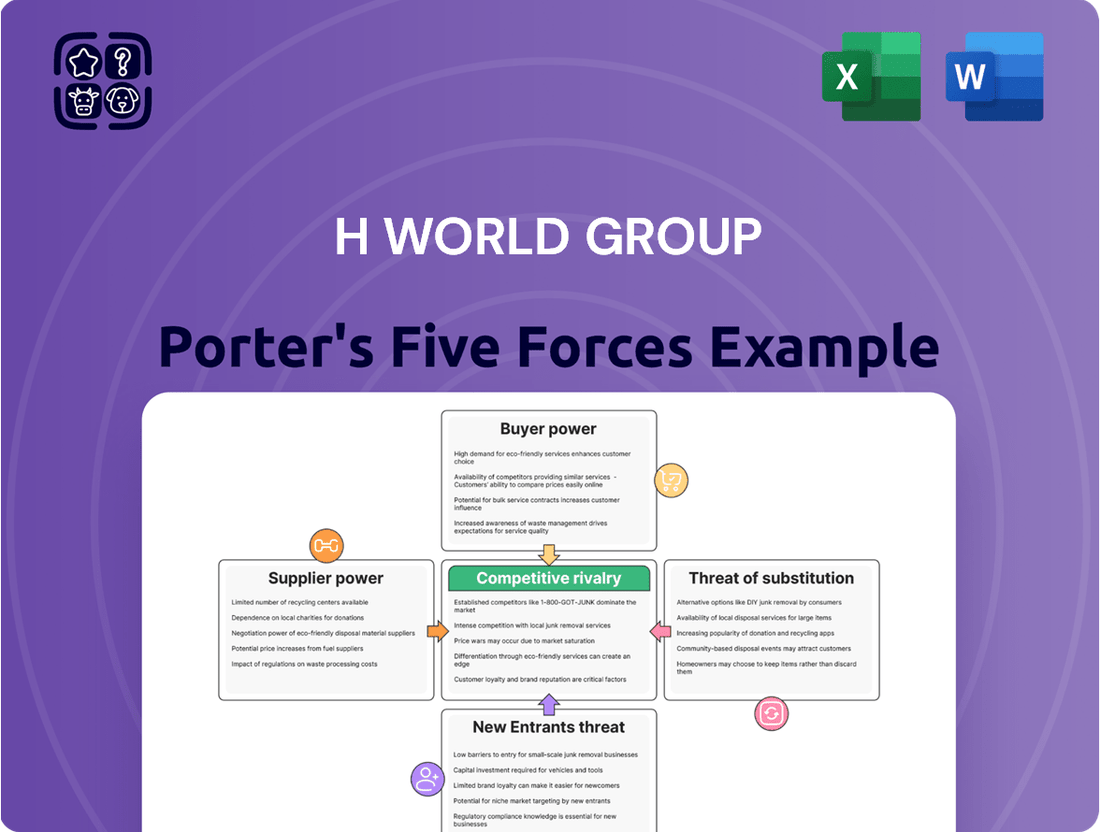

H World Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

H World Group operates within a dynamic hospitality landscape, where intense rivalry and evolving customer expectations significantly shape its competitive environment. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this market effectively.

The complete report reveals the real forces shaping H World Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for H World Group is a key factor in determining their bargaining power. If a significant portion of essential resources, such as advanced property management systems or specialized interior design elements, comes from a limited number of providers, those suppliers gain considerable leverage. For instance, if only a few companies offer the proprietary technology H World relies on for its operations, they can command higher prices or dictate terms.

Switching costs are a crucial factor in the bargaining power of suppliers for H World Group. If the company has deeply integrated a supplier's technology or relies on specialized equipment, the expense and effort to change vendors become substantial, thereby strengthening the supplier's leverage. For instance, if H World Group's hotel management system is proprietary and built around a specific supplier's platform, the cost and disruption of migrating to a new system could be millions, making it difficult to switch.

The uniqueness of inputs significantly shapes supplier bargaining power. For H World Group, if suppliers provide proprietary technology for their central reservation systems or exclusive, high-end amenities for their luxury hotels, these suppliers gain considerable leverage. This is because H World Group would face higher costs and operational disruptions if they tried to switch to alternative suppliers for these specialized inputs.

Conversely, when inputs are commoditized, meaning they are widely available from multiple sources with little differentiation, H World Group’s bargaining power increases. For instance, in 2024, the hotel industry saw continued competition among providers of standard operational supplies like linens and cleaning products, allowing major hotel groups to negotiate favorable terms due to the abundance of choices.

Threat of Forward Integration

The threat of forward integration by suppliers can significantly amplify their bargaining power, as they could potentially enter the hotel market themselves. For H World Group, this threat is more pronounced with suppliers of critical technology or those involved in property development. For instance, a major hotel management software provider might leverage its expertise and existing client relationships to launch its own branded hotel chain, directly competing with its current customers. This possibility forces hotel groups like H World to maintain favorable terms with such suppliers.

While not a widespread concern across all supplier categories, for specific strategic partners, the potential for forward integration is a real consideration. This is particularly relevant in the context of the evolving hospitality technology landscape. For example, a company providing integrated booking systems and guest experience platforms could, in theory, develop its own hotel brand leveraging its proprietary technology to streamline operations and enhance guest services. This capability inherently strengthens their negotiating position.

- Suppliers’ ability to enter the hotel market directly increases their leverage.

- This threat is more significant for technology and property development partners.

- A hotel management software provider could launch its own brand.

- This capability strengthens suppliers' negotiating power with hotel chains.

Importance of Supplier to H World Group's Business

The bargaining power of suppliers for H World Group is influenced by how critical their offerings are to the company's operations. Suppliers of core technology platforms or essential brand-related services would wield more influence than those providing standard amenities.

H World Group's asset-light strategy, which emphasizes franchised and manachised hotels, shifts its supplier reliance. While this model might lessen dependence on suppliers for physical property maintenance, it heightens the need for reliable providers of brand standards, central reservation systems, and other key services that maintain the group's operational integrity and customer experience.

- Criticality of Supplies: Suppliers providing unique technology or brand-enforcing services have higher bargaining power.

- Asset-Light Model Impact: Reduced direct ownership lowers reliance on property-specific suppliers, but increases dependence on central service providers.

- Supplier Concentration: A concentrated supplier base for essential services would increase their leverage over H World Group.

- Switching Costs: High costs associated with changing suppliers for critical systems can empower existing suppliers.

The bargaining power of suppliers for H World Group is moderate, primarily due to the diverse nature of its supply chain and the group's asset-light strategy. While some specialized technology providers may hold significant leverage, the availability of numerous suppliers for general goods and services limits overall supplier power.

In 2024, the hospitality sector continued to see a competitive landscape for many operational supplies, which benefits hotel groups like H World. For instance, the market for hotel linens and standard amenities remains robust with many providers, allowing H World to negotiate favorable terms. However, for proprietary software or unique brand experience components, supplier power can be higher.

The potential for suppliers to integrate forward into hotel operations, particularly in technology and brand management, represents a key factor that H World must manage. This threat is more pronounced for suppliers of critical, integrated systems that are deeply embedded in H World's operational framework.

| Factor | Impact on H World Group | Example |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized inputs; Low for commoditized inputs | Few providers for proprietary PMS software vs. many for cleaning supplies. |

| Switching Costs | High for integrated technology systems; Low for standard supplies | Migrating from a custom-built central reservation system is costly. |

| Input Uniqueness | High for brand-specific design elements or technology; Low for general furnishings | Exclusive interior design packages for luxury brands vs. standard furniture. |

| Forward Integration Threat | Moderate, especially for technology and brand service providers | A hotel management software firm could launch its own hotel brand. |

What is included in the product

This analysis unpacks the competitive forces shaping H World Group's industry, evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable H World Group Porter's Five Forces Analysis, designed for rapid strategic adjustment.

Customers Bargaining Power

H World Group's customer base shows a spectrum of price sensitivity. Economy travelers, a significant portion of their market, are highly attuned to pricing, often choosing hotels based on cost. In 2023, China's domestic tourism saw a robust recovery, with budget-friendly options remaining popular, indicating sustained price consciousness in this segment.

Conversely, customers in the upscale segment, while still mindful of value, tend to place a greater emphasis on service quality, comfort, and brand reputation. This segment may be less swayed by minor price fluctuations if the overall experience meets their expectations. The trend of rational consumption, observed in China, suggests that even higher-spending customers are increasingly scrutinizing value for money, seeking benefits that justify the cost.

The availability of substitutes significantly influences customer bargaining power for H World Group. Customers can easily switch to numerous independent hotels or other hotel chains in China's fragmented market, or even consider short-term rental platforms. This abundance of choice empowers them to demand better pricing and service, as switching costs are generally low.

Customers of H World Group now have unprecedented access to information, significantly boosting their bargaining power. Online review sites and social media platforms provide detailed insights into hotel experiences, while price comparison websites make it easy to find the best deals. This transparency means customers can readily compare H World Group's offerings against competitors, pushing the company to maintain competitive pricing and service quality.

Customer Volume

H World Group caters to a diverse clientele, encompassing individual leisure travelers, corporate entities, and group bookings. The sheer volume of business generated by large corporate clients or tour operators grants them considerable leverage. This is particularly true when these entities commit to substantial booking volumes, giving them a stronger negotiating position.

The bargaining power of customers is significantly influenced by their volume of business. For H World Group, this means that key B2B accounts, which have shown an increase in recent years, can exert more pressure on pricing and service terms. For instance, if a large corporation consistently books hundreds of room nights per quarter, they are in a much stronger position to negotiate discounted rates compared to an individual traveler.

- Customer Volume: H World Group serves individual leisure guests, corporate clients, and groups.

- Leverage of Large Clients: Significant booking volumes by corporate clients or tour operators increase their bargaining power.

- B2B Growth: H World Group has observed an upward trend in business-to-business bookings, amplifying the impact of large corporate customers.

Switching Costs for Customers

For most hotel stays, the switching costs for customers are relatively low. This means travelers can easily opt for a different hotel for their next trip without incurring significant expenses or hassle. For instance, a traveler booking a standard room in 2024 typically faces minimal penalties for canceling or simply choosing another brand for a future reservation, unlike industries with complex integration or long-term contracts.

This low switching cost significantly enhances the bargaining power of customers. They can readily leverage this flexibility to demand more competitive pricing and higher service quality from hotel providers. In 2024, online travel agencies and comparison websites further amplify this by making it effortless for consumers to find and compare the best available rates and amenities across numerous brands.

To counter this, hotel groups implement strategies like loyalty programs. H World Group's H Rewards program, for example, aims to increase these switching costs by offering tangible benefits for repeat stays. These benefits can include points accumulation for free nights, room upgrades, or exclusive member discounts, incentivizing customers to remain loyal rather than switch to a competitor.

- Low Switching Costs: Customers can easily change hotels without significant financial or practical barriers.

- Increased Customer Power: This ease of switching allows customers to negotiate for better prices and service.

- Loyalty Programs as a Counter: Initiatives like H Rewards aim to build customer retention by adding value to repeat business.

H World Group faces considerable customer bargaining power due to the fragmented nature of the hotel market and the ease with which customers can switch providers. The prevalence of online platforms offering price comparisons and reviews further empowers consumers, allowing them to readily identify and opt for more cost-effective or higher-quality alternatives. This dynamic necessitates that H World Group consistently deliver competitive pricing and superior service to retain its customer base.

The volume of business from certain customer segments, particularly corporate clients and tour operators, grants them significant leverage. These larger clients, by committing to substantial booking volumes, can negotiate more favorable rates and terms. H World Group's increasing focus on business-to-business bookings, a trend observed in recent years, means that the bargaining power of these key accounts is amplified, directly impacting the company's pricing strategies and service level agreements.

Loyalty programs, such as H World Group's H Rewards, are crucial tools for mitigating customer bargaining power. By offering incentives like points for free stays and room upgrades, these programs aim to increase switching costs and foster customer retention. The effectiveness of these programs is key to building a loyal customer base that is less sensitive to competitor offerings and price changes.

| Factor | Impact on H World Group | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Price Sensitivity | High, especially for economy segment | China's domestic tourism recovery in 2023 saw continued demand for budget-friendly options. |

| Availability of Substitutes | High | Fragmented Chinese hotel market with numerous independent hotels and chains. |

| Customer Information Access | High | Widespread use of online review sites and price comparison platforms. |

| Customer Volume | Significant for B2B clients | Upward trend in B2B bookings indicates growing leverage for large corporate clients. |

| Switching Costs | Low | Minimal penalties for cancellations or choosing alternative brands in 2024. |

Full Version Awaits

H World Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for H World Group, detailing the competitive landscape and strategic implications. The document you see here is precisely what you'll receive, fully formatted and ready for immediate download upon purchase. It offers a comprehensive examination of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products for H World Group.

Rivalry Among Competitors

The competitive landscape for H World Group is intensely crowded. China's hotel market is remarkably fragmented, featuring a vast array of domestic and global brands vying for market share across all service tiers.

H World Group directly contends with formidable Chinese rivals like Jinjiang Hotels and BTG Homeinns, both of which possess extensive portfolios. Furthermore, prominent international hospitality giants, including Marriott International, Hilton Worldwide, and Accor, maintain a significant presence, intensifying the rivalry.

The Chinese hotel market is on a strong growth trajectory, fueled by increasing domestic and international travel, ongoing urbanization, and a steady rise in consumer spending power. This expansion is a key factor influencing competitive dynamics within the industry.

A burgeoning market, projected to reach $170.40 billion by 2033, can often temper intense rivalry. With robust demand, there's typically sufficient opportunity for numerous companies to thrive, potentially softening the pressure on any single player to aggressively undercut competitors.

H World Group differentiates its offerings across a spectrum of brands, from budget-friendly economy options to more upscale selections. This strategy aims to capture a broader market by emphasizing brand recognition, the quality of its lodging, and the level of service provided. For instance, their economy brands like Hanting Hotels often compete on value, while brands like Blossom Hill Hotels focus on a more curated guest experience.

However, the inherent nature of the hotel industry, particularly in the economy segment, can lead to product homogenization. When many hotels offer similar basic amenities and services, competition can intensify, often devolving into price wars. This makes it challenging for H World Group to maintain strong differentiation and pricing power when rivals can easily replicate core offerings.

Exit Barriers

High exit barriers can indeed keep companies locked in competition, even when profits are low. Think about hotels with massive investments in their properties or long-term leases; it's not easy to just walk away. This can make the rivalry even tougher because these businesses have to keep fighting for market share rather than cutting their losses.

However, H World Group is actively shifting towards an asset-light strategy. This means they are less burdened by those significant fixed assets. In 2023, H World Group's hotel portfolio included 2,104 hotels in operation, with a notable portion being franchised and managed hotels. This asset-light approach can reduce the intensity of exit barriers for H World Group specifically, potentially giving them more flexibility compared to competitors heavily invested in owned properties.

- Asset-Light Strategy: H World Group's focus on franchised and managed hotels reduces its exposure to high fixed asset exit barriers.

- Flexibility: This strategy allows for greater agility in responding to market downturns compared to competitors with substantial owned real estate.

- Reduced Lock-in: By minimizing ownership of physical assets, H World Group faces lower financial penalties or losses when considering exiting certain markets or business segments.

Strategic Importance of the Market

China's status as a crucial market for global hotel brands is undeniable, fueled by its massive tourism sector and an expanding middle class. This strategic significance naturally intensifies competition, with both local and international companies pouring significant resources into capturing market share.

The fierce rivalry is evident in the rapid expansion and investment seen across the sector. For instance, in 2023, China's domestic tourism revenue reached approximately 4.03 trillion yuan, highlighting the market's immense draw. This robust performance encourages aggressive strategies from established players and new entrants alike.

- Vast Tourism Potential: China's domestic and international tourist numbers continue to grow, presenting a significant opportunity for hotel operators.

- Growing Middle Class: An increasing disposable income among Chinese consumers translates to higher demand for quality accommodation and travel experiences.

- Intense Investment: Major hotel groups are actively investing in new properties and brand development to solidify their presence in this lucrative market.

- Market Share Battles: This strategic importance leads to fierce competition, with companies vying for dominance through pricing, service innovation, and brand loyalty programs.

The competitive rivalry for H World Group is intense, driven by a fragmented Chinese hotel market with numerous domestic and international players. Brands like Jinjiang Hotels and BTG Homeinns are significant local competitors, while global giants such as Marriott and Hilton also maintain a strong presence, all vying for a piece of China's burgeoning travel market, which saw domestic tourism revenue hit approximately 4.03 trillion yuan in 2023.

| Competitor | Market Segment Focus | Key Strengths |

|---|---|---|

| Jinjiang Hotels | Economy to Mid-scale | Extensive network in China, strong brand recognition |

| BTG Homeinns | Economy to Mid-scale | Large domestic presence, loyalty programs |

| Marriott International | All segments (especially Upscale) | Global brand strength, diverse portfolio, loyalty program |

| Hilton Worldwide | All segments (especially Upscale) | Strong international reputation, operational excellence |

| Accor | All segments | European heritage, broad brand range |

SSubstitutes Threaten

The threat of substitutes for H World Group's traditional hotel offerings is significant, primarily stemming from alternative accommodation types. These include guesthouses, serviced apartments, and increasingly, short-term rentals. Platforms facilitating these rentals, especially local Chinese alternatives to Airbnb, provide a competitive choice for travelers.

While Airbnb exited the mainland China market in 2022, its absence has paved the way for domestic players to capture this segment. These alternatives often appeal to travelers seeking more localized experiences or longer stays, potentially at different price points than standard hotel rooms.

The threat of substitutes for H World Group, particularly in the budget hotel segment, is significant if alternatives offer a substantial cost advantage while still catering to essential traveler needs. For instance, the rise of alternative accommodations like Airbnb, especially in popular tourist destinations, can present a compelling price point for travelers seeking basic lodging. In 2024, the average daily rate for budget hotels in many major cities remained competitive, but the flexibility and often lower per-night cost of non-traditional lodging options continue to pose a challenge.

The threat of substitutes for H World Group is amplified when these alternatives can deliver a comparable or even better experience, especially for niche segments like unique local cultural immersion or extended stays. For instance, the burgeoning trend of experiential travel in China, where consumers increasingly seek authentic local encounters over standardized offerings, presents a significant challenge. This shift means that boutique hotels, homestays, and even curated travel agencies offering distinct local experiences can draw customers away from H World's more conventional hotel brands.

Changing Consumer Preferences

Shifting consumer tastes, particularly a growing demand for more genuine, locally-infused, or shared experiences, can bolster the attractiveness of alternative offerings. This trend is evident in the increasing inclination towards more considered spending and a focus on getting the most value for money when traveling.

For instance, the rise of the sharing economy and boutique accommodations directly caters to a desire for unique, personalized stays, presenting a viable substitute to traditional hotel chains. In 2024, the global alternative accommodation market, including vacation rentals and homestays, continued its robust growth, with projections indicating a significant expansion driven by these evolving preferences.

- Evolving Consumer Preferences: Travelers increasingly seek authentic, localized, and communal experiences, making alternative lodging options more appealing.

- Rational Consumption: A growing segment of consumers prioritizes value-centric travel, comparing price and perceived benefits across various accommodation types.

- Market Impact: In 2024, the alternative accommodation sector saw continued expansion, fueled by these shifts, potentially drawing market share from traditional hotel providers.

Technological Advancements

Technological advancements are significantly amplifying the threat of substitutes for H World Group. The proliferation of online travel agencies (OTAs) and peer-to-peer accommodation platforms, such as Airbnb and its global counterparts, has dramatically lowered the barriers to entry for alternative lodging options. These digital marketplaces empower travelers with unprecedented choice and convenience, making it simpler than ever to discover and book non-traditional accommodations. For instance, in 2024, the global alternative accommodations market was valued at over $100 billion, demonstrating its substantial and growing impact.

The ease of access provided by mobile applications and sophisticated booking websites means that travelers can compare prices, amenities, and locations of hotels against vacation rentals or serviced apartments in mere moments. This digital accessibility directly challenges the market share of traditional hotel chains like H World Group. By 2025, it's projected that over 80% of travel bookings will occur through digital channels, further solidifying the power of these substitute platforms.

Furthermore, ongoing innovations in technology are continuously enhancing the substitute offerings. Virtual reality tours of properties, personalized AI-driven recommendations, and seamless payment gateways all contribute to a more attractive and competitive substitute experience. These advancements mean that the threat isn't static; it's evolving and becoming more sophisticated, requiring traditional players to adapt rapidly.

Key technological drivers of substitute threats include:

- Online Travel Agencies (OTAs): Platforms like Booking.com and Expedia aggregate a vast array of lodging options, including hotels and alternative accommodations, offering consumers extensive choice and price comparison tools.

- Sharing Economy Platforms: Companies such as Airbnb have revolutionized the accommodation sector by enabling individuals to rent out their properties, directly competing with hotel room inventory.

- Mobile Booking Applications: The widespread adoption of smartphones has made booking alternatives incredibly convenient, allowing for spontaneous travel decisions and easy access to a wide range of substitute options.

- Digital Marketing and Reviews: Advanced digital marketing techniques and user-generated review systems on these platforms build trust and influence consumer choice, often bypassing traditional hotel marketing channels.

The threat of substitutes for H World Group is substantial, driven by a growing array of alternative accommodations like vacation rentals and homestays. These options often cater to evolving traveler preferences for unique, localized experiences and can present a compelling value proposition. In 2024, the global alternative accommodation market continued its robust expansion, projected to exceed $120 billion, underscoring its significant impact on traditional hotel players.

| Substitute Type | Key Appeal | 2024 Market Trend |

|---|---|---|

| Short-Term Rentals (e.g., Airbnb-style) | Local experience, unique stays, often lower cost per night for longer stays | Continued strong growth, particularly in leisure travel segments |

| Serviced Apartments | Extended stay comfort, home-like amenities, suitable for business travelers | Increasing demand for flexibility and self-catering options |

| Boutique Hotels/Independent Stays | Distinctive design, personalized service, local immersion | Growing preference among travelers seeking unique, non-chain experiences |

Entrants Threaten

Launching a hotel group comparable to H World Group demands immense financial resources. Consider that in 2023, the global hotel construction pipeline saw a robust 4.7% increase, with over 16,000 projects and 2.7 million rooms, indicating significant investment activity. This scale of investment for new properties, renovations, and marketing creates a formidable capital barrier for aspiring competitors.

Established brands, like those within H World Group's portfolio, often command significant customer loyalty and recognition. This deep-seated trust makes it considerably harder for new players to carve out market share. For instance, H World Group boasts a substantial membership base, a testament to its enduring appeal and consistent service delivery.

The formidable brand loyalty enjoyed by H World Group acts as a significant barrier to entry. Newcomers must invest heavily in marketing and promotions to even begin to rival the established reputation and customer relationships that H World Group has cultivated over time. This makes the threat of new entrants relatively low in segments where brand equity is paramount.

New entrants often face significant hurdles in securing access to crucial distribution channels. This includes established online travel agencies (OTAs), corporate booking platforms, and the increasingly important direct booking systems that many travelers now prefer. Without strong relationships or substantial marketing budgets, new players can find it difficult to reach their target audience effectively.

H World Group, for instance, leverages its proprietary central reservation system and a robust membership program to maintain direct customer relationships and bypass some of these channel access challenges. In 2023, H World Group reported that its membership base continued to grow, contributing significantly to its direct booking revenue, which helps insulate it from the reliance on external OTAs.

Regulatory Hurdles

The hospitality sector in China presents significant regulatory challenges for potential new entrants. Navigating complex licensing requirements, stringent safety standards, and obtaining necessary operational permits can be a lengthy and resource-intensive process. These bureaucratic complexities act as a substantial barrier, deterring many from entering the market.

For instance, in 2024, the average time to secure all necessary operating permits for a new hotel in major Chinese cities was reported to be between 6 to 12 months, with some cases extending beyond that. This lengthy approval period increases upfront costs and delays revenue generation, making it a significant hurdle.

- Licensing Complexity: Obtaining and maintaining various licenses, from business operation to food and beverage service, requires meticulous adherence to evolving Chinese regulations.

- Safety and Environmental Standards: New entrants must comply with increasingly strict safety protocols and environmental regulations, which often necessitate substantial capital investment in infrastructure and upgrades.

- Operational Permits: Securing permits for specific services like travel agencies or event management adds further layers of complexity and can vary significantly by province and city.

Economies of Scale and Experience

New entrants face significant hurdles due to H World Group's established economies of scale. Their massive purchasing power allows for lower costs on everything from amenities to technology, a level difficult for newcomers to match without substantial upfront capital. For instance, H World Group's extensive network provides a substantial advantage in bulk procurement and centralized services.

Furthermore, H World Group's considerable experience in hotel operations, marketing, and customer service creates a high barrier to entry. They have refined their processes over time, leading to greater efficiency and brand recognition. As one of the fastest-growing hotel groups globally, H World Group's continuous expansion reinforces these advantages, making it challenging for smaller, less experienced entities to gain traction.

- Economies of Scale: H World Group leverages its size for cost advantages in procurement and operations.

- Experience Curve: Decades of operational experience translate into efficiency and brand loyalty.

- Market Growth: H World Group's rapid global expansion intensifies competitive pressures on new entrants.

- Capital Requirements: New players need significant investment to overcome H World Group's scale and experience advantages.

The threat of new entrants for H World Group is generally considered moderate to low, primarily due to substantial capital requirements and established brand loyalty. Significant investment is needed to acquire properties, renovate, and market effectively, a barrier highlighted by the 4.7% increase in the global hotel construction pipeline in 2023, representing millions of rooms and substantial capital outlay. Newcomers must also overcome the deep-seated customer trust and recognition that H World Group has cultivated, as evidenced by its growing membership base.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for H World Group is built upon a comprehensive review of company annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from leading industry research reports and market intelligence platforms.