iA Financial Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iA Financial Corporation Bundle

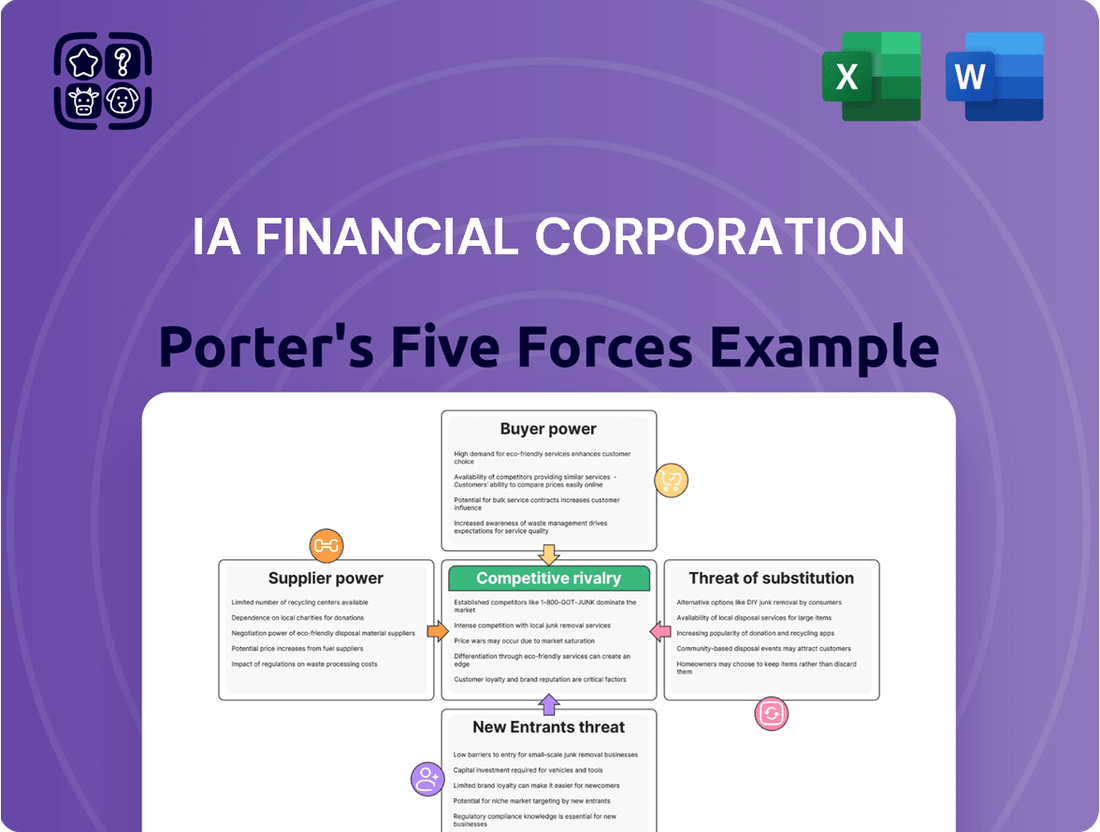

iA Financial Corporation operates within a dynamic insurance landscape, facing moderate bargaining power from both buyers and suppliers. The threat of new entrants is somewhat limited by regulatory hurdles and capital requirements, while the intensity of rivalry among existing players requires constant innovation and customer focus. Substitutes, though present, often lack the comprehensive benefits offered by established insurance providers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore iA Financial Corporation’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of technology providers for iA Financial Corporation is significant, particularly given the company's reliance on advanced digital platforms, data analytics, and AI. As financial services firms, including insurers like iA Financial, pour more resources into modernization and customer experience enhancements, the demand for specialized software, cloud infrastructure, and robust cybersecurity solutions escalates. For instance, the global spending on digital transformation in the financial services sector was projected to reach over $2 trillion by 2025, highlighting the critical nature of these technology investments.

The financial services sector, including iA Financial Corporation, relies heavily on specialized human capital. Think of actuaries, investment managers, and seasoned financial advisors – these individuals are essentially critical suppliers of expertise. Their specialized knowledge is not easily replicated, giving them significant leverage.

The competition for these highly skilled professionals is fierce, especially for those with skills in digital transformation and artificial intelligence. In 2024, the demand for AI specialists in finance outstripped supply, leading to significant salary increases and enhanced benefits packages, a clear indicator of their growing bargaining power.

For iA Financial, securing and keeping this top-tier talent is paramount. Companies that invest in robust training, attractive compensation, and a positive work environment are better positioned to retain these valuable employees, thereby safeguarding their competitive edge and capacity for innovation.

Reinsurance companies are critical suppliers for iA Financial Corporation, enabling it to manage and mitigate substantial risks inherent in its life and health insurance offerings. The global reinsurance market is quite concentrated, with a handful of major players wielding considerable influence over pricing and contract conditions.

This concentration grants these reinsurers significant bargaining power, directly affecting iA Financial's expenses for risk transfer and, consequently, its overall profitability. For instance, in 2024, the global reinsurance market continued to see robust demand, with major reinsurers reporting strong premium growth, which can translate into upward pricing pressure for cedents like iA Financial.

Data and Information Services

In the financial services sector, data and information providers hold significant sway. These entities supply essential market data, credit ratings, demographic insights, and analytical platforms that are foundational for insurance and wealth management operations. For iA Financial Corporation, access to accurate and timely data is paramount for effective underwriting, risk management, and strategic planning.

The bargaining power of these suppliers stems from the critical nature of their offerings and, in some cases, the proprietary or specialized nature of their data and analytical services. This can create dependencies for financial institutions, allowing data providers to exert leverage.

- Critical Dependence: Financial institutions like iA Financial Corporation rely heavily on external data providers for market intelligence, credit scoring, and regulatory compliance, making them indispensable.

- Proprietary Data & Analytics: Some data providers offer unique datasets or sophisticated analytical tools that are not easily replicated, granting them pricing power. For instance, Bloomberg Terminal, a key data service, commands a significant subscription fee due to its comprehensive and integrated nature.

- Industry Consolidation: In certain segments of the data services market, consolidation has led to fewer, larger players, potentially increasing their bargaining strength.

- Switching Costs: Migrating data systems and analytical processes to a new provider can be costly and time-consuming, further solidifying the position of existing suppliers.

Marketing and Distribution Partners

iA Financial Corporation leverages a diverse distribution strategy, incorporating both its internal channels and external marketing and distribution partners. These independent networks, including wealth management advisors, are crucial for reaching a broader customer base. Their existing client relationships and specialized marketing skills can translate into significant bargaining power, affecting iA Financial's customer acquisition costs and overall market penetration efficiency.

The reliance on these external partners means their ability to deliver results directly impacts iA Financial's sales performance. For instance, a strong independent advisor network can significantly boost sales in specific market segments. Conversely, if these partners have limited reach or are less effective, it can hinder the company's growth trajectory.

- Distribution Reach: Independent advisors and marketing agencies often possess established client bases, giving them leverage in negotiations.

- Marketing Expertise: Specialized marketing skills from partners can enhance customer acquisition, but also increase costs if not managed effectively.

- Cost of Acquisition: The bargaining power of these partners can directly influence the cost iA Financial incurs to acquire new customers.

- Market Penetration: The effectiveness of these external channels is a key determinant in how deeply iA Financial can penetrate various market segments.

The bargaining power of suppliers for iA Financial Corporation is influenced by several key factors, including technology providers, specialized talent, reinsurers, data providers, and distribution partners.

Technology providers hold significant leverage due to iA Financial's increasing reliance on digital platforms and AI, with global financial services digital transformation spending projected to exceed $2 trillion by 2025. Similarly, highly skilled professionals like actuaries and AI specialists, in high demand in 2024, command strong bargaining power due to their specialized knowledge and the competitive market for talent.

Reinsurers, critical for risk management, also exert considerable power due to the concentrated nature of the global reinsurance market, which saw robust premium growth in 2024, potentially leading to upward pricing pressure. Data providers are essential for iA Financial's operations, and their proprietary data, coupled with high switching costs, strengthens their position.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on iA Financial |

|---|---|---|

| Technology Providers | Reliance on advanced platforms, AI; high demand for specialized solutions | Increased costs for modernization, potential dependency |

| Specialized Talent (e.g., Actuaries, AI Specialists) | Unique skills, fierce competition for talent (especially AI in 2024) | Higher compensation and benefits costs, retention challenges |

| Reinsurers | Market concentration, strong demand for reinsurance (2024) | Higher risk transfer costs, potential impact on profitability |

| Data & Information Providers | Critical nature of data, proprietary offerings, high switching costs | Dependency on data accuracy, potential for increased data service fees |

| Distribution Partners (e.g., Independent Advisors) | Established client relationships, marketing expertise | Influence on customer acquisition costs and market penetration |

What is included in the product

This analysis delves into the competitive pressures faced by iA Financial Corporation, examining the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes within the financial services industry.

Instantly assess competitive pressures across all five forces, providing a clear roadmap for strategic adjustments and pain point mitigation.

Customers Bargaining Power

Customers of iA Financial Corporation, whether individuals seeking insurance or businesses requiring wealth management, face a highly competitive market with numerous options. In 2024, the Canadian financial services sector continued to demonstrate this, with a significant number of providers vying for market share. This broad array of choices enhances customer bargaining power, as they can easily compare products and switch providers if not satisfied.

For instance, individuals looking for life insurance in 2024 had over 20 major Canadian life insurers to consider, alongside numerous smaller players and independent brokers. Similarly, businesses seeking group benefits or wealth management services could engage with large diversified banks, credit unions, and a growing segment of independent wealth management firms, many of which expanded their offerings and client bases through 2024.

Customers are increasingly sensitive to prices, especially for standardized products like basic insurance policies or simple investment accounts. This means that if iA Financial Corporation or its competitors raise prices too much on these offerings, customers are likely to look elsewhere. This is a big deal because, in 2024, the insurance industry saw continued pressure on pricing as more information became readily available online, making comparisons easier than ever.

The ease of comparing options online means that even for more complex financial products, customers can still get a sense of what a fair price should be. This transparency puts a constant squeeze on providers to keep their pricing competitive. For instance, while personalized financial advice is valuable, the underlying costs of delivering that advice are becoming more transparent, forcing companies to justify their fees carefully.

While some intricate wealth management or long-term insurance contracts can present moderate hurdles for customers to switch providers, many of iA Financial Corporation's simpler product offerings have quite low barriers to entry for competitors. This ease of transitioning basic accounts or simply obtaining new insurance quotes allows customers to actively seek out more favorable terms or better-suited products elsewhere, thereby amplifying their collective bargaining power.

Demand for Digital and Personalized Experiences

Modern customers increasingly demand intuitive digital interactions and tailored financial guidance. iA Financial Corporation, like its peers, faces pressure as consumers expect integrated solutions that simplify their financial lives. Failing to deliver these seamless experiences, especially compared to nimble fintech competitors, can lead to customer attrition.

The growing influence of customers is evident in their willingness to switch providers for superior digital platforms and personalized advice. iA Financial's investment in digitizing its services and offering holistic advice is crucial for maintaining customer loyalty and satisfaction in this evolving landscape.

For instance, a 2024 report indicated that 65% of consumers consider digital convenience a primary factor when choosing a financial institution. This highlights the direct impact of a firm's technological capabilities on its ability to retain and attract customers, amplifying the bargaining power of these digitally savvy consumers.

Key aspects of this demand include:

- Seamless Digital Onboarding: Customers expect quick and easy account opening and service access online.

- Personalized Product Recommendations: Tailored advice and product offerings based on individual financial goals and behavior are highly valued.

- Integrated Financial Management Tools: The ability to view and manage all financial products from a single, user-friendly interface is a significant draw.

- Proactive Communication and Support: Customers appreciate timely updates and accessible support through their preferred digital channels.

Access to Information and Comparison Tools

Customers today have access to a wealth of information thanks to the internet and numerous financial comparison websites. This makes it much easier for them to research products, compare prices, and read reviews from other users. For instance, in 2024, platforms like Ratehub.ca and LowestRates.ca continue to offer Canadians side-by-side comparisons of insurance, mortgage, and banking products, directly impacting how consumers choose providers.

This transparency significantly levels the playing field, reducing the information gap that previously favored financial institutions. Armed with detailed product knowledge and competitive pricing data, customers are better equipped to negotiate favorable terms and select the most cost-effective options. In 2024, the ongoing digital transformation means that more consumers than ever are utilizing these tools before making significant financial decisions.

- Increased Transparency: Online platforms provide easy access to product features, fees, and customer satisfaction ratings.

- Informed Decision-Making: Customers can compare multiple providers quickly, leading to more educated choices.

- Negotiating Power: Knowledge of competitor offerings empowers customers to seek better rates and terms.

The bargaining power of customers for iA Financial Corporation is substantial due to the highly competitive financial services landscape. In 2024, the availability of numerous providers, coupled with increasing price sensitivity and ease of online comparison, empowers consumers to demand better terms and pricing. This is further amplified by a growing expectation for seamless digital experiences and personalized advice, making customer retention a critical focus for iA Financial.

| Factor | Impact on iA Financial | 2024 Data/Trend |

|---|---|---|

| Market Competition | High | Numerous insurers and wealth managers in Canada |

| Price Sensitivity | High for standardized products | Easy online price comparisons drive down margins |

| Switching Costs | Low for basic products | Customers can easily obtain new quotes or switch accounts |

| Digital Expectations | High | 65% of consumers prioritize digital convenience (2024 report) |

What You See Is What You Get

iA Financial Corporation Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of iA Financial Corporation, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the insurance and financial services sectors, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

iA Financial Corporation faces significant competitive rivalry in the Canadian financial services landscape, largely due to the presence of large, diversified players. Major banks and established life insurers like Manulife and Sun Life are key competitors, offering a broad spectrum of insurance and wealth management products, directly challenging iA across various market segments.

This market concentration means that actions taken by any of these major entities, such as pricing adjustments or new product launches, can have a substantial ripple effect on the entire industry, intensifying the competitive pressure for iA Financial Corporation.

The Canadian life insurance sector displayed a mature market characteristic in 2024, with record new annualized premiums but a continued decline in the number of policies sold for the fourth year running. This suggests intense rivalry focused on acquiring existing customers rather than broad market expansion.

Similarly, the wealth management landscape, while experiencing growth in assets under management, is also contending with heightened competition and industry consolidation. These dynamics compel companies like iA Financial Corporation to prioritize innovation and strategic maneuvers to gain market share from competitors.

Competitive rivalry in the insurance sector goes far beyond just pricing; it’s a fierce battleground for product features, service excellence, and cutting-edge digital innovation. In 2024, insurers like iA Financial are heavily invested in differentiating their offerings, from enhanced participating whole life products to integrated wealth management solutions and intuitive digital platforms designed to capture and hold client attention.

This intense competition means companies must constantly innovate to stand out. iA Financial's strategic emphasis on its distinct business model and its commitment to developing best-in-class digital tools are crucial differentiators in a market where clients expect seamless, personalized experiences and robust product portfolios.

High Exit Barriers

The insurance and wealth management industries, where iA Financial Corporation operates, are characterized by substantial capital outlays, intricate regulatory landscapes, and deeply entrenched customer relationships. These factors combine to erect significant barriers to exiting the market for established firms.

Consequently, even companies experiencing lower profitability often choose to persist rather than divest, as the costs and complexities of exiting are prohibitive. This dynamic ensures that a greater number of players remain active, intensifying the competitive struggle for market share and putting downward pressure on profit margins across the board.

- Significant Capital Investments: Establishing and maintaining operations in financial services requires vast sums for technology, infrastructure, and compliance, making it difficult to recoup these investments upon exit.

- Regulatory Complexities: Navigating the intricate web of financial regulations and obtaining necessary approvals for divestiture or closure can be a lengthy and costly process.

- Long-Term Customer Commitments: Insurance policies and wealth management relationships are typically long-term, creating an obligation to serve existing clients that discourages rapid market departure.

- Sustained Rivalry: The inability or unwillingness of firms to exit leads to a more crowded marketplace, where companies must constantly compete to retain customers and market position, thereby suppressing profitability.

M&A Activity and Strategic Acquisitions

The financial services industry, particularly in wealth management, is seeing significant consolidation through mergers and acquisitions (M&A). This activity is driven by a need for greater scalability, broader market access, and enriched product portfolios. For instance, iA Financial Corporation bolstered its presence in the high-net-worth sector and expanded its distribution channels through strategic acquisitions like RF Capital Group. This ongoing M&A trend underscores a highly competitive environment where companies actively pursue consolidation to secure a more robust competitive standing.

The strategic importance of M&A in the financial sector is evident in the pursuit of competitive advantages through scale and market penetration. Firms are actively seeking targets that complement their existing operations or offer entry into new, lucrative segments. This dynamic landscape means that a company's strategic growth often hinges on its ability to identify and execute successful acquisition strategies, thereby reshaping the competitive forces at play.

- Industry Consolidation: Ongoing M&A activity is a key feature, especially in wealth management, aimed at achieving economies of scale and market expansion.

- Strategic Acquisitions by iA Financial: iA Financial's acquisition of RF Capital Group exemplifies the trend, strengthening its position in the high-net-worth market and distribution network.

- Competitive Landscape Dynamics: This M&A trend highlights a fluid competitive environment where firms consolidate to gain a significant edge.

Competitive rivalry is intense for iA Financial Corporation, fueled by large, diversified players and a mature Canadian financial services market. In 2024, the life insurance sector saw record new premiums but fewer policies, indicating a battle for existing customers. Similarly, wealth management faces increased competition and consolidation, forcing iA to innovate.

The inability of firms to easily exit the market, due to high capital investments, regulatory hurdles, and long-term customer commitments, ensures sustained rivalry. This keeps the marketplace crowded, intensifying competition for market share and putting pressure on profit margins.

Mergers and acquisitions are reshaping the competitive landscape, as seen with iA Financial's acquisition of RF Capital Group, aiming for greater scale and market access. This trend underscores a dynamic environment where strategic consolidation is key to gaining a competitive advantage.

| Metric | iA Financial Corporation (2024 Estimate) | Key Competitors (2024 Estimate) |

|---|---|---|

| Market Share (Life Insurance) | ~7% | Manulife (~15%), Sun Life (~12%) |

| Assets Under Management (Wealth) | $100B+ | Large banks' wealth divisions ($500B+) |

| New Annualized Premiums (Life Insurance) | $2B+ | Competitors collectively $15B+ |

SSubstitutes Threaten

The proliferation of direct investment and self-management platforms presents a significant threat of substitutes for iA Financial Corporation. These online brokerage and robo-advisor services, such as Wealthsimple and Questrade, empower individuals to directly manage their portfolios with significantly lower fees compared to traditional advisory models. For instance, robo-advisors typically charge annual management fees in the range of 0.25% to 0.75%, a stark contrast to the potentially higher fees associated with human advisors.

This accessibility and cost-effectiveness make these platforms particularly attractive to a growing segment of investors, especially younger demographics and those with a higher degree of financial literacy. By offering greater control and reduced costs, these substitutes directly challenge the value proposition of iA Financial's wealth management services. This necessitates that iA Financial clearly articulate and demonstrate the unique benefits of its integrated solutions and professional guidance to retain and attract clients in this evolving landscape.

Government social programs like public healthcare and universal pension plans can act as substitutes for private insurance, potentially dampening demand for iA Financial's life, health, and disability products. For instance, Canada’s universal healthcare system covers essential medical services, reducing the immediate need for comprehensive private health insurance for many citizens.

While these programs offer a baseline of support, they often don't match the breadth or customization of private offerings. iA Financial can counter this threat by emphasizing the unique benefits, such as enhanced coverage options, tax advantages, and personalized financial planning, that its products provide beyond government provisions.

Fintech innovations are a significant threat to iA Financial Corporation, particularly in insurance and wealth management. Companies like Lemonade, for instance, have disrupted the insurance industry by leveraging AI and behavioral economics to offer streamlined, direct-to-consumer policies. In 2023, the insurtech market continued its growth trajectory, with significant venture capital flowing into solutions that offer greater convenience and often lower costs than traditional providers. This trend is expected to accelerate, with embedded insurance, where coverage is seamlessly integrated into other purchases, becoming increasingly prevalent. For example, buying a new car could automatically offer roadside assistance insurance, bypassing iA Financial's traditional channels.

Alternative Risk Management Strategies for Businesses

The threat of substitutes for iA Financial's group insurance segment is significant. Businesses, particularly larger ones, are increasingly exploring alternative risk management strategies that bypass traditional insurance providers. These alternatives can offer substantial cost advantages and more tailored control over risk. For instance, a substantial portion of large corporations in North America now utilize some form of self-insurance or captive insurance programs to manage their liabilities, a trend that has been growing steadily. In 2024, the global alternative risk transfer market was estimated to be worth over $100 billion, reflecting a strong demand for these options.

These alternative approaches can provide direct cost savings by eliminating insurer overhead and profit margins. Furthermore, they allow companies to retain underwriting profits and investment income generated from their own reserves. This can be particularly attractive for businesses with predictable risk profiles. For example, a large manufacturing firm might establish a captive to insure its property damage risks, investing the premiums internally and benefiting from any favorable claims experience.

The increasing sophistication of financial markets and the availability of specialized risk management solutions mean that businesses have more options than ever before. This necessitates that iA Financial Corporation continuously innovate and offer highly competitive, value-added group insurance products. They must demonstrate clear benefits beyond basic coverage, such as superior claims management, enhanced employee benefits administration, or specialized risk mitigation services, to retain market share against these substituting strategies.

- Self-Insurance: Businesses retain their own risk, setting aside funds to cover potential losses.

- Captive Insurance: A subsidiary created by a parent company to insure its own risks, offering greater control and potential cost savings.

- Alternative Risk Transfer (ART): Mechanisms like finite risk insurance, catastrophe bonds, and weather derivatives that shift risk to capital markets.

- Growing Market: The global ART market's expansion indicates a clear shift in how businesses approach risk management.

Lifestyle Changes and Risk Perception

Shifting societal views on risk and financial security directly impact the demand for iA Financial Corporation's offerings. For example, a growing preference for flexible, on-demand services over traditional long-term commitments might lead consumers to seek alternative solutions for protection and savings. This trend is evident in the rise of the gig economy, where a significant portion of the workforce may prioritize immediate income over long-term insurance or retirement planning.

The emphasis on preventative health and wellness is another factor. As individuals become more proactive about their health, they may perceive certain health-related insurance needs differently, potentially reducing the perceived value of some traditional products. In 2024, for instance, the global wellness market continued its expansion, indicating a strong consumer focus on proactive health management.

- Evolving Consumer Preferences: A move towards personalized and flexible financial solutions challenges standardized insurance products.

- Health and Lifestyle Trends: Increased focus on preventative health can alter the perceived need for certain medical or life insurance coverages.

- Alternative Financial Models: The growth of peer-to-peer lending and crowdfunding platforms offers substitutes for traditional savings and investment vehicles.

- Digitalization of Services: Online platforms offering financial advice and product comparisons empower consumers to find alternatives more easily.

Direct investment platforms and robo-advisors present a significant substitute by offering lower fees and greater control, attracting investors seeking cost-effective portfolio management. For instance, robo-advisors typically charge annual fees between 0.25% and 0.75%, a fraction of traditional advisory costs.

Fintech innovations, like AI-driven insurance providers, offer streamlined, direct-to-consumer policies, disrupting traditional insurance models. The insurtech market saw substantial venture capital investment in 2023, fueling growth in convenient and often cheaper digital solutions.

Businesses increasingly opt for self-insurance or captive insurance programs, particularly large corporations, to manage risks more cost-effectively. The global alternative risk transfer market, valued at over $100 billion in 2024, highlights the strong demand for these risk management alternatives.

| Substitute Type | Key Features | Impact on iA Financial | Example |

| Robo-Advisors | Low fees (0.25%-0.75% annually), self-directed investing | Challenges traditional wealth management fees and advisory models | Wealthsimple, Questrade |

| Fintech Insurers | AI-driven, direct-to-consumer, streamlined policies | Disrupts traditional insurance distribution and pricing | Lemonade |

| Self/Captive Insurance | Cost savings, greater risk control, retention of underwriting profits | Reduces demand for group insurance products from traditional providers | Large corporations managing own liabilities |

Entrants Threaten

The financial services sector, especially insurance and wealth management, requires immense capital. New players must navigate significant barriers like licensing fees, solvency ratio maintenance, and complex compliance rules. For instance, in 2024, Canadian financial institutions faced ongoing scrutiny and adaptation to evolving regulations such as updated Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) rules, adding to the capital burden for any potential entrant.

Established brand loyalty and trust are significant hurdles for new entrants aiming to compete with incumbents like iA Financial Corporation. iA Financial has cultivated strong brand recognition and a reputation built on years of reliable service, making it difficult for newcomers to gain customer confidence. In 2023, iA Financial reported a robust customer base, underscoring the deep trust customers place in their established relationships when making crucial financial decisions.

Building a widespread and efficient distribution network is a significant hurdle for any new player in the financial services industry. This involves establishing relationships with independent advisors, brokers, and developing direct sales channels, all of which demand substantial time and financial investment.

For iA Financial Corporation, its well-established distribution network is a core competitive advantage. In 2024, iA Financial reported a strong presence across Canada, leveraging its network of over 6,000 advisors. New entrants would face immense difficulty in quickly matching this extensive reach and the deep-seated relationships iA Financial has cultivated, making it hard to gain market traction and acquire a substantial customer base.

Economies of Scale and Scope

Economies of scale and scope present a significant barrier for new entrants looking to challenge established players like iA Financial Corporation. Large, incumbent financial institutions leverage their size to achieve lower unit costs across operations, technology, and marketing. For instance, in 2024, major Canadian banks with substantial asset bases continued to report lower cost-to-income ratios compared to smaller, emerging fintechs. This cost advantage allows them to offer a wider array of products and services, from insurance to wealth management, at more competitive price points, making it difficult for newcomers to match their value proposition.

New entrants often struggle to replicate the breadth of offerings and the associated cost efficiencies that established firms enjoy. Without the scale to spread fixed costs over a larger volume of business, startups face higher per-unit expenses. This cost disadvantage can limit their ability to invest in cutting-edge technology or extensive marketing campaigns, crucial for attracting and retaining customers in the highly competitive financial services sector. Consequently, new companies may find it challenging to compete on price or offer the comprehensive suite of financial solutions that customers expect from a seasoned provider.

The ability to achieve economies of scope, by offering multiple related products and services, further solidifies the position of established firms. iA Financial Corporation, for example, can cross-sell insurance products to its banking or wealth management clients, creating a more integrated and cost-effective customer relationship. New entrants typically start with a narrower focus, requiring substantial investment to build out a comparable range of integrated services, thereby increasing their capital requirements and time to market.

- Cost-to-Income Ratio: Major Canadian banks in 2024 often maintained cost-to-income ratios below 50%, a benchmark difficult for new entrants to achieve initially.

- Product Diversification: Established firms offer bundled services, reducing the average cost of customer acquisition and service delivery.

- Investment Capacity: Larger firms can allocate greater resources to R&D and digital transformation, creating a technological moat.

Intense Competition from Incumbents

The Canadian financial services landscape is characterized by significant rivalry among established players, making it a formidable challenge for new entrants. Incumbents like iA Financial Corporation actively defend their market share through aggressive pricing strategies, innovative product development, and substantial marketing investments. For instance, in 2023, iA Financial reported strong net income growth, underscoring its competitive strength and ability to reinvest in its operations.

This intense competition means any new company entering the market would likely face a robust defensive reaction. Such a reaction could manifest as price wars, accelerated product launches, and amplified advertising campaigns designed to retain customer loyalty and deter new market participants. The established market presence and financial resources of companies like iA Financial create high barriers to entry.

- Incumbent Defenses: Established firms deploy competitive pricing and enhanced product offerings to ward off new competitors.

- Market Share Protection: Aggressive marketing and customer retention strategies are key tactics used by existing players.

- iA Financial's Strength: iA Financial's robust financial performance in 2023, with significant net income increases, highlights the challenging environment for newcomers.

- Barriers to Entry: The financial capacity and market entrenchment of incumbents create substantial hurdles for new entrants.

The threat of new entrants for iA Financial Corporation is generally considered low due to substantial capital requirements, stringent regulatory compliance, and the need for extensive licensing. For example, in 2024, Canadian financial regulators continued to emphasize robust capital adequacy and operational resilience, making it costly and time-consuming for new entities to establish themselves. The significant upfront investment in technology, talent, and marketing further amplifies these barriers.

Established brand loyalty and the trust iA Financial has built over years present a formidable challenge for newcomers. Customers often prioritize stability and reliability for their financial needs, making it difficult for new entrants to gain traction. In 2023, iA Financial's strong customer retention rates, exceeding 90% in key segments, illustrate the deep-seated confidence consumers place in established providers.

The extensive and deeply entrenched distribution network of iA Financial, comprising thousands of advisors across Canada, is a significant barrier. Replicating this reach and the associated client relationships would require immense time and financial resources for any new competitor. By 2024, iA Financial's advisor network remained a cornerstone of its market presence, facilitating broad product distribution.

Economies of scale and scope enjoyed by iA Financial also deter new entrants. The ability to spread fixed costs over a large customer base and offer a diversified product portfolio, from insurance to wealth management, leads to cost efficiencies that are hard for smaller, new firms to match. In 2024, iA Financial's operational efficiency, reflected in its competitive cost-to-income ratio, allowed for reinvestment in innovation and customer service, further solidifying its market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for iA Financial Corporation is built upon a foundation of comprehensive data, including iA's annual reports, investor presentations, and regulatory filings with securities commissions. We also incorporate industry-specific reports from reputable sources and macroeconomic data to provide a robust understanding of the competitive landscape.