Hunt Consolidated/Hunt Oil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Uncover the intricate web of external factors shaping Hunt Consolidated/Hunt Oil's destiny. From evolving geopolitical landscapes impacting exploration to economic shifts influencing energy demand, this PESTLE analysis provides a critical lens. Understand the technological advancements driving efficiency and the social pressures demanding sustainability. Download the full version to equip yourself with the strategic foresight needed to navigate this dynamic industry.

Political factors

Government policies significantly shape the oil and gas industry, influencing everything from energy transition initiatives to the issuance of drilling permits and environmental compliance. Hunt Oil's extensive global footprint means it navigates a diverse array of political environments, directly impacting its ability to secure exploration rights, manage production levels, and control operational expenditures.

Shifts in political leadership, like those anticipated after the 2024 US elections, can introduce substantial changes to energy policy. These alterations can directly affect Hunt Oil's investment decisions and strategic planning within the United States, potentially altering the landscape for domestic exploration and production.

Global geopolitical tensions significantly impact oil and gas supply chains and prices, directly affecting Hunt Oil's profitability. For instance, in early 2024, the ongoing conflict in the Middle East led to increased oil prices, with Brent crude futures trading around $80 per barrel, reflecting supply concerns.

Ongoing conflicts, such as the Russia-Ukraine war, continue to disrupt energy trade flows and contribute to price volatility. This instability can lead to unexpected price swings, making it challenging for companies like Hunt Oil to forecast revenue and manage operational costs effectively.

Hunt Oil's international exploration and production activities are particularly vulnerable to political instability in host countries. For example, in 2023, political unrest in parts of Africa led to temporary shutdowns of operations for some energy firms, highlighting the risks to assets and personnel in politically sensitive regions.

International trade policies, including tariffs and sanctions, significantly influence Hunt Oil's market access and operational costs. For instance, ongoing geopolitical tensions and evolving trade agreements, particularly those involving major oil-producing nations, can directly impact global energy supply and demand. In 2024, the International Monetary Fund (IMF) projected that trade restrictions could slow global economic growth, a factor that would naturally affect energy demand and pricing for companies like Hunt Oil.

US tariffs and sanctions on specific oil-producing countries, a recurring theme in recent years, continue to reshape global energy dynamics. These measures can create complex operational environments, potentially restricting market access in some regions while opening up new avenues in others. Hunt Oil's diversified global footprint allows for some adaptability, but navigating these fluctuating trade landscapes remains a key strategic consideration.

Nationalization and Resource Control

Some nations are increasingly emphasizing nationalization, a move designed to bolster local dominion over valuable natural resources and employment. This growing trend can directly influence Hunt Oil's operational flexibility, potentially necessitating more robust local collaborations or affecting the repatriation of profits earned within those borders. For instance, in 2024, several African nations continued to review or revise their upstream oil and gas contracts, seeking greater state equity and control.

Navigating these sovereign interests is a critical challenge for energy companies like Hunt Oil. They must balance their global business objectives with the national economic and political agendas of host countries. This often involves adapting business models to incorporate national oil companies as partners or accepting stricter regulations. The global push for energy security and economic self-sufficiency has intensified these nationalistic sentiments in resource-rich regions throughout 2024 and into 2025.

- Increased State Participation: Many countries are pushing for higher stakes for their national oil companies in joint ventures, impacting foreign investor ownership percentages.

- Profit Repatriation Restrictions: Some governments are tightening rules on how much profit can be sent back to the parent company, affecting financial planning.

- Local Content Requirements: Stricter mandates for using local labor, services, and materials are becoming more common, requiring operational adjustments.

- Contract Renegotiations: Existing production sharing agreements are frequently reviewed by host governments to secure more favorable terms for the state.

International Climate Agreements

International climate agreements, such as the Paris Agreement, set ambitious targets for reducing greenhouse gas emissions globally. These accords encourage nations to implement policies that favor renewable energy sources and disincentivize fossil fuel reliance, directly impacting companies like Hunt Oil. For instance, the United Nations Climate Change Conference (COP28) in late 2023 saw a significant agreement to begin transitioning away from fossil fuels, a move that will shape regulatory landscapes for years to come.

National commitments stemming from these international frameworks can manifest as carbon taxes, emissions trading schemes, or mandates for cleaner fuel standards. Hunt Oil must navigate these evolving regulations, which may increase operational costs or necessitate investment in carbon capture technologies. The International Energy Agency’s (IEA) projections indicate continued growth in renewable energy capacity, suggesting a challenging long-term outlook for traditional oil and gas producers facing these policy shifts.

- Global Emission Reduction Targets: Many nations have pledged to achieve net-zero emissions by mid-century, influencing energy policy.

- Carbon Pricing Mechanisms: The increasing adoption of carbon taxes and emissions trading systems globally raises the cost of fossil fuel production.

- Renewable Energy Subsidies: Government incentives for solar, wind, and other clean energy sources accelerate the transition away from oil and gas.

- IEA Forecasts: The IEA anticipates significant growth in renewables, potentially displacing demand for traditional fuels.

Political stability and government policies are paramount for Hunt Oil's operations, influencing everything from exploration permits to environmental regulations. The company's global presence means it must adeptly manage diverse political landscapes, impacting its ability to secure rights and control costs.

Geopolitical events, such as conflicts and trade disputes, directly affect oil prices and supply chains, influencing Hunt Oil's profitability. For example, in early 2024, Middle Eastern tensions pushed Brent crude futures to around $80 per barrel, highlighting the impact of global instability.

Nationalistic policies, where countries seek greater control over their natural resources, can affect Hunt Oil's operational flexibility and profit repatriation. In 2024, many African nations were reviewing upstream contracts to increase state equity, a trend that requires careful partnership management.

International climate agreements, like the Paris Agreement, are driving a global shift towards renewables, potentially impacting the long-term demand for fossil fuels. COP28 in late 2023 marked a significant step towards transitioning away from fossil fuels, influencing future regulatory environments.

What is included in the product

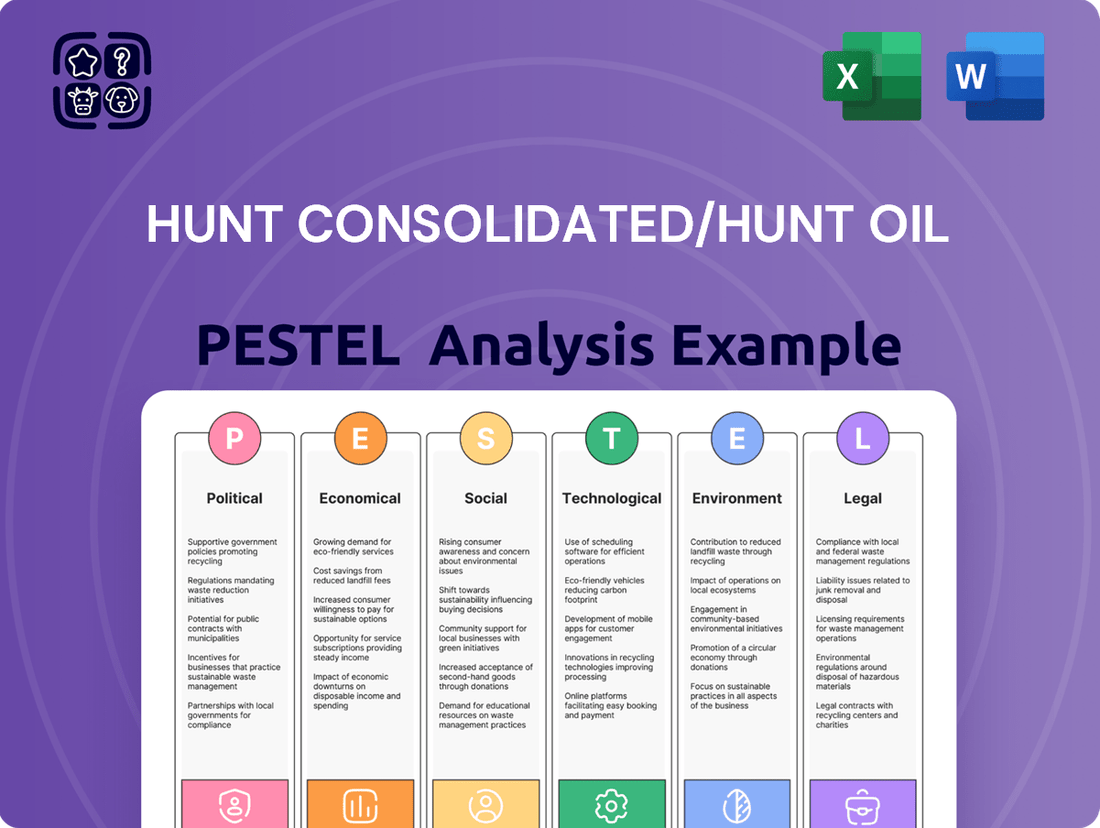

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hunt Consolidated/Hunt Oil, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It aims to equip stakeholders with a clear understanding of the dynamic landscape, highlighting potential threats and strategic opportunities for informed decision-making.

This PESTLE analysis for Hunt Consolidated/Hunt Oil offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during strategic meetings and simplifying complex market dynamics for all stakeholders.

Economic factors

Global oil and gas prices are a critical economic factor for Hunt Oil, given its core business relies heavily on these volatile commodities. The company's revenue and profitability are directly tied to the price of crude oil and natural gas.

Looking ahead, projections suggest an oversupply in the global oil market extending through 2026. This is anticipated due to rising production from nations outside the OPEC+ alliance and a plateau in demand from China.

This potential oversupply environment could exert downward pressure on oil and gas prices, directly impacting Hunt Oil's earnings. For instance, a sustained drop in Brent crude prices from an average of $82.76 per barrel in 2023 to, say, $70 per barrel in 2025 would significantly alter revenue forecasts.

Such price volatility necessitates careful strategic planning by Hunt Oil, influencing decisions regarding exploration investments, production levels, and capital expenditures. The ability to adapt to these fluctuating market conditions is paramount for sustained success.

Global economic expansion is a primary driver of energy consumption, directly impacting Hunt Consolidated's varied business interests. As economies grow, so does the need for power across industries and households, creating opportunities for energy providers.

While the overall demand for energy is on an upward trajectory, especially for electricity, the growth anticipated for conventional fuels like oil is expected to be more measured. This signals a changing energy landscape that Hunt Consolidated must navigate.

For instance, projections from the International Energy Agency (IEA) in their 2024 outlook suggest that while global energy demand will increase, the pace of growth for oil might be tempered by efficiency gains and the increasing adoption of alternative sources.

A deceleration in global industrial output, a potential outcome of geopolitical instability or economic downturns, could significantly curb energy demand. Similarly, a faster-than-anticipated shift by consumers towards electric vehicles, driven by policy or technology advancements, would directly affect the long-term demand for oil and, consequently, Hunt Oil's market position.

Hunt Consolidated's substantial real estate portfolio is directly influenced by national and regional market trends. For instance, the company's ambitious $5 billion development project in downtown Dallas highlights a significant bet on urban revitalization and growth.

The success of these real estate ventures, including residential, commercial, and retail spaces, hinges on robust market demand. In 2024, metropolitan areas like Dallas saw continued population influx, driving demand for housing and commercial properties, though rising interest rates in late 2024 presented a headwind for some segments.

Nationally, the US housing market in early 2025 shows signs of stabilization after a period of volatility. Median home prices, while still elevated from pre-pandemic levels, are experiencing more moderate year-over-year growth, reflecting a balance between persistent demand and affordability challenges.

Power Sector Investment Landscape

The power generation segment within Hunt Consolidated operates within a dynamic energy landscape. The ongoing transition towards renewable energy sources is a significant trend, driving substantial investment and technological advancements in this area. This shift presents both challenges and opportunities for established players.

Despite the rapid growth in clean energy capacity, a notable paradox emerged in 2024: power sector carbon dioxide emissions reached their highest point ever. This surge was primarily attributed to a substantial increase in overall electricity demand, underscoring the ongoing reliance on existing, higher-emission generation sources to meet immediate needs.

This environment creates a dual investment landscape. Opportunities abound in expanding renewable power generation, including solar, wind, and battery storage, to meet future demand sustainably. Simultaneously, strategic investments may still be warranted in traditional power generation assets to ensure grid stability and meet current, elevated demand, necessitating careful capital allocation.

- Renewable Energy Growth: Global renewable energy capacity additions are projected to reach approximately 500 GW in 2024, a record high.

- Emissions Paradox: Despite renewable growth, global power sector CO2 emissions are estimated to have increased by around 1.5% in 2024, reaching an all-time peak.

- Investment Needs: The International Energy Agency (IEA) forecasts that annual clean energy investment needs to triple by 2030 to align with net-zero goals.

- Grid Modernization: Significant investment is required in grid infrastructure to integrate variable renewable sources effectively.

Inflation and Interest Rates

Inflationary pressures and rising interest rates present a significant challenge for Hunt Consolidated, impacting its diverse portfolio. For instance, the US annual inflation rate was 3.4% in April 2024, a slight decrease from 3.5% in March, but still a concern for managing operational expenses across oil exploration, real estate development, and power generation.

Higher interest rates directly increase the cost of capital. For a company like Hunt Consolidated, which often finances large-scale projects, this means borrowing becomes more expensive. For example, if a new oil exploration project requires $1 billion in funding, a 1% increase in interest rates could add $10 million annually to financing costs.

This heightened cost of capital can compress profit margins and reduce the overall attractiveness of new investments. Hunt Consolidated must carefully consider these increased financing costs when evaluating the viability and potential returns of future projects in its energy, infrastructure, and real estate divisions.

- Inflation Rate: US annual inflation stood at 3.4% in April 2024.

- Cost of Capital Impact: Rising interest rates make debt financing for new projects significantly more expensive.

- Project Viability: Higher financing costs can negatively affect the projected returns on investment for Hunt Consolidated's energy and real estate ventures.

- Operational Costs: Increased inflation directly translates to higher day-to-day operating expenses across all business segments.

Economic factors significantly shape Hunt Consolidated's diverse operations, from volatile oil prices to broader economic growth. Projections indicate a potential oversupply in oil through 2026, which could depress prices, impacting Hunt Oil's revenue. Conversely, global economic expansion fuels energy demand, benefiting Hunt Consolidated's power generation and real estate arms, although the growth of conventional fuels is expected to moderate.

Inflation and rising interest rates, with US inflation at 3.4% in April 2024, directly increase Hunt Consolidated's cost of capital, affecting project financing across its energy and real estate ventures. This necessitates careful financial planning to manage higher operational expenses and ensure investment viability.

| Factor | 2024/2025 Projection/Data | Impact on Hunt Consolidated |

|---|---|---|

| Global Oil Prices | Potential oversupply through 2026, Brent crude ~$70-80/barrel range | Downward pressure on Hunt Oil's revenue and profitability |

| Global Economic Growth | Continued, but measured growth in energy demand, especially electricity | Opportunities for power generation, tempered growth for conventional fuels |

| Inflation Rate (US) | 3.4% (April 2024) | Increased operational costs and higher cost of capital for new projects |

| Interest Rates | Elevated, impacting borrowing costs | Reduced project viability and potential compression of profit margins |

Full Version Awaits

Hunt Consolidated/Hunt Oil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Hunt Consolidated/Hunt Oil delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and operational challenges. Understand the strategic implications of these external forces for Hunt Consolidated/Hunt Oil's future success.

Sociological factors

Public sentiment increasingly scrutinizes the energy sector, with a growing emphasis on Environmental, Social, and Governance (ESG) performance. This trend directly impacts Hunt Consolidated, as stakeholders, including investors and potential employees, are evaluating companies based on their social responsibility, sustainability initiatives, and ethical conduct. For instance, a 2024 survey by PwC revealed that 77% of investors consider ESG factors material to their investment decisions. Consequently, Hunt Consolidated must actively showcase its commitment to these principles to maintain its investment attractiveness and secure top talent.

Hunt Consolidated's diverse operations, including significant ventures in oil and gas exploration and large-scale real estate development, directly shape the fabric of local communities. Their activities in these sectors necessitate careful consideration of community well-being and local economic dynamics.

Maintaining a social license to operate hinges on robust community engagement. This means proactively addressing resident concerns regarding environmental stewardship, responsible land use, and the creation of sustainable employment opportunities. For instance, in 2024, Hunt Oil's projects in regions like the Permian Basin faced increased scrutiny regarding water usage and local infrastructure strain, highlighting the need for transparent communication and tangible benefits for host communities.

Effective engagement can mitigate potential conflicts and foster positive relationships. In 2025, Hunt Realty's expansion projects are being evaluated for their integration with existing community plans, aiming to balance development with preserving local character and providing accessible amenities. Successful integration often involves partnerships with local organizations and direct investment in community projects, demonstrating a commitment beyond immediate business interests.

The energy industry, including oil and gas, is undergoing a significant generational transition. In 2024, it's estimated that a substantial portion of the experienced workforce, particularly in skilled trades, is approaching retirement age. This trend directly impacts companies like Hunt Consolidated by creating a pronounced need for new talent.

Hunt Oil, like many in the sector, faces the challenge of filling these roles. Projections for 2025 indicate an increasing demand for workers proficient in digital operations and emerging technologies. Therefore, a strategic focus on attracting and developing younger talent, alongside upskilling existing employees, becomes critical for maintaining operational efficiency and innovation.

Energy Transition and Consumer Preferences

Societal shifts towards sustainability are significantly reshaping energy consumption. Consumers increasingly favor cleaner energy options and electric vehicles, directly influencing the long-term demand for conventional oil and gas products. This trend is evident in the growing market share of EVs; for instance, global EV sales were projected to reach over 13 million units in 2024, a substantial increase from previous years, indicating a clear consumer preference shift.

Hunt Consolidated's strategic diversification is crucial in navigating these evolving market dynamics. By investing in power generation and exploring low-carbon solutions, the company is positioning itself to meet the changing demands of consumers and the broader energy market. This proactive approach allows Hunt Consolidated to adapt rather than merely react to shifts in consumer preferences.

- Consumer Demand Shift: Growing preference for EVs and renewable energy sources directly impacts demand for traditional fossil fuels.

- Market Adaptation: Hunt Consolidated's investments in power and low-carbon technologies facilitate adaptation to new market conditions.

- Sustainability Focus: Increased environmental awareness drives consumer choices towards sustainable energy solutions.

- Regulatory Influence: Government policies and incentives supporting clean energy further accelerate this transition.

Health and Safety Standards

Societal expectations demand robust health and safety standards in the oil and gas sector, a critical area for Hunt Oil. This includes protecting employees and surrounding communities from operational hazards, a non-negotiable aspect of responsible business conduct.

Hunt Oil's commitment to safety directly impacts its public perception and operational license. Recent industry data from the International Association of Oil & Gas Producers (IOGP) for 2024 indicates a continued focus on reducing incidents, with a 5% year-over-year decrease in recordable injuries reported across major global operators. This trend underscores the growing societal pressure for demonstrable safety improvements.

Adherence to and advancement of safety protocols are paramount for Hunt Oil's reputation and sustainability. This focus is not just about regulatory compliance but also about fostering trust with stakeholders and ensuring long-term operational viability. The company's investment in advanced safety training and technology, such as real-time monitoring systems, reflects these societal demands.

- Societal Pressure: Growing public demand for zero-harm operations in the energy sector.

- Reputational Risk: Safety lapses can severely damage public trust and brand image.

- Operational Continuity: Stringent safety measures prevent disruptions and ensure uninterrupted production.

- Employee Well-being: Protecting the workforce is a fundamental ethical and operational imperative.

Societal expectations regarding corporate responsibility are increasingly influencing business operations, particularly in resource-intensive industries like energy. Hunt Consolidated must actively demonstrate its commitment to ethical practices, community well-being, and environmental stewardship to maintain its social license to operate. This includes transparent communication about impacts and tangible benefits provided to host communities, especially as projects like those in the Permian Basin in 2024 faced heightened scrutiny regarding water usage and infrastructure strain.

The generational shift in the workforce presents both challenges and opportunities for Hunt Consolidated, as a significant portion of skilled labor nears retirement. By 2025, there will be a greater demand for digitally proficient workers, making talent acquisition and development crucial for maintaining operational efficiency and fostering innovation within Hunt Oil.

Consumer preferences are rapidly shifting towards sustainable energy solutions, with electric vehicle adoption accelerating globally; over 13 million EVs were projected to be sold in 2024 alone. Hunt Consolidated's strategic diversification into power generation and low-carbon technologies is a direct response to this trend, ensuring its relevance in an evolving energy landscape and meeting changing consumer demands.

The demand for stringent health and safety standards in the oil and gas sector is a paramount societal expectation. Hunt Oil's focus on robust safety protocols, evidenced by a 5% year-over-year decrease in recordable injuries reported by major global operators in 2024 according to IOGP data, is critical for maintaining public trust and ensuring operational continuity.

| Sociological Factor | Impact on Hunt Consolidated | Key Data/Trend (2024-2025) | Actionable Insight |

|---|---|---|---|

| Public Sentiment on ESG | Influences investor decisions and talent acquisition. | 77% of investors consider ESG material (PwC, 2024). | Enhance ESG reporting and initiatives. |

| Generational Workforce Shift | Creates talent gaps and demand for new skills. | Significant retirement of experienced workers; demand for digital skills projected for 2025. | Focus on recruitment and upskilling for digital roles. |

| Consumer Preference for Sustainability | Drives demand for cleaner energy options. | Global EV sales projected over 13 million units in 2024. | Continue diversification into low-carbon solutions. |

| Health and Safety Expectations | Impacts reputation and operational license. | 5% year-over-year decrease in recordable injuries (IOGP, 2024). | Maintain and advance leading safety practices. |

Technological factors

Digital transformation, encompassing automation, the Internet of Things (IoT), big data analytics, and artificial intelligence (AI), is fundamentally altering the oil and gas sector, leading to significant efficiency gains and cost savings. For instance, by 2024, the global oil and gas automation market was projected to reach over $30 billion, indicating substantial investment in these areas.

Hunt Oil can strategically deploy these advanced technologies to enhance its operations. Real-time monitoring of wells and equipment, facilitated by IoT sensors, can provide immediate insights, while AI-powered predictive maintenance can anticipate potential failures, minimizing downtime. This data-driven approach supports more informed decisions throughout the exploration, drilling, and production lifecycle.

The adoption of AI in oil and gas is expected to boost productivity by up to 15% in certain applications, according to industry reports from late 2023 and early 2024. By integrating these digital tools, Hunt Oil can optimize resource allocation, improve safety protocols, and ultimately enhance its competitive edge in a rapidly evolving market.

Innovations in energy extraction are continuously reshaping the oil and gas landscape. Advanced drilling techniques, like horizontal drilling and hydraulic fracturing, have become standard, allowing access to previously uneconomical reserves. Enhanced Oil Recovery (EOR) methods, such as CO2 injection and thermal recovery, are crucial for maximizing output from mature fields, with global EOR deployment expected to add millions of barrels per day to production by 2030.

Hunt Oil's strategic investment in licensed Organic Oil Recovery (OOR) technology underscores its proactive approach to leveraging cutting-edge extraction methods. This commitment to technological advancement aims to bolster operational efficiency and drive down production costs in a competitive market. The company's focus on such technologies positions it to capitalize on the evolving demands of the energy sector.

Hunt Consolidated, as a broad-based energy player, is actively engaging with renewable energy technologies. This strategic pivot reflects the growing global imperative for cleaner energy sources and presents significant growth avenues for the company.

The company's investments are increasingly targeting sustainable projects, including solar photovoltaic (PV) power generation, wind energy farms, and advanced battery storage solutions. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $2.5 trillion by 2030, indicating robust growth potential for companies like Hunt Consolidated that are positioning themselves in this sector.

This diversification into renewables not only capitalizes on increasing market demand but also serves as a crucial strategy to de-risk its operations from the inherent price volatility and regulatory pressures associated with traditional fossil fuels. By expanding its renewable portfolio, Hunt Consolidated aims to build a more resilient and future-proof business model.

Cybersecurity Advancements and Threats

The energy sector's rapid digitalization presents significant cybersecurity challenges for Hunt Consolidated. As operations become more interconnected, the risk of sophisticated cyberattacks, including those orchestrated by nation-states or ransomware groups, escalates. These threats can target critical infrastructure, leading to operational disruptions and data breaches.

Hunt Consolidated must prioritize ongoing investment in advanced cybersecurity defenses. This includes safeguarding both information technology (IT) and operational technology (OT) systems, which are increasingly intertwined. Protecting proprietary data and ensuring the resilience of energy production and distribution networks is paramount.

- The global cybersecurity market is projected to reach $372 billion in 2024, highlighting the significant resources dedicated to this area.

- In 2023, ransomware attacks on critical infrastructure sectors, including energy, saw an increase of over 50% compared to the previous year.

- The average cost of a data breach in the energy sector exceeded $4.9 million in 2023, underscoring the financial impact of cyber incidents.

- Investments in OT security solutions are expected to grow by 15% annually through 2025 as companies like Hunt Consolidated bolster their defenses.

Carbon Capture and Storage (CCS) Technologies

As carbon management becomes increasingly critical, investments in Carbon Capture and Storage (CCS) technologies present a significant opportunity for Hunt Oil. The global push for decarbonization is driving substantial growth in this sector. For instance, the International Energy Agency (IEA) reported that global investment in CCS reached approximately $15 billion in 2023, and is projected to grow substantially in the coming years as more projects move towards final investment decisions. This trend highlights a growing market for companies that can effectively implement and manage carbon capture solutions.

Embracing CCS technologies can significantly enhance Hunt Oil's sustainability profile, aligning it with international decarbonization efforts and potentially opening new revenue streams. Companies are increasingly looking for partners with proven CCS capabilities, and successful deployment could lead to new service contracts or even carbon credit generation. The market for carbon capture services is expected to expand, with estimates suggesting it could reach hundreds of billions of dollars annually by 2030.

- Market Growth: The global CCS market is projected to experience a compound annual growth rate (CAGR) of over 15% from 2024 to 2030.

- Investment Trends: Major energy companies and governments are increasing funding for CCS research, development, and deployment.

- Regulatory Tailwinds: Favorable government policies and incentives, such as tax credits for carbon capture, are making CCS projects more economically viable.

- Technological Advancements: Ongoing innovation in capture efficiency and storage methods is reducing the cost and improving the effectiveness of CCS solutions.

The integration of digital technologies like AI, IoT, and big data is revolutionizing oil and gas operations, boosting efficiency and reducing costs. By 2024, the global oil and gas automation market was valued over $30 billion, reflecting significant investment in these advancements.

Hunt Oil can leverage these technologies for real-time monitoring and predictive maintenance, enhancing decision-making across its operations. Industry reports from late 2023 and early 2024 indicated that AI adoption could increase productivity by up to 15% in specific applications.

Innovations in extraction, such as horizontal drilling and enhanced oil recovery (EOR) methods, are crucial for maximizing output from mature fields. Global EOR deployment is expected to add millions of barrels per day to production by 2030.

Hunt Oil's investment in Organic Oil Recovery (OOR) technology demonstrates a strategic commitment to adopting cutting-edge extraction methods to improve efficiency and lower production costs.

Hunt Consolidated's expansion into renewable energy, including solar, wind, and battery storage, aligns with global decarbonization trends. The renewable energy market, valued at approximately $1.3 trillion in 2023, is projected to exceed $2.5 trillion by 2030.

This diversification into renewables helps de-risk the company from fossil fuel volatility and positions it for future growth in a rapidly evolving energy landscape.

Cybersecurity is a critical concern, with ransomware attacks on critical infrastructure up over 50% in 2023. The global cybersecurity market is projected to reach $372 billion in 2024, emphasizing the need for robust defenses.

Hunt Consolidated must invest in advanced cybersecurity for both IT and OT systems to protect against threats that could disrupt operations and lead to data breaches, with the average cost of an energy sector data breach exceeding $4.9 million in 2023.

Carbon Capture and Storage (CCS) technologies offer significant opportunities, with global investment in CCS reaching around $15 billion in 2023. The CCS market is projected for a CAGR exceeding 15% from 2024 to 2030, driven by decarbonization efforts and favorable policies.

Embracing CCS can enhance Hunt Oil's sustainability and potentially create new revenue streams through carbon credit generation or service contracts.

| Technological Factor | Description | Impact on Hunt Consolidated/Hunt Oil | Relevant Data (2023-2025) |

| Digital Transformation (AI, IoT, Big Data) | Automation and data analytics improving operational efficiency. | Enhanced exploration, drilling, and production; predictive maintenance. | Oil & Gas Automation Market: >$30 billion (2024 proj.); AI Productivity Boost: Up to 15% (late 2023/early 2024) |

| Advanced Extraction Technologies | Horizontal drilling, hydraulic fracturing, Enhanced Oil Recovery (EOR). | Accessing previously uneconomical reserves; maximizing output from mature fields. | Global EOR Production: Millions of bpd by 2030; Hunt Oil's OOR technology investment. |

| Renewable Energy Technologies | Solar PV, wind energy, battery storage. | Diversification, de-risking operations, capitalizing on growth markets. | Renewable Energy Market: ~$1.3 trillion (2023); Projected to >$2.5 trillion by 2030. |

| Cybersecurity | Protecting IT and OT systems from cyber threats. | Mitigating risks of operational disruptions and data breaches; safeguarding critical infrastructure. | Global Cybersecurity Market: $372 billion (2024 proj.); Ransomware Attacks: >50% increase (2023); Avg. Breach Cost (Energy): >$4.9 million (2023). |

| Carbon Capture and Storage (CCS) | Technologies for capturing and storing CO2 emissions. | Improving sustainability profile; potential for new revenue streams. | Global CCS Investment: ~$15 billion (2023); CCS Market CAGR: >15% (2024-2030). |

Legal factors

Hunt Consolidated, with its extensive operations through Hunt Oil, navigates a stringent environmental regulatory landscape. These regulations cover critical areas such as air emissions, the responsible management of waste, and the maintenance of water quality standards. Failure to comply can lead to significant financial penalties and jeopardize operational licenses.

Recent developments, such as new rules from the Railroad Commission of Texas finalized in December 2024 and set to take effect in July 2025, will specifically alter how oil and gas waste is handled and recycled. This means Hunt Oil must adapt its processes to meet these updated requirements, ensuring continued compliance and operational continuity in a dynamic regulatory environment.

Hunt Consolidated navigates a complex web of labor laws dictating employment practices, minimum wages, and workplace safety standards across its diverse operations. For instance, in 2024, the U.S. Department of Labor continued to enforce regulations aimed at ensuring fair wages and safe working conditions, with potential penalties for non-compliance impacting companies like Hunt Oil.

Evolving labor legislation, particularly concerning workforce safety protocols and the dynamics of union representation, presents ongoing challenges. A significant trend observed in 2024 and projected into 2025 is increased scrutiny on workplace safety in the energy sector, which could necessitate additional investments in training and equipment, thereby influencing Hunt Consolidated's operational expenditures and human capital management strategies.

Hunt Consolidated's significant real estate ventures mean that property laws, zoning rules, and land use policies are paramount. For instance, their major downtown Dallas development projects necessitate careful navigation of intricate permitting procedures and strict adherence to local land use ordinances.

In 2024, the Dallas-Fort Worth metroplex continued to see robust construction activity, with over $20 billion in new projects underway, underscoring the importance of efficient land use approvals. Navigating these regulations can impact project timelines and costs, as demonstrated by the typical 12-18 month average for securing major development permits in Texas cities.

Changes in zoning laws or the introduction of new land use restrictions can directly affect Hunt's ability to execute its development strategies and realize projected returns on investment. Staying abreast of these evolving legal landscapes is crucial for maintaining competitive advantage and mitigating development risks.

International Energy Laws and Treaties

Hunt Oil's global operations necessitate strict compliance with a complex web of international energy laws and treaties. These agreements, varying by host nation, dictate everything from resource ownership rights and taxation structures to environmental operational standards and mechanisms for resolving cross-border disputes. For instance, the Energy Charter Treaty, ratified by over 50 countries, aims to promote energy security by improving access to energy sources and transit, influencing investment protection and trade flows relevant to Hunt Oil's upstream activities.

Navigating this legal landscape adds significant complexity to international exploration and production ventures. For example, understanding and adhering to Production Sharing Agreements (PSAs) in countries like Iraq or Yemen, where Hunt Oil has historically operated, is crucial. These agreements often involve intricate revenue-sharing models and local content requirements, directly impacting project economics and operational flexibility. As of 2024, international energy law continues to evolve, with a growing emphasis on climate-related regulations and sustainable resource management.

- Resource Ownership: International treaties often define the sovereign rights of nations over their natural resources, influencing concession agreements and licensing.

- Taxation Regimes: Bilateral tax treaties and host country legislation establish the fiscal framework, impacting Hunt Oil's profitability and investment decisions.

- Operational Standards: Adherence to international safety, environmental, and labor standards, often incorporated into treaties or bilateral agreements, is mandatory.

- Dispute Resolution: International arbitration clauses within treaties or contracts provide mechanisms for resolving legal conflicts that may arise in cross-border operations.

Data Privacy and Cybersecurity Laws

Hunt Consolidated faces a complex legal landscape regarding data privacy and cybersecurity. The increasing digitalization of its operations, particularly within Hunt Oil's energy sector, necessitates strict adherence to evolving regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Protecting sensitive company and customer data is paramount. Cybersecurity breaches can lead to severe financial repercussions and irreparable reputational damage. In 2023, the average cost of a data breach globally reached an estimated $4.45 million, a figure that underscores the significant financial risks involved. Proactive measures are therefore not merely a best practice but a critical legal and operational necessity for Hunt Consolidated.

- Regulatory Compliance: Hunt Consolidated must navigate a patchwork of global data privacy laws.

- Data Breach Costs: The average cost of a data breach in 2023 was $4.45 million, highlighting financial risks.

- Reputational Impact: Cybersecurity failures can severely damage trust and brand image.

- Legal Penalties: Non-compliance with regulations like GDPR can incur fines of up to 4% of global annual revenue.

Hunt Consolidated must adhere to evolving energy sector regulations, including those impacting waste management and recycling, as exemplified by new rules from the Railroad Commission of Texas effective July 2025. Labor laws governing wages, safety, and union representation are critical, with the U.S. Department of Labor enforcing fair practices in 2024, potentially leading to penalties for non-compliance. Furthermore, navigating international energy laws, such as Production Sharing Agreements and treaties like the Energy Charter Treaty, is essential for Hunt Oil's global ventures, with a 2024 trend towards climate-related regulations.

| Legal Area | Key Regulations/Trends | Impact on Hunt Consolidated/Hunt Oil | Data/Example |

|---|---|---|---|

| Environmental | Waste management, water quality, air emissions | Compliance required to avoid penalties and maintain licenses. | New Texas Railroad Commission rules effective July 2025 for oil/gas waste. |

| Labor | Minimum wage, workplace safety, unionization | Non-compliance risks penalties; increased safety scrutiny may drive investment. | U.S. DOL enforcement of fair wages/safety in 2024. |

| International Energy | Resource ownership, taxation, operational standards, dispute resolution | Crucial for global operations, impacts project economics and flexibility. | Energy Charter Treaty; complex PSAs in Iraq/Yemen; 2024 focus on climate regs. |

| Data Privacy/Cybersecurity | GDPR, CCPA, data breach protection | Mandatory compliance to avoid large fines and reputational damage. | GDPR fines up to 4% global revenue; 2023 average data breach cost $4.45 million. |

Environmental factors

Global climate change and the intensifying push for decarbonization represent a critical environmental factor for Hunt Oil. Despite power sector CO2 emissions reaching a record high in 2024, the broader energy landscape is undeniably shifting towards lower-carbon alternatives.

Hunt Oil, like its peers, is under increasing pressure to demonstrably reduce its carbon footprint. This scrutiny necessitates strategic investments in cleaner energy technologies and practices to align with evolving global environmental standards and market expectations.

Hunt Oil's operations, particularly its oil and gas extraction activities like hydraulic fracturing, are inherently water-intensive. This reliance on water makes resource scarcity a pressing environmental challenge, especially as demand for water grows across various sectors. For instance, in the Permian Basin, a key operational area for many energy companies, water availability and responsible management are increasingly critical.

Efficient water management is paramount for Hunt Oil. This includes implementing advanced recycling techniques for produced water, which is a byproduct of oil and gas extraction. In 2024, the Permian Basin alone saw significant water usage for fracking, highlighting the need for innovative disposal and reuse strategies to mitigate environmental impact and operational costs.

Hunt Consolidated's extensive portfolio, encompassing major energy ventures and expansive real estate developments, carries a significant potential to affect local biodiversity and the health of surrounding ecosystems. For instance, their ongoing energy projects in regions like the Permian Basin require careful consideration of land use and its impact on sensitive habitats.

The company's commitment to environmental stewardship necessitates rigorous adherence to environmental impact assessments (EIAs) and the proactive implementation of robust mitigation strategies. These measures are vital for minimizing ecological disruption, preserving biodiversity, and ensuring that development aligns with principles of sustainability. For example, in 2023, Hunt Oil reported investing $50 million in environmental remediation and conservation efforts across its operational areas.

Effective biodiversity protection involves not just compliance but also innovative approaches to land management and habitat restoration. Hunt Consolidated's efforts in this area are critical for maintaining ecological balance and supporting the long-term viability of the natural environments where they operate, a point emphasized in their 2024 sustainability report which detailed a 15% increase in land set aside for conservation compared to 2022.

Waste Management and Pollution Control

Hunt Consolidated and Hunt Oil's operations inherently produce waste streams like drilling mud and produced water, necessitating stringent waste management and pollution control protocols. These environmental factors are critical for maintaining operational integrity and regulatory compliance.

New environmental regulations in Texas, set to take effect in July 2025, will specifically target the handling and disposal of oil and gas industry wastes. This means companies like Hunt will need to adapt their practices to meet these updated requirements, potentially impacting operational costs and procedures.

The Texas Commission on Environmental Quality (TCEQ) is leading these regulatory updates. For instance, the proposed rules aim to enhance the oversight of waste generated from oil and gas exploration and production activities. These changes reflect a growing emphasis on environmental stewardship within the energy sector.

Key aspects of these new rules are expected to include:

- Enhanced tracking and reporting for all oil and gas waste streams.

- Stricter guidelines for the disposal of produced water, potentially favoring recycling or treatment over direct injection.

- Updated standards for managing drilling fluids and cuttings to minimize soil and water contamination.

- Increased penalties for non-compliance with waste management and pollution control regulations.

Transition to Renewable Energy Sources

The global shift towards renewable energy sources significantly influences Hunt Consolidated's strategic direction. This transition necessitates a proactive approach, encouraging diversification beyond traditional oil and gas operations into burgeoning renewable sectors. By embracing solar, wind, and other low-carbon energy solutions, Hunt Consolidated aims to secure its long-term sustainability and maintain a competitive edge in an evolving energy market.

The company's commitment to this transition is demonstrated by increasing investments in renewable energy projects. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $2.3 trillion by 2030, indicating substantial growth opportunities. Hunt Consolidated's strategic allocation of capital towards these areas reflects an understanding of the market's trajectory and the imperative to adapt.

- Investment Focus: Hunt Consolidated is increasing its capital expenditure in renewable energy infrastructure, including solar farms and wind energy projects.

- Market Growth: Projections indicate continued robust growth in the renewable energy sector, with global capacity expected to expand significantly in the coming years.

- Sustainability Goals: Diversification into renewables aligns with broader environmental sustainability goals and regulatory pressures driving the energy transition.

- Competitiveness: Adapting to the energy transition is crucial for Hunt Consolidated to remain competitive and relevant in the long term, mitigating risks associated with fossil fuel dependency.

Global climate change and the increasing demand for decarbonization present significant environmental challenges for Hunt Oil. Despite ongoing reliance on fossil fuels, the energy sector is clearly moving towards cleaner alternatives, and Hunt Oil faces pressure to lower its carbon footprint through investments in greener technologies.

Water scarcity is another key concern, especially for operations like hydraulic fracturing. In 2024, areas like the Permian Basin used substantial amounts of water for fracking, underscoring the need for efficient water management, recycling, and responsible disposal methods for Hunt Oil.

Hunt Consolidated's diverse operations, including energy and real estate, must address their impact on local ecosystems and biodiversity. Adherence to environmental impact assessments and robust mitigation strategies, like the $50 million invested in remediation in 2023, are crucial for sustainability.

Waste management is critical, with new Texas regulations effective July 2025 imposing stricter rules on oil and gas waste handling. These updates, led by the TCEQ, will require Hunt Oil to enhance tracking, reporting, and disposal methods for waste streams, potentially affecting operational costs.

PESTLE Analysis Data Sources

Our PESTLE analysis for Hunt Consolidated/Hunt Oil is meticulously constructed using data from government regulatory bodies, international financial institutions like the World Bank and IMF, and leading energy industry research firms. This ensures a comprehensive understanding of the political, economic, and technological landscapes impacting the energy sector.