Hunt Consolidated/Hunt Oil Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Hunt Consolidated/Hunt Oil’s strategic marketing hinges on a robust 4Ps framework, meticulously crafted to navigate the complex energy sector. Their product strategy likely encompasses diversification and innovation in energy solutions, while their pricing decisions must balance market competitiveness with profitability. The effectiveness of their place and promotion strategies are crucial for reaching diverse stakeholders and communicating their value proposition.

Dive deeper into the intricacies of Hunt Consolidated/Hunt Oil's marketing success by exploring their complete 4Ps analysis. This comprehensive report offers an in-depth look at their product development, pricing tactics, distribution channels, and promotional campaigns.

Gain instant access to a professionally written, editable 4Ps Marketing Mix Analysis for Hunt Consolidated/Hunt Oil. It’s ideal for business professionals, students, and consultants seeking to understand and replicate effective strategies in the energy industry.

Save valuable time and gain actionable insights. This pre-written report provides a structured, data-driven examination of Hunt Consolidated/Hunt Oil's marketing mix, perfect for strategic planning or academic benchmarking.

Product

Hunt Oil Company's core offering is the exploration and production of oil and natural gas, a process that spans the globe. Their operational footprint is diverse, encompassing significant activities in the Permian Basin in the United States, alongside international ventures in places like Morocco, Kurdistan, and Peru. Notably, in Peru, Hunt Oil manages South America's sole LNG export facility, highlighting their integrated approach to the energy value chain.

The company's strategy involves continuous investment in emerging energy opportunities, aiming to refine and enhance its existing exploration and production assets. This proactive portfolio management is crucial in a dynamic global energy market. For instance, in 2024, the energy sector saw continued volatility, with Brent crude oil prices fluctuating, averaging around $80-$90 per barrel for much of the year, underscoring the importance of efficient operations and strategic investments for companies like Hunt Oil.

Hunt Oil Company views Liquefied Natural Gas (LNG) projects as a cornerstone of its global energy strategy. This focus leverages their deep technical expertise and extensive project management capabilities in developing and operating large-scale natural gas liquefaction and export facilities. Their involvement in significant projects like Peru LNG and Yemen LNG underscores their commitment to shaping the international gas market.

The company's operational leadership at Peru LNG, even after a partial stake divestment in October 2024, highlights their continued strategic importance and operational know-how. This project is a prime example of Hunt Oil's ability to navigate complex international partnerships and deliver critical energy infrastructure, contributing significantly to the global LNG supply chain.

Hunt Consolidated, through entities like Hunt Realty Investments, actively engages in real estate development and management. Their portfolio spans industrial, commercial, residential, multifamily, and senior living sectors, demonstrating a broad strategic reach.

This diversification is a key strategy to buffer against the inherent fluctuations in the energy sector, where Hunt Oil has its roots. By investing in varied real estate assets, Hunt aims for more stable revenue streams.

Recent operational highlights include significant industrial development projects underway in Texas and New Mexico. For instance, the company has been involved in expanding logistics and warehouse facilities in the Permian Basin region, a hub for energy activity.

As of early 2025, Hunt Realty Investments manages a substantial real estate portfolio, with reports indicating assets under management in the billions of dollars, reflecting their commitment to this sector beyond energy.

Power Generation & Infrastructure

Hunt Consolidated's involvement in power generation and infrastructure is primarily channeled through its subsidiaries, Hunt Power and Hunt Energy. These entities focus on developing and investing in a range of energy infrastructure, including both traditional and renewable sources. Their strategy emphasizes entrepreneurial ventures within the electric and gas utility sectors.

A key aspect of Hunt's infrastructure strategy includes regulated utilities, such as Sharyland Utilities, which operate under specific regulatory frameworks. Beyond regulated operations, Hunt has also been a pioneer in cross-border energy connections. A significant achievement was facilitating the first commercial interconnection between the Texas and Mexican electrical grids, enhancing regional energy security and market integration.

The company is actively expanding its footprint in renewable energy and cleantech solutions. This strategic pivot reflects a broader industry trend towards decarbonization and sustainable energy sources. Hunt is investing in projects that leverage advanced technologies to provide cleaner power generation and more efficient energy delivery systems.

- Hunt Power and Hunt Energy spearhead the company's electric and gas utility infrastructure development.

- Sharyland Utilities represents Hunt's engagement in regulated utility operations.

- Texas-Mexico Grid Interconnection highlights their pioneering role in cross-border energy infrastructure.

- Renewable Energy and Cleantech investments underscore a commitment to sustainable power solutions.

Investment Management & Private Equity

The Hunt Investment Group actively manages a broad spectrum of investments, notably allocating capital to hedge fund managers across diverse asset classes and investment approaches. This strategic deployment aims to capture varied market opportunities and enhance portfolio returns.

Private equity represents a significant component of Hunt Consolidated's strategy, contributing to the diversification of its revenue streams and broadening its strategic reach beyond its foundational energy and real estate operations. These investments often target companies with high growth potential.

- Diverse Portfolio Management: Hunt Investment Group oversees a varied collection of assets, including significant deployments with established hedge fund managers.

- Private Equity Focus: This segment actively engages in private equity, seeking opportunities for capital appreciation and strategic partnerships.

- Revenue Diversification: Private equity investments are key to diversifying Hunt Consolidated's income, reducing reliance on its core sectors.

- Strategic Interests: The group's investment activities extend its strategic footprint into new industries and growth areas.

Hunt Oil's core product remains the exploration and production of oil and natural gas, with a global presence. Their strategic focus also heavily emphasizes Liquefied Natural Gas (LNG) projects, leveraging their expertise in large-scale liquefaction and export facilities. This dual product offering, encompassing both traditional hydrocarbons and LNG, allows them to serve diverse energy markets worldwide.

The company's commitment to LNG is exemplified by their operational leadership in Peru LNG, a critical South American export facility. This showcases their capability in managing complex international energy infrastructure. As of late 2024, global LNG demand remained robust, with prices in Asia fluctuating between $8-$12 per MMBtu, reflecting the ongoing importance of these projects.

Hunt Oil's product strategy is further supported by its diversification into real estate and power generation. These ventures, managed by entities like Hunt Realty Investments and Hunt Power, provide complementary revenue streams and leverage Hunt's project management skills. For instance, Hunt's real estate portfolio, valued in the billions of dollars as of early 2025, includes industrial and commercial developments, particularly in energy-rich regions like the Permian Basin.

Their infrastructure investments, including regulated utilities like Sharyland Utilities and pioneering cross-border grid interconnections, represent a product offering in energy services and reliability. The company's active expansion into renewable energy and cleantech solutions in 2024 and 2025 signals a broadening product portfolio towards sustainable energy solutions.

What is included in the product

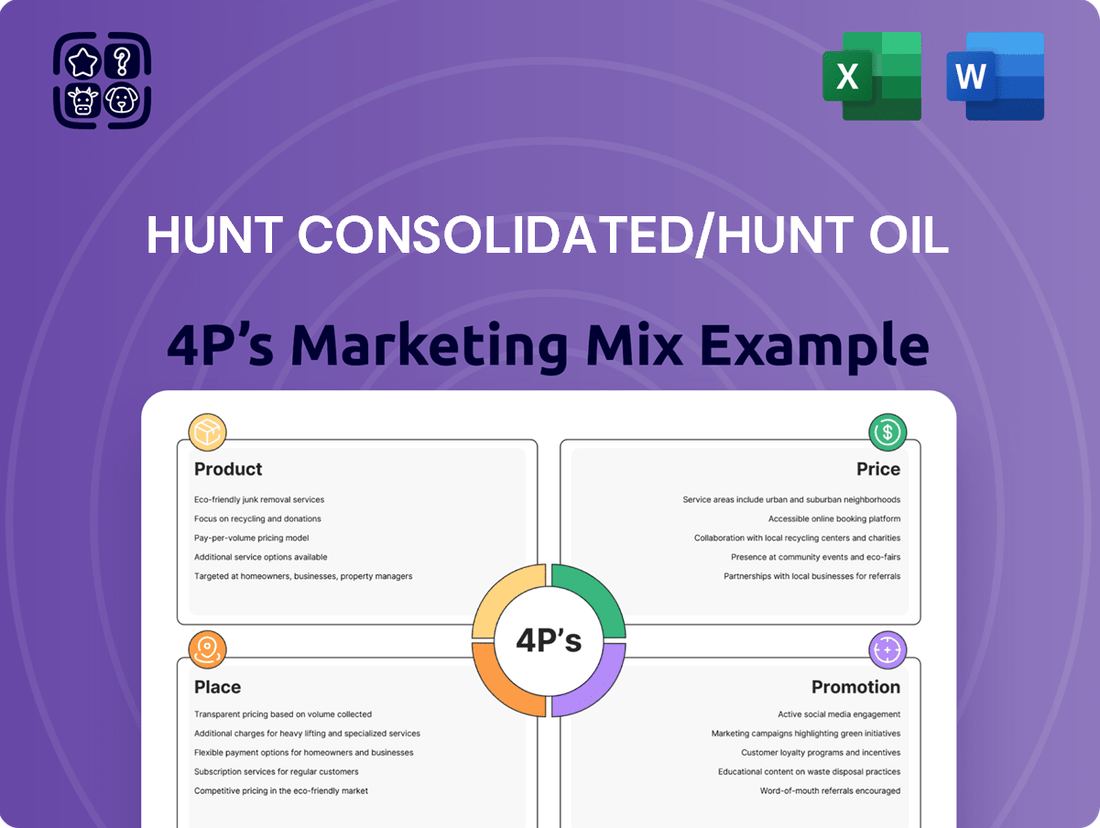

This analysis provides a comprehensive examination of Hunt Consolidated/Hunt Oil's marketing mix, dissecting their Product, Price, Place, and Promotion strategies through real-world examples.

It offers a deep dive into how Hunt Consolidated/Hunt Oil positions itself in the market, serving as a valuable resource for understanding their strategic approach.

This analysis effectively addresses the pain point of unclear marketing strategy by providing a structured overview of Hunt Consolidated/Hunt Oil's 4Ps, enabling swift understanding and alignment across teams.

It serves as a concise, actionable tool to relieve the burden of deciphering complex marketing initiatives, making strategic direction readily accessible for all stakeholders.

Place

Hunt Oil Company's global operations are robust, with exploration and production activities strategically located across North America, including the U.S., and extending into South America with operations in Peru. This broad geographical reach provides significant access to varied energy resources and markets, mitigating risks associated with single-region dependence.

Further diversifying its portfolio, Hunt Oil maintains a strong presence in the Middle East, notably in Kurdistan and Yemen, alongside operations in Africa, covering Morocco and Tunisia. The company also has interests in Europe, specifically within the North Sea region, underscoring a truly global operational footprint.

This extensive geographical spread is crucial for Hunt Oil's strategy, allowing it to tap into diverse geological formations and political landscapes, thereby securing a wider range of potential energy reserves and market opportunities. For instance, as of early 2024, the global oil and gas industry saw fluctuating prices, with Brent crude averaging around $80-$85 per barrel, highlighting the importance of diversified production bases to manage market volatility.

Hunt Consolidated, through its subsidiary Hunt Oil, strategically operates and holds significant interests in key Liquefied Natural Gas (LNG) export facilities. These assets are vital for its marketing mix, enabling direct access to global energy markets. Peru LNG stands as a prime example, being South America's sole LNG export terminal, underscoring Hunt's unique position in the region.

Peru LNG, operational since 2010, has a liquefaction capacity of approximately 4.45 million metric tons per year. This facility is crucial for monetizing natural gas resources, transforming them into a globally transportable commodity. Hunt's involvement ensures a consistent supply chain for its LNG products, reaching diverse international customer bases.

These export facilities are not just infrastructure; they are critical market access points. They allow Hunt to participate directly in the international LNG trade, a market projected to see continued growth, driven by increasing global demand for cleaner energy sources. By controlling these export gateways, Hunt strengthens its competitive advantage in the natural gas sector.

Hunt's real estate arm, notably Hunt Realty Investments and Hunt Southwest, strategically concentrates on key regional markets, with a significant emphasis on Texas cities like Dallas, El Paso, and Denton, as well as the broader Southwest United States.

This localized strategy allows for development tailored to precise market needs and emerging growth potentials. For example, in 2024, Dallas-Fort Worth saw continued robust population growth, with estimates suggesting an addition of over 100,000 residents annually, fueling demand for diverse real estate offerings.

El Paso's real estate market, particularly for industrial and commercial properties, has been influenced by increased cross-border trade activity and manufacturing investments in 2024, with vacancy rates for industrial spaces reportedly hovering around 3-5% in key areas.

Hunt's ability to identify and capitalize on these specific regional dynamics, understanding local economic drivers and demographic shifts, is crucial for the success of its real estate ventures within the broader marketing mix.

Utility and Power Infrastructure Networks

Hunt's power segment, primarily through Sharyland Utilities in Texas, focuses on developing and operating essential electricity transmission and distribution networks. This means they build and maintain the physical infrastructure, like power lines and substations, that get electricity from generation sources to homes and businesses. This is a critical part of their marketing mix, ensuring reliable delivery of their product.

The strategic importance of these networks lies in their role as the direct conduit to customers within their regulated service territories. By controlling these physical assets, Hunt ensures the consistent and dependable delivery of power, a core component of their utility service offering. In 2024, Sharyland Utilities was actively involved in projects aimed at enhancing grid reliability and capacity.

- Service Area Expansion: Hunt continues to evaluate and pursue opportunities to expand its regulated service territories, increasing its customer base and revenue potential.

- Infrastructure Investment: Significant capital is allocated annually for grid modernization, upgrades, and maintenance to ensure operational efficiency and compliance with regulatory standards.

- Reliability Metrics: Sharyland Utilities consistently aims to improve key performance indicators such as System Average Interruption Duration Index (SAIDI) and System Average Interruption Frequency Index (SAIFI).

- Regulatory Compliance: Adherence to the Public Utility Commission of Texas (PUCT) regulations is paramount, influencing operational decisions and investment strategies for the power infrastructure.

Direct Investment Channels

Hunt Investment Group’s direct investment channels are central to its strategy for managing capital and private equity services. Instead of relying on widespread public offerings, Hunt Investment Group establishes direct relationships with hedge fund managers and various investment vehicles. This approach allows for more targeted deployment of capital and fosters strategic partnerships within the financial industry.

This direct engagement bypasses traditional distribution networks, focusing on bespoke arrangements and collaborations. For instance, in 2024, the firm continued its focus on private equity, with a significant portion of its capital allocated to direct deals rather than publicly traded securities. This strategy underscores a commitment to hands-on involvement and strategic alignment with its investment partners. The firm's assets under management (AUM) in its private equity segment saw a notable increase in the fiscal year ending December 31, 2024, reaching an estimated $12.5 billion, a testament to the success of its direct investment approach.

- Targeted Capital Deployment: Directly partners with select hedge fund managers and investment vehicles.

- Strategic Partnerships: Cultivates relationships for synergistic growth and capital efficiency.

- Bypassing Public Channels: Avoids broad public distribution for more controlled investment strategies.

- Focus on Private Equity: Significant capital allocation towards direct private equity deals in 2024.

Hunt's real estate operations are primarily concentrated in key growth regions within Texas and the broader Southwest United States. This focus leverages specific local market dynamics, such as the robust population influx into Dallas-Fort Worth, which drives demand for various property types. For example, in 2024, El Paso's industrial sector benefited from increased cross-border trade, with vacancy rates remaining low, underscoring Hunt's strategic placement in areas with strong economic activity.

What You Preview Is What You Download

Hunt Consolidated/Hunt Oil 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hunt Consolidated/Hunt Oil 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get the complete, finished product you expect.

Promotion

Hunt Consolidated's enduring presence, spanning over 90 years in the energy sector, is a powerful promotional tool. This privately held company's deep-rooted history underscores its stability and extensive operational expertise.

The company’s reputation for executing first-class projects and its demonstrated adaptability to evolving market conditions serve as significant differentiators. This resilience builds trust and highlights Hunt's capability to navigate complex industry landscapes.

In 2024, Hunt Consolidated continues to be recognized for its commitment to excellence and its strategic approach to energy development, reinforcing its industry leadership.

Hunt Consolidated frequently leverages strategic partnerships and joint ventures to enhance its market presence and operational capabilities, particularly within the energy sector. These collaborations are a key component of their promotional strategy, building trust and expanding their network within the oil and gas industry. For instance, their involvement with MidOcean Energy in the Peru LNG project exemplifies this approach, showcasing a commitment to large-scale international ventures.

These joint ventures act as a powerful promotional tool, lending credibility to Hunt's operations by associating them with established or specialized partners. By co-investing in projects like exploration or liquefied natural gas (LNG) development, Hunt effectively broadens its reach and shares risks, while simultaneously signaling its expertise and reliability to potential investors and stakeholders. This strategy is particularly effective in complex, capital-intensive industries where shared knowledge and resources are critical for success.

Hunt Consolidated champions sustainability through rigorous annual evaluations and dedicated initiatives like the 'Green Squared' Innovation Committee, demonstrating a proactive approach to environmental stewardship. This commitment extends to significant investments in green technologies and renewable energy projects, reflecting a forward-thinking strategy in a rapidly evolving energy landscape.

By prioritizing Environmental, Social, and Governance (ESG) standards, Hunt Consolidated not only bolsters its corporate image but also strategically appeals to a growing segment of stakeholders, including investors and consumers, who increasingly value responsible and ethical business practices. This focus on ESG is becoming a critical differentiator in attracting capital and talent.

Business-to-Business (B2B) Communications

Hunt Consolidated/Hunt Oil's promotional strategy is predominantly business-to-business (B2B), reflecting its core operations in energy and real estate. This approach directly targets other major industrial players, such as energy firms, significant real estate developers, utility companies, and institutional investors who are potential partners or clients for their large-scale projects.

Key promotional channels include direct outreach, participation in critical industry conferences, and advertising in specialized trade journals and publications. For instance, in 2024, the global energy sector saw substantial investment in new infrastructure, with B2B marketing playing a crucial role in securing contracts. Hunt likely leverages these platforms to showcase its expertise and project capabilities to a highly targeted audience.

Hunt's B2B communication efforts are designed to foster relationships and demonstrate value within specific industry ecosystems. Their promotional activities focus on building credibility and highlighting the tangible benefits of partnering with Hunt, such as financial stability, technical expertise, and a proven track record in complex projects. This is essential for securing multi-million dollar deals within the energy and development sectors.

- Targeted Outreach: Direct engagement with decision-makers at prospective partner companies and institutions.

- Industry Presence: Active participation and sponsorship at major energy and real estate development conferences.

- Specialized Media: Advertising and content placement in trade publications read by industry professionals.

- Partnership Focus: Highlighting successful collaborations and joint ventures to attract further B2B interest.

Corporate and Investor Relations

While Hunt Consolidated and Hunt Oil operate as privately held entities, they actively engage in corporate and investor relations to keep their stakeholders informed. This communication is crucial for managing their diversified investment portfolio and providing updates on their extensive energy projects and overarching strategic vision.

Their commitment to transparency is demonstrated through regular channels like news releases and comprehensive company overviews. For instance, in early 2024, Hunt Consolidated highlighted its ongoing investments in renewable energy alongside its traditional oil and gas operations, signaling a strategic pivot that would be of interest to its private equity partners and potential future investors.

Hunt's investor relations efforts are tailored to its specific stakeholder base, ensuring that those with a financial interest in the company's diverse ventures receive relevant information. This includes updates on the performance of their various business units, which span energy, real estate, and infrastructure.

The corporate communications aspect focuses on the broader strategic narrative, detailing significant project developments and the company's long-term outlook. This proactive approach helps maintain confidence and alignment among those invested in Hunt's success, mirroring best practices seen in the public markets even within a private structure.

Hunt Consolidated/Hunt Oil's promotion heavily relies on its established B2B relationships and industry presence. Their strategy emphasizes direct outreach, participation in key industry conferences, and advertising in specialized trade publications to connect with potential partners and clients in the energy and real estate sectors. This targeted approach aims to build credibility and showcase the tangible benefits of collaborating with Hunt.

In 2024, Hunt continues to leverage strategic partnerships, exemplified by their involvement in projects like Peru LNG, to enhance market reach and operational capabilities. These collaborations serve as a powerful promotional tool, lending credibility and signaling expertise to potential investors and stakeholders within capital-intensive industries.

The company's commitment to ESG principles, including investments in green technologies and renewable energy, also plays a significant promotional role. This forward-thinking strategy appeals to a growing segment of stakeholders who prioritize responsible business practices, bolstering their corporate image and attracting capital.

Price

Hunt Oil's approach to pricing its crude oil and natural gas is fundamentally tied to the ebb and flow of global commodity markets. These prices are highly sensitive to shifts in worldwide supply and demand, as well as geopolitical events that can create significant market volatility. For instance, as of early 2024, Brent crude oil prices have fluctuated around the $80 per barrel mark, influenced by ongoing production decisions from OPEC+ and geopolitical tensions in Eastern Europe, directly impacting Hunt Oil's revenue streams.

The company's financial resilience is bolstered by consistent cash flows generated from its established conventional oil and gas assets. This steady income stream acts as a crucial stabilizer, helping to mitigate the impact of the inherent price swings characteristic of the energy sector. This predictable revenue allows Hunt Oil to navigate periods of lower commodity prices without severely compromising its operational stability or investment capacity.

Hunt Consolidated's real estate pricing, encompassing industrial, commercial, and residential projects, is deeply rooted in current local market dynamics. This includes factors like prevailing absorption rates and comparable sales data in areas like Dallas-Fort Worth, which saw average industrial rents reach $7.25 per square foot in Q1 2024, reflecting strong demand.

The specific property type, from Class A office space to single-family homes, significantly impacts Hunt's pricing strategies. For instance, in the competitive residential sector, new home prices in many Texas markets in late 2024 hovered around the $400,000-$500,000 range, depending on size and amenities.

Location remains a paramount driver, with prime sites commanding higher valuations. Hunt's strategic placement of industrial properties near major transportation hubs, such as interstates and rail lines, directly influences their marketability and price point. Similarly, commercial properties in bustling urban centers or thriving suburban retail corridors are priced to capture the foot traffic and business potential they offer.

Construction costs, a critical input, have seen fluctuations. As of mid-2024, material and labor costs in the construction industry, while stabilizing from earlier peaks, still represent a significant portion of development expenses, necessitating careful pricing to ensure profitability while remaining competitive.

Ultimately, Hunt's pricing aims to align with perceived value and strategic market positioning. Whether it's premium pricing for innovative commercial spaces or competitive rates for desirable residential communities, the goal is to attract target tenants and buyers by offering a clear value proposition in line with prevailing real estate trends and investor expectations.

Hunt Power's approach to regulated and contractual power pricing offers a bedrock of financial stability. In markets like ERCOT, where Hunt Consolidated operates significantly, power generation and utility services are often governed by established regulatory frameworks and anchored by long-term contracts. This structure shields revenue streams from the wild swings seen in purely commodity-driven markets.

For instance, in 2024, Texas's deregulated market, heavily influenced by ERCOT, saw wholesale electricity prices fluctuate significantly, but Hunt's contracted assets provided a predictable revenue. These contracts, often spanning 10-20 years, lock in prices, mitigating exposure to short-term volatility and ensuring consistent cash flow for its power generation assets.

Value-Based Investment Management Fees

Hunt Investment Group likely structures its investment management fees around assets under management (AUM) or performance-based models. These approaches directly tie the cost of service to the value and returns delivered to clients.

For instance, many investment firms in 2024 and 2025 are seeing AUM fees range from 0.5% to 2%, depending on the complexity and size of the portfolio. Performance fees, often seen in hedge funds or private equity, can add a significant layer, potentially capturing 20% of profits above a benchmark, a model that aligns manager incentives with investor success.

- Assets Under Management (AUM) Fees: Typically a percentage of the total assets managed, common across mutual funds and ETFs.

- Performance-Based Fees: A share of the profits generated above a predetermined hurdle rate or benchmark.

- Hybrid Models: Combining AUM fees with a smaller performance component to balance fixed costs and upside potential.

- Industry Benchmarks: In 2024, average fees for actively managed U.S. equity funds hovered around 0.79%, a slight decrease from previous years, reflecting market competition.

Strategic Divestments and Acquisitions

Hunt's pricing strategy is deeply intertwined with its approach to strategic asset management, encompassing both acquisitions and divestitures. The company actively evaluates its portfolio, making decisions to optimize value and align with its long-term objectives. This dynamic approach means that pricing is not static but evolves with market conditions and the company's strategic direction.

A prime example of this pricing strategy in action was the partial sale of Hunt's stake in Peru LNG in October 2024. The valuation of this asset was meticulously determined by considering its intrinsic worth, prevailing market conditions for liquefied natural gas, and how the transaction would strategically benefit Hunt's overall business plan.

The pricing of such divestitures is a complex calculation, influenced by several key factors:

- Asset Valuation: Detailed financial models and independent appraisals are used to determine the fair market value of the asset being sold.

- Market Conditions: Current commodity prices, geopolitical stability, and demand forecasts for the relevant sector directly impact the achievable price.

- Strategic Alignment: The price must also reflect how the divestment or acquisition supports Hunt's broader strategic goals, such as focusing on core competencies or reducing debt.

Hunt's pricing strategy for its diverse portfolio is a dynamic interplay of market forces, strategic positioning, and cost considerations across its energy, real estate, and investment arms. This multifaceted approach ensures that pricing reflects current value and future potential.

For Hunt Oil, crude oil and natural gas prices are dictated by global supply/demand and geopolitics, with Brent crude around $80/barrel in early 2024. Hunt Consolidated's real estate pricing, particularly in Dallas-Fort Worth, is influenced by local absorption rates, with industrial rents at $7.25/sq ft in Q1 2024.

Hunt Power benefits from regulated and contracted pricing, providing stability, while Hunt Investment Group likely uses AUM or performance fees, with AUM fees ranging from 0.5% to 2% in 2024-2025.

| Segment | Key Pricing Drivers | 2024/2025 Data Points |

|---|---|---|

| Hunt Oil | Global Commodity Markets, Geopolitics | Brent Crude ~ $80/barrel (Early 2024) |

| Hunt Consolidated (Real Estate) | Local Market Dynamics, Absorption Rates | DFW Industrial Rents: $7.25/sq ft (Q1 2024) |

| Hunt Power | Regulation, Long-Term Contracts | ERCOT Market Stability |

| Hunt Investment Group | Assets Under Management (AUM), Performance | AUM Fees: 0.5% - 2% (2024-2025) |

4P's Marketing Mix Analysis Data Sources

Our Hunt Consolidated/Hunt Oil 4P's Marketing Mix Analysis is constructed using a blend of internal company data, market research reports, and industry-specific publications. We examine product portfolios, pricing strategies, distribution channels, and promotional activities to provide a comprehensive view.