iA Financial Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iA Financial Corporation Bundle

Curious about iA Financial Corporation's market standing? This preview offers a glimpse into their BCG Matrix, highlighting key product segments. To truly unlock strategic opportunities and understand where to invest for future growth, dive into the comprehensive analysis.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for iA Financial Corporation.

Stars

iA Financial Group dominates the Canadian segregated fund market, holding the top sales position. This leadership is underscored by a remarkable 52% year-over-year sales increase in Q1 2025, fueled by substantial net fund inflows. The broader Canadian wealth management sector's growth further solidifies segregated funds as a key high-growth, high-market-share product for iA.

US Individual Insurance is a star performer for iA Financial Corporation. Sales in this segment surged by 62% in the first quarter of 2025, a clear indicator of strong market demand and successful strategy execution.

This remarkable sales growth directly fueled a significant 58% year-over-year increase in core earnings for the entire US Operations segment. It highlights Individual Insurance as a high-growth area with expanding market share.

iA Financial Group's Canadian Group Insurance segment is a standout performer, demonstrating impressive sales momentum. In the first quarter of 2025, sales surged to $178 million, a remarkable nearly threefold increase and a 30.9% jump from the prior year's first quarter.

This robust growth underscores the segment's position as a high-potential area within the Canadian insurance landscape. iA Financial Group is actively capitalizing on this by broadening its reach in employee benefits and travel medical insurance, thereby expanding its market presence.

Overall Individual Wealth Management Sales

The Individual Wealth Management segment at iA Financial Corporation demonstrated impressive momentum, with sales surging by 30.2% to reach $3,053 million in the first quarter of 2025.

This robust sales performance directly contributed to a significant 15% increase in the company's overall assets under management and administration over the preceding twelve months. The growth reflects iA Financial Corporation's success in capturing opportunities within a favorable market landscape.

The Canadian wealth management market is experiencing a notable expansion, positioning iA Financial Corporation's offerings within a high-growth sector. This favorable market dynamic supports the continued upward trajectory of the Individual Wealth Management segment.

- Sales Growth: 30.2% increase to $3,053 million in Q1 2025.

- AUM/Admin Growth: 15% rise over the last 12 months.

- Market Context: Expansion in the Canadian wealth management market.

US Dealer Services

iA Financial Corporation's US Dealer Services segment is a shining example of a star within its BCG Matrix. This division experienced a remarkable surge in sales, climbing 23% in the first quarter of 2025. This robust growth is a key driver behind the impressive 58% rise in core earnings for iA's overall US Operations.

The consistent strong performance of US Dealer Services solidifies its position as a high-growth product line for iA in the American market. This upward trajectory indicates significant potential for continued expansion and market share gains.

- US Dealer Services Sales Growth: 23% increase in Q1 2025.

- Contribution to US Operations: Significant factor in the 58% rise in core earnings.

- Market Position: Identified as a high-growth product line for iA in the US.

The US Dealer Services segment is a clear star for iA Financial Corporation, showing a 23% sales increase in Q1 2025. This segment's strong performance is a major contributor to the 58% core earnings growth in US Operations, cementing its status as a high-growth product in the US market.

| Business Segment | Q1 2025 Sales Growth | Contribution to US Operations Earnings | Market Position |

| US Dealer Services | 23% | Key driver for 58% core earnings growth | High-growth product line |

What is included in the product

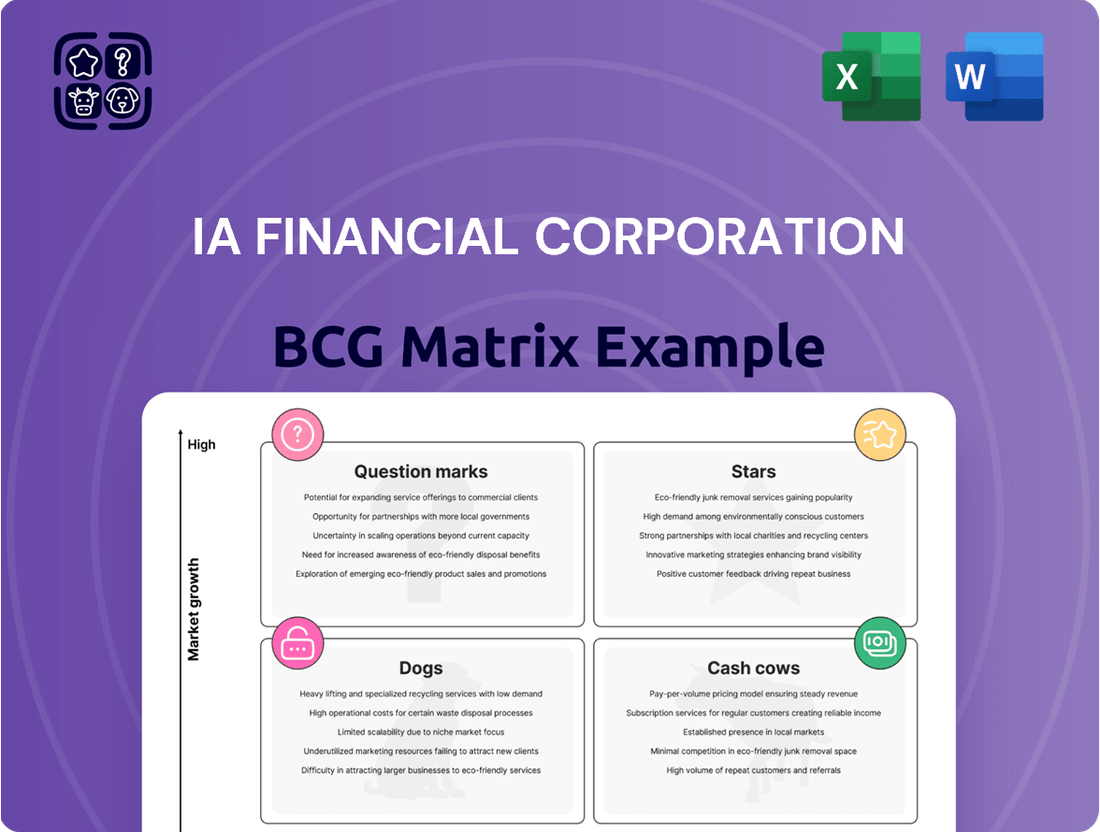

iA Financial Corporation's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps iA Financial Corporation identify which units to invest in, hold, or divest to optimize its portfolio.

The iA Financial Corporation BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain of strategic uncertainty.

Cash Cows

iA Financial Group stands out in the Canadian individual insurance sector, holding a significant 27% market share for policies issued. This demonstrates a strong and established presence in a competitive landscape.

Despite a record high in new annualized premiums for the Canadian life insurance market in 2024, the total number of policies sold actually decreased. This trend suggests a maturing market where iA Financial Group’s ability to maintain a high and stable market share is particularly noteworthy.

Canadian Critical Illness Insurance stands as a prime Cash Cow for iA Financial Group. The company boasts the leading market share in Canada for critical illness insurance premiums, capturing an impressive 29% of the market.

This dominant position within a mature segment of the Canadian insurance industry allows iA Financial Group to generate substantial and consistent cash flow. The product requires relatively low investment for growth, contributing to its stability.

In the Canadian disability insurance market, iA Financial Corporation holds a solid second position, capturing an 18% share of premiums. This established presence in a mature sector means the product generates consistent, stable earnings for the company.

Much like its critical illness insurance, disability insurance benefits from iA's strong competitive standing. This allows the company to require less marketing expenditure to maintain its market position, contributing to predictable profitability.

Established Group Savings and Retirement Plans

iA Financial Corporation's established Group Savings and Retirement Plans segment, while seeing some fluctuations in sales recently, remains a bedrock for the company's financial strength. This mature market, characterized by its loyal client base and impressive retention rates, reliably generates substantial assets under management and administration, ensuring a consistent and predictable cash flow. For instance, as of the first quarter of 2024, this segment continued to be a significant contributor to iA Financial's overall financial performance, reflecting its stability.

This segment's contribution to iA Financial Corporation's overall financial health is undeniable. Its mature nature translates into predictable revenue streams, making it a vital component of the company's cash cow strategy.

- Consistent Asset Growth: The segment consistently adds to iA's assets under management and administration, demonstrating its ongoing relevance and stability.

- High Retention Rates: Mature markets like group savings and retirement plans typically boast high client retention, minimizing churn and maximizing long-term value.

- Stable Cash Flow Generation: The predictable nature of these plans provides iA Financial with a reliable source of cash, funding other business initiatives or investments.

- Mature Market Dynamics: Operating in a well-established market allows for efficient operations and less susceptibility to rapid market shifts, further solidifying its cash cow status.

iA Auto and Home (Canada)

iA Auto and Home in Canada is a prime example of a Cash Cow within iA Financial Corporation's portfolio. Its direct written premiums saw a substantial 13% increase in the first quarter of 2025, following an impressive 16% growth in 2024.

This performance highlights the segment's robust market presence and its ability to consistently generate revenue in the established Canadian property and casualty insurance sector. The sustained premium growth indicates strong customer retention and effective market penetration.

- Consistent Growth: iA Auto and Home's direct written premiums grew 16% in 2024 and continued this trend with a 13% increase in Q1 2025.

- Mature Market Strength: The segment thrives in the competitive Canadian property and casualty insurance landscape.

- Strong Revenue Generation: This business unit is a reliable source of income for iA Financial Corporation.

Canadian Critical Illness Insurance and Disability Insurance are key cash cows for iA Financial Group. The company leads the market in critical illness with a 29% share of premiums and holds a strong second position in disability insurance with an 18% share. These mature segments generate stable earnings with lower investment needs, contributing significantly to predictable profitability.

iA Financial Corporation's Group Savings and Retirement Plans segment, despite recent sales fluctuations, acts as a stable cash cow. Its mature market characteristics, including high retention rates, ensure substantial assets under management and administration, providing consistent cash flow as demonstrated by its ongoing contribution in Q1 2024.

The Auto and Home insurance segment is another strong cash cow, exhibiting robust growth with a 16% increase in direct written premiums in 2024 and a further 13% in Q1 2025. This sustained performance in the Canadian property and casualty sector highlights its reliable revenue generation and market penetration.

| Segment | Market Position | Key Metric | 2024/Q1 2025 Data |

| Critical Illness Insurance | Leading | Market Share (Premiums) | 29% |

| Disability Insurance | Second | Market Share (Premiums) | 18% |

| Group Savings & Retirement | Established | Assets Under Management/Admin | Consistent contributor (Q1 2024) |

| Auto and Home Insurance | Strong | Direct Written Premiums Growth | 16% (2024), 13% (Q1 2025) |

Preview = Final Product

iA Financial Corporation BCG Matrix

The iA Financial Corporation BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, ensuring you get a professionally designed and analysis-ready document for immediate strategic application.

Dogs

In the fourth quarter of 2024, iA Financial Group experienced a notable downturn in insured annuity sales, which fell to $434 million compared to $702 million in the same period of the previous year. This substantial decrease suggests a shift in client preference towards higher-risk investment opportunities, likely driven by a more optimistic financial market outlook.

This trend indicates a potentially stagnant or shrinking market for insured annuities. If this pattern continues and iA Financial Group does not hold a commanding position within this particular product category, it would align with the characteristics of a 'dog' in the BCG matrix, signifying a low-growth, low-market-share segment.

Certain traditional term life insurance policies from iA Financial Corporation might be classified as question marks or even dogs within a BCG matrix analysis. While the Canadian life insurance market saw premium growth in 2024, the actual number of policies sold, including term life, has been on a downward trend for four consecutive years. This suggests a potentially declining market for these specific products.

If iA's traditional term life offerings are not keeping pace with market demand or are facing stiff competition, they could represent products with low market share in a slow-growing or contracting segment. For instance, if iA's market share in traditional term life in Canada was below the industry average in 2024, and the overall growth rate for this product type remained stagnant or negative, it would reinforce a dog classification.

Within iA Financial Corporation's Dealer Services segment, specific credit insurance products faced a sales decline of 9% in 2024. This downturn, coupled with a potentially low market share in this particular niche, positions these products as potential 'dogs' in the BCG matrix.

Underperforming Legacy Investment Offerings

While iA Financial Corporation demonstrates strong sales in segregated and mutual funds, it's probable that some older investment products within their wealth management segment are underperforming. These legacy offerings may possess a smaller market share, attracting limited new business and contributing minimally to overall growth. Consequently, these products could demand significant management attention without yielding commensurate returns.

For instance, by the end of 2023, iA Financial Group reported total assets under management and administration of $230.6 billion. Within this vast portfolio, older, less adaptable investment vehicles might represent a shrinking portion of new sales, even if the overall fund sales figures remain healthy. This scenario positions these specific products as potential 'Dogs' in the BCG matrix.

- Low Market Share: Certain niche or outdated investment products may hold a declining share of the market.

- Minimal New Business: These offerings might not be attracting significant new investments, hindering growth.

- Disproportionate Effort: Management resources could be allocated to these products without generating substantial returns.

- Potential for Divestment or Restructuring: Underperforming legacy products may require strategic review, including potential divestment or significant restructuring to align with current market demands.

Geographically Limited or Niche Products with Stagnant Market Share

Geographically limited products or niche services within iA Financial Corporation, particularly those not experiencing significant market share growth in their specific regions, can be categorized as dogs. These offerings might be consuming valuable resources without demonstrating a clear path to future profitability or market expansion. For instance, a highly specialized insurance product tailored to a very small, specific demographic in a single province, if not seeing increased uptake, would fit this description.

These underperforming assets can become a drain on the company's financial resources. Without substantial investment or a strategic pivot, they are unlikely to contribute meaningfully to overall growth. It's crucial for iA Financial Corporation to identify and manage these segments to reallocate capital towards more promising ventures.

- Stagnant Market Share: Products with a fixed or declining percentage of their limited market.

- Resource Drain: Operations that require ongoing investment without commensurate returns.

- Limited Growth Potential: Offerings unlikely to expand beyond their current niche or geographic boundaries.

Products classified as dogs within iA Financial Corporation's portfolio exhibit low market share in slow-growing or declining segments. These offerings, such as certain traditional term life insurance policies or niche credit insurance products, may not attract significant new business and could consume resources without generating substantial returns.

For example, a 9% sales decline in specific Dealer Services credit insurance products in 2024, coupled with potentially low market share, indicates a dog classification. Similarly, older, less adaptable investment products within wealth management might represent a shrinking portion of new sales, even if overall fund sales are healthy.

These segments require careful management, potentially involving restructuring or divestment, to reallocate capital towards more promising growth areas. The company must identify these underperforming assets to optimize its overall business strategy and financial performance.

iA Financial Corporation's 2024 performance data, such as the decrease in insured annuity sales to $434 million from $702 million year-over-year, highlights a potential shift away from certain product lines, further emphasizing the need to analyze and manage segments that may be classified as dogs.

Question Marks

iA Financial Corporation's acquisition of RF Capital Group (Richardson Wealth) in July 2025 positions it to capture a significant share of the high-net-worth market, adding over $40 billion in assets under administration. This strategic expansion into a lucrative segment, while requiring initial investment, is projected to be neutral to core earnings in its first year before becoming accretive in the second. This indicates a deliberate strategy to integrate and grow its presence in this valuable demographic.

The Canadian insurance sector is actively seeking new digital approaches, mirroring a broader trend of online market expansion. iA Financial Corporation is channeling resources into digital advancements to boost sales and operational efficiency. For instance, the online insurance market in Canada saw a notable increase in adoption rates throughout 2023, with digital channels accounting for an estimated 15% of new life insurance policies sold, up from 12% in 2022.

New digital insurance and wealth platforms, though operating in a dynamic, high-growth segment, are likely still developing their market presence for iA. These ventures, while promising, represent significant investment opportunities in their nascent stages. Industry analysts project the digital insurance market in Canada to grow at a compound annual growth rate of 8% through 2028, underscoring the strategic importance of these iA initiatives.

iA Financial Corporation's strategy for expanding into new US Dealer Services segments focuses on targeted acquisitions and organic growth to build a stronger presence. While the overall US Dealer Services sector is expanding, iA is making deliberate moves into specific, high-potential sub-segments within this market.

In these emerging areas, iA's market share is likely to be relatively low initially due to the nascent nature of these sub-segments. This necessitates substantial investment to establish a leadership position and capitalize on future growth opportunities. For instance, if iA acquired a niche provider of digital financing solutions for dealerships in late 2023, their initial market share in that specific digital segment would be minimal, requiring significant capital allocation for development and market penetration.

Targeted Growth in Specific High-Net-Worth Segments

iA Financial Corporation's strategic move with the acquisition of Richardson Wealth is a clear indicator of its focus on targeted growth within specific high-net-worth segments. This acquisition is designed to significantly bolster iA's position in the Canadian independent wealth management sector, a market segment characterized by substantial growth potential.

The company recognizes this as a high-growth area where its current market share is relatively lower, making it a prime candidate for strategic investment. This initiative underscores a deliberate effort to capture a larger portion of this lucrative market.

- Targeted Segment: High-net-worth individuals in the Canadian independent wealth management market.

- Strategic Rationale: Enhance market presence and capture growth in a segment where iA's current share is lower.

- Investment Focus: Requires strategic investment and integration to unlock the full potential of this high-growth target market.

- 2024 Context: The wealth management industry in Canada saw continued consolidation and a strong focus on attracting and retaining high-net-worth clients throughout 2024, with firms like iA actively pursuing strategic acquisitions to achieve this.

Emerging Markets/Products in Canadian Wealth Management

The Canadian wealth management sector is experiencing robust expansion, with forecasts indicating continued strong growth. Key areas of opportunity lie in delivering highly personalized financial advice and facilitating the smooth transfer of wealth between generations. For iA Financial Corporation, any new, innovative products or advisory models designed to tap into these burgeoning high-growth segments would likely begin with a modest market share, necessitating significant investment to establish a competitive position.

Emerging opportunities in Canadian wealth management are poised for significant growth. For instance, the demand for hyper-personalized financial advice is escalating as clients seek tailored strategies. Furthermore, the impending intergenerational wealth transfer, estimated to involve trillions of dollars in Canada over the coming decades, presents a substantial opportunity for wealth managers equipped to handle complex estate planning and investment transitions.

- Personalized Advice: Growing client demand for tailored financial strategies.

- Intergenerational Wealth Transfer: A significant demographic shift creating new client needs.

- Digital Integration: Leveraging technology to enhance client experience and advisory efficiency.

- ESG Investing: Increasing investor interest in sustainable and responsible investment options.

Question marks in iA Financial Corporation's BCG Matrix likely represent emerging ventures or new market entries where the company's market share is low, but the market's growth potential is high. These are areas requiring significant investment and strategic focus to develop into future stars or cash cows.

For example, iA's expansion into niche digital insurance solutions or specific segments of the US Dealer Services market could be considered question marks. These ventures are in high-growth industries but may still be establishing their footprint and market share.

The company's investment in digital platforms and its acquisition strategy for specific wealth management niches also fit this profile. While the potential is substantial, initial market penetration and revenue generation might be lower, necessitating careful management and further capital infusion.

The success of these question marks will depend on iA's ability to effectively execute its growth strategies, adapt to market dynamics, and capture a significant share of these expanding markets.

BCG Matrix Data Sources

Our BCG Matrix leverages iA Financial Corporation's internal financial statements, annual reports, and product performance data. This is augmented by external market research, industry growth forecasts, and competitor analysis to ensure accurate strategic positioning.