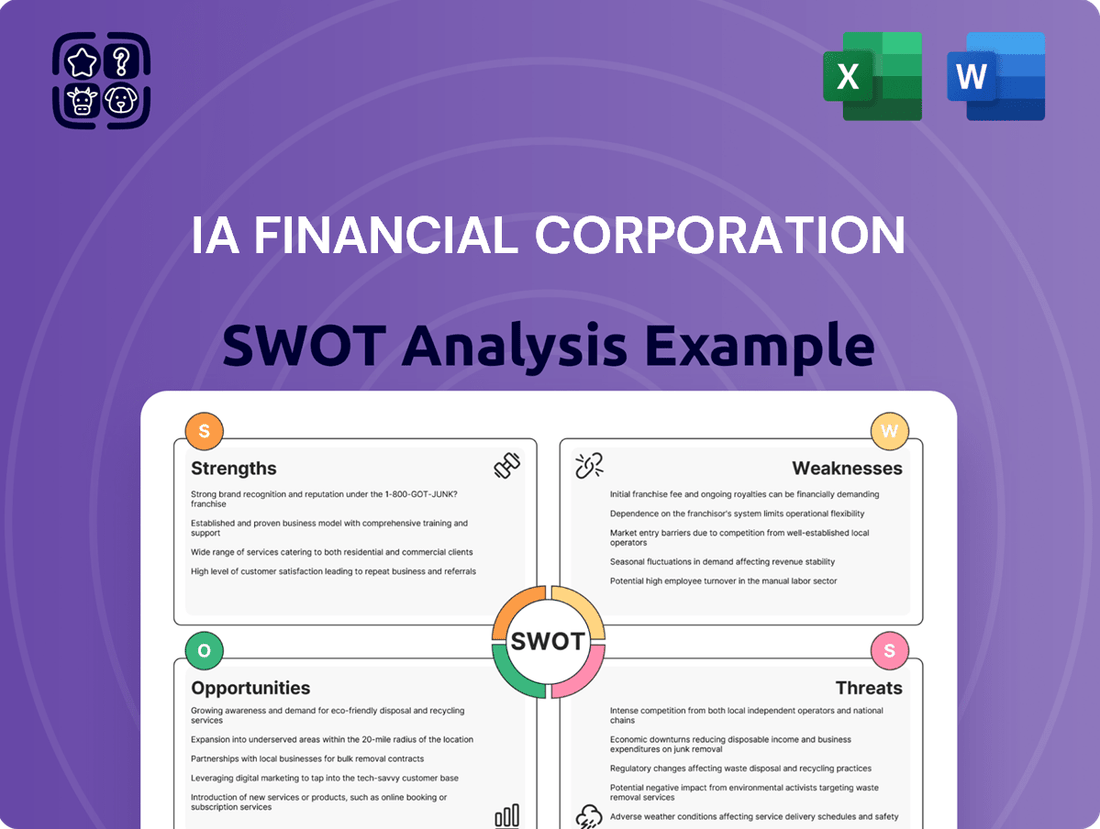

iA Financial Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iA Financial Corporation Bundle

iA Financial Corporation demonstrates robust strengths in its diversified product offerings and strong brand recognition, but faces challenges from evolving regulatory landscapes and increasing competition. Understanding these internal capabilities and external market forces is crucial for strategic planning.

Want the full story behind iA Financial Corporation’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

iA Financial Corporation boasts a robust and diversified product portfolio, spanning both life and health insurance and a wide array of wealth management services. This includes everything from individual and group insurance policies to savings plans, retirement solutions, mutual funds, and securities. This broad offering allows the company to serve a diverse clientele and tap into multiple revenue streams, reducing reliance on any single market segment.

The strategic advantage of this diversification was evident in the company's performance through 2024 and into the first quarter of 2025. Strong sales momentum was observed across almost all of iA Financial Corporation's business units during this period. This widespread success underscores the market's positive reception to its comprehensive suite of financial products and services.

iA Financial Corporation has showcased impressive financial results, with core diluted earnings per common share (EPS) experiencing substantial growth. In the first quarter of 2025, this metric saw a 19% increase compared to the previous year. This strong performance is further underscored by a trailing 12-month core return on equity (ROE) of 16.1%, putting the company on track to achieve its 2027 target of 17% or higher.

The company's capital position is equally robust, as evidenced by its solvency ratio. As of March 31, 2025, this ratio stood at a healthy 132%. This figure significantly exceeds regulatory minimums, demonstrating a solid foundation of capital that supports both current operations and future expansion initiatives, providing a key strength for the organization.

iA Financial Corporation demonstrates significant strength through its leadership in key Canadian market segments, notably holding the top position in segregated fund sales for both gross and net figures. This dominance underscores its robust product offerings and effective distribution channels within Canada.

Further bolstering its competitive edge, iA Financial's U.S. operations are experiencing notable expansion. In the first quarter of 2025, the company reported a substantial increase in individual insurance sales, signaling successful market penetration and growth in its international endeavors.

Strategic Acquisitions and Growth Initiatives

iA Financial Corporation demonstrates a strong growth trajectory through its commitment to strategic acquisitions. This approach allows the company to broaden its market presence and enrich its product and service portfolio.

A prime example of this strategy is the planned acquisition of RF Capital Group Inc., announced in July 2025. This move is set to significantly bolster iA Wealth's standing within the Canadian independent wealth management sector.

- Market Expansion: The acquisition of RF Capital Group Inc. is expected to add over $40 billion in assets under administration to iA Wealth.

- Diversification of Offerings: This strategic integration aims to enhance iA Wealth's competitive edge by expanding its service capabilities.

- Synergistic Growth: Combined with ongoing organic growth efforts, these acquisitions are fundamental to iA Financial Corporation's overarching expansion strategy.

Commitment to Sustainability and ESG

iA Financial Group demonstrates a robust commitment to Environmental, Social, and Governance (ESG) principles, as detailed in their 2024 Sustainability Report. The company has actively pursued reductions in carbon emissions across its real estate and investment holdings, alongside enhancing diversity and inclusion programs. This dedication to sustainability resonates with increasing stakeholder demands and bolsters the company's long-term resilience and public image.

Key ESG achievements and initiatives include:

- Carbon Emission Reduction: Progress made in lowering the carbon footprint of its property portfolio.

- Diversity and Inclusion: Expansion of initiatives aimed at fostering a more diverse and inclusive workforce.

- Sustainable Investments: Integration of ESG factors into investment strategies to promote responsible growth.

- Stakeholder Alignment: Meeting and exceeding evolving expectations from investors and the broader community regarding corporate responsibility.

iA Financial Corporation's diversified product suite, encompassing insurance and wealth management, provides a significant competitive advantage. This breadth allows the company to cater to a wide customer base and generate multiple revenue streams, as demonstrated by strong sales across most business units in early 2025.

The company's financial health is a key strength, highlighted by a 19% year-over-year increase in core diluted EPS in Q1 2025 and a trailing 12-month core ROE of 16.1%. Furthermore, a solvency ratio of 132% as of March 31, 2025, indicates a robust capital position exceeding regulatory requirements.

iA Financial's market leadership in Canada, particularly in segregated fund sales, is a notable strength. This is complemented by successful expansion in its U.S. operations, with significant growth in individual insurance sales reported in Q1 2025.

Strategic acquisitions, such as the planned integration of RF Capital Group Inc. in July 2025, are poised to further enhance iA Financial's market presence and service offerings, adding over $40 billion in assets under administration to iA Wealth.

What is included in the product

Analyzes iA Financial Corporation’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear identification of iA Financial Corporation's competitive advantages and areas for improvement, directly addressing the pain point of strategic uncertainty.

Weaknesses

iA Financial Corporation saw a dip in its reported net income for common shareholders in the first quarter of 2025, even as its underlying business performed well. This $245 million reported net income in Q1 2025 compares to $270 million in Q1 2024, indicating a notable decrease.

This difference between core earnings and the reported figure suggests that factors outside of the company's main operations, such as investment fluctuations or one-time charges, are impacting the bottom line.

While iA Financial Corporation's solvency ratio remains strong, it saw a dip from 142% in the first quarter of 2024 to 132% in the first quarter of 2025. This reduction is linked to capital management and deployment initiatives, including acquisitions and share repurchases.

This shift suggests a potentially more aggressive approach to deploying capital. If this strategy isn't carefully balanced, it could lead to a decrease in the company's financial flexibility moving forward.

iA Financial Corporation, like many in the financial services sector, faces ongoing challenges from market volatility and shifts in broader economic conditions. Fluctuations in interest rates and the performance of credit markets can directly impact profitability.

While iA Financial reported an improved net investment result in the first quarter of 2025, this segment's performance is inherently tied to market stability. Persistent instability could erode investment gains and put pressure on the company's overall financial health, as seen in previous periods of heightened economic uncertainty.

Integration Risks of Acquisitions

iA Financial Corporation’s strategy heavily relies on growth through acquisitions, a path that inherently introduces integration risks. The recent agreement to acquire RF Capital Group, for instance, highlights this. Successfully merging diverse operations, distinct corporate cultures, and varied technology platforms is a complex undertaking. Failure to do so can jeopardize the expected synergies and the positive financial impact of the deal.

Key challenges in these integrations include:

- Cultural Clashes: Merging different organizational mindsets and employee expectations can lead to friction and reduced productivity.

- Technology Integration: Combining disparate IT systems is often costly and time-consuming, with potential for operational disruptions.

- Talent Retention: Keeping key personnel, particularly advisors and client-facing staff, is critical for maintaining business momentum and client relationships post-acquisition.

- Client Transition: Ensuring a smooth transition for clients of the acquired entity, minimizing disruption and maintaining service levels, is paramount to realizing value.

Competition in the Financial Services Sector

iA Financial Corporation faces intense rivalry in the financial services industry, contending with established large banks and other prominent insurance and wealth management firms across Canada and the U.S. This crowded market demands constant adaptation and differentiation to secure and expand its customer base.

The need for continuous innovation, attractive pricing, and robust client engagement presents a significant hurdle in this saturated environment. For instance, in the Canadian insurance market, competition is fierce, with major players like Manulife, Sun Life, and Canada Life vying for market share. iA Financial's ability to stand out hinges on its strategic responses to these competitive pressures.

- Intense Competition: iA Financial competes with major Canadian banks (e.g., RBC, TD, Scotiabank) offering a wide range of financial products, alongside specialized insurance and wealth management firms.

- Market Saturation: The Canadian and U.S. markets are mature, making it difficult to gain significant new market share without substantial investment in marketing, product development, and client retention strategies.

- Price Sensitivity: In many segments, particularly insurance, clients are price-sensitive, forcing iA Financial to balance competitive pricing with profitability.

- Innovation Demands: Competitors are actively investing in digital transformation and new product offerings, requiring iA Financial to keep pace to avoid falling behind.

iA Financial Corporation's reliance on acquisitions, such as the RF Capital Group deal, introduces significant integration risks. Challenges like cultural clashes, technology integration, and talent retention could hinder expected synergies and financial benefits. Successfully merging operations and client bases is crucial to realizing the value of these strategic moves.

The company operates in a highly competitive landscape, facing pressure from large Canadian banks and established insurance and wealth management firms. Market saturation in Canada and the U.S. necessitates substantial investment in differentiation, product innovation, and client retention to maintain and grow market share.

Market volatility and economic shifts pose ongoing threats, directly impacting profitability through interest rate fluctuations and credit market performance. While iA Financial reported an improved net investment result in Q1 2025, sustained instability could erode these gains.

Full Version Awaits

iA Financial Corporation SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into the strategic assessment of iA Financial Corporation.

Purchase unlocks the entire in-depth version, providing a comprehensive understanding of iA Financial Corporation's internal and external factors.

Opportunities

iA Financial Corporation has shown impressive momentum in the U.S. market, evidenced by robust year-over-year sales increases in both its Individual Insurance and Dealer Services segments. This sustained performance underscores the potential for further expansion.

Strategic investments and a continued focus on growing its U.S. footprint offer a clear avenue for iA Financial to boost overall revenue and reduce its reliance on any single geographic region. The company's own investor communications frequently point to the U.S. as a critical engine for future growth, signaling a deliberate strategy to capitalize on this opportunity.

The wealth management sector, especially for high-net-worth individuals, presents a significant opportunity for iA Financial Corporation. Segregated funds have seen remarkable growth, with iA Financial achieving record sales and securing the top spot in Canada for this product category.

The strategic acquisition of RF Capital Group is a key move to bolster iA Wealth's standing within the high-net-worth market. This acquisition is projected to substantially increase assets under administration and generate more fee income, directly capitalizing on this growth trend.

Leveraging digital transformation is a key opportunity for iA Financial Corporation. By investing in and utilizing advanced digital tools, the company can significantly improve how it serves its clients, making interactions smoother and more personalized. This focus on a best-in-class digital experience is crucial for staying competitive.

Streamlining operations through technology offers substantial efficiency gains. iA Financial's commitment to simplifying processes via digital solutions not only cuts costs but also frees up resources, allowing for greater investment in growth initiatives. This strategic use of technology can unlock new avenues for expansion in the evolving financial market.

Strategic Partnerships and Distribution Network Enhancement

iA Financial Corporation can significantly boost its market presence by expanding and fortifying its distribution channels. Strategic alliances with other financial entities and the continued cultivation of its distinct brand identities, such as Richardson Wealth, Investia, and iA Wealth, are key to this expansion. This multi-pronged strategy is designed to draw in a greater number of independent financial advisors and tap into previously unreached client demographics.

By offering advisors the flexibility to select business models that align with their individual working styles and client engagement philosophies, iA Financial Corporation can foster a more robust and diverse advisory network. This commitment to advisor choice is projected to enhance overall recruitment and retention within the advisory force.

- Distribution Network Growth: iA Financial Corporation aims to broaden its reach by forging new strategic partnerships.

- Brand Channel Strength: Maintaining and developing distinct channels like Richardson Wealth, Investia, and iA Wealth is crucial for attracting advisors and clients.

- Advisor Flexibility: Empowering advisors with choices in business models can lead to a larger and more engaged advisory network.

- Market Penetration: These efforts are expected to open doors to new client segments, increasing overall market share.

Capital Deployment for Further Acquisitions and Investments

iA Financial Corporation's robust capital position, as evidenced by its strong solvency ratios and available liquidity, presents a significant opportunity for strategic expansion. The company's capacity to deploy capital effectively allows for the pursuit of accretive acquisitions and targeted investments, potentially accelerating market share growth and enhancing business diversification. For instance, with a reported Common Equity Tier 1 (CET1) ratio consistently above regulatory minimums, iA Financial is well-positioned to finance such strategic moves.

This financial flexibility directly translates into the ability to execute inorganic growth strategies, which can be faster and more impactful than organic growth alone. By strategically deploying capital, iA Financial can enter new markets, acquire complementary businesses, or invest in innovative technologies, thereby solidifying its competitive advantage.

- Capital Deployment Capacity: iA Financial possesses substantial capital reserves and a flexible balance sheet, enabling strategic acquisitions and investments.

- Accelerated Growth: The ability to deploy capital for inorganic growth can expedite market share expansion and business diversification efforts.

- Strategic Advantage: Pursuing acquisitions and investments allows iA Financial to enhance its competitive positioning and explore new revenue streams.

iA Financial Corporation's strong performance in the U.S. market, particularly in Individual Insurance and Dealer Services, offers significant potential for continued expansion and revenue growth. The company's strategic focus on the U.S. as a key growth engine is a deliberate strategy to diversify its geographic footprint and capitalize on market opportunities.

The wealth management sector, especially catering to high-net-worth individuals, represents a substantial growth avenue. iA Financial's record sales in segregated funds and its top Canadian position in this category, bolstered by the acquisition of RF Capital Group, directly leverage this trend by increasing assets under administration and fee income.

Digital transformation is a critical opportunity, enabling iA Financial to enhance client service through smoother, more personalized interactions and streamline operations for efficiency gains. This focus on a superior digital experience is vital for maintaining a competitive edge and unlocking new expansion avenues.

Expanding and strengthening distribution channels through strategic alliances and distinct brand identities like Richardson Wealth, Investia, and iA Wealth is key to reaching new client segments and advisors. Offering advisors flexibility in business models further cultivates a diverse and engaged advisory network, driving recruitment and retention.

iA Financial's robust capital position, demonstrated by strong solvency ratios and liquidity, empowers strategic expansion through accretive acquisitions and targeted investments. This financial flexibility allows for accelerated market share growth and business diversification, enhancing its competitive advantage.

Threats

The financial services sector faces increasingly rigorous oversight, with Canada and the U.S. consistently updating their regulatory frameworks. For iA Financial Corporation, this means navigating a complex landscape where new rules can translate directly into higher operational expenses and the need for more sophisticated compliance systems.

For instance, changes to capital adequacy rules, like those proposed or enacted in 2024 impacting solvency ratios, could necessitate iA Financial holding more capital, potentially affecting its return on equity. Similarly, evolving consumer protection legislation, such as enhanced disclosure requirements for investment products, adds to administrative burdens and the cost of doing business.

iA Financial Corporation faces significant risks from adverse economic conditions. For instance, a potential recession in 2024 or 2025 could lead to a decline in asset values within its investment portfolios, impacting profitability. High inflation also erodes the real value of assets and can dampen consumer spending on financial products.

Furthermore, market downturns directly affect the demand for wealth management services as clients become more risk-averse. Geopolitical tensions, such as ongoing conflicts or trade disputes, can exacerbate economic instability, creating a challenging operating environment for iA Financial throughout 2024 and into 2025.

Interest rate volatility presents a significant challenge for iA Financial Corporation. Rapid and unpredictable shifts in interest rates can negatively affect the company's profitability, particularly impacting its insurance product margins and the market value of its substantial fixed-income investment portfolio. For instance, a sharp increase in rates could devalue existing bond holdings, while prolonged low rates might compress the yield on new investments, both scenarios impacting earnings.

Cybersecurity Risks and Data Breaches

As a financial services firm, iA Financial Corporation is constantly exposed to cybersecurity risks, including the potential for data breaches. Protecting sensitive client information is paramount, and any compromise could have severe repercussions.

A successful cyberattack could result in substantial financial losses for iA Financial, not only from direct theft but also from the costs associated with incident response, remediation, and potential legal liabilities. For instance, the average cost of a data breach in the financial sector in 2024 was estimated to be around $5.72 million, according to IBM's Cost of a Data Breach Report. This figure highlights the significant financial exposure.

Beyond financial penalties, a data breach can cause severe reputational damage, leading to a loss of client trust and potentially impacting customer retention and acquisition efforts. In 2024, over 60% of consumers indicated they would stop doing business with a company after a data breach. Furthermore, regulatory bodies often impose hefty fines for non-compliance with data protection laws, adding another layer of financial and operational threat.

- Cybersecurity Threats: iA Financial must continually invest in robust security measures to defend against evolving cyber threats.

- Data Breach Impact: A breach could lead to significant financial losses, estimated in the millions for financial institutions.

- Reputational Damage: Loss of client trust post-breach can deter new business and alienate existing customers.

- Regulatory Penalties: Non-compliance with data protection regulations can result in substantial fines.

Competitive Pressure and Disruption from Fintech

The financial services industry is experiencing significant disruption from fintech companies and innovative startups. These agile, tech-focused players are introducing new solutions that challenge traditional models, potentially drawing customers away from established institutions like iA Financial. This competitive pressure necessitates continuous innovation and adaptation to remain relevant in the evolving market landscape.

Fintech advancements, particularly in areas like digital onboarding, personalized financial advice, and streamlined payment systems, are setting new customer expectations. For instance, by Q1 2024, the global fintech market was valued at over $2.5 trillion, demonstrating the scale of this transformation. iA Financial must actively invest in and integrate similar technologies to counter this threat and maintain its market share.

- Agile Competitors Fintech startups often operate with lower overheads and a greater capacity for rapid product development compared to larger, incumbent institutions.

- Customer Expectations The user experience offered by fintechs, characterized by seamless digital interactions, is increasingly becoming the benchmark for all financial service providers.

- Market Share Erosion Failure to adapt to technological shifts could lead to a gradual loss of market share as customers opt for more modern and convenient digital solutions.

iA Financial Corporation faces intense competition from agile fintech companies that are setting new customer experience standards. The rapid growth of the fintech sector, valued at over $2.5 trillion globally by early 2024, highlights the disruptive potential. Failure to innovate and integrate similar technologies could lead to market share erosion as consumers gravitate towards more user-friendly digital solutions.

SWOT Analysis Data Sources

This analysis draws from iA Financial Corporation's official financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate SWOT assessment.