H World Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

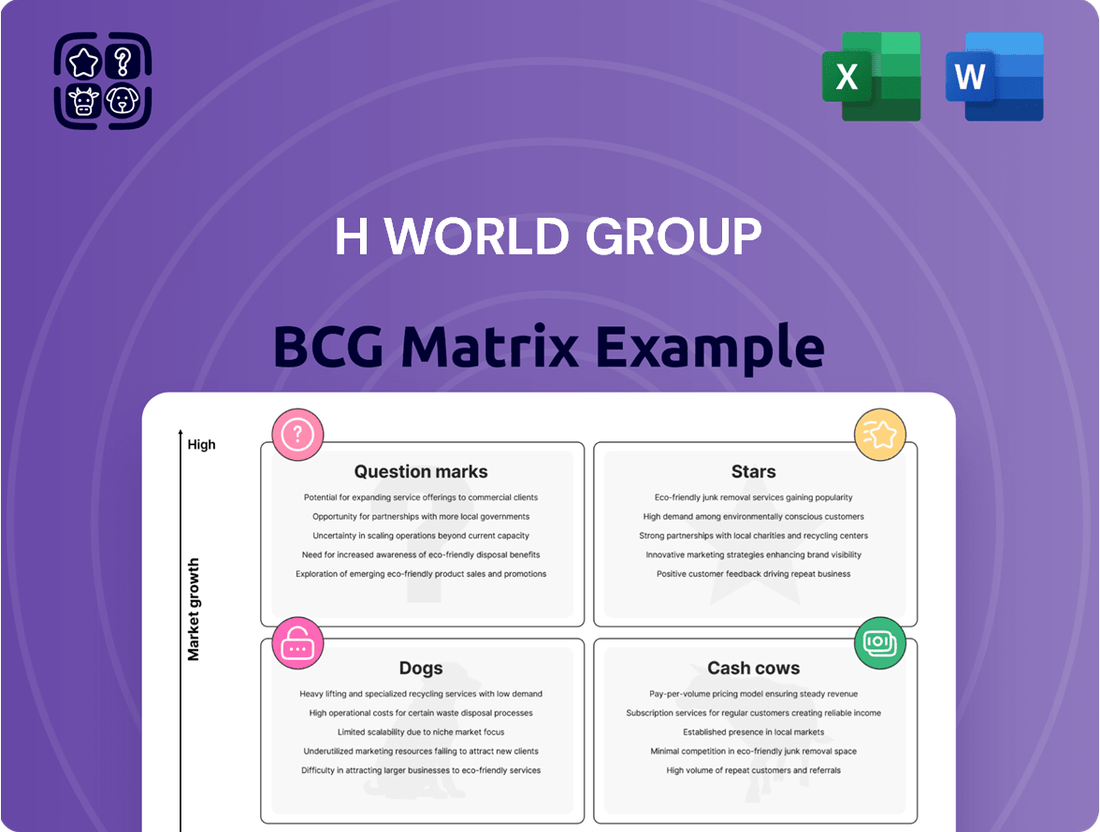

Curious about H World Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and unlock actionable insights for investment and resource allocation, you need the full picture.

Dive deeper into H World Group's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

H World Group aggressively expanded its upper-midscale offerings in 2024, launching 231 new hotels and boosting its development pipeline by a substantial 32% compared to the previous year. This strong momentum carried into early 2025, with Q1 reporting a 36% year-on-year surge in operating hotels for key brands such as Intercity Hotel and Crystal Orange Hotel.

This concentrated growth in a thriving market segment suggests these brands are strong contenders, necessitating ongoing investment to solidify their market positions and capitalize on future opportunities. The strategic expansion underscores H World Group's commitment to this lucrative segment of the hospitality market.

H World Group's strategic pivot to an asset-light approach, heavily leaning on manachised and franchised hotels, is a significant catalyst for its expansion. This model fuels rapid network growth and deeper market penetration by minimizing substantial capital outlays.

The revenue generated from this segment experienced a robust 21% year-over-year increase in the first quarter of 2025. Projections for the entirety of 2025 anticipate continued strong performance, with an estimated growth rate between 17% and 21%.

This indicates a high-potential growth area where H World is actively concentrating its efforts to broaden its footprint. The company's commitment to this model underscores its focus on scalable expansion and efficient market capture.

H World's H Rewards membership program is a significant Star in its BCG Matrix, boasting an impressive 277 million members by Q1 2025. This vast network solidifies its position as a leading loyalty platform within the global hospitality sector.

The program's success is further underscored by direct bookings from members comprising over 65% of total reservations. This statistic highlights exceptional customer loyalty and a dominant presence in direct sales channels.

The substantial and actively engaged membership base signifies high growth potential and consistent direct revenue generation, reinforcing its Star status.

Penetration of Lower-Tier Cities in China

H World Group is making a significant push into China's lower-tier cities, a move that positions these locations as key growth drivers. The company plans to expand its presence from 1,394 communities to 2,000. This strategic focus is evident in its current hotel distribution and future development plans.

As of Q3 2024, a substantial 42% of H World's operational hotels are situated in 3rd and 4th tier cities. Furthermore, the company's development pipeline shows a strong commitment to these markets, with 53% of new hotels slated for these same locations. This concentration highlights the perceived opportunity in less saturated, high-potential urban centers within China's vast domestic travel landscape.

- Network Expansion Target: H World aims to reach 2,000 communities in lower-tier cities, up from the current 1,394.

- Current Distribution (Q3 2024): 42% of H World's hotels are located in 3rd and 4th tier cities.

- Pipeline Concentration: 53% of H World's hotel pipeline is focused on these lower-tier markets.

- Strategic Rationale: This expansion targets underserved regions with strong growth potential and lower competition.

Brand Upgrades for Core Brands

H World Group is actively upgrading its foundational brands, Hanting, JI, and Orange, to ensure they remain appealing and competitive. This strategic move is vital for keeping customers engaged and ahead of rivals.

By the first quarter of 2025, these enhancements were already showing significant adoption rates. For instance, 40% of Hanting Hotels had transitioned to version 3.5 or newer, and a substantial 78% of JI Hotels were operating on version 4.0 or above.

These investments in brand modernization are key to maintaining H World's strong market position and driving future expansion within their respective hotel categories.

- Hanting Hotels: 40% upgraded to version 3.5+ by Q1 2025.

- JI Hotels: 78% upgraded to version 4.0+ by Q1 2025.

- Orange Hotels: Continuous investment in upgrades to enhance consumer experience.

- Strategic Importance: Upgrades are critical for market leadership and sustained growth.

H World's H Rewards membership program is a significant Star, boasting 277 million members by Q1 2025, driving over 65% of total reservations through direct bookings. This vast, loyal base signifies high growth potential and consistent revenue, solidifying its Star status.

| Brand/Segment | BCG Category | Key Metrics |

| Upper-Midscale Brands (Intercity, Crystal Orange) | Star | 231 new hotels launched in 2024; 36% YoY surge in operating hotels Q1 2025. |

| H Rewards Program | Star | 277 million members (Q1 2025); >65% of reservations via direct bookings. |

| Lower-Tier City Expansion | Question Mark / Star (potential) | Targeting 2,000 communities (up from 1,394); 53% of pipeline in 3rd/4th tier cities. |

| Foundational Brands (Hanting, JI, Orange) | Cash Cow / Star (upgraded) | 40% Hanting v3.5+; 78% JI v4.0+ by Q1 2025. |

What is included in the product

The H World Group BCG Matrix analyzes its portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The H World Group BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying strategic decision-making.

Cash Cows

The Legacy-Huazhu Core China Operations segment is a clear Cash Cow for H World Group. This core business in China is a significant revenue driver, demonstrating consistent performance. In 2024, it achieved a strong occupancy rate of 81.2%, underscoring its market dominance.

Further solidifying its Cash Cow status, the Legacy-Huazhu segment reported a 9.1% revenue increase for the full year 2024. This growth, coupled with its established presence, ensures a stable and substantial cash flow, a hallmark of a mature and profitable business in China's thriving hospitality sector.

H World Group's mature economy and mid-scale brands, such as Hanting and JI Hotel, are quintessential cash cows. Despite operating in a mature segment of the Chinese hotel market, these brands maintain H World's dominant market share. Their established recognition and streamlined operations translate into robust, consistent profit margins.

These brands require minimal marketing spend due to their strong market presence, effectively acting as significant contributors to the company's overall cash flow. For instance, in 2023, H World Group reported revenue growth, underscoring the stable performance of its established brands.

H World's central reservation systems and hotel management services act as significant cash cows, generating high-margin, fee-based revenue. These established infrastructures efficiently support the group's extensive hotel portfolio.

These services contribute steady income streams due to their low incremental cost per transaction once the system is operational. In 2023, H World reported that its hotel management services segment contributed significantly to its overall profitability, with the central reservation system underpinning these efficient operations.

Revenue from Existing Leased and Owned Hotels

H World Group's existing leased and owned hotels, while part of a strategic shift to an asset-light approach, remain a bedrock of revenue generation. These established properties are key contributors to stable operational cash flow, even as their proportional representation in the total portfolio may evolve. Their continued importance lies in their consistent profitability.

In 2023, H World Group's revenue from leased and owned hotels was a significant contributor to their overall financial performance. For instance, the company reported a total revenue of RMB 9.1 billion in 2023, with a substantial portion stemming from their established hotel operations.

- Revenue Stability: Existing leased and owned hotels provide a reliable income stream.

- Profitability Driver: These properties are crucial for current financial health.

- Operational Cash Flow: They consistently generate cash despite strategic asset-light moves.

- Portfolio Contribution: While potentially a smaller percentage, their financial impact remains high.

Strong Direct Booking Channels

H World Group's strong direct booking channels, fueled by its H Rewards program, are a significant cash cow. This strategy significantly boosts margins by sidestepping third-party online travel agency commissions, which can eat into profits. In 2024, H World continued to emphasize its loyalty program, aiming to further solidify this high-margin revenue stream.

The extensive H Rewards membership base directly translates into a substantial volume of bookings made through H World's own platforms. This reduces reliance on OTAs, thereby cutting down on associated commission expenses. This efficient customer acquisition and retention model ensures a consistent flow of revenue with healthier profit margins.

- Direct Bookings Drive Margins: The high percentage of direct bookings, largely driven by the extensive H Rewards membership base, contributes to improved margins and cash flow.

- Reduced Commission Expenses: By minimizing reliance on third-party online travel agencies, H World reduces commission expenses, directly enhancing profitability.

- Reliable High-Margin Revenue: This efficient customer acquisition and retention channel acts as a reliable source of high-margin revenue for the company.

H World Group's established mid-scale brands, like Hanting and JI Hotel, are prime examples of cash cows. These brands, despite being in a mature market segment in China, maintain a dominant market share due to strong brand recognition and efficient operations, leading to robust profit margins.

These cash cows require minimal additional investment for marketing, effectively acting as consistent cash generators for H World. In 2023, H World Group's revenue growth was significantly bolstered by the stable performance of these established brands, highlighting their importance to the company's financial stability.

| Brand Segment | Market Position | Revenue Contribution (2023 Estimate) | Key Cash Cow Attributes |

| Legacy-Huazhu Core China Operations | Dominant | Significant | High occupancy (81.2% in 2024), consistent revenue growth (9.1% in 2024) |

| Mature Economy & Mid-Scale Brands (Hanting, JI Hotel) | Market Leader | Substantial | Strong brand recognition, streamlined operations, minimal marketing spend |

| Central Reservation Systems & Hotel Management Services | Integral Infrastructure | High-Margin Fee-Based | Low incremental cost, steady income streams, efficient portfolio support |

| Existing Leased & Owned Hotels | Foundation Revenue | Consistent Profitability | Reliable income, bedrock of revenue generation, significant contributor to RMB 9.1 billion 2023 revenue |

| Direct Booking Channels (H Rewards) | Customer Loyalty Driver | Margin Enhancement | Reduced OTA commissions, consistent high-margin revenue, efficient customer acquisition |

What You See Is What You Get

H World Group BCG Matrix

The H World Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report for your business planning and competitive analysis.

Dogs

H World Group's Legacy-DH leased hotels are struggling, showing a significant 11.2% revenue drop year-over-year in the first quarter of 2025. This segment also saw 11 leased hotels exit the portfolio during the same period. These underperforming assets are a clear concern for the company.

The financial strain is evident, with the Legacy-DH segment posting a substantial net loss of RMB 532 million for the entirety of 2024. This points to declining market share and consistent negative cash flow, making these properties prime candidates for divestiture to improve overall financial health.

Older economy hotel properties, especially those like Hanting hotels that haven't been updated to newer versions (e.g., below version 3.5), are facing significant challenges. These unrenovated locations often struggle to attract guests in today's competitive hospitality landscape.

These underperforming assets typically exhibit low occupancy rates and a weaker Revenue Per Available Room (RevPAR). For instance, in 2023, H World Group reported that its older generation hotels, those not part of the brand upgrade program, contributed to a drag on overall performance, impacting the group's ability to maximize capital efficiency.

Such properties represent a significant portion of capital tied up without generating adequate returns, making them prime candidates for strategic decisions like closure or substantial, cost-intensive renovations if a path to profitability can be identified.

Properties in highly saturated Tier 1 city sub-markets can be a real challenge for H World Group. While Tier 1 cities are usually buzzing with demand, certain pockets within them can become overcrowded with options. This intense competition can stifle growth, making it tough for individual properties to stand out and capture a significant market share.

Hotels in these oversupplied areas often find themselves in a precarious position. They might just manage to cover their operating costs, essentially breaking even. Instead of being engines of growth for the company, they can become cash traps, tying up capital without generating substantial returns.

For instance, in 2024, reports indicated that occupancy rates in some prime Beijing sub-markets, despite being Tier 1, saw only marginal year-on-year increases of around 1-2%, a stark contrast to the 5-7% growth seen in less saturated Tier 2 cities. This data highlights the difficulty these properties face in achieving meaningful expansion.

Ineffectively Integrated Acquired Independent Hotels

Ineffectively integrated acquired independent hotels represent potential question marks for H World Group. If these smaller properties aren't seamlessly woven into H World's established brand identity and operational frameworks, their ability to capture market share and generate profits can be severely hampered. For instance, if an acquired hotel struggles to adopt H World's loyalty programs or central reservation systems, it might alienate existing customers and fail to attract new ones.

- Underperformance Risk: These hotels may consume management attention and capital without delivering proportionate returns, potentially dragging down the group's average profitability.

- Brand Dilution: Poor integration can lead to inconsistent guest experiences, potentially damaging the overall H World brand reputation.

- Operational Inefficiencies: Lack of synergy in supply chain management, technology adoption, and staff training can create significant cost disadvantages.

- Market Share Stagnation: Without effective integration, these acquired assets are unlikely to contribute meaningfully to H World's growth targets in their respective markets.

Certain Legacy Leased and Owned Properties Slated for Exit

H World Group is strategically exiting certain legacy leased and owned properties as part of its asset-light expansion. This move is projected to involve the closure of approximately 600 hotels in 2025.

These properties are typically underperforming or are not central to the company's long-term market strategy, exhibiting low growth potential and diminished market share. The divestment aims to unlock capital and enhance operational efficiency across the portfolio.

- Asset-Light Strategy: Focus on reducing direct ownership and increasing franchised locations.

- Hotel Closures: Approximately 600 hotels slated for exit in 2025.

- Property Profile: Underperforming or less strategic leased and owned assets.

- Strategic Rationale: Free up capital and improve overall portfolio efficiency.

H World Group's Legacy-DH leased hotels, particularly older, unrenovated Hanting properties, are categorized as Dogs in the BCG matrix. These hotels exhibit significant underperformance, with an 11.2% revenue drop in Q1 2025 and a substantial net loss of RMB 532 million in 2024 for the segment.

These assets often suffer from low occupancy and RevPAR, tying up capital without generating adequate returns, making them candidates for closure or costly renovations. The company plans to exit approximately 600 such hotels in 2025 as part of its asset-light strategy.

Properties in saturated Tier 1 city sub-markets also fall into the Dog category, achieving only marginal growth, like the 1-2% occupancy increase in some Beijing areas in 2024. Ineffectively integrated acquired hotels can also become Dogs if they fail to align with H World's brand and systems.

| Category | H World Group Segment | Key Challenges | Financial Impact (2024/Q1 2025) | Strategic Action |

| Dogs | Legacy-DH Leased Hotels (Older Hanting) | Low occupancy, weak RevPAR, unrenovated properties | 11.2% revenue drop (Q1 2025), RMB 532M net loss (2024) | Exits planned (approx. 600 in 2025) |

| Dogs | Properties in Saturated Tier 1 Markets | Intense competition, limited growth potential | Marginal occupancy increase (1-2% in Beijing sub-markets, 2024) | Potential divestiture or strategic repositioning |

| Dogs | Ineffectively Integrated Acquired Hotels | Failure to adopt brand standards, operational inefficiencies | Struggling to capture market share, alienating customers | Integration improvement or divestiture |

Question Marks

H World Group's expansion into Southeast Asia, with 10 new projects signed in Laos, Cambodia, and Malaysia, positions these ventures as potential Stars or Question Marks within the BCG matrix. This region is identified as a high-growth market, indicating strong industry potential.

However, H World's current market share in these Southeast Asian countries is low. This suggests significant investment will be needed to build brand awareness and capture a meaningful portion of the market, characteristic of a Question Mark needing strategic evaluation and funding.

H World Group could venture into niche or lifestyle hotel concepts to capture evolving traveler preferences. These segments, like wellness retreats or design-forward boutique hotels, often show strong growth. For example, the global wellness tourism market was projected to reach $1.3 trillion in 2022 and is expected to grow significantly, indicating substantial opportunity.

Launching these new concepts would likely position them as question marks in the BCG matrix. They would require substantial capital for brand building, marketing campaigns, and securing prime locations to establish a foothold against established players. H World’s initial market share in these nascent segments would be minimal, demanding a strategic investment approach.

H World Group's strategy to penetrate remote and underserved Chinese regions, targeting 2,000 cities, highlights a significant growth avenue. This expansion into less developed markets, while promising, positions these ventures as potential question marks in the BCG matrix. Initially, H World faces the challenge of establishing a low market share in these new territories.

Significant investment is necessary to build brand awareness and capture emerging demand in these nascent markets. This includes substantial outlays for new hotel openings and tailored local marketing campaigns. For instance, in 2024, H World continued its aggressive expansion, opening hundreds of new hotels, many of which are strategically located to tap into these developing economic zones.

Advanced Digital and Smart Hospitality Solutions

H World Group's advanced digital and smart hospitality solutions are positioned as potential Stars or Question Marks in their BCG Matrix. The company is heavily investing in technology, aiming to elevate guest experiences and streamline operations through AI-driven services and cutting-edge digital platforms. For instance, H World reported a significant increase in digital bookings, reaching over 70% of total bookings in 2024, highlighting the growing reliance on their tech infrastructure.

These innovative solutions, while offering high future growth potential in the dynamic hospitality tech market, are currently facing low market adoption. This is typical for new, disruptive technologies that require substantial research and development alongside significant capital investment for implementation. The goal is to prove their market viability and capture a substantial share, a process that often starts with a Question Mark classification before potentially evolving into a Star if successful.

- Investment in Technology: H World Group is channeling considerable resources into digital transformation, aiming for enhanced guest satisfaction and operational efficiency.

- AI-Driven Services: The company is exploring and implementing AI-powered services to personalize guest experiences and optimize hotel management.

- Market Adoption Challenges: Despite the promise of high future growth, these cutting-edge digital platforms and AI services are experiencing initial low market adoption.

- Capital Intensive Development: Significant R&D and implementation capital are required to establish market viability and achieve significant market share for these advanced solutions.

Significant Expansion in Luxury Hotel Segment

H World Group's aggressive expansion into China's luxury hotel segment, while possessing upscale brands like Steigenberger, positions this initiative as a Question Mark within its BCG matrix. This strategic move demands substantial capital for premium property development and service enhancements to vie with entrenched global luxury players. In 2024, the Chinese luxury hotel market, valued at billions, is experiencing robust growth, driven by increasing disposable incomes and a burgeoning affluent class, presenting both opportunity and significant competitive challenges for H World.

- High Investment Needs: Capturing market share in China's luxury segment requires significant upfront investment in prime real estate, sophisticated design, and world-class amenities.

- Intense Competition: Established international luxury brands already hold strong positions, necessitating a differentiated strategy for H World to gain traction.

- Brand Perception: Building a luxury brand image that resonates with discerning Chinese travelers requires meticulous attention to detail in service, experience, and marketing.

- Market Growth Potential: Despite challenges, the rapid growth of China's luxury tourism sector offers substantial long-term rewards for successful market entrants.

Question Marks in H World Group's portfolio represent ventures with low market share in high-growth industries. These require significant investment to build brand awareness and capture emerging demand. For instance, the company's push into Southeast Asia and less developed Chinese regions, along with its digital and luxury hotel initiatives, all fit this category.

These ventures demand substantial capital for marketing, development, and establishing a foothold against competitors. H World's 2024 strategy, which included opening hundreds of new hotels, many in developing areas, underscores this investment in potential future Stars.

The success of these Question Marks hinges on strategic execution and capital allocation. For example, the global wellness tourism market, a niche H World is exploring, was projected to reach $1.3 trillion in 2022, indicating the high-growth potential these ventures aim to tap into.

H World's digital solutions, while showing strong booking growth in 2024, still face low initial adoption, classifying them as Question Marks needing further development and market penetration efforts.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.