i3 Verticals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

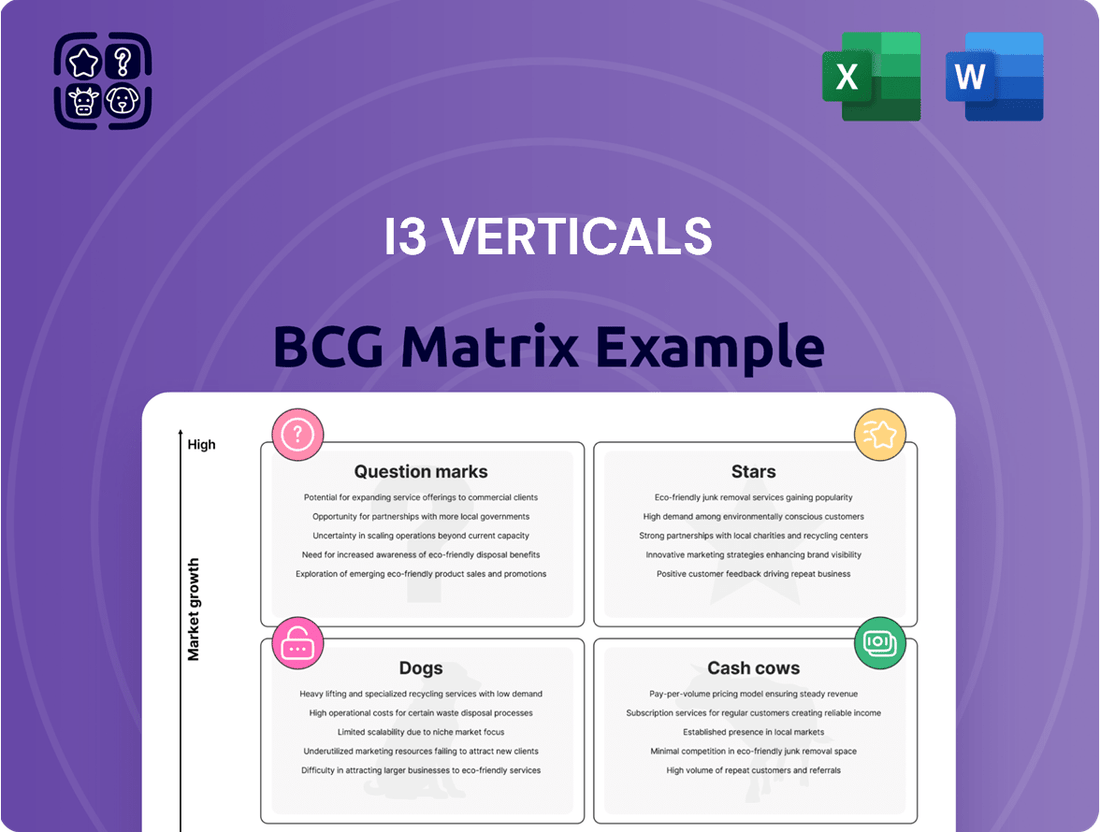

Explore the strategic positioning of i3 Verticals' product portfolio with our insightful BCG Matrix preview. Understand which offerings are driving growth and which require careful consideration for future investment.

This snapshot is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your capital allocation and product strategy.

Stars

i3 Verticals' Public Sector SaaS solutions, encompassing transportation, ERP, public safety, K-12 education, enterprise utilities, and justice tech, are strategically placed within the BCG matrix. This segment is a key driver for the company, benefiting from a rapidly expanding market. The global government software market is anticipated to surpass $77 billion by 2031, growing at a compound annual growth rate of 10.1% from 2024 to 2031.

The company's performance in Q1 2025 highlights the strength of its public sector SaaS business. Revenue from these offerings saw a significant 12% year-over-year increase, contributing 80% to i3 Verticals' total revenue. This substantial contribution underscores the company's dominant position in a market experiencing robust expansion.

Integrated payment solutions within i3 Verticals' public sector software are a clear Star. This strategic move embeds payment processing directly into their core offerings, simplifying operations for government entities and fostering customer loyalty. This integration is a key driver for recurring revenue, bolstering the overall value of their software suite.

The company's focus on payment integration, particularly following its merchant services divestiture, positions it for increased profitability. By offering seamless payment experiences, i3 Verticals enhances its cross-selling capabilities within a rapidly expanding market. For instance, in 2023, the fintech sector saw significant growth, with payment processing innovations playing a crucial role.

i3 Verticals' public sector software is demonstrating strong momentum with its recurring license sales, a clear indicator of a successful SaaS model adoption. The company saw a significant increase from $0.4 million in Q1 2024 to $2.7 million in Q1 2025 for these sales, highlighting a rapid shift towards a more stable revenue stream.

JusticeTech Solutions

i3 Verticals' JusticeTech solutions are demonstrating robust expansion, driven by advanced software for justice and court case management across all governmental levels. The company's strategic pursuit of significant contracts, such as a recent statewide court system agreement, underscores its growing market penetration in a specialized and expanding public sector segment. This dedication to mission-critical, niche software solidifies JusticeTech's position as a high-potential Star within the i3 Verticals portfolio.

The market for justice technology is experiencing significant tailwinds, with increased demand for modernization and efficiency in judicial processes. In 2024, i3 Verticals reported strong performance from its JusticeTech segment, contributing to the company's overall revenue growth. This segment benefits from recurring revenue models and high customer retention rates due to the essential nature of its software.

- Market Growth: The global legal tech market, encompassing justice solutions, is projected to grow substantially, with various reports indicating compound annual growth rates exceeding 15% through 2027.

- Contract Wins: i3 Verticals has secured several key contracts in the past year, including expansions with existing state and local government clients, reinforcing their market leadership.

- Product Innovation: Continuous investment in R&D has led to enhanced features in their case management software, improving user experience and system integration, which is crucial for adoption in complex government environments.

- Competitive Landscape: While competitive, JusticeTech's specialized focus and proven track record in public sector IT solutions provide a distinct advantage.

Utility Billing Software (Recent Acquisition)

The acquisition of a utility billing software company in April 2025 for $9 million positions this segment as a new Star for i3 Verticals. This move significantly enhances their presence in the utilities sector across various states, tapping into the ongoing digital transformation within government services.

This strategic acquisition offers substantial opportunities for i3 Verticals to integrate its existing payment processing capabilities and pursue cross-selling initiatives. By doing so, it strengthens their market standing within a sector experiencing robust growth.

- Acquisition Value: $9 million in April 2025.

- Market Expansion: Increased footprint in the utilities market across multiple states.

- Strategic Alignment: Supports digital transformation in government services.

- Growth Opportunities: Integration of payment processing and cross-selling potential.

i3 Verticals' Public Sector SaaS solutions, particularly integrated payment solutions and JusticeTech, are positioned as Stars in the BCG matrix. These segments benefit from high market growth and strong company performance, evident in the 12% year-over-year revenue increase for public sector SaaS in Q1 2025, which constitutes 80% of total revenue.

The recent acquisition of a utility billing software company for $9 million in April 2025 further solidifies the utilities segment's Star status. This strategic move enhances i3 Verticals' market presence and offers significant cross-selling opportunities, aligning with the digital transformation trend in government services.

The company's recurring license sales have seen a substantial jump from $0.4 million in Q1 2024 to $2.7 million in Q1 2025, underscoring the success of its SaaS model within these high-growth areas.

The global government software market is projected to exceed $77 billion by 2031, with a CAGR of 10.1% from 2024 to 2031, providing a fertile ground for these Star performers.

| Segment | BCG Category | Key Growth Drivers | 2025 Performance Indicator | Market Context |

|---|---|---|---|---|

| Integrated Payment Solutions (Public Sector SaaS) | Star | Embedded payment processing, recurring revenue, customer loyalty | Strong contribution to overall SaaS revenue | Fintech sector growth, payment processing innovation |

| JusticeTech | Star | Advanced software for justice and court case management, mission-critical niche | Strong performance reported in 2024, high customer retention | Legal tech market growth (est. >15% CAGR through 2027) |

| Utilities Software (Post-Acquisition) | Star | Digital transformation in utilities, integration of payment processing, cross-selling | New Star status post-$9M acquisition (April 2025) | Growing demand for modernization in government services |

What is included in the product

The i3 Verticals BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The i3 Verticals BCG Matrix provides a clear, actionable roadmap for resource allocation, relieving the pain of strategic uncertainty.

Cash Cows

i3 Verticals' established cloud-hosted financial management and ERP software serving the public sector are undoubtedly Cash Cows. These systems are deeply integrated into government operations, creating high switching costs and ensuring stable, predictable recurring revenue.

The public administration and ERP segment for i3 Verticals likely boasts a significant market share, even if its growth rate is more moderate compared to emerging technologies. This strong market position translates into consistent and reliable cash flow generation, supporting other areas of the business.

The K-12 education payment and software solutions offered by i3 Verticals are a prime example of a Cash Cow within their portfolio. This segment serves public schools, providing crucial payment processing and related administrative software. The stability of this market is underpinned by long-term contracts and the essential nature of the services, ensuring a predictable and consistent revenue stream.

The mature and relatively low-growth environment of the K-12 education sector, coupled with i3 Verticals' established market presence, means that significant investment in aggressive marketing or expansion is not required. This allows the business to generate substantial cash flow with minimal ongoing capital expenditure, a hallmark of a Cash Cow.

i3 Verticals' core payment processing platform, now primarily supporting its vertical software, functions as a Cash Cow. This integrated system generates steady, transaction-based revenue and processing fees from its existing customer base in high-share verticals. Despite divesting a significant portion of its merchant services, the retention of this platform underscores its ongoing value and profitability.

Long-term Software Maintenance and Support Services

i3 Verticals' long-term software maintenance and support services, especially for its public sector clients, are a prime example of a Cash Cow. These services generate consistent, predictable income due to high customer retention and the recurring nature of subscriptions. Once the initial development and implementation costs are covered, the ongoing investment needed to maintain these revenue streams is minimal.

- High Renewal Rates: Public sector entities often prioritize stability, leading to strong renewal rates for essential maintenance and support.

- Predictable Revenue: This segment provides a stable, recurring revenue base, crucial for financial planning and stability.

- Low Incremental Investment: After the initial sale, the cost to continue providing these services is relatively low, maximizing profitability.

Transportation Solutions

i3 Verticals' transportation solutions, particularly their robust statewide systems, are strong candidates for the Cash Cow quadrant in a BCG Matrix analysis. These offerings represent critical infrastructure, often secured through long-term contracts with government entities, which translates to predictable and stable revenue streams.

While the transportation sector might not be experiencing hyper-growth, the indispensable nature of these services ensures a reliable and typically high-margin income for i3 Verticals. For instance, in 2024, many government IT contracts for infrastructure management, including transportation systems, continue to provide steady income, reflecting the essential services they support.

- Stable Revenue: Long-term government contracts for statewide transportation systems offer predictable income.

- High Margins: The essential nature of these services often allows for strong profit margins.

- Market Position: Established players like i3 Verticals benefit from high barriers to entry in critical infrastructure.

- Low Growth, High Share: These solutions likely have a significant market share in a mature, albeit essential, market segment.

i3 Verticals' established public sector ERP and cloud-hosted financial management software are definitive Cash Cows. Their deep integration into government operations creates high switching costs and ensures a stable, predictable recurring revenue stream, even in a mature market.

The K-12 education payment and software solutions are another strong Cash Cow. These essential services for public schools, often secured by long-term contracts, provide a consistent and reliable revenue base with minimal need for further investment.

The company's core payment processing platform, supporting its vertical software, also operates as a Cash Cow. This platform generates steady, transaction-based revenue, demonstrating continued profitability even after strategic divestitures.

i3 Verticals' transportation solutions, particularly statewide systems, are prime examples of Cash Cows. These critical infrastructure offerings, secured by long-term government contracts, ensure predictable, high-margin income. For instance, in 2024, these systems continue to provide steady revenue reflecting their essential nature.

| Segment | BCG Quadrant | Key Characteristics | Supporting Data (Illustrative) |

| Public Sector ERP/Financial Management | Cash Cow | High market share, stable revenue, high switching costs | Recurring revenue from long-term contracts, high customer retention rates. |

| K-12 Education Software/Payments | Cash Cow | Established market, essential services, predictable income | Strong renewal rates for software maintenance and support. |

| Core Payment Processing Platform | Cash Cow | Steady transaction-based revenue, integrated system | Consistent processing fees from existing vertical clients. |

| Transportation Solutions | Cash Cow | Critical infrastructure, long-term government contracts, stable margins | 2024 revenue from statewide systems reflects essential service demand. |

Full Transparency, Always

i3 Verticals BCG Matrix

The i3 Verticals BCG Matrix preview you're seeing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or altered content, just the complete strategic analysis ready for your immediate use. You can confidently assess its value, knowing the purchased version will be exactly the same, allowing for seamless integration into your business planning. This ensures you get precisely what you need to make informed decisions about i3 Verticals' portfolio.

Dogs

The divested merchant services business of i3 Verticals, sold to Payroc in September 2024, fits the profile of a Dog in the BCG Matrix. This segment likely experienced slower market growth and faced intense competition, diminishing its strategic importance.

This business unit, prior to its sale, probably offered lower growth potential and tighter profit margins than i3 Verticals' core software offerings. The decision to divest underscores its status as a less desirable asset, potentially a cash drain rather than a growth driver.

The Healthcare Revenue Cycle Management (RCM) business, divested to Infinx in May 2025, clearly fits the profile of a Dog in the BCG matrix. i3 Verticals themselves acknowledged that this particular market demanded a scale they couldn't readily achieve, making it difficult to compete with established, larger competitors.

This segment likely suffered from a low market share and struggled to generate significant growth, a common characteristic of Dog businesses. The decision to divest suggests a strategic move to shed underperforming assets and concentrate resources on areas with greater potential, thereby optimizing i3 Verticals' overall business structure.

Non-recurring software license sales, while still a revenue source, are a strategic Dog for i3 Verticals. The company's deliberate shift towards a Software-as-a-Service (SaaS) model means these one-time sales are becoming less important. This trend is evident as i3 Verticals prioritizes predictable, recurring revenue streams over less stable, upfront license fees, signaling a de-emphasis on this business segment.

Legacy Systems with Limited Growth Potential

Legacy systems at i3 Verticals that are not aligned with the company's public sector SaaS strategy represent "Dogs" in the BCG matrix. These might include older software solutions with a small market share and minimal growth prospects. For instance, if i3 Verticals has a legacy product that only serves a niche, declining market and requires significant resources for upkeep without contributing to future growth, it would fall into this category. Such systems may still generate some revenue, but their contribution to overall company growth is negligible, and they often demand disproportionate maintenance costs.

These "Dog" products or services are characterized by low market share and low market growth. They might be older software offerings that are no longer actively developed or integrated into i3 Verticals' core public sector SaaS focus. For example, a system that was once popular but has been superseded by newer technologies or is no longer supported by the company's strategic direction would be a prime candidate. These offerings often have a dwindling customer base and require ongoing, but increasingly inefficient, maintenance.

- Low Market Share: These systems typically hold a small percentage of their respective markets, often due to outdated features or a lack of competitive innovation.

- Limited Growth Potential: The markets these legacy systems serve are generally stagnant or declining, offering little opportunity for expansion or increased revenue.

- Disproportionate Maintenance Costs: Despite low revenue generation, these systems can consume significant resources for upkeep and support, hindering investment in more promising areas.

- Strategic Misalignment: They do not fit with i3 Verticals' current strategic emphasis on public sector Software-as-a-Service (SaaS) solutions.

Outdated or Niche Payment-Only Solutions

Outdated or niche payment-only solutions, lacking integration with i3 Verticals' core software, would likely fall into the Dogs category of the BCG matrix. These offerings, often found in saturated or low-growth payment markets, represent a declining segment with minimal future investment potential. For instance, a standalone, unintegrated credit card processing service for a small, niche retail sector would fit this description. i3 Verticals' strategic shift towards integrated vertical solutions underscores a move away from such isolated payment products.

These "Dogs" typically exhibit:

- Low Market Share: Minimal penetration in their respective payment niches.

- Low Market Growth: Operating in payment segments that are not expanding significantly.

- Limited Strategic Value: Not aligned with i3 Verticals' focus on comprehensive, integrated software solutions.

- Potential for Divestment: May be considered for sale or discontinuation to reallocate resources.

The divested merchant services business, sold in September 2024, and the Healthcare Revenue Cycle Management (RCM) business, sold in May 2025, both fit the BCG matrix's Dog category. These segments likely had low market share and experienced slow growth, prompting i3 Verticals to divest them to focus on more promising areas.

Non-recurring software license sales and legacy systems not aligned with the company's public sector SaaS strategy also represent Dogs. These areas have limited growth potential and may incur disproportionate maintenance costs, making them less strategically valuable.

Outdated or niche payment-only solutions, lacking integration with i3 Verticals' core offerings, are further examples of Dogs. These products operate in saturated or low-growth markets and have minimal strategic value.

The strategic decision to divest or de-emphasize these segments highlights i3 Verticals' focus on optimizing its portfolio for future growth and efficiency.

Question Marks

i3 Verticals is actively investing in new AI initiatives, including an AI service agent for the transportation sector and an automated indexing module for its Enterprise Resource Planning (ERP) systems. These ventures represent new product offerings within the rapidly expanding technology landscape.

While these AI applications are positioned in a high-growth market, their market share and customer adoption rates are still in the early stages, indicating they are question marks in the BCG matrix. Significant investment in research, development, and marketing will be crucial to gauge their future potential and determine if they can evolve into Stars.

Expansion into new public sector sub-verticals via acquisition for i3 Verticals, within a BCG Matrix framework, would position these ventures as potential question marks. While the public sector market is substantial, with government technology spending projected to reach $165 billion in the US in 2024, entering new, unproven sub-verticals carries inherent risks.

The success of such acquisitions hinges on i3 Verticals' ability to effectively integrate acquired entities, secure market acceptance, and achieve meaningful market share in these novel areas. The company's active pursuit of these opportunities signals a strategic intent to diversify, but the outcome remains uncertain, reflecting the typical characteristics of question mark investments.

i3 Verticals is actively pursuing geographic expansion within the public sector, targeting states like Idaho, Texas, Oklahoma, North Carolina, and Delaware where its presence is currently limited. This strategic move aims to tap into the significant growth potential inherent in these new markets. For instance, securing contracts in public education within these regions represents a key entry point.

However, this expansion necessitates considerable investment. i3 Verticals must allocate resources towards building robust sales and marketing infrastructure, alongside adapting its solutions to meet the specific needs and regulations of each new locale. This commitment is crucial for establishing a strong foothold and capturing substantial market share in these untapped territories.

Specific Emerging Technologies within Public Sector Software

Investing in emerging technologies like advanced data analytics and blockchain for public sector software presents a significant opportunity for i3 Verticals. These areas, while in early adoption, promise high growth potential. For example, the global government big data analytics market was projected to reach $10.5 billion in 2024, indicating substantial future expansion.

- Advanced Data Analytics: Enhancing predictive capabilities for resource allocation and citizen services.

- Blockchain for Government Records: Improving security and transparency in areas like land registries and voting systems.

- AI-Powered Automation: Streamlining administrative tasks and improving efficiency in public service delivery.

- Cloud-Native Solutions: Facilitating scalability and agility in government IT infrastructure.

High-Growth, Low-Market Share Offerings in Healthcare (Post-Divestiture Remaining)

Following i3 Verticals' divestiture of its RCM business, any remaining smaller healthcare software offerings that operate in rapidly expanding but intensely competitive markets, where the company currently holds a minor market share, would likely be classified as Question Marks. These nascent solutions face a critical juncture: they require substantial investment to gain traction and scale, or they risk stagnating into Dogs.

For instance, if i3 Verticals retains a niche solution for, say, AI-driven patient engagement in a burgeoning telehealth market, and that market is projected to grow at 25% annually but i3 Verticals holds only a 2% market share, it fits this category. Such ventures demand strategic decisions regarding resource allocation for aggressive market penetration or potential divestment to avoid further capital drain.

- High Growth Potential: These offerings are in markets experiencing significant expansion, indicating future revenue opportunities.

- Low Market Share: i3 Verticals has a limited presence, meaning substantial effort is needed to capture a meaningful portion of the market.

- Investment Requirement: Scaling these solutions necessitates considerable capital for product development, sales, and marketing to compete effectively.

- Risk of Becoming a Dog: Without adequate investment and strategic focus, these offerings could fail to gain traction and become unprofitable assets.

i3 Verticals' AI initiatives, like the transportation sector AI service agent and ERP automated indexing module, are prime examples of Question Marks. These are in high-growth markets but currently have low market share, requiring significant investment to determine their future success.

Geographic expansion into new public sector sub-verticals also falls into the Question Mark category. While the public sector tech market is substantial, with US government technology spending expected to hit $165 billion in 2024, entering unproven areas carries inherent risks and requires substantial investment for integration and market acceptance.

Emerging technologies such as advanced data analytics and blockchain for public sector software represent further Question Marks. The government big data analytics market alone was projected to reach $10.5 billion in 2024, highlighting the growth potential, but i3 Verticals' current market share in these nascent areas is minimal, necessitating investment to capture market share.

The company's smaller healthcare software offerings, particularly those in rapidly expanding but competitive markets where i3 Verticals holds a minor share, are also Question Marks. These require substantial capital for product development and marketing to compete, or they risk becoming Dogs.

| Category | Market Growth | i3 Verticals Market Share | Investment Need | Outlook |

| AI Initiatives | High | Low | High | Uncertain (Potential Star) |

| New Public Sector Sub-verticals | Moderate to High | Low | High | Uncertain (Potential Star) |

| Emerging Tech (Data Analytics, Blockchain) | High | Low | High | Uncertain (Potential Star) |

| Niche Healthcare Software | High | Low | High | Uncertain (Potential Dog) |

BCG Matrix Data Sources

Our i3 Verticals BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.