Hunt Consolidated/Hunt Oil SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Hunt Consolidated/Hunt Oil possesses significant strengths in its diversified portfolio and established global presence, but also faces challenges from fluctuating commodity prices and increasing regulatory scrutiny.

Our comprehensive SWOT analysis delves deeper, revealing crucial opportunities for expansion in emerging markets and potential threats from technological disruption.

Want the full story behind the company’s strengths, risks, and growth drivers?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hunt Consolidated's diverse business portfolio, spanning oil and gas, real estate, power generation, and various investments, provides a strong strategic advantage. This broad operational base significantly reduces the company's vulnerability to downturns in any single market sector. For instance, during periods of oil price volatility, strong performance in their real estate or power generation segments can help stabilize overall financial results.

This diversification allows Hunt to effectively manage risk and capture opportunities across different economic phases. For example, in 2023, while energy markets experienced fluctuations, Hunt's real estate development projects continued to show steady growth, contributing positively to the company's overall revenue. This multi-sector approach enhances the company's resilience and adaptability.

Hunt Consolidated's extensive experience in the energy sector, primarily through Hunt Oil Company, is a significant strength. This deep-rooted history in global crude oil and natural gas exploration and production means they possess decades of accumulated industry knowledge. This expertise is crucial for navigating volatile energy markets and identifying valuable reserves.

This long-standing presence has cultivated a strong reputation for reliability and fostered robust relationships across the industry. This advantage allows Hunt to effectively identify promising opportunities and optimize operational efficiencies, a critical factor in the competitive energy landscape.

Hunt Oil Company's extensive global exploration and production (E&P) operations grant it access to a wide array of geological basins and diverse markets. This broad geographic reach is a significant strength, as it minimizes the company's reliance on any single region's economic or political climate, offering a buffer against localized instability.

This worldwide footprint enables Hunt Oil to strategically allocate its resources, chasing the most profitable projects across the globe. By diversifying its operational areas, the company effectively de-risks its portfolio, allowing it to capitalize on opportunities presented by various international energy markets and geological formations.

Private Ownership Structure

Hunt Consolidated's private ownership structure offers significant strategic advantages, particularly in its ability to prioritize long-term vision over short-term market reactions. This autonomy allows the company to invest in projects with extended development cycles, such as those common in the energy sector, without the constant scrutiny of quarterly earnings reports. For instance, while specific financials are private, the company's sustained involvement in large-scale infrastructure and energy development, often requiring decades of planning and capital, underscores this strength.

This private status also enables greater agility in responding to evolving market dynamics. Without the need for immediate public disclosure, Hunt Consolidated can make swift decisions regarding investments, divestitures, or strategic pivots. This can be crucial in volatile industries where rapid adaptation is key to maintaining a competitive edge. The confidentiality inherent in private ownership also shields proprietary information and financial performance details, acting as a shield against competitors seeking to exploit such data.

- Strategic Flexibility: Unburdened by quarterly public market demands, Hunt Consolidated can focus on multi-year or multi-decade investment horizons.

- Agility in Decision-Making: The private structure allows for quicker strategic adjustments in response to market shifts.

- Confidentiality: Operational and financial details remain private, offering a competitive advantage by withholding information from rivals.

- Long-Term Project Viability: Facilitates the pursuit of capital-intensive, long-horizon projects essential in sectors like energy and infrastructure.

Established Asset Base and Operational Capabilities

Hunt Consolidated, through its subsidiaries like Hunt Oil, boasts a significant and diversified asset base. This includes a substantial portfolio of existing oil and gas reserves, which in 2023 continued to contribute steadily to production volumes. Beyond energy, their extensive real estate holdings, particularly in prime development areas, provide a stable and growing revenue stream.

The company’s operational capabilities are a core strength, honed over decades. Hunt Oil’s expertise in exploration, production, and project management ensures efficient extraction and delivery of hydrocarbons, a critical factor in maintaining profitability. Similarly, their power generation facilities operate with high reliability, underpinning their service delivery in that sector.

- Established Oil and Gas Reserves: Hunt Oil held substantial proved developed producing reserves as of year-end 2023, underpinning its upstream segment.

- Diversified Real Estate Portfolio: Significant acreage in key growth corridors provides long-term value and development opportunities.

- Robust Power Generation Assets: Operating capacity across multiple power generation facilities ensures consistent energy supply and revenue.

- Operational Expertise: Decades of experience in managing complex energy and real estate projects translate to efficient operations and cost control.

Hunt Consolidated's diversified business model is a key strength, reducing reliance on any single sector. For example, in 2023, while oil prices fluctuated, the company's real estate and power generation segments provided stable revenue streams, demonstrating resilience.

The company's deep expertise in the global energy market, particularly through Hunt Oil, offers a significant competitive edge. This long history, dating back decades, translates into invaluable knowledge for navigating complex exploration and production challenges and identifying profitable ventures.

Hunt Oil's extensive global footprint, with operations across numerous geological basins, minimizes exposure to localized political or economic instability. This worldwide presence allows for strategic resource allocation, capitalizing on opportunities in diverse international energy markets.

Hunt Consolidated's status as a privately held entity affords it the freedom to pursue long-term strategies without the pressure of short-term public market expectations. This allows for sustained investment in capital-intensive projects, a crucial factor in the energy and infrastructure sectors.

What is included in the product

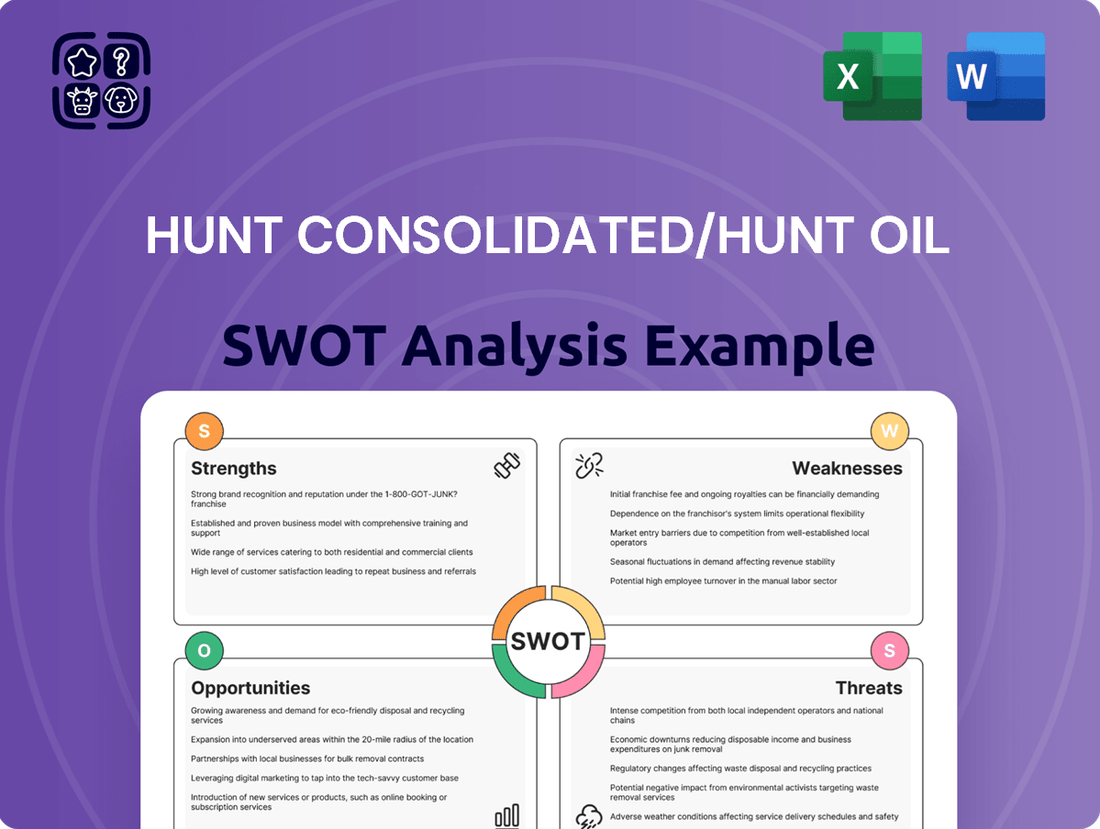

Delivers a strategic overview of Hunt Consolidated/Hunt Oil’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Highlights critical competitive advantages and potential threats for Hunt Consolidated/Hunt Oil, enabling proactive risk mitigation and opportunity maximization.

Weaknesses

As a privately held entity, Hunt Consolidated, like its subsidiary Hunt Oil, isn't obligated to the same level of public disclosure as its publicly traded counterparts. This means external parties, such as potential investors or partners, might find it harder to get a clear picture of the company's financial standing, how well its operations are doing, or its future plans. For instance, while many energy firms actively report quarterly earnings and detailed operational metrics, Hunt Consolidated's private status means such data is not readily available for public consumption.

This limited transparency can be a hurdle when seeking certain types of financing, as many capital markets and institutional investors prefer or require the detailed insights provided by public filings. Without the readily accessible data that public companies offer, it can be more challenging to build trust and attract investment from those who rely heavily on standardized reporting for their due diligence processes.

Hunt Consolidated's private ownership structure, while offering operational flexibility, inherently limits its access to the vast capital pools available through public equity and debt markets. This means significant expansion projects or major acquisitions, which often require billions in funding, might be more challenging to finance compared to publicly traded energy companies that can tap into a broad investor base. For instance, as of early 2024, major oil and gas players often raise capital through multi-billion dollar bond offerings or large-scale equity issuances, a route less accessible to private entities like Hunt.

Consequently, Hunt's growth trajectory and the scale of its strategic initiatives are primarily constrained by its internal capital generation, its ability to secure private debt, or its success in forming limited partnerships. This reliance on more bespoke financing avenues can potentially slow down the pace of development or limit the sheer size of undertakings compared to competitors that can readily access public capital markets for substantial funding needs. The need for more intricate and potentially protracted financing arrangements for major strategic moves is a direct consequence.

Despite Hunt Consolidated's efforts to diversify, Hunt Oil Company remains a foundational pillar, meaning the entire conglomerate is susceptible to the unpredictable swings in crude oil and natural gas prices. This exposure is a significant weakness, as substantial drops in energy prices can directly and heavily affect a large portion of the company's earnings and overall financial health.

For instance, in 2023, global oil prices experienced considerable volatility, with Brent crude averaging around $82 per barrel, a figure that, while higher than some historical lows, still represents a significant variable for Hunt Oil's revenue streams. This inherent dependency underscores the critical need for sophisticated risk management protocols to effectively cushion the impact of these price fluctuations.

Succession Planning Complexity

Hunt Consolidated, as a long-standing, privately held entity with deep family roots, faces inherent complexities in succession planning for its leadership. This isn't uncommon for such organizations, where maintaining continuity alongside evolving leadership is paramount. The challenge lies in ensuring a seamless handover of critical responsibilities and preserving decades of institutional knowledge.

The company's multi-generational ownership structure necessitates a deliberate approach to leadership transitions. This careful planning is vital for safeguarding Hunt Oil's long-term stability and fostering continued growth. Without robust succession strategies, institutional memory could be diluted, potentially impacting strategic decision-making and operational efficiency. For instance, according to the 2023 Forbes Global 2000 list, companies with well-defined succession plans often exhibit greater resilience during market volatility, a factor crucial for a company operating in the energy sector.

Key considerations for Hunt Consolidated's succession planning include:

- Identifying and developing future leaders from within the organization and family.

- Ensuring a structured knowledge transfer process to new leadership.

- Balancing the need for new perspectives with the preservation of core company values and strategies.

Slower Adoption of Emerging Technologies

Hunt Consolidated, as a private entity, may face a slower adoption curve for emerging technologies compared to publicly traded competitors. This lack of immediate shareholder pressure to innovate could result in a lag in implementing cutting-edge solutions that could boost efficiency or enhance environmental stewardship. For instance, while the energy sector saw significant investment in AI and machine learning for exploration and production optimization, a private company might delay such capital expenditures.

This slower technological uptake can manifest in several ways:

- Operational Lag: A delay in adopting advanced drilling techniques or digital twin technology could lead to less efficient operations than rivals who are aggressively pursuing these advancements.

- Environmental Performance: Competitors might be faster to integrate carbon capture technologies or advanced emissions monitoring systems if driven by public environmental, social, and governance (ESG) mandates.

- Competitive Disadvantage: While the 2024-2025 period shows continued investment in digital transformation across the energy sector, private companies without this direct public scrutiny might find it harder to justify the upfront costs of disruptive technologies, potentially falling behind in the long run.

Hunt Consolidated's private ownership limits its access to public capital markets, making large-scale funding for expansion or acquisitions more challenging than for publicly traded peers. This reliance on internal capital or private debt can potentially slow growth compared to competitors that can readily tap into investor bases for billions. As of early 2024, major energy firms frequently utilize multi-billion dollar bond offerings or equity issuances, a route less accessible to private entities like Hunt.

The company's significant dependence on Hunt Oil exposes its overall financial health to the volatile fluctuations of crude oil and natural gas prices. For instance, with Brent crude averaging around $82 per barrel in 2023, these price swings directly impact a substantial portion of Hunt's earnings, necessitating robust risk management.

As a privately held, multi-generational family business, Hunt Consolidated faces inherent complexities in leadership succession planning. This can impact the seamless transfer of knowledge and potentially dilute institutional memory, affecting strategic decision-making and operational efficiency, a contrast to companies with formalized succession plans that often show greater resilience.

Full Version Awaits

Hunt Consolidated/Hunt Oil SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis delves into Hunt Consolidated/Hunt Oil's Strengths, Weaknesses, Opportunities, and Threats, providing a strategic overview. You'll gain insights into their market position, operational capabilities, and potential growth avenues. The complete document is ready for your immediate use after purchase.

Opportunities

Hunt Consolidated can capitalize on the burgeoning renewable energy sector by integrating solar, wind, and geothermal projects into its existing power generation infrastructure. This strategic move directly addresses the global shift towards sustainable energy solutions, a trend gaining considerable momentum. For instance, by 2024, the International Energy Agency projected that renewable energy capacity additions would reach nearly 500 gigawatts globally, underscoring the significant market opportunity.

Expanding into renewables offers Hunt Consolidated a clear path to diversify its revenue streams away from traditional fossil fuels. This diversification is crucial for long-term stability and resilience in a rapidly evolving energy landscape. Furthermore, a stronger commitment to renewable energy enhances the company's environmental, social, and governance (ESG) profile, appealing to a growing segment of environmentally conscious investors and partners.

Hunt Consolidated can strategically acquire companies to bolster its presence in established oil and gas, real estate, and power sectors. For instance, a move into renewable energy infrastructure, a rapidly expanding market with significant government incentives in 2024 and 2025, could diversify its portfolio.

These acquisitions offer a direct route to new technologies and markets, potentially fast-tracking Hunt's entry into high-growth areas like advanced battery storage or carbon capture solutions. Such strategic moves can significantly sharpen its competitive edge in an evolving energy landscape.

The company's real estate division, which has seen substantial development activity, could benefit from acquiring distressed commercial properties or land banks in burgeoning urban centers, capitalizing on post-pandemic economic shifts and urban revitalization trends projected through 2025.

By meticulously identifying acquisition targets that offer genuine synergies, Hunt can unlock considerable value, integrating new assets and expertise to create a more robust and diversified business model, a strategy that proved highly effective for many conglomerates in the 2024 M&A environment.

Hunt Consolidated can leverage technological advancements to boost efficiency in its Exploration & Production (E&P) activities. Integrating AI and big data analytics, for instance, can refine seismic data interpretation, leading to more accurate reservoir identification and reduced drilling costs. The company's embrace of digital transformation across its operations, including real estate and power management, can streamline processes and improve decision-making.

Enhanced Oil Recovery (EOR) techniques, powered by new technologies, present a significant opportunity. By adopting advanced EOR methods, Hunt Oil can increase the recovery rates from existing fields, extending their lifespan and maximizing asset value. This focus on operational optimization through technology is crucial in the current market landscape, where cost efficiency is paramount.

Real Estate Development and Portfolio Optimization

Hunt Consolidated's substantial real estate holdings present a significant opportunity. The company can leverage current favorable market conditions, potentially seeing growth in residential, commercial, and industrial property sectors. For instance, the U.S. commercial real estate market, while facing some headwinds, still offers opportunities in specific sub-sectors like logistics and data centers, with projected growth in logistics real estate occupancy rates in 2024-2025.

Optimizing the existing real estate portfolio is another key avenue. Strategic sales of underperforming assets or targeted redevelopment of prime locations can free up capital and improve overall asset efficiency. This adaptability allows Hunt Consolidated to align its real estate assets with changing urban planning and commercial demands, potentially enhancing returns and supporting future growth initiatives.

- Capitalize on favorable market conditions for new property developments.

- Optimize existing real estate portfolio through strategic divestments or redevelopments.

- Unlock substantial capital and enhance asset utilization.

- Adapt to evolving urban and commercial needs.

Leveraging Global Market Shifts for E&P

Hunt Oil can capitalize on evolving global energy demand by pinpointing exploration and production (E&P) activities in regions offering stable regulations, favorable fiscal policies, and promising reserves. This strategic focus is crucial as the world navigates shifts in energy consumption patterns and seeks reliable supply chains.

Adapting to evolving geopolitical landscapes presents a significant opportunity for Hunt Oil. Identifying and entering new frontier markets, especially those prioritizing energy security, can unlock substantial growth avenues. For instance, many European nations are actively seeking diversified energy sources beyond traditional suppliers, creating potential entry points for companies like Hunt Oil.

The company should also monitor and respond to changing supply chain dynamics. As global trade routes and manufacturing hubs shift, optimizing logistics and sourcing for E&P operations will be key. This includes considering the impact of nearshoring or friend-shoring initiatives on project costs and timelines.

- Targeting Regions with Stable Governance: Focus on countries with predictable legal frameworks and low corruption indices to mitigate exploration risks.

- Securing Favorable Fiscal Terms: Negotiate advantageous production sharing agreements and tax regimes that balance government revenue with acceptable investor returns.

- Exploring Underexploited Basins: Identify and invest in geological basins with proven hydrocarbon potential but limited past exploration due to political or economic instability.

- Responding to Energy Transition Demands: While focusing on traditional E&P, consider opportunities in lower-carbon intensity projects or regions where natural gas plays a transitional role.

Hunt Consolidated can expand its renewable energy portfolio by investing in solar, wind, and geothermal projects, aligning with the global push for sustainability. The International Energy Agency projected global renewable capacity additions to reach nearly 500 gigawatts by 2024, highlighting a significant market expansion opportunity.

Acquiring companies with expertise in renewable energy infrastructure, particularly those benefiting from 2024-2025 government incentives, offers a strategic diversification path. This approach can accelerate entry into high-growth areas like battery storage and carbon capture, enhancing the company's competitive standing.

Hunt Consolidated can leverage its real estate division by acquiring underperforming commercial properties or land in growing urban centers. This strategy capitalizes on post-pandemic economic shifts and urban revitalization trends expected through 2025, allowing for value creation through integration and synergy.

Hunt Oil can capitalize on evolving global energy demand by focusing E&P activities in regions with stable regulations and favorable fiscal policies, as countries seek energy security. For instance, Europe's drive for diversified energy sources presents opportunities for companies like Hunt Oil to enter new markets.

| Opportunity Area | Specific Action | Market Context/Data Point |

| Renewable Energy Expansion | Integrate solar, wind, geothermal projects. | Global renewable capacity additions projected near 500 GW by 2024 (IEA). |

| Strategic Acquisitions | Acquire companies in renewables and other sectors. | Government incentives for renewables in 2024-2025 create favorable entry points. |

| Real Estate Portfolio Optimization | Acquire distressed properties/land in growing urban areas. | Post-pandemic economic shifts and urban revitalization trends through 2025. |

| Geographic Exploration Focus | Target regions with stable governance and favorable fiscal terms. | Global demand for energy security drives interest in new exploration markets. |

Threats

Hunt Consolidated, through Hunt Oil, faces the persistent threat of volatility in global energy markets. Fluctuations in crude oil and natural gas prices, often triggered by geopolitical tensions or shifts in supply and demand, can directly impact revenue streams. For instance, the average Brent crude oil price saw significant swings, trading around $80-$90 per barrel in early 2024, a stark contrast to the lows experienced during economic downturns.

Sustained periods of low energy prices, such as those seen in previous years, pose a significant risk to Hunt Oil's profitability and cash flow. This can jeopardize the economic feasibility of new exploration and production ventures, potentially limiting future growth opportunities. The capital-intensive nature of the oil and gas industry means that price downturns can have a prolonged impact on project viability.

To counter these threats, Hunt Oil must maintain robust hedging strategies to mitigate price risk and implement stringent cost control measures across its operations. For example, effective hedging can lock in prices for a portion of production, providing a degree of revenue stability even when market prices fall. Continuous operational efficiency improvements are also crucial to maintaining competitiveness in a volatile environment.

Hunt Oil faces significant threats from increasingly stringent environmental regulations and climate policies worldwide. Governments are implementing carbon pricing, such as the EU Emissions Trading System which saw allowances trade around €65-€100 per tonne in late 2023 and early 2024, and stricter emissions standards, directly increasing operational expenses for fossil fuel producers.

These evolving mandates can hinder the approval of new exploration and development projects and may even lead to the devaluation of existing oil and gas reserves as the global economy transitions towards cleaner energy sources. For instance, many nations are setting ambitious targets for renewable energy adoption, potentially reducing long-term demand for hydrocarbons.

Adapting to and complying with these dynamic regulatory landscapes requires substantial investment in new technologies and operational adjustments, posing a continuous challenge to Hunt Oil's business model and profitability. The financial implications of failing to meet these standards could include substantial fines and reputational damage.

Hunt Oil faces a formidable competitive landscape, challenged by major energy corporations such as ExxonMobil and Shell, which command significantly larger capital reserves and operational footprints. These giants, along with national oil companies like Saudi Aramco, benefit from economies of scale and established global infrastructure, making it difficult for a privately held entity like Hunt Oil to match their market penetration and pricing power. For instance, in 2023, major oil companies reported record profits, allowing for substantial reinvestment in exploration and production, directly impacting market dynamics.

The energy sector is also experiencing disruption from new entrants focused on renewable energy and alternative fuels, representing a growing threat to traditional oil and gas businesses. Companies investing heavily in solar, wind, and hydrogen technologies are carving out new market share and influencing energy policy, potentially reducing demand for Hunt Oil's core products in the long term. For example, global investment in renewable energy surpassed $1.7 trillion in 2023, demonstrating the rapid growth and increasing competitiveness of these alternative sectors.

To navigate these competitive pressures, Hunt Oil must prioritize continuous innovation in exploration techniques and operational efficiency. This includes adopting advanced seismic imaging technologies and optimizing extraction methods to reduce costs and improve recovery rates. Furthermore, exploring strategic partnerships or diversified investments in emerging energy technologies could be crucial for maintaining market relevance and profitability amidst evolving global energy demands.

Geopolitical Instability and Operational Risks in Global E&P

Operating internationally means Hunt Oil faces significant geopolitical instability, which could lead to disruptions. For instance, countries like Yemen, where Hunt Oil has had operations, have experienced prolonged civil conflict, creating substantial operational hurdles and investment risks. Such political volatility can result in asset seizures or severe operational limitations, directly impacting production and profitability. The global energy market in 2024 and 2025 is particularly sensitive to these events, with conflicts in Eastern Europe and the Middle East already influencing oil prices and supply routes. Hunt Oil's strategy must therefore include robust scenario planning for regions with heightened political tensions.

Hunt Oil's global footprint exposes it to a range of operational risks tied to geopolitical factors. These can include:

- Political Instability: Civil unrest or sudden regime changes in host countries can halt or severely damage operations, as seen in various African and Middle Eastern nations.

- Expropriation of Assets: Governments may nationalize or seize foreign-owned assets, leading to complete loss of investment.

- International Sanctions: Trade embargoes or sanctions imposed on certain countries can prevent Hunt Oil from operating or repatriating profits.

- Supply Chain Disruptions: Geopolitical tensions can interrupt the flow of equipment, personnel, and refined products, impacting project timelines and costs.

Shift Towards Renewable Energy and Decarbonization

The global push towards renewable energy and decarbonization poses a significant long-term threat to Hunt Oil's core business. As nations and industries increasingly prioritize cleaner energy sources, demand for traditional hydrocarbons is expected to decline. This transition could render existing oil reserves less valuable, potentially leading to stranded assets.

For instance, the International Energy Agency (IEA) projected in its 2024 scenarios that renewable energy sources could meet over 70% of global electricity demand by 2030, a substantial increase from current levels. This trajectory directly impacts the market for fossil fuels.

The implications include reduced investment in new exploration and production projects for oil and gas. Companies that do not adapt their strategies to incorporate or pivot towards renewable energy solutions risk facing substantial financial and operational challenges. Hunt Oil's ability to navigate this paradigm shift will be critical for its future sustainability.

- Declining Demand: Projections indicate a sustained decrease in the global consumption of fossil fuels as renewable energy adoption accelerates.

- Stranded Asset Risk: Investments in oil and gas reserves may become uneconomical due to shifts in energy policy and market preferences.

- Investment Diversion: Capital is increasingly flowing towards renewable energy projects, potentially reducing funding availability for traditional oil and gas ventures.

- Regulatory Pressures: Stricter environmental regulations and carbon pricing mechanisms globally could further impact the profitability of hydrocarbon-based operations.

Hunt Oil contends with the significant threat of accelerating global decarbonization efforts and the increasing adoption of renewable energy sources. This shift directly challenges the long-term demand for its core products, potentially leading to reduced investment in new oil and gas projects and the risk of stranded assets. For instance, the International Energy Agency's 2024 outlook suggests renewables could dominate electricity generation by 2030, directly impacting fossil fuel markets.

Furthermore, stringent environmental regulations and carbon pricing mechanisms are increasing operational costs and potentially limiting project approvals. The evolving regulatory landscape necessitates substantial investment in new technologies and operational adjustments to maintain compliance and profitability. Failure to adapt could result in significant financial penalties and reputational damage.

The competitive landscape is intensifying with major energy corporations and new entrants focused on renewables. These competitors often possess greater capital and established infrastructure, posing a challenge to Hunt Oil's market position. For example, substantial profits reported by major oil companies in 2023 enable significant reinvestment, impacting market dynamics.

Geopolitical instability in operating regions presents another substantial threat, potentially leading to operational disruptions, asset seizure, or sanctions that impede business. The global energy market in 2024-2025 remains sensitive to conflicts, influencing prices and supply chains, underscoring the need for robust risk management and scenario planning.

SWOT Analysis Data Sources

The data sources for this Hunt Consolidated/Hunt Oil SWOT analysis include publicly available financial statements, reputable industry publications, and expert market analyses to provide a comprehensive view.