H World Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

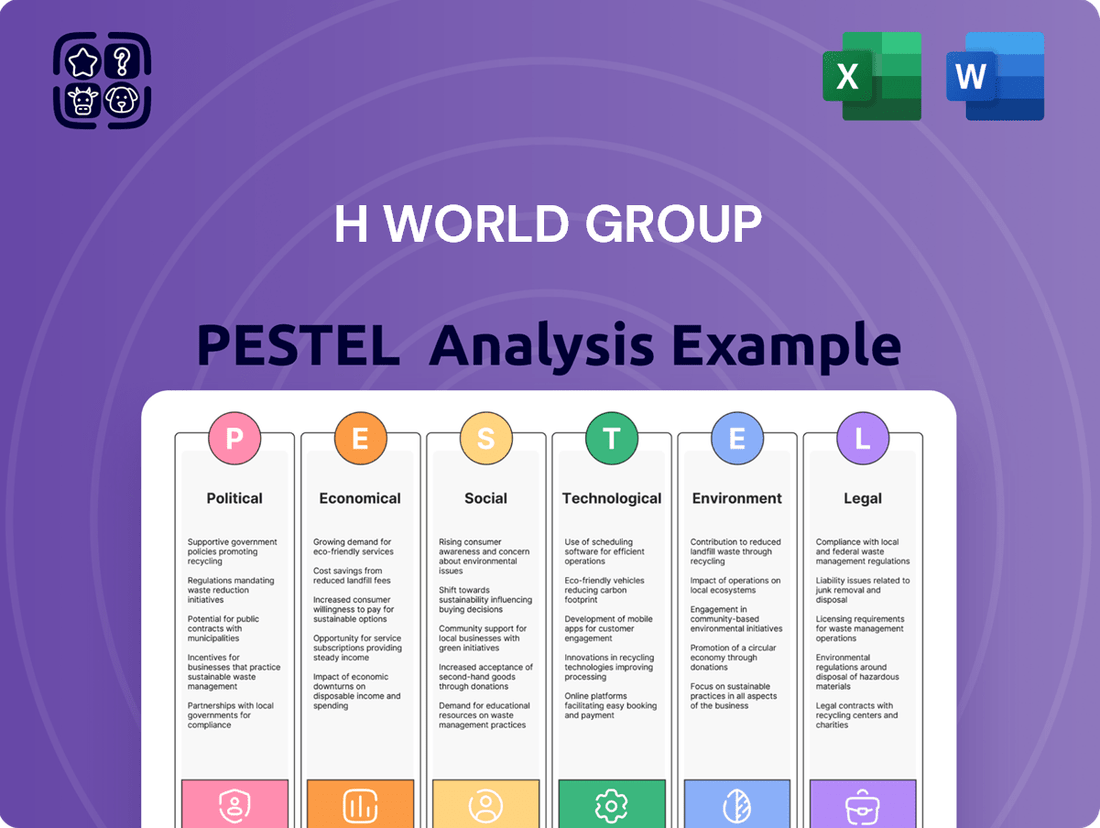

Navigate the complex external environment impacting H World Group by understanding the political, economic, social, technological, legal, and environmental factors at play. Our comprehensive PESTLE analysis offers deep insights into these forces, empowering you to anticipate shifts and capitalize on opportunities. Gain a strategic advantage by downloading the full report today.

Political factors

The Chinese government's commitment to boosting tourism is evident in its proactive policies, including the easing of visa restrictions for a growing number of nations. This strategic move is designed to enhance inbound travel and foster greater international engagement, directly benefiting hotel operators like H World Group.

For instance, by the end of 2023, China had implemented visa-free policies for citizens of France, Germany, Italy, the Netherlands, Spain, and Malaysia, with similar agreements extended to other countries. These measures are anticipated to significantly increase the influx of international visitors into China, the primary market for H World Group's extensive hotel network.

Geopolitical tensions and economic uncertainties are significant headwinds for international travel, potentially dampening demand for long-haul trips. While China has been actively expanding visa-free access, the expected surge in foreign visitors hasn't fully materialized, partly attributed to ongoing strained relations with several Western nations.

H World Group, with its expanding global footprint, must closely track these evolving geopolitical dynamics. These shifts can profoundly influence both inbound tourism into China and outbound travel patterns originating from the country, impacting the group's revenue streams.

The Chinese government's commitment to boosting domestic tourism is a major political factor for H World Group. This includes significant investments in transportation infrastructure, like the expansion of high-speed rail networks and airport upgrades, making travel within China more accessible and convenient. For instance, by the end of 2023, China had over 159,000 kilometers of operating railway lines, with high-speed rail accounting for more than 45,000 kilometers, directly benefiting domestic travel patterns.

This strategic focus on internal travel, combined with increasing consumer spending power, directly fuels demand for hospitality services, a key area for H World Group. Government support for niche tourism sectors, such as rural and 'red tourism' (historical sites), opens up new avenues for hotel development and expansion into previously underserved regions, aligning with H World Group's growth strategy.

Regulatory Environment for Hospitality Industry

The regulatory landscape for China's hospitality sector is dynamic, impacting companies like H World Group. Recent directives in 2024 and anticipated changes for 2025 focus on areas such as foreign investment caps, stringent operational hygiene standards, and increasingly robust data privacy laws, mirroring global trends. Navigating these evolving legal frameworks is crucial for maintaining compliance and adapting business strategies to new government mandates.

These regulatory shifts can significantly influence market entry strategies and operational expenditures. For instance, changes in foreign ownership rules could alter H World Group's expansion plans, while updated safety regulations might necessitate capital investments in property upgrades. The competitive environment is also shaped by these policies, potentially creating advantages for compliant operators or barriers for those slow to adapt.

Key regulatory considerations for H World Group in 2024-2025 include:

- Foreign Investment Policies: Monitoring adjustments to rules governing foreign equity stakes in hospitality ventures.

- Operational Standards: Ensuring adherence to updated health, safety, and service quality benchmarks.

- Data Privacy and Security: Complying with China's Personal Information Protection Law (PIPL) and cybersecurity regulations, especially concerning customer data.

- Environmental Regulations: Adapting to new mandates on sustainability and waste management within hotel operations.

Support for Sustainable Development and Green Initiatives

The Chinese government's strong push for sustainable development directly benefits H World Group, which prioritizes eco-friendly practices in its buildings, operations, and services. This alignment with national policy creates a favorable environment for the company's green initiatives.

H World Group's commitment to environmental, social, and governance (ESG) principles is increasingly being recognized. For instance, being named an 'Outstanding ESG Practice Case of 2024' by the China Association for Public Companies highlights this support. Such acknowledgments suggest that businesses demonstrating strong ESG performance can anticipate supportive government policies and potential incentives.

- Government Focus: China's emphasis on sustainable development and green growth provides a supportive political backdrop for H World Group's business model.

- ESG Recognition: H World Group's 'Outstanding ESG Practice Cases of 2024' award underscores political validation of its environmental commitments.

- Policy Incentives: Expect potential favorable policies and incentives for companies like H World Group that actively pursue green initiatives and ESG best practices.

The Chinese government's proactive stance on tourism, including expanding visa-free travel and investing in infrastructure, directly supports H World Group's growth. For example, by late 2023, China had visa-free policies with several European nations and Malaysia, aiming to boost inbound tourism. The government's focus on domestic travel, evidenced by over 45,000 km of high-speed rail by the end of 2023, also fuels demand for hospitality services.

Navigating China's evolving regulatory environment is critical for H World Group. In 2024-2025, key areas include foreign investment rules, stringent hygiene standards, and data privacy laws like PIPL. Compliance with these mandates, such as updated safety regulations, can influence operational costs and expansion strategies.

China's commitment to sustainable development creates a favorable political climate for H World Group's ESG initiatives. The company's recognition as an 'Outstanding ESG Practice Case of 2024' highlights this alignment, suggesting potential for supportive government policies and incentives for its green practices.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting H World Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights to identify strategic opportunities and mitigate potential risks for H World Group within its operating landscape.

A concise, actionable summary of the H World Group's PESTLE analysis, designed to quickly identify and address external challenges and opportunities during strategic planning.

Economic factors

China's economy has shown remarkable resilience, with GDP growth projected to be around 5.0% for 2024, according to various economic forecasts. This sustained growth directly translates to an increase in disposable income for a significant portion of the population, particularly the burgeoning middle class.

This rising disposable income is a powerful catalyst for the hospitality sector. In 2023, China's domestic tourism market saw a significant rebound, with travel spending reaching approximately 90% of pre-pandemic levels by the end of the year. This indicates a strong appetite for travel and leisure activities among Chinese consumers.

As more Chinese households experience enhanced spending power, the demand for both domestic and international travel experiences continues to surge. This trend bodes well for H World Group, whose portfolio caters to a wide range of travelers, from budget-conscious individuals to those seeking more premium experiences.

Inflationary pressures and rising operating costs present a significant challenge for H World Group. Increased employer costs, including wages and benefits, along with escalating property rates, directly squeeze hotel profitability. For instance, in 2024, many regions experienced wage growth exceeding 4%, impacting labor expenses across the hospitality sector.

To navigate these headwinds, H World Group must actively implement robust cost-saving programs and relentlessly optimize operational efficiency. This strategic focus is crucial for mitigating the impact of higher expenses and preserving healthy profit margins in a competitive market. By streamlining processes and controlling expenditures, the company can better absorb external cost increases.

Consumer spending in China is projected to see an uptick, with a notable surge expected among affluent individuals prioritizing premium travel experiences. This aligns with forecasts suggesting a cautious approach to travel frequency in 2025, yet a concurrent increase in per-trip expenditure. For H World Group, this dynamic is advantageous, as their broad hotel portfolio, encompassing economy to luxury tiers, positions them well to capture spending across different consumer budgets.

Foreign Exchange Fluctuations

Foreign exchange fluctuations present a significant challenge for H World Group, particularly as its international operations expand. Changes in currency values can directly affect the reported earnings and the real value of assets and liabilities held in foreign currencies. For instance, the company's financial performance in 2024 was impacted by foreign exchange losses, which contributed to a decrease in net income.

Effective management of these currency risks is therefore crucial for maintaining financial stability and predictable earnings. H World Group needs robust strategies to hedge against adverse currency movements, ensuring that its international growth does not lead to undue financial volatility.

- Impact on Revenue: A stronger domestic currency can reduce the value of revenue earned in foreign markets when converted back.

- Cost of Goods Sold: Fluctuations can also affect the cost of imported raw materials or components, impacting profit margins.

- 2024 Performance: H World Group reported foreign exchange losses in its 2024 financial results, which negatively affected net income.

- Hedging Strategies: Implementing financial instruments like forward contracts or options can mitigate the impact of currency volatility.

Investment and Development in Hospitality Sector

The Chinese hotel market is booming, with a record number of hotels under construction. This presents a significant opportunity for H World Group, a major player in the industry. Their focus on an asset-light model, relying on management and franchise agreements, allows them to expand rapidly without substantial capital outlay.

This expansion is fueled by strong consumer demand and government support for tourism. For instance, by the end of 2023, China's hotel construction pipeline was at an all-time high, indicating robust investor confidence. H World Group is well-positioned to benefit from this trend, aiming to open numerous new properties across its various brands.

- Record Construction Pipeline: China's hotel construction pipeline reached unprecedented levels by the close of 2023, signaling substantial industry growth.

- Asset-Light Advantage: H World Group's manachised and franchised model enables efficient scaling in response to market demand.

- Increased Competition: The surge in new hotel openings also intensifies competition, requiring strategic differentiation.

- Market Opportunity: The expanding Chinese hospitality sector offers significant potential for H World Group to increase its footprint and market share.

China's economic trajectory remains a primary driver for H World Group. With GDP growth anticipated around 5.0% for 2024, consumer spending power, especially among the middle class, is set to rise. This directly fuels demand in the hospitality sector, as evidenced by the strong rebound in domestic travel in 2023, nearing 90% of pre-pandemic levels.

However, persistent inflationary pressures, particularly in labor costs and property rates, are a notable concern. Wage growth exceeding 4% in many regions during 2024 directly impacts operating expenses. Additionally, foreign exchange volatility poses a challenge, with H World Group reporting foreign exchange losses in 2024 that affected net income, underscoring the need for robust hedging strategies.

| Economic Factor | 2024 Projection/Data | Impact on H World Group | Mitigation Strategy |

|---|---|---|---|

| GDP Growth | ~5.0% | Increased consumer spending, higher demand for hospitality | Capitalize on market expansion |

| Inflation (Wages) | >4% in many regions | Increased operating costs, squeezed profit margins | Cost-saving programs, operational efficiency |

| Foreign Exchange | Reported losses in 2024 | Reduced net income, financial volatility | Hedging strategies (e.g., forward contracts) |

Preview the Actual Deliverable

H World Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of H World Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external landscape shaping H World Group's business environment.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element with actionable analysis for informed strategic planning.

Sociological factors

Chinese travelers are increasingly prioritizing unique, personalized experiences over traditional group tours, with a growing interest in cultural immersion and self-guided adventures. This trend saw a notable uptick in 2024, with reports indicating a significant rise in bookings for boutique hotels and homestays offering local flavor. H World Group can capitalize on this by expanding its portfolio of distinct hotel brands and developing curated local experiences that cater to this demand for authenticity.

Domestic tourism in China remains a robust growth engine, significantly boosted by lingering pandemic-era preferences for local exploration and the emergence of new, less-traveled destinations. This trend is evident in the increasing preference of Chinese consumers for provincial getaways and inter-provincial journeys, indicating a deeper engagement with their own country's diverse offerings.

H World Group, with its vast operational footprint spanning numerous cities and regions throughout China, is strategically positioned to capitalize on this sustained demand for domestic travel. The company's extensive network allows it to effectively serve and cater to the evolving needs of travelers seeking authentic regional experiences.

Following the global pandemic, traveler priorities have significantly shifted, with health and safety now paramount. This trend is reshaping expectations across the hospitality sector, pushing companies to invest in advanced hygiene protocols and well-being initiatives to rebuild confidence.

While specific data for H World Group's 2024/2025 health and safety investments isn't publicly detailed, the industry's trajectory indicates a strong focus on contactless technology and enhanced sanitation. For instance, a 2024 industry survey revealed that 75% of travelers consider cleanliness as a top factor when booking accommodation, a marked increase from pre-pandemic levels.

H World Group's established reputation for service excellence suggests a deep commitment to guest well-being. This likely translates into rigorous adherence to hygiene standards, potentially exceeding regulatory requirements, to ensure a safe and comfortable experience for all patrons.

Influence of Younger Generations on Travel Habits

Millennials and Gen Z are significantly reshaping travel norms, with a strong inclination towards international and unique experiences. Their preference for spontaneous planning and digital booking platforms necessitates a strategic shift for companies like H World Group to capture this market.

Data from 2024 indicates a substantial portion of younger travelers are prioritizing experiences over material possessions, directly impacting holiday spending. For instance, a significant percentage of Gen Z and Millennial travelers in 2024 reported spending more on unique travel activities than on souvenirs or traditional gifts.

- Digital Dominance: Younger demographics overwhelmingly rely on online channels and mobile apps for travel research, booking, and reviews.

- Experience Seekers: There's a clear trend towards seeking authentic, immersive, and often off-the-beaten-path travel experiences.

- Spontaneity Factor: Travel planning is increasingly last-minute, driven by social media trends and flexible work arrangements.

- Value-Conscious: While seeking unique experiences, these generations are also highly attuned to value for money and sustainability.

Demand for Sustainable and Eco-Friendly Travel

There's a noticeable shift in how people approach travel, with a strong and growing preference for options that are kind to the planet. This isn't just a niche trend anymore; it's becoming a mainstream expectation. Travelers are increasingly aware of their carbon footprint and actively seek out businesses that demonstrate a commitment to environmental responsibility.

This heightened awareness directly translates into demand for eco-friendly accommodations and tourism experiences. For H World Group, this means that their proactive investments in sustainable practices, such as green building certifications and energy-efficient operations, are not just good for the environment but also strategically aligned with consumer desires. For instance, in 2024, a significant percentage of travelers indicated they would pay more for sustainable travel options, with some reports suggesting this figure could exceed 60% in key markets.

- Growing Consumer Consciousness: Travelers are increasingly factoring environmental impact into their booking decisions.

- Demand for Green Initiatives: This fuels demand for hotels with green certifications and responsible operational practices.

- H World Group's Strategic Alignment: Investments in green buildings and services directly cater to this evolving consumer preference, potentially enhancing brand loyalty and market share.

- Market Data: Surveys in 2024 indicated a substantial willingness among travelers to choose and even pay a premium for sustainable travel options, highlighting a clear market opportunity.

Societal shifts are profoundly influencing travel preferences, with younger demographics like Millennials and Gen Z driving demand for unique, digital-first experiences. These groups prioritize authenticity and often book spontaneously, making online presence crucial for H World Group. Furthermore, a growing environmental consciousness means travelers are increasingly seeking sustainable options, a trend evident in 2024 surveys where a significant majority expressed willingness to pay more for eco-friendly travel.

| Trend | Description | Impact on H World Group | 2024/2025 Data/Observation |

|---|---|---|---|

| Experience Economy | Demand for authentic, personalized, and local travel experiences. | Expand unique hotel offerings and curated local activities. | Rise in bookings for boutique hotels and homestays. |

| Digital Native Travelers | Younger generations (Millennials, Gen Z) prefer online research, booking, and reviews. | Enhance digital platforms and mobile app functionality. | Significant percentage of Gen Z/Millennial spending on unique travel activities. |

| Sustainability Focus | Growing consumer preference for eco-friendly and responsible travel. | Invest in green operations and certifications. | Travelers willing to pay more for sustainable options; reports suggest over 60% in key markets. |

Technological factors

The hospitality sector's digital transformation is profound, with a staggering 90% of travel bookings in China now occurring via Online Travel Agencies (OTAs). This shift necessitates that H World Group aggressively leverage digital platforms and optimize its online visibility to connect with a broad customer base.

Strategic partnerships with prominent OTAs are crucial for H World Group to enhance its reach and streamline the booking journey for travelers. This focus on digital integration is key to navigating the evolving landscape of travel commerce and securing a competitive edge in the 2024-2025 period.

The hospitality industry is rapidly adopting AI to streamline operations and elevate guest satisfaction. For instance, AI-powered chatbots are handling customer inquiries, and smart systems are optimizing resource management, such as linen usage. H World Group can leverage these advancements to boost efficiency and offer more personalized guest experiences, potentially reducing operational costs by an estimated 10-15% in areas like customer service and inventory management.

Technological upgrades are a significant focus for Chinese hotels, with advancements in Mechanical, Electrical, and Plumbing (MEP) systems representing key capital expenditure priorities. This push for modernization aims to enhance energy efficiency and improve operational control across hotel infrastructure.

H World Group is actively embracing these technological shifts, notably through its adoption of modular construction techniques for its new hotel developments. This approach streamlines the building process and signifies a commitment to innovative and efficient construction methods within the hospitality sector.

Data Analytics for Personalized Guest Experiences

H World Group leverages big data and predictive analytics to craft hyper-personalized guest experiences, a critical technological factor in today's hospitality market. By meticulously analyzing guest data, the company can tailor services and promotions, directly boosting guest satisfaction and fostering loyalty. This data-centric strategy is a defining trend shaping the future of the industry.

The increasing sophistication of data analytics allows H World Group to anticipate guest needs and preferences with remarkable accuracy. For instance, analyzing booking patterns, in-room service requests, and past feedback enables the creation of customized offers, such as preferred room amenities or dining recommendations. This proactive approach differentiates H World Group in a competitive landscape.

- Data-Driven Personalization: H World Group's investment in advanced analytics allows for granular understanding of individual guest behavior.

- Enhanced Guest Loyalty: Customized experiences driven by data analysis lead to higher repeat bookings and positive word-of-mouth.

- Competitive Advantage: The ability to offer unique, data-informed services sets H World Group apart from competitors less adept at data utilization.

- Operational Efficiency: Predictive analytics can also optimize staffing and resource allocation based on anticipated guest demand.

Mobile-First Booking and Digital Content Influence

Chinese travelers increasingly rely on their smartphones for every aspect of their journey, from initial inspiration to final booking. This mobile-first mindset means H World Group must prioritize seamless, intuitive mobile booking platforms. In 2024, mobile bookings are expected to continue their upward trajectory, with reports indicating over 70% of travel bookings in China originating from mobile devices.

Digital content, including reviews, social media posts, and influencer recommendations, significantly shapes travel decisions for this demographic. H World Group's strategy should actively incorporate engaging visual content and leverage social media to inspire and inform potential guests. For instance, platforms like Xiaohongshu (Little Red Book) are crucial for showcasing hotel experiences, with user-generated content often driving booking intent.

- Mobile Dominance: Over 70% of travel bookings in China are projected to be made via mobile in 2024.

- Digital Influence: Social media and online reviews are key drivers for Chinese traveler inspiration and booking decisions.

- Content Strategy: H World Group must create compelling digital content optimized for mobile discovery and sharing.

Technological advancements are reshaping how H World Group operates and interacts with guests. The company's focus on big data and predictive analytics allows for hyper-personalized experiences, directly enhancing guest satisfaction and loyalty. This data-driven approach is crucial for staying competitive, with over 70% of Chinese travel bookings expected to originate from mobile devices in 2024, underscoring the need for seamless mobile platforms.

The integration of AI is also a significant trend, with AI chatbots handling inquiries and smart systems optimizing resource management, potentially reducing operational costs by 10-15% in areas like customer service. Furthermore, H World Group is embracing modular construction techniques for new developments, streamlining building processes and demonstrating a commitment to efficient and innovative construction.

| Technological Factor | Impact on H World Group | Data/Statistic (2024-2025 Focus) |

|---|---|---|

| Digital Transformation & OTAs | Necessitates aggressive digital platform leverage and online visibility optimization. | 90% of travel bookings in China occur via OTAs. |

| Artificial Intelligence (AI) | Enhances operational efficiency and guest personalization. | Potential 10-15% cost reduction in customer service & inventory management. |

| Big Data & Predictive Analytics | Enables hyper-personalized guest experiences and fosters loyalty. | Crucial for tailoring services, offers, and anticipating guest needs. |

| Mobile-First Approach | Requires seamless, intuitive mobile booking platforms. | Over 70% of travel bookings in China expected from mobile devices in 2024. |

| Digital Content & Social Media | Influences travel decisions; requires engaging visual content and social media presence. | Platforms like Xiaohongshu are crucial for showcasing experiences and driving booking intent. |

| Construction Technology | Focus on MEP system upgrades and modular construction for efficiency. | Modular construction adopted for new hotel developments. |

Legal factors

As digitalization accelerates, data privacy and information security regulations are becoming increasingly strict globally. H World Group, recognizing this trend, has implemented robust internal policies, including an Information Security Management Framework and comprehensive data privacy statements, to ensure compliance with these evolving legal landscapes.

Adherence to these regulations is not merely a legal obligation but a critical component for safeguarding customer data and fostering enduring trust. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, highlighting the significant financial implications of non-compliance.

China's labor laws and employment regulations significantly influence H World Group's operations, dictating staffing levels, wage structures, and overall working conditions within the hospitality sector. Navigating these legal frameworks is crucial for maintaining compliance and fostering a positive employee environment.

The hospitality industry, particularly roles in guest services and food and beverage, faces persistent recruitment challenges. In 2024, the average monthly wage for service staff in China's major cities hovered around ¥6,000-¥8,000, a figure influenced by minimum wage laws and the need to attract and retain talent amidst a competitive job market.

H World Group's diverse hotel portfolio, spanning various market segments, necessitates strict adherence to a complex web of local and national licensing and operational permits. For instance, in 2024, China, a key market for H World, continued to emphasize stringent health and safety regulations for hospitality businesses, requiring regular inspections and certifications for all establishments, including those operating under franchise agreements.

Maintaining continuous compliance across all owned, leased, and franchised properties is paramount to H World Group's operational integrity and reputation. Failure to meet these evolving regulatory standards can lead to significant penalties, operational disruptions, and even the suspension of business activities, impacting revenue streams and brand trust.

Potential shifts in these licensing and permit requirements, whether due to new government policies or updated safety protocols, pose a direct risk to H World Group's expansion plans and existing operations. For example, a sudden increase in permit fees or the introduction of new environmental compliance standards could affect profitability and the feasibility of new development projects in 2025.

Franchising and Brand Management Regulations

H World Group, as a major player in hotel franchising, navigates a complex web of regulations governing franchisor-franchisee relationships and brand standards. These legal frameworks are crucial for ensuring consistent service quality and protecting intellectual property rights across its diverse hotel portfolio. Failure to comply can lead to significant legal challenges and damage to brand reputation.

Key legal considerations include adherence to franchise disclosure laws, which mandate transparency regarding fees, obligations, and operational requirements. For instance, in many jurisdictions, franchisors must provide detailed Franchise Disclosure Documents (FDDs) well in advance of any agreement signing. This ensures potential franchisees are fully informed.

- Franchise Disclosure Laws: Mandate detailed information sharing between franchisor and franchisee.

- Brand Standards Enforcement: Legal frameworks support the enforcement of brand consistency and quality.

- Intellectual Property Protection: Regulations safeguard trademarks and brand assets, crucial for H World's portfolio.

- Contractual Compliance: Adherence to franchise agreements is legally binding for both parties.

Consumer Protection Laws in Hospitality

Consumer protection laws are paramount in the hospitality sector, ensuring guests receive fair treatment and high-quality service. These regulations cover aspects like transparent pricing, accurate advertising, and safety standards, directly impacting guest experiences and trust. For H World Group, adhering to these laws is not just a legal obligation but a strategic imperative for maintaining brand reputation and customer loyalty.

H World Group's proactive approach, including its 'Guest Listening' programs, demonstrates a commitment to aligning with and often exceeding consumer protection expectations. By actively soliciting and responding to guest feedback, the company can identify and rectify potential issues before they escalate, reinforcing its dedication to service excellence and guest satisfaction. This focus helps mitigate risks associated with non-compliance and builds a stronger, more reliable brand image.

Key areas of consumer protection relevant to hospitality include:

- Truth in Advertising: Ensuring all promotional materials accurately reflect services and pricing.

- Health and Safety Standards: Maintaining hygienic conditions and safe environments for guests.

- Fair Contract Practices: Clear terms and conditions for bookings, cancellations, and services.

- Data Privacy: Protecting guest personal information collected during stays and bookings.

H World Group operates within a dynamic legal environment, requiring strict adherence to data privacy and information security regulations. Compliance with laws like GDPR, with potential fines up to 4% of global turnover, is critical for protecting customer data and maintaining trust. China's labor laws also significantly impact operations, influencing wages and working conditions, with average monthly wages for service staff in major cities around ¥6,000-¥8,000 in 2024.

The company must also navigate stringent licensing and permit requirements, particularly in its key market, China, which continued to emphasize health and safety regulations for hospitality businesses in 2024. Franchise agreements are governed by specific disclosure laws and brand standards enforcement, with intellectual property protection being vital for H World's extensive hotel portfolio.

Consumer protection laws are paramount, covering truth in advertising, health and safety, fair contract practices, and data privacy, all of which directly influence guest experience and brand loyalty. H World's proactive approach, including guest feedback programs, aims to exceed these expectations and mitigate compliance risks.

Environmental factors

H World Group champions green building through modular construction for its core offerings. This innovative method not only speeds up development and enhances quality but also dramatically shrinks the environmental impact of new hotel projects. For instance, by 2024, the company aimed to have a significant portion of its new builds utilize these sustainable practices, contributing to reduced waste and energy consumption.

This dedication to eco-friendly construction directly addresses the growing global demand for sustainable tourism and hospitality. By minimizing the environmental footprint of its developments, H World Group aligns with increasing regulatory pressures and consumer preferences for environmentally responsible businesses, a trend projected to continue through 2025.

H World Group actively incorporates environmental considerations into its supplier relationships, emphasizing the use of eco-friendly materials and promoting smart linen management systems. These initiatives are designed to significantly cut down on resource usage, particularly water and electricity, while simultaneously mitigating carbon emissions.

In 2023, H World Group reported a 5% reduction in water consumption per occupied room compared to the previous year, a direct result of implementing advanced laundry systems and water-saving technologies across its properties. This focus on greener operations not only aligns with growing environmental awareness but also contributes to operational cost efficiencies.

Effective waste management and pollution control are crucial for the hospitality sector. While specific data for H World Group's waste reduction initiatives isn't publicly detailed, their commitment to green operations suggests a focus on minimizing environmental impact. For instance, in 2024, the global hospitality industry is increasingly adopting circular economy principles, with many hotel chains reporting significant reductions in landfill waste through enhanced recycling and composting programs.

Climate Change Impact on Tourism and Operations

Climate change poses a significant threat to tourism, altering travel patterns and impacting operational stability. Extreme weather events, such as those experienced in China during 2024, directly disrupt travel plans and can severely affect hotel operations, from guest safety to infrastructure damage. H World Group's response to the Guilin floods in June 2024, by providing shelter to affected residents, highlights a reactive strategy to immediate environmental crises.

The increasing frequency and intensity of extreme weather events, like the heavy rainfall that led to the Guilin floods, underscore the vulnerability of the tourism sector. These events can lead to significant revenue losses due to cancellations and reduced bookings. For instance, the economic impact of natural disasters on tourism in affected regions can be substantial, with recovery taking months or even years.

- Increased Frequency of Extreme Weather: Global data indicates a rise in severe weather events, impacting travel reliability and destination appeal.

- Operational Disruptions: Floods, heatwaves, or storms can force temporary hotel closures, leading to lost revenue and increased operational costs for repairs.

- Shifting Tourism Patterns: Climate change can make certain destinations less attractive due to environmental degradation or extreme conditions, necessitating adaptation in marketing and service offerings.

ESG Reporting and Environmental Responsibility

H World Group actively showcases its environmental stewardship through its yearly Sustainability Report, detailing its approaches and successes in environmental responsibility. This commitment is further validated by accolades for Outstanding ESG Practice Cases, underscoring their transparent environmental reporting and performance.

For instance, in their 2023 Sustainability Report, H World Group highlighted a 5% reduction in energy consumption per occupied room compared to 2022. They also reported a 7% increase in waste recycling rates across their hotel portfolio.

- Energy Efficiency: Focused on reducing energy usage in operations, including lighting upgrades and HVAC system optimization.

- Waste Management: Implemented enhanced recycling programs and reduced single-use plastics in guest amenities.

- Water Conservation: Introduced water-saving fixtures and promoted responsible water usage among guests and staff.

- Green Procurement: Prioritized sourcing environmentally friendly products and materials for hotel operations.

H World Group's environmental strategy centers on modular construction, aiming for reduced waste and energy use in new builds. This aligns with a growing global preference for sustainable tourism, a trend expected to strengthen through 2025.

The company also focuses on eco-friendly materials and water-saving systems, as evidenced by a 5% reduction in water consumption per occupied room in 2023. These efforts contribute to both environmental responsibility and operational cost savings.

Climate change presents risks, with extreme weather events like the June 2024 Guilin floods impacting travel and operations. H World Group's response demonstrated a commitment to assisting affected communities.

| Environmental Initiative | 2023 Performance | Target/Trend |

|---|---|---|

| Water Consumption Reduction (per occupied room) | 5% | Continued reduction through 2025 |

| Energy Consumption Reduction (per occupied room) | 5% | Focus on efficiency upgrades |

| Waste Recycling Rate | 7% increase | Further improvement via enhanced programs |

PESTLE Analysis Data Sources

Our H World Group PESTLE analysis is grounded in comprehensive data from reputable sources including governmental economic reports, international financial institutions, and leading market research firms. This ensures a robust understanding of political, economic, and social landscapes affecting the company.