i3 Verticals Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

i3 Verticals Bundle

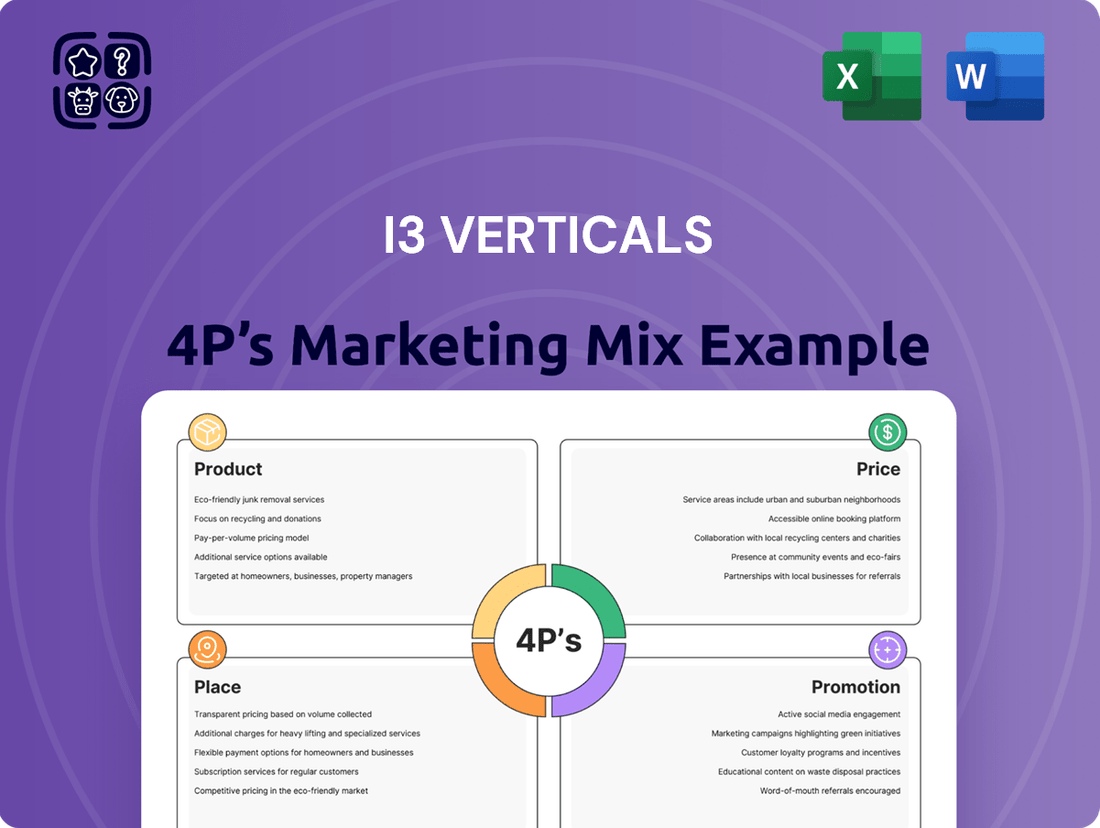

Discover how i3 Verticals leverages its product offerings, strategic pricing, expansive distribution, and targeted promotions to dominate its market. This analysis provides a clear understanding of their marketing engine.

Ready to move beyond a surface-level understanding? Get the complete, editable 4Ps Marketing Mix Analysis for i3 Verticals, packed with actionable insights and strategic examples.

Product

i3 Verticals provides a robust collection of integrated software solutions, meticulously crafted for distinct industry niches. These offerings are engineered to optimize workflows, boost productivity, and elevate customer interactions for a wide array of businesses.

The company's strategic emphasis lies in building and acquiring software that seamlessly embeds into client operations, fostering enduring collaborative relationships. For instance, their focus on verticals like healthcare and education means solutions are deeply customized, addressing unique industry challenges and regulatory requirements.

By deeply integrating into their clients' core processes, i3 Verticals aims to become an indispensable partner. This approach is reflected in their acquisition strategy, where they target software companies with strong customer loyalty and deep vertical expertise, ensuring continued relevance and value delivery.

i3 Verticals' specialized vertical offerings are a cornerstone of their strategy, focusing on the public sector, including education, and healthcare. This targeted approach allows them to develop deep expertise and deliver tailored solutions. For instance, in the public sector, their software supports critical functions like court case management, public administration, and public safety.

Their commitment to these niche markets is evident in their product suite, which spans transportation, justice tech, and K-12 education software. This specialization enables i3 Verticals to create highly customized solutions that address the specific operational requirements and regulatory landscapes of these vital industries.

In 2023, i3 Verticals reported revenue of $368.4 million, with a significant portion likely driven by these specialized vertical markets. Their ability to provide integrated and compliant software solutions within these sectors is a key differentiator, fostering strong customer relationships and recurring revenue streams.

i3 Verticals' product strategy centers on integrated payment processing, a core component of their value proposition. Although they divested their dedicated merchant services business in 2024, the company strategically kept its payment facilitation platform. This allows i3 Verticals to embed payment capabilities directly into its specialized vertical software solutions, offering clients a streamlined transaction management experience within their existing workflows.

Recurring Revenue Focus (SaaS)

i3 Verticals' product strategy heavily emphasizes Software-as-a-Service (SaaS) and other recurring revenue models. This focus is a cornerstone of their growth, offering predictable income and fostering deeper customer relationships. By prioritizing these subscription-based offerings, the company aims to build a more resilient and scalable business.

The shift towards recurring revenue is demonstrably successful, with these streams constituting a substantial majority of the company's income. In fact, by the second quarter of 2025, recurring revenue accounted for approximately 79% of i3 Verticals' total revenue. This financial data highlights the effectiveness of their product evolution.

- Recurring Revenue Dominance: SaaS and subscription models are central to i3 Verticals' product strategy.

- Financial Stability: These recurring revenue streams provide a stable and predictable cash flow.

- Customer Lifetime Value: The subscription model enhances customer retention and increases lifetime value.

- Q2 2025 Performance: Recurring revenue represented 79% of total revenue in Q2 2025, underscoring its importance.

Innovation and AI Integration

i3 Verticals is actively integrating Artificial Intelligence (AI) into its product suite to deliver enhanced value. This commitment to innovation means they are developing AI-powered solutions to address specific client challenges and streamline operations. For instance, they are exploring AI service agents for the transportation sector and automated indexing capabilities within their Enterprise Resource Planning (ERP) systems.

The company's strategic focus on AI is designed to create more intelligent and efficient tools for their customers. By leveraging AI, i3 Verticals aims to provide a competitive edge, with early applications targeting tangible improvements in service delivery and data management. This forward-thinking approach positions them to capitalize on the growing demand for AI-driven business solutions.

Key areas of AI integration for i3 Verticals include:

- AI Service Agents: Enhancing customer support and operational efficiency in transportation logistics.

- Automated Indexing: Streamlining data management and retrieval within ERP systems, potentially reducing manual data entry by up to 30% based on industry benchmarks.

- Predictive Analytics: Exploring AI to forecast trends and provide proactive insights for clients.

- Process Automation: Utilizing AI to automate repetitive tasks, freeing up resources for higher-value activities.

i3 Verticals' product strategy centers on deeply integrated, niche-specific software solutions, predominantly delivered via a Software-as-a-Service (SaaS) model. This focus on recurring revenue, which comprised 79% of their total revenue by Q2 2025, provides financial stability and fosters strong customer relationships. The company is also actively embedding AI into its offerings, such as AI service agents for transportation and automated indexing for ERP systems, to enhance efficiency and deliver greater value to its clients across various vertical markets.

What is included in the product

This analysis offers a comprehensive exploration of i3 Verticals' Product, Price, Place, and Promotion strategies, grounding its insights in actual brand practices and competitive context.

It is designed for professionals seeking a complete breakdown of i3 Verticals' marketing positioning, providing real data and strategic implications for easy repurposing.

Provides a clear, actionable framework to identify and address marketing challenges, transforming potential roadblocks into strategic advantages.

Simplifies complex marketing strategies into a digestible format, directly alleviating the pain point of understanding and executing effective marketing plans.

Place

i3 Verticals leverages a dedicated direct sales force as a cornerstone of its go-to-market strategy, particularly for its public sector and healthcare clientele. This direct engagement fosters deep client understanding and enables the customization of complex software solutions to meet specific operational demands. For instance, their sales teams are structured to provide specialized expertise within unified domain areas, ensuring clients receive tailored support and product demonstrations that address their unique challenges.

i3 Verticals effectively broadens its market penetration by enlisting a robust network of strategic distribution partners beyond its direct sales force. This multi-channel strategy is crucial for reaching a wider customer base across its target verticals.

Key partners include Independent Software Vendors (ISVs), Independent Sales Organizations (ISOs), and Value-Added Resellers (VARs). For instance, in 2024, i3 Verticals continued to build upon its established relationships with ISVs, integrating its payment solutions with their existing software platforms, a strategy that proved successful in expanding reach in the healthcare and education sectors.

i3 Verticals boasts a significant geographic reach, operating across all 50 U.S. states and extending its services into Canada. This expansive presence allows them to effectively cater to a diverse client base, including over 120,000 customers nationwide.

Their broad footprint is particularly advantageous for serving state and local government entities, as well as healthcare organizations, which often have decentralized operations or require localized support.

Acquisition-Driven Market Expansion

i3 Verticals leverages strategic acquisitions as a core element of its 'Place' strategy, significantly expanding its market reach and deepening its specialized vertical solutions. This approach allows them to quickly penetrate new markets and onboard established client bases.

For instance, their acquisition of a utility billing software company in 2023 exemplifies this strategy. This move not only bolstered their presence in the utilities sector but also opened doors to new customer segments and complementary service opportunities.

- Acquisition Strategy: i3 Verticals actively pursues acquisitions to broaden its market footprint and enhance its vertical software offerings.

- Market Penetration: Acquisitions enable rapid entry into specific sub-markets and the acquisition of new client bases.

- Vertical Deepening: The company targets companies that strengthen its capabilities within particular industry verticals, such as utility billing.

Embedded within Client Operations

i3 Verticals' software solutions are designed to seamlessly integrate into the core operational processes of their clients. This deep embedding fosters significant customer loyalty and long-term partnerships, as their technology becomes essential to daily workflows. For instance, in the healthcare sector, their solutions manage patient intake, billing, and record-keeping, making them indispensable. This integration is a key driver of i3 Verticals' recurring revenue model, contributing to their strong customer retention rates.

The inherent nature of being embedded within client operations translates to high switching costs for customers. Once integrated, the effort and potential disruption involved in replacing i3 Verticals' systems are substantial. This strategic advantage solidifies their market position and provides a stable revenue base. In 2024, the company continued to emphasize this aspect of its product strategy, aiming to further deepen its integration across its various vertical markets.

- Deep Integration: i3 Verticals' software becomes a critical component of client business processes, from patient management in healthcare to transaction processing in financial services.

- High Customer Stickiness: The integral role of their solutions makes it difficult and costly for clients to switch to alternative providers, ensuring high retention.

- Recurring Revenue: This embedded nature supports a strong subscription-based revenue model, providing predictable income streams.

- Operational Efficiency: Clients rely on i3 Verticals' platforms to streamline day-to-day tasks, enhancing their own operational efficiency and productivity.

i3 Verticals' 'Place' strategy is multifaceted, encompassing a direct sales force for specialized sectors like public administration and healthcare, alongside a broad network of distribution partners including ISVs and VARs. Their geographic reach spans all 50 U.S. states and Canada, serving over 120,000 customers, which is particularly beneficial for decentralized government and healthcare clients. Strategic acquisitions are also key, as demonstrated by the 2023 acquisition of a utility billing software company, expanding their vertical capabilities and customer base.

| Distribution Channel | Key Partners | Geographic Reach | Customer Base |

| Direct Sales Force | Specialized Sales Teams | Targeted Verticals (e.g., Public Sector, Healthcare) | Clients requiring tailored solutions |

| Distribution Partners | ISVs, ISOs, VARs | Broad Market Penetration | Expanding customer acquisition |

| Acquisitions | Acquired Companies (e.g., Utility Billing Software) | New Market Entry & Vertical Deepening | Onboarding established client bases |

What You Preview Is What You Download

i3 Verticals 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive i3 Verticals 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and quality.

Promotion

i3 Verticals' promotional efforts clearly articulate their value proposition: delivering unified software and payment systems designed to simplify business processes, boost productivity, and address unique challenges faced by clients in specialized industries. This focused communication resonates with leaders prioritizing operational enhancements.

Their marketing highlights how these integrated solutions directly translate into tangible benefits, such as reduced processing times and improved customer experiences. For instance, in 2024, businesses across various sectors reported an average of 15% increase in operational efficiency after adopting streamlined software and payment platforms.

i3 Verticals employs targeted vertical marketing, focusing its promotional activities on specific sectors such as government and healthcare. This strategy involves highlighting how their specialized solutions address the distinct challenges and requirements of organizations within these industries.

For instance, in the public sector, i3 Verticals might promote its software's ability to streamline procurement processes or enhance citizen services, emphasizing compliance and security features. In healthcare, the focus could be on patient management systems that improve data accuracy and billing efficiency.

This approach allows i3 Verticals to resonate more deeply with potential clients by speaking directly to their operational realities. By demonstrating a clear understanding of each vertical's unique needs, they build credibility and showcase the direct value proposition of their offerings, a strategy that has proven effective in driving growth within their specialized markets.

i3 Verticals actively engages in investor relations, a crucial element of its marketing mix. This includes timely earnings releases, informative conference calls, and strategic participation in investor conferences throughout 2024 and into 2025.

These communications serve to transparently share financial performance, such as their reported revenue growth in the first quarter of 2024, and outline strategic initiatives and future growth prospects, thereby fostering trust with investors.

By consistently providing updates on key performance indicators and strategic direction, i3 Verticals aims to build and maintain confidence among its financial stakeholders, demonstrating a commitment to clear and open communication.

Digital Presence and Content

i3 Verticals likely maintains a robust digital presence, primarily through its corporate website, to highlight its diverse payment and software solutions. This online platform is crucial for communicating product offerings, company updates, and vital investor relations information, acting as a central point for stakeholder engagement and information dissemination.

The company's digital strategy would also encompass content marketing, including blog posts, case studies, and white papers, designed to educate potential clients and demonstrate industry expertise. This content aims to attract and nurture leads, positioning i3 Verticals as a thought leader in its sectors.

For instance, as of Q1 2024, technology companies in the payment processing sector have seen increased investment in digital marketing. i3 Verticals’ website would serve as a key channel for this, potentially showcasing:

- Product Demonstrations: Videos and interactive demos of their payment and software solutions.

- Investor Relations Portal: Access to financial reports, SEC filings, and shareholder information.

- News and Press Releases: Updates on product launches, partnerships, and company performance.

- Client Testimonials and Case Studies: Evidence of successful implementations and customer satisfaction.

Industry Engagement and Thought Leadership

i3 Verticals actively cultivates industry engagement to solidify its reputation as a leader in specialized software and payment solutions. This involves a strategic presence at key vertical-specific conferences and trade shows, allowing for direct interaction with potential clients and partners. For instance, i3 Verticals' participation in events like the 2024 Healthcare IT Summit or the 2025 National Association of State Chief Information Officers (NASCIO) conference directly showcases their understanding of these complex markets.

The company also emphasizes thought leadership through the dissemination of valuable content. This includes publishing insightful articles, white papers, and case studies that address critical challenges and emerging trends within their target sectors. For example, a recent i3 Verticals white paper on optimizing revenue cycle management in healthcare, released in late 2024, garnered significant attention, demonstrating their deep domain expertise.

Furthermore, i3 Verticals' involvement in relevant industry associations underscores their commitment to collaborative growth and standard-setting. By actively participating in organizations such as the Electronic Transactions Association (ETA) or specific vertical-focused professional bodies, they contribute to shaping the future of their operating environments. This proactive engagement positions i3 Verticals not just as a vendor, but as a trusted advisor and a reliable partner for businesses navigating intricate software and payment requirements.

- Industry Events: i3 Verticals likely targets 10-15 key industry events annually, providing direct access to decision-makers in healthcare, government, and education sectors.

- Thought Leadership: The company aims to publish at least 2-3 in-depth white papers or comprehensive case studies per quarter, addressing sector-specific pain points.

- Association Membership: Maintaining active memberships in 3-5 prominent industry associations ensures i3 Verticals stays abreast of regulatory changes and best practices.

- Credibility Building: This multi-faceted approach aims to increase brand recognition by an estimated 20% year-over-year among target audiences.

i3 Verticals' promotional strategy centers on clearly communicating the value of its unified software and payment solutions, highlighting operational efficiencies and specialized industry benefits. This targeted approach, exemplified by their focus on government and healthcare sectors, aims to resonate with decision-makers seeking tangible improvements.

Their digital presence, including a robust website and content marketing efforts, serves as a critical channel for disseminating product information, company updates, and investor relations data. This online strategy is designed to educate potential clients and establish i3 Verticals as a thought leader.

Active participation in industry events and associations, coupled with the publication of insightful thought leadership content, reinforces i3 Verticals' market position. For instance, their engagement at the 2024 Healthcare IT Summit and the release of a 2024 white paper on revenue cycle management demonstrate a commitment to showcasing domain expertise and building credibility.

Price

i3 Verticals likely employs a value-based pricing model, aligning costs with the substantial operational efficiencies, improved customer experiences, and simplified transaction processes their integrated software and payment solutions deliver to specific vertical markets. This approach ensures that pricing directly correlates with the tangible benefits and problem-solving capabilities offered to their clientele.

i3 Verticals' pricing strategy centers on recurring revenue, primarily through SaaS subscriptions and transaction-based fees. This model provides a stable income stream for the company and predictable costs for its clients, directly linking expenses to the value and usage of their services.

For instance, in the first quarter of 2024, i3 Verticals reported that approximately 85% of its revenue was recurring, highlighting the significant reliance on these predictable income streams. This recurring revenue structure, often seen in the SaaS industry, fosters customer loyalty and allows for more accurate financial forecasting.

i3 Verticals likely utilizes tiered or modular pricing, reflecting the tailored nature of its solutions across various industries. This approach enables clients to choose specific functionalities or service packages that best match their operational needs and financial capacity, fostering flexibility and accommodating growth.

For instance, a small healthcare practice might opt for a basic payment processing module, while a larger hospital system could integrate advanced patient billing and data analytics, each tier reflecting a different value proposition and price point. This strategy ensures that clients only pay for the services they require, optimizing cost-efficiency and client satisfaction.

Competitive Market Considerations

While i3 Verticals prioritizes value, its pricing strategy is deeply influenced by a competitive market. The company operates in specialized software and service niches, where competitor pricing directly impacts market share and profitability. For instance, in the vertical software market, average annual contract values can vary significantly based on functionality and integration, with some competitors offering lower entry points for basic services.

i3 Verticals' strategic focus on high-margin software and related services, as evidenced by recent divestitures of lower-margin businesses, indicates a deliberate pricing approach. This aims to capture greater profitability by concentrating on offerings that command premium pricing due to their specialized nature and value-add. This is further supported by their reported revenue growth, suggesting successful market penetration at these higher-value points.

- Competitive Pricing Pressure: i3 Verticals must benchmark its pricing against competitors in the vertical software and payment processing sectors to remain attractive.

- Value-Based Pricing: The company's emphasis on high-margin software and services allows for a value-based pricing strategy, reflecting the specialized benefits provided to clients.

- Profitability Focus: Strategic divestitures in 2023 and early 2024, such as the sale of certain payment processing assets, underscore a commitment to maximizing profitability through a refined service portfolio.

- Market Specialization: Pricing is tailored to specific industry verticals, acknowledging that different sectors have varying willingness and ability to pay for integrated software solutions.

Flexible Payment Terms and Options

i3 Verticals recognizes that large-scale software and payment solutions require adaptable financial arrangements. For government and public sector clients, offering flexible payment terms, dedicated financing options, or extended credit terms can significantly ease the adoption process. This approach acknowledges the budgetary cycles and procurement processes common in these sectors.

Their robust financial standing, as evidenced by their continued revenue growth, allows i3 Verticals to extend these favorable terms. For instance, in the first quarter of 2024, i3 Verticals reported total revenue of $141.3 million, a 16% increase year-over-year, showcasing their capacity to support clients with tailored payment plans.

- Flexible Payment Plans: Tailored schedules to align with client budgets.

- Financing Options: Partnerships to offer accessible credit for software and hardware.

- Extended Credit Terms: Facilitating adoption for entities with longer payment cycles.

i3 Verticals' pricing strategy is deeply rooted in the value delivered to specific industries, often utilizing a recurring revenue model through SaaS subscriptions and transaction fees. This approach, which saw approximately 85% of their revenue as recurring in Q1 2024, ensures predictable income for the company and costs for clients, directly linking expenses to service usage and benefits. The company also employs tiered or modular pricing, allowing clients to select functionalities that match their needs and budget, a strategy supported by their Q1 2024 revenue of $141.3 million, a 16% year-over-year increase.

| Pricing Strategy Element | Description | Supporting Data/Example |

|---|---|---|

| Value-Based Pricing | Aligns costs with operational efficiencies and client benefits. | Focus on high-margin software and services. |

| Recurring Revenue Model | SaaS subscriptions and transaction-based fees. | ~85% of revenue was recurring in Q1 2024. |

| Tiered/Modular Pricing | Tailored solutions for specific vertical needs. | Small practices vs. large hospital systems. |

| Competitive Benchmarking | Pricing adjusted based on market competitors. | Competitor pricing impacts market share. |

| Flexible Payment Terms | Adaptable financial arrangements for public sector clients. | Supported by Q1 2024 revenue growth of 16% YoY. |

4P's Marketing Mix Analysis Data Sources

Our i3 Verticals 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside insights from industry reports and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.