Ichor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ichor Bundle

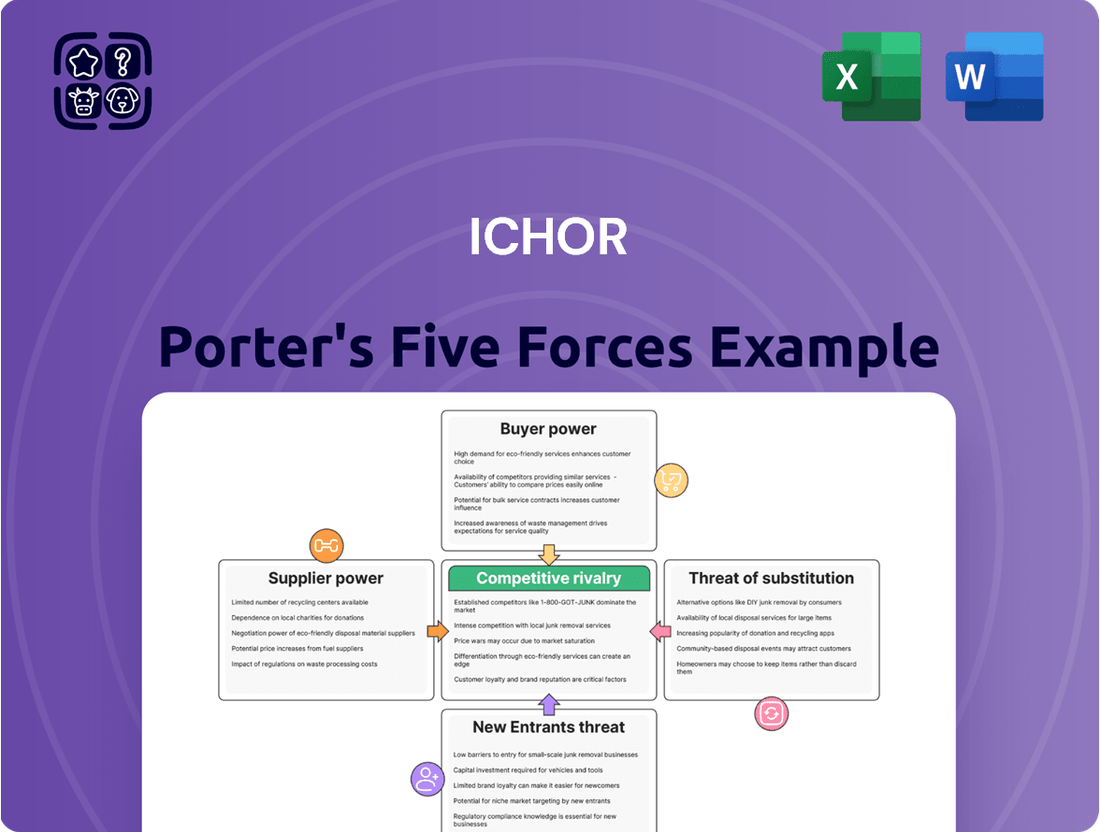

Ichor's competitive landscape is shaped by five key forces, revealing the underlying dynamics that influence profitability and strategic positioning.

Understanding the threat of new entrants and the bargaining power of buyers is crucial for navigating Ichor's market.

We've also analyzed the intensity of rivalry among existing competitors and the potential impact of substitute products.

Furthermore, the bargaining power of suppliers plays a significant role in Ichor's cost structure and operational efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ichor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ichor's reliance on a small number of suppliers for highly specialized components, like advanced ceramics and precision-machined parts, significantly boosts supplier bargaining power. These specialized suppliers often hold unique manufacturing capabilities or proprietary technology, making it difficult for Ichor to switch. This concentration means suppliers can dictate terms, potentially leading to higher input costs for Ichor.

Ichor faces significant supplier bargaining power due to high switching costs for its critical semiconductor manufacturing components. These costs encompass lengthy requalification processes, necessary redesigns of their equipment, and the inherent risk of production schedule disruptions.

The extremely stringent quality and purity requirements within the semiconductor industry make transitioning to a new supplier a complex and time-intensive undertaking. This complexity inherently strengthens the leverage of established suppliers.

For instance, in 2024, the lead times for specialized semiconductor equipment components often extended to over 12 months, making immediate supplier changes impractical and costly for manufacturers like Ichor.

This reliance on a limited number of highly specialized suppliers creates a dependency that suppliers can exploit to command better terms, impacting Ichor's operational flexibility and profitability.

The components and materials Ichor sources are frequently unique, meticulously engineered, and absolutely vital for the high performance and dependability of its semiconductor manufacturing equipment. These critical inputs are not readily replaceable, and their quality directly influences the efficiency and output of the final semiconductor chips.

This inherent criticality significantly boosts the bargaining power of Ichor's suppliers. For instance, in 2024, the semiconductor industry faced ongoing supply chain disruptions, particularly for specialized components. Companies like Ichor, which rely on these precise parts, found it challenging to secure alternatives, giving suppliers greater leverage in pricing and terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Ichor's business, manufacturing fluid delivery subsystems themselves, is a nuanced concern. While the complexity and capital requirements of Ichor's direct market make this less common, it's a potential long-term risk.

If a supplier holds critical intellectual property or possesses advanced manufacturing capabilities, they could decide to enter Ichor's market. This would reduce Ichor's dependency on them, shifting the power dynamic.

For instance, in the semiconductor equipment sector, where Ichor operates, suppliers of highly specialized components like advanced valves or mass flow controllers might possess the technical know-how to assemble entire subsystems.

While Ichor's 2023 revenue was $1.1 billion, a supplier with a strong technology base could potentially challenge this if they decide to leverage their expertise to capture a larger share of the value chain.

- Supplier Forward Integration Risk: While generally low due to market complexity, specialized suppliers with significant IP could enter Ichor's market.

- Impact on Ichor: Such a move would decrease Ichor's reliance on these suppliers and potentially pressure margins.

- Industry Example: Semiconductor equipment suppliers of critical components could theoretically move into subsystem manufacturing.

- Financial Context: Ichor's $1.1 billion revenue in 2023 highlights the scale of the market, but a well-positioned supplier could still pose a threat.

Intellectual Property and Proprietary Technologies

Suppliers possessing critical patents or proprietary manufacturing processes for essential components wield significant influence. Ichor's reliance on these advanced technologies, often protected by intellectual property, directly impacts its ability to innovate and maintain a competitive edge.

This intellectual property barrier restricts Ichor's available choices, consequently amplifying the bargaining power of its suppliers. For instance, in the semiconductor manufacturing sector, where Ichor operates, exclusive rights to cutting-edge fabrication techniques can create substantial dependencies. In 2024, the demand for specialized semiconductor manufacturing equipment continued to surge, with lead times for certain advanced systems extending well into 2025, underscoring the suppliers' leverage.

- Intellectual Property as a Lever: Suppliers holding patents on key materials or manufacturing processes gain a powerful negotiation tool.

- Dependency on Advanced Technologies: Ichor's innovation and competitive standing are often tied to accessing these proprietary supplier technologies.

- Limited Alternatives: The exclusivity of these technologies constrains Ichor's supplier options, strengthening the suppliers' position.

- Impact on Ichor's Strategy: This dynamic can influence Ichor's product development timelines and cost structures, necessitating strategic supplier relationship management.

Ichor's bargaining power with its suppliers is significantly constrained by the specialized nature of its components and the high switching costs involved. Suppliers of critical materials like advanced ceramics and precision-machined parts often possess unique manufacturing capabilities or proprietary technology, making it difficult and costly for Ichor to find alternatives.

In 2024, the semiconductor industry experienced extended lead times, sometimes exceeding 12 months, for these specialized components, highlighting supplier leverage and limiting Ichor's ability to switch. This reliance on a few key suppliers, coupled with stringent quality requirements, gives them considerable power to dictate terms and pricing, impacting Ichor's profitability and operational agility.

The threat of forward integration by suppliers exists, particularly for those with advanced manufacturing expertise who could potentially enter Ichor's market. While complex, this remains a long-term risk that could shift the power dynamic. Intellectual property held by suppliers, such as patents on essential fabrication techniques, further solidifies their negotiating position, impacting Ichor's innovation and cost structures.

| Factor | Description | Impact on Ichor | Example (2024 Data) |

|---|---|---|---|

| Supplier Concentration | Reliance on a few specialized suppliers for critical components. | Increased supplier leverage, potential for higher costs. | Extended lead times for advanced ceramics and precision parts. |

| Switching Costs | High costs associated with requalification, redesign, and production risks. | Limits Ichor's ability to change suppliers, strengthens existing relationships. | Complex qualification processes for new semiconductor equipment components. |

| Component Criticality | Vital, unique, and precisely engineered inputs essential for Ichor's equipment performance. | Suppliers can command better terms due to the irreplaceable nature of their products. | Stringent purity requirements for semiconductor manufacturing materials. |

| Intellectual Property | Suppliers holding patents or proprietary manufacturing processes for key components. | Restricts Ichor's choices and amplifies supplier bargaining power. | Exclusive rights to cutting-edge fabrication techniques in the semiconductor sector. |

What is included in the product

This analysis dissects the competitive forces impacting Ichor, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry to understand Ichor's strategic positioning.

Effortlessly identify and address competitive threats with a dynamic, visual representation of all five forces, simplifying complex market analysis.

Customers Bargaining Power

Ichor's customer base is heavily concentrated, with major semiconductor capital equipment manufacturers forming its primary clientele. This means a few large customers are responsible for a significant chunk of Ichor's revenue. For instance, in 2023, Ichor reported that its top 10 customers represented approximately 67% of its total revenue, highlighting the significant reliance on a limited number of buyers.

This concentration grants these large customers considerable bargaining power. Their ability to influence pricing and terms is amplified because Ichor's sales and profitability could be disproportionately affected by the loss of even a single major client. This dynamic forces Ichor to carefully manage relationships and pricing with its key accounts to maintain stability.

Ichor's customers, particularly major semiconductor manufacturers, often place substantial orders for fluid delivery systems. These high-volume purchases grant them considerable leverage in negotiations. For instance, a single large order can represent a significant portion of Ichor's revenue for a given period, making it difficult for Ichor to refuse customer demands for better pricing or customized solutions. This dependency on large clients amplifies customer bargaining power.

The degree of standardization or modularity in Ichor's fluid delivery components directly impacts customer bargaining power. If certain components, like standard fittings or tubing, are readily available from multiple suppliers with similar specifications, customers can easily switch, forcing Ichor to compete on price and terms.

For instance, if a significant portion of Ichor's product line relies on commonly manufactured parts, a customer might find that 20% of their fluid delivery system can be sourced elsewhere. This reduces Ichor's leverage, as customers can threaten to take their entire business to a competitor offering better deals on those standardized elements.

This modularity allows customers to mix and match components, increasing their options and thereby their power to negotiate. When Ichor's solutions are built from less proprietary, more interchangeable parts, the cost of switching suppliers for those specific modules diminishes, empowering the customer.

Customer's Threat of Backward Integration

Large semiconductor capital equipment manufacturers have substantial engineering and manufacturing expertise. This means they could potentially produce certain fluid delivery subsystems themselves rather than buying them from Ichor.

While bringing production in-house would require a significant capital outlay, the mere possibility of this backward integration gives customers considerable bargaining power. It pressures Ichor to consistently offer competitive pricing and cutting-edge innovation to keep their business.

This threat is particularly relevant as the semiconductor industry continues to see massive investments. For example, in 2024, global semiconductor capital expenditure was projected to reach around $200 billion, indicating the financial capacity of major players to undertake such vertical integration if deemed strategically advantageous.

- Customer Capability: Major semiconductor equipment makers possess the engineering talent and manufacturing infrastructure to produce fluid delivery subsystems internally.

- Investment Threshold: Undertaking backward integration would necessitate substantial financial investment from these customers.

- Competitive Pressure: The threat of customers producing components in-house compels Ichor to maintain price competitiveness and drive continuous innovation.

- Market Dynamics: In 2024, significant capital expenditure in the semiconductor industry suggests customers have the financial means to pursue vertical integration if necessary.

Price Sensitivity Due to Cost Structure

Ichor's products are a substantial part of semiconductor capital equipment's total cost. This means customers are keenly aware of pricing, as it directly affects their own manufacturing expenses and profit margins. For example, if Ichor's subsystems represent 15% of a customer's equipment cost, a 5% price increase from Ichor could translate to a significant impact on the customer's bottom line.

This heightened price sensitivity compels customers to actively push Ichor for lower prices and greater efficiencies. They understand that by negotiating better terms for components like Ichor's, they can improve their own competitiveness in the market.

- High Cost Component: Ichor's products are a significant portion of the overall cost for semiconductor capital equipment manufacturers.

- Customer Price Sensitivity: Buyers are highly sensitive to the pricing of these essential subsystems due to its direct impact on their profitability.

- Pressure for Cost Reduction: This sensitivity leads customers to exert considerable pressure on Ichor to reduce costs and improve operational efficiency.

Ichor's significant reliance on a concentrated customer base, where the top 10 customers accounted for approximately 67% of revenue in 2023, grants these buyers substantial bargaining power. Their ability to influence pricing and terms is a direct consequence of their large order volumes and the potential impact of their business on Ichor's overall performance.

| Factor | Impact on Ichor's Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Reduces Ichor's power; large customers have significant leverage. | Top 10 customers represented ~67% of 2023 revenue. |

| Product Standardization | Weakens Ichor's power; customers can switch suppliers for common parts. | Customers may source up to 20% of fluid delivery systems from alternatives. |

| Customer Integration Threat | Limits Ichor's power; customers can consider in-house production. | Semiconductor CAPEX projected at ~$200 billion in 2024, indicating customer financial capacity. |

| Component Cost Significance | Diminishes Ichor's power; customers are highly price-sensitive. | Ichor's subsystems can represent 15% of customer equipment cost. |

Full Version Awaits

Ichor Porter's Five Forces Analysis

The document you see here is the complete Ichor Porter's Five Forces Analysis you will receive. This preview showcases the exact, professionally formatted document, so you know precisely what you're purchasing. Upon completing your transaction, you'll gain instant access to this comprehensive analysis, ready for immediate use without any surprises. This detailed report will equip you with the strategic insights needed to understand Ichor's competitive landscape.

Rivalry Among Competitors

The market for fluid delivery subsystems in semiconductor capital equipment is quite concentrated, with a handful of specialized companies, like Ichor, dominating. This means competition is intense as these established players battle for dominance.

The stakes are incredibly high in the semiconductor industry, pushing these companies to constantly innovate and secure market share. Their products are absolutely vital for the advanced manufacturing processes that define modern chip production.

For instance, in 2024, the global semiconductor capital equipment market was projected to reach over $100 billion, underscoring the significant value and competitive landscape Ichor operates within. Companies are fiercely competing for contracts that enable the production of cutting-edge semiconductors.

Ichor’s substantial investments in state-of-the-art manufacturing, research and development, and skilled personnel translate into high fixed costs. For instance, the semiconductor equipment industry, where Ichor operates, often involves significant capital expenditure on complex machinery and cleanroom facilities, creating a high cost base.

To offset these fixed costs and achieve profitability, Ichor must maintain high capacity utilization. This means keeping its advanced manufacturing lines running at or near their full potential.

When industry demand softens, this necessity for high utilization intensifies competitive rivalry. Companies like Ichor face pressure to secure orders, often leading to aggressive pricing strategies and a greater willingness to accept lower margins.

This dynamic was evident in 2024, a year marked by some cyclical slowdowns in certain segments of the semiconductor market, increasing the importance for manufacturers to aggressively compete for available business to maintain operational efficiency and profitability.

Competitive rivalry in the semiconductor manufacturing sector is intensely driven by a relentless pursuit of product differentiation and innovation. Companies are locked in a continuous race to develop next-generation solutions that meet increasingly stringent demands for ultra-purity, precision, and efficiency in chip production. This constant drive necessitates substantial investment in research and development, as firms strive to introduce superior products and maintain a competitive edge.

Global Market Reach and Geopolitical Factors

The semiconductor capital equipment market, where Ichor operates, is inherently global. Key customers and competitors are spread across major economic hubs like Asia-Pacific, North America, and Europe. This broad reach means competitive rivalry isn't confined to a single region, intensifying the need for companies to maintain a strong international presence and adapt to diverse market demands.

Geopolitical factors significantly shape this competitive landscape. Trade policies, export controls, and international relations can create both advantages and disadvantages for companies like Ichor. For instance, in 2023, the U.S. implemented stricter export controls on advanced semiconductor technology to China, impacting supply chains and market access for equipment manufacturers. This adds a crucial layer of complexity, as companies must navigate evolving international regulations to remain competitive and maintain their global market share.

- Global Customer Base: Major semiconductor manufacturers, Ichor's primary customers, are located worldwide, particularly in Taiwan, South Korea, and the United States.

- Regional Manufacturing Hubs: Asia-Pacific, especially Taiwan and South Korea, dominates semiconductor manufacturing, making it a critical market for capital equipment providers.

- Trade Policy Impact: In 2023, export restrictions imposed by the U.S. on advanced semiconductor technology to China highlighted how geopolitical tensions directly influence market access and competitive dynamics for equipment suppliers.

- Competitive Interdependence: Companies must consider the global positioning of their rivals and their ability to serve diverse international markets, often influenced by national industrial policies and trade agreements.

Customer Relationships and Service Excellence

Ichor's competitive strength is significantly bolstered by its deep-rooted relationships with major original equipment manufacturers (OEMs). These aren't just transactional ties; they are built on trust and consistent delivery of exceptional service, making it difficult for rivals to replicate.

Beyond product specifications, Ichor's commitment to being a turn-key partner, offering timely support and collaborating on custom solutions, creates substantial switching costs for its clients. This dedication to service excellence acts as a formidable barrier to entry for new competitors.

In 2023, Ichor reported that a substantial portion of its revenue came from its top customers, underscoring the importance of these long-standing partnerships. This loyalty is a direct result of their focus on customer relationships.

- Strong OEM Partnerships: Ichor has cultivated enduring relationships with key players in its target markets.

- Service as a Differentiator: Exceptional customer service, including timely support and custom solution development, sets Ichor apart.

- Turn-key Partner Approach: Ichor aims to be more than a supplier, acting as an integrated solutions provider for its clients.

- Customer Loyalty: The high retention rate among its major customers in 2023 highlights the success of its relationship-building strategy.

Competitive rivalry within the semiconductor capital equipment sector is exceptionally fierce, characterized by intense price competition and a constant drive for innovation. Companies must maintain high capacity utilization to offset significant fixed costs, often leading to aggressive strategies when demand fluctuates, as seen in 2024’s market dynamics. This environment necessitates substantial R&D investment to differentiate products and secure market share in a globalized industry influenced by geopolitical events and trade policies.

| Metric | 2023 Data | 2024 Projection/Trend |

|---|---|---|

| Global Semiconductor Capital Equipment Market Size | ~$90 billion (estimated) | Projected to exceed $100 billion |

| Ichor's Top Customer Revenue Share | Significant portion reported | Continued reliance on key partnerships |

| Rivalry Intensity | High | Elevated due to cyclical market conditions and geopolitical factors |

SSubstitutes Threaten

The threat of substitutes for critical fluid delivery subsystems in semiconductor manufacturing is notably low due to the absence of direct functional alternatives. These systems are engineered for unparalleled precision, purity, and reliability, essential for the highly sensitive processes involved in chip production. For instance, the ultra-high purity gas delivery systems used in advanced node fabrication, such as those enabling 3nm chip production, require specialized materials and engineering that simpler fluid handling solutions cannot replicate.

The stringent requirements of semiconductor fabrication, including the handling of corrosive chemicals and ultra-pure gases at precise flow rates, necessitate highly specialized equipment. Any deviation in purity or delivery accuracy can lead to significant yield loss, making functional substitutes that compromise these parameters unviable. The complexity and specificity of these applications mean that alternative product types, lacking the same rigorous design and material science, pose minimal threat.

In 2024, the semiconductor industry continued its investment in advanced manufacturing, with capital expenditures from major players like TSMC and Intel exceeding tens of billions of dollars, underscoring the critical nature of their specialized equipment. This ongoing investment reinforces the demand for highly engineered fluid delivery systems, as they are integral to achieving the performance and reliability required for cutting-edge semiconductor technologies.

The threat of substitutes for Ichor's specialized fluid delivery systems is primarily driven by potential advancements in semiconductor manufacturing processes rather than direct product replacements. For instance, the development of novel deposition or etching techniques could significantly alter the demand for existing fluid delivery components or even render certain systems obsolete. Consider the ongoing research into advanced materials and process integration that aims to streamline manufacturing steps, potentially reducing the number of fluid-dependent stages.

Original Equipment Manufacturers (OEMs) in the semiconductor capital equipment sector possess the capability to develop certain fluid delivery components or subsystems internally. This is a significant threat because it directly reduces the market available for specialized suppliers like Ichor. For instance, a major OEM might decide to bring the manufacturing of critical fluid manifolds in-house, bypassing the need to procure them externally.

This move by OEMs represents a form of backward integration, where they absorb functions previously outsourced. While not a direct substitute product, an OEM’s in-house development effectively replaces Ichor’s offering with an internally produced alternative. This can shrink Ichor's potential revenue streams by converting a customer purchase into an internal manufacturing operation.

Consider the substantial R&D budgets of leading semiconductor equipment manufacturers. Companies like ASML, with revenues exceeding €20 billion in 2023, have the financial muscle and technical expertise to explore in-house solutions for complex components. This capacity makes the threat of backward integration a tangible concern for suppliers in the ecosystem.

Alternative Materials or Chemical Formulations

The threat of substitutes for Ichor’s fluid delivery systems is notably influenced by advancements in alternative materials and chemical formulations. For instance, breakthroughs in materials science could yield new process chemistries or materials that utilize simpler delivery mechanisms, bypassing the need for Ichor's complex, high-purity systems. This presents an indirect substitution risk, potentially diminishing demand for Ichor's specialized offerings.

Consider the semiconductor industry, where Ichor primarily operates. The drive for cost reduction and simplified manufacturing processes is constant. If a new semiconductor fabrication method emerges that uses less sensitive chemicals or requires less stringent environmental control, the need for Ichor’s advanced gas and liquid delivery solutions could decrease. For example, the development of new dry etch processes or novel deposition techniques might reduce reliance on the ultra-high purity chemical delivery systems that are Ichor's core competency. In 2024, the semiconductor equipment market saw significant investment, with companies actively seeking innovations to improve efficiency and reduce costs.

- Potential for simpler delivery mechanisms: New materials or chemical processes might not require the precision and purity Ichor's systems provide.

- Cost reduction motive: Competitors or new technologies could offer cheaper alternatives if they simplify the fluid delivery process.

- Impact on Ichor's core business: A significant shift to alternative chemistries could directly reduce the demand for Ichor's specialized, high-margin equipment.

- Industry trends: The ongoing pursuit of manufacturing efficiency and cost-effectiveness in sectors like semiconductors fuels the search for such substitutions.

Obsolescence Due to Technological Advancements

The semiconductor industry is a hotbed of innovation, and this pace directly impacts Ichor's fluid delivery systems. Rapid technological advancements mean that systems designed today could be outdated tomorrow if they can't keep up with new process demands or integrate with the latest equipment. For instance, the increasing complexity of chip manufacturing, requiring finer precision and new material handling, could render older systems incapable of meeting these evolving needs.

This threat isn't about a direct substitute product but rather the risk of obsolescence. If Ichor doesn't continuously innovate and adapt its fluid delivery solutions to align with industry shifts, its current offerings could become irrelevant. Consider the shift towards advanced node technologies; fluid delivery systems must be able to handle new chemistries and higher purity requirements, a challenge that older designs might not overcome.

The market for semiconductor manufacturing equipment is highly dynamic. In 2024, companies are heavily investing in R&D to support next-generation lithography and etching processes. For example, the push for sub-3nm process nodes necessitates fluid delivery systems with unparalleled accuracy and contamination control. Failure to meet these stringent requirements means Ichor's products could be bypassed by competitors offering more advanced solutions.

- Technological Obsolescence: Fluid delivery systems risk becoming outdated as chip manufacturing processes evolve.

- Integration Challenges: Inability to integrate with next-generation semiconductor equipment poses a significant threat.

- Market Evolution: Competitors offering advanced, compliant solutions can displace Ichor if innovation falters.

- R&D Investment: The high R&D spend in semiconductors means rapid obsolescence is a constant concern for equipment suppliers.

The threat of substitutes for highly specialized fluid delivery systems in semiconductor manufacturing remains low. These systems are critical for maintaining ultra-high purity and precise flow control, factors that simpler alternatives cannot match without compromising chip yields. For instance, the extreme purity demands for depositing thin films in 2024’s advanced node manufacturing necessitate materials and designs far beyond standard fluid handling.

The industry’s reliance on sophisticated processes, such as those involving corrosive gases or novel chemistries for sub-5nm chip production, creates a high barrier for substitutes. Any deviation in purity or flow accuracy can lead to significant manufacturing defects, making unproven or less specialized alternatives a substantial risk. This inherent complexity ensures that only highly engineered solutions, like those Ichor provides, are viable.

The ongoing demand for advanced semiconductor manufacturing, evidenced by capital expenditures exceeding $100 billion globally in 2024, reinforces the need for these specialized fluid delivery systems. Companies like TSMC continue to invest billions in new fabrication facilities, driving the requirement for the precision and reliability that Ichor's technology offers.

Entrants Threaten

Entering the critical fluid delivery subsystems market for semiconductor capital equipment demands an immense capital outlay. Companies need to invest heavily in state-of-the-art manufacturing facilities, precision machinery, and highly controlled cleanroom environments, which are crucial for producing high-purity components. For instance, establishing a new semiconductor fabrication plant can cost billions of dollars, and the specialized equipment required for fluid delivery systems contributes significantly to this figure. This high barrier to entry deters many potential new players from even attempting to compete.

New entrants must overcome the significant hurdle of developing proprietary technologies and amassing extensive expertise in critical areas such as fluid dynamics, materials science, and the highly specialized field of ultra-high-purity manufacturing. This requires substantial investment in research and development, often spanning many years and considerable capital outlay.

The intellectual property and accumulated know-how possessed by incumbent firms like Ichor, which has a long history of innovation in semiconductor fluid handling, serve as a powerful barrier. For instance, Ichor's continuous investment in R&D, which forms a core part of their competitive strategy, means potential entrants face a moving target and a high bar for entry in terms of technological sophistication and process efficiency.

The semiconductor industry faces a significant barrier to entry due to extremely strict regulatory compliance and quality standards. New players must meticulously adhere to rigorous purity, safety, and performance benchmarks. For instance, qualifying to supply major original equipment manufacturers (OEMs) like Apple or Intel involves extensive, multi-year testing and validation processes that can cost millions of dollars.

Navigating this complex web of certifications and qualification procedures presents a substantial hurdle for potential entrants. The time and capital investment required to meet these exacting demands, coupled with the need for specialized manufacturing facilities and highly skilled personnel, effectively limits the number of new companies that can realistically enter the market.

Established Customer Relationships and Trust

Established customer relationships represent a significant barrier for new entrants in the semiconductor capital equipment market. Ichor and its key competitors have cultivated deep, multi-year partnerships with major Original Equipment Manufacturers (OEMs) in the semiconductor industry. These relationships are built on trust and extensive collaboration, often extending to joint product development initiatives. For instance, major players like Applied Materials and ASML have long-standing ties with their customer base, making it difficult for newcomers to establish a foothold.

Gaining the confidence of risk-averse customers in this sector is a formidable challenge for any new entrant. The semiconductor manufacturing process relies heavily on precision and reliability, meaning OEMs are hesitant to switch suppliers unless there's a compelling technological or cost advantage. This entrenched loyalty means new companies must offer a demonstrably superior product or a significantly lower price point to even be considered.

- Long-term Contracts: Many existing relationships are formalized through multi-year supply agreements, locking in incumbent suppliers and limiting opportunities for new entrants.

- Collaborative Development: Deep integration into OEM product roadmaps through joint development makes it harder for new players to offer comparable solutions without extensive R&D investment and time.

- Trust and Reliability: The high-stakes nature of semiconductor manufacturing demands proven reliability, which new entrants lack compared to established, trusted suppliers.

- Switching Costs: OEMs face substantial costs and risks associated with qualifying new equipment and integrating it into their complex manufacturing lines.

Economies of Scale and Experience Curve

New entrants face a significant hurdle due to established players’ formidable economies of scale. In 2024, major semiconductor manufacturers, for instance, continued to leverage massive production volumes, enabling them to negotiate lower raw material costs and spread R&D expenses across a wider output. This cost advantage makes it exceptionally difficult for newcomers to match pricing and achieve comparable profit margins.

The experience curve further solidifies the position of incumbents. Years of operational refinement and process optimization in complex industries mean existing firms have honed their manufacturing techniques and supply chain efficiencies. A new entrant would need substantial time and investment to traverse this learning curve, a process that inherently carries higher initial costs and risks compared to experienced players.

- Economies of Scale: Companies like TSMC, a leader in semiconductor manufacturing, benefit from colossal production volumes, allowing them to drive down per-unit costs in 2024.

- Procurement Advantages: Large-scale buyers can secure better deals on essential materials, a significant factor in industries with high input costs.

- R&D Investment Leverage: Established firms can amortize substantial R&D expenditures over a larger installed base, making innovation more cost-effective.

- Experience Curve Benefits: In sectors like aerospace or advanced manufacturing, accumulated operational knowledge leads to higher yields and reduced waste, a competitive edge for incumbents.

The threat of new entrants into the critical fluid delivery subsystems market for semiconductor capital equipment remains low due to substantial barriers. These include immense capital requirements for specialized facilities, the need for proprietary technology and deep expertise, and the formidable challenge of meeting stringent regulatory and quality standards. Established customer relationships and significant economies of scale enjoyed by incumbents like Ichor further solidify this position.

Porter's Five Forces Analysis Data Sources

Our Ichor Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings to capture the competitive landscape.