i3 Verticals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

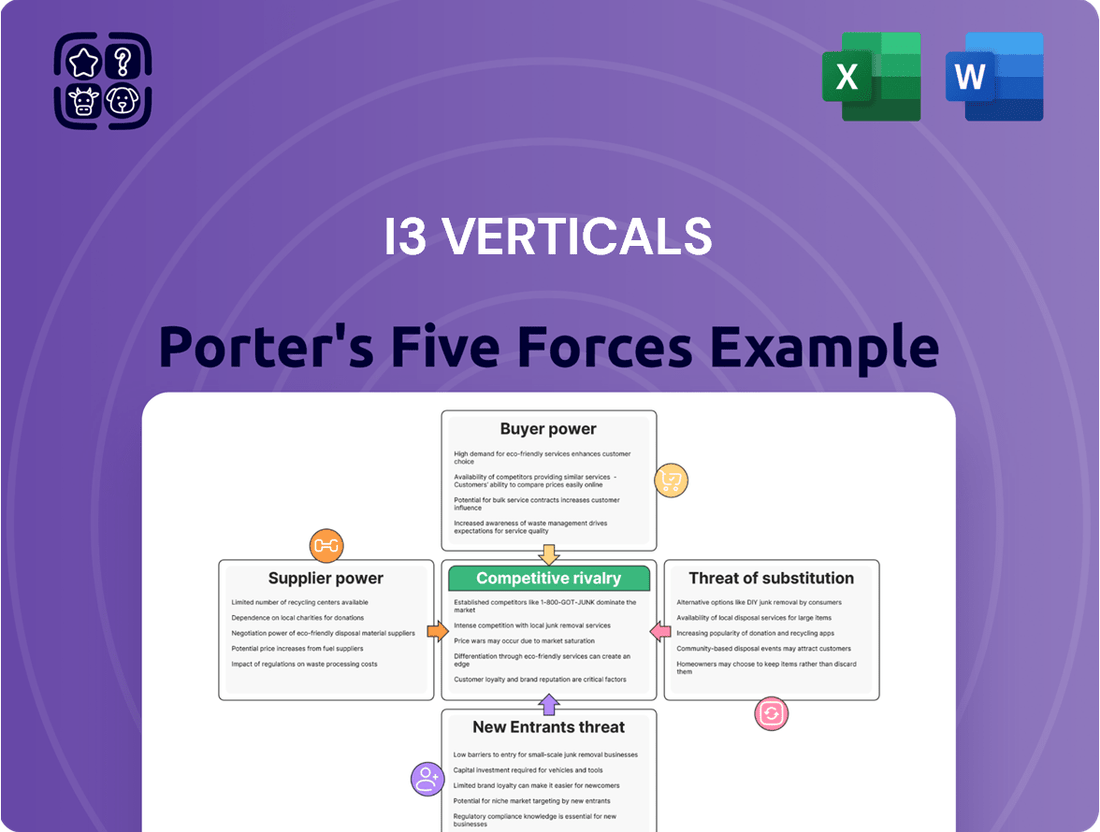

i3 Verticals operates in a dynamic market where supplier power is moderate due to specialized software needs, while buyer power is significant given the availability of alternative payment processing solutions. The threat of new entrants is high, as the barrier to entry is relatively low in the payment processing sector, and substitute products are readily available, impacting pricing and market share.

The competitive rivalry within the payment processing industry is intense, with numerous established players and emerging fintech companies vying for market dominance. This environment necessitates continuous innovation and strategic differentiation for i3 Verticals to maintain its competitive edge.

Ready to move beyond the basics? Get a full strategic breakdown of i3 Verticals’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The payment processing industry is heavily reliant on a few major payment networks, such as Visa and Mastercard. This limited number of dominant players grants them substantial bargaining power over companies like i3 Verticals.

These networks can effectively dictate the terms and fees associated with processing transactions. For instance, in 2023, Visa and Mastercard continued to represent the vast majority of card-present and card-not-present transaction routing, solidifying their influence.

i3 Verticals, like many in the payment processing sector, relies on a select group of technology providers for essential services such as cloud hosting and specialized software. This reliance on a limited pool of core technology vendors can grant these suppliers significant leverage. For instance, in 2024, the cloud computing market, a vital component for payment solutions, continued to be dominated by a few major players, potentially limiting i3 Verticals' bargaining power.

Changing core payment processing systems or major software platforms is a complex and costly undertaking for integrated payment companies like i3 Verticals. These high switching costs mean that once i3 Verticals is integrated with a supplier's technology, it becomes difficult and expensive to transition, which naturally boosts the supplier's leverage.

For instance, the average cost for a business to switch payment processors can range from $500 to $5,000, not including potential downtime or lost transaction revenue. This significant investment in new hardware, software, and employee training creates a substantial barrier for i3 Verticals to seek alternative suppliers, thereby strengthening the bargaining power of their current technology providers.

Talent and Expertise in Niche Verticals

The bargaining power of suppliers for i3 Verticals is significantly influenced by the specialized nature of the industries it serves. In sectors like education, healthcare, and government, where i3 Verticals focuses, suppliers offering highly specialized software components or possessing unique expertise can wield considerable influence. This is because the pool of providers for such niche capabilities is often limited, making their offerings scarce and therefore more valuable.

For instance, consider the healthcare vertical. A supplier providing a critical, HIPAA-compliant data analytics platform tailored for electronic health records might have strong bargaining power. If i3 Verticals relies heavily on such a component to deliver its solutions, the supplier's ability to dictate terms or pricing increases. This dynamic is amplified when the supplier's technology is deeply integrated and difficult to substitute.

- Niche Expertise: Suppliers with deep knowledge and specialized tools for education, healthcare, or government sectors hold greater sway.

- Scarcity of Talent: Access to highly skilled developers or consultants experienced in these specific verticals can be limited, increasing supplier leverage.

- Integrated Solutions: If a supplier's component is a core part of i3 Verticals' offering and difficult to replace, their bargaining power is enhanced.

- Industry-Specific Regulations: Compliance with stringent regulations within these verticals (e.g., HIPAA in healthcare) can further consolidate the market for specialized suppliers.

Potential for Forward Integration by Suppliers

Suppliers of core payment technologies or niche software solutions possess the capability to move into the integrated payment and software market themselves. This potential for forward integration by suppliers significantly bolsters their bargaining power, as they can transition from being mere vendors to direct competitors of companies like i3 Verticals.

This threat can manifest in several ways:

- Direct Market Entry: Suppliers could launch their own integrated platforms, leveraging their existing technology and customer relationships.

- Acquisition Strategy: Instead of building from scratch, a powerful supplier might acquire smaller players in the integrated solutions space.

- Partnership Leverage: Suppliers might form strategic alliances with other companies to offer competing integrated solutions, using their foundational technology as a key differentiator.

For instance, a major credit card network or a leading payment gateway provider could develop or acquire software capabilities to offer a bundled solution, directly challenging i3 Verticals' market position and potentially dictating terms more aggressively.

The bargaining power of suppliers for i3 Verticals is substantial, primarily due to the concentrated nature of payment networks like Visa and Mastercard, which control transaction routing and can dictate fees. Furthermore, reliance on a limited number of specialized technology providers, particularly in cloud computing where a few major players dominate, also grants suppliers significant leverage.

High switching costs associated with integrated payment and software systems make it difficult and expensive for i3 Verticals to change vendors, thereby strengthening the suppliers' negotiating position. The specialized nature of the industries i3 Verticals serves, such as healthcare and government, further empowers suppliers who possess niche expertise and cater to specific regulatory requirements.

The potential for suppliers to integrate forward into the market, either by developing their own solutions or acquiring competitors, poses a direct threat to i3 Verticals, enhancing supplier bargaining power. This dynamic is evident as major payment networks explore bundled offerings, directly competing with integrated solution providers.

| Factor | Impact on i3 Verticals | Example Data/Trend (2023-2024) |

| Payment Network Concentration | High Leverage for Networks | Visa and Mastercard processing over 90% of card transactions globally. |

| Technology Provider Reliance | Supplier Power in Cloud/Software | Continued dominance of AWS, Azure, and GCP in cloud infrastructure for fintech. |

| Switching Costs | Supplier Retention Advantage | Estimated $500-$5,000+ cost for businesses to switch payment processors. |

| Niche Industry Expertise | Supplier Power in Verticals | Demand for specialized, HIPAA-compliant software in healthcare sector remains high. |

| Forward Integration Threat | Potential for Supplier Competition | Major payment gateways exploring broader integrated software solutions. |

What is included in the product

This analysis dissects the competitive forces impacting i3 Verticals, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Customer switching costs for integrated solutions like those offered by i3 Verticals are a significant factor. Moving between payment and software providers often incurs expenses such as data migration, which can be complex and time-consuming. Furthermore, retraining employees on new systems and managing potential operational disruptions during the transition all add to this cost, effectively limiting the bargaining power of individual customers.

i3 Verticals operates across various industry verticals such as education, healthcare, and government sectors. This broad reach means their customer base is highly fragmented.

Because i3 Verticals serves many different customers, and no single customer represents a large percentage of their overall revenue, the bargaining power of any one customer is relatively low. For instance, in 2023, i3 Verticals reported total revenue of $402.4 million, with their largest customers contributing only a small fraction of this total, underscoring the lack of significant leverage for individual clients.

Customers today have a significantly wider selection of payment processing and software solutions than ever before. This includes established financial institutions, a burgeoning landscape of fintech competitors, and even the option for businesses to develop their own in-house systems. For instance, the global fintech market size was valued at approximately $2.5 trillion in 2023 and is projected to grow substantially, indicating a highly competitive environment.

This abundance of choice directly translates into increased bargaining power for customers. They can more easily compare features, pricing, and service levels across various providers, putting pressure on companies like i3 Verticals to offer competitive terms. The availability of readily accessible alternatives empowers customers to switch if they find better value elsewhere.

While i3 Verticals focuses on developing specialized, vertical-specific solutions, a strategy designed to foster customer loyalty and reduce churn, the sheer breadth of available alternatives remains a significant factor in customer bargaining power. Even with tailored offerings, the underlying threat of customers migrating to a competitor with a similar or even slightly less specialized but more cost-effective solution is ever-present.

Demand for Integrated and Tailored Solutions

Customers in i3 Verticals' target markets are increasingly seeking integrated payment and software solutions designed for their unique operational requirements. This growing demand for customization and efficiency shifts power towards providers who can deliver these comprehensive offerings, like i3 Verticals.

By successfully providing tailored, end-to-end solutions, i3 Verticals can strengthen its position and mitigate the bargaining power of its customers. This focus on integrated services allows the company to potentially command better pricing and foster greater customer loyalty.

- Demand for Integration: Businesses are moving away from siloed systems, preferring unified platforms for payments and business management.

- Tailored Solutions: Generic software is less appealing than solutions that directly address specific industry pain points.

- i3 Verticals' Advantage: The company's strategy of acquiring and integrating specialized software companies allows it to offer these sought-after integrated solutions.

- Customer Retention: High switching costs associated with integrated systems can reduce customer power.

Customer Sophistication and Industry Knowledge

Customers in sectors like government and healthcare often exhibit high sophistication and deep industry knowledge. This means they understand complex regulatory landscapes and specific operational needs, giving them significant leverage when selecting service providers. For instance, government entities might require adherence to stringent data privacy laws, while healthcare providers are focused on HIPAA compliance and interoperability standards.

This advanced understanding allows these customers to more effectively evaluate offerings, negotiate terms, and demand tailored solutions. In 2024, the increasing digitalization of these sectors further amplified customer sophistication, as they became more adept at assessing technology capabilities and security protocols. This trend empowers them to seek providers like i3 Verticals who demonstrate a profound grasp of their unique challenges and can deliver compliant, robust solutions.

- High Regulatory Demands: Sectors like government and healthcare face intricate compliance requirements, such as HIPAA and FedRAMP, which sophisticated customers use to their advantage.

- Demand for Specialized Solutions: Customers with deep industry knowledge seek providers who can offer tailored solutions that address specific pain points, rather than generic offerings.

- Informed Negotiation: A well-informed customer base can negotiate more effectively on price, service levels, and contract terms due to their understanding of market alternatives and their own operational costs.

- Technology Scrutiny: Sophisticated buyers meticulously assess the technological capabilities, scalability, and security of potential vendors, increasing the pressure on providers to innovate and maintain high standards.

The bargaining power of customers for i3 Verticals is influenced by several factors, including the availability of alternatives and the switching costs involved. While the market offers numerous payment and software solutions, i3 Verticals' focus on integrated, vertical-specific offerings aims to increase customer stickiness.

The fragmented customer base across various sectors, such as education, healthcare, and government, means no single customer holds significant sway. For example, i3 Verticals' 2023 revenue of $402.4 million was spread across many clients, limiting individual leverage.

Customers are increasingly sophisticated, particularly in regulated industries like healthcare and government, demanding tailored solutions and scrutinizing technology. This sophistication allows them to negotiate terms more effectively, especially as digitalization accelerates in 2024.

High switching costs, stemming from data migration and employee retraining for integrated systems, further reduce customer bargaining power. This makes it challenging for clients to move to competitors, even with a wide array of options available in the growing global fintech market, valued around $2.5 trillion in 2023.

Preview the Actual Deliverable

i3 Verticals Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for i3 Verticals, offering a comprehensive examination of industry competition and profitability. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The fintech and business services sectors are intensely crowded, with i3 Verticals facing a multitude of competitors. These rivals range from large, established payment processors and software providers to nimble, emerging startups, all vying for market share. This dynamic means i3 Verticals must constantly innovate and differentiate its offerings to stand out.

In 2024, the landscape remains highly fragmented. For instance, the payment processing market alone features hundreds of providers, from global giants like Fiserv and FIS to specialized niche players. i3 Verticals' success hinges on its ability to carve out distinct advantages in specific verticals, such as its focus on healthcare and education.

The payment and software solutions sector, where i3 Verticals operates, is a hotbed of rapid technological change. Innovations like artificial intelligence, blockchain technology, and the widespread adoption of real-time payment systems are constantly reshaping the landscape. This relentless pace of development means companies must continuously invest in cutting-edge technologies just to keep up, directly fueling competitive rivalry.

For i3 Verticals, this means the pressure is on to integrate these advancements into its offerings. Companies that fail to adapt risk becoming obsolete. For instance, the global fintech market was valued at over $110 billion in 2023 and is projected to grow significantly, driven by these very technological shifts, underscoring the imperative for continuous innovation to capture market share.

i3 Verticals' strategic focus on niche vertical markets, such as education, healthcare, and government, serves as a key differentiator against more generalized payment processors. This specialization allows them to tailor solutions to specific industry needs, fostering deeper client relationships.

However, this niche strategy also intensifies competitive rivalry within those specific sectors. Companies like Fiserv and FIS, with their broad payment processing capabilities, often expand into these verticals. For instance, in the government sector, i3 Verticals faces competition from established players offering integrated solutions for public services, a market segment that saw significant digital transformation efforts in 2024 as agencies sought more efficient payment collection methods.

Mergers and Acquisitions Activity

The payments and integrated software sectors are seeing a surge in mergers and acquisitions (M&A). Companies are actively acquiring specialized solutions to broaden their market reach and enhance their service offerings. This trend is a significant factor in competitive rivalry for i3 Verticals.

This consolidation can lead to the emergence of larger, more formidable competitors. These consolidated entities often possess greater resources, a wider product suite, and an expanded customer base, directly intensifying the competitive landscape for i3 Verticals.

- Increased Consolidation: The payments and software industries have witnessed substantial M&A activity. For instance, in 2023, the technology sector alone saw over $500 billion in M&A deals, with a significant portion attributed to software and fintech.

- Capability Expansion: Companies are acquiring smaller, specialized firms to quickly gain new technologies, enter new markets, or bolster their existing capabilities. This creates more comprehensive service providers that can challenge i3 Verticals across multiple fronts.

- Heightened Rivalry: As larger, integrated players emerge through M&A, the competitive pressure on i3 Verticals intensifies. These larger entities can leverage economies of scale and broader market penetration to offer more competitive pricing and bundled solutions.

Pricing Pressure and Commoditization

While i3 Verticals provides integrated payment and software solutions, specific components within payment processing, like basic transaction routing, are susceptible to commoditization. This means competitors can offer similar, standardized services, intensifying pricing pressure across the industry. For instance, in 2024, the average transaction fee for many small businesses hovered around 2.9% plus a small per-transaction charge, a benchmark that i3 Verticals must contend with.

The drive to remain competitive necessitates offering attractive pricing, particularly for businesses seeking more straightforward payment processing. This constant need to balance aggressive pricing with the imperative of maintaining healthy profit margins fuels the intensity of rivalry, especially for i3 Verticals' more standardized service offerings.

- Commoditization of Payment Processing: Certain core payment processing functions are becoming standardized, allowing competitors to offer similar services at lower price points.

- Pricing Pressure: The commoditized nature of some services forces i3 Verticals to compete on price, potentially impacting profit margins.

- Rivalry Intensity: The need to offer competitive pricing for standardized services directly contributes to a more intense competitive environment.

Competitive rivalry for i3 Verticals is fierce due to the fragmented nature of the fintech and business services sectors. Hundreds of providers, from global giants to niche startups, compete for market share, pushing i3 Verticals to constantly innovate and differentiate its offerings, particularly within its specialized vertical markets like healthcare and education.

The rapid pace of technological change, including AI and real-time payments, necessitates continuous investment, intensifying competition. Furthermore, significant merger and acquisition activity in 2023 and 2024 consolidates the market, creating larger, more formidable competitors for i3 Verticals. This trend, coupled with the commoditization of basic payment processing functions, leads to significant pricing pressure, forcing i3 Verticals to balance competitive pricing with profit margins.

| Competitor Type | Key Characteristic | Impact on i3 Verticals |

| Large, Established Providers (e.g., Fiserv, FIS) | Broad capabilities, significant resources, expanding into niche verticals | Intensified competition within specific vertical markets; pressure to match integrated offerings |

| Emerging Startups | Agile, innovative, often focused on specific technological advancements | Drive for continuous innovation; potential disruption of existing market segments |

| Consolidated Entities (Post-M&A) | Increased scale, wider product suites, expanded customer bases | Heightened competitive pressure due to economies of scale and market penetration |

SSubstitutes Threaten

While digital payments are gaining momentum, traditional methods like paper checks remain a viable substitute, especially in business-to-business (B2B) transactions. In 2023, checks still accounted for a significant portion of B2B payments, although their prevalence is gradually decreasing.

However, the inherent advantages of integrated digital payment solutions, such as enhanced security, faster processing times, and improved efficiency, are actively diminishing the appeal of paper checks. This trend is particularly evident as businesses increasingly adopt platforms like those provided by i3 Verticals, which streamline payment workflows.

Large enterprises may consider building their own payment processing systems, acting as a substitute for services like those offered by i3 Verticals. This in-house approach, however, involves substantial upfront investment in technology and ongoing maintenance, often proving more costly than utilizing specialized third-party providers.

The development and upkeep of internal payment solutions demand significant technical expertise and continuous updates to comply with evolving security standards and regulations. For instance, the Payment Card Industry Data Security Standard (PCI DSS) requires rigorous adherence, which can be a considerable burden for companies not specializing in payment technology.

In 2023, the global fintech market, which includes payment processing, was valued at over $11 trillion, demonstrating the scale and complexity of the industry. This vast market underscores the specialized nature of payment processing, making it challenging for many businesses to replicate efficiently in-house compared to partnering with established providers like i3 Verticals.

Generic software solutions with payment plugins present a significant threat. Businesses can opt for widely available ERP or accounting software and add third-party payment gateways instead of adopting i3 Verticals' specialized, integrated platforms.

While these generic options offer basic functionality, they often fall short in providing the deep, industry-specific features and streamlined workflows that i3 Verticals delivers. For instance, a small retail business might find a generic accounting package with a Square plugin sufficient, bypassing the need for i3 Verticals' dedicated retail POS and payment processing.

Direct Bank Offerings

Traditional banks are increasingly enhancing their digital payment and B2B financial services, potentially acting as substitutes by offering more comprehensive solutions directly to businesses. For instance, by mid-2024, many major banks saw significant growth in their digital transaction volumes, with some reporting double-digit increases year-over-year in B2B payment processing.

However, i3 Verticals' expertise in specific verticals and integrated software provides a competitive edge, differentiating its offerings from the more generalized services of traditional banks. This specialization allows i3 Verticals to tailor solutions to the unique needs of industries like healthcare or education, a depth that broad-based banking solutions often lack. For example, in 2024, i3 Verticals continued to deepen its vertical-specific integrations, leading to higher customer retention rates in its target markets compared to competitors with less focused product suites.

- Banks are expanding digital payment and B2B financial services.

- This expansion presents a potential substitute threat to i3 Verticals.

- i3 Verticals' vertical expertise and integrated software offer a key differentiator.

- Specialization allows for tailored solutions that generic banking services may not match.

Emerging Fintech Solutions

The burgeoning fintech landscape poses a significant threat of substitution for i3 Verticals. Innovations like real-time payment networks, decentralized finance (DeFi) leveraging blockchain, and direct account-to-account payment systems offer alternative methods for transaction processing and financial management that bypass traditional intermediaries. For instance, the growth of open banking initiatives, which enable third-party providers to access bank data with customer consent, allows for new service offerings that could compete with i3 Verticals' existing solutions.

i3 Verticals needs to proactively integrate or counter these advancements to maintain its competitive edge. The company must invest in research and development to understand and potentially adopt these emerging technologies. Failing to adapt could lead to a gradual erosion of market share as customers migrate to more modern, efficient, and potentially lower-cost fintech alternatives.

- Fintech Adoption: Global fintech investment reached $120.1 billion in 2023, indicating a strong trend towards new financial technologies.

- Account-to-Account Payments: The adoption of A2A payments is projected to grow significantly, with some markets expecting double-digit annual growth rates in the coming years, directly challenging card-based transaction models.

- Blockchain in Finance: The market for blockchain in financial services is expected to expand, with applications ranging from cross-border payments to digital asset management, offering disruptive potential.

The threat of substitutes for i3 Verticals' services is multifaceted, encompassing traditional payment methods, in-house solutions, generic software, and evolving fintech innovations. While digital payments are ascendant, paper checks persist in B2B, though their utility is waning due to the efficiency of integrated digital platforms. In 2023, checks still represented a notable portion of B2B payments, but this is declining as businesses adopt more streamlined solutions.

Large enterprises might consider developing proprietary payment systems, a substitute that demands substantial investment and ongoing technical expertise, particularly concerning compliance with standards like PCI DSS. The global fintech market, exceeding $11 trillion in 2023, highlights the specialized nature of payment processing, making in-house replication challenging for many.

Generic software with payment plugins also poses a threat, offering basic functionality that may suffice for simpler needs but lacking the deep, industry-specific features i3 Verticals provides. Traditional banks are enhancing their digital and B2B services, with many reporting double-digit growth in digital transaction volumes by mid-2024, yet i3 Verticals' vertical specialization remains a key differentiator.

The fintech landscape, including real-time payments and DeFi, presents a significant substitution threat, with open banking initiatives enabling new competitive services. Global fintech investment reached $120.1 billion in 2023, underscoring the rapid pace of innovation. Account-to-account payments are projected for strong growth, directly challenging existing transaction models.

| Substitute Type | Description | Impact on i3 Verticals | 2023/2024 Data Point |

|---|---|---|---|

| Paper Checks | Traditional B2B payment method | Declining relevance due to digital efficiency | Still significant in B2B, but decreasing |

| In-house Systems | Proprietary payment processing | High cost & complexity, challenging for non-specialists | N/A (Company-specific) |

| Generic Software + Plugins | ERP/Accounting with added gateways | Lacks vertical specialization and deep integration | N/A (Market trend) |

| Traditional Banks | Enhanced digital/B2B financial services | Growing competition, but i3 Verticals' specialization is a differentiator | Double-digit growth in digital transaction volumes for many banks by mid-2024 |

| Fintech Innovations | Real-time payments, DeFi, A2A, Open Banking | Disruptive potential, requires proactive adaptation | Fintech investment: $120.1 billion in 2023; A2A growth projected strong |

Entrants Threaten

Entering the integrated payment and software solutions market, like the one i3 Verticals operates in, demands significant upfront capital. Companies need to invest heavily in developing robust technology, building secure infrastructure, and ensuring compliance with a myriad of financial regulations. For instance, the Payment Card Industry Data Security Standard (PCI DSS) alone requires substantial ongoing investment to maintain compliance.

These regulatory hurdles, which are often complex and constantly changing, act as a powerful deterrent to potential new entrants. Navigating regulations like those from the Consumer Financial Protection Bureau (CFPB) or international data privacy laws such as GDPR requires specialized legal and technical expertise, further increasing the cost and complexity of market entry.

The need for specialized industry knowledge and established relationships presents a significant barrier for new entrants into i3 Verticals' target markets. i3 Verticals' success in sectors like education, healthcare, and government hinges on understanding unique regulatory landscapes, customer needs, and existing vendor ecosystems. For instance, in the healthcare sector, navigating HIPAA compliance and integrating with existing Electronic Health Record (EHR) systems requires deep, sector-specific expertise that newcomers would struggle to quickly replicate.

In the competitive landscape of financial services and software, brand recognition and trust are paramount. Established companies like i3 Verticals have cultivated strong reputations over years of reliable service, presenting a significant hurdle for newcomers aiming to quickly earn customer confidence and capture market share.

For instance, in 2023, customer acquisition costs in the fintech sector continued to rise, with some estimates suggesting it can cost upwards of $100 to acquire a new customer, a figure that is even higher for businesses requiring significant trust, like those handling financial data.

Access to Payment Networks and Banking Partnerships

New companies entering the payment processing space, like those i3 Verticals competes with, face a significant hurdle in securing access to established payment networks such as Visa and Mastercard, as well as critical banking partnerships. This process is often lengthy and resource-intensive, requiring extensive due diligence and negotiation. For instance, in 2024, the average time for a new fintech to establish a direct relationship with a major card network could extend over 18 months, involving substantial upfront investment and compliance checks.

Existing players, including i3 Verticals, already possess these vital relationships, giving them a considerable advantage. These established partnerships streamline operations and ensure reliable transaction processing, which is a core competency in the industry. By 2023, i3 Verticals reported processing billions of dollars in payment volume, a testament to the robustness of its existing network integrations.

- Barrier to Entry: Establishing connections with major payment networks (Visa, Mastercard) and acquiring banking partnerships is a complex, time-consuming, and costly endeavor for new entrants.

- Existing Advantage: i3 Verticals benefits from pre-existing, well-established relationships with these networks and banking institutions, facilitating smoother and more efficient transaction processing.

- Operational Efficiency: These established partnerships are crucial for the operational efficiency and reliability that i3 Verticals offers its clients, a capability difficult for newcomers to replicate quickly.

Talent Acquisition and Retention

The demand for skilled professionals in fintech and integrated software development remains exceptionally high. New entrants to the i3 Verticals market face a significant hurdle in attracting and retaining the specialized talent needed to build and scale their operations effectively.

Consider the intense competition for talent. In 2024, the average salary for a software engineer in the US fintech sector saw an increase, with some senior roles commanding upwards of $150,000 annually. This competitive environment makes it challenging for newcomers to lure experienced developers and operational experts away from established players or other lucrative industries.

- High Demand for Specialized Skills: Fintech and software development require niche expertise, making talent acquisition a bottleneck.

- Competitive Salary Landscape: Established companies often offer more attractive compensation packages, a significant barrier for new entrants.

- Retention Challenges: Even if acquired, retaining top talent is difficult due to ongoing recruitment efforts by competitors.

- Impact on Scalability: A lack of skilled personnel directly impedes a new entrant's ability to develop products and scale operations efficiently.

The threat of new entrants into i3 Verticals' market is moderate. Significant capital investment is required for technology development, secure infrastructure, and regulatory compliance, such as PCI DSS. Navigating complex financial regulations, like those from the CFPB, also demands specialized expertise, increasing entry costs.

Established relationships with payment networks like Visa and Mastercard, along with banking partnerships, are critical and difficult for newcomers to secure, often taking over 18 months in 2024. i3 Verticals benefits from these existing integrations, having processed billions in payment volume by 2023.

The need for deep, sector-specific knowledge, particularly in areas like healthcare's HIPAA compliance and EHR integration, presents another substantial barrier. Furthermore, the high demand for skilled fintech professionals, with average US fintech software engineer salaries exceeding $150,000 in 2024, makes talent acquisition a significant challenge for new entrants.

| Barrier Type | Description | Example Data/Trend |

| Capital Requirements | High upfront investment in technology, infrastructure, and compliance. | PCI DSS compliance investment. |

| Regulatory Hurdles | Complex and evolving financial regulations require specialized expertise. | CFPB regulations, GDPR. |

| Network Access & Partnerships | Securing relationships with payment networks and banks is time-consuming and costly. | Average 18+ months for new fintechs to establish direct card network relationships (2024). |

| Industry Expertise | Understanding niche market needs and regulatory landscapes. | HIPAA compliance in healthcare. |

| Talent Acquisition | Intense competition for skilled fintech professionals. | US fintech software engineer salaries exceeding $150,000 (2024). |

Porter's Five Forces Analysis Data Sources

Our i3 Verticals Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company financial reports, industry-specific market research, and publicly available regulatory filings.

We leverage insights from trade publications, competitor announcements, and market share data to thoroughly assess the competitive landscape and strategic positioning of i3 Verticals.