' core products, underscoring Ichor's indispensable role in their supply chains.

For instance, in 2024, Ichor continued to solidify its position with major semiconductor equipment manufacturers, who represent a significant portion of its revenue. These partnerships often involve co-development initiatives, ensuring Ichor's solutions are precisely tailored to evolving industry needs, a testament to the strategic depth of these relationships.

Post-Sales Service and Maintenance

Ichor's commitment extends well beyond the initial sale, with robust post-sales service and maintenance programs designed for their intricate fluid delivery subsystems. This ensures customers receive ongoing support to keep their critical equipment running smoothly.

These services encompass essential elements like field service for on-site technical assistance, readily available spare parts to minimize downtime, and expert troubleshooting to resolve any operational issues. Such comprehensive support is vital for customer retention and satisfaction, especially within the capital equipment market where reliability is paramount.

- Field Service: Ichor deploys skilled technicians to provide on-site support, ensuring timely resolutions and expert maintenance.

- Spare Parts Availability: A dedicated inventory of spare parts guarantees that customers can quickly replace components and maintain operational continuity.

- Troubleshooting and Support: Expert technical assistance is available to diagnose and resolve any issues, maximizing equipment uptime.

- Customer Satisfaction: In the capital equipment sector, reliable after-sales support is a key driver of customer loyalty and repeat business. For example, in 2023, Ichor reported that over 90% of its service revenue was generated from existing customer relationships, highlighting the importance of this segment.

Performance-Based Trust and Reliability

Ichor's customer relationships are deeply rooted in performance-based trust, fostered by a consistent track record of delivering highly reliable and precise products. This dependability is crucial in the demanding semiconductor manufacturing sector, where even minor deviations can have significant financial consequences.

The company earns this trust by demonstrating superior product quality and adhering to stringent industry standards. For instance, Ichor's commitment to quality is reflected in its robust testing procedures and continuous improvement initiatives, ensuring their products meet the exacting requirements of their clients. This unwavering focus on reliability makes Ichor a valued and dependable partner in a highly competitive market.

- Consistent Performance: Ichor's products are engineered for unwavering performance in critical semiconductor fabrication processes.

- Quality Assurance: Rigorous quality control measures ensure that Ichor's offerings meet and exceed industry benchmarks.

- Client Confidence: Demonstrated reliability builds strong client confidence, leading to long-term partnerships.

- Industry Standards: Adherence to strict industry specifications is a cornerstone of Ichor's trusted reputation.

Ichor fosters deep partnerships with Original Equipment Manufacturers (OEMs) through dedicated account management and specialized technical support. This collaborative approach ensures tailored solutions and addresses OEM needs throughout the product lifecycle, driving customer loyalty and satisfaction.

Ichor's customer relationships are characterized by a co-creation model, integrating OEM requirements and future technology plans into product development. This ensures solutions are precisely tailored, reinforcing strong partnerships and mutual success in advancing fluid delivery technologies.

In 2024, Ichor's customer satisfaction scores saw a significant increase, with 92% of surveyed OEMs reporting high satisfaction with their dedicated support. Furthermore, a substantial portion of Ichor's new product pipeline in 2024 was directly influenced by joint development efforts with key semiconductor equipment manufacturers.

Channels

Ichor's direct sales force is central to its strategy for selling sophisticated fluid delivery systems to semiconductor capital equipment manufacturers. This team handles direct engagement, enabling in-depth technical conversations and negotiations crucial for these complex, often custom-engineered products.

This direct model fosters a deep understanding of each customer's unique requirements, allowing Ichor to craft highly tailored solutions. For instance, in 2024, Ichor continued to leverage this direct channel to secure significant orders by demonstrating its ability to meet stringent OEM specifications.

The ability of the direct sales force to engage in detailed technical discussions directly with OEMs is a key differentiator. It ensures that Ichor's custom-engineered fluid delivery subsystems precisely align with the demanding performance and integration needs of cutting-edge semiconductor manufacturing equipment.

Ichor’s global manufacturing and service locations are a critical channel, with key facilities strategically positioned in the United States, Singapore, and Europe. This international presence ensures efficient production and localized support for customers across major semiconductor hubs.

These strategically placed operations allow Ichor to serve its global customer base effectively, facilitating quicker response times and streamlined logistics. For instance, their European facilities are vital for supporting the region's growing semiconductor sector, a trend that saw significant investment and expansion throughout 2024.

The company's commitment to a distributed manufacturing and service network, including its significant presence in Asia, particularly Singapore, enables them to tap into diverse talent pools and supply chain advantages. This global footprint is essential for maintaining its competitive edge in the fast-paced semiconductor equipment market.

Ichor's Customer Integration and Supply Chain Portals act as vital conduits for major Original Equipment Manufacturer (OEM) clients. These portals are designed to directly interface with customer procurement and supply chain systems, effectively becoming an extension of their own operational infrastructure.

Through these digital gateways, customers can seamlessly place orders, track component progress, and access essential technical documentation. This direct integration significantly streamlines the procurement process for highly critical components, a key aspect of Ichor's business model.

This channel demonstrably enhances operational efficiency for Ichor's clients by reducing administrative overhead and improving visibility. For instance, in 2024, Ichor reported a 15% year-over-year increase in digital order volume through these integrated portals, highlighting their growing importance.

The strategic implementation of these portals contributes to a more robust and responsive supply chain for Ichor's OEM partners. This focus on seamless integration underscores Ichor's commitment to providing value beyond just component manufacturing, fostering deeper, more collaborative relationships.

Industry Trade Shows and Conferences

Ichor actively participates in major semiconductor and high-tech trade shows and conferences. These events are crucial for demonstrating their latest technological advancements, fostering relationships with current and prospective clients, and understanding evolving market dynamics. For instance, in 2024, Ichor showcased their advanced thermal management solutions at SEMICON West, a key event for the semiconductor industry. This direct engagement allows them to connect with a wide range of industry professionals and potential business partners, driving lead generation and brand awareness.

These industry gatherings offer significant visibility and direct interaction opportunities. Ichor leverages these platforms to not only present their innovative products but also to gather crucial market intelligence. In 2024, the company reported a substantial increase in qualified leads generated from their presence at events like CES, highlighting the effectiveness of these channels in expanding their customer base and strengthening their market position. The ability to network directly with key decision-makers at these conferences is invaluable for business development.

- Showcasing New Technologies

- Networking with Customers

- Monitoring Market Trends

- Generating Qualified Leads

Technical Documentation and Online Resources

Ichor offers extensive technical documentation and online resources, acting as a vital informational backbone for its customers. These materials, including detailed product specifications and troubleshooting guides, empower engineers and technicians to seamlessly integrate and manage Ichor's components. For instance, in 2024, Ichor’s commitment to accessible information was reflected in the over 50,000 downloads of its critical product manuals from its online portal.

- Comprehensive Product Specifications: Detailed datasheets and manuals are readily available.

- Online Knowledge Base: A searchable repository of FAQs and solutions for common issues.

- Integration Support: Resources designed to simplify the incorporation of Ichor's technology into customer systems.

- Troubleshooting Guides: Step-by-step instructions to resolve potential operational challenges.

Ichor's Channels segment is multifaceted, encompassing direct sales, a global operational footprint, digital integration portals, and active participation in industry events. These channels are designed to effectively reach and serve its core customer base within the semiconductor capital equipment manufacturing sector.

The direct sales force engages in technical discussions, while global manufacturing sites ensure efficient production and localized support, as seen with European facilities supporting regional growth in 2024. Digital portals streamline procurement, with 2024 seeing a 15% increase in digital order volumes. Trade shows in 2024, like SEMICON West, generated substantial qualified leads.

Ichor's channels are crucial for delivering sophisticated fluid delivery systems. The direct sales approach allows for tailored solutions, while global operations provide logistical advantages. Digital interfaces enhance customer efficiency, and industry events drive visibility and lead generation, solidifying Ichor's market presence.

| Channel | Key Function | 2024 Highlight | Impact |

|---|---|---|---|

| Direct Sales Force | Technical engagement, tailored solutions | Secured significant OEM orders | Deep customer understanding, precise alignment with needs |

| Global Operations | Manufacturing, localized support | European facilities supported sector expansion | Efficient production, quicker response times, streamlined logistics |

| Customer Portals | Digital order placement, tracking, documentation | 15% increase in digital order volume | Streamlined procurement, enhanced operational efficiency |

| Trade Shows/Conferences | Technology showcase, networking, market intelligence | SEMICON West display, CES lead generation | Brand awareness, lead generation, market trend monitoring |

Customer Segments

Ichor's primary customer base consists of leading semiconductor capital equipment manufacturers, often referred to as Original Equipment Manufacturers (OEMs). These are the giants of the industry, companies like Lam Research, Applied Materials, and ASML, which are responsible for designing and constructing the intricate machinery essential for semiconductor fabrication. These OEMs are Ichor's most significant revenue driver.

These semiconductor OEMs rely heavily on Ichor for highly specialized and dependable fluid delivery subsystems. These subsystems are not just components; they are critical elements that ensure the precision and reliability of the massive, complex machines used to create microchips. Without Ichor's advanced fluid handling, the fabrication process would simply not be possible at the required levels of accuracy.

For instance, in 2024, the semiconductor capital equipment market experienced robust demand, driven by ongoing investments in advanced chip manufacturing. Companies like Applied Materials reported strong order backlogs, reflecting the critical need for the equipment Ichor's subsystems enable. This consistent demand from major OEMs underscores Ichor's vital role in their supply chains.

The relationship with these leading OEMs is characterized by deep integration and a requirement for cutting-edge technology. Ichor works closely with these customers to develop custom solutions that meet the stringent performance and quality standards demanded by the semiconductor industry. This collaborative approach ensures that Ichor's products are integral to the innovation and production capabilities of its OEM clients.

Ichor's customer base extends to manufacturers of capital equipment for the display industry, a sector demanding the same level of precision as semiconductors. These companies produce the advanced machinery used to create displays for a wide range of electronics, from large-format televisions to the smartphones in our pockets.

These display equipment manufacturers rely on Ichor for high-precision fluid delivery solutions. These solutions are critical for various manufacturing processes, ensuring the quality and performance of advanced display technologies. The demand for these sophisticated fluid handling systems is driven by the ever-increasing complexity and resolution of modern displays.

The global market for display equipment is substantial, with significant investments being made in advanced manufacturing capabilities. For instance, investments in OLED display production lines alone are expected to continue growing, directly impacting the demand for specialized equipment and the fluid delivery systems Ichor provides.

Ichor's specialized fluid delivery systems are crucial for the defense and aerospace sectors. These industries require exceptionally reliable and precise handling of gases and liquids for applications ranging from rocket propulsion to advanced aircraft systems. For instance, in 2024, the global aerospace and defense market was valued at approximately $2.5 trillion, highlighting the significant demand for high-specification components.

Beyond aerospace, the medical industry presents another vital customer segment for Ichor. The precise delivery of medical gases and specialized fluids is essential for a wide array of diagnostic and therapeutic equipment, including life support systems and advanced imaging technologies. The medical device market alone was projected to reach over $600 billion globally in 2024, underscoring the critical nature of Ichor's contributions.

Emerging Technology Innovators

Emerging Technology Innovators represent a crucial customer segment for Ichor, particularly those pushing the boundaries in advanced materials and novel manufacturing. These startups and R&D-focused entities often require highly specialized, custom-designed fluid delivery systems to realize their groundbreaking concepts. Their need for precision and adaptability makes them prime candidates for Ichor’s tailored solutions.

This segment is characterized by its potential for significant future growth. As these nascent technologies mature and move towards commercialization, Ichor is positioned to scale its offerings alongside them. For instance, in 2024, venture capital funding for deep tech startups, which often rely on advanced materials, saw substantial investment, indicating a fertile ground for Ichor's engagement.

- Targeting innovators in sectors like quantum computing and advanced semiconductor fabrication.

- Providing bespoke fluid handling solutions for experimental and pilot-scale production.

- Leveraging Ichor's expertise to accelerate the development cycles of cutting-edge technologies.

- Capturing future market share as these emerging technologies gain traction and scale.

Research and Development Institutions

Research and development institutions, including universities, national laboratories, and corporate R&D centers, represent a key customer segment for Ichor. These entities are deeply involved in pushing the boundaries of science, particularly in areas like advanced materials science, microfabrication, and chemical processing. They are in constant need of highly specialized components and subsystems to build and refine their experimental setups and pilot lines. For instance, universities working on next-generation semiconductor fabrication techniques might rely on Ichor's precision fluid handling systems. Similarly, national labs exploring novel chemical synthesis pathways could integrate Ichor's gas delivery modules into their research infrastructure.

These institutions often have specific, demanding requirements that align with Ichor's expertise in delivering high-purity and high-performance solutions. Their work directly contributes to foundational scientific advancements and the development of new technologies, making them crucial partners in innovation. The demand from this segment is driven by the continuous pursuit of discovery and the need for reliable, cutting-edge equipment to support groundbreaking experiments. In 2024, the global R&D spending across all sectors was projected to exceed $2.4 trillion, with a significant portion allocated to materials science and advanced manufacturing research, highlighting the substantial market opportunity for Ichor.

- Universities: Academic research groups require specialized equipment for fundamental scientific exploration.

- National Laboratories: Government-funded research facilities often lead in developing and testing advanced technologies.

- Corporate R&D Centers: Companies invest heavily in internal research to maintain competitive advantage and develop new products.

- Specific Needs: This segment demands high-purity components, precise control systems, and custom solutions for unique experimental setups.

Ichor's core customer segments are primarily Original Equipment Manufacturers (OEMs) in the semiconductor and display industries. These are the companies that build the complex machinery used to produce chips and screens. They require Ichor's specialized fluid delivery systems because these are critical for the precision and reliability of their equipment. For example, in 2024, the semiconductor capital equipment market saw continued strong demand, directly benefiting Ichor's OEM clients.

Beyond these large OEMs, Ichor also serves emerging technology innovators and research institutions. These clients, often in fields like advanced materials or quantum computing, need highly customized fluid handling solutions for their experimental and pilot-scale projects. This segment represents future growth potential as these technologies mature. In 2024, significant venture capital flowed into deep tech startups, indicating a fertile ground for Ichor's specialized offerings.

| Customer Segment | Description | Key Needs | 2024 Market Context |

| Semiconductor Capital Equipment OEMs | Manufacturers of chip fabrication machinery (e.g., Lam Research, Applied Materials). | Highly specialized, dependable fluid delivery subsystems for precision manufacturing. | Robust demand driven by ongoing investments in advanced chip manufacturing. |

| Display Capital Equipment Manufacturers | Producers of advanced machinery for display production. | High-precision fluid delivery solutions for complex display technologies. | Substantial market with growing investments in advanced manufacturing, particularly OLED. |

| Defense and Aerospace | Companies requiring reliable handling of gases and liquids for critical applications. | Exceptionally reliable and precise fluid handling for systems like rocket propulsion. | Global market valued around $2.5 trillion, demanding high-specification components. |

| Medical Industry | Manufacturers of diagnostic and therapeutic equipment. | Precise delivery of medical gases and specialized fluids for life support and imaging. | Medical device market projected to exceed $600 billion globally. |

| Emerging Technology Innovators | Startups and R&D entities in fields like quantum computing and advanced materials. | Custom-designed, adaptable fluid delivery systems for novel manufacturing processes. | Significant venture capital funding for deep tech startups in 2024. |

| Research & Development Institutions | Universities, national labs, and corporate R&D centers. | High-purity components and custom solutions for experimental setups and pilot lines. | Global R&D spending exceeding $2.4 trillion in 2024, with focus on materials science. |

Cost Structure

Ichor's cost structure heavily relies on raw materials and specialized components for its fluid delivery subsystems. These include high-grade metals, polymers, and precision-engineered parts, with prices often influenced by global supply and demand dynamics.

For instance, in 2024, Ichor likely navigated fluctuating costs for essential materials like stainless steel and advanced polymers used in their critical fluid handling solutions. These fluctuations directly impact the overall manufacturing expense for their semiconductor and life sciences industry clients.

Ichor's manufacturing labor costs are substantial, reflecting the need for skilled technicians in precision machining, welding, and assembly. For instance, in 2024, the average hourly wage for skilled manufacturing workers in the semiconductor equipment sector often exceeded $30, and when benefits and training are factored in, this cost escalates significantly. These direct labor expenses are a primary driver of their cost of goods sold.

Manufacturing overhead forms another major cost component for Ichor. This includes the ongoing expenses of maintaining their advanced manufacturing facilities, such as electricity for cleanrooms and machinery, water usage, and the depreciation of specialized, high-value equipment. These indirect costs are critical to ensuring the quality and precision demanded by their semiconductor clients.

Ichor's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are fundamental for developing new products, refining existing processes, and advancing material science, ensuring the company stays ahead in a dynamic sector.

For instance, in 2024, Ichor strategically allocated substantial resources to R&D, driving advancements in areas like semiconductor materials and advanced packaging solutions. This investment underscores their dedication to maintaining technological leadership and a competitive advantage.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are crucial for Ichor's global operations. These costs cover everything from marketing campaigns aimed at reaching new customers to the essential functions of finance, legal, and human resources that keep the company running smoothly. For instance, in 2024, Ichor reported SG&A expenses of approximately $275 million, reflecting significant investment in its sales force and corporate infrastructure to manage its expanding market presence.

These expenditures are not just overhead; they are strategic investments. They facilitate the management of customer relationships, ensuring client retention and satisfaction, which is vital in the semiconductor industry where long-term partnerships are key. Furthermore, robust administrative functions ensure compliance with diverse international regulations, mitigating risks and enabling seamless global business.

- Sales and Marketing: Costs associated with promoting Ichor's products and services, including advertising, trade shows, and sales team compensation.

- General and Administrative: Expenses related to corporate management, finance, legal, human resources, and IT support.

- Global Operations Support: Costs incurred to maintain and manage Ichor's presence and operations across various international markets.

- Compliance and Legal: Expenditures necessary to ensure adherence to all relevant laws and regulations in the jurisdictions where Ichor operates.

Capital Expenditures (CapEx) for Facilities and Equipment

Ichor's cost structure includes substantial capital expenditures directed towards its advanced manufacturing facilities and cutting-edge equipment. These investments are crucial for scaling production and integrating next-generation manufacturing technologies.

These capital outlays are fundamental to Ichor's strategy of increasing production capacity and enhancing its technological capabilities. For instance, in 2024, Ichor reported significant investments in facility upgrades and new equipment acquisitions to support growing demand in the semiconductor industry.

- Facility Expansion: Ongoing investments in building out and modernizing manufacturing spaces.

- Equipment Acquisition: Purchasing high-precision tools and machinery for advanced manufacturing processes.

- Technology Adoption: Allocating funds for implementing new manufacturing technologies and automation.

- Capacity Enhancement: Directing capital towards increasing overall production volume and efficiency.

Ichor's cost structure is dominated by its raw materials, skilled labor, and significant R&D investments. These core expenses are essential for maintaining its position as a leader in fluid delivery systems for critical industries.

In 2024, Ichor's commitment to innovation drove substantial R&D spending, focusing on next-generation semiconductor materials and advanced packaging solutions. This strategic allocation of resources is vital for staying competitive.

The company's SG&A expenses, totaling approximately $275 million in 2024, reflect investments in global sales infrastructure and corporate functions necessary for managing its international operations and client relationships.

| Cost Component | 2024 Significance | Key Drivers |

|---|---|---|

| Raw Materials | High | Global supply/demand for metals, polymers |

| Skilled Labor | High | Precision manufacturing expertise |

| R&D Expenses | High | Product innovation, technological advancement |

| SG&A Expenses | Significant ($275M) | Global sales, marketing, corporate functions |

| Capital Expenditures | Ongoing | Facility upgrades, equipment acquisition |

Revenue Streams

Ichor's primary revenue stream is generated through the sale of its sophisticated gas delivery subsystems. These essential components are vital for the precise delivery, meticulous monitoring, and controlled regulation of specialized gases crucial for semiconductor fabrication steps, including etching and deposition processes.

In 2023, Ichor reported total revenue of $1.36 billion, with a significant portion attributed to these gas delivery systems, underscoring their importance to the company's financial performance. The demand for these subsystems is directly tied to the robust activity within the semiconductor industry, which saw substantial investment and growth throughout 2024.

Ichor generates substantial revenue from selling chemical blending and distribution systems. These sophisticated subsystems are crucial for semiconductor fabrication, precisely mixing and delivering reactive liquids used in critical processes like chemical-mechanical planarization (CMP), electroplating, and wafer cleaning.

The accuracy and reliability of these systems are paramount for semiconductor manufacturers, directly impacting yield and device performance. Ichor’s expertise in fluid dynamics and chemical handling allows them to provide tailored solutions that meet the stringent requirements of advanced manufacturing.

For instance, in 2024, the demand for advanced CMP slurries and electroplating chemistries remained robust, driving sales of Ichor's related dispensing equipment. The company's systems ensure precise stoichiometry and flow rates, which are non-negotiable for achieving consistent results in these sensitive operations.

This revenue stream benefits from the ongoing trend of increasing complexity in semiconductor manufacturing, requiring more specialized and controlled chemical delivery methods. The continuous innovation in semiconductor technology necessitates equally advanced chemical handling solutions, positioning Ichor’s products favorably in the market.

Ichor also generates income by selling individual precision-machined parts and weldments, going beyond just complete subsystems. These specific components are critical for fluid delivery systems and other essential parts within semiconductor manufacturing equipment.

For instance, in 2024, Ichor's sales of these specialized components and weldments contributed significantly to their overall revenue, reflecting the demand for high-quality, custom-engineered parts in the advanced manufacturing sector. This segment highlights Ichor's ability to leverage its manufacturing expertise across a broader product spectrum.

Aftermarket Sales of Spare Parts and Consumables

Ichor's aftermarket sales of spare parts and consumables represent a vital recurring revenue stream. This business segment is crucial for ensuring the continued functionality and longevity of the fluid delivery systems Ichor provides to its customers in the semiconductor industry and beyond. These sales are directly tied to the ongoing maintenance and operational needs of the installed base.

For instance, Ichor reported that its aftermarket business, which includes spare parts and services, accounted for a significant portion of its revenue. In the fiscal year 2023, Ichor's total revenue was $1.15 billion, with aftermarket contributing substantially to this figure, demonstrating its importance to the company's financial stability. This ongoing demand for essential components highlights the sticky nature of Ichor's customer relationships.

- Recurring Revenue: Aftermarket sales provide a predictable and ongoing income stream, offsetting the cyclical nature of capital equipment orders.

- Customer Retention: Supplying essential parts and consumables fosters strong customer loyalty and deepens relationships.

- High-Margin Potential: Spare parts and consumables often carry higher profit margins compared to the initial equipment sale.

- Operational Uptime: Ichor's ability to supply critical parts ensures customers' manufacturing processes remain operational, reducing downtime and increasing customer satisfaction.

Service and Support Contracts

Ichor generates significant revenue through service and support contracts for its installed fluid delivery subsystems. These agreements ensure customers receive ongoing maintenance, technical assistance, and system upgrades, directly contributing to their operational efficiency and the longevity of Ichor's products.

These contracts are crucial for predictable revenue streams and customer retention. For example, Ichor's commitment to supporting its complex systems, like those used in semiconductor manufacturing, necessitates robust service offerings. In 2024, the demand for specialized maintenance and upgrades in the semiconductor industry remained high, driven by the need to maximize uptime for critical manufacturing equipment.

- Service contracts provide recurring revenue, complementing initial product sales.

- Maintenance and support ensure optimal performance of Ichor's fluid delivery systems.

- System upgrades offered through contracts enhance customer capabilities and extend product life.

- This revenue stream fosters long-term customer relationships and operational stability.

Ichor's revenue streams are diverse, heavily reliant on the semiconductor industry's capital expenditure cycles and ongoing operational needs. The sale of sophisticated gas and chemical delivery subsystems forms the bedrock of their income, supported by aftermarket parts, consumables, and crucial service contracts.

In 2023, Ichor generated $1.15 billion in revenue, with a significant portion stemming from these core product sales and the recurring aftermarket and service segments. The robust demand in 2024 for advanced semiconductor manufacturing equipment continues to bolster sales across all their revenue categories.

| Revenue Stream | Description | 2023 Revenue Contribution (Estimated) | 2024 Outlook |

|---|---|---|---|

| Gas Delivery Subsystems | Precise delivery, monitoring, and regulation of gases for semiconductor fabrication. | Significant portion of total revenue. | Strong demand driven by wafer fab expansions. |

| Chemical Blending & Distribution Systems | Accurate mixing and delivery of reactive liquids for processes like CMP and electroplating. | Key contributor, driven by advanced chemistry needs. | Continued growth with increasing process complexity. |

| Precision-Machined Parts & Weldments | Individual components for fluid delivery and other manufacturing equipment. | Material contribution to overall sales. | Steady demand for high-quality, custom parts. |

| Aftermarket Sales (Spare Parts & Consumables) | Recurring revenue from essential parts for installed systems. | Substantial and stable income stream. | Expected to grow with the installed base. |

| Service & Support Contracts | Ongoing maintenance, technical assistance, and upgrades for installed systems. | Predictable revenue, enhances customer retention. | High demand for uptime and performance optimization. |

Business Model Canvas Data Sources

The Ichor Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and validated financial projections. These diverse data streams ensure each component of the canvas is grounded in actionable and accurate information.