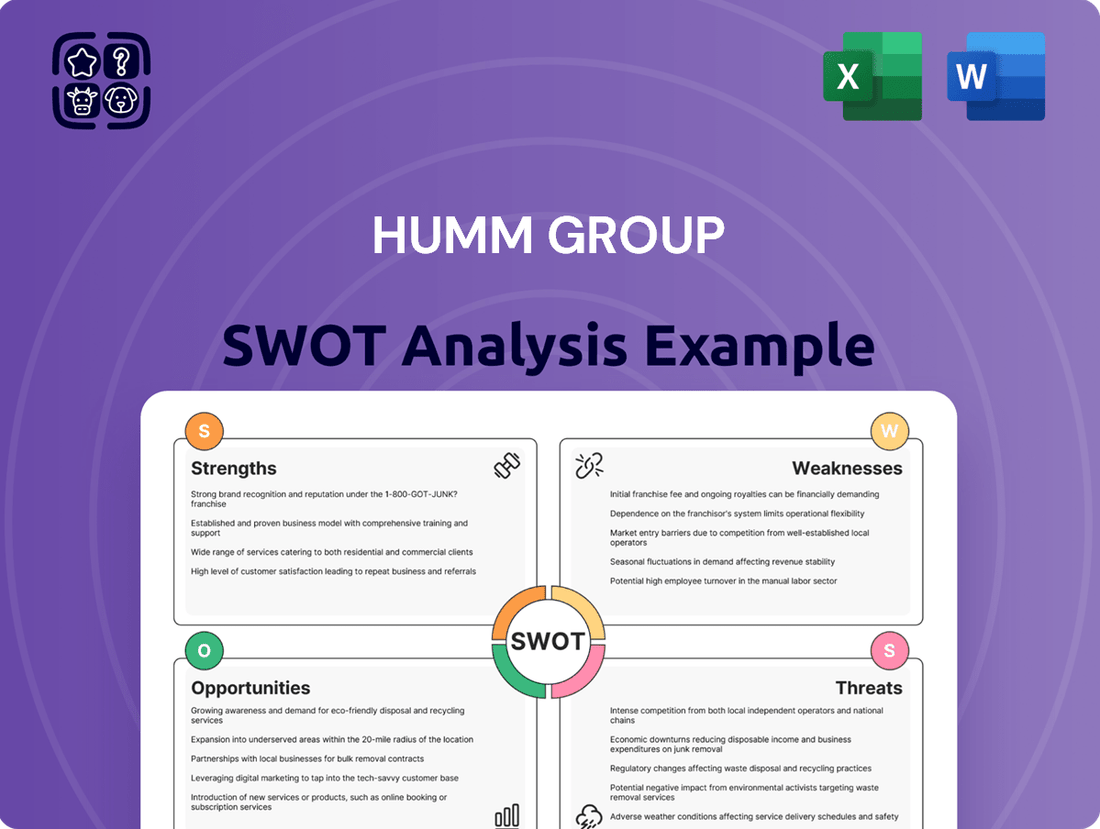

Humm Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Humm Group's market position is shaped by its innovative payment solutions and strong customer loyalty, but also faces challenges from evolving regulations and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the fintech space.

Want the full story behind Humm Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Humm Group has showcased impressive financial resilience, with a notable 119% surge in cash profit after tax, reaching $29.8 million in the first half of FY2025. This robust performance is further underscored by a substantial 555% increase in statutory net profit, signaling efficient operations and a strong earnings outlook.

Humm Group's diversified product portfolio, encompassing traditional Buy Now, Pay Later (BNPL), point-of-sale finance for significant purchases, and business financing solutions, provides a robust revenue base. This breadth of offerings reduces dependence on any single segment, enhancing financial stability.

The company's expansive geographic footprint across Australia, New Zealand, Ireland, Canada, and the United Kingdom is a significant strength. This international presence diversifies revenue streams and mitigates the impact of localized economic downturns or regulatory changes, as seen in the varied performance across these markets in recent years.

Humm Group's commercial finance division stands out as a significant contributor to its financial success. In the first half of 2025, this segment reported an impressive 35% increase in cash profit, underscoring its robust performance. Furthermore, assets under management within this division grew by 18% during the same period, highlighting expanding market reach and client trust.

Proven Cost Management and Low Credit Losses

Humm Group has demonstrated strong capabilities in managing its operational expenses, evidenced by a notable 13% reduction in operating expenses during the first half of 2025. This efficiency gain directly bolsters the company's bottom line.

Furthermore, the company has consistently maintained historically low credit losses. This achievement underscores Humm Group's robust credit risk assessment and prudent lending strategies, minimizing potential financial setbacks.

- Effective Cost Control: Achieved a 13% reduction in operating expenses in 1H25.

- Low Credit Losses: Maintained historically low credit loss rates.

- Financial Stability: Dual focus on cost efficiency and risk mitigation enhances profitability.

Experience Operating in Regulated Environments

Humm Group's extensive experience operating within highly regulated financial sectors provides a significant competitive advantage, especially as the Buy Now, Pay Later (BNPL) industry grapples with evolving oversight. This established track record in compliance allows the company to proactively adapt to new legislation, a crucial factor in the rapidly changing fintech landscape.

For instance, Humm Group has a history of managing credit and financial services in markets with stringent consumer protection laws, a background that directly translates to navigating the increasing regulatory scrutiny on BNPL providers. This deep understanding of compliance frameworks can streamline their response to new regulations, potentially reducing the operational impact compared to less experienced competitors.

- Established Regulatory Expertise: Humm Group has a proven history of operating successfully within regulated financial environments.

- Adaptability to New Legislation: This experience positions them to readily comply with emerging BNPL regulations.

- Competitive Differentiator: Their regulatory background sets them apart from newer entrants in the BNPL market.

Humm Group's robust financial performance, highlighted by an 119% surge in cash profit after tax to $29.8 million in 1H25, showcases strong operational execution. This is complemented by a diversified product suite, spanning BNPL, point-of-sale, and business financing, which provides a stable revenue foundation and reduces reliance on any single market segment. Their international presence across Australia, New Zealand, Ireland, Canada, and the UK further diversifies income and mitigates regional economic risks.

| Metric | 1H25 Result | Commentary |

|---|---|---|

| Cash Profit After Tax | $29.8 million (up 119%) | Demonstrates strong underlying profitability. |

| Statutory Net Profit | Significant increase (555%) | Indicates broad-based earnings growth. |

| Operating Expenses | Reduced by 13% | Highlights effective cost management. |

| Commercial Finance Profit | Up 35% | Shows strength in a key business segment. |

| Commercial Finance Assets Under Management | Up 18% | Indicates growing market penetration. |

What is included in the product

Delivers a strategic overview of Humm Group’s internal and external business factors, highlighting its strengths in customer loyalty and market penetration, while acknowledging weaknesses in technological infrastructure and opportunities in expanding its product offerings.

Humm Group's SWOT analysis serves as a pain point reliever by offering a clear, actionable framework to identify and address internal weaknesses and external threats, thereby guiding strategic adjustments and mitigating potential risks.

Weaknesses

Humm Group faces challenges stemming from its legacy technology infrastructure. While the company is investing in modernization to improve customer experience and operational efficiency, the historical reliance on older systems can present limitations in agility and potentially higher maintenance expenditures. Successful navigation of these technological hurdles is critical for Humm Group's future competitiveness.

Humm Group's commercial finance division, while generally robust, showed a 2.8% decline in commercial volume during the third quarter of fiscal year 2025. This downturn was directly attributed to a softening in the Small and Medium-sized Enterprise (SME) market.

This vulnerability highlights Humm Group's sensitivity to macroeconomic shifts that impact SMEs. Should these economic headwinds continue, it could pose a significant challenge to the company's growth trajectory within this crucial business segment.

Humm Group's consumer business experienced a reduction in total receivables during FY24, directly linked to the strategic decision to discontinue unprofitable product lines. This move, while aimed at boosting long-term profitability, naturally creates a short-term drag on revenue growth.

The wind-down process necessitates meticulous management of the remaining customer portfolios to mitigate any negative impact on financial performance. This also serves as a clear indicator of previous product development choices that ultimately failed to meet financial expectations.

Increased Operational Costs due to New Regulations

Upcoming regulatory shifts in Australia, set to take effect in June 2025, mandate that Buy Now Pay Later (BNPL) providers, including Humm Group, secure an Australian Credit License and comply with updated responsible lending obligations. This transition is anticipated to increase Humm's operational expenses and administrative workload, even with their existing experience in regulated markets.

The financial impact of these new regulations is estimated to add a significant percentage to compliance costs. For instance, similar regulatory implementations in other financial sectors have historically seen compliance costs rise by 10-15% in the initial year of adoption.

- Australian Credit License: Humm Group will incur costs associated with application fees, legal counsel, and establishing new compliance frameworks.

- Responsible Lending Obligations: Implementing enhanced checks and balances for consumer creditworthiness will require investment in technology and personnel.

- Increased Administrative Burden: Managing reporting, audits, and ongoing compliance activities will necessitate additional resources, potentially impacting profitability.

Intense Competition in the BNPL Sector

The Buy Now, Pay Later (BNPL) market is incredibly crowded. Humm Group faces fierce competition from a multitude of players, including established banks and agile fintech startups. This intense rivalry can significantly squeeze profit margins.

The sheer number of BNPL providers means Humm Group must invest heavily in marketing to stand out. For instance, Klarna, a major competitor, reported over $2.2 billion in revenue for 2023, highlighting the scale of investment needed to capture market share. This necessitates continuous innovation to keep customers engaged and attract new ones in a rapidly evolving landscape.

- Intense Competition: Numerous BNPL providers, including Affirm, Afterpay (Block), Klarna, and PayPal, are actively competing for merchant and consumer adoption.

- Margin Pressure: Aggressive pricing strategies and promotional offers from competitors can force Humm Group to reduce its own fees, impacting profitability.

- Innovation Demands: Competitors are constantly introducing new features and payment options, requiring Humm Group to invest in R&D to remain competitive.

- Customer Acquisition Costs: High marketing spend is often required to acquire new customers in this saturated market.

Humm Group's reliance on legacy technology presents a significant weakness, potentially limiting operational agility and increasing maintenance costs. The company's commercial finance division experienced a 2.8% decline in volume in Q3 FY25 due to a softening SME market, indicating sensitivity to economic downturns. Furthermore, the strategic discontinuation of unprofitable consumer product lines in FY24, while beneficial long-term, resulted in a short-term reduction in total receivables.

| Weakness Category | Specific Issue | Impact |

|---|---|---|

| Technology Infrastructure | Legacy systems | Limited agility, higher maintenance costs |

| Market Sensitivity | Softening SME market | 2.8% decline in commercial volume (Q3 FY25) |

| Strategic Decisions | Discontinuation of unprofitable consumer products | Reduction in total receivables (FY24) |

What You See Is What You Get

Humm Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Humm Group SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you'll gain access to the complete, in-depth report, providing a comprehensive understanding of Humm Group's strategic position.

Opportunities

The global Buy Now, Pay Later (BNPL) market is experiencing robust expansion, with Australia's segment alone anticipated to reach USD 1,915.7 million by 2033. This significant growth trajectory offers Humm Group a prime opportunity to boost transaction volumes and broaden its customer reach. Consumers are increasingly favoring flexible payment solutions, a trend Humm Group is well-positioned to leverage.

Humm Group's planned launch of regulated hybrid loan products in Australia during the fourth quarter of fiscal year 2025 presents a significant opportunity to diversify its revenue streams. This strategic move aims to cater to a broader customer base and offer more flexible financing solutions.

These new products are specifically designed to expand Humm's tailored merchant-specific offerings, allowing for more customized solutions that can attract and retain business partners. This focus on merchant needs is crucial for growth in a competitive market.

By introducing these hybrid loans, Humm anticipates opening new distribution channels and improving profitability, especially for larger transaction values. This will help differentiate Humm in the rapidly evolving Buy Now, Pay Later (BNPL) sector, moving beyond traditional short-term credit.

Humm Group is strategically eyeing expansion into new geographic territories, notably planning a re-entry into the United Kingdom market. This move, coupled with a push into Canada, signifies a deliberate effort to broaden its customer base and tap into previously underserved regions. For instance, the UK buy-now-pay-later market, while competitive, showed significant growth in 2024.

Beyond geographical reach, Humm Group is also diversifying its operational verticals. The company intends to leverage its existing commercial lending capabilities to enter sectors like agribusiness and the medical industry. This diversification aims to create new avenues for revenue generation and mitigate risks associated with over-reliance on a single market segment.

Ongoing Technology Platform Modernization

Humm Group is actively modernizing its consumer IT platforms, a significant undertaking that includes migrating to cloud-hosted services and establishing a contemporary data platform. This strategic investment aims to streamline operations and boost efficiency.

These technological upgrades are poised to deliver substantial benefits, including improved product reliability and the agility to quickly launch innovative customer offerings. For instance, by adopting cloud infrastructure, Humm can expect to reduce its reliance on legacy systems, potentially leading to cost savings and enhanced scalability. The implementation of a modern data platform will empower more sophisticated analytics, enabling a deeper understanding of customer behavior and market trends, crucial for competitive advantage in 2024 and beyond.

- Cloud Migration Benefits: Enhanced scalability and potential cost reductions through reduced on-premise infrastructure.

- Data Platform Advancement: Improved data analytics capabilities for better customer insights and faster product development cycles.

- Operational Efficiency: Streamlined processes leading to quicker service delivery and increased internal productivity.

- Competitive Edge: Ability to rapidly introduce new customer value propositions, staying ahead in the evolving fintech landscape.

Potential Boost from Improved Consumer Confidence and Spending

Anticipated interest rate cuts in Australia during 2024 and 2025 are poised to alleviate cost-of-living pressures, potentially stimulating a rebound in consumer confidence and discretionary spending. This improvement directly translates into a stronger demand for Humm Group's consumer finance products.

An uplift in consumer spending is a key driver for Humm Group’s core business. Higher transaction volumes and an increase in outstanding receivables are direct positive outcomes, bolstering the company's revenue streams and overall financial performance.

- Economic Tailwinds: Falling interest rates are predicted to inject more disposable income into households, encouraging spending.

- Increased Transaction Volumes: A more confident consumer is likely to engage more frequently with buy-now-pay-later services.

- Receivables Growth: Higher spending naturally leads to a larger pool of customer receivables for Humm Group.

- Market Share Expansion: Humm Group is well-positioned to capture a greater share of this revitalized consumer spending market.

The expanding global Buy Now, Pay Later (BNPL) market, with Australia's segment projected to reach USD 1,915.7 million by 2033, presents a substantial growth avenue for Humm Group. The company's planned introduction of regulated hybrid loan products in Australia by Q4 FY25 offers diversification and caters to a wider customer base. Humm is also strategically re-entering the UK market and expanding into Canada, tapping into new geographic revenue streams.

Furthermore, Humm is leveraging its commercial lending expertise to enter agribusiness and the medical sectors, diversifying its operational verticals. Significant investment in modernizing consumer IT platforms, including cloud migration and a new data platform, aims to boost efficiency and enable faster product innovation. Anticipated interest rate cuts in Australia for 2024-2025 are expected to boost consumer confidence and spending, directly benefiting Humm's core business through increased transaction volumes.

| Opportunity Area | Key Driver | Humm Group's Action | Projected Impact |

|---|---|---|---|

| BNPL Market Growth | Consumer preference for flexible payments | Expand transaction volumes, broaden customer reach | Increased market share |

| Product Diversification | Demand for varied financing solutions | Launch regulated hybrid loans (Q4 FY25) | New revenue streams, wider customer appeal |

| Geographic Expansion | Untapped market potential | Re-enter UK, expand into Canada | Broader customer base, new revenue sources |

| Vertical Diversification | Mitigate single-segment risk | Enter agribusiness and medical sectors | New revenue avenues, risk reduction |

| Technological Modernization | Operational efficiency & innovation | Cloud migration, new data platform | Improved reliability, faster product launches |

| Economic Tailwinds | Interest rate cuts, increased spending | Capitalize on higher transaction volumes | Revenue growth, improved financial performance |

Threats

The buy-now-pay-later (BNPL) sector is facing increased regulatory attention, a significant threat to Humm Group. New legislation in Australia, set to take effect in June 2025, will bring BNPL providers under stricter oversight.

Complying with these new rules, which include requirements like obtaining an Australian Credit License and upholding responsible lending obligations, will undoubtedly increase Humm Group's operational burden and associated financial risks.

Rising interest rates directly impact Humm Group's cost of capital, making borrowing more expensive. For instance, the Reserve Bank of Australia's cash rate hikes throughout 2023 and into 2024 have pushed up funding costs for financial institutions. This increased expense can translate to tighter lending criteria for consumers, potentially reducing loan origination volumes and requiring Humm Group to re-evaluate its fee structures or operational efficiencies to maintain profitability.

The ease of accessing Buy Now Pay Later (BNPL) services can unfortunately lead some consumers to spend more than they can afford, increasing the likelihood of missed payments and late fees. This not only hurts the consumer's credit score but also poses a significant risk to Humm Group's financial health.

A general uptick in consumer defaults directly impacts Humm Group's asset quality, meaning the value of the loans it holds could decrease. This, in turn, would negatively affect the company's profitability, making strong credit risk management absolutely crucial for stability.

Market Saturation and Aggressive Competition

The Buy Now, Pay Later (BNPL) market is experiencing significant saturation, with numerous players, including established financial institutions and tech behemoths, vying for market share. This heightened competition intensifies pricing pressures and necessitates substantial investment in ongoing innovation to remain relevant.

The crowded landscape presents a considerable threat to Humm Group. For instance, by the end of 2023, the global BNPL market was projected to reach over $3.5 trillion, with major players like Klarna and Afterpay (Block) continually expanding their offerings and geographical reach. This intense rivalry can erode profit margins and make customer acquisition increasingly expensive.

- Market Saturation: The BNPL sector is crowded, with over 100 providers globally as of early 2024, making differentiation difficult.

- Intensified Competition: Traditional banks like Commonwealth Bank and Westpac are launching their own BNPL services, directly challenging fintech disruptors.

- Pricing Pressures: Increased competition can force providers to lower fees or offer more attractive terms, impacting revenue streams.

- Innovation Costs: Staying ahead requires continuous investment in technology and product development, which can strain resources.

Potential for Consolidation and Acquisition Pressures

Humm Group is currently navigating a significant industry trend toward consolidation, as evidenced by its consideration of a non-binding indicative proposal to acquire its Buy Now, Pay Later (BNPL) platform. This situation underscores the intense M&A activity prevalent in both the broader financial services landscape and the specific BNPL sector. For instance, the BNPL market has seen several high-profile deals, with Klarna raising $800 million in August 2023 at a valuation significantly lower than its previous rounds, signaling investor caution and a potential drive for efficiency through consolidation.

The potential for Humm Group's acquisition means its ownership structure, strategic imperatives, and overall market standing could be subject to substantial shifts. This M&A pressure is not unique to Humm; many fintech companies are facing increased scrutiny and pressure to achieve scale or be acquired. In 2024, the financial services sector is expected to continue this consolidation, with reports indicating a rise in M&A deal volumes compared to 2023, driven by a need for profitability and market share expansion.

- Industry Consolidation: The BNPL sector is experiencing a wave of mergers and acquisitions as companies seek scale and profitability.

- Acquisition Pressure: Humm Group's consideration of a sale highlights the external pressures for consolidation within its market.

- Strategic Impact: A successful acquisition would likely lead to a re-evaluation of Humm Group's strategic direction and market positioning.

- Market Dynamics: Increased M&A activity in financial services in 2024 suggests a challenging environment for standalone players.

The BNPL sector faces increasing regulatory scrutiny globally, with Australia implementing new credit licensing and responsible lending obligations from June 2025. This will likely increase Humm Group's compliance costs and operational complexity.

Rising interest rates, as seen with the Reserve Bank of Australia's cash rate increases through 2023 and 2024, directly elevate Humm Group's cost of funding. This could lead to reduced consumer borrowing and necessitate adjustments to Humm's pricing or efficiency measures to maintain profitability.

Intensified competition, with over 100 global BNPL providers by early 2024 and traditional banks entering the space, creates pricing pressures and demands continuous innovation investment. The global BNPL market was projected to exceed $3.5 trillion by the end of 2023, highlighting fierce rivalry.

Industry consolidation is a significant threat, as demonstrated by Humm Group's consideration of acquisition proposals. This trend, with Klarna raising $800 million in August 2023 at a reduced valuation, signals a market push for scale and efficiency, potentially impacting Humm's strategic independence.

SWOT Analysis Data Sources

This SWOT analysis for Humm Group is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary. These diverse data sources ensure a robust and accurate assessment of the company's internal capabilities and external market positioning.