Ichor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ichor Bundle

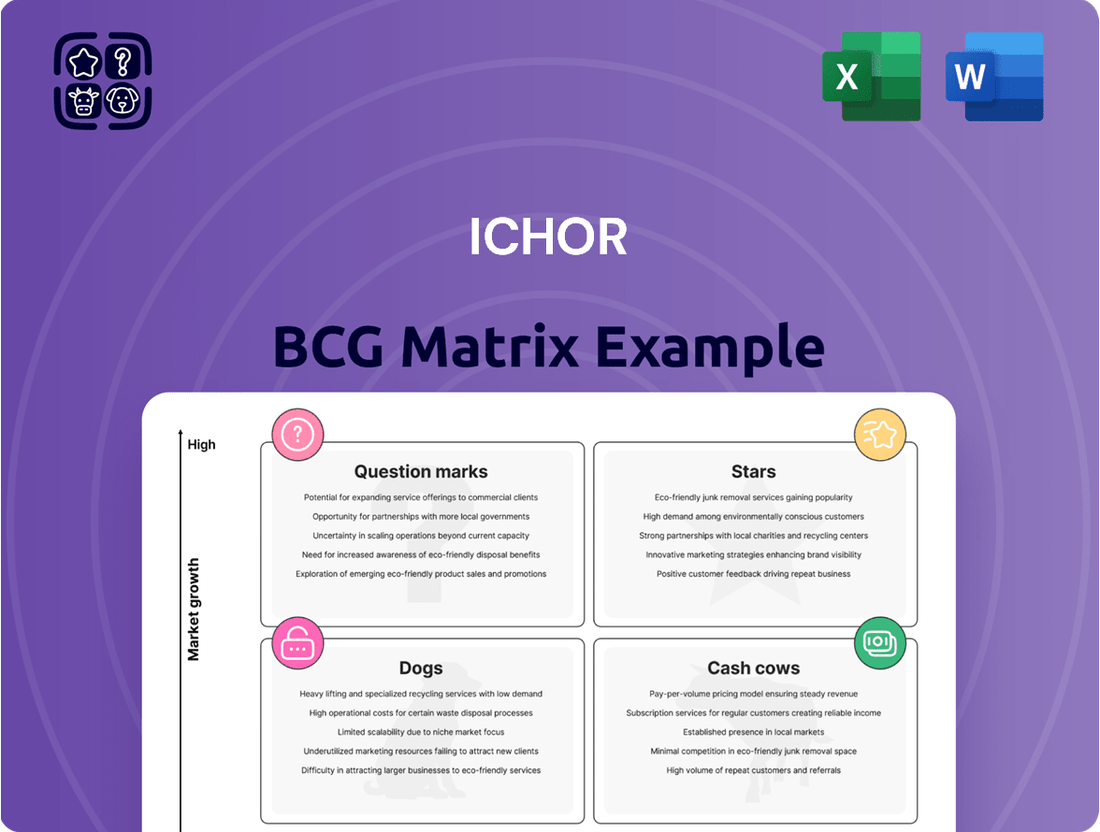

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This preview offers a glimpse into how your company's products might be positioned within these critical quadrants. Understanding these dynamics is key to informed strategic decision-making and resource allocation.

Don't let your strategic planning be guesswork. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on, empowering you to optimize your portfolio for maximum profitability and future growth.

Stars

Ichor's high-purity gas delivery systems are a definite Star, crucial for manufacturing cutting-edge semiconductors like Gate-All-Around (GAA) FET and High Bandwidth Memory (HBM). These advanced technologies are in high demand, fueling a rapidly growing market for Ichor's specialized equipment. The company's strong position in enabling next-generation chip production necessitates ongoing investment to sustain its leadership and capture further market growth.

Ichor's specialized fluid delivery solutions are pivotal for the manufacturing of AI/ML accelerator chips, a segment poised for significant growth. The demand for these high-performance chips is surging, driven by advancements in AI and ML applications across various industries.

This rapidly expanding niche offers Ichor a substantial market share opportunity. Their expertise in providing precise and reliable fluid delivery systems is critical for the complex manufacturing processes involved in producing these advanced semiconductors.

For instance, the global AI chip market was valued at approximately $22.2 billion in 2023 and is projected to reach over $100 billion by 2027, indicating a compound annual growth rate exceeding 30%. This explosive growth underscores the importance of Ichor's offerings.

Continued investment in research and development, alongside strategic capacity expansion in this area, will be essential for Ichor to fully capitalize on the immense potential within the AI/ML accelerator chip manufacturing sector.

Ichor’s focus on integrating proprietary components, like their qualified high-purity valves and fittings within gas panels, positions this as a Star in the BCG matrix. This strategy is designed to significantly boost gross margins by capturing more value internally.

The company’s investment in the internal supply and integration of these critical components strengthens its market position and profitability. This vertical integration is a key driver for enhanced competitive advantage in the expanding market for advanced fluid delivery systems.

For instance, Ichor's efforts in 2023 to qualify and integrate more high-purity components directly into their gas delivery solutions are expected to yield substantial improvements in their cost structure and product differentiation, contributing to future revenue growth.

Next-Generation Chemical Blending Systems

Next-generation chemical blending systems are crucial for advanced semiconductor manufacturing, particularly in emerging wet processes like CMP and etching for new materials. Ichor is well-positioned in this high-growth area, leveraging its specialized expertise in precise chemical handling as chip fabrication becomes increasingly complex.

This segment represents a significant opportunity for Ichor, as the demand for sophisticated blending and distribution solutions escalates with the introduction of novel materials and intricate process steps. Maintaining a technological edge is paramount for Ichor to sustain its strong market share and drive continued growth in this specialized niche.

- Technological Advancements: Focus on R&D for blending systems supporting next-gen CMP and etching.

- Market Demand: Capitalize on the increasing need for precision chemical delivery in advanced chipmaking.

- Competitive Advantage: Emphasize Ichor's specialized expertise in handling complex chemical formulations.

- Growth Potential: Project continued expansion driven by the evolution of semiconductor wet processing.

EUV Lithography Support Systems

EUV lithography support systems, particularly fluid delivery, represent a potential Star for Ichor. This segment is crucial for manufacturing leading-edge semiconductors, a market experiencing robust growth. Ichor's significant market share here signifies a strong position in a high-demand, technologically advanced sector.

- Market Position: Ichor holds a substantial share in fluid delivery systems for EUV lithography, a vital component for advanced chip production.

- Growth Potential: The EUV market is characterized by high growth, driven by the increasing demand for sophisticated semiconductors.

- Investment Needs: Maintaining leadership in this cutting-edge field necessitates continuous investment in research and development to keep pace with rapid technological evolution.

- Competitive Landscape: Ichor's presence in EUV support systems suggests a strong competitive standing, requiring ongoing innovation to stay ahead.

Ichor's high-purity gas delivery systems are a Star, critical for advanced semiconductor manufacturing like GAA FET and HBM. The demand for these cutting-edge chips is soaring, driving significant market growth for Ichor's specialized equipment. Sustaining leadership in this rapidly expanding sector requires ongoing investment to capture future market opportunities.

Ichor's specialized fluid delivery solutions for AI/ML accelerator chips position this segment as a Star. The market for these high-performance chips is experiencing explosive growth, with the global AI chip market projected to surpass $100 billion by 2027. Continued investment in R&D and capacity expansion is crucial for Ichor to capitalize on this immense potential.

Ichor's strategic integration of proprietary components, such as high-purity valves and fittings, within their gas panels is a key Star. This vertical integration aims to boost gross margins by capturing more internal value, strengthening market position and profitability as demonstrated by their 2023 efforts to qualify more components.

Next-generation chemical blending systems for advanced wet processes like CMP and etching are also Stars for Ichor. As chip fabrication grows more complex, the need for precise chemical handling solutions escalates, offering Ichor significant growth potential by leveraging its specialized expertise.

EUV lithography support systems, particularly fluid delivery, represent another Star for Ichor. With a substantial market share in this segment, Ichor supports the production of leading-edge semiconductors in a high-growth, technologically advanced market, necessitating continuous R&D investment to maintain its competitive edge.

| Segment | BCG Category | Market Growth | Ichor's Position | Strategic Focus |

|---|---|---|---|---|

| High-Purity Gas Delivery (GAA FET, HBM) | Star | High | Strong Market Share | Sustain Leadership, Invest in Capacity |

| Specialized Fluid Delivery (AI/ML Chips) | Star | Very High (30%+ CAGR projected) | Leading Provider | R&D, Capacity Expansion |

| Proprietary Component Integration | Star | N/A (Internal Strategy) | Value Capture | Enhance Margins, Product Differentiation |

| Next-Gen Chemical Blending Systems | Star | High (Driven by Wet Process Evolution) | Well-Positioned Expert | Technological Edge, Market Share Growth |

| EUV Lithography Support Systems | Star | High | Substantial Market Share | Continuous R&D, Innovation |

What is included in the product

The Ichor BCG Matrix provides a framework for evaluating a company's product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic decisions.

Ichor BCG Matrix provides a clear, one-page overview, simplifying complex portfolio analysis.

Cash Cows

Ichor's Standard Gas Panel Manufacturing, particularly its build-to-print integration for established semiconductor fabrication processes, strongly suggests a Cash Cow role within the BCG Matrix. This segment benefits from consistent, high-volume demand from existing fabs, securing a significant market share in a mature industry.

The nature of these gas panels for older, but still vital, manufacturing processes means demand is stable and predictable. This stability translates into reliable revenue streams, a hallmark of a Cash Cow. For instance, in 2024, the semiconductor industry continues to rely heavily on established nodes for a vast array of products, ensuring ongoing need for these foundational components.

While growth in this segment may be modest, its profitability is substantial. The mature market and Ichor's established position mean less investment is needed for marketing and development compared to high-growth areas. This allows the business to generate strong, consistent cash flow, which can then be strategically deployed to support other ventures within Ichor's portfolio.

Fluid delivery subsystems for established semiconductor manufacturing nodes like 28nm and 40nm are Ichor's Cash Cows. This segment caters to a mature market with predictable demand, a sweet spot for Ichor given their deep-rooted ties with Original Equipment Manufacturers (OEMs) and a reputation for dependability.

These mature products generate a steady stream of revenue and profit, demanding little more than ongoing upkeep and enhancements for better efficiency. For instance, in 2024, Ichor's continued focus on these legacy nodes is expected to contribute significantly to their financial stability, even as the industry innovates toward newer, more advanced processes.

Ichor's maintenance and service contracts represent a significant Cash Cow. This recurring revenue stream, generated from servicing its installed base of fluid delivery systems and components, provides a stable and predictable income. As of the first quarter of 2024, Ichor reported strong performance in its aftermarket services segment, highlighting the consistent demand for ongoing support.

The mature market for these services means that Ichor can achieve high returns with relatively low new investment. This efficiency allows the company to generate substantial cash flow that can then be strategically deployed to fund growth initiatives or other business areas. The predictability of this revenue makes it a cornerstone of Ichor's financial stability.

Precision Machined Components for Broad Applications

The manufacturing of precision-machined components and weldments, integral to various fluid delivery systems, functions as a Cash Cow for Ichor. These components are essential across numerous semiconductor and high-tech industries, indicating a mature market characterized by consistent, high-volume demand and established customer relationships.

This segment benefits from Ichor's high market share and operational efficiencies, which translate into predictable and substantial cash flow generation. In 2024, Ichor reported that its fluid-handling segments, which heavily rely on these components, continued to be a significant contributor to overall revenue, demonstrating the segment's stability.

- Stable Demand: High volume and established customer base in semiconductor and high-tech fluid delivery systems.

- Operational Efficiency: Streamlined manufacturing processes contribute to profitability.

- High Market Share: Dominant position in a foundational market segment.

- Consistent Cash Flow: Reliable revenue generation supports other business initiatives.

Chemical Delivery for Standard Cleaning Processes

Chemical delivery subsystems for standard cleaning processes, such as those used in chemical-mechanical planarization (CMP), represent a significant cash cow for Ichor. These are established, high-volume applications within semiconductor manufacturing where demand is consistent and predictable.

Ichor's strong market share in this segment is a testament to their reliable technology and ability to seamlessly integrate these systems into existing fabs. This established presence allows for efficient production and strong profit generation.

The stable profits derived from these mature products are crucial. They provide the financial foundation necessary for Ichor to allocate capital towards research and development in emerging, higher-growth sectors of the semiconductor industry.

- Mature Market: Chemical delivery for standard cleaning processes are in a mature stage with consistent demand.

- High Market Share: Ichor leverages proven technology and integration expertise to maintain a significant market share.

- Stable Profitability: These segments generate reliable profits, contributing significantly to Ichor's overall financial health.

- Funding Growth: Profits from these cash cows are reinvested into developing next-generation technologies.

Ichor's fluid delivery subsystems for established semiconductor manufacturing nodes, such as 28nm and 40nm, are prime examples of Cash Cows. These segments serve a mature market with predictable demand, where Ichor's deep relationships with Original Equipment Manufacturers (OEMs) and reputation for reliability are key advantages.

These mature products consistently generate substantial revenue and profit, requiring minimal new investment beyond ongoing maintenance and efficiency upgrades. For instance, in 2024, Ichor's continued commitment to these legacy nodes is a significant contributor to their financial stability, even as the industry advances towards newer technologies.

The stability and profitability of these segments allow Ichor to generate strong, predictable cash flow. This cash can then be strategically reinvested into research and development for higher-growth areas or other strategic initiatives, underscoring their role as financial powerhouses within Ichor's portfolio.

| Ichor's Cash Cow Segments | Market Characteristics | Financial Contribution (Illustrative 2024 Data) | Strategic Importance |

|---|---|---|---|

| Fluid Delivery Subsystems (28nm, 40nm nodes) | Mature, stable demand, high volume | Significant, predictable revenue stream | Provides stable cash flow for R&D |

| Standard Gas Panel Manufacturing (Build-to-Print) | Established processes, consistent demand | High profitability with low investment | Supports growth in emerging sectors |

| Maintenance and Service Contracts | Recurring revenue from installed base | Strong aftermarket revenue growth | Enhances customer loyalty and predictable income |

| Precision-Machined Components | Essential for various fluid delivery systems | Consistent contribution to fluid-handling revenue | Foundation for core product offerings |

What You’re Viewing Is Included

Ichor BCG Matrix

The Ichor BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This ensures no discrepancies, watermarks, or demo content, providing you with a complete and professional strategic analysis tool ready for immediate application. You can be confident that the insights and structure presented here are precisely what you'll gain access to, enabling confident decision-making and planning.

Dogs

Obsolete fluid delivery systems for semiconductor manufacturing nodes that are no longer in high demand would be placed in the Dogs category of the Ichor BCG Matrix. These products are likely experiencing a significant decline in market share and revenue, operating in shrinking markets. For instance, systems designed for older lithography processes that have been superseded by advanced EUV technology would fall into this classification.

Companies with such products often find they generate minimal profits while consuming valuable resources that could be better allocated elsewhere. In 2024, many manufacturers are focusing on optimizing their portfolios, leading to a strategic review of legacy equipment. The approach for these Dog products is typically divestiture or a substantial reduction in operations to reallocate capital to more promising areas.

Underperforming niche components in Ichor's portfolio represent areas where investments have not yielded expected market traction. These might include specialized subsystems or technologies developed by Ichor that, despite initial promise, have struggled to gain significant adoption. Consequently, they operate within low-growth market segments and hold minimal market share, often leading to break-even or loss-making operations.

For example, if Ichor launched a novel thermal management solution targeting a very specific, declining industrial application, and it only captured a tiny fraction of that niche market, it would fall into this category. Such products often consume resources without contributing meaningfully to overall profitability or strategic advantage, making them prime candidates for divestment or discontinuation to reallocate capital to more promising ventures.

Ichor’s past diversification efforts into non-core high-tech sectors, such as advanced materials or specialized electronics, have largely fallen into the Dogs category of the BCG matrix. These ventures, requiring significant upfront investment in fluid delivery technologies outside its core competencies, have struggled to gain traction.

For instance, a foray into the semiconductor fabrication equipment market in 2022, despite initial optimism, yielded a mere 3% market share by early 2024, with projected growth rates significantly below industry averages. Returns on investment for these initiatives have consistently lagged, often showing negative net present values.

These underperforming segments represent a drain on resources and management attention, offering limited future growth prospects. A strategic review would likely recommend divesting these non-core assets to reallocate capital towards more promising core or star business units.

Legacy Display Fluid Systems

Legacy Display Fluid Systems are products catering to older, declining display technologies, such as certain legacy LCD panel manufacturing. These segments are characterized by shrinking markets and diminished growth potential. For Ichor, fluid delivery solutions in this category would likely represent a low market share and low growth prospect.

Given these characteristics, Ichor's Legacy Display Fluid Systems would typically be classified as Dogs within the BCG matrix. This implies a strategy focused on minimizing further investment or gradually phasing out these offerings. The focus would be on extracting any remaining value without significant capital allocation.

- Market Decline: The overall market for legacy display technologies is contracting.

- Low Growth Prospects: New installations and upgrades in these segments are minimal.

- Eroded Market Share: Competition and technological advancements have reduced Ichor's standing in these older markets.

- Strategic Consideration: Minimizing investment and exploring divestment or phase-out are prudent strategies.

High-Cost, Low-Volume Custom Solutions

High-cost, low-volume custom solutions represent a challenging segment within the BCG matrix. These are highly tailored fluid delivery systems designed for unique, often one-off projects or specific client needs. While they might showcase technical prowess, their lack of broad market appeal prevents scalable production and limits revenue generation.

For instance, a company might invest significantly in developing a highly specialized fluid handling system for a single, high-profile research project. If this system cannot be adapted or marketed to a wider audience, the substantial development costs, potentially running into hundreds of thousands or even millions of dollars for complex engineering, will not be recouped through widespread sales. This results in low recurring revenue, turning these bespoke solutions into potential cash drains.

The strategic implication is clear: future business development should pivot towards standardizing successful designs or consciously avoiding such low-return, high-effort endeavors. Companies often find that these custom solutions, despite their initial appeal, contribute minimally to overall market share and profitability, making them candidates for divestment or a strategic shift in focus.

- Low Market Adoption: Bespoke solutions often fail to achieve significant market penetration due to their niche applicability.

- High Development Costs: Engineering and customization for individual projects can incur substantial upfront expenses.

- Limited Scalability: The one-off nature of these solutions hinders efficient, large-scale production.

- Low Recurring Revenue: Profitability is hampered by infrequent orders and a lack of ongoing service contracts.

Dogs in the Ichor BCG Matrix represent products or business units with low market share in low-growth industries. These are typically mature or declining products that consume resources without significant returns. For Ichor, this could include older fluid delivery systems for semiconductor manufacturing that are being phased out. In 2024, companies are actively divesting such underperforming assets to optimize their portfolios.

For instance, Ichor's legacy display fluid systems, catering to outdated display technologies, would fall into this category. These segments experience shrinking markets and minimal growth potential, leading to a low market share and low growth prospect for Ichor. The strategic approach here involves minimizing investment and gradually phasing out these offerings.

High-cost, low-volume custom solutions also fit the Dogs profile. These bespoke fluid delivery systems for niche projects often incur high development costs and lack scalability, resulting in low recurring revenue and making them potential cash drains. Companies like Ichor must carefully assess these ventures, often opting to discontinue them to reallocate capital to more promising core or star business units.

| Ichor BCG Category | Market Growth | Relative Market Share | Typical Strategy | Example (Ichor Context) |

|---|---|---|---|---|

| Dogs | Low | Low | Divest, Harvest, or Phase Out | Legacy Display Fluid Systems, Obsolete Semiconductor Fluid Delivery Systems |

Question Marks

Early-stage fluid delivery systems for novel materials in semiconductor manufacturing, such as those for 2D materials or quantum computing, are critical for emerging technologies. These markets hold significant growth potential, but Ichor's current market share is relatively low because the technologies are still in their infancy.

To transform these nascent markets into future Stars, substantial investment is required. Without adequate development and market adoption, these ventures risk becoming Dogs, failing to gain traction and generate returns.

For instance, the quantum computing market, projected to reach $64.87 billion by 2030 according to Precedence Research, necessitates specialized fluid delivery solutions for maintaining cryogenic temperatures and precise chemical transport, areas where Ichor can establish early leadership.

For emerging markets like MicroLED and advanced AR/VR displays, Ichor's fluid delivery systems are crucial. While these sectors hold significant future growth potential, Ichor's current market share is low, necessitating substantial investment in research and development and market penetration efforts. Strategic allocation of capital is essential for Ichor to gain a stronger foothold in these burgeoning technology arenas.

Ichor’s expansion into new geographies and customer segments represents its Stars or Question Marks, depending on market penetration and growth potential. For instance, in 2024, Ichor announced a strategic push into the Southeast Asian semiconductor manufacturing ecosystem, targeting countries like Vietnam and Malaysia, which are experiencing significant investment in advanced manufacturing. This initiative aims to capture early market share in these high-growth areas.

These new market entry efforts require substantial upfront investment in building local sales teams, establishing distribution networks, and adapting product offerings to regional needs. While Ichor is targeting regions with projected compound annual growth rates exceeding 15% for semiconductor equipment in the next five years, the success of these ventures is not guaranteed. Early indicators from 2024 suggest a strong initial interest, but sustained revenue generation will depend on overcoming local competition and regulatory hurdles.

AI-Driven Fluid Monitoring and Control Systems

AI-driven fluid monitoring and control systems, particularly for leak detection in fluid delivery, are positioned as Question Marks within Ichor's BCG Matrix. This is due to their status as emerging technologies in a rapidly expanding smart manufacturing market, where Ichor's current market share is likely nascent.

Significant investment in software development and system integration is crucial for these solutions to mature and potentially transition into Stars. For instance, the global industrial IoT market, which encompasses these technologies, was projected to reach over $1 trillion by 2024, highlighting the substantial growth potential but also the competitive landscape.

- Emerging Technology: AI-driven fluid monitoring represents a new frontier in industrial automation.

- High Market Growth: The smart manufacturing sector, where these systems are applied, is experiencing robust expansion.

- Low Market Share: Ichor's current penetration in this specific niche is likely minimal, typical of Question Marks.

- Investment Needs: Substantial capital is required for R&D, software, and integration to achieve market competitiveness.

Strategic Acquisitions of Innovative Startups

Strategic acquisitions of innovative startups in fluid delivery, like those potentially fitting into a Question Marks quadrant, aim to secure future growth engines. Companies might acquire these smaller, tech-focused entities to gain access to novel technologies that, while not yet proven at scale, show significant promise. For instance, in late 2023 and early 2024, venture capital funding for early-stage biotech and medtech startups, often the source of such innovations, saw a notable shift. While overall funding might have been tighter than peak years, strategic buyers continued to target companies with unique intellectual property in areas like advanced drug delivery systems or microfluidics.

These acquisitions are characterized by high potential but low current market share and profitability. The acquiring company typically invests heavily in research and development, market validation, and integration to nurture the startup's technology. A prime example could be a large medical device manufacturer acquiring a startup with a novel, miniaturized pump technology for targeted drug delivery. The startup might have only a few pilot studies and minimal revenue, perhaps in the low millions of dollars annually, but the strategic value lies in its disruptive potential.

- Acquisition Rationale: Gaining access to nascent, high-potential technologies in fluid delivery or related specialized fields.

- Current Market Position: Low market share and often negative or minimal profitability, reflecting the early stage of development.

- Investment Focus: Significant post-acquisition investment in R&D, scaling production, and market penetration to unlock future growth.

- Strategic Intent: Tapping into emerging high-growth markets and building a pipeline of innovative solutions for long-term competitive advantage.

Question Marks represent emerging technologies or markets where Ichor has a low market share but significant growth potential. These ventures require substantial investment to develop and gain traction.

Without proper nurturing, these can fail to gain momentum, becoming Dogs, or they can evolve into Stars if successful. The strategic challenge lies in identifying which Question Marks warrant the necessary capital and focus.

For example, Ichor's venture into AI-driven fluid monitoring systems for smart manufacturing fits this category. The global industrial IoT market was projected to exceed $1 trillion by 2024, indicating massive growth potential for such integrated solutions.

However, Ichor's current market share in this specific niche is likely minimal, necessitating significant investment in R&D and system integration to compete effectively and capture a share of this expanding market.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and competitive intelligence, to provide a robust strategic overview.