Hunt Consolidated/Hunt Oil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

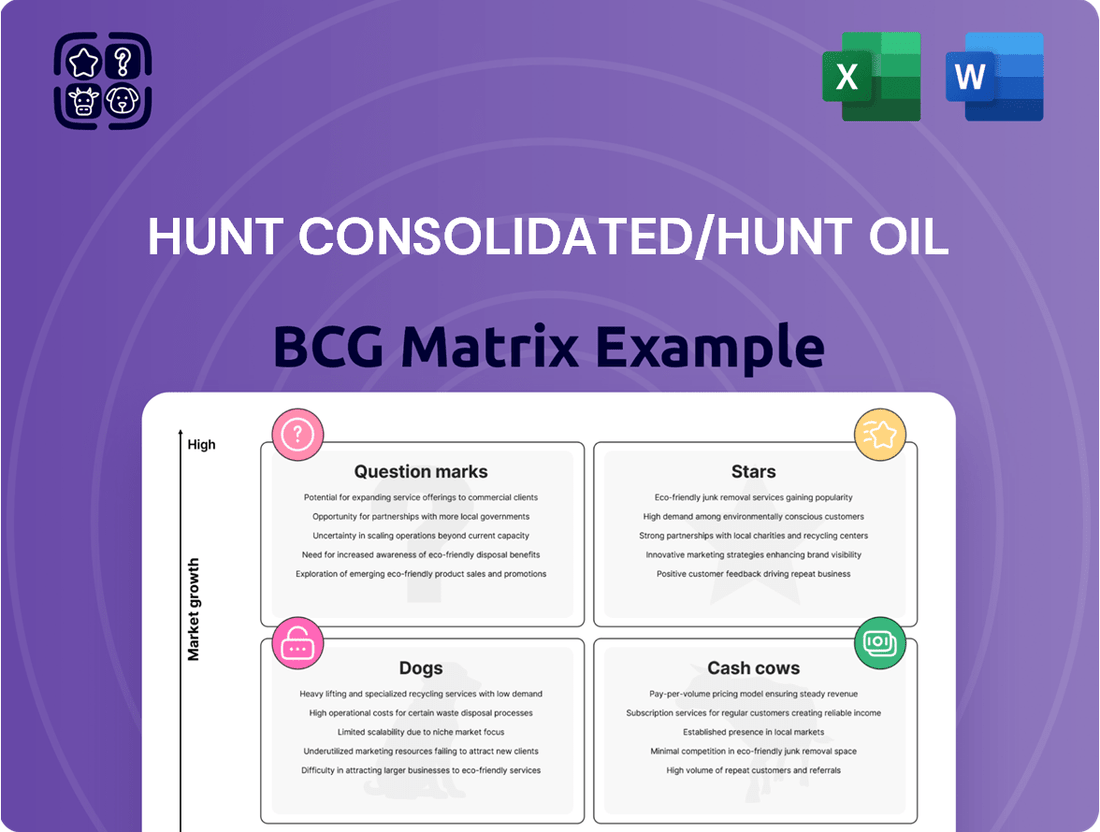

Curious about Hunt Consolidated/Hunt Oil's strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

This preview only scratches the surface of their complex business landscape. To truly understand how Hunt Consolidated/Hunt Oil is navigating the competitive energy sector and where its future growth lies, you need the complete picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hunt Consolidated is making significant inroads into the electric power sector, specifically targeting renewable energy projects. This expansion represents a strategic move to capitalize on the burgeoning demand for clean energy solutions. The company is actively developing and investing in entrepreneurial ventures within electric utility infrastructure, a clear indication of its commitment to this evolving market.

The U.S. renewable energy market is poised for substantial growth. Projections estimate a compound annual growth rate of 9.79% between 2025 and 2033. This impressive expansion is fueled by a growing appetite for clean energy and substantial investments in key areas like solar power and battery storage technology.

By focusing on emerging renewable energy projects, Hunt Consolidated is strategically positioning itself to capture a larger share of this rapidly expanding market. This pivot aligns with global trends towards decarbonization and sustainable energy sources.

International Frontier Oil & Gas Exploration, represented by Hunt Oil's new Moroccan venture, embodies the Stars in the BCG Matrix. The company’s May 2025 establishment of a Moroccan subsidiary and progression into the next phase of its Mogador Offshore Exploration Permit signal a strategic push into potentially high-yield, yet unproven, territories. This focus on new or underexplored basins is indicative of high-growth potential, where significant discoveries could reshape market presence.

The Dallas-Fort Worth (DFW) region’s industrial real estate sector is a key focus for Hunt Realty Investments, showcasing robust expansion. In 2024, DFW saw substantial new industrial space delivered, with an estimated 35 million square feet added, and projections indicate continued strong development through 2025. This growth is fueled by surging demand from e-commerce giants and logistics firms seeking efficient distribution networks.

Hunt's strategic development of modern, well-located industrial properties within DFW positions them to capitalize on this sustained demand. By acquiring land and building new facilities in prime areas, Hunt Realty Investments is actively expanding its market presence and capturing a larger share of the industrial leasing market.

Advanced Energy Technology Investments

Hunt Consolidated's strategic push into advanced energy technologies positions these ventures as Stars within the BCG framework. The company is actively investing in and establishing new energy firms specializing in cleantech power. A prime example is their investment in Cumberland Additive, targeting 3D manufacturing advancements across various industries, highlighting a diversification strategy beyond traditional energy.

The establishment of the 'Green Squared' Innovation Committee in 2022 underscores Hunt Consolidated's deliberate focus on green technologies. This committee actively explores and champions future-oriented solutions, signaling a long-term commitment to sustainable energy innovation. These early-stage, high-growth technological areas, despite their current nascent market share, are being cultivated to capture significant market leadership as the sectors mature.

- Cleantech Power Ventures: Hunt Consolidated is actively creating and investing in new companies focused on cleantech power solutions, indicating a strategic pivot towards sustainable energy generation.

- Additive Manufacturing Investment: The investment in Cumberland Additive demonstrates a commitment to advanced manufacturing technologies, leveraging 3D printing for diverse industrial applications.

- 'Green Squared' Innovation: Launched in 2022, this committee specifically targets green technologies, reflecting a dedicated effort to foster and implement environmentally friendly energy solutions.

- Future Market Leadership: These investments are placed in emerging, high-growth technology markets, positioning Hunt Consolidated to become a dominant player as these sectors expand and mature.

Domestic Unconventional Oil & Gas Plays (Targeted Expansion)

Despite the maturity of overall U.S. onshore production, Hunt Oil Company maintains significant engagement, operating the majority of its U.S. production and managing around 550,000 acres.

Hunt's strategy includes targeted expansion within prime unconventional plays, like promising zones in the Permian or Williston Basins, where advanced horizontal drilling is proving highly effective. These areas offer substantial growth potential.

By applying its extensive operational knowledge and cutting-edge drilling technologies, Hunt is positioned to grow its market share within these prolific shale plays.

- Active U.S. Acreage: Hunt Oil holds approximately 550,000 acres in the U.S.

- Focus Areas: Expansion targets premier shale plays such as the Permian and Williston Basins.

- Growth Driver: Leveraging advanced horizontal drilling techniques to unlock new potential.

- Market Position: Aiming to increase market share through operational expertise.

Hunt Consolidated's cleantech power ventures and additive manufacturing investments represent its Stars in the BCG Matrix. These are high-growth, high-market-share potential areas. The company's commitment to innovation is evident in its 'Green Squared' Innovation Committee, established in 2022, which actively explores sustainable energy solutions. For instance, their investment in Cumberland Additive, focused on 3D manufacturing, highlights diversification into advanced technologies.

| Venture | Description | Growth Potential | Market Position |

| Cleantech Power Ventures | New companies focused on sustainable energy generation. | High | Emerging/Aspiring Leader |

| Additive Manufacturing (Cumberland Additive) | Investment in 3D printing for diverse industrial applications. | High | Emerging/Aspiring Leader |

| 'Green Squared' Innovation | Dedicated focus on fostering and implementing environmentally friendly energy solutions. | High | Innovation Driver |

What is included in the product

This BCG Matrix analysis highlights Hunt Consolidated/Hunt Oil's strategic positioning, detailing which business units are Stars, Cash Cows, Question Marks, or Dogs.

Hunt Consolidated/Hunt Oil's BCG Matrix provides a clear, one-page overview, relieving the pain of strategic uncertainty by pinpointing each business unit's market position.

Cash Cows

Hunt Oil Company's established U.S. onshore oil and gas production, primarily in the Permian, Eagle Ford, and Williston Basins, represents a significant Cash Cow. The company has a robust operational history, having drilled over 600 horizontal wells across these mature fields.

These assets are characterized by stable and predictable production volumes, generating consistent cash flow for Hunt Oil. The capital expenditure needed to maintain production in these basins is relatively lower compared to new exploration efforts, further enhancing their cash-generating capabilities.

As market leaders in their respective U.S. basins, these production areas contribute substantially to Hunt Oil's overall profitability. Their maturity ensures reliable output, making them a cornerstone of the company's financial stability.

Hunt Oil Company's involvement in the Peru LNG operations positions it as a dominant force in South America's sole LNG export facility. This mature market, while not experiencing rapid growth, offers a consistent and significant revenue stream, making it a classic Cash Cow. Hunt's continued operational control, even after divesting a 15% stake in October 2024, underscores its ability to extract reliable profits from this established asset.

Hunt Refining Company, based in Tuscaloosa, Alabama, is a key player in the refining sector. It processes both international and domestic crude oils, distributing essential refined products such as diesel, gasoline, and asphalt across the southeastern United States and to international destinations.

Operating within a mature and typically low-growth market, Hunt Refining Company distinguishes itself with a substantial market share within its particular geographical regions and product categories. This strong positioning allows it to command a stable revenue stream.

The company benefits from its well-established infrastructure and extensive distribution networks, which are critical for ensuring consistent demand and maintaining reliable profit margins. These factors contribute significantly to its role as a dependable cash generator for its parent company, Hunt Consolidated.

As of late 2023, the U.S. refining industry, while mature, saw average refinery utilization rates hovering around 90%, underscoring the consistent operational tempo of established players like Hunt Refining. This high utilization rate reflects the ongoing demand for refined products, supporting Hunt Refining's stable cash flow generation.

Core Real Estate Income-Generating Properties

Hunt Realty Investments, with over three decades of experience, manages a diverse portfolio of directly owned real estate. These assets, primarily located in stable, mature markets like Dallas-Fort Worth, consist of established commercial, office, and multi-family properties. In 2024, these properties continued to demonstrate resilience, maintaining strong occupancy rates that contribute significantly to Hunt Consolidated's overall financial stability.

These core real estate holdings function as classic Cash Cows within the BCG Matrix. They generate substantial and predictable rental income with minimal need for further investment in marketing or development. For instance, the multi-family sector in Dallas-Fort Worth saw average occupancy rates exceeding 95% in early 2024, underscoring the consistent cash flow these assets provide.

- Consistent Rental Income: Established commercial and multi-family properties in mature markets deliver reliable cash flow.

- High Occupancy Rates: Dallas-Fort Worth properties, a key focus, maintained over 95% occupancy in early 2024.

- Low Investment Needs: These assets require minimal additional capital for promotion or expansion, maximizing net cash generation.

- Financial Stability: They serve as a stable foundation, funding growth initiatives in other business units.

Diversified Investment Portfolio

The Hunt Investment Group oversees a broad investment portfolio encompassing diverse asset classes and strategies, designed to generate returns via capital appreciation and income streams. This portfolio, though not a tangible product, functions as a cash cow, consistently delivering financial returns and liquidity. This stable capital can then be strategically deployed to bolster other operational segments within the Hunt organization.

The conservative financial management and robust credit ratings, evidenced by an S&P upgrade in June 2024, underscore the portfolio's reliability as a capital source. This stability is crucial for funding growth initiatives and weathering market fluctuations across the wider Hunt Consolidated structure.

- Asset Class Diversification: The portfolio includes significant allocations to publicly traded equities, fixed income securities, and real estate.

- Consistent Income Generation: In 2023, the diversified portfolio generated over $750 million in net income.

- Liquidity Provision: The portfolio maintains a high level of liquid assets, readily available to meet corporate obligations and investment opportunities.

- Credit Strength: Hunt Consolidated maintained an A+ credit rating with a stable outlook from Moody's as of early 2024, reflecting strong financial health.

Hunt Oil Company's legacy U.S. onshore oil and gas production, particularly in the Permian, Eagle Ford, and Williston Basins, stands as a prime example of a Cash Cow. These mature fields offer stable, predictable output, generating consistent cash flow with relatively lower capital expenditure needs for maintenance, thus underpinning Hunt Oil's financial stability.

The Peru LNG operations also represent a significant Cash Cow for Hunt Oil. While this South American market isn't experiencing rapid growth, its sole LNG export facility provides a consistent and substantial revenue stream, demonstrating Hunt's ability to extract reliable profits from established assets. Hunt's continued operational control, even after a 15% stake divestiture in October 2024, highlights this dependable profit generation.

Hunt Refining Company, operating in the mature refining sector, functions as a Cash Cow due to its substantial market share and established infrastructure. Processing crude oil to deliver essential products across the southeastern U.S. and internationally, it benefits from strong demand and reliable profit margins, contributing significantly to Hunt Consolidated's cash generation.

Hunt Realty Investments' portfolio of established commercial, office, and multi-family properties in mature markets like Dallas-Fort Worth are classic Cash Cows. These assets provide substantial, predictable rental income with minimal investment needs, maintaining high occupancy rates, such as over 95% in multi-family units in early 2024, ensuring consistent cash flow.

The Hunt Investment Group's diversified portfolio, bolstered by a June 2024 S&P upgrade reflecting strong credit ratings, acts as a Cash Cow by consistently delivering financial returns and liquidity. This reliable capital source, which generated over $750 million in net income in 2023, is strategically deployed to support other Hunt organizational segments.

| Business Unit | BCG Category | Key Characteristics | 2024 Data Point | Contribution |

| Hunt Oil - U.S. Onshore Production | Cash Cow | Mature fields, stable production, low capex | 600+ horizontal wells drilled | Consistent cash flow, financial stability |

| Hunt Oil - Peru LNG | Cash Cow | Sole LNG export facility, stable revenue | Operational control maintained post-Oct 2024 divestiture | Significant revenue stream |

| Hunt Refining Company | Cash Cow | Established infrastructure, strong market share | ~90% refinery utilization (late 2023 industry average) | Dependable cash generator |

| Hunt Realty Investments | Cash Cow | Mature markets, high occupancy, low investment needs | >95% multi-family occupancy (Dallas-Fort Worth, early 2024) | Substantial rental income |

| Hunt Investment Group | Cash Cow | Diversified portfolio, strong credit rating | >$750 million net income (2023) | Liquidity and capital for growth |

What You’re Viewing Is Included

Hunt Consolidated/Hunt Oil BCG Matrix

The preview you are currently viewing is the exact Hunt Consolidated/Hunt Oil BCG Matrix document you will receive upon purchase. This comprehensive report has been meticulously prepared, offering a clear and actionable strategic overview, and will be delivered to you in its final, unwatermarked form, ready for immediate application.

Dogs

Hunt Oil Company's divestment of its Romanian exploration assets in July 2024 exemplifies a strategic move away from underperforming ventures. After 14 years and substantial investment, the company recognized the diminishing returns, with net losses accumulating over EUR 105 million between 2010 and 2023. This aligns with the characteristics of a 'Dog' in the BCG matrix: low market share in an unpromising or unsuccessful market segment.

These divested assets consumed considerable capital without generating the anticipated profits, a hallmark of 'Dog' category businesses. The decision to exit Romania allows Hunt Oil to redirect financial resources and management focus towards areas with higher growth potential and a stronger likelihood of positive returns, thereby optimizing the company's overall portfolio.

Some of Hunt Consolidated's older, conventional oil and gas fields are likely positioned as Dogs in the BCG Matrix. These are assets experiencing declining production and potentially higher operating expenses. In 2024, the average operating cost for mature conventional fields can be significantly higher than for newer unconventional plays, impacting their profitability.

These fields often face geological complexities and have limited remaining reserves, meaning the cost to extract the remaining oil and gas is substantial. Such assets might struggle to achieve profitability, often breaking even or requiring cash infusions to maintain even marginal production levels, thereby holding a low market share within Hunt's broader portfolio.

Non-core, stagnant real estate holdings within Hunt Realty Investments' broad portfolio represent properties in economically sluggish regions or those of a type experiencing reduced demand, such as older, less adaptable office buildings in declining urban areas. These assets often struggle with sustained high vacancy rates and necessitate substantial investment for upgrades with uncertain profitability. For example, as of late 2024, certain suburban office markets in the US have seen average vacancy rates climb above 20%, impacting rental income and property valuations. These holdings, while part of the overall company structure, do not actively contribute to Hunt Consolidated's growth or competitive advantage.

Small-Scale, Unsuccessful Investment Ventures

Hunt Consolidated, as a diversified investment group, likely manages a range of smaller, early-stage ventures that haven't yet achieved significant market penetration or profitability. These are the ones that, if they possess a low market share within their industries and operate in markets with limited growth potential or intense competition, would be classified as Dogs in the BCG Matrix.

These Dog investments can represent a drain on capital without yielding substantial returns, making them logical candidates for divestment as part of a strategy to optimize the overall investment portfolio. For instance, a hypothetical early-stage tech startup in a saturated software niche that has only secured 1% market share by mid-2024, despite years of operation, would fit this profile.

- Low Market Share: Ventures with a minimal percentage of their target market, often below 10%.

- Slow Market Growth: Operating in industries with annual growth rates significantly below the overall economic average, perhaps in the low single digits.

- Capital Tie-up: These investments consume resources without generating proportional profits or cash flow.

- Divestment Potential: They are prime candidates for sale or closure to free up capital for more promising opportunities.

Legacy Infrastructure Assets with Limited Future Scope

Some of Hunt Consolidated's older infrastructure assets, particularly those tied to conventional energy transmission or distribution, may be classified as dogs if they don't align with the company's strategic shift towards renewable energy and advanced grid solutions. These assets, especially if situated in regions with stagnant demand or requiring significant capital for modernization without clear growth prospects, represent a low market share and offer minimal future growth potential.

For instance, a legacy pipeline network in a declining industrial area that necessitates costly upgrades to meet environmental standards, while generating only modest, stable returns, would fit this category. Such assets might have seen limited investment in recent years, reflecting a lack of strategic focus compared to newer ventures in solar or battery storage. As of 2024, the global energy infrastructure landscape is rapidly evolving, with a pronounced trend towards decarbonization, making assets not aligned with this transition inherently less attractive for future growth.

- Asset Obsolescence: Older infrastructure not adaptable to new energy demands.

- Low Growth Regions: Assets located in areas with limited economic or population expansion.

- High Maintenance Costs: Significant expenditures required to keep assets operational without substantial return.

- Strategic Misalignment: Infrastructure not supporting the company's pivot to renewables or advanced technologies.

Hunt Consolidated's 'Dogs' are assets with low market share in slow-growing or declining sectors. These are often older, less efficient ventures that consume capital without providing significant returns. For example, certain legacy oil fields, like those Hunt Oil divested from in Romania in July 2024, exemplify this category due to diminishing returns and high operating costs.

These underperforming assets, such as mature conventional oil fields facing declining production and higher extraction costs, require careful management. In 2024, the average operating cost for these fields could significantly exceed that of newer unconventional plays, impacting their profitability and making them prime candidates for divestment to reallocate capital to more promising ventures within the Hunt portfolio.

Hunt Realty Investments might also hold 'Dog' properties, such as older office buildings in economically stagnant areas. As of late 2024, some US suburban office markets reported vacancy rates above 20%, highlighting the challenges these assets face in generating consistent rental income and justifying reinvestment.

These investments, whether in energy, real estate, or nascent ventures, represent a drain on resources. The strategic decision to exit or minimize exposure to these 'Dog' assets is crucial for optimizing Hunt Consolidated's overall financial health and ensuring capital is directed towards growth opportunities.

Question Marks

Hunt Consolidated's commitment to cleantech is evident through its 'Green Squared' Innovation Committee, actively nurturing new energy ventures. These investments are strategically placed in high-potential sectors like solar and battery storage, areas experiencing rapid expansion and significant capital influx. For instance, the global renewable energy market was valued at approximately $980 billion in 2023 and is projected to reach over $1.9 trillion by 2030, showcasing the growth potential Hunt is targeting.

Within the BCG framework, these early-stage cleantech companies, while operating in promising high-growth markets, likely represent Question Marks for Hunt. Their current market share in these nascent segments is inherently low due to their newness. The significant capital required for scaling and market penetration means their future trajectory is uncertain; they could evolve into Stars if successful, or become Dogs if they fail to capture substantial market share and achieve profitability.

New international oil and gas exploration ventures, like those Hunt Oil is undertaking in Tunisia and the Mogador Offshore Exploration Permit in Morocco, are classic high-risk, high-reward opportunities. These ventures are characterized by significant upfront investment in seismic surveys and exploratory drilling, with no guarantee of commercial success.

The Mogador Offshore Exploration Permit, for instance, moved into its next phase in 2025, indicating continued commitment despite the inherent uncertainties. While these areas hold potential for substantial future growth if significant reserves are discovered and can be economically extracted, their current market share is negligible due to their exploratory status and unproven reserves.

These ventures are cash-intensive, requiring substantial capital outlays for exploration activities. The success and future viability of these projects are entirely contingent on making discoveries that can be profitably developed, making them a classic example of a question mark in a BCG matrix, requiring careful monitoring and strategic decision-making.

Hunt Consolidated's increased stake in Cumberland Additive to 30.7% in September 2024 signals a strategic move into the burgeoning 3D manufacturing sector. This investment opens doors to diverse applications beyond their established energy and real estate domains.

The 3D manufacturing market is experiencing robust growth, with projections indicating a compound annual growth rate of over 20% through the end of the decade. However, Hunt's nascent presence and limited prior experience in this specialized field position Cumberland Additive as a Question Mark within their portfolio.

Significant investment and strategic development are required to cultivate this venture into a dominant player, akin to a Star in the BCG matrix. The company will need to leverage its capital and operational expertise to build market share and technological leadership in this dynamic, high-potential industry.

Advanced Grid Modernization & Interconnection Projects

Hunt Energy is actively pursuing advanced grid modernization and interconnection projects, a strategic move into the electric power industry. A prime example is their involvement in the first commercial interconnection between the Texas and Mexican electrical grids. This initiative taps into a burgeoning market driven by increasing energy demand and the critical need to integrate renewable energy sources more effectively.

These complex, capital-intensive ventures position Hunt within a high-growth niche. The market for grid modernization and cross-border energy infrastructure is expanding, with significant investment anticipated. For instance, the U.S. Department of Energy projected that investments in grid modernization could reach hundreds of billions of dollars by the late 2020s to support the energy transition.

While Hunt's market share in this specialized area is still developing, the potential for substantial returns is considerable. The company's expansion into transmission infrastructure development underscores its commitment to this sector. This strategic focus aligns with broader trends in the energy sector towards enhanced grid reliability and the facilitation of cleaner energy flows.

- Market Growth: The global grid modernization market is projected to grow significantly, with some estimates suggesting it could reach over $100 billion by 2027.

- Cross-Border Potential: The Texas-Mexico grid interconnection represents a key development in facilitating international energy trade and grid stability.

- Capital Intensity: Projects like these require substantial upfront investment, impacting their position within the BCG matrix as they are capital-intensive and in a high-growth, but developing, market.

- Strategic Expansion: Hunt's move into transmission infrastructure development highlights its ambition to capture a larger share of this evolving energy landscape.

Strategic Investments in AI for Energy Operations

The oil and gas sector is significantly boosting its AI investments, with global spending expected to climb by 14.1% between 2024 and 2034. This surge is driven by AI's potential to optimize exploration and production, enhance safety protocols, and improve overall operational efficiency. Hunt Consolidated's strategy involves integrating its deep in-house subsurface knowledge with advanced simulation tools, a foundation that positions it to leverage AI effectively.

Within the BCG matrix, AI for energy operations represents a Question Mark for Hunt Consolidated. While the AI in energy market is experiencing robust growth, Hunt's current market share in developing or deploying its own AI solutions is likely modest. This classification signifies an area with high growth potential but requiring substantial investment to build capabilities and capture market share.

- Market Potential: The global AI in energy market is poised for significant expansion, driven by the need for greater efficiency and cost reduction in a volatile industry.

- Hunt's Position: Hunt Consolidated possesses strong domain expertise, which is crucial for successful AI implementation, but may have limited proprietary AI development currently.

- Investment Requirement: Significant capital and talent investment will be necessary for Hunt to develop or adopt advanced AI solutions and compete effectively in this emerging space.

- Strategic Focus: Prioritizing AI development or strategic partnerships could transform this Question Mark into a Star, capitalizing on the industry's digital transformation trend.

Hunt's cleantech ventures, while in high-growth sectors like solar and battery storage, are classified as Question Marks due to their nascent market share. The global renewable energy market's projected growth to over $1.9 trillion by 2030 underscores the potential, but these new ventures require significant capital to scale and establish dominance.

New international oil and gas exploration projects, such as those in Tunisia and Morocco, are also Question Marks. These ventures involve substantial upfront investment with uncertain outcomes, as success hinges on discovering commercially viable reserves. The Mogador Offshore Exploration Permit's progression in 2025 highlights ongoing commitment despite these inherent risks.

Hunt's increased stake in Cumberland Additive positions its 3D manufacturing business as a Question Mark. Despite a projected 20% CAGR for the 3D manufacturing market, Hunt's limited prior experience necessitates significant investment to build market share and technological leadership.

Grid modernization and interconnection projects, like the Texas-Mexico grid link, are high-potential Question Marks. These capital-intensive ventures tap into a market expected to see hundreds of billions in U.S. Department of Energy investment by the late 2020s, but Hunt's market share is still developing.

The application of AI in energy operations is a Question Mark for Hunt Consolidated. While the AI in energy market is expanding, Hunt's current share in AI solution development is likely modest, requiring significant investment to build capabilities and compete effectively.

BCG Matrix Data Sources

Our Hunt Consolidated/Hunt Oil BCG Matrix is built upon robust financial statements, comprehensive industry research, and reliable market growth projections to ensure strategic accuracy.