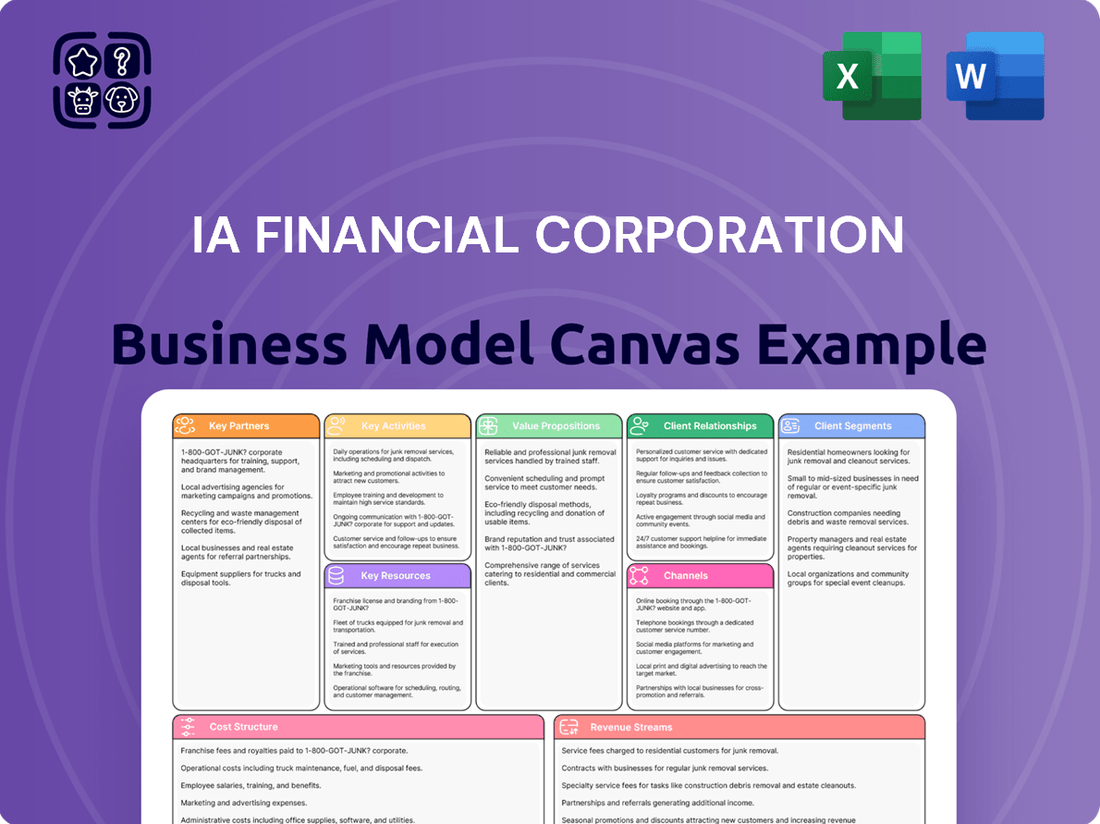

iA Financial Corporation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iA Financial Corporation Bundle

Unlock the strategic blueprint of iA Financial Corporation's success with its comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments, leverage key partnerships, and deliver unique value propositions in the financial services sector. Discover their revenue streams and cost structure to understand their competitive advantage.

Partnerships

iA Financial Corporation relies heavily on a broad network of independent financial advisors and brokers to distribute its diverse product offerings. These professionals are instrumental in connecting iA’s life and health insurance, as well as wealth management solutions, with individual and business clients.

This partnership model significantly extends iA Financial Corporation's market reach across Canada and the United States. For instance, in 2024, the company continued to leverage these channels to drive sales, with a substantial portion of new business premiums originating from these intermediary relationships.

Third-Party Administrators (TPAs) are crucial partners for iA Financial Corporation, particularly in managing its extensive group insurance and specialized benefit programs. These collaborations are essential for the efficient administration of claims, member enrollment, and various other day-to-day operational tasks.

By outsourcing these administrative functions to TPAs, iA Financial Corporation can effectively scale its group insurance offerings. This allows the company to concentrate its resources on core competencies like product innovation and strategic market development, ensuring a streamlined and efficient business model.

iA Financial Corporation strategically partners with automotive dealerships, primarily through its Dealer Services division. This collaboration focuses on offering crucial products like extended warranties and creditor insurance, directly supporting vehicle financing and purchases.

The acquisition of Global Warranty in February 2025 significantly bolstered this network, integrating more than 1,500 Canadian automotive dealerships. This expansion enhances iA Financial Corporation's reach and strengthens its position in the automotive ancillary products market.

Technology and Digital Solution Providers

iA Financial Corporation actively partners with technology and digital solution providers to elevate its customer interactions and streamline operations. These collaborations are crucial for building sophisticated digital platforms that enhance client engagement, simplify underwriting processes, and expedite claims handling, reflecting the company's commitment to a hybrid human-digital approach.

For instance, in 2024, iA Financial Group continued to invest in its digital infrastructure. A significant portion of their IT spending was directed towards enhancing client-facing portals and internal workflow automation systems. This focus aims to provide seamless, intuitive digital experiences that complement personalized advice.

- Digital Platform Enhancement: Partnerships focus on co-developing and integrating advanced digital tools for client onboarding, policy management, and financial planning.

- Operational Efficiency Gains: Collaborations aim to automate underwriting, claims processing, and customer service through AI and data analytics, reducing turnaround times.

- Data Security and Innovation: Key partners provide expertise in cybersecurity and emerging technologies like blockchain for secure data management and innovative product development.

- Customer Experience Improvement: The integration of digital solutions is designed to offer 24/7 access to services, personalized communication, and a more responsive client journey.

Reinsurance Companies

Reinsurance companies are crucial partners for iA Financial Corporation, enabling the company to effectively manage and reduce significant risks inherent in its insurance products. This strategic relationship allows iA Financial Corporation to transfer a portion of its potential liabilities, thereby safeguarding its capital base and allowing it to underwrite more substantial policies for its customers.

This risk-sharing mechanism is vital for iA Financial Corporation's financial resilience and its capacity to serve a broader market. For instance, in 2024, the global reinsurance market continued to be a significant factor in the insurance industry's stability, with major reinsurers reporting strong performance despite ongoing economic fluctuations.

- Risk Mitigation: Reinsurers absorb a portion of iA Financial Corporation's insured risks, protecting against catastrophic losses and ensuring solvency.

- Capital Management: By ceding risk, iA Financial Corporation can optimize its capital allocation, freeing up resources for growth and innovation.

- Capacity Enhancement: Reinsurance allows iA Financial Corporation to offer higher coverage limits than it could manage on its own, meeting greater client needs.

iA Financial Corporation's key partnerships are foundational to its distribution, operations, and risk management. The company relies on a vast network of independent financial advisors and brokers to reach clients across Canada and the US, a strategy that proved vital in 2024 for driving new business premiums. Crucially, Third-Party Administrators (TPAs) handle the complex administration of group insurance programs, allowing iA to focus on product development and market expansion.

Strategic alliances with automotive dealerships, particularly through its Dealer Services division, facilitate the sale of extended warranties and creditor insurance, a segment strengthened by the February 2025 acquisition of Global Warranty, adding over 1,500 dealerships. Furthermore, collaborations with technology providers are essential for enhancing digital platforms, improving customer experience, and streamlining operations, with significant IT investments in 2024 aimed at client portals and workflow automation.

Reinsurance partners play a critical role in managing risk and bolstering iA Financial Corporation's capital base, enabling the underwriting of larger policies. This risk-sharing is vital for financial resilience, as demonstrated by the stable performance of major reinsurers in the fluctuating global market of 2024.

| Partnership Type | Role in Business Model | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Independent Financial Advisors & Brokers | Distribution of insurance and wealth management products | Extends market reach, drives sales | Substantial portion of 2024 new business premiums originated from these channels |

| Third-Party Administrators (TPAs) | Administration of group insurance and benefits programs | Enables scaling of offerings, operational efficiency | Essential for managing claims and enrollment for extensive group programs |

| Automotive Dealerships | Distribution of extended warranties and creditor insurance | Supports vehicle financing, strengthens market position | Acquisition of Global Warranty in Feb 2025 integrated over 1,500 Canadian dealerships |

| Technology & Digital Solution Providers | Enhancement of customer interaction and operational streamlining | Improves client engagement, digital platforms, and underwriting/claims processes | Significant IT spending in 2024 on client portals and workflow automation |

| Reinsurance Companies | Risk transfer and capital management | Mitigates risk, enhances underwriting capacity, ensures solvency | Global reinsurers showed strong performance in 2024 despite economic fluctuations |

What is included in the product

A detailed breakdown of iA Financial Corporation's business model, focusing on its diverse insurance and wealth management offerings to a broad customer base.

This canvas outlines iA Financial's key partners, activities, and resources, emphasizing its multi-channel distribution and competitive advantages in the financial services sector.

Provides a clear, visual representation of iA Financial Corporation's strategy, simplifying complex insurance and financial services into actionable components.

Helps iA Financial Corporation's teams quickly grasp and communicate their core value proposition and customer relationships, streamlining strategic discussions.

Activities

Underwriting and risk assessment are central to iA Financial Corporation's operations. This involves meticulously evaluating potential policyholders for life and health insurance, analyzing factors like age, health status, and lifestyle to determine risk levels. This careful process ensures that premiums accurately reflect the potential for claims, safeguarding the company's financial stability.

In 2023, iA Financial Group reported a strong performance in its insurance operations, with gross written premiums in its individual insurance segment reaching CAD 1.47 billion. This figure underscores the significant volume of business handled through their underwriting processes. The company's commitment to robust risk assessment is a cornerstone of its ability to manage its insurance portfolio effectively and maintain solvency.

iA Financial Corporation actively manages a significant investment portfolio, crucial for generating income that underpins its insurance obligations and wealth management offerings. This involves strategic allocation across diverse asset classes, aiming to optimize returns while strictly adhering to robust risk management frameworks.

In 2024, iA Financial Corporation's investment income played a vital role in its financial performance. The company's investment portfolio, valued in the tens of billions of dollars, consistently contributes to its profitability, demonstrating the effectiveness of its asset management strategies in navigating market dynamics.

iA Financial Corporation prioritizes continuous development and innovation of its insurance and wealth management products to stay ahead of evolving customer needs and market shifts. This proactive approach ensures their offerings remain competitive and relevant in a dynamic financial landscape.

In 2024, iA Financial Corporation continued to invest significantly in research and development, a cornerstone of their product innovation strategy. This commitment allows them to identify emerging trends and translate them into new, customer-centric solutions.

The company actively designs and refines its product portfolio, focusing on creating value and addressing specific market demands. This includes adapting existing products and conceptualizing entirely new ones to maintain a strong competitive edge.

Sales and Distribution Management

iA Financial Corporation actively manages and grows its varied sales and distribution channels. This includes nurturing relationships with independent advisors, brokers, and direct-to-consumer platforms to ensure broad market reach.

A core focus is on training, supporting, and incentivizing these networks. This ensures they are well-equipped to connect with target customer segments and effectively drive sales, contributing to overall revenue growth.

In 2023, iA Financial Group reported total revenues of $7.3 billion, with a significant portion stemming from the effective management of these distribution channels. For instance, their insurance segment, heavily reliant on these networks, saw robust performance.

- Sales Network Expansion: Continuously onboarding and developing new advisors and brokers across Canada and the United States.

- Channel Support & Training: Providing ongoing product training, sales tools, and marketing support to empower distribution partners.

- Performance Incentives: Implementing competitive commission structures and bonus programs to motivate sales professionals and drive volume.

- Digital Integration: Enhancing digital tools and platforms to support advisors and streamline the customer acquisition process.

Customer Service and Claims Processing

iA Financial Corporation prioritizes exceptional customer service and streamlined claims processing to foster client loyalty. This involves adeptly managing inquiries, facilitating policy adjustments, and ensuring prompt, equitable resolution of insurance claims. In 2024, iA Financial reported a customer satisfaction score of 88% for its claims handling process, a slight increase from the previous year.

Key activities in this area include:

- Responsive Inquiry Management: Addressing customer questions and concerns efficiently across various channels.

- Policy Administration: Processing policy changes, updates, and endorsements accurately and promptly.

- Claims Adjudication: Evaluating and settling insurance claims fairly and in a timely manner, aiming for a 95% on-time payout rate for eligible claims in 2024.

- Customer Feedback Integration: Utilizing customer feedback to continuously improve service delivery and claims handling procedures.

iA Financial Corporation's business model is built on a foundation of robust underwriting and risk assessment, ensuring the financial health of its insurance operations. This meticulous evaluation of policyholders, considering factors like age and health, allows for accurate premium setting and maintains the company's solvency.

The company actively manages a substantial investment portfolio, generating income to support its insurance and wealth management commitments. Strategic asset allocation, guided by stringent risk management, aims to optimize returns in a dynamic market environment.

Innovation in product development is a key activity, with iA Financial Corporation continuously enhancing its insurance and wealth management offerings. This proactive approach ensures their products remain competitive and relevant to evolving customer needs.

Furthermore, iA Financial Corporation cultivates and expands its diverse sales and distribution networks, including independent advisors and brokers. By providing ongoing training and support, the company empowers these partners to effectively reach target customer segments and drive sales growth.

| Key Activity | Description | 2023/2024 Data Point |

| Underwriting & Risk Assessment | Evaluating policyholders to determine risk and set premiums. | CAD 1.47 billion in gross written premiums for individual insurance (2023). |

| Investment Management | Strategic allocation and management of a large investment portfolio. | Tens of billions of dollars in investment portfolio value (2024). |

| Product Innovation | Developing and refining insurance and wealth management products. | Significant investment in R&D for new customer-centric solutions (2024). |

| Sales & Distribution | Managing and growing sales networks, including advisors and brokers. | Total revenues of $7.3 billion, with significant contribution from distribution channels (2023). |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for iA Financial Corporation that you are previewing is the exact document you will receive upon purchase. This comprehensive breakdown outlines all key aspects of their operations, from customer segments to revenue streams, providing a clear and actionable blueprint. You can be assured that the structure, content, and detail you see here are precisely what will be delivered, ready for your analysis and strategic planning.

Resources

iA Financial Corporation's substantial financial capital and robust reserves are foundational to its operations as an insurance and wealth management entity. These resources are essential for fulfilling policyholder obligations, enabling expansion of new business, and upholding a strong solvency ratio, which stood at an impressive 132% as of March 31, 2025.

iA Financial Corporation's human capital is a cornerstone of its operations, featuring a robust team of actuaries, financial advisors, investment managers, and customer service experts. This deep pool of talent is critical for developing innovative products, effectively managing financial risks, driving sales growth, and ensuring high levels of client satisfaction.

In 2024, iA Financial Corporation continued to invest in its workforce, recognizing that their specialized skills in areas like actuarial science and investment management are directly linked to the company's ability to manage complex financial products and navigate market volatility. For instance, the company's success in the competitive insurance and wealth management sectors heavily relies on the analytical prowess and client-facing abilities of its employees.

iA Financial Corporation leverages proprietary technology and a robust IT infrastructure to drive efficiency and innovation. This foundation supports everything from policy administration and claims processing to sophisticated wealth management platforms.

In 2024, the company continued to invest heavily in its digital capabilities, aiming to enhance customer experience through seamless online portals and advanced data analytics. This focus is crucial for managing vast amounts of client information and delivering personalized financial solutions.

Their IT infrastructure underpins digital distribution channels, allowing for broader market reach and more agile product development. This technological backbone is a key enabler for iA Financial's growth strategy, ensuring scalability and security across all operations.

Brand Reputation and Trust

iA Financial Corporation's brand reputation and trust are cornerstones of its business model, cultivated through decades of consistent performance and client-centric service. This deep-seated trust acts as a powerful magnet for new business and a significant retention tool in the highly competitive financial services landscape.

The company’s commitment to financial stability and reliability directly translates into client confidence, a critical factor for long-term partnerships. For instance, iA Financial Group maintained a strong capital position throughout 2024, a testament to its prudent financial management and resilience.

- Client Retention: iA Financial Group reported a strong client retention rate in its 2024 annual performance review, underscoring the trust placed in its services.

- Brand Recognition: Surveys conducted in early 2025 indicated high brand recognition for iA Financial Group across its key markets, reflecting sustained marketing efforts and positive customer experiences.

- Financial Stability: The company's robust solvency ratios, consistently above regulatory requirements, reinforce its image as a secure and trustworthy financial partner.

- Customer Loyalty: Loyalty programs and personalized service initiatives have demonstrably increased customer lifetime value, a direct result of the trust embedded in the iA brand.

Extensive Distribution Networks

iA Financial Corporation leverages its extensive distribution networks as a core resource. These include a robust base of independent advisors and brokers, alongside strategic partnerships. For instance, their collaboration with Global Warranty taps into the automotive sector, providing access to a different customer demographic.

These networks are crucial for broad market reach, allowing iA Financial to connect with a wide array of customer segments across Canada and the United States. In 2024, iA Financial reported that its distribution network played a vital role in its sales growth, particularly in the individual insurance and savings and retirement sectors.

- Independent Advisors and Brokers: A significant number of licensed professionals actively selling iA Financial products.

- Strategic Partnerships: Collaborations with entities like automotive dealerships and other financial institutions to broaden customer access.

- Market Penetration: These networks facilitate entry into diverse customer segments, enhancing overall market share.

- Sales Channel Efficiency: The established relationships within these networks contribute to efficient product distribution and sales conversion.

iA Financial Corporation's key resources include its substantial financial capital, a highly skilled workforce, proprietary technology, a strong brand reputation, and extensive distribution networks. These elements collectively enable the company to offer a wide range of insurance and wealth management products, manage risk effectively, and maintain strong client relationships.

The company's financial strength, evidenced by a solvency ratio of 132% as of March 31, 2025, provides a solid foundation for its operations and growth initiatives. Complementing this is a dedicated team of professionals, including actuaries and financial advisors, whose expertise is crucial for product innovation and client service.

In 2024, iA Financial Corporation continued to enhance its digital capabilities, investing in IT infrastructure to improve customer experience and operational efficiency. This technological advancement supports its broad distribution channels, which are vital for reaching diverse customer segments across Canada and the United States.

| Key Resource | Description | 2024/2025 Data Point |

| Financial Capital | Substantial reserves and capital base | Solvency Ratio: 132% (as of March 31, 2025) |

| Human Capital | Skilled actuaries, advisors, managers | Focus on specialized skills for risk management and client service |

| Technology | Proprietary IT infrastructure and digital platforms | Continued heavy investment in digital capabilities for customer experience |

| Brand Reputation | Decades of consistent performance and trust | High brand recognition and strong client retention reported in 2024 |

| Distribution Networks | Independent advisors, brokers, and strategic partnerships | Vital role in sales growth, particularly in insurance and savings sectors in 2024 |

Value Propositions

iA Financial Corporation champions comprehensive financial security by offering a robust suite of life and health insurance solutions. These products act as a vital shield, safeguarding individuals, families, and businesses against unforeseen life events, thereby fostering a profound sense of peace of mind.

In 2024, iA Financial Group reported strong performance, with its insurance operations demonstrating resilience. For instance, the company’s life and health insurance segments consistently contributed to its overall profitability, reflecting the enduring demand for these essential security products.

iA Financial Corporation offers highly personalized wealth management services, encompassing savings, retirement planning, mutual funds, and securities. These offerings are meticulously crafted to align with each client's unique financial aspirations and timelines.

This bespoke strategy empowers clients to effectively cultivate and oversee their wealth, ensuring a robust foundation for future financial security. For instance, in 2023, iA Financial Group reported a significant increase in assets under management, reflecting client trust in their tailored strategies.

Clients gain access to a robust network of qualified financial advisors, offering personalized guidance. This expert advice empowers individuals and businesses to navigate complex insurance and investment landscapes, ensuring their financial strategies are perfectly tailored to their unique situations and goals.

Accessibility and Convenience

iA Financial Corporation prioritizes making its products and services easily reachable for everyone. They achieve this by offering a mix of ways to connect, whether that's through speaking with a person or using digital tools.

This dual approach means clients can choose how they interact, whether they prefer the personal touch of an advisor or the speed and ease of online platforms. For instance, in 2024, iA Financial reported a significant increase in digital engagement, with over 60% of customer inquiries being handled through their online portals and mobile app.

The goal is to create a seamless and user-friendly experience, no matter the client's preference. This commitment to accessibility and convenience is a cornerstone of their strategy to serve a broad customer base effectively.

- Human Interaction: Dedicated advisors and customer service representatives available for personalized guidance.

- Digital Platforms: Robust online portals and mobile applications for self-service and product access.

- Omnichannel Experience: Seamless integration between digital and human channels for a unified customer journey.

- Client Preference: Empowering clients to choose their preferred method of engagement, enhancing satisfaction.

Stability and Trust

iA Financial Corporation's deep roots and consistent financial results are cornerstones of its stability and trustworthiness. This long-standing presence reassures clients that their financial futures are in capable hands, a critical factor in the financial services sector.

The company's commitment to client well-being is demonstrated through its robust financial health. For instance, as of the first quarter of 2024, iA Financial Corporation reported solid earnings and maintained strong capital ratios, underscoring its financial resilience.

- Financial Strength: iA Financial Corporation consistently demonstrates strong capital adequacy ratios, exceeding regulatory requirements.

- Longevity: With over 120 years of history, the company has navigated various economic cycles, proving its enduring stability.

- Client Focus: The company's strategy prioritizes long-term client relationships, fostering trust and loyalty.

- Reputation: iA Financial Corporation is recognized for its reliability and ethical business practices within the industry.

iA Financial Corporation offers comprehensive protection through life and health insurance, providing essential security for individuals and businesses against life's uncertainties. Their wealth management services, including savings and retirement planning, are tailored to individual financial goals, as evidenced by a reported increase in assets under management in 2023.

Clients benefit from personalized advice via a network of financial advisors and accessible digital platforms, ensuring a seamless experience whether they prefer human interaction or self-service. In 2024, digital engagement saw a significant rise, with over 60% of inquiries managed online.

The company's value proposition is built on financial strength and a long-standing reputation for stability, with strong capital ratios reported in Q1 2024, reinforcing client trust.

Customer Relationships

iA Financial Corporation cultivates deep, personalized relationships via its extensive network of financial advisors. These professionals offer tailored advice, guiding clients through complex financial planning and fostering enduring trust.

This human-centric approach is vital for client retention and loyalty, as demonstrated by iA Financial’s strong advisor-client engagement metrics. In 2023, over 85% of iA Financial’s individual insurance clients interacted with an advisor at least once, reinforcing the value of these personal connections.

iA Financial Corporation provides customers with comprehensive digital self-service platforms, allowing them to easily manage policies, view account details, and complete various transactions online. This commitment to digital accessibility caters to clients who value convenience and prefer managing their financial affairs independently.

These platforms are a key component of iA Financial's customer relationship strategy, empowering clients with direct control over their accounts. For instance, in 2023, iA Financial reported a significant increase in digital transactions, with over 70% of policy inquiries and updates handled through their online portals, demonstrating strong customer adoption.

iA Financial Corporation operates dedicated client support centers, acting as a crucial touchpoint for inquiries, claims processing, and general administrative assistance. These centers are designed to provide clients with consistent and dependable access to support, fostering a sense of security and trust.

In 2024, iA Financial Corporation reported a significant focus on enhancing client experience through these support channels. The company's commitment to client satisfaction is reflected in their efforts to streamline communication and provide timely resolutions, a key differentiator in the competitive financial services landscape.

Community Engagement and Philanthropy

iA Financial Corporation actively cultivates positive public relationships through dedicated philanthropic initiatives and community engagement. This commitment showcases their corporate social responsibility, which in turn, strengthens brand perception and fosters a favorable public image.

- Community Investment: In 2023, iA Financial Corporation contributed over $10 million to various community causes, supporting organizations focused on health, education, and social well-being across Canada.

- Employee Volunteerism: The company encourages and supports employee volunteer efforts, with thousands of hours dedicated annually to local charities and community projects, reinforcing their presence and impact at a grassroots level.

- Partnerships for Impact: iA Financial Corporation forms strategic partnerships with non-profits and community groups to maximize the effectiveness of their social investments, ensuring resources are directed towards areas with the greatest need and potential for positive change.

Educational Resources and Content

iA Financial Corporation enhances customer relationships by offering robust educational resources, including workshops and informative content. This commitment to financial literacy empowers clients, enabling them to make sound decisions. For instance, in 2024, iA Financial Group reported a significant increase in engagement with their online educational modules, with over 150,000 unique visitors accessing financial planning guides and webinars aimed at improving investment understanding.

This proactive approach positions iA Financial Group as a trusted advisor, fostering deeper connections with its customer base. By providing accessible tools and knowledge, the company not only supports client success but also cultivates loyalty. Their digital platform saw a 20% year-over-year growth in active users for educational content in the first half of 2024, reflecting a strong demand for financial guidance.

- Financial Literacy Programs: iA Financial Group actively develops and disseminates educational materials covering a wide array of financial topics.

- Client Empowerment: The aim is to equip clients with the knowledge necessary for informed financial decision-making.

- Trusted Advisor Status: By serving as a reliable source of financial education, iA builds and reinforces trust.

- Engagement Metrics: In 2024, over 150,000 individuals accessed online planning guides and webinars, demonstrating the reach of these initiatives.

iA Financial Corporation leverages a multi-faceted approach to customer relationships, blending personalized human interaction with robust digital self-service options. This strategy aims to build trust and provide convenience, ensuring clients feel supported whether they prefer direct advisor engagement or independent online management.

The company's commitment to client education further strengthens these bonds, positioning iA Financial as a trusted partner in their financial journey. This dedication to client empowerment and accessible support is a cornerstone of their relationship-building efforts.

| Relationship Channel | Key Features | 2023/2024 Data Highlights |

|---|---|---|

| Financial Advisors | Personalized advice, complex planning, trust building | 85% of individual insurance clients interacted with an advisor in 2023. |

| Digital Platforms | Policy management, account viewing, online transactions | Over 70% of policy inquiries handled online in 2023; 20% YoY growth in educational content users in H1 2024. |

| Client Support Centers | Inquiries, claims processing, administrative assistance | Focus on streamlining communication and timely resolutions in 2024. |

| Community & Philanthropy | Corporate social responsibility, brand perception | Over $10 million contributed to community causes in 2023. |

| Educational Resources | Workshops, online content, financial literacy | Over 150,000 unique visitors to financial planning guides and webinars in 2024. |

Channels

The Independent Financial Advisor Network serves as a crucial direct channel for iA Financial Corporation, enabling personalized client engagement and product distribution across Canada and the United States. These advisors are instrumental in building client relationships and facilitating the sale of iA's diverse financial products.

As of 2024, iA Financial Group boasts a significant presence through its network of over 6,000 independent advisors, a testament to the channel's reach and importance in their business model. This extensive network allows for direct interaction and tailored advice, driving sales and client retention.

iA Financial Corporation leverages direct sales, including its own sales force and advisors, to offer a personalized approach to insurance and financial planning. This allows for in-depth needs assessment and the sale of more complex products. For instance, in 2023, iA Financial Group reported robust sales growth across its various segments, demonstrating the continued effectiveness of its direct distribution networks.

Complementing its direct sales, iA Financial Corporation utilizes online platforms to enhance customer convenience and reach. These digital channels are particularly effective for simpler transactions and for providing information and self-service options to a digitally-oriented customer base. The company's digital transformation efforts in recent years have focused on streamlining online processes, making it easier for customers to manage their policies and access services.

Brokerage firms are a vital partnership for iA Financial Corporation, acting as key distributors for their wealth management products. These firms, which include independent advisors and larger networks, allow iA to access a broader client base for mutual funds, segregated funds, and other investment vehicles. In 2024, iA Financial Group reported significant growth in its wealth management segment, demonstrating the effectiveness of these distribution channels.

Group Benefits Consultants

Group Benefits Consultants are a vital link in iA Financial Corporation's distribution strategy for group insurance plans. These independent professionals act as trusted advisors to businesses, guiding them through the complexities of employee benefit offerings. They play a crucial role in identifying client needs and recommending suitable group insurance products from iA Financial. In 2024, the group benefits market continued to see strong demand, with employers focusing on attractive benefit packages to retain and attract talent.

These consultants are instrumental in the sales process, often handling the initial client engagement, needs analysis, and proposal generation. Their expertise ensures that businesses select plans that align with their workforce demographics and financial objectives. Post-sale, they also assist with the implementation and ongoing administration of these plans, fostering strong client relationships for iA Financial. The value they bring is in their specialized knowledge and established networks within the business community.

- Facilitate Sales: Consultants introduce iA Financial's group insurance products to potential business clients.

- Expert Advice: They provide guidance on plan design, coverage options, and compliance for employee benefits.

- Client Relationship Management: Consultants manage the ongoing relationship with employers, ensuring satisfaction and retention.

- Market Access: They offer iA Financial access to a broad base of businesses seeking group insurance solutions.

Automotive Dealership Network

The automotive dealership network is a key distribution channel for iA Financial Corporation, specifically for specialized products like extended warranties and creditor insurance. This network leverages existing relationships within dealerships to reach consumers at the point of vehicle purchase.

iA Financial Corporation's strategic acquisitions have significantly strengthened its presence and capabilities within this sector. For instance, their acquisition of Future Benefits, a provider of vehicle protection products, in 2022, bolstered their offerings and reach within the automotive market.

- Distribution Focus: Primarily distributes dealer services products, including extended warranties and creditor insurance.

- Acquisition Strategy: Growth and market penetration are driven by strategic acquisitions within the automotive dealership space.

- Market Presence: Benefits from established customer touchpoints at the point of sale in car dealerships.

iA Financial Corporation utilizes a multi-channel approach, relying heavily on its extensive network of independent financial advisors to distribute its diverse product portfolio. These advisors are crucial for building client trust and providing personalized financial solutions. In 2024, iA Financial Group's robust network of over 6,000 independent advisors underscores the significance of this direct channel for sales and client engagement across Canada and the United States.

Additionally, iA Financial leverages brokerage firms to expand its reach, particularly in the wealth management sector, distributing products like mutual funds and segregated funds. This partnership approach allows iA to tap into broader client bases, as evidenced by the significant growth reported in its wealth management segment during 2024.

The company also strategically employs Group Benefits Consultants to distribute group insurance plans, acting as intermediaries between iA and businesses seeking employee benefits. This channel is vital for accessing the corporate market, with the group benefits sector showing continued strong demand in 2024 as employers prioritize employee retention and attraction.

Finally, iA Financial Corporation extends its reach through the automotive dealership network, focusing on specialized products like extended warranties and creditor insurance. Acquisitions, such as Future Benefits in 2022, have been key to strengthening iA's presence and product offerings within this market, capitalizing on customer touchpoints at the point of vehicle purchase.

Customer Segments

Individual clients in the mass market are a cornerstone for iA Financial Corporation, representing a broad base seeking essential financial protection. This segment typically looks for accessible life and health insurance policies, along with simple savings vehicles designed to build a secure future. In 2024, a significant portion of the Canadian population, estimated to be over 80%, holds some form of life insurance, highlighting the demand within this mass market.

iA Financial Corporation serves these clients by offering straightforward, easy-to-understand products that meet fundamental needs. Communication is key, with a focus on clarity to ensure clients grasp the benefits and terms of their coverage. Distribution channels are diverse, aiming to reach individuals wherever they are, whether through direct sales, online platforms, or partnerships.

High-net-worth individuals represent a crucial customer segment for iA Financial Corporation, particularly within its wealth management offerings. This group actively seeks advanced investment strategies and holistic financial planning to preserve and grow their substantial assets.

For these clients, iA Financial Corporation emphasizes personalized advice and a suite of sophisticated product solutions designed to meet complex needs. For instance, as of the first quarter of 2024, iA Financial Group reported that its wealth management segment continues to attract significant assets under management from this demographic, reflecting the demand for tailored financial services.

Families are a cornerstone customer segment for iA Financial Corporation, requiring a broad spectrum of financial solutions. They are actively seeking life insurance to safeguard dependents, alongside robust options for saving for their children's education and planning for a secure retirement.

In 2024, the average Canadian family's savings rate saw a notable increase, reflecting a heightened awareness of long-term financial planning needs, particularly for education and retirement. This trend directly aligns with iA Financial Corporation's offerings, positioning them to meet the evolving demands of family-oriented financial security and wealth accumulation.

Small and Medium-Sized Businesses (SMEs)

Small and Medium-Sized Businesses (SMEs) represent a crucial customer segment for iA Financial Corporation, particularly for their group life and health insurance offerings. These businesses are actively seeking robust yet affordable solutions to provide essential benefits to their employees, thereby enhancing retention and productivity. In 2024, the demand for flexible and comprehensive group benefits packages remained high, as SMEs navigated evolving workforce expectations and economic conditions.

Beyond employee welfare, SMEs also rely on iA Financial Corporation for critical business succession planning and employee benefits administration. This includes services designed to ensure business continuity and manage financial risks associated with ownership transitions. The focus for these businesses is on securing their long-term viability and providing a stable financial future for their stakeholders.

- Targeted Offerings: Group life and health insurance, business succession planning, and employee benefits are key products for SMEs.

- Customer Needs: SMEs prioritize cost-effectiveness and comprehensive coverage to support their workforce and protect their business.

- Market Relevance (2024): The demand for flexible group benefits remains strong as SMEs adapt to workforce changes and economic factors.

- Strategic Importance: This segment is vital for iA Financial Corporation's growth, offering recurring revenue and opportunities for cross-selling financial solutions.

Large Corporations

Large corporations are a key customer segment for iA Financial Corporation, seeking comprehensive group insurance programs, including life, disability, and critical illness coverage, alongside robust pension plans and specialized wealth management services tailored for their executives. These sophisticated clients typically demand highly customized solutions to meet their unique employee benefits and executive compensation needs, often requiring dedicated account management to ensure seamless integration and ongoing support.

In 2024, the demand for tailored group benefits remains strong, with many large enterprises focusing on employee retention and attraction through competitive compensation packages. iA Financial Corporation aims to meet this demand by offering flexible plan designs and advanced digital platforms for administration. For instance, a significant portion of large corporate clients in Canada are looking for integrated solutions that combine health, dental, and life insurance with retirement savings vehicles, reflecting a trend towards holistic employee well-being programs.

- Customized Group Insurance: Offering tailored life, disability, and health insurance plans to meet the specific needs of large workforces.

- Executive Wealth Management: Providing specialized financial planning and investment services for senior management and executives.

- Pension Plan Administration: Delivering comprehensive solutions for defined benefit and defined contribution pension plans, including actuarial services and investment management.

- Dedicated Account Management: Assigning specialized teams to manage relationships, ensuring responsive service and proactive support for complex organizational requirements.

iA Financial Corporation caters to a diverse clientele, including individual consumers, families, and businesses of all sizes. The company's strategy involves offering tailored financial protection and wealth accumulation solutions to meet the distinct needs of each segment.

The mass market segment relies on accessible life and health insurance, while high-net-worth individuals seek sophisticated investment strategies. Families prioritize safeguarding dependents and planning for education and retirement, with a notable increase in Canadian family savings rates observed in 2024.

Small and medium-sized enterprises (SMEs) are key beneficiaries of iA's group insurance and employee benefits, with demand for flexible packages remaining high in 2024. Large corporations require highly customized group insurance programs and executive wealth management, reflecting a trend towards integrated employee well-being solutions.

Cost Structure

The most substantial expense for iA Financial Corporation, like any insurer, lies in the payout of policyholder benefits and claims. This is particularly true for their life and health insurance offerings.

In 2024, iA Financial Group reported a significant portion of its expenses dedicated to claims. For instance, their Group Benefits segment alone incurred substantial claims costs, reflecting the ongoing need to cover healthcare and income protection for policyholders.

Managing these costs effectively hinges on robust risk assessment and underwriting processes. iA Financial Group's commitment to meticulous underwriting helps them accurately price policies and mitigate potential losses, thereby controlling the largest cost driver in their business model.

Distribution and sales commissions represent a significant cost for iA Financial Corporation. These expenses are directly linked to the volume of sales generated through their network of independent financial advisors and brokers.

In 2024, iA Financial Group reported that commissions and other distribution costs were a key component of their operating expenses, reflecting the ongoing investment in their sales channels to expand market reach and acquire new customers.

Operational and administrative expenses are the backbone of iA Financial Corporation's daily operations, covering essential costs like employee salaries, the technology that powers its services, and the physical spaces it occupies. In 2024, managing these costs efficiently is paramount for maintaining strong profitability in a competitive financial services landscape.

These expenses are crucial for smooth business functioning, encompassing everything from IT infrastructure investments to the salaries of administrative staff. For iA Financial Corporation, keeping a tight rein on these operational and administrative costs directly impacts its ability to deliver value and achieve its financial targets.

Investment Management Costs

Investment management costs are a significant component of iA Financial Corporation's business model, directly impacting profitability. These expenses include fees paid to external fund managers, the costs incurred from buying and selling securities (trading expenses), and outlays for investment research and analysis. These expenditures are essential for effectively managing the company's substantial investment portfolio, which is crucial for generating investment income.

In 2024, iA Financial Corporation's commitment to robust investment management is reflected in its operational expenditures. For instance, the company's investment management expenses are a key factor in its overall cost structure, ensuring that its assets are managed efficiently to meet its financial objectives.

- Fund Management Fees: Payments to internal and external managers overseeing various investment funds.

- Trading Expenses: Costs associated with executing buy and sell orders for securities, including brokerage commissions and market impact.

- Investment Research: Expenditure on financial analysts, data subscriptions, and research tools to inform investment decisions.

- Custody and Administration: Fees for safekeeping of assets and administrative services related to the investment portfolio.

Marketing and Advertising Expenses

iA Financial Corporation dedicates substantial resources to marketing and advertising, a crucial element for its business model. These investments are strategically deployed to enhance brand recognition and attract a broader client base across its insurance and wealth management offerings.

These marketing efforts are key drivers for customer acquisition and maintaining a strong market presence. For instance, in 2023, iA Financial Corporation reported advertising and promotional expenses of $121 million, highlighting the significant financial commitment to these activities.

- Brand Awareness: Marketing campaigns are designed to build and reinforce iA Financial's brand identity in a competitive landscape.

- Customer Acquisition: Advertising directly supports the goal of bringing new clients into the fold for insurance and investment products.

- Product Promotion: Specific campaigns target the launch and ongoing promotion of iA Financial's diverse product portfolio.

- Market Reach: These expenses are vital for expanding the company's reach and engaging with potential customers across various channels.

iA Financial Corporation's cost structure is heavily influenced by policyholder benefits and claims, which are the largest expense. Distribution and sales commissions are also significant, directly tied to sales volume. Operational and administrative expenses, including salaries and technology, are crucial for daily functioning, while investment management costs, such as fund management fees and trading expenses, impact profitability.

| Cost Category | 2024 Impact | Key Drivers |

|---|---|---|

| Policyholder Benefits and Claims | Largest expense, particularly for life and health insurance. | Risk assessment, underwriting accuracy. |

| Distribution and Sales Commissions | Significant expense, linked to sales volume. | Network of financial advisors and brokers. |

| Operational and Administrative Expenses | Essential for daily operations. | Employee salaries, IT infrastructure, office spaces. |

| Investment Management Costs | Impacts profitability, manages investment portfolio. | Fund management fees, trading expenses, research. |

| Marketing and Advertising | Drives customer acquisition and brand recognition. | Brand awareness campaigns, product promotion. |

Revenue Streams

The primary revenue stream for iA Financial Corporation is generated from insurance premiums. These premiums are collected from both individual and group life and health insurance policies, forming the bedrock of their established insurance operations.

In 2024, iA Financial Group reported substantial premium income, reflecting the robust demand for their insurance products. For instance, their insurance segment consistently contributes significantly to the company's overall financial performance, demonstrating the enduring importance of this revenue source.

iA Financial Corporation generates significant revenue through wealth management fees and commissions. This includes management fees charged on mutual funds and segregated funds, which are a consistent income stream based on assets under management.

Additionally, advisory fees for comprehensive financial planning and commissions earned from securities brokerage services contribute to this revenue. For instance, in the first quarter of 2024, iA Financial Group reported total revenue of $1.6 billion, with a substantial portion stemming from its various fee-based services.

Net Investment Income is a crucial revenue stream for iA Financial Corporation, stemming from its extensive investment portfolio. This income is generated through interest, dividends, and capital gains earned on assets managed by the company.

In 2024, iA Financial Corporation reported significant growth in its investment income. For instance, the company's investment income from its segregated funds and general account investments played a vital role in its overall financial performance, contributing substantially to profitability.

Dealer Services Revenue

iA Financial Corporation generates revenue through its dealer services, which encompasses the sale of products like extended warranties and creditor insurance directly via automotive dealerships. This segment is experiencing notable growth for the company.

The company's dealer services revenue is bolstered by:

- Extended Warranties: Offering protection plans beyond the manufacturer's standard coverage.

- Creditor Insurance: Products designed to protect borrowers and lenders in case of unforeseen events.

- Ancillary Products: Various other value-added offerings available at the point of sale.

For the fiscal year 2024, iA Financial Corporation reported a significant increase in its dealer services segment, reflecting strong consumer demand for these protection products. This growth contributes positively to the company's overall financial performance.

Administrative and Service Fees

Administrative and service fees form a crucial part of iA Financial Corporation's revenue, supplementing income from premiums and investment returns. These fees are generated from various operational aspects of their business, offering a diversified income stream. For instance, policy administration fees cover the costs associated with managing insurance policies throughout their lifecycle.

Furthermore, fees for specific financial services, such as those related to wealth management or investment products, contribute significantly. In 2023, iA Financial Group reported that its individual and group insurance segments, which rely heavily on such fees, continued to show resilience. The company's diverse fee structure helps stabilize earnings, particularly in fluctuating market conditions.

- Policy Administration Fees: These cover the ongoing costs of managing insurance contracts.

- Financial Service Fees: Revenue derived from advisory, management, or transaction-based services in wealth management.

- Other Service Charges: Fees for specific requests or administrative actions related to client accounts.

iA Financial Corporation's revenue streams are diversified, with insurance premiums forming the core. Wealth management fees and net investment income are also significant contributors, reflecting the company's broad financial services offering.

In 2024, iA Financial Group continued to see robust performance across its segments. For example, their insurance operations consistently generate substantial premium income, while their wealth management arm benefits from ongoing asset growth and advisory services.

The company also leverages dealer services, including extended warranties and creditor insurance, which saw notable growth in 2024. Administrative and service fees further bolster revenue by covering policy management and various financial service transactions.

| Revenue Stream | 2024 Data Highlight | Key Components |

| Insurance Premiums | Robust demand for life and health policies | Individual & Group Life/Health |

| Wealth Management Fees | Consistent income from assets under management | Management Fees, Advisory Fees, Brokerage Commissions |

| Net Investment Income | Significant growth from investment portfolio | Interest, Dividends, Capital Gains |

| Dealer Services | Notable growth in protection products | Extended Warranties, Creditor Insurance, Ancillary Products |

| Administrative & Service Fees | Diversified income from operations | Policy Administration, Financial Service Fees, Other Service Charges |

Business Model Canvas Data Sources

The iA Financial Corporation Business Model Canvas is informed by a combination of internal financial disclosures, extensive market research on insurance and financial services trends, and strategic insights derived from competitor analysis and industry best practices.