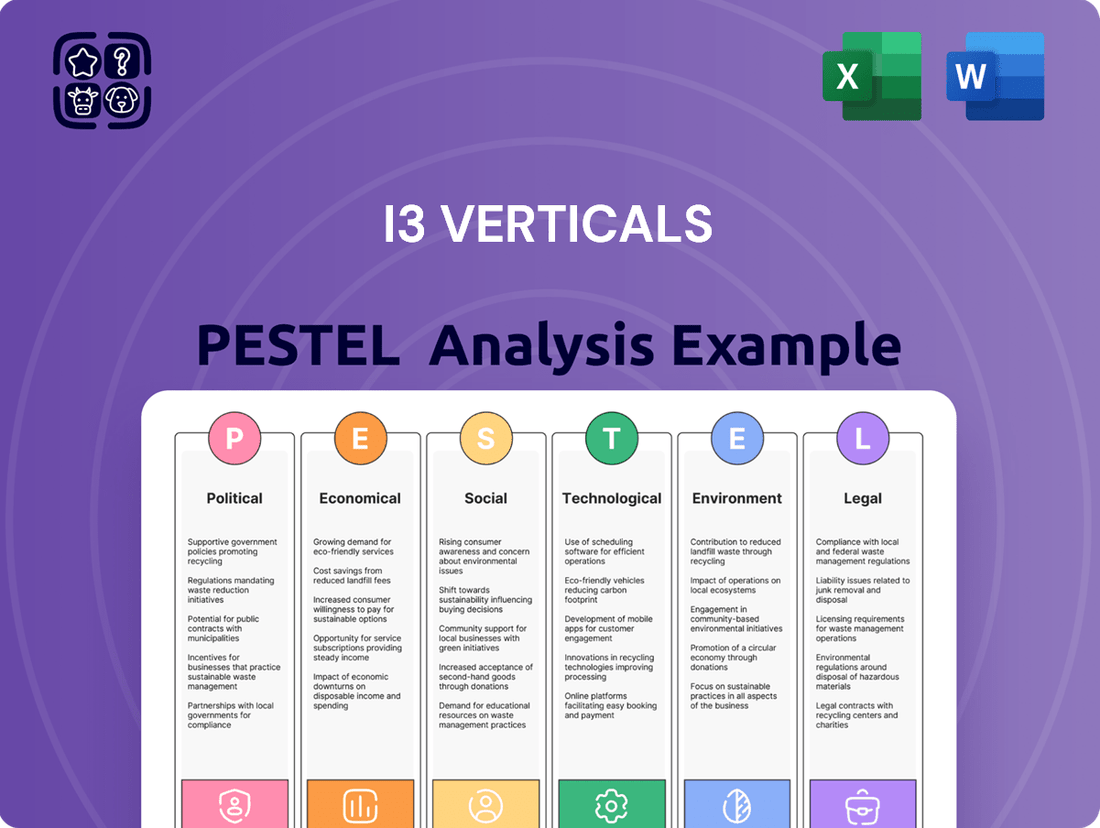

i3 Verticals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

Navigate the complex external forces shaping i3 Verticals's market with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities.

Gain a strategic advantage by leveraging expert insights into how these macro-environmental trends directly impact i3 Verticals's operations and future growth potential. Equip yourself with the knowledge to make informed decisions.

Don't let external shifts catch you off guard. Download our full PESTLE analysis for i3 Verticals now and unlock actionable intelligence to strengthen your strategic planning and competitive positioning.

Political factors

Government regulatory shifts, particularly in financial services and data privacy, present a dynamic landscape for i3 Verticals. For instance, the ongoing evolution of Payment Card Industry Data Security Standard (PCI DSS) requirements, with updates expected in 2024 and 2025, directly influences the security protocols i3 Verticals must implement for its payment processing solutions. Non-compliance can lead to significant fines, as seen in past industry breaches, underscoring the need for continuous adaptation.

New legislation concerning data privacy, such as potential expansions of state-level regulations similar to California's CCPA/CPRA, could mandate further enhancements to i3 Verticals' data handling and consent management features within their software offerings. These changes may necessitate investment in new compliance technologies or adjustments to service delivery models, potentially impacting operational costs but also creating opportunities for enhanced data security services.

Public sector spending policies are a critical driver for i3 Verticals, given its focus on government, education, and healthcare. For instance, the U.S. federal government's commitment to digital transformation in these sectors, as highlighted by initiatives like the Technology Modernization Fund, directly impacts i3 Verticals' opportunities. A 2024 report indicated a projected 5% increase in government IT spending, signaling potential growth for companies providing integrated solutions.

Shifts in budget allocations can significantly alter the landscape for i3 Verticals. If government bodies prioritize digital infrastructure upgrades, this could translate into increased demand for i3 Verticals' payment and software solutions. Conversely, a contraction in public sector budgets, perhaps due to economic downturns, might lead to slower adoption rates or smaller contract values for the company's services.

The increasing complexity of data privacy legislation, including potential new federal acts and evolving state-level regulations like the California Privacy Rights Act (CPRA) which expanded consumer rights in 2023, directly impacts i3 Verticals' handling of sensitive customer and transaction data. Compliance is crucial to avoid significant fines, with the CPRA allowing for statutory damages up to $7,500 per intentional violation.

Antitrust and Competition Policies

Government scrutiny over market concentration in fintech and payment processing directly impacts i3 Verticals' strategic decisions, particularly regarding mergers and acquisitions. For instance, in 2024, regulatory bodies continued to closely examine large tech companies' market dominance, setting precedents that could influence how payment processors operate and consolidate.

Policies aimed at fostering competition can create both opportunities and challenges. Increased regulatory oversight, as seen with ongoing investigations into potential monopolistic practices by major payment networks, could level the playing field for i3 Verticals by limiting the exclusive advantages of larger competitors.

Understanding these antitrust dynamics is crucial for i3 Verticals to effectively navigate the competitive landscape and plan for future expansion. The Federal Trade Commission (FTC) has been particularly active, with reports indicating a focus on anti-competitive behavior in digital markets throughout 2024 and into 2025.

- Regulatory Focus: Antitrust actions by agencies like the FTC and DOJ in 2024 targeted market concentration in technology sectors, including financial services.

- M&A Impact: Stricter antitrust reviews can slow down or block mergers and acquisitions, forcing companies like i3 Verticals to adapt their growth strategies.

- Competition Promotion: Policies encouraging new entrants or interoperability can benefit i3 Verticals by reducing barriers to entry and market access.

Geopolitical Stability and Trade Relations

While i3 Verticals primarily operates within the United States, global geopolitical stability still carries indirect implications. For instance, disruptions in international trade, perhaps stemming from increased tariffs or regional conflicts, could impact the availability and cost of essential hardware components used in their payment processing solutions. A stable global environment generally supports stronger economic confidence, which can translate into more robust client spending and investment in technology upgrades.

Geopolitical instability can introduce volatility into the broader economic landscape, affecting client confidence and their willingness to invest in new payment systems or software. For example, a significant geopolitical event in 2024 or early 2025 could lead to a slowdown in capital expenditures by businesses, potentially impacting i3 Verticals' growth trajectory. Conversely, a period of sustained global peace and cooperation would likely bolster market sentiment.

- Impact on Hardware Supply Chains: Geopolitical tensions can disrupt the manufacturing and shipping of electronic components, a critical input for payment terminals and related hardware.

- Economic Confidence: Global stability influences overall business confidence, affecting clients' propensity to upgrade payment infrastructure.

- Trade Policy Uncertainty: Shifting international trade policies could indirectly raise costs for i3 Verticals or its clients, depending on the origin of sourced components.

Government regulatory shifts, particularly concerning data privacy and financial services, directly impact i3 Verticals. For instance, evolving Payment Card Industry Data Security Standard (PCI DSS) requirements, with updates expected through 2025, necessitate continuous adaptation of security protocols. New data privacy legislation, such as expanded state-level regulations, may require further investment in data handling and consent management features within their software offerings.

Public sector spending policies are a key driver for i3 Verticals, given its focus on government and education sectors. The U.S. federal government's commitment to digital transformation in these areas, as seen in initiatives like the Technology Modernization Fund, directly influences opportunities. Projections for 2024 indicated a potential 5% increase in government IT spending, signaling growth prospects.

Antitrust actions by agencies like the FTC and DOJ in 2024 targeted market concentration in technology and financial services. Stricter antitrust reviews can impact mergers and acquisitions, forcing companies like i3 Verticals to adapt growth strategies. Policies promoting competition, such as those encouraging interoperability, can benefit i3 Verticals by reducing market access barriers.

Geopolitical stability indirectly affects i3 Verticals through supply chain impacts and economic confidence. Disruptions in international trade can influence the cost of essential hardware components. Global stability generally supports stronger economic confidence, which can translate into more robust client spending on technology upgrades.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting i3 Verticals across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A concise, actionable summary of i3 Verticals' PESTLE analysis, presented in a digestible format, alleviates the pain of information overload and facilitates focused strategic discussions.

Economic factors

The health of the U.S. economy and consumer spending are critical for i3 Verticals. In 2024, projections for U.S. GDP growth hover around 2-3%, indicating a generally supportive environment for businesses and, consequently, for transaction volumes. When consumers feel confident and have disposable income, they spend more, directly benefiting i3 Verticals' clients and increasing the demand for their payment processing services.

Conversely, economic slowdowns pose a risk. A significant contraction in consumer spending, such as what was observed during certain periods of 2020, can lead to a direct decrease in the number and value of transactions. This directly impacts i3 Verticals' revenue streams, as their business model is closely tied to the success and activity levels of their merchant clients across various sectors.

Rising inflation presents a significant challenge for i3 Verticals, potentially increasing operational expenses for labor and technology infrastructure. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, which directly impacts input costs.

Fluctuations in interest rates, such as the Federal Reserve's benchmark rate which remained between 5.25% and 5.50% through mid-2024, can alter the cost of capital for i3 Verticals and its clientele. This directly influences decisions regarding investments in new technologies and the expansion of payment systems, impacting the pace of innovation and client adoption.

The increasing adoption of digital payments is a major economic tailwind for i3 Verticals. As more businesses and consumers shift to cashless transactions, the demand for integrated payment processing solutions grows. For instance, by the end of 2023, global digital payment transaction values were projected to reach over $10 trillion, indicating a substantial and expanding market for companies like i3 Verticals.

This trend directly benefits i3 Verticals by broadening its addressable market, particularly in sectors like education and healthcare where electronic payments are becoming standard. The continued growth in transaction volumes, fueled by this digital shift, is expected to support sustained revenue streams and operational expansion for the company throughout 2024 and beyond.

Industry-Specific Economic Health

The economic health of i3 Verticals' key sectors—education, healthcare, government, and non-profit—directly impacts its growth prospects. For example, government spending on education and healthcare, often influenced by economic cycles and policy, can unlock significant opportunities for i3 Verticals' payment processing and software solutions. A robust economy generally correlates with increased public and private investment in these areas.

Monitoring sector-specific funding trends is crucial. For instance, in the education sector, increased state and federal appropriations for K-12 or higher education can lead to greater adoption of integrated payment systems. Similarly, in healthcare, expanded patient volumes or new reimbursement models can drive demand for specialized financial technology.

- Education Sector Funding: In fiscal year 2024, many states saw budget surpluses, potentially leading to increased education spending, although specific allocations vary.

- Healthcare Investment: Healthcare IT spending globally was projected to reach over $200 billion in 2024, indicating strong demand for technology solutions.

- Government Spending: Federal government spending on technology and services is a significant driver, with IT budgets often reflecting national economic priorities.

- Non-profit Sector Growth: The non-profit sector's reliance on donations and grants means its economic health is tied to individual and corporate giving, which can fluctuate with broader economic conditions.

Competitive Pricing Pressures

The payment processing sector is intensely competitive, forcing i3 Verticals to consistently re-evaluate its pricing structures and service charges. This pressure is amplified when economic downturns encourage clients to seek cost reductions, directly impacting i3 Verticals' revenue streams.

For instance, in 2024, many businesses reported a significant focus on operational efficiency and cost optimization, making them more sensitive to transaction fees. i3 Verticals navigates this by aiming to offer value-added services that justify its pricing, rather than engaging in a pure price war.

- Intense Competition: The payment processing market features numerous players, leading to constant price adjustments.

- Client Cost Sensitivity: Economic pressures in 2024 heightened client demand for lower processing fees.

- Balancing Act: i3 Verticals must maintain competitive pricing while ensuring profitability and funding innovation.

The economic landscape significantly shapes i3 Verticals' performance, with U.S. GDP growth projected around 2-3% for 2024, supporting transaction volumes. However, rising inflation, with the CPI at 3.4% year-over-year in April 2024, increases operational costs. Interest rates, held by the Federal Reserve between 5.25%-5.50% through mid-2024, affect capital costs and investment decisions.

The increasing adoption of digital payments is a major tailwind, with global transaction values projected over $10 trillion by end-2023. This trend expands i3 Verticals' market, particularly in education and healthcare. Sector-specific funding, such as healthcare IT spending projected over $200 billion in 2024, also drives demand for their solutions.

| Economic Factor | 2024 Projection/Data | Impact on i3 Verticals |

|---|---|---|

| U.S. GDP Growth | 2-3% | Supports transaction volumes and client activity. |

| U.S. CPI (April 2024) | 3.4% (YoY) | Increases operational costs (labor, technology). |

| Federal Reserve Interest Rate | 5.25%-5.50% | Affects cost of capital for i3 Verticals and clients. |

| Global Digital Payment Value | >$10 Trillion (End 2023 Projection) | Expands addressable market and demand for processing. |

| Healthcare IT Spending | >$200 Billion (2024 Projection) | Drives demand for specialized financial technology solutions. |

Preview the Actual Deliverable

i3 Verticals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of i3 Verticals delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

Societal shifts are heavily influencing how people and businesses prefer to pay. There's a clear move towards convenience and digital interactions, meaning mobile, contactless, and online payments are becoming the norm. This trend is particularly strong in 2024, with many consumers expecting seamless digital payment experiences.

For i3 Verticals, this means staying agile and ensuring their payment solutions cater to these evolving preferences. Offering support for popular digital wallets, like Apple Pay and Google Pay, and ensuring broad acceptance across various online platforms is crucial. By 2024, over 70% of consumers globally reported using contactless payment methods at least once a month, highlighting the demand for these technologies.

Public and client concerns about the security and privacy of financial data are increasingly significant. In 2024, a significant percentage of consumers reported being highly concerned about how their personal financial information is handled by businesses, with some surveys indicating over 70% of respondents prioritizing data security when choosing financial service providers.

Societal expectations for robust cybersecurity measures and transparent data handling are now the norm. Many clients expect proactive security protocols, regular updates on data protection efforts, and clear communication in the event of any breaches. This heightened awareness means that companies like i3 Verticals must demonstrate a strong commitment to safeguarding sensitive information.

i3 Verticals' capacity to build and sustain trust hinges on its secure systems and responsible data practices. For instance, in 2024, businesses that experienced data breaches often saw a tangible drop in customer loyalty and faced increased regulatory scrutiny, impacting client acquisition and retention significantly. Demonstrating a proactive approach to cybersecurity is therefore not just a compliance issue but a core business imperative.

While digital adoption is on the rise, significant disparities in digital literacy persist across various demographics and business types. This can create hurdles for companies like i3 Verticals, which need to cater to clients with differing technological proficiencies. For instance, a 2024 Pew Research Center study indicated that while a majority of US adults use smartphones, a notable portion still struggles with advanced digital tasks.

i3 Verticals must prioritize user-friendly design and robust customer support to onboard clients who may be less tech-savvy. This includes offering clear tutorials and accessible help resources. By effectively bridging this digital literacy gap, i3 Verticals can unlock new market segments, particularly within industries that are slower to adopt new technologies.

Demand for Integrated Solutions

Businesses and organizations are increasingly demanding integrated solutions that go beyond basic payment processing. They want systems that can handle point-of-sale, generate detailed reports, and manage administrative tasks, all within a single platform. This shift is driven by a desire for greater operational efficiency and a reduction in the complexity of managing multiple disparate software systems.

This sociological trend directly benefits i3 Verticals, as their strategy centers on providing comprehensive, tailored software and payment solutions. By offering a unified approach, they address this growing market need effectively. For instance, a 2024 survey indicated that 78% of small to medium-sized businesses prioritize vendors offering end-to-end solutions to simplify their technology stack.

- Demand for Unified Platforms: Businesses are actively seeking single-vendor solutions for payments, POS, and back-office functions.

- Efficiency and Simplicity Driver: The primary motivation behind this demand is the drive to streamline operations and reduce IT management overhead.

- i3 Verticals' Strategic Alignment: The company's focus on comprehensive, integrated software and payment offerings directly caters to this evolving customer preference.

- Market Growth Indicator: Industry reports from late 2024 suggest that the market for integrated business management software is projected to grow by over 15% annually through 2027.

Workforce Demographics and Talent Acquisition

The demographic shifts in the workforce directly influence i3 Verticals' talent acquisition, particularly in tech, sales, and customer service roles. As the demand for specialized fintech skills escalates, companies like i3 Verticals must offer competitive compensation packages and cultivate a robust company culture to attract and retain top performers. For instance, the U.S. Bureau of Labor Statistics projected a 25% growth for software developers from 2022 to 2032, a sector crucial for i3 Verticals.

Embracing evolving work models is also key. Adapting to widespread remote work trends and tapping into diverse talent pools, both domestically and internationally, presents a significant strategic advantage for i3 Verticals. This flexibility can broaden access to specialized expertise, potentially lowering recruitment costs and increasing employee satisfaction. In 2024, a significant portion of the U.S. workforce continues to engage in hybrid or fully remote arrangements, a trend i3 Verticals can leverage.

- Talent Pool Expansion: Remote work policies allow i3 Verticals to access a wider range of candidates beyond geographical limitations.

- Skills Gap Mitigation: Embracing diverse talent can help address the growing demand for specialized fintech skills, such as AI and blockchain expertise.

- Competitive Landscape: The need for competitive salaries and benefits is amplified by the high demand for tech talent, with average tech salaries in the U.S. continuing to rise, exceeding $120,000 annually in many specialized fields as of late 2024.

- Employee Retention: Offering flexible work arrangements and a positive company culture is crucial for retaining skilled employees in a competitive market.

Consumer demand for seamless, digital payment experiences continues to surge, with a strong preference for mobile and contactless options evident in 2024. This trend is further amplified by a heightened societal focus on data security and privacy, compelling businesses to demonstrate robust cybersecurity measures. i3 Verticals must prioritize user-friendly interfaces and accessible support to accommodate varying levels of digital literacy among its client base.

Businesses are increasingly seeking integrated solutions that streamline operations, driving demand for unified platforms that combine payment processing, POS systems, and administrative functions. This preference for end-to-end services directly aligns with i3 Verticals' strategic focus on providing comprehensive software and payment offerings. The market for such integrated business management software is projected for substantial annual growth through 2027.

Demographic shifts and evolving work models are reshaping talent acquisition, necessitating competitive compensation and flexible arrangements to attract skilled professionals in the fintech sector. i3 Verticals can leverage remote work policies to access a broader talent pool, mitigating skills gaps and enhancing employee retention in a competitive market where tech salaries continue to climb.

| Sociological Factor | Trend/Preference | Impact on i3 Verticals | Supporting Data (2024/2025) |

|---|---|---|---|

| Digital Payment Adoption | Preference for mobile, contactless, and online payments | Need for agile, user-friendly digital solutions; integration with digital wallets | 70%+ consumers use contactless monthly; strong demand for seamless digital experiences |

| Data Security & Privacy Concerns | High consumer expectations for robust cybersecurity and transparent data handling | Requirement for strong security protocols, clear communication, and trust-building practices | 70%+ consumers prioritize data security; breaches lead to customer loyalty drops |

| Demand for Integrated Solutions | Businesses seek single-vendor platforms for payments, POS, and back-office functions | Opportunity to offer comprehensive, tailored software and payment solutions | 78% of SMBs prioritize end-to-end solutions; integrated software market projected >15% annual growth |

| Digital Literacy Disparities | Varying levels of technological proficiency across demographics | Necessity for user-friendly design and robust customer support | Notable portion of smartphone users struggle with advanced digital tasks |

| Workforce Demographics & Models | Shift towards remote/hybrid work; demand for specialized tech talent | Leverage remote work for talent acquisition; offer competitive packages for retention | 25% growth projected for software developers; tech salaries exceeding $120,000 annually in specialized fields |

Technological factors

The payment technology landscape is evolving at a breakneck pace. Innovations like artificial intelligence are revolutionizing fraud detection, with systems in 2024 and projected into 2025 showing increased accuracy in identifying suspicious transactions. Blockchain technology continues to offer enhanced security and transparency for payment processing, a critical factor for businesses handling sensitive financial data.

i3 Verticals faces a clear imperative to stay at the forefront of these technological shifts. Continuous investment in research and development is essential to integrate advancements such as tokenization, which safeguards customer payment information, into their existing platforms. This proactive approach ensures their payment solutions remain competitive, efficient, and robust against emerging threats, a necessity for maintaining market leadership.

Cybersecurity threats are a growing concern for all businesses, especially those handling sensitive financial data. In 2024, the cost of a data breach averaged $4.73 million globally, a significant increase from previous years, highlighting the escalating sophistication of attacks. For a payments company like i3 Verticals, a breach could lead to substantial financial losses and severe damage to customer trust.

To counter these risks, i3 Verticals must prioritize continuous investment in advanced cybersecurity measures. This includes implementing robust encryption for transaction data, leveraging threat intelligence platforms to proactively identify vulnerabilities, and ensuring strict compliance with evolving security standards like PCI DSS. The company's ability to safeguard sensitive information is paramount to its operational integrity and market reputation.

The widespread adoption of cloud computing is a significant technological enabler for i3 Verticals, allowing them to deliver highly scalable and dependable payment and software solutions. This infrastructure is crucial for handling fluctuating transaction volumes efficiently. For instance, the global cloud computing market was valued at over $600 billion in 2023 and is projected to continue its robust growth, underscoring the strategic advantage of leveraging these services.

By utilizing cloud infrastructure, i3 Verticals can rapidly adjust to changes in demand and expand their service offerings without the burden of substantial upfront capital investments. This agility is key in a dynamic market. In 2024, businesses are increasingly prioritizing cloud-native solutions for their flexibility and cost-effectiveness, a trend that directly benefits i3 Verticals’ business model.

Integration Capabilities and APIs

i3 Verticals' focus on integration capabilities, particularly through its robust APIs, is a significant technological advantage. This allows for seamless connections with diverse client systems, including ERPs and accounting software, simplifying adoption and operational efficiency. For instance, their payment processing solutions can be embedded directly into existing business workflows, reducing friction for users.

The company's investment in flexible integration tools directly addresses a key client need: the ability to connect with legacy systems and modern platforms alike. This adaptability is critical in a market where businesses often operate with a mix of older and newer technologies. i3 Verticals' commitment to open APIs fosters an ecosystem where their services can be easily incorporated, enhancing their value proposition.

Ease of integration serves as a major competitive differentiator for i3 Verticals. In 2024, businesses are increasingly prioritizing solutions that minimize disruption and implementation time. By offering straightforward integration pathways, i3 Verticals positions itself as a more attractive partner compared to competitors with more rigid or complex integration processes. This technological focus directly impacts client acquisition and retention rates.

- Seamless Integration: i3 Verticals' platforms are designed to integrate with a wide range of existing client software, including ERP, accounting, and POS systems.

- API Investment: Significant investment in robust APIs and flexible integration tools enhances the utility and appeal of their payment and vertical market solutions.

- Competitive Differentiator: Ease of integration is a key factor setting i3 Verticals apart, enabling clients to streamline operations more effectively.

- Reduced Disruption: The technological approach minimizes implementation time and disruption for businesses adopting i3 Verticals' services.

Emergence of New Payment Methods

The payment landscape is rapidly evolving with new methods like Buy Now, Pay Later (BNPL), digital currencies, and biometric payments becoming increasingly popular. For i3 Verticals, this means staying agile and ensuring its platforms can seamlessly integrate these innovations to meet consumer demand and maintain market competitiveness. This adaptability is crucial for clients to offer the payment flexibility their customers expect.

The adoption of these new payment methods is significant. For instance, BNPL services saw substantial growth, with global BNPL payment volume projected to reach over $3.2 trillion by 2026, up from approximately $1.2 trillion in 2022. This trend underscores the need for payment processors like i3 Verticals to support a wide array of options.

- BNPL Growth: Global BNPL payment volume is expected to surge, reflecting a major shift in consumer purchasing behavior.

- Digital Currency Integration: The increasing interest and potential future adoption of digital currencies necessitate exploration and integration capabilities.

- Biometric Security: Advancements in biometric payment authentication offer enhanced security and convenience, requiring platform compatibility.

- Consumer Preference: Supporting diverse payment methods directly addresses evolving consumer expectations for flexibility and ease of use.

Technological advancements are reshaping payment processing, with AI enhancing fraud detection accuracy in 2024 and blockchain offering improved security. i3 Verticals must integrate innovations like tokenization to maintain competitiveness and protect sensitive data.

The increasing sophistication of cyber threats, with data breaches costing an average of $4.73 million globally in 2024, mandates robust cybersecurity investments. i3 Verticals needs to prioritize encryption, threat intelligence, and compliance with standards like PCI DSS to safeguard operations and trust.

Cloud computing's scalability and cost-effectiveness, with the market exceeding $600 billion in 2023, provide a strategic advantage for i3 Verticals. This infrastructure allows for agile service expansion and efficient handling of transaction volumes, aligning with the 2024 trend towards cloud-native solutions.

i3 Verticals' investment in APIs facilitates seamless integration with diverse client systems, a key differentiator in 2024. This ease of connection reduces client disruption and implementation time, enhancing their value proposition in a market prioritizing operational efficiency.

The rise of new payment methods like BNPL, with global payment volume projected to exceed $3.2 trillion by 2026, necessitates platform adaptability. i3 Verticals must support these evolving consumer preferences, including digital currencies and biometrics, to remain competitive.

Legal factors

Adherence to the Payment Card Industry Data Security Standard (PCI DSS) is a fundamental legal and operational requirement for i3 Verticals. Maintaining continuous compliance with these stringent security standards for handling cardholder data is critical to avoid penalties, maintain processor relationships, and ensure client trust.

Non-compliance can lead to significant fines, with potential penalties for data breaches often reaching tens of thousands of dollars per incident, impacting revenue and reputation. Regular audits and updates to security protocols are essential to navigate the evolving threat landscape and maintain the integrity of financial transactions processed by i3 Verticals.

The increasing number of state-level data privacy laws, mirroring the CCPA, presents a significant challenge for i3 Verticals. For instance, by early 2024, states like Virginia (VCDPA), Colorado (CPA), and Utah (UCPA) have enacted comprehensive privacy legislation, each with unique requirements for data handling and consumer rights. This patchwork of regulations necessitates continuous adaptation of i3 Verticals' data management practices to avoid penalties and maintain customer trust.

As a financial technology firm, i3 Verticals operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are in place to combat financial crime and ensure the integrity of transactions. For instance, the Bank Secrecy Act in the United States, a cornerstone of AML efforts, mandates robust customer due diligence.

Compliance with these regulations requires i3 Verticals to implement thorough customer identity verification processes and continuous transaction monitoring. Failure to adhere can result in significant penalties; in 2023, fines for AML/KYC violations globally exceeded billions of dollars, highlighting the critical importance of these legal frameworks for companies like i3 Verticals.

Consumer Protection Laws

Consumer protection laws are crucial for i3 Verticals, dictating how financial transactions and services must be transparent, fair, and secure. For instance, the Electronic Fund Transfer Act (EFTA) in the U.S. mandates specific disclosures and error resolution procedures for electronic payments, impacting how i3 Verticals structures its payment processing services.

Ensuring compliance with these regulations, such as those overseen by the Consumer Financial Protection Bureau (CFPB), is vital. i3 Verticals needs to meticulously align its contracts, service agreements, and methods for resolving customer disputes with these legal frameworks to safeguard consumers and prevent costly legal entanglements. This focus not only mitigates regulatory risk but also cultivates essential consumer trust, a key differentiator in the competitive fintech landscape.

- Regulatory Compliance: Adherence to consumer protection laws, like the EFTA, ensures i3 Verticals operates within legal boundaries for financial services.

- Consumer Trust: Transparent and fair practices, mandated by consumer protection, foster stronger relationships with clients and end-users.

- Risk Mitigation: Compliance reduces the likelihood of fines, lawsuits, and reputational damage stemming from consumer complaints.

- Market Competitiveness: Demonstrating a commitment to consumer rights can provide a competitive advantage in the financial technology sector.

Contractual and Intellectual Property Law

The legal framework governing i3 Verticals' operations, particularly contractual and intellectual property law, is foundational. Robust contracts with clients, partners, and vendors are essential for securing revenue streams and clearly outlining service level agreements, minimizing disputes. In 2024, companies across the software and technology sector saw a significant increase in litigation related to contract breaches, highlighting the importance of meticulously drafted agreements.

Protecting i3 Verticals' intellectual property (IP), including its proprietary software and technology, is paramount. Safeguarding these assets from infringement ensures a competitive advantage and supports ongoing innovation. According to industry reports from late 2024, the cost of IP litigation can run into millions, underscoring the need for proactive IP protection strategies.

- Contractual Clarity: Ensuring all client, partner, and vendor agreements are unambiguous to prevent disputes and protect revenue.

- IP Protection: Implementing strong measures to safeguard proprietary software and technology from unauthorized use or replication.

- Compliance: Adhering to all relevant contract and IP laws to avoid legal challenges and maintain business integrity.

- Risk Mitigation: Proactive legal diligence in contract management and IP defense is critical for long-term business security and innovation.

i3 Verticals must navigate a complex web of financial regulations, including those governing payment processing, data security, and consumer protection. Staying compliant with evolving laws like the Payment Card Industry Data Security Standard (PCI DSS) and state-specific privacy legislation is crucial to avoid significant fines, which can reach tens of thousands of dollars per incident, and to maintain customer trust. Furthermore, adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, such as those stemming from the Bank Secrecy Act, is paramount to prevent financial crime and avoid billions in potential global penalties.

Consumer protection laws, such as the Electronic Fund Transfer Act (EFTA), dictate transparency and fairness in financial transactions, impacting service agreements and dispute resolution processes. For instance, the Consumer Financial Protection Bureau (CFPB) oversees many of these protections. Companies like i3 Verticals must ensure their operations align with these mandates to mitigate legal risks and build consumer confidence.

Contractual and intellectual property (IP) law forms another critical legal pillar. Meticulously drafted contracts with clients and partners are essential, especially as contract breach litigation saw an increase in the technology sector in 2024. Protecting i3 Verticals' proprietary software and technology through robust IP strategies is also vital, as IP litigation can cost millions, underscoring the need for proactive defense to maintain competitive advantage and foster innovation.

| Legal Area | Key Regulations/Acts | 2024/2025 Impact/Data | i3 Verticals' Focus |

|---|---|---|---|

| Data Security & Privacy | PCI DSS, CCPA, VCDPA, CPA, UCPA | Fines for data breaches can reach tens of thousands per incident. Patchwork of state laws requires continuous adaptation. | Maintaining strict data security protocols and adapting to diverse privacy laws. |

| Financial Crime Prevention | Bank Secrecy Act (AML), KYC regulations | Global AML/KYC violation fines exceeded billions in 2023. Robust customer due diligence is mandated. | Implementing thorough identity verification and transaction monitoring. |

| Consumer Protection | EFTA, CFPB regulations | EFTA mandates disclosures and error resolution for electronic payments. | Ensuring transparent, fair, and secure transaction practices and dispute resolution. |

| Contractual & IP Law | Contract Law, IP Law | Increased contract breach litigation in tech sector in 2024. IP litigation can cost millions. | Clear contracts and proactive IP protection for proprietary technology. |

Environmental factors

Societal and investor pressure for sustainable business practices is intensifying. This trend impacts companies like i3 Verticals, even as a software and services provider, as clients increasingly scrutinize vendors' environmental footprints. For instance, a 2024 survey by Morningstar found that 75% of investors consider ESG (Environmental, Social, and Governance) factors in their investment decisions, a significant jump from previous years.

While i3 Verticals' core business isn't directly tied to heavy industry, demonstrating a commitment to sustainability can bolster its brand image and attract environmentally conscious clients. This can translate into competitive advantages in procurement processes where sustainability is a key criterion. The company's indirect impact, such as through energy-efficient data centers or promoting digital transformation that reduces paper usage for clients, can be highlighted to meet this growing demand.

The substantial energy demands of data centers, which power i3 Verticals' digital infrastructure, present a key environmental consideration. These facilities are critical for processing and storing the vast amounts of data involved in payment processing and software services.

Even if i3 Verticals utilizes third-party cloud services, the energy consumption and associated carbon emissions of these data centers are under increasing global scrutiny. For instance, the global IT sector's carbon footprint was estimated to be around 2.1% of the total in 2023, a figure expected to rise with digital expansion.

Companies like i3 Verticals may find it beneficial to advocate for or prioritize cloud providers committed to sustainable energy sources and energy-efficient data center operations. This approach can help mitigate environmental impact and align with growing corporate social responsibility expectations.

While i3 Verticals primarily offers software, their integrated point-of-sale systems necessitate hardware. This brings e-waste management into play, a growing environmental concern. Globally, e-waste generation reached an estimated 62 million tonnes in 2020, projected to climb. Responsible recycling and disposal of this hardware are crucial for i3 Verticals' environmental footprint.

Adopting sustainable hardware lifecycle management, from sourcing to end-of-life, is becoming increasingly important. This includes exploring options for hardware refurbishment or take-back programs. For instance, the global IT asset disposition market was valued at approximately $40.1 billion in 2022, indicating a significant focus on responsible electronics management.

Climate Change Impact and Business Continuity

While i3 Verticals, a software and payment processor, isn't directly impacted by weather like a factory, climate change poses indirect risks. Severe weather events, such as hurricanes or widespread power outages, could disrupt the infrastructure their clients rely on, potentially affecting service demand or payment processing. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $145 billion in damages, highlighting the increasing frequency and cost of such events.

To mitigate these risks, i3 Verticals must ensure its business continuity plans are robust and account for climate-related disruptions. This includes having comprehensive disaster recovery strategies for their digital services, ensuring data integrity and availability even during widespread outages. A focus on resilient cloud infrastructure and geographically dispersed data centers can help maintain operations. For example, many cloud providers are investing heavily in sustainability and resilience, with companies like Microsoft aiming for 100% renewable energy for their data centers by 2025, which can indirectly benefit i3 Verticals' operational stability.

- Indirect Impact: Climate change can disrupt i3 Verticals' clients through severe weather, affecting demand for software and payment services.

- Business Continuity: Robust disaster recovery and resilient digital infrastructure are crucial for maintaining service availability.

- Infrastructure Resilience: Investments in geographically dispersed and renewably powered data centers by cloud providers can enhance operational stability.

- Financial Risk: The increasing frequency of billion-dollar weather events (e.g., NOAA's 2023 data) underscores the potential for indirect financial impacts.

Reporting on ESG Initiatives

Investors and stakeholders are increasingly scrutinizing companies' Environmental, Social, and Governance (ESG) performance. For i3 Verticals, even a smaller direct environmental impact necessitates transparent reporting on initiatives like data center energy efficiency or responsible e-waste management to meet these evolving expectations.

This commitment to reporting not only showcases corporate responsibility but also serves to attract capital from the growing pool of ESG-focused investors. For instance, a significant portion of global assets under management, estimated to be in the trillions by 2025, are now guided by ESG principles.

- Investor Demand: A growing number of institutional investors are integrating ESG factors into their investment decisions, with surveys indicating over 70% of investors consider ESG criteria.

- Data Center Efficiency: Reporting on energy consumption and carbon emissions related to data center operations can highlight i3 Verticals' commitment to sustainability.

- E-Waste Management: Transparent policies for the disposal and recycling of electronic equipment used in their operations demonstrate responsible resource management.

- Attracting Capital: Companies with strong ESG reporting often see improved access to capital and potentially lower cost of capital.

Environmental regulations are tightening globally, impacting how companies manage their digital infrastructure and hardware. This includes increasing pressure to reduce carbon footprints associated with data centers, a critical component for i3 Verticals' services.

The growing concern over e-waste also affects i3 Verticals, necessitating responsible disposal and recycling practices for any hardware involved in their payment processing solutions. Companies are increasingly expected to demonstrate a commitment to circular economy principles.

Climate change presents indirect risks, such as extreme weather events disrupting client operations and thus demand for i3 Verticals' services. Ensuring business continuity through resilient infrastructure is paramount.

Investor focus on ESG factors is a significant driver, with a substantial portion of global assets now aligned with sustainability principles. i3 Verticals must transparently report on its environmental initiatives to attract this capital.

| Environmental Factor | Impact on i3 Verticals | Data/Trend (2023-2025) |

|---|---|---|

| Data Center Energy Use | Operational costs, carbon footprint | IT sector carbon footprint ~2.1% of global total (2023); Cloud providers aiming for 100% renewable energy (e.g., Microsoft by 2025). |

| E-Waste Management | Compliance, brand reputation | Global e-waste generation projected to climb; IT asset disposition market valued at ~$40.1 billion (2022). |

| Climate Change/Weather Events | Business continuity, client stability | U.S. experienced 28 billion-dollar weather disasters in 2023, costing over $145 billion. |

| Investor ESG Scrutiny | Access to capital, stakeholder relations | Over 70% of investors consider ESG factors; Trillions in global AUM guided by ESG principles by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for i3 Verticals is built on a robust foundation of data sourced from official government publications, reputable industry associations, and leading financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.