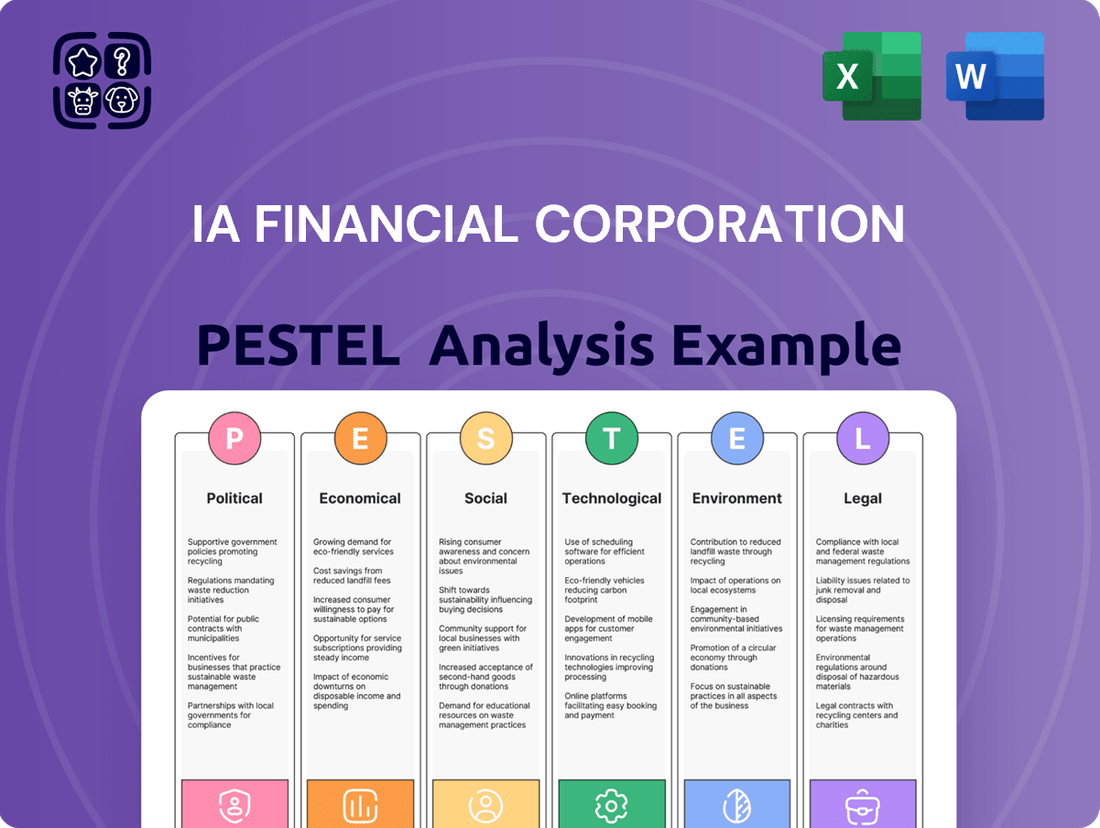

iA Financial Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iA Financial Corporation Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping iA Financial Corporation's trajectory. This comprehensive PESTLE analysis provides the strategic foresight needed to navigate a dynamic market. Gain a competitive edge by understanding these external forces. Download the full version now for actionable intelligence.

Political factors

iA Financial Corporation navigates a complex web of government regulations in both Canada and the United States. For instance, in Canada, the Office of the Superintendent of Financial Institutions (OSFI) sets stringent capital adequacy requirements, which directly influence how iA Financial Corporation manages its balance sheet and product development. These rules are designed to safeguard policyholders and ensure the overall health of the financial system.

Changes to these regulatory frameworks, such as updates to solvency rules or consumer protection laws, can significantly alter iA Financial Corporation's operational costs and strategic direction. For example, new data privacy regulations introduced in 2024 across various North American jurisdictions necessitate ongoing investment in compliance and security measures, impacting how the company handles customer information.

Changes to corporate tax rates directly impact iA Financial Corporation's bottom line, particularly concerning its insurance premiums and investment earnings. For instance, if the Canadian federal corporate tax rate were to increase, iA Financial would see a reduction in its net income unless it could offset the impact through other means.

The implementation of new tax frameworks, such as Canada's adoption of the Global Minimum Tax Act in line with the OECD's Pillar Two, necessitates significant adjustments in how iA Financial collects and reports its financial data. This ensures compliance with international standards and can influence how the company structures its global operations and tax liabilities.

Trade agreements and geopolitical tensions significantly shape iA Financial Corporation's cross-border activities. With operations in both Canada and the United States, changes in trade policies or international relations directly affect its investment strategies and operational efficiency.

For example, potential shifts in trade agreements could introduce new complexities for iA Financial. The company's Q1 2025 report highlighted that uncertainties surrounding tariffs could indeed impact its projected business growth, underscoring the sensitivity of its financial performance to these international dynamics.

Government Spending and Fiscal Policy

Government fiscal policies, particularly spending on social programs and economic stimulus measures, directly impact consumer disposable income, thereby influencing demand for iA Financial Corporation's insurance and wealth management products. For instance, increased government spending on healthcare or retirement support could free up personal finances for other financial products. Canada's federal budget for 2024 projected significant spending, aiming to stimulate economic growth and support key sectors, which could indirectly benefit the financial services industry.

Changes in government debt management and the overall economic stability fostered by fiscal policy have a ripple effect on the financial markets where iA Financial operates. A stable fiscal environment generally leads to more predictable market conditions, benefiting investment portfolios and the company's asset management divisions. The Bank of Canada's monetary policy, closely tied to fiscal decisions, also plays a crucial role in interest rate environments, affecting product pricing and investment returns.

- Government Spending Trends: Canada's federal government expenditure was projected to be around $450 billion for the fiscal year 2023-2024, with a focus on social infrastructure and economic development initiatives.

- Fiscal Deficit Management: Monitoring the government's approach to managing its deficit and debt levels is crucial, as this influences market confidence and interest rate stability.

- Stimulus Impact: Economic stimulus programs, if implemented, can boost consumer spending power, potentially increasing uptake of life insurance and investment products.

- Regulatory Environment: Fiscal policies often intertwine with financial regulations, affecting how iA Financial structures its products and manages its capital.

Political Stability and Policy Certainty

Political stability and predictable policy frameworks are vital for iA Financial Corporation's long-term strategic planning and investment decisions. For instance, Canada, where iA Financial operates, consistently ranks high in global political stability indices, fostering a reliable environment for financial institutions. In 2024, Canada's political landscape remained largely stable, with established regulatory bodies overseeing the financial sector, providing a degree of policy certainty.

However, any significant political instability or abrupt policy changes, such as shifts in taxation or regulatory oversight, can introduce considerable uncertainty. Such events can dampen investor confidence, potentially affecting iA Financial Corporation's market valuation and its ability to execute long-term growth strategies. For example, unexpected changes in capital gains tax policies could directly impact the profitability of investment products offered by iA Financial.

- Political Stability: Canada's consistent ranking in global stability reports provides a foundation for predictable business operations.

- Policy Certainty: Established regulatory frameworks, like those from the Office of the Superintendent of Financial Institutions (OSFI), offer clarity for financial planning.

- Impact of Instability: Sudden policy shifts can create market volatility, affecting investor sentiment and iA Financial's strategic agility.

- Regulatory Environment: The evolving regulatory landscape, including data privacy laws and capital requirements, demands continuous adaptation by iA Financial.

Government regulations significantly shape iA Financial Corporation's operations, with entities like OSFI in Canada imposing strict capital adequacy rules. New data privacy laws enacted in 2024 across North America require ongoing compliance investments, impacting how customer data is handled.

Changes in corporate tax rates, such as potential increases, directly affect iA Financial's net income. Furthermore, international tax frameworks like Canada's adoption of the Global Minimum Tax Act necessitate adjustments in financial reporting and operational structuring.

Geopolitical shifts and trade agreement modifications influence iA Financial's cross-border investments and operational efficiency. The company's Q1 2025 report indicated that tariff uncertainties could indeed impact projected business growth.

Government fiscal policies, including spending on social programs and economic stimulus, influence consumer disposable income and demand for iA Financial's products. Canada's 2024 federal budget aimed to stimulate economic growth, potentially benefiting the financial services sector.

| Factor | Impact on iA Financial | Data/Example |

|---|---|---|

| Regulatory Compliance | Increased operational costs and product development adjustments | New data privacy laws enacted in 2024 |

| Taxation | Direct impact on profitability and net income | Potential changes in corporate tax rates, Global Minimum Tax Act adoption |

| Trade & Geopolitics | Influence on investment strategies and growth projections | Q1 2025 report noted tariff uncertainties impacting growth |

| Fiscal Policy | Affects consumer spending and demand for financial products | Canada's 2024 federal budget focused on economic stimulus |

What is included in the product

This PESTLE analysis of iA Financial Corporation examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive understanding of the external landscape, identifying potential risks and opportunities for iA Financial Corporation's growth and sustainability.

This PESTLE analysis for iA Financial Corporation offers a visually segmented breakdown by category, acting as a pain point reliever by enabling quick interpretation of external factors for strategic decision-making.

Economic factors

Interest rate fluctuations significantly shape the landscape for life and health insurers, including iA Financial Corporation. Historically, periods of declining rates presented challenges, impacting certain product sales. However, recent data indicates a positive shift, with a notable rebound in fixed universal life sales, and projections suggest this growth trajectory will continue through 2024 and into 2025.

These shifts directly influence iA Financial Corporation's investment returns, as insurers rely on these returns to meet policyholder obligations and generate profits. Furthermore, interest rate movements are a key determinant in product pricing strategies, affecting the competitiveness and profitability of iA Financial Corporation's offerings in the evolving market.

Inflation directly impacts iA Financial Corporation by affecting consumer purchasing power and the cost of claims. While inflation has shown signs of stabilization, hovering around 3% in recent periods, the insurance sector, particularly property insurance, remains sensitive to rising construction costs, which are a key factor in underwriting and pricing strategies.

The persistent concern over inflation, even at moderated levels, means that iA Financial must carefully consider its implications for the long-term value of financial products. For instance, high inflation can significantly erode the real returns on savings and retirement plans that the company offers, potentially impacting customer satisfaction and the attractiveness of these offerings in the market.

A healthy economy fuels consumer confidence, directly boosting demand for financial services like insurance and wealth management. iA Financial Corporation experienced this firsthand in Q1 2025, reporting strong sales momentum.

This robust performance translated into significant growth for iA Financial, with premiums and deposits increasing by 8% year-over-year, reaching $15.2 billion by the end of the quarter. Assets under management and administration also saw a healthy uptick, climbing 6% to $125.5 billion, reflecting greater consumer engagement with financial products.

Employment Rates and Wage Growth

High employment rates and steady wage growth are positive indicators for iA Financial Corporation. As more people are employed and earning more, they have greater disposable income. This directly translates to increased demand for financial products like insurance and wealth management services, as individuals and families have more capacity to save and invest.

A robust job market is crucial for expanding iA Financial's customer base. For instance, in Canada, the unemployment rate remained low, hovering around 5.8% in early 2024, and wage growth showed signs of picking up, with average weekly earnings increasing by approximately 3.5% year-over-year by the end of 2023. This economic environment supports iA Financial's growth strategies by providing a larger pool of potential clients with the financial means to purchase their offerings.

- Increased Disposable Income: Higher employment and wages mean more money available for insurance premiums and investments.

- Expanded Customer Base: A healthy job market allows iA Financial to attract and retain more clients.

- Demand for Protection: As incomes rise, individuals are more likely to seek life, disability, and critical illness insurance.

- Wealth Accumulation: Growing wages facilitate greater participation in retirement savings plans and investment products.

Capital Market Performance

The performance of equity and bond markets significantly impacts iA Financial Corporation's investment portfolio and its wealth management operations. For instance, in 2024, major equity indices like the S&P 500 saw substantial gains, and bond yields, while fluctuating, offered opportunities. This environment directly affects iA Financial's assets under management and administration, boosting its fee-based income streams.

Positive market trends in 2024, such as continued economic growth and manageable inflation in key markets, generally translate to higher asset values. This can lead to increased revenue for iA Financial through management fees and a greater volume of assets to administer. Conversely, market downturns can negatively impact these figures.

- Equity Market Performance: In 2024, the S&P 500 index experienced a notable upward trend, reflecting investor confidence and corporate earnings growth.

- Bond Market Performance: Bond yields saw shifts throughout 2024, influenced by central bank policies and inflation expectations, presenting varied opportunities for fixed-income investments.

- Impact on Assets Under Management: Favorable market conditions in 2024 contributed to an increase in assets under management for financial institutions, including iA Financial Corporation.

- Fee-Based Income: Higher assets under management directly correlate with increased fee-based income for wealth management services offered by companies like iA Financial.

Economic factors significantly influence iA Financial Corporation's performance, with interest rate changes directly impacting investment returns and product pricing. Inflation, even at moderated levels around 3% as seen in recent periods, affects consumer purchasing power and claim costs, particularly for property insurance due to rising construction expenses. A healthy economy with high employment and steady wage growth, as evidenced by Canada's low unemployment rate around 5.8% in early 2024 and wage growth of approximately 3.5% year-over-year by late 2023, boosts demand for financial services and expands iA Financial's client base.

Equity and bond market performance in 2024, with the S&P 500 showing substantial gains and bond yields fluctuating, directly impacts iA Financial's assets under management and fee-based income. Positive market trends in 2024 generally lead to higher asset values, enhancing revenue from management fees, although downturns pose risks.

| Economic Factor | Impact on iA Financial | Supporting Data (2024-2025) |

| Interest Rates | Affects investment returns, product pricing, and sales (e.g., fixed universal life sales rebound). | Projections indicate continued growth in fixed universal life sales through 2024-2025. |

| Inflation | Impacts purchasing power, claim costs, and real returns on savings products. | Inflation stabilized around 3%; construction costs remain a concern for property insurance. |

| Economic Growth & Employment | Drives demand for financial services and expands customer base. | Q1 2025 saw strong sales momentum; premiums and deposits grew 8% YoY to $15.2 billion. Canada's unemployment rate was ~5.8% in early 2024. |

| Market Performance (Equities/Bonds) | Influences investment portfolio, assets under management, and fee-based income. | S&P 500 saw substantial gains in 2024; bond yields fluctuated. Assets under management grew 6% to $125.5 billion. |

What You See Is What You Get

iA Financial Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of iA Financial Corporation delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain valuable insights into the strategic landscape shaping this financial giant.

Sociological factors

Canada's population is aging, with the proportion of individuals aged 65 and over projected to reach 23.7% by 2030, up from 17.7% in 2019. This demographic trend significantly boosts demand for iA Financial Corporation's retirement planning services and annuity products, as more Canadians prepare for their post-work years. Furthermore, the increasing life expectancy fuels a greater need for health and long-term care insurance, presenting a key growth avenue for the company.

The United States is also experiencing a similar demographic shift, with the 65+ population expected to nearly double to 88 million by 2050. This presents iA Financial Corporation with a substantial market opportunity in the US for its specialized financial products catering to seniors. However, an older demographic can also translate to higher claims in certain insurance lines, such as life and disability insurance, requiring careful risk management and product pricing strategies.

Consumers are increasingly prioritizing financial protection, a trend amplified by recent global events. This heightened awareness is fueling a consistent demand for life insurance products. For instance, in 2024, the global life insurance market is projected to reach over $3.4 trillion, demonstrating this robust consumer interest.

Furthermore, there's a clear preference for financial products that are easy to understand and manage. This is driving a demand for simplified policy structures and transparent terms. The digital transformation is also reshaping consumer engagement, with a strong push towards online platforms and mobile-first experiences for purchasing and managing financial services.

Societal health trends significantly shape the insurance landscape for iA Financial Corporation. For instance, the increasing prevalence of chronic diseases like diabetes and heart disease, which affected an estimated 11.7% and 7.1% of Canadian adults respectively in 2023, directly impacts the demand for health and life insurance products. This necessitates more sophisticated underwriting practices to accurately assess risk and price policies accordingly.

Furthermore, a growing societal emphasis on wellness and preventative care, evidenced by the rising popularity of fitness trackers and health-focused apps, presents iA Financial Corporation with opportunities for innovation. Developing new products that incentivize healthy lifestyles, such as discounted premiums for policyholders who meet certain health metrics, could capture a larger market share and align with evolving consumer preferences. This shift towards proactive health management is a key trend to monitor for future product development.

Financial Literacy and Awareness

Financial literacy remains a significant hurdle for many Canadians, impacting their willingness to invest in financial products like insurance. Misconceptions about premiums and coverage can deter potential customers, limiting market expansion. For instance, a 2024 survey indicated that a substantial portion of adults still struggle with basic financial concepts, which directly affects their understanding of insurance needs and benefits.

iA Financial Corporation can actively bridge this knowledge gap through targeted educational campaigns. By demystifying insurance costs and highlighting the long-term value of financial planning, the company can foster greater consumer confidence and product adoption. These initiatives are crucial for not only iA Financial Corporation's growth but also for empowering individuals to secure their financial futures.

Key areas for educational focus include:

- Understanding insurance as an investment, not just an expense.

- Clarifying the different types of insurance policies and their benefits.

- Addressing common myths and misconceptions about the insurance industry.

- Providing accessible tools and resources for financial planning.

Diversity, Equity, and Inclusion (DEI)

Societal expectations regarding diversity, equity, and inclusion (DEI) are increasingly shaping how companies operate, from hiring practices to how they interact with customers. iA Financial Group has been actively enhancing its DEI initiatives, recognizing the importance of fostering an inclusive environment.

These efforts include encouraging employees to self-identify their backgrounds, a key step in understanding workforce demographics. Furthermore, the company is committed to appointing diverse individuals to leadership positions, aiming for representation at all levels.

iA Financial Group's dedication is further evidenced by its retention of certifications like the Silver Parity designation from Women in Governance. This certification specifically recognizes organizations for their progress in achieving gender parity on their boards and in senior management roles. As of their latest reporting, iA Financial Group continues to demonstrate a commitment to these principles, aligning with broader societal trends that prioritize equitable representation in the workplace.

Shifting consumer values are driving a greater demand for personalized financial solutions and ethical business practices. iA Financial Corporation is responding by focusing on customer-centric product development and transparent communication, aligning with a growing societal preference for authenticity and trust in financial institutions.

The increasing emphasis on financial wellness and mental health support also presents opportunities for iA Financial Corporation. By offering resources that promote overall well-being, the company can attract and retain clients who value a holistic approach to financial security. This trend is supported by data showing a rise in demand for mental health services, indicating a broader societal shift towards prioritizing well-being.

Technological factors

iA Financial Corporation is heavily investing in digital transformation, with a significant focus on automating core processes like underwriting. This initiative aims to streamline operations and improve efficiency across the board.

By leveraging advanced platforms for real-time decision-making, iA Financial aims to accelerate policy approvals, directly enhancing the client experience. For instance, in 2024, the company reported a 15% increase in digital service adoption by its clients, indicating a positive reception to these technological advancements.

The integration of artificial intelligence and advanced data analytics is a significant technological factor for iA Financial Corporation. These tools are essential for refining risk assessments, tailoring product offerings to individual client needs, and bolstering fraud detection capabilities.

By leveraging AI and data analytics, iA Financial can achieve more accurate underwriting processes, leading to improved operational efficiency and substantial cost savings. For instance, in 2024, the insurance industry saw AI-driven fraud detection systems reduce false positives by up to 30%, a benefit iA Financial can capitalize on.

As iA Financial Corporation increasingly operates in the digital realm, cybersecurity and data privacy are critical technological factors. The escalating sophistication of cyber threats means that safeguarding client information from breaches is not just a technical necessity but a fundamental aspect of maintaining customer trust and regulatory compliance.

In 2023, the financial services sector globally experienced a significant increase in cyberattacks, with ransomware and phishing attempts being particularly prevalent. For iA Financial Corporation, this translates to a continuous need for investment in advanced security infrastructure and employee training to mitigate risks associated with sensitive client data, which is crucial for their ongoing operations and reputation.

Online Sales and Distribution Channels

The increasing reliance on online sales and distribution channels is fundamentally reshaping how financial services companies, including iA Financial Corporation, connect with customers. This digital shift is not just about convenience; it's a critical factor in expanding market reach and meeting evolving consumer expectations. In 2024, digital channels are no longer an option but a necessity for competitive engagement.

iA Financial Corporation's success hinges on its capacity to provide smooth, intuitive online experiences. This includes everything from initial product exploration and application processes to ongoing customer service and policy management. By effectively leveraging digital platforms, the company can tap into a wider demographic and cater to the preferences of a digitally native customer base, which is increasingly dominant in the market.

Key aspects of this technological factor include:

- Enhanced Customer Accessibility: Online platforms allow iA Financial Corporation to serve customers across diverse geographical locations without the need for physical branches, significantly broadening its potential client pool.

- Streamlined Operations: Digital distribution channels can automate many administrative tasks, leading to greater efficiency and potentially lower operational costs.

- Data-Driven Insights: Online interactions generate valuable data that can be analyzed to understand customer behavior, personalize offerings, and improve service delivery.

- Competitive Differentiation: Companies offering superior digital experiences are likely to gain a competitive edge, attracting and retaining customers who prioritize digital engagement.

Emerging Technologies (e.g., Blockchain, IoT)

Emerging technologies like blockchain and the Internet of Things (IoT) are poised to reshape the insurance landscape for iA Financial Corporation. Blockchain's potential for secure, transparent transactions could streamline claims processing and reduce fraud, while IoT devices offer new avenues for data collection, particularly in health and auto insurance, enabling personalized risk assessment and product development. For instance, the global IoT market is projected to reach $1.5 trillion by 2025, highlighting the vast potential for data-driven insights.

iA Financial Corporation must actively monitor and integrate these technological advancements to maintain a competitive edge. This includes exploring how IoT data, such as telematics from vehicles or wearable health trackers, can inform underwriting and pricing strategies, potentially leading to more accurate risk profiles and customer-centric offerings. By embracing these innovations, the company can unlock significant operational efficiencies and foster new product lines.

The strategic adoption of these technologies presents both opportunities and challenges:

- Blockchain Adoption: Potential to reduce transaction costs by an estimated 30% in financial services, as suggested by various industry reports, by automating processes and enhancing security.

- IoT Data Integration: Opportunities to create usage-based insurance (UBI) products, which saw significant growth in the auto insurance sector in 2024, with adoption rates climbing by over 15% in key markets.

- Cybersecurity Enhancements: The increased reliance on digital platforms and data necessitates robust cybersecurity measures, a critical factor given the rising sophistication of cyber threats, with global cybercrime costs estimated to exceed $10 trillion annually by 2025.

- Customer Experience Improvement: Leveraging AI-powered chatbots and personalized digital platforms, driven by data analytics, to enhance customer service and engagement.

iA Financial Corporation is enhancing its digital capabilities, focusing on automation for underwriting and claims processing to boost efficiency. The company saw a 15% rise in digital service adoption in 2024, indicating strong customer engagement with these advancements.

Artificial intelligence and data analytics are key technological drivers, enabling more precise risk assessment and personalized product development. Industry-wide, AI in fraud detection improved accuracy by up to 30% in 2024, a benefit iA Financial can leverage.

The increasing reliance on digital channels for sales and customer interaction is paramount for iA Financial's market reach and competitive standing. By 2025, global cybercrime costs are projected to surpass $10 trillion annually, underscoring the critical need for robust cybersecurity investments.

Emerging technologies like blockchain and IoT offer significant potential for iA Financial to innovate in areas such as claims processing and usage-based insurance. The global IoT market is expected to reach $1.5 trillion by 2025, presenting substantial opportunities for data-driven product enhancement.

| Technology Area | Impact on iA Financial | 2024/2025 Data Point |

| Digital Transformation & Automation | Streamlined operations, improved efficiency, enhanced customer experience | 15% increase in digital service adoption (2024) |

| AI & Data Analytics | Refined risk assessment, personalized offerings, fraud detection | Up to 30% reduction in false positives from AI fraud detection (Industry, 2024) |

| Cybersecurity | Safeguarding client data, maintaining trust, regulatory compliance | Global cybercrime costs projected to exceed $10 trillion annually (by 2025) |

| Emerging Technologies (Blockchain, IoT) | Potential for secure transactions, new product development (e.g., UBI) | Global IoT market projected to reach $1.5 trillion (by 2025) |

Legal factors

iA Financial Corporation operates under the watchful eye of the Canadian Insurance Companies Act and various provincial insurance acts. These laws are not static; they evolve, requiring constant adaptation. For instance, capital adequacy rules like the Life Insurance Capital Adequacy Test (LICAT) are crucial. As of the first quarter of 2024, iA Financial Group maintained a strong LICAT ratio, demonstrating its robust financial health and adherence to solvency requirements designed to protect policyholders.

Consumer protection laws significantly shape iA Financial Corporation's operations. Regulations focusing on fair practices, transparent disclosure, and robust complaint resolution directly influence how the company markets products, handles sales, and manages claims. For instance, upcoming 2025 regulations will standardize complaint handling, potentially increasing operational costs but also fostering greater customer trust.

iA Financial Corporation operates under stringent privacy legislation, such as Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) and similar global regulations like the EU's GDPR. These laws dictate precisely how the company can gather, utilize, and safeguard sensitive client data, a crucial aspect given the increasing reliance on digital platforms for financial services. Failure to adhere to these regulations can result in significant fines and damage to customer confidence.

In 2024, the global data privacy market is projected to exceed $30 billion, highlighting the significant regulatory and operational focus on data protection. For iA Financial Corporation, maintaining robust privacy practices is not just a legal obligation but a strategic imperative to build and retain trust with its diverse client base across various jurisdictions.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) Laws

Financial institutions, including iA Financial Corporation, operate under strict Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) laws. These regulations are designed to prevent the use of the financial system for illegal purposes. For instance, in 2023, Canadian financial institutions reported over 250,000 suspicious transactions to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Compliance with AML/ATF mandates involves rigorous Know Your Customer (KYC) procedures. This means iA Financial Corporation must verify the identity of its clients and understand the nature of their financial activities. Failure to comply can result in substantial penalties; for example, in 2024, a major Canadian bank was fined $30 million for AML deficiencies.

Key aspects of AML/ATF compliance include:

- Enhanced due diligence for high-risk clients.

- Continuous monitoring of transactions for unusual patterns.

- Timely reporting of suspicious activities to regulatory bodies.

- Maintaining comprehensive records of all customer interactions and transactions.

Contract Law and Product Liability

Contract law is the bedrock of iA Financial Corporation's operations, dictating the terms and enforceability of all insurance policies and wealth management agreements. Any shifts in contract law, such as new regulations on disclosure requirements or policy cancellation clauses, directly impact how iA Financial structures its products and interacts with its clients. For instance, in 2024, regulatory bodies continued to scrutinize insurance contract clarity, pushing companies like iA Financial to ensure policy documents are easily understood by consumers.

Product liability laws are equally critical, holding iA Financial accountable for any damages arising from its financial products or advice. This means that if a wealth management product is found to be misrepresented or causes financial harm due to negligence, the company could face significant legal repercussions. The legal landscape surrounding financial product liability is constantly evolving, with regulators in 2024 focusing on consumer protection in areas like variable annuities and complex investment strategies.

- Regulatory Scrutiny: Ongoing reviews of insurance contract clarity in 2024 by financial regulators aim to protect consumers, potentially leading to revised disclosure standards for iA Financial.

- Product Liability Risks: Potential lawsuits related to mis-sold investment products or inadequate advice could expose iA Financial to substantial financial penalties.

- Contractual Disputes: Changes in consumer protection laws could alter grounds for policy disputes or claims, impacting iA Financial's claims handling and legal costs.

- Compliance Burden: Adapting to evolving legal interpretations of product liability and contract law necessitates continuous investment in legal and compliance teams for iA Financial.

iA Financial Corporation must navigate a complex web of legal and regulatory frameworks, including capital adequacy rules like LICAT, which it met with a strong ratio in Q1 2024. Consumer protection laws, particularly those standardizing complaint handling by 2025, will influence its sales and claims processes. Furthermore, stringent data privacy laws, such as PIPEDA, govern its handling of sensitive client information, a critical area given the projected over $30 billion global data privacy market in 2024.

Environmental factors

Climate change is a growing concern, leading to more frequent and intense natural disasters like wildfires, floods, and hailstorms across Canada and worldwide. This trend directly affects iA Financial Corporation's property and casualty insurance operations, as it translates to increased insured losses. Consequently, the company must adapt its underwriting processes and pricing models to account for these escalating risks.

Financial institutions like iA Financial Group face increasing demands from regulators, investors, and the public to embed Environmental, Social, and Governance (ESG) principles into their core operations and investment strategies. This trend is a significant environmental factor shaping the financial landscape.

In response, iA Financial Group has been proactive, publishing detailed sustainability reports that showcase its commitment to ESG. These reports highlight specific progress on initiatives such as developing a robust climate strategy and setting ambitious decarbonization targets, demonstrating a tangible effort to address environmental concerns.

For instance, in its 2023 sustainability report, iA Financial Group detailed its efforts to reduce its operational greenhouse gas emissions, aiming for a 30% reduction by 2030 compared to a 2019 baseline. This commitment reflects the growing importance of measurable environmental performance for stakeholders.

iA Financial Corporation is making strides in reducing its environmental impact, particularly concerning carbon emissions. The company has established clear objectives to lower the greenhouse gas emission intensity within its Canadian real estate portfolio. This initiative reflects a proactive approach to sustainability within its operational footprint.

Furthermore, iA Financial Corporation has set a target to decrease the carbon intensity of its public corporate bond holdings by 2035. This commitment extends to its investment strategies, aiming to align financial growth with environmental responsibility. Such targets underscore the company's dedication to contributing to broader decarbonization efforts.

Regulatory Requirements for Climate Risk Disclosure

Canadian financial institutions, particularly insurers like iA Financial Corporation, are navigating a landscape of intensifying, mandatory sustainability reporting. These regulations are increasingly focused on the management and disclosure of climate-related risks, reflecting a global shift towards greater transparency in environmental, social, and governance (ESG) matters.

The Office of the Superintendent of Financial Institutions (OSFI) has made climate risk assessment and disclosure a key priority for Canadian insurers. This focus translates into concrete expectations for how companies like iA Financial Corporation must identify, measure, and report on their exposure to climate change impacts, both physical and transitional.

In 2024, the regulatory environment continues to solidify, with expectations for robust climate risk disclosures becoming more defined. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, which OSFI's guidelines largely align with, is becoming the de facto standard. Many Canadian companies are already reporting in line with TCFD recommendations, with further integration expected as regulations mature.

- Mandatory Climate Risk Disclosure: Canadian insurers are facing increasing regulatory pressure to disclose their climate-related risks, aligning with international best practices.

- OSFI's Role: The Office of the Superintendent of Financial Institutions (OSFI) is actively guiding and enforcing climate risk assessment and disclosure requirements for the insurance sector.

- TCFD Alignment: Regulatory expectations often mirror the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), emphasizing governance, strategy, risk management, and metrics/targets.

- Growing Investor Demand: Beyond regulatory mandates, there's a significant push from investors and stakeholders for greater transparency on climate risk, influencing corporate strategy and reporting.

Resource Scarcity and Water Management

Broader environmental issues like resource scarcity and water management can subtly impact iA Financial Corporation. For instance, increasing water stress in key agricultural regions, which saw several areas in Canada facing drought conditions in 2023, can affect the profitability of agribusiness clients, potentially leading to increased loan defaults and impacting the corporation's investment portfolio.

These factors also influence the long-term viability of industries reliant on specific natural resources. Companies heavily dependent on water-intensive processes, such as certain manufacturing or energy sectors, may face higher operational costs or even disruptions due to stricter water usage regulations or outright scarcity. This could indirectly affect iA Financial Corporation's exposure to these sectors.

The financial health of clients is also tied to these environmental concerns. For example, clients in sectors facing resource depletion or water shortages might experience reduced revenues, impacting their ability to service debts or invest, which in turn could influence iA Financial Corporation's risk assessment and product offerings.

- Water scarcity impacts industries: Over 2 billion people live in countries experiencing high water stress, a figure projected to rise by 2050, affecting sectors from agriculture to manufacturing.

- Resource depletion affects investment: The depletion of critical minerals, for instance, can increase costs for technology and automotive sectors, influencing their financial performance and iA Financial Corporation's holdings.

- Regulatory changes: Evolving water management policies and resource extraction regulations can create new compliance costs and operational challenges for businesses, potentially impacting their financial stability.

The increasing frequency and severity of climate-related events, such as the widespread wildfires experienced in Canada during 2023, directly impact iA Financial Corporation's property and casualty insurance segment through higher claims. This necessitates continuous adaptation of underwriting and pricing strategies to reflect these escalating physical risks.

iA Financial Corporation is actively responding to growing demands for ESG integration, as highlighted by its 2023 sustainability report detailing a commitment to a 30% reduction in operational greenhouse gas emissions by 2030 from a 2019 baseline. This aligns with broader industry trends and investor expectations for measurable environmental performance.

Regulatory bodies like OSFI are mandating more robust climate risk disclosures for Canadian insurers, pushing companies like iA Financial Corporation to align with frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD). This trend is expected to intensify in 2024 and beyond, increasing transparency requirements.

Environmental factors like water scarcity, evidenced by drought conditions in parts of Canada in 2023, can indirectly affect iA Financial Corporation by impacting the financial health of clients in sectors like agriculture, potentially leading to increased loan defaults and affecting its investment portfolio.

PESTLE Analysis Data Sources

Our PESTLE analysis for iA Financial Corporation is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry analysis firms. These sources provide current insights into political stability, economic trends, technological advancements, and regulatory changes impacting the financial services sector.