Hunt Consolidated/Hunt Oil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Hunt Consolidated/Hunt Oil navigates a complex energy landscape where supplier power can be significant, especially for specialized equipment and raw materials. The threat of new entrants, while potentially high in some energy sectors, is mitigated by substantial capital requirements and regulatory hurdles.

The bargaining power of buyers in the oil and gas industry can fluctuate, influenced by global demand and the availability of alternative energy sources. Intense rivalry among established players, including major oil corporations and independent producers, shapes pricing and market share dynamics.

The threat of substitute products, particularly renewable energy technologies, poses a growing challenge to traditional oil and gas consumption. Understanding these forces is crucial for strategic positioning and long-term success in this dynamic sector.

The complete report reveals the real forces shaping Hunt Consolidated/Hunt Oil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential exploration and production equipment significantly impacts bargaining power. For instance, companies providing highly specialized drilling rigs or advanced seismic imaging technology, where few firms possess the proprietary expertise, can command higher prices. This scarcity of alternatives means Hunt Oil has limited leverage in negotiating terms for these critical components.

The availability and demand for highly skilled geologists, engineers, and field technicians significantly influence the bargaining power of suppliers in the energy sector. In 2024, the global energy industry continued to face a robust demand for specialized talent, particularly in areas like renewable energy integration and advanced extraction techniques.

A notable shortage of experienced professionals in niche fields such as deepwater drilling and complex reservoir management directly translates to increased leverage for these skilled individuals. This scarcity allows them to negotiate for higher compensation packages and more favorable working conditions, impacting Hunt Consolidated/Hunt Oil's labor costs.

The bargaining power of land and mineral rights holders is a significant factor for Hunt Oil. In many jurisdictions, governments or indigenous groups hold exclusive rights to subsurface resources. For instance, in 2024, countries with nationalized oil industries, such as Saudi Arabia or Venezuela, exert immense control over resource extraction terms, directly influencing potential profit margins for companies operating there.

Where concessions are limited or the regulatory landscape is intricate, these rights holders can impose stringent terms. This can translate into higher royalty rates, specific tax structures, or even requirements for local partnerships. These stipulations directly impact Hunt Oil's operational expenses and overall profitability, especially in regions where securing exploration and production rights is highly competitive.

Logistics and Transportation Services

Hunt Consolidated, particularly its energy ventures like Hunt Oil, faces significant supplier power within the logistics and transportation sector. The company's reliance on third-party providers for moving vital equipment, personnel, and crude oil means these logistics firms can indeed wield considerable influence.

The degree of this power hinges on several factors. If Hunt Oil operates in regions with constrained transportation infrastructure, such as limited pipeline access or a scarcity of specialized carriers for oversized drilling components, the few available logistics partners gain leverage. This can translate into higher shipping rates or restricted service availability, directly impacting Hunt's operational efficiency and costs.

In 2024, the global logistics market experienced fluctuating rates due to geopolitical events and demand shifts, with specialized oil and gas logistics facing particular volatility. For instance, the cost of shipping heavy machinery to remote exploration sites can be a substantial portion of a project's budget, making the choice of logistics provider critical.

- Dependence on Specialized Carriers: Hunt Oil's need for carriers capable of handling large, heavy equipment and hazardous materials for oil extraction and transport creates a dependence on a niche market.

- Infrastructure Bottlenecks: Limited access to ports, rail lines, or pipelines in operational areas can concentrate power among logistics providers controlling these key access points.

- Pricing Power of Logistics Providers: In 2024, reports indicated that specialized freight rates for the energy sector saw increases of up to 15-20% in certain regions due to supply chain pressures, directly affecting companies like Hunt.

- Service Limitations and Reliability: A shortage of reliable and experienced logistics partners in remote or challenging terrains can force Hunt to accept less favorable terms or face delays.

Environmental and Regulatory Compliance Services

The bargaining power of suppliers for environmental and regulatory compliance services is significant for Hunt Consolidated/Hunt Oil. As environmental standards become more stringent worldwide, specialized consultants are essential for navigating complex regulations, obtaining permits, and ensuring compliance. This reliance increases their leverage.

The demand for these services is growing, driven by evolving global environmental policies. For instance, the U.S. Environmental Protection Agency (EPA) continues to update regulations, requiring companies to invest more in compliance. In 2024, the market for environmental consulting services was estimated to be worth over $40 billion globally, indicating a substantial and growing need.

Key factors influencing supplier power include:

- Specialized Expertise: Firms offering niche environmental science, engineering, and legal expertise hold considerable sway due to the scarcity of such specialized knowledge.

- Regulatory Complexity: The intricate and ever-changing nature of environmental laws, such as those related to emissions, water quality, and waste management, makes specialized guidance indispensable.

- Limited Substitutes: For critical compliance tasks, there are few readily available substitutes for qualified environmental consulting firms.

- High Switching Costs: The process of changing compliance service providers can be time-consuming and costly, involving knowledge transfer and re-establishing relationships with regulatory bodies.

Hunt Oil's reliance on specialized equipment manufacturers, particularly for advanced drilling and seismic technology, grants these suppliers significant bargaining power. The scarcity of firms possessing proprietary expertise in these critical areas allows them to dictate higher prices, limiting Hunt Oil's negotiation leverage.

The energy sector's persistent demand for highly skilled professionals, like geologists and engineers, bolstered supplier power in 2024. A notable deficit in experienced individuals for deepwater drilling and complex reservoir management directly translated into higher compensation demands, increasing Hunt Oil's labor costs.

| Factor | Impact on Hunt Oil | 2024 Data/Trend |

| Specialized Equipment Scarcity | Increased costs for essential drilling tech | Limited suppliers for advanced seismic imaging |

| Skilled Labor Shortage | Higher wage demands for geologists/engineers | Robust demand for specialized energy talent |

| Logistics Infrastructure | Higher shipping rates in constrained regions | Specialized freight rates increased 15-20% in some areas |

| Regulatory Expertise | Increased reliance on environmental consultants | Global environmental consulting market > $40 billion |

What is included in the product

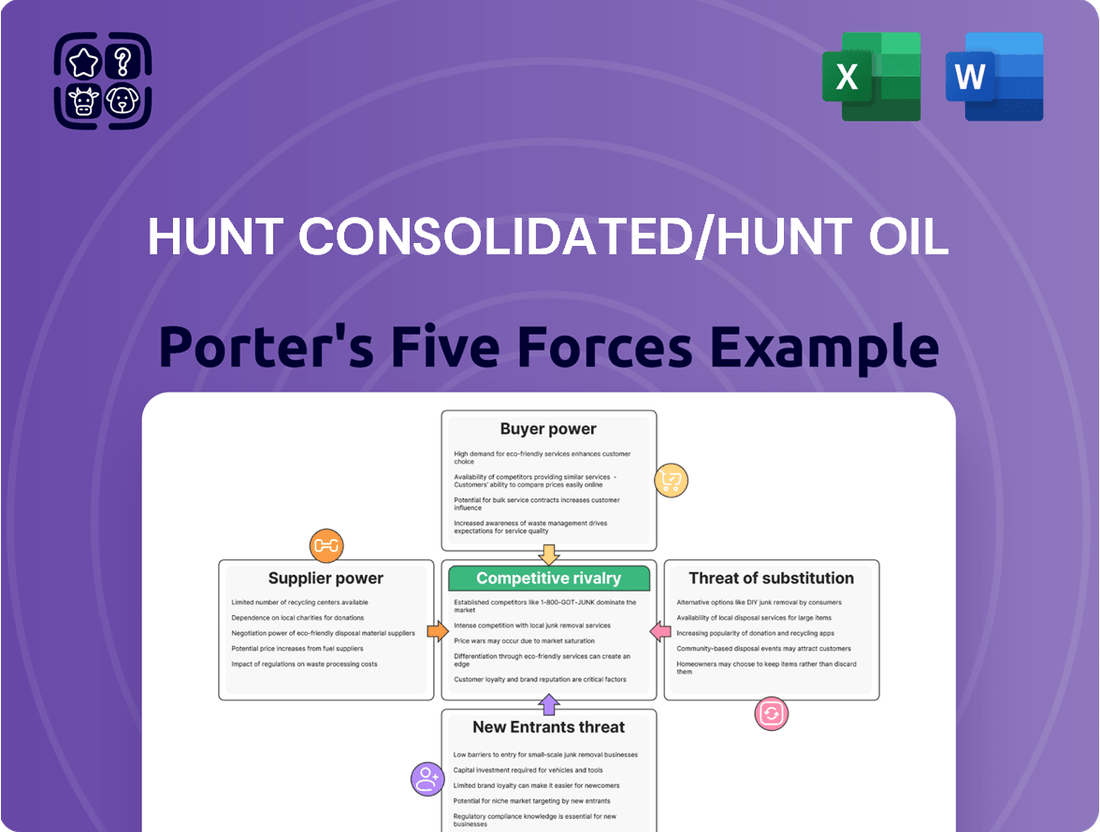

This analysis examines the competitive intensity for Hunt Consolidated/Hunt Oil by dissecting the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors in the energy sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Hunt Consolidated/Hunt Oil.

Customers Bargaining Power

The bargaining power of customers in the refining and petrochemical sector, particularly for Hunt Consolidated/Hunt Oil, is substantial. Large, integrated refining companies represent a concentrated customer base. These entities often possess the scale to purchase vast quantities of crude oil, giving them leverage.

These major refiners frequently have multiple sourcing options for their crude supply, both domestically and internationally. This ability to switch suppliers or tap into different markets, especially when global crude supplies are abundant, allows them to negotiate more favorable pricing. For instance, during periods of oversupply, as seen periodically in 2023 and early 2024, customers can exert significant downward pressure on prices.

The financial health and operational capacity of these refining giants are also key factors. Companies with high utilization rates and strong balance sheets are in a better position to demand better terms. Their ability to process different grades of crude oil also provides flexibility, reducing reliance on a single supplier's specific product.

Large industrial consumers, like power plants and manufacturers, wield significant bargaining power over natural gas utilities. Their ability to switch between suppliers or even alternative fuels, such as coal or renewables for power generation, gives them considerable leverage. This diversity in sourcing options, including liquefied natural gas (LNG) imports and gas from various domestic basins, allows them to negotiate for lower prices and more favorable contract conditions, putting pressure on utility margins.

In the global commodity markets, Hunt Consolidated's customers, particularly those in the energy sector, face pricing largely dictated by international benchmarks for crude oil and natural gas. This means individual buyers have limited direct power to negotiate prices lower than the prevailing market rate. For instance, in early 2024, Brent crude oil prices fluctuated significantly, often trading in the $80-$90 per barrel range, a reflection of global supply and demand forces rather than the leverage of any single customer.

However, the collective demand from a broad customer base significantly influences these global price discovery mechanisms. High aggregate demand can push prices up, while reduced consumption can lead to price decreases, indirectly demonstrating customer power. The sheer volume of consumption by industries and nations worldwide creates a powerful, albeit indirect, influence on the price of oil and gas that Hunt Consolidated sells.

Switching Costs for Customers

The bargaining power of customers in the oil and gas sector, specifically concerning Hunt Consolidated/Hunt Oil, is significantly influenced by switching costs. For many industrial and commercial clients, the effort and expense involved in changing suppliers can be substantial. This might include the cost of retooling equipment, renegotiating contracts, or even the disruption to operations that a supplier change could entail.

If these switching costs are low, customers possess greater leverage. They can readily shift their business to competitors offering more favorable pricing or better service terms, thereby pressuring Hunt Consolidated/Hunt Oil to remain competitive. Conversely, high switching costs act as a deterrent, effectively locking customers into their current relationships and diminishing their immediate bargaining power.

For instance, a large industrial user of natural gas might face significant upfront costs to adapt their combustion systems if they were to switch from one supplier to another, especially if the gas composition or delivery pressure differs. This financial and operational hurdle makes them less likely to switch unless the price differential is exceptionally large.

Consider the following factors influencing customer switching costs:

- Contractual Lock-ins: Long-term supply agreements often include penalties for early termination, creating a financial disincentive to switch.

- Equipment Compatibility: Industrial equipment may be calibrated for specific fuel types or delivery specifications, requiring costly modifications to accommodate a new supplier.

- Integration and Logistics: The complexity of integrating a new supplier into existing supply chains and logistics can be a significant barrier.

- Supplier Relationship and Reliability: Established relationships built on trust and consistent delivery can outweigh minor price differences for many customers.

Customer Price Sensitivity and Demand Elasticity

Hunt Consolidated's customers, particularly those in industries where energy is a substantial cost component like manufacturing or transportation, exhibit significant price sensitivity for crude oil and natural gas. This sensitivity directly translates into increased bargaining power.

The elasticity of demand for these commodities is a crucial factor. When demand is inelastic, meaning consumption doesn't change much with price fluctuations, suppliers like Hunt Consolidated generally have more leverage. However, for large industrial consumers, the ability to switch to alternative fuels or implement energy efficiency measures can introduce a degree of elasticity, thereby enhancing their power.

- Price Sensitivity: Industries with high energy expenditure, such as petrochemicals and heavy manufacturing, are acutely sensitive to oil and gas price changes, granting them greater negotiation leverage.

- Demand Elasticity: While core energy demand can be inelastic, factors like technological advancements in energy efficiency and the availability of substitutes can increase demand elasticity for specific customer segments.

- 2024 Market Data: In 2024, global crude oil prices, while fluctuating, remained a significant operational cost for many businesses, reinforcing customer focus on price stability and cost reduction strategies.

- Bargaining Power Impact: High price sensitivity and increasing demand elasticity empower customers to negotiate more favorable terms, potentially impacting Hunt Consolidated's profit margins.

The bargaining power of customers for Hunt Consolidated/Hunt Oil is considerable, primarily due to the concentrated nature of large buyers in the refining and petrochemical sectors. These entities, with their vast purchasing volumes and numerous sourcing options, can exert significant downward pressure on prices, especially during periods of ample global supply, such as observed in early 2024.

Customer price sensitivity and the potential for switching to alternative fuels or implementing efficiency measures also amplify their leverage. While contractual lock-ins and equipment compatibility can create switching costs, the overall ability of major consumers to seek better terms directly impacts supplier margins. For example, in 2024, industries heavily reliant on energy costs, like manufacturing, actively pursued price stability, leveraging market conditions to negotiate more favorable contracts.

| Customer Segment | Leverage Factors | Impact on Hunt Consolidated | 2024 Relevance |

|---|---|---|---|

| Large Refiners | High volume purchasing, multiple sourcing options | Ability to negotiate lower crude prices | Significant during periods of global oversupply |

| Industrial Consumers (e.g., Power Plants) | Ability to switch fuels, multiple gas suppliers (LNG, domestic) | Negotiate lower natural gas prices and favorable terms | Continual pressure on utility margins |

| End-Users (Manufacturing, Transportation) | Price sensitivity, potential for demand elasticity | Greater power to demand competitive pricing | Focus on cost reduction strategies amplified |

Preview Before You Purchase

Hunt Consolidated/Hunt Oil Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Hunt Consolidated/Hunt Oil, reflecting the exact document you will receive immediately after purchase. The document meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the oil and gas sector. This in-depth analysis provides actionable insights for strategic decision-making. You are looking at the actual document, which is fully formatted and ready for your use upon completion of your purchase.

Rivalry Among Competitors

The global oil and gas exploration and production (E&P) sector is characterized by a vast and diverse array of competitors. This includes colossal integrated oil giants, state-owned national oil companies, and a multitude of agile independent producers, such as Hunt Oil.

This sheer volume and variety of players, each possessing distinct cost structures and pursuing unique strategic aims, significantly escalates the intensity of competitive rivalry within the industry.

For instance, as of early 2024, the E&P landscape features hundreds of publicly traded companies, alongside numerous private entities and state-backed enterprises, all vying for access to resources and market share.

The presence of companies like Saudi Aramco, ExxonMobil, and Shell alongside smaller, specialized E&P firms creates a complex competitive dynamic, where innovation, efficiency, and resource access are paramount.

The oil and gas industry is characterized by its cyclical nature and varying growth rates across different segments and geographies. While upstream exploration and production can experience periods of high growth driven by demand and price surges, the overall market is often considered mature, especially in established regions. This maturity means that companies like Hunt Consolidated often face intensified rivalry as they compete for a finite amount of market share, leading to pressure on pricing and increased investment in efficiency and new technologies to maintain or grow their position.

Crude oil and natural gas are largely considered commoditized products, meaning they are largely undifferentiated from one supplier to another. This lack of unique product features means that competition within the industry, including for companies like Hunt Oil, heavily emphasizes factors like price, operational efficiency, and the reliability of supply chains. Buyers, such as refineries and industrial consumers, face minimal barriers when switching between suppliers, further intensifying this price-driven rivalry.

In 2024, the global oil market experienced significant price volatility, with Brent crude futures averaging around $83 per barrel for the year, reflecting ongoing supply and demand dynamics. This price sensitivity underscores the importance of cost management and efficient production for companies like Hunt Oil. The ease with which large industrial consumers can shift their purchasing from one oil producer to another, assuming comparable quality, means that even minor price advantages can lead to significant shifts in market share.

Exit Barriers and Industry Overcapacity

The oil and gas industry presents significant exit barriers for companies like Hunt Consolidated. Specialized, high-value assets, such as offshore platforms and refineries, are difficult and costly to repurpose or sell, effectively trapping capital. Furthermore, long-term supply contracts and the substantial expenses associated with decommissioning aging infrastructure, including well plugging and site remediation, further discourage premature exit.

These high exit barriers contribute to persistent industry overcapacity. Companies often continue to operate and produce even when prices are low to cover at least variable costs and avoid immediate write-offs of their fixed assets. This dynamic intensifies competitive rivalry as firms fight for market share, often leading to price wars.

- Specialized Assets: Oil and gas extraction and processing equipment are highly specific, with limited alternative uses, making them difficult to divest.

- Long-Term Contracts: Existing agreements for supply or transportation can obligate companies to continue operations, even in unfavorable market conditions.

- Decommissioning Costs: The expense of safely shutting down and restoring sites post-operation can run into hundreds of millions of dollars per facility. For instance, decommissioning a single offshore platform can cost upwards of $100 million.

- Overcapacity Impact: In 2023, global oil production capacity often exceeded demand, contributing to price volatility and reinforcing the competitive pressure to maintain output.

Strategic Stakes and Aggressiveness of Competitors

The strategic importance of the oil and gas sector significantly fuels competitive rivalry for Hunt Consolidated/Hunt Oil. Integrated majors and national oil companies often view exploration and production not just as a profit center but as crucial for energy security and geopolitical leverage. This can lead to aggressive bidding for exploration rights and a willingness to sustain operations even during periods of low commodity prices.

For instance, in 2024, major national oil companies continued to invest heavily in upstream projects, sometimes prioritizing long-term resource acquisition over immediate returns. This strategic focus means that competitors might engage in sustained rivalry, aiming to capture market share and secure future production capacity, even if it means lower short-term profitability.

- Strategic Importance: For national oil companies and integrated majors, controlling oil and gas assets is vital for energy independence and global influence, driving aggressive competition.

- Market Share vs. Profitability: Some competitors may prioritize gaining or maintaining market share and securing long-term reserves over maximizing short-term profits.

- Geopolitical Influence: Geopolitical considerations can lead to increased investment and competitive intensity in regions deemed strategically important.

- Sustained Rivalry: The long-term nature of oil and gas projects means that aggressive competitive behavior can be sustained over extended periods, impacting Hunt Consolidated/Hunt Oil.

The competitive rivalry within the oil and gas sector is intense due to the sheer number of players, ranging from global giants to independent producers like Hunt Oil. This broad spectrum of participants, each with unique cost structures and strategies, fuels fierce competition for resources and market share.

The commoditized nature of oil and gas means competition is heavily driven by price and operational efficiency, as buyers can easily switch suppliers. For example, in 2024, Brent crude averaged around $83 per barrel, highlighting the constant pressure on producers to manage costs effectively to remain competitive.

High exit barriers, such as specialized assets and significant decommissioning costs, contribute to overcapacity. This often forces companies to maintain production even in low-price environments, intensifying rivalry as firms fight for market position.

The strategic importance of energy security for national oil companies and integrated majors also plays a role, leading to aggressive competition for exploration rights and a willingness to prioritize long-term resource acquisition over immediate profits, as seen in continued upstream investments by state-owned enterprises in 2024.

| Competitor Type | Key Characteristic | Impact on Rivalry |

| Integrated Majors (e.g., ExxonMobil, Shell) | Global reach, diversified operations, significant capital reserves | High investment capacity, ability to weather price downturns, extensive market presence |

| National Oil Companies (e.g., Saudi Aramco) | State-backed, often prioritized for national energy security, significant resource control | Strategic long-term focus, potential for aggressive market share pursuit, influence on global supply |

| Independent Producers (e.g., Hunt Oil) | Focus on E&P, often more agile, varying sizes and capabilities | Innovation-driven, cost-efficiency focused, can specialize in niche markets or technologies |

SSubstitutes Threaten

The increasing viability and adoption of renewable energy sources like solar, wind, and hydro present a significant threat to Hunt Consolidated's traditional fossil fuel business, particularly natural gas and fuel oil. As of early 2024, the global renewable energy sector continues its rapid expansion, driven by technological advancements and falling costs. For instance, the International Energy Agency reported that solar PV capacity additions alone are expected to reach record levels in 2024, significantly impacting electricity generation markets previously dominated by fossil fuels.

This shift is directly challenging the demand for Hunt's core products. The declining levelized cost of electricity (LCOE) for solar and wind power, which in many regions is now competitive with or cheaper than new natural gas power plants, makes renewables a compelling alternative for power producers. This trend is projected to continue, further eroding the market share for fossil fuels in electricity generation. The long-term implications for Hunt are substantial as energy markets transition towards cleaner, more sustainable sources.

The accelerating shift to electric vehicles (EVs) and the development of alternative fuels like hydrogen and biofuels present a substantial threat to traditional oil demand. By late 2024, global EV sales are projected to surpass 15 million units annually, directly curtailing the need for refined petroleum products in the transportation sector. This transition impacts Hunt Consolidated's core business by reducing future demand for crude oil, its primary commodity.

The increasing adoption of energy efficiency and conservation measures presents a significant threat of substitutes for Hunt Consolidated/Hunt Oil. Widespread implementation of improved insulation, more efficient appliances, and smart energy management systems directly reduces overall energy demand across residential, commercial, and industrial sectors. For instance, the U.S. Department of Energy reported that by 2023, energy efficiency measures alone accounted for nearly 40% of the nation's total energy savings.

Battery Storage and Grid Modernization

Advancements in battery storage and grid modernization are significantly bolstering the integration of renewable energy sources like solar and wind. This makes them more reliable alternatives to traditional fossil fuels, thereby increasing the threat of substitution for companies like Hunt Consolidated, which have significant fossil fuel operations.

By improving the stability and dispatchability of renewables, these technological shifts directly challenge the market position of fossil fuel-based power generation. For instance, by mid-2024, global battery storage capacity is projected to reach over 300 GW, a substantial increase that enhances the viability of renewable energy portfolios.

- Enhanced Renewable Integration: Battery storage smooths out the intermittent nature of renewables, making them a more consistent power source.

- Grid Modernization: Smart grid technologies improve the efficiency and reliability of electricity distribution, facilitating greater renewable penetration.

- Cost Competitiveness: Falling battery costs, projected to decrease by another 10-15% by the end of 2024, make renewable-plus-storage solutions increasingly cost-effective against fossil fuels.

- Policy Support: Government incentives and mandates for clean energy further accelerate the adoption of these substitute technologies.

Policy and Regulatory Support for Decarbonization

The increasing global commitment to decarbonization significantly amplifies the threat of substitutes for Hunt Oil. Governments worldwide are implementing policies and regulations aimed at reducing carbon emissions, directly impacting fossil fuel demand. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, driving demand for renewable energy sources and electric vehicles.

Carbon pricing mechanisms, such as carbon taxes and emissions trading systems, are becoming more widespread. In 2024, the World Bank reported that 73 national and 16 subnational jurisdictions have implemented carbon pricing, covering about 23% of global emissions. These financial disincentives make fossil fuels less competitive, further encouraging the adoption of cleaner alternatives like solar, wind, and hydrogen power.

- Global Decarbonization Push: Governments are enacting policies to reduce carbon footprints.

- Carbon Pricing Impact: Mechanisms like carbon taxes increase the cost of fossil fuels.

- Renewable Energy Growth: The adoption of solar and wind power is accelerating due to these policies.

- Regulatory Acceleration: Environmental regulations are pushing industries towards cleaner energy alternatives.

The rise of renewable energy sources, coupled with advancements in energy efficiency and electric vehicles, presents a substantial threat of substitutes to Hunt Consolidated's traditional fossil fuel business. As of early 2024, renewable energy adoption is accelerating globally, driven by falling costs and supportive policies. For instance, the International Energy Agency noted that solar PV capacity additions were set for record levels in 2024, directly impacting electricity generation markets. Furthermore, the increasing adoption of electric vehicles, projected to exceed 15 million units annually by late 2024, directly curtails the demand for refined petroleum products in transportation.

| Substitute Technology | Impact on Hunt Consolidated | Key Data Point (Early 2024) |

|---|---|---|

| Renewable Energy (Solar, Wind) | Reduces demand for natural gas and fuel oil in power generation. | Global solar PV capacity additions projected for record levels in 2024. |

| Electric Vehicles (EVs) | Decreases demand for crude oil in the transportation sector. | Global EV sales projected to surpass 15 million units annually by late 2024. |

| Energy Efficiency Measures | Lowers overall energy consumption across sectors. | U.S. energy efficiency measures accounted for nearly 40% of total energy savings by 2023. |

Entrants Threaten

The oil and gas industry, including companies like Hunt Oil, presents a formidable barrier to new entrants due to exceptionally high capital requirements. Initiating exploration and production demands substantial upfront investment in seismic surveys, drilling rigs, and essential infrastructure like pipelines and processing facilities. For instance, a single offshore oil platform can cost billions of dollars to construct and deploy, a figure far beyond the reach of most new players.

These prohibitive costs, coupled with the inherent risks and long lead times for return on investment, effectively deter many potential competitors. The sheer scale of financial commitment needed to establish a meaningful presence in the sector means that only well-capitalized entities can realistically consider entering. This financial hurdle significantly reduces the threat of new entrants for established players like Hunt Oil.

The difficulty in acquiring access to commercially viable oil and gas reserves presents a significant barrier to entry. These reserves are often tightly controlled by national oil companies or deeply entrenched established players, making it challenging for newcomers to secure acreage. Complex bidding processes and the high upfront costs associated with exploration rights further exacerbate this challenge.

Securing exploration and production rights in promising basins is a major hurdle for any new entrant. For instance, in 2024, the average cost for a seismic survey alone can run into millions of dollars, not to mention the substantial investment needed for drilling and development. Many prime areas are already licensed, leaving less attractive or more technically demanding regions for new companies to pursue.

The oil and gas industry, including companies like Hunt Oil, demands highly specialized technological knowledge across critical areas such as geology, geophysics, drilling engineering, and reservoir management. New entrants must invest heavily in acquiring or developing this deep expertise to even begin competing effectively.

Building and maintaining a workforce proficient in these complex fields is a significant hurdle. For instance, the demand for experienced petroleum engineers remains high, with the U.S. Bureau of Labor Statistics projecting a 10% growth for petroleum, chemical, and materials engineers between 2022 and 2032, indicating a competitive talent market.

The substantial cost and time required to cultivate this specialized talent, coupled with the ongoing need for continuous technological advancement, create a formidable barrier. Companies lacking established R&D capabilities and a proven track record in innovation face immense challenges in attracting and retaining the necessary personnel.

Regulatory Hurdles and Environmental Compliance

The oil and gas sector faces significant regulatory hurdles that act as a substantial barrier to entry. Navigating the complex web of global regulations, which include rigorous environmental impact assessments, extensive permitting processes, and stringent safety standards, demands considerable expertise and financial resources. For instance, the U.S. Environmental Protection Agency (EPA) mandates various compliance measures for oil and gas operations, with significant penalties for non-adherence. These compliance costs can easily run into millions of dollars for new projects, effectively deterring smaller or less capitalized new entrants.

These regulatory complexities translate into tangible costs and time delays. New companies must invest heavily in legal counsel, environmental consultants, and specialized personnel to ensure adherence to evolving standards. For example, the time taken for obtaining permits can extend for years, significantly impacting the return on investment timeline for new ventures. This protracted process, coupled with the risk of unforeseen regulatory changes, creates a challenging environment for potential new players looking to enter the market.

- High Capital Requirements: Environmental compliance and safety standards often necessitate substantial upfront investment in specialized equipment and infrastructure, presenting a significant financial barrier.

- Extended Permitting Times: The process of securing necessary permits for exploration, drilling, and production can be lengthy, often taking several years, which delays revenue generation and increases project risk.

- Evolving Regulatory Landscape: Governments worldwide are continuously updating environmental regulations, such as those concerning methane emissions and water usage, requiring ongoing adaptation and investment from operators.

- Global Variation in Standards: Companies operating internationally must contend with diverse and sometimes conflicting regulatory frameworks across different jurisdictions, adding layers of complexity and cost.

Established Infrastructure and Distribution Channels

Hunt Consolidated, like other major players in the oil and gas sector, benefits from significant barriers to entry due to its established infrastructure. Building out a comparable network of pipelines, refineries, and export terminals is incredibly capital-intensive. For instance, the cost of constructing a new major oil pipeline can easily run into billions of dollars, a hurdle that deters many potential new entrants.

The existing distribution channels are deeply entrenched, offering established companies like Hunt Oil a significant competitive advantage. Newcomers would struggle to secure the necessary rights-of-way for pipelines or gain access to scarce refining capacity and prime export terminal locations. This creates a formidable obstacle, making it difficult for smaller or newer companies to compete effectively on scale and reach.

- Capital Expenditure: Building new, large-scale oil and gas infrastructure, such as refineries, can cost tens of billions of dollars. For example, the Baytown refinery complex in Texas, one of the largest in the US, represents a massive investment.

- Regulatory Hurdles: Securing permits and approvals for new pipeline construction or major facility upgrades is a lengthy and complex process, often involving multiple government agencies and facing public scrutiny, adding significant time and cost.

- Economies of Scale: Existing, integrated infrastructure allows companies like Hunt Oil to achieve economies of scale in processing and transportation, lowering per-unit costs and making it difficult for new entrants without similar scale to match pricing.

- Access to Existing Networks: New entrants would need to either build their own, costly infrastructure or negotiate access to existing networks, which established players are often reluctant to grant, further solidifying incumbents' positions.

The threat of new entrants for Hunt Consolidated/Hunt Oil is significantly low due to the immense capital required to enter the oil and gas industry. Establishing operations necessitates massive investments in exploration, drilling, and infrastructure, with single offshore platforms costing billions. For instance, in 2024, the cost of seismic surveys alone can reach millions, deterring smaller players. These financial barriers, along with the long payback periods and inherent risks, effectively limit the pool of potential new competitors.

Porter's Five Forces Analysis Data Sources

Our Hunt Consolidated/Hunt Oil Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, investor relations materials, and industry-specific market research reports.

We also leverage insights from regulatory filings, news archives, and expert commentary to provide a comprehensive understanding of the competitive landscape.