H World Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

H World Group's market position is defined by its strong brand recognition and extensive hotel network, but it also faces intense competition and evolving consumer preferences. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind H World Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H World Group's extensive brand portfolio is a significant strength, encompassing 33 distinct hotel and serviced apartment brands. This diversity allows the company to effectively target and serve a wide spectrum of customers across different market segments, from budget-conscious travelers to those seeking premium accommodations.

The sheer scale of H World's operations underscores its market presence. As of March 31, 2025, the group managed an impressive 11,685 hotels, offering more than 1.14 million rooms. This vast network, spanning 19 countries, solidifies its position as a major player in the global hospitality industry.

H World Group's strength lies in its robust asset-light expansion strategy, heavily leaning on manachised and franchised hotels. As of March 31, 2025, a significant 92% of their hotel rooms operated under this model.

This approach allows for swift and cost-effective growth, minimizing capital expenditure. The company demonstrated this by opening a net of 538 hotels in Q1 2025, with an impressive pipeline of 2,888 hotels ready for development.

The asset-light model directly contributes to enhanced operating margins by reducing the company's direct ownership of physical assets and associated costs.

H World Group holds a dominant position within China's rapidly expanding hotel sector, capitalizing on robust domestic travel trends and a growing middle class. The company's ambitious plan to reach 2,000 cities in China, up from its current 1,394, and its target of establishing 20,000 hotels by 2030 underscore a profound belief in its domestic market's potential. This strategic expansion is well-timed, as China's chain hotel market demonstrated consistent growth throughout 2024.

Powerful Loyalty Program and Direct Booking Capabilities

H World Group's 'H Rewards' program is a significant strength, boasting a massive 277 million members as of Q1 2025, making it one of the largest in the hospitality sector. This extensive loyalty base directly fuels a substantial portion of their business.

The program's success is evident in its ability to drive direct bookings, which represented over 65% of all reservations in the first quarter of 2025. This high percentage of direct bookings is crucial for the company's financial health.

These direct bookings contribute to improved profit margins by reducing reliance on third-party booking channels and enhance customer lifetime value through direct engagement and tailored offers.

- Extensive Loyalty Base: 277 million members as of Q1 2025.

- Direct Booking Dominance: Over 65% of reservations in Q1 2025.

- Margin Improvement: Reduced commission costs from direct bookings.

- Enhanced Customer Value: Increased customer lifetime value through direct relationships.

Consistent Product Upgrades and Operational Efficiency

H World Group's commitment to consistent product upgrades is a significant strength, evident in its continuous investment in core brands such as Hanting, JI, and Orange. This focus directly enhances the customer experience and brand appeal.

The company's dedication to operational efficiency is a key driver of its robust financial performance. This is underscored by a notable 14.3% year-over-year increase in hotel turnover during the first quarter of 2025.

- Brand Enhancement: Ongoing upgrades to Hanting, JI, and Orange improve customer satisfaction.

- Financial Growth: Revenue from manachised and franchised hotels saw a 21% year-over-year increase.

- Operational Excellence: A 14.3% rise in hotel turnover in Q1 2025 highlights efficiency gains.

H World Group's extensive brand portfolio is a significant strength, encompassing 33 distinct hotel and serviced apartment brands, allowing it to cater to a wide range of customer preferences and market segments.

The sheer scale of H World's operations is a testament to its market presence, managing an impressive 11,685 hotels with over 1.14 million rooms across 19 countries as of March 31, 2025, solidifying its global hospitality leadership.

The company's strength lies in its asset-light expansion strategy, with 92% of its hotel rooms operating under manachised and franchised models as of March 31, 2025, enabling rapid, cost-effective growth and improved operating margins.

H World Group dominates China's hotel sector, planning to expand into 2,000 cities and reach 20,000 hotels by 2030, capitalizing on strong domestic travel trends and a growing middle class, with the chain hotel market showing consistent growth in 2024.

The H Rewards program, boasting 277 million members by Q1 2025, drives over 65% of direct bookings, significantly boosting profit margins by reducing reliance on third-party channels and enhancing customer lifetime value.

Consistent investment in core brands like Hanting, JI, and Orange enhances customer experience, while operational efficiency is demonstrated by a 14.3% year-over-year increase in hotel turnover in Q1 2025.

| Metric | Q1 2025 Data | Significance |

|---|---|---|

| Total Hotels Managed | 11,685 | Demonstrates extensive market reach. |

| Total Rooms | 1.14 million+ | Underlines significant operational scale. |

| Manachised/Franchised Rooms | 92% | Highlights asset-light growth strategy. |

| H Rewards Members | 277 million | Indicates a strong, loyal customer base. |

| Direct Bookings Percentage | >65% | Boosts profit margins and customer engagement. |

| Hotel Turnover Growth (YoY) | 14.3% | Shows operational efficiency and performance. |

What is included in the product

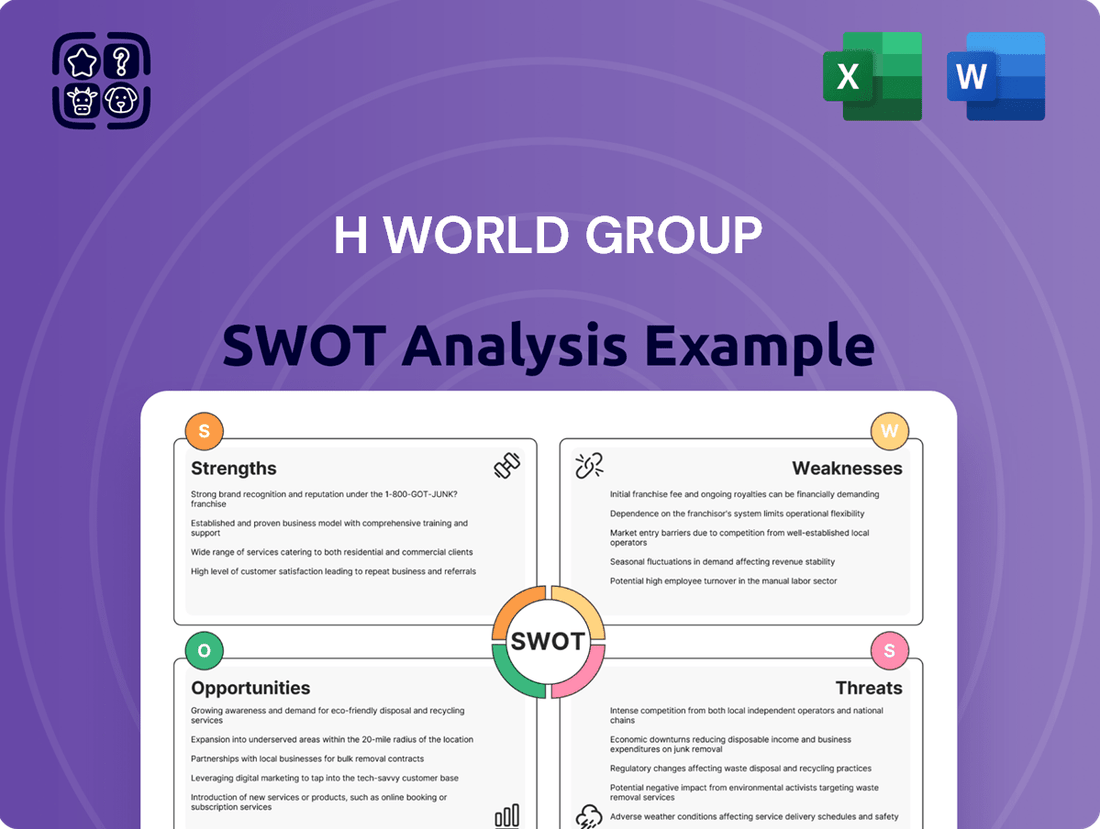

Delivers a strategic overview of H World Group’s internal and external business factors, highlighting its market strengths and potential growth opportunities.

Offers a clear visualization of H World Group's strategic landscape, enabling swift identification of key strengths, weaknesses, opportunities, and threats to inform actionable planning.

Weaknesses

H World Group's substantial reliance on the Chinese market, while a core strength, also represents a significant weakness due to concentration risk. For instance, in 2023, China accounted for the vast majority of H World's hotel portfolio, with over 5,000 hotels.

Economic downturns or shifts in domestic travel policies within China could therefore have an outsized negative effect on the company's revenue and profitability. This geographic concentration leaves H World particularly susceptible to region-specific challenges and regulatory changes that might impact the hospitality sector.

The Legacy-DH segment, representing Deutsche Hospitality, continues to face significant profitability hurdles. In the first quarter of 2025, this segment reported a loss of RMB 77 million. This follows a substantial net loss of RMB 532 million for the entirety of 2024, highlighting persistent difficulties.

These ongoing financial struggles within the European operations suggest that integration and optimization efforts have not yet yielded the desired results. Such persistent losses in a key segment can act as a drag on H World Group's overall financial performance, even as its domestic Chinese market demonstrates strength.

The Chinese hospitality market is incredibly crowded. H World Group faces intense rivalry not only from established hotel chains but also from emerging domestic brands and the growing influence of online travel agencies (OTAs) and short-term rental platforms like Airbnb. This heightened competition makes it challenging to capture market share and maintain premium pricing power.

This fierce competition directly impacts key performance indicators. For instance, in 2023, while the overall hospitality sector saw recovery, the pressure from numerous new entrants and alternative lodging options put a strain on occupancy rates and average daily rates (ADR) for many hotel operators, including those in H World Group's segments.

Rising Operational Costs and Inflationary Pressures

H World Group, like many in the hospitality sector, is grappling with escalating operational expenses. This includes higher labor costs due to increased wages, surging energy prices impacting utilities, and ongoing supply chain disruptions that inflate the cost of goods and services. These inflationary pressures directly affect profit margins, making it difficult to maintain profitability while investing in necessary operational improvements.

The need to control these mounting costs is significant. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings in the leisure and hospitality sector saw a notable increase. This trend, coupled with volatile energy markets, necessitates careful expense management. To counter these challenges and ensure long-term sustainability, H World Group may need to consider substantial upfront investments in areas like energy-efficient technologies and optimized supply chain strategies.

- Increased Wage Demands: Labor costs are a major component, with industry-wide wage hikes impacting payroll expenses.

- Energy Price Volatility: Fluctuations in energy markets directly increase utility bills for hotels and other facilities.

- Supply Chain Inefficiencies: Disruptions lead to higher costs for essential supplies, from linens to food and beverage.

- Margin Squeeze: The combination of these factors puts pressure on the company's ability to maintain healthy profit margins.

Potential Impact of Global Economic Uncertainties

Broader global economic factors, including elevated interest rates and dwindling consumer savings, pose a significant threat to travel demand, especially for leisure. For instance, in early 2024, many developed economies continued to grapple with inflation, leading central banks to maintain higher borrowing costs, which directly impacts discretionary spending on travel.

These macroeconomic uncertainties can create a challenging environment for H World Group, potentially dampening their financial outlook and growth projections. The specter of trade disputes or increased tariffs also adds another layer of complexity, potentially impacting international travel volumes and the cost of operations.

- Higher Interest Rates: Increased borrowing costs for consumers can reduce disposable income available for travel.

- Declining Consumer Savings: A drawdown of pandemic-era savings means less buffer for discretionary spending like vacations.

- Potential Tariff Issues: Trade tensions can disrupt international travel patterns and increase operational expenses.

- Inflationary Pressures: Persistent inflation erodes purchasing power, making travel less affordable for a wider segment of the population.

H World Group's substantial reliance on the Chinese market, while a core strength, also represents a significant weakness due to concentration risk. For instance, in 2023, China accounted for the vast majority of H World's hotel portfolio, with over 5,000 hotels. Economic downturns or shifts in domestic travel policies within China could therefore have an outsized negative effect on the company's revenue and profitability. This geographic concentration leaves H World particularly susceptible to region-specific challenges and regulatory changes that might impact the hospitality sector.

The Legacy-DH segment, representing Deutsche Hospitality, continues to face significant profitability hurdles. In the first quarter of 2025, this segment reported a loss of RMB 77 million. This follows a substantial net loss of RMB 532 million for the entirety of 2024, highlighting persistent difficulties. These ongoing financial struggles within the European operations suggest that integration and optimization efforts have not yet yielded the desired results. Such persistent losses in a key segment can act as a drag on H World Group's overall financial performance, even as its domestic Chinese market demonstrates strength.

The Chinese hospitality market is incredibly crowded. H World Group faces intense rivalry not only from established hotel chains but also from emerging domestic brands and the growing influence of online travel agencies (OTAs) and short-term rental platforms like Airbnb. This heightened competition makes it challenging to capture market share and maintain premium pricing power. This fierce competition directly impacts key performance indicators. For instance, in 2023, while the overall hospitality sector saw recovery, the pressure from numerous new entrants and alternative lodging options put a strain on occupancy rates and average daily rates (ADR) for many hotel operators, including those in H World Group's segments.

H World Group, like many in the hospitality sector, is grappling with escalating operational expenses. This includes higher labor costs due to increased wages, surging energy prices impacting utilities, and ongoing supply chain disruptions that inflate the cost of goods and services. These inflationary pressures directly affect profit margins, making it difficult to maintain profitability while investing in necessary operational improvements. The need to control these mounting costs is significant. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings in the leisure and hospitality sector saw a notable increase. This trend, coupled with volatile energy markets, necessitates careful expense management. To counter these challenges and ensure long-term sustainability, H World Group may need to consider substantial upfront investments in areas like energy-efficient technologies and optimized supply chain strategies.

Broader global economic factors, including elevated interest rates and dwindling consumer savings, pose a significant threat to travel demand, especially for leisure. For instance, in early 2024, many developed economies continued to grapple with inflation, leading central banks to maintain higher borrowing costs, which directly impacts discretionary spending on travel. These macroeconomic uncertainties can create a challenging environment for H World Group, potentially dampening their financial outlook and growth projections. The specter of trade disputes or increased tariffs also adds another layer of complexity, potentially impacting international travel volumes and the cost of operations.

| Weakness | Description | Impact | Supporting Data (2023-2025) |

| Geographic Concentration | Heavy reliance on the Chinese market. | Increased vulnerability to China-specific economic or regulatory shocks. | Over 5,000 hotels in China (2023). |

| Legacy-DH Performance | Persistent profitability issues in the Deutsche Hospitality segment. | Drains overall company financial performance. | Q1 2025 loss: RMB 77 million; 2024 loss: RMB 532 million. |

| Intense Market Competition | High rivalry from domestic brands and alternative lodging. | Challenges in market share growth and pricing power. | Pressure on occupancy rates and ADR in 2023. |

| Rising Operational Costs | Increased labor, energy, and supply chain expenses. | Erosion of profit margins. | Wage increases in hospitality sector (2024); volatile energy markets. |

| Macroeconomic Headwinds | Impact of inflation, high interest rates, and reduced consumer savings. | Potential dampening of travel demand and financial outlook. | Elevated interest rates in developed economies (early 2024); declining consumer savings. |

Preview Before You Purchase

H World Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual H World Group SWOT analysis, offering a clear snapshot of its strategic positioning. Purchase unlocks the complete, in-depth report.

Opportunities

H World Group is strategically targeting China's underserved markets and lower-tier cities, a move poised to unlock substantial growth. This expansion taps into regions with burgeoning domestic tourism, fueled by a growing middle class and enhanced infrastructure, presenting a less saturated competitive landscape.

In 2023, China's domestic tourism saw a remarkable recovery, with over 4.89 billion trips taken, a 67.9% increase year-on-year, according to the Ministry of Culture and Tourism. This trend underscores the significant potential for H World Group to capture market share in these developing urban centers.

The strong recovery in domestic tourism, particularly in leisure travel, is a significant tailwind for H World Group. The increasing appetite for experience-led tourism, where travelers seek unique and memorable activities, offers substantial growth potential. For instance, China's domestic tourism revenue reached approximately 4.77 trillion yuan in 2023, showing a robust rebound.

H World Group is well-positioned to capitalize on emerging traveler segments. The growing "silver-haired" demographic, with increasing disposable income and leisure time, presents a key opportunity for tailored offerings. Furthermore, the return of inbound tourism, with China welcoming more international visitors, allows H World to leverage its brand and service quality to attract a diverse global clientele.

H World Group can significantly boost guest satisfaction and streamline operations by adopting advanced technologies. Integrating AI for personalized recommendations, contactless check-in, and IoT-enabled smart rooms offers a modern, efficient guest journey. This focus on technology is crucial for staying competitive in the evolving hospitality landscape.

Investing in technology upgrades, such as robust data management systems, allows H World Group to gain deeper insights into guest preferences. For example, understanding booking patterns and service requests can inform targeted marketing campaigns and improve service delivery. This data-driven approach optimizes resource allocation, from staffing to inventory, directly impacting profitability.

The company's commitment to tech investment is evident in its ongoing digital transformation efforts. By enhancing digital platforms and implementing new guest-facing technologies, H World Group aims to differentiate itself. This strategy supports operational efficiency, evidenced by a projected increase in booking conversion rates through improved online user experience and personalized offers.

Strategic International Expansion, Particularly in Southeast Asia

H World Group is actively pursuing strategic international expansion, with a significant emphasis on Southeast Asia over the next five years. This geographic diversification is crucial for broadening its revenue base beyond China. For instance, in 2023, the company announced plans to open hotels in Laos, Cambodia, and Malaysia, signaling a commitment to these emerging markets.

This expansion into Southeast Asia is driven by the region's robust economic growth and increasing inbound tourism. Countries like Malaysia, for example, saw a substantial rebound in tourism in 2023, with international arrivals reaching approximately 28 million, a strong indicator of market potential for H World Group's brands.

- Targeting High-Growth Markets: Southeast Asia presents a significant opportunity due to its expanding middle class and increasing disposable income.

- Diversifying Revenue Streams: Expansion into new international markets reduces reliance on the domestic Chinese market, mitigating geopolitical and economic risks.

- Leveraging Brand Strength: H World Group aims to replicate its domestic success by introducing its established brands, such as Hanting Hotels, into these new territories.

- Capitalizing on Tourism Trends: The region's growing popularity as a tourist destination provides a ready customer base for the company's hospitality services.

Shift Towards an Asset-Light Model and Franchise Growth

H World Group's strategic pivot towards an asset-light model, heavily featuring manachised and franchised hotels, presents a substantial avenue for growth. This strategy inherently lowers capital expenditure, enabling quicker scaling of their hotel network. By focusing on franchise partnerships, the company can expand its reach more efficiently, which is crucial for capturing market share in a competitive landscape.

This shift is already demonstrating positive financial implications. For instance, in the first quarter of 2024, H World Group reported that its franchised and manachised hotels accounted for a significant portion of its total hotel portfolio. This asset-light approach not only accelerates expansion but also improves profitability by reducing the burden of property ownership and operational costs. The company is actively seeking more franchisees, indicating a strong pipeline for future growth.

- Accelerated Expansion: The asset-light model allows for faster deployment of new hotels, increasing market presence rapidly.

- Reduced Capital Intensity: Lower upfront investment in properties frees up capital for other strategic initiatives.

- Enhanced Financial Performance: Reduced operational costs and a focus on management fees contribute to improved margins.

- Franchisee Attraction: A proven model and strong brand support make H World an attractive partner for potential franchisees.

H World Group is strategically positioned to capitalize on the growing demand for travel in China's lower-tier cities and underserved markets. The company's expansion into these regions taps into a burgeoning domestic tourism sector, bolstered by infrastructure improvements and a rising middle class, offering a less congested competitive environment.

The robust recovery in China's domestic tourism, with 4.89 billion trips in 2023, a 67.9% year-on-year increase, highlights the significant potential for H World Group in these developing urban centers. Furthermore, the company can leverage the increasing appetite for experience-led tourism, as evidenced by the 4.77 trillion yuan generated in domestic tourism revenue in 2023.

H World Group's focus on technological integration, including AI and IoT, promises to enhance guest experiences and operational efficiency. By embracing digital transformation, the company aims to differentiate itself through personalized services and streamlined processes, potentially boosting booking conversion rates.

The company's international expansion into Southeast Asia, including planned openings in Laos, Cambodia, and Malaysia, targets regions with strong economic growth and increasing inbound tourism. Malaysia's 28 million international arrivals in 2023 underscore the market's potential for H World Group's brands.

The adoption of an asset-light model, emphasizing manachised and franchised hotels, allows H World Group to accelerate expansion and reduce capital expenditure. This strategy, which saw franchised and manachised hotels forming a significant portion of the portfolio in Q1 2024, enhances profitability and scalability by focusing on management fees.

Threats

H World Group faces a significant threat from escalating competition within the hospitality industry. This includes not only established hotel brands but also a growing number of alternative lodging options, like short-term rentals, which are increasingly popular with travelers.

This heightened competition directly impacts key financial metrics. Specifically, it puts downward pressure on Revenue Per Available Room (RevPAR) and Average Daily Rate (ADR). For instance, in 2023, while China's hotel occupancy rates began to recover, intense competition in popular destinations meant that ADR growth was often more subdued compared to pre-pandemic levels, impacting overall revenue generation for companies like H World Group.

Global economic conditions present a significant threat to H World Group. Persistent inflation and elevated interest rates, as seen in many major economies throughout 2024 and projected into 2025, can dampen discretionary spending on travel and leisure. For instance, the International Monetary Fund (IMF) projected global growth to slow in 2024, with inflation remaining a concern in many advanced economies.

Furthermore, escalating trade tensions and unpredictable geopolitical events, such as ongoing conflicts and political realignments, create an uncertain operating environment. These factors can directly impact international tourism flows and lead to increased operational costs for H World Group due to supply chain disruptions, a persistent issue in 2024 that shows little sign of full resolution into 2025.

H World Group, like many in the hospitality sector, grapples with persistent talent shortages, making employee acquisition and retention a significant hurdle. This scarcity directly fuels rising labor costs, as companies must offer more competitive wages and enhanced benefits to attract and keep skilled staff.

The impact of these increased labor expenses on H World Group's bottom line is substantial, potentially squeezing profit margins and necessitating adjustments to operational budgets. Furthermore, a lack of adequate staffing can compromise service quality, a critical factor in customer satisfaction and loyalty within the competitive hotel market.

Evolving Guest Expectations and Need for Continuous Adaptation

Guest expectations are a moving target, with travelers in 2024 and 2025 increasingly prioritizing personalized digital experiences, seamless check-ins, and a genuine commitment to sustainability. For H World Group, failing to keep pace with these evolving demands, perhaps by not investing in AI-driven personalization or eco-friendly operational upgrades, could mean losing out to competitors who are more agile.

This continuous need for adaptation presents a significant threat. For instance, a recent industry report indicated that over 60% of travelers in 2024 are willing to pay a premium for hotels demonstrating strong sustainability practices. H World Group's ability to integrate these practices, alongside digital enhancements, will be crucial.

- Rising Demand for Personalization: Guests expect tailored recommendations and services, driven by data analytics.

- Emphasis on Seamless Technology: Mobile check-in, keyless entry, and integrated in-room technology are becoming standard.

- Sustainability as a Core Value: Eco-conscious choices, from waste reduction to energy efficiency, are increasingly influencing booking decisions.

- Competitive Landscape Pressure: Competitors investing heavily in these areas can quickly gain market share if H World Group lags.

Cybersecurity and Data Management Risks

H World Group, like many in the hospitality sector, faces growing cybersecurity and data management risks. As the company increasingly relies on digital platforms for bookings and guest services, the potential for breaches of sensitive guest data or disruptions to its IT infrastructure becomes a significant threat. For instance, the global hospitality industry experienced a notable increase in cyberattacks targeting customer data in 2023, with some reports indicating a rise of over 20% compared to the previous year.

Such incidents could result in substantial financial losses due to remediation costs and potential regulatory fines, alongside severe reputational damage that erodes customer trust. The complexities of managing vast amounts of guest information also present challenges, where inadequate data governance could lead to compliance issues and legal liabilities, particularly with evolving data privacy regulations worldwide.

- Increased vulnerability: Greater reliance on digital systems for bookings and guest services amplifies exposure to cyber threats.

- Financial impact: Data breaches can lead to significant costs from recovery, fines, and potential lawsuits.

- Reputational damage: Compromised guest data can severely harm customer trust and brand image.

- Regulatory compliance: Managing guest data effectively is crucial to avoid penalties under global data protection laws.

Intensifying competition from both traditional hotel chains and alternative lodging providers poses a significant threat to H World Group's market share and pricing power. This dynamic environment, characterized by evolving consumer preferences for personalized digital experiences and sustainability, necessitates continuous investment in technology and eco-friendly practices to remain competitive.

Global economic headwinds, including inflation and potential interest rate hikes through 2025, could dampen travel demand and impact revenue streams. Geopolitical instability and trade tensions add further uncertainty, potentially disrupting international tourism and increasing operational costs for H World Group.

Labor shortages continue to challenge the hospitality sector, driving up operational expenses for H World Group as it competes for talent. This pressure on margins, coupled with the need to meet rising guest expectations for seamless digital interactions and sustainability, creates a complex operating landscape.

The increasing reliance on digital platforms exposes H World Group to heightened cybersecurity risks, with the potential for data breaches leading to significant financial penalties and reputational damage. Ensuring robust data management and security protocols is paramount to maintaining customer trust and operational integrity.

SWOT Analysis Data Sources

This H World Group SWOT analysis is built upon a foundation of robust data, drawing from official company financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.