H World Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

H World Group masterfully crafts its product offerings, from budget-friendly hotels to premium experiences, ensuring broad market appeal. Their pricing strategies are dynamic, adapting to demand and competition to maximize revenue while maintaining value perception.

Discover the intricate details of H World Group's distribution channels and promotional campaigns that drive customer engagement and loyalty. This preview offers a glimpse into their strategic brilliance; imagine the actionable insights you'll unlock with the full, editable analysis!

Save yourself hours of intensive research. The complete 4Ps Marketing Mix Analysis for H World Group provides a structured, ready-to-use framework packed with expert insights, perfect for strategic planning, benchmarking, or academic projects.

Product

H World Group's diverse hotel portfolio is a cornerstone of its marketing strategy, offering a spectrum of brands from economy to upscale. This approach ensures they can cater to a broad range of traveler needs and budgets across various markets.

The company boasts a robust lineup including popular domestic brands like HanTing Hotel, JI Hotel, and Orange Hotel, alongside internationally recognized names such as Steigenberger Hotels & Resorts, IntercityHotel, and Zleep Hotels. This expansion, notably through the acquisition of Deutsche Hospitality, significantly broadens their global reach and service offerings.

As of the first quarter of 2024, H World Group operated 5,004 hotels, with a significant portion, 3,597, belonging to the HanTing brand, highlighting its core strength in the economy segment. The company continues to strategically develop and refine this diverse portfolio, aiming to capture evolving market demands and traveler preferences, particularly in China and Europe.

H World Group's technology-driven accommodation services are central to their marketing strategy. They've invested heavily in a proprietary tech infrastructure, evident in their mobile app offering real-time booking and digital check-in/check-out. This focus streamlines operations and elevates the guest experience, a key differentiator in the competitive hospitality market.

Further enhancing this is their integration of smart room technology and AI. Features like the 'Hello Huazhu' voice control and an intelligent AI assistant within their mobile app provide a personalized and convenient stay. For instance, in Q1 2024, H World Group reported that over 70% of their bookings were made through their own digital channels, highlighting the success of their technology adoption.

H World Group's product strategy extends beyond mere rooms to offer comprehensive hospitality experiences. This includes quality accommodation, enhanced amenities, and modern designs, catering to both individual travelers and corporate clients. For example, their midscale and upscale brands frequently incorporate breakfast and robust food & beverage options, enriching the overall guest stay.

The company emphasizes standardized service delivery across its portfolio, ensuring a consistent guest experience. Simultaneously, higher-tier hotels differentiate themselves with premium locations and more extensive facilities, providing a premium product offering. This dual approach allows H World to capture a wider market segment.

Loyalty Program: H Rewards

The H Rewards loyalty program is a cornerstone of H World Group's marketing strategy, acting as a powerful product offering designed to cultivate deep customer relationships. By the close of the first quarter of 2025, this program had amassed an impressive 277 million members, underscoring its extensive reach across all H World Group brands.

This program is meticulously crafted to enhance customer loyalty through a multi-faceted approach. Members benefit from points accumulation on their spending, exclusive discounts, and access to special perks. Furthermore, tiered status levels incentivize continued engagement and spending, directly contributing to increased direct bookings and a higher overall customer lifetime value.

- Massive Membership: 277 million members by Q1 2025.

- Core Benefits: Points, member discounts, exclusive benefits, tiered status.

- Strategic Goal: Drive direct bookings and enhance customer lifetime value.

- Customer Experience: Focus on first-class service via direct channels and personalization.

Hotel Management and Franchise Services

H World Group's product offering in hotel management and franchise services is central to its market strategy. They provide comprehensive management expertise and access to their robust central reservation system to a wide network of hotels. This approach is key to their growth, allowing them to maintain brand standards across diverse locations.

The company's operational models, including leased, owned, franchised, and manachised, are designed for scalability. The manachise model, in particular, is an asset-light strategy that enables rapid expansion and consistent brand delivery. This model generates revenue primarily through franchise fees and management charges, supporting efficient market penetration.

By focusing on these services, H World Group ensures brand consistency and operational efficiency across its portfolio. This strategy is crucial for attracting franchisees and maintaining customer loyalty. For instance, as of the first quarter of 2024, H World Group had 10,140 hotels in its pipeline, a testament to the appeal of its management and franchise offerings.

- Asset-Light Strategy: Primarily utilizes manachise and franchise models to minimize capital expenditure and accelerate growth.

- Brand Consistency: Centralized management and reservation systems ensure a uniform guest experience across all properties.

- Revenue Streams: Generates income through franchise fees, management fees, and central reservation system usage.

- Scalability: The business model is built for rapid expansion, evidenced by a significant pipeline of new hotels.

H World Group's product strategy centers on a diverse hotel portfolio, ranging from economy to upscale, ensuring broad market appeal. Their commitment to technology, including a proprietary app and smart room features, enhances guest experience and drives direct bookings, with over 70% of bookings via their own digital channels in Q1 2024. The H Rewards loyalty program, boasting 277 million members by Q1 2025, is crucial for customer retention and increased lifetime value.

| Brand Segment | Key Brands | Q1 2024 Hotel Count |

|---|---|---|

| Economy | HanTing Hotel | 3,597 |

| Midscale | JI Hotel, Orange Hotel | 1,407 |

| Upscale/Luxury | Steigenberger, IntercityHotel, Zleep Hotels | N/A (Part of total 5,004) |

What is included in the product

This analysis provides a comprehensive breakdown of H World Group's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities.

Simplifies the complex H World Group 4Ps into actionable insights, alleviating the pain of understanding their market strategy.

Provides a clear, concise overview of H World Group's marketing approach, easing the burden of strategic analysis for busy executives.

Place

H World Group boasts an extensive domestic and international network, a cornerstone of its marketing strategy. Domestically, its presence is deeply rooted in China, spanning over 1,394 cities with ambitious plans to reach 2,000 cities. This broad reach ensures significant market penetration and accessibility for its brands.

Internationally, H World is steadily expanding its footprint, now operating in 19 countries. A key driver of this global expansion is the acquisition of Deutsche Hospitality, which has solidified its presence in Europe. Recent strategic moves, including expansions into markets like Laos, further demonstrate its commitment to a diversified international portfolio.

As of March 31, 2025, H World's operational scale is impressive, with a total of 11,685 hotels under its management globally. This vast network, combining both domestic strength and growing international reach, provides a significant competitive advantage in the hospitality sector.

H World Group's expansion strategy is multifaceted, focusing on both deepening its presence in established markets and venturing into new territories. This includes organic growth, where they build upon their existing hotel portfolio, and strategic acquisitions of regional hotel chains to quickly gain market share and operational expertise. A key element is their targeted expansion into emerging business corridors, especially in China's lower-tier cities, recognizing the growing demand in these developing economic hubs.

The company's ambition is to solidify its leadership in the limited-service hotel segment while simultaneously increasing its footprint in the upper-midscale category within these new city markets. This dual approach is driven by a strong belief that the demand for accessible and affordable accommodation will remain robust. For instance, in 2023, H World Group reported a significant increase in its hotel pipeline, with a substantial portion allocated to these lower-tier cities, signaling their commitment to this growth strategy.

H World Group ensures broad product accessibility through a multi-channel distribution strategy. This includes direct hotel operations, proprietary online booking platforms, and strategic alliances with corporate partners and travel agencies.

The company's commitment to its direct channels is evident, with over 65% of bookings in Q1 2025 originating from its H Rewards loyalty members. This strong direct booking performance significantly lowers dependency on costly third-party intermediaries.

Urban and Business-Centric Locations

H World Group strategically situates its hotels in urban and business-centric areas, with a notable concentration in China's tier-1 and tier-2 cities. This geographic focus ensures accessibility for a broad range of travelers, aligning with the Product availability aspect of their marketing mix. By being present in these key locations, H World Group maximizes the convenience and reach of its hotel offerings.

The company's expansion strategy includes a growing footprint in tier-3 and lower-tier cities across China. This move aims to tap into a wider segment of the domestic hotel market, further solidifying their product's availability. As of the first quarter of 2024, H World Group reported having over 7,000 hotels in operation, with a significant portion of these located in these strategically chosen urban centers.

- Geographic Concentration: Primarily in tier-1 and tier-2 cities in China.

- Strategic Advantage: Maximizes convenience for business and leisure travelers.

- Expansion Focus: Increasing presence in tier-3 and lower-tier cities.

- Operational Scale: Over 7,000 hotels in operation as of Q1 2024.

Efficient Logistics and Property Management

H World Group's 'manachise' and franchise models are key to its efficient logistics and property management. This structure allows for consistent brand standards and operational oversight across its vast hotel portfolio. For instance, by the end of 2023, H World Group operated over 7,000 hotels, a testament to the scalability of its management approach.

This asset-light strategy is crucial for rapid expansion, enabling H World Group to optimize sales potential and boost customer satisfaction through standardized, streamlined operations. The company's focus on efficient property management, supported by its franchise partners, helps maintain high service levels even as it grows. In 2023, H World Group reported a revenue of RMB 12.5 billion, indicating the success of its operational efficiency in driving financial performance.

- Scalable Operations: The manachise and franchise models facilitate efficient logistics and property management across a large network.

- Brand Consistency: Standardized operational control ensures a uniform customer experience.

- Rapid Expansion: The asset-light approach supports quick growth and market penetration.

- Optimized Performance: Streamlined operations enhance sales potential and customer satisfaction.

H World Group's place strategy centers on deep domestic penetration and strategic international expansion. In China, they operate in over 1,394 cities, aiming for 2,000, ensuring widespread accessibility. Internationally, their acquisition of Deutsche Hospitality has bolstered their European presence, with operations now in 19 countries, including recent entries into markets like Laos.

This extensive network, totaling 11,685 hotels as of March 31, 2025, provides a significant competitive edge. Their expansion targets emerging business corridors and lower-tier cities in China, alongside organic growth and acquisitions, to capture growing demand in these developing economic hubs.

| Metric | Value (as of Q1 2025/2024 or latest available) | Significance |

| Chinese Cities Covered | 1,394+ (Target: 2,000) | Deep market penetration in China |

| International Countries | 19 | Diversified global footprint |

| Total Hotels Globally | 11,685 (as of March 31, 2025) | Significant operational scale |

| Hotels in Operation (Q1 2024) | 7,000+ | Demonstrates rapid growth and reach |

Preview the Actual Deliverable

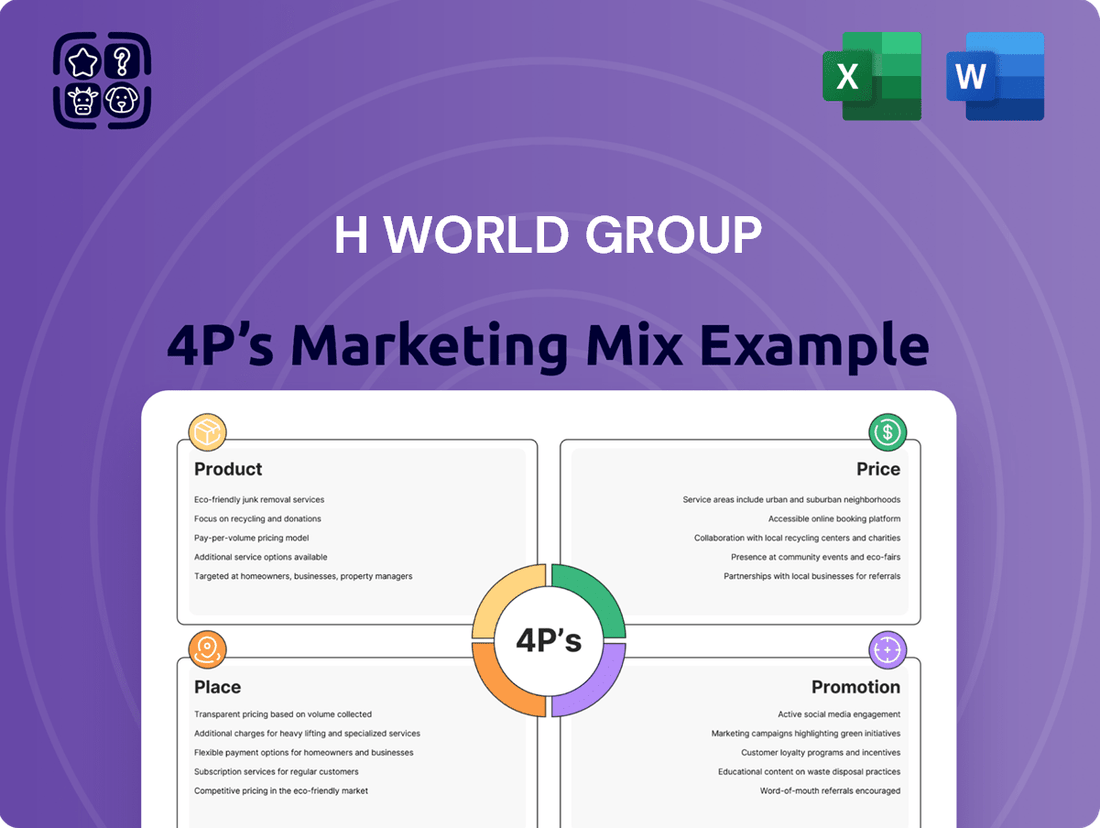

H World Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of H World Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

H World Group excels in digital marketing and social media, utilizing platforms like WeChat and Weibo to connect with its vast customer base. This strategy is crucial for driving brand awareness and executing targeted promotions.

The company effectively engages its massive loyalty program members through these digital channels, fostering a strong community and encouraging repeat business. For instance, in 2023, H World Group's loyalty program boasted over 100 million members, a significant portion of whom are actively engaged online.

The H Rewards loyalty program is a key promotional element for H World Group, leveraging its vast 277 million members for targeted marketing and tailored offers. This program drives repeat business and customer loyalty through exclusive deals, discounts, and tiered rewards.

The program's success directly fuels direct bookings, a trend that has seen significant growth as digital engagement rises. This shift not only strengthens customer relationships but also contributes to improved profit margins for the group.

H World Group is dedicated to solidifying its brand positioning by championing service excellence throughout its extensive hotel brand portfolio. This commitment is evident in their marketing efforts, which consistently showcase high-quality accommodation and superior hospitality, a key differentiator in a crowded market.

In 2023, H World Group reported a significant increase in revenue, reaching RMB 11.7 billion, demonstrating the effectiveness of their brand strategy. This growth is partly attributed to their focus on product upgrades, aimed at elevating the overall consumer experience and reinforcing their market standing.

Public Relations and Strategic Partnerships

H World Group actively uses public relations to boost its brand presence and draw in new patrons. They strategically announce key developments like new hotel openings, financial performance updates, and their commitment to sustainability through press releases and investor relations communications.

Strategic partnerships are a cornerstone of H World's expansion strategy. For instance, securing co-development rights for international brands significantly broadens their market reach and enhances brand recognition across new territories.

In 2024, H World Group continued to emphasize these efforts. Their investor relations communications highlighted a robust pipeline of new hotel openings, with plans to add hundreds of new properties across China and internationally by the end of the year, reinforcing their growth narrative.

- Brand Visibility: Public relations activities, including press releases on new openings and financial results, are key to maintaining and increasing brand awareness.

- Customer Acquisition: Effective PR and partnerships aim to attract new customers by showcasing the company's growth and commitment to quality and sustainability.

- Market Expansion: Strategic alliances, particularly for international brand development, are crucial for H World Group's geographical and market segment expansion.

- Investor Relations: Transparent communication of financial performance and strategic initiatives through investor channels builds confidence and supports valuation.

Technology-Enhanced Customer Communication

H World Group leverages technology to significantly enhance guest communication. Their mobile applications provide guests with real-time booking capabilities and interactive services, streamlining the customer journey. This digitalization effort is central to the company's strategy for improving interactive experiences across all guest touchpoints.

The focus on digital communication ensures that messages and benefits are effectively conveyed to their target audience. For instance, in 2023, H World Group reported a substantial increase in digital bookings, underscoring the success of their technology-driven approach to customer engagement.

- Mobile App Functionality: Real-time booking, interactive services, and personalized offers.

- Digitalization Drive: Strengthening interactive service experiences at various touchpoints.

- Communication Effectiveness: Ensuring clear and timely delivery of messages and benefits.

- Guest Engagement: Increased digital bookings and positive feedback on app usability in 2023.

H World Group's promotional strategy heavily relies on its extensive digital presence and a robust loyalty program. By leveraging platforms like WeChat and Weibo, they effectively reach their vast customer base, driving brand awareness and targeted campaigns.

The H Rewards program, boasting over 100 million active members in 2023, serves as a powerful tool for customer acquisition and retention. It facilitates personalized offers and exclusive deals, directly contributing to increased direct bookings and improved profit margins.

Public relations and strategic partnerships further bolster their promotional efforts. Announcements of new hotel openings and financial performance, coupled with co-development rights for international brands, expand market reach and reinforce brand recognition.

In 2024, the group's investor communications highlighted a significant pipeline of new hotel openings, with hundreds planned across China and internationally, underscoring their growth narrative and commitment to market expansion.

| Promotional Tactic | Key Engagement Channel | 2023 Data/Impact | 2024 Focus |

|---|---|---|---|

| Digital Marketing & Social Media | WeChat, Weibo | Drives brand awareness, targeted promotions | Continued expansion and engagement |

| Loyalty Program (H Rewards) | Direct communication, app | 277 million members, drives repeat business | Enhanced personalization and benefits |

| Public Relations | Press releases, investor relations | Announced new openings, financial updates | Reinforce growth narrative |

| Strategic Partnerships | Co-development rights | Broadens market reach for international brands | Securing new brand alliances |

Price

H World Group utilizes a segmented pricing strategy across its portfolio of hotel brands. This approach allows them to cater to a broad spectrum of travelers by offering distinct price points for their economy, midscale, and upscale/luxury segments. For instance, brands like Hanting Hotels typically target budget-conscious travelers with competitive rates, while brands such as Grand Mercure or Novotel, part of their upscale offerings, command higher prices reflecting enhanced amenities and services.

H World Group employs dynamic pricing and sophisticated revenue management to adjust room rates, reacting to market demand, occupancy levels, and broader economic trends. This strategy aims to maximize revenue per available room (RevPAR) by aligning prices with real-time conditions.

Despite a slight dip in RevPAR for its Legacy-Huazhu segment in 2024, the company demonstrated resilience by maintaining a high occupancy rate. This suggests their pricing adjustments were effective in a challenging market, ensuring a steady flow of guests even as average rates faced pressure.

H World Group leverages value-driven pricing for its H Rewards members, offering special discounts and exclusive rates. This approach directly ties into the perceived value of loyalty, incentivizing members to book through direct channels. For instance, in 2023, H World Group reported a significant portion of its revenue came from its loyalty program members, underscoring the effectiveness of this pricing strategy in driving direct bookings and fostering customer retention.

Competitive Market Positioning

H World Group navigates a fiercely competitive travel market, especially within China, by carefully calibrating its pricing. The company's strategy focuses on ensuring its offerings are not just appealing but also competitively priced against rivals.

This approach is crucial given the dynamic pricing prevalent in the industry. For instance, in the first quarter of 2024, the average daily rate (ADR) for hotels in China's major cities saw significant fluctuations, with some markets experiencing year-over-year increases of over 10% due to demand surges, while others remained more stable.

- Competitive Pricing: H World Group actively monitors competitor pricing to position its products attractively.

- Market Environment: The company operates in a travel sector characterized by intense price sensitivity.

- Chinese Market Dynamics: China's domestic travel market, a key focus for H World Group, is particularly prone to aggressive pricing strategies.

Asset-Light Model Impact on Pricing

H World Group's asset-light strategy, primarily through its manachised and franchised hotels, shifts its pricing focus from direct ownership costs to fee-based revenue streams. This model allows for more agile pricing adjustments and a greater emphasis on operational efficiency to boost margins, which indirectly influences the perceived value and competitiveness of its brands. The company projects substantial growth in its manachised and franchised segments for 2025, indicating a continued reliance on this model for revenue generation and profitability.

This approach impacts pricing by allowing H World to concentrate on service quality and brand standards, rather than the capital expenditure of owning properties. The revenue derived from management and franchise fees is less sensitive to property depreciation and more tied to occupancy and average daily rates achieved by the hotels under its brands. This allows for a more flexible pricing strategy that can adapt to market demand more readily.

- Fee-Based Revenue Focus: Pricing is influenced by management and franchise fees, not direct property ownership costs.

- Margin Improvement: The model aims to enhance profitability through efficient operations and scaled brand recognition.

- 2025 Growth Forecast: H World anticipates significant expansion in manachised and franchised revenue, reinforcing the pricing strategy's importance.

- Brand Value Pricing: Pricing reflects the strength and appeal of H World's brands, supported by consistent service standards.

H World Group's pricing strategy is deeply intertwined with its brand segmentation and market positioning, ensuring competitive rates across its economy to luxury offerings. For instance, in Q1 2024, the company maintained a strong occupancy rate, even as average daily rates (ADR) in some Chinese markets experienced volatility, with some cities seeing over 10% year-over-year increases in ADR.

The company's focus on its loyalty program, H Rewards, further refines its pricing by offering exclusive rates and discounts, driving direct bookings and customer retention. This is supported by their asset-light model, emphasizing fee-based revenue, which allows for agile pricing adjustments tied to operational efficiency and brand value, with significant growth projected in franchised segments for 2025.

| Metric | 2023 (Actual) | Q1 2024 (Actual) | Outlook 2025 (Projected) |

|---|---|---|---|

| Occupancy Rate | ~85% | ~83% | Stable to slight increase |

| Average Daily Rate (ADR) | Varied by segment | Influenced by market demand | Expected to grow with segment expansion |

| Loyalty Program Contribution | Significant portion of revenue | Continued driver of direct bookings | Key to retaining and attracting guests |

4P's Marketing Mix Analysis Data Sources

Our H World Group 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also leverage insights from industry-specific market research and competitive intelligence platforms to ensure accuracy.