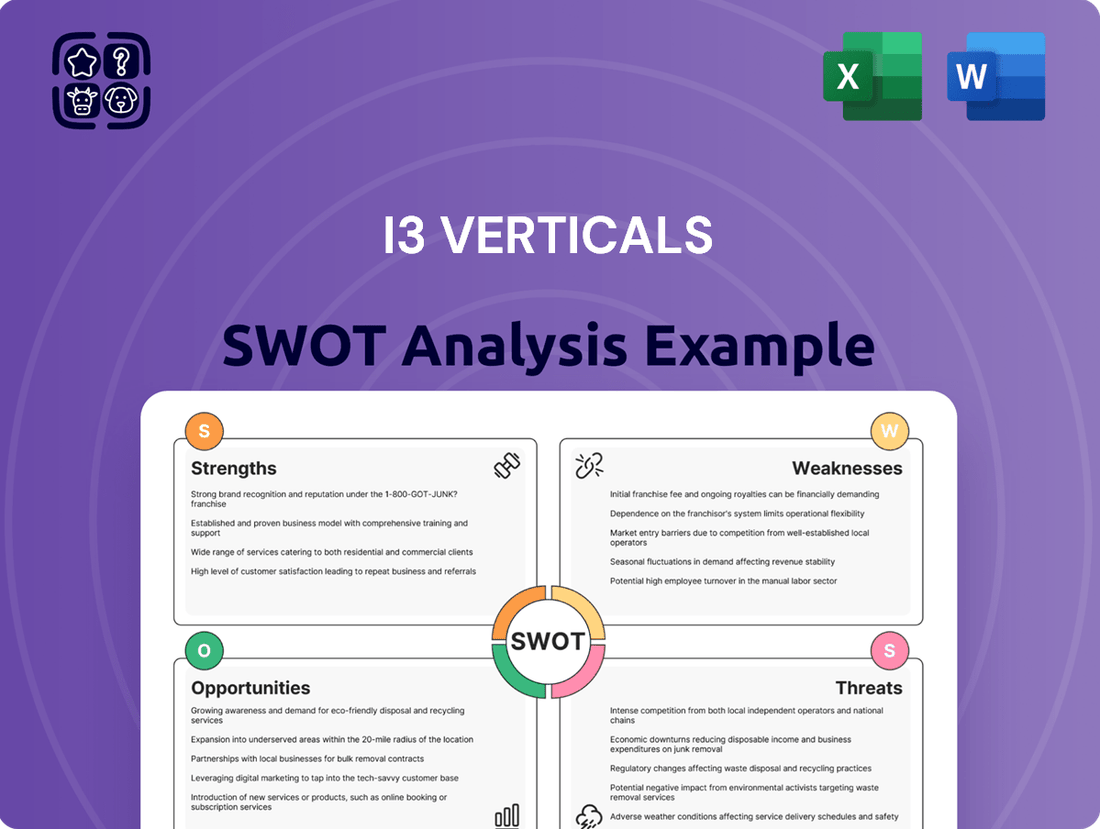

i3 Verticals SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

i3 Verticals demonstrates a strong market position with its specialized software solutions, leveraging a robust customer base and recurring revenue model. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed strategic decisions.

Want the full story behind i3 Verticals' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

i3 Verticals’ strength lies in its dedicated focus on specific industry verticals like education, healthcare, and government. This specialization allows them to craft integrated payment and software solutions that are precisely tailored to the unique demands and regulatory landscapes of these sectors. For instance, their solutions for the government sector are designed to handle complex compliance and reporting requirements, differentiating them from broader payment providers.

This deep vertical expertise translates into highly customized offerings that resonate strongly with clients. By understanding the intricate operational needs of, say, educational institutions or healthcare providers, i3 Verticals builds solutions that offer significant value beyond basic payment processing. This deep understanding fosters robust client loyalty and establishes a significant competitive moat against less specialized competitors.

i3 Verticals boasts robust recurring revenue streams, a testament to its strategic shift towards a software-centric business model. This focus on Software-as-a-Service (SaaS) and transaction-based software significantly enhances financial stability and predictability.

In the first quarter of 2025, a substantial 78% of i3 Verticals' revenue was recurring. Furthermore, the company experienced a healthy 16% growth in its SaaS revenue during the same period, underscoring the strength of its subscription-based offerings.

i3 Verticals' strength lies in its integrated payment and software solutions, a powerful combination that streamlines operations for its clients. This synergy allows businesses to manage both their payment processing and specialized software needs through a single, cohesive platform.

This integration directly enhances client efficiency and improves the overall customer experience by simplifying workflows. For instance, attaching payment capabilities directly to vertical-specific software, such as in the healthcare or education sectors, provides a significant competitive advantage.

In 2024, i3 Verticals reported a significant portion of its revenue derived from its integrated software and payment offerings, demonstrating strong market adoption. This trend is expected to continue as businesses increasingly seek unified solutions to reduce complexity and boost productivity.

Strategic Acquisitions and De-leveraging

i3 Verticals has demonstrated a strong capability in executing strategic acquisitions, notably expanding its software portfolio within the public sector. This proactive approach fuels its growth and market penetration.

The company's financial health has been significantly bolstered by the sale of its merchant services business in Q4 2024. This strategic move has allowed for substantial de-leveraging, creating a more robust balance sheet.

With a strengthened financial position, i3 Verticals is now ideally positioned to pursue further acquisitions. These will be targeted towards businesses that seamlessly integrate with and enhance its existing vertical market software strategy, driving synergistic value.

- Strategic Acquisitions: Expanded public sector software offerings through targeted M&A.

- De-leveraging: Strengthened balance sheet following Q4 2024 merchant services divestiture.

- Financial Flexibility: Well-positioned for future acquisitions aligning with vertical market strategy.

Strong Financial Performance and Outlook

i3 Verticals has showcased robust financial performance, with recent quarters highlighting consistent revenue growth and enhanced profitability. This positive trajectory is a significant strength, underpinning the company's operational efficiency and market position.

Specifically, in the first quarter of fiscal year 2025, i3 Verticals reported a notable 12% increase in revenue and a substantial 17% rise in adjusted EBITDA. These figures reflect effective cost controls and an expansion of profit margins, demonstrating the company's ability to translate top-line growth into bottom-line improvement.

Management's confidence in the company's future is evident in its reaffirmed positive outlook for fiscal year 2025. Expectations include high-single-digit organic revenue growth and continued margin expansion, suggesting a sustained period of financial strength.

The company's financial strengths can be summarized as follows:

- Consistent Revenue Growth: Demonstrated by a 12% increase in Q1 2025.

- Improved Profitability: Marked by a 17% rise in adjusted EBITDA in Q1 2025.

- Positive Future Outlook: Management projects high-single-digit organic revenue growth and margin expansion for FY 2025.

- Effective Expense Management: Leading to higher profit margins.

i3 Verticals' core strength is its deep specialization in specific industry verticals like education, healthcare, and government. This focus allows for the creation of highly tailored payment and software solutions that address unique sector needs and compliance requirements. Their ability to integrate payment processing directly into vertical-specific software, as seen in their healthcare solutions, significantly streamlines operations for clients.

| Key Strength | Description | Supporting Data (Q1 2025 unless noted) |

| Vertical Specialization | Tailored solutions for education, healthcare, government. | N/A (Qualitative) |

| Integrated Solutions | Synergy of payment and software for operational efficiency. | Strong market adoption in 2024 for unified solutions. |

| Recurring Revenue Model | Focus on SaaS and transaction-based software. | 78% of revenue was recurring; 16% SaaS revenue growth. |

| Financial Performance | Consistent revenue growth and improved profitability. | 12% revenue increase; 17% adjusted EBITDA rise. |

| Strategic M&A & Divestiture | Acquisitions expanding software, divestiture strengthening balance sheet. | Merchant services sold Q4 2024; Public sector software expanded. |

What is included in the product

Delivers a strategic overview of i3 Verticals’s internal and external business factors, highlighting its market position and competitive landscape.

Offers a clear, actionable framework to identify and address market challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

i3 Verticals' focus on specific sectors, particularly the public sector and healthcare, presents a potential weakness. A significant downturn or adverse policy shifts within these core markets could disproportionately affect the company's revenue streams. For instance, a reduction in government spending on technology or new regulations impacting healthcare IT could directly hinder growth.

The divestiture of i3 Verticals' merchant services business in Q4 2024, while aimed at long-term strategic alignment, did impact short-term financial metrics. Specifically, this sale resulted in a decrease in adjusted EBITDA from continuing operations for that quarter.

This transition period necessitates careful financial management to navigate the immediate adjustments and mitigate any potential disruption to ongoing revenue streams and overall profitability.

The integrated payments and vertical software sectors are intensely competitive. i3 Verticals faces rivals ranging from niche providers to broad-spectrum technology giants, all vying for market dominance.

To stay ahead, i3 Verticals needs constant innovation and clear differentiation. This is crucial for retaining existing customers and acquiring new ones amidst pressure from both seasoned competitors and disruptive fintech startups entering the space.

For instance, the broader fintech market saw significant investment in 2023, with venture capital funding reaching tens of billions of dollars, indicating the high level of activity and the challenge of standing out.

Potential Integration Challenges from Acquisitions

While i3 Verticals actively pursues growth through acquisitions, integrating these newly acquired software companies and their teams can be complex. These integrations often present operational hurdles and cultural differences that need careful management. For instance, in 2023, i3 Verticals completed several acquisitions, and the success of these integrations hinges on harmonizing disparate technology stacks and business processes to avoid disrupting existing services and client relationships.

Ensuring a smooth transition for both technology and personnel is paramount to unlocking the full value of these strategic purchases. Failure to effectively integrate can lead to inefficiencies and hinder the expected synergies. For example, if a newly acquired company uses legacy systems that are incompatible with i3 Verticals' core platforms, significant investment in IT infrastructure and training may be required, potentially delaying the realization of cost savings or revenue enhancements.

- Technology Compatibility: Merging diverse software platforms and data systems can be technically demanding, requiring substantial IT resources and expertise.

- Cultural Alignment: Bridging different organizational cultures, communication styles, and employee expectations is critical for team cohesion and productivity.

- Process Harmonization: Standardizing workflows, customer support protocols, and internal operations across acquired entities is essential for operational efficiency.

- Talent Retention: Retaining key personnel from acquired companies is vital to preserve institutional knowledge and maintain customer relationships during the integration period.

Vulnerability to Evolving Regulatory Landscape

i3 Verticals operates in highly regulated sectors like payments and healthcare, making it susceptible to shifts in compliance requirements. For instance, the evolving nature of data privacy laws, such as potential updates to HIPAA or GDPR-like regulations impacting payment data, could force costly overhauls of their systems. This vulnerability is underscored by the increasing focus on consumer data protection across the globe, which often translates into new operational burdens for technology providers.

The company must continually adapt its offerings to meet new mandates, which can divert resources from innovation and growth. For example, in 2024, the U.S. saw continued discussions and proposed legislation around data security and consumer rights, potentially impacting how payment processors handle sensitive information. Failure to adapt swiftly could lead to penalties or loss of market access.

- Regulatory Uncertainty: The dynamic nature of payment processing and healthcare compliance presents ongoing challenges.

- Compliance Costs: Adapting to new regulations can significantly increase operational expenses.

- Market Adaptability: Swift response to evolving legal frameworks is crucial for maintaining competitiveness.

i3 Verticals' reliance on specific sectors, like public sector and healthcare, poses a risk; adverse policy changes or economic slowdowns in these areas could significantly impact revenue. The divestiture of its merchant services business in Q4 2024, while strategic, did reduce adjusted EBITDA from continuing operations for that quarter, highlighting the need for careful financial management during this transition.

What You See Is What You Get

i3 Verticals SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual i3 Verticals SWOT analysis, ensuring transparency and quality. Once purchased, the complete, in-depth report will be immediately available for your strategic planning needs.

Opportunities

i3 Verticals can leverage its established expertise in integrated payments and software to penetrate new, underserved vertical markets. This strategic move allows the company to tap into niches requiring specialized solutions, potentially unlocking substantial new revenue streams and broadening its customer base. For instance, the company's success in sectors like healthcare and education suggests a replicable model for other industries with similar needs for streamlined payment processing and business management software.

The ongoing shift towards digital and embedded payment solutions, including the rise of digital wallets and instant payment networks, creates a significant avenue for growth. For instance, the global digital payments market was projected to reach over $15 trillion by 2024, highlighting the immense scale of this trend.

i3 Verticals is well-positioned to leverage this trend by further developing and integrating its payment processing capabilities into various business workflows. This allows businesses to offer customers more convenient and modern payment options, directly addressing the increasing consumer preference for seamless digital transactions.

Leveraging AI and advanced technologies presents a significant opportunity for i3 Verticals to bolster its fraud detection capabilities, leading to reduced losses and increased trust from its clients. For instance, in 2024, the financial services industry saw AI-powered fraud detection systems achieve an average accuracy rate of 95%, a substantial improvement over traditional methods.

Furthermore, integrating AI can streamline internal operations, optimizing processes like customer onboarding and support, thereby enhancing overall efficiency. This technological adoption could also unlock new revenue streams by offering advanced analytics or AI-driven features within their existing software and payment platforms, potentially capturing a larger market share.

Strategic Partnerships and Collaborations

Forming strategic partnerships with other technology providers, financial institutions, or industry-specific organizations can significantly expand i3 Verticals' market reach and enhance its service capabilities. These collaborations can unlock new avenues for growth and innovation.

Collaborations can accelerate new product development and facilitate broader market penetration by leveraging partners' existing customer bases and distribution channels. This synergy allows i3 Verticals to offer more comprehensive and attractive value propositions to its clients.

- Expanded Market Access: Partnerships can provide entry into new verticals or geographic regions, potentially increasing i3 Verticals' addressable market. For instance, a 2024 collaboration with a regional bank could onboard thousands of new small business clients.

- Enhanced Product Offerings: Integrating complementary technologies through partnerships can create bundled solutions, offering clients a more robust and seamless experience. This could involve combining i3 Verticals' payment processing with a partner's CRM system.

- Cost Efficiencies: Sharing development costs or marketing efforts with partners can lead to significant cost savings, improving overall profitability.

Cross-Selling and Upselling within Existing Client Base

i3 Verticals has a prime opportunity to leverage its established presence within specific industries to introduce a wider array of its offerings. By effectively cross-selling additional software modules and payment processing solutions, the company can tap into a readily available revenue stream from its current customers.

Deepening these client relationships by expanding the services they utilize is a direct path to boosting organic growth. For instance, if a client is using i3 Verticals for practice management software, there's a clear opening to offer integrated payment solutions or specialized reporting tools. This strategy not only increases revenue per client but also enhances customer loyalty by providing a more comprehensive and integrated service package.

- Cross-selling Potential: i3 Verticals can offer its payment services to clients already using its vertical-specific software, such as those in healthcare or education.

- Upselling Opportunities: Existing clients can be encouraged to upgrade to premium software features or add new modules that enhance their operational efficiency.

- Revenue Growth: By increasing the average revenue per user (ARPU) through these strategies, i3 Verticals can achieve significant organic growth without necessarily acquiring new customers.

- Client Retention: A broader suite of integrated services makes it harder for clients to switch to competitors, thereby improving retention rates.

i3 Verticals can capitalize on the growing demand for integrated payment and software solutions by expanding into new, underserved vertical markets. The company's proven success in sectors like healthcare and education provides a strong foundation for replicating its model in other industries requiring specialized, streamlined operations. This expansion offers a clear path to unlocking new revenue streams and significantly broadening its customer base.

Threats

The payments and vertical software sectors are magnets for innovation, drawing in a crowd of competitors. This means i3 Verticals faces a constant barrage from both seasoned companies and nimble fintech startups. This dynamic landscape pressures pricing and demands significant investment in staying ahead.

For instance, the broader fintech market saw substantial investment in 2023, with deal volumes remaining robust, indicating continued high interest and new players entering the fray. This intense competition can erode market share and necessitate ongoing, expensive innovation to maintain a competitive edge.

As a company deeply involved with sensitive financial and operational data, i3 Verticals is inherently exposed to cybersecurity risks and the potential for data breaches. These threats are not theoretical; the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of these dangers.

A significant security incident could have devastating consequences for i3 Verticals, including substantial financial losses stemming from remediation efforts and potential regulatory fines. Furthermore, the damage to the company's reputation and the erosion of customer trust following a breach could be long-lasting and severely impact future business operations.

The payments and software industries are moving at lightning speed. For i3 Verticals, this means a constant need to invest in research and development to ensure their products and services remain cutting-edge. For instance, the global fintech market was valued at approximately $11.2 trillion in 2023 and is projected to reach $33.4 trillion by 2030, highlighting the intense competition and rapid evolution.

If i3 Verticals doesn't keep pace with new technologies or evolving industry standards, there's a real risk of becoming outdated. This could lead to a loss of market share and relevance as competitors embrace newer, more efficient solutions.

Economic Downturns Affecting Client Verticals

Economic downturns pose a significant threat to i3 Verticals, particularly given its focus on sectors like public sector, healthcare, and education. A slowdown in government spending or budget constraints within these industries directly impacts the demand for i3 Verticals' software and payment solutions. For instance, if state and local government IT budgets shrink, as seen during periods of economic contraction, it can lead to delayed or reduced investment in new systems.

Reduced client spending power can manifest in several ways for i3 Verticals. This might include slower adoption rates for new payment processing technologies or even contract cancellations as organizations look to cut costs. For example, a tightening fiscal environment in the education sector could mean fewer schools upgrading their student information systems or payment portals, directly affecting i3 Verticals' revenue streams.

- Reduced Public Sector Spending: Economic slowdowns often lead to budget cuts in government services, impacting i3 Verticals' public sector clients.

- Healthcare Budgetary Pressures: Financial constraints in healthcare organizations can slow down the adoption of new payment and software solutions.

- Education Sector Austerity: Decreased funding for schools and universities might result in postponed technology upgrades and payment system enhancements.

Regulatory Scrutiny and Compliance Burden

The payments sector faces escalating regulatory oversight, with a particular focus on data privacy, consumer safeguards, and anti-money laundering (AML) efforts. For i3 Verticals, this translates into a constant need to adapt and invest in robust compliance frameworks, potentially impacting operational efficiency and profitability.

Stricter regulations or shifts in compliance mandates could present significant financial and operational challenges for i3 Verticals. For instance, the Payment Card Industry Data Security Standard (PCI DSS) updates, which are periodically revised, require ongoing investment in security infrastructure and personnel training to maintain compliance. Failure to adhere can result in substantial fines and reputational damage.

- Increased compliance costs: Adhering to evolving regulations like GDPR or CCPA can necessitate significant investments in data protection technologies and legal counsel.

- Potential for fines: Non-compliance with AML or consumer protection laws can lead to hefty penalties, impacting i3 Verticals' bottom line.

- Operational disruptions: Implementing new compliance protocols may require temporary adjustments to business processes, potentially affecting service delivery.

- Competitive disadvantage: Companies that struggle to keep pace with regulatory changes might be outmaneuvered by more agile competitors.

The rapid evolution of technology in the payments and vertical software sectors presents a significant threat. i3 Verticals must continuously invest in research and development to keep its offerings competitive, as the global fintech market, valued at approximately $11.2 trillion in 2023 and projected to reach $33.4 trillion by 2030, demonstrates the intense pace of innovation.

Intensifying competition from both established players and agile fintech startups pressures pricing and demands constant adaptation. The sheer volume of investment in the fintech space in 2023 underscores this dynamic, potentially eroding market share if i3 Verticals cannot maintain its edge.

Cybersecurity risks are a paramount concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. A data breach could lead to substantial financial losses, regulatory fines, and severe damage to customer trust and reputation.

Escalating regulatory oversight in payments, particularly concerning data privacy and consumer protection, necessitates ongoing investment in compliance frameworks. Failure to adhere to evolving standards, such as PCI DSS updates, can result in significant penalties and operational disruptions.

SWOT Analysis Data Sources

This i3 Verticals SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.