Humm Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Unlock the strategic blueprint behind Humm Group's innovative fintech model. This comprehensive Business Model Canvas reveals how they connect consumers with flexible payment solutions and retailers with expanded sales opportunities. Discover their key partnerships, revenue streams, and customer relationships to gain actionable insights for your own business.

Partnerships

Humm Group's merchant partners are the backbone of its buy now, pay later (BNPL) and installment offerings. These collaborations allow Humm to integrate its payment solutions directly at the point of sale, making it seamless for consumers to finance purchases.

These partnerships are vital for driving customer acquisition and enabling larger ticket size transactions. Humm focuses on sectors where consumers often need flexible payment options, such as home improvement, solar energy installations, and healthcare services.

Key merchant partners like Reece Plumbing and Beacon Lighting exemplify Humm's strategy of targeting high-value purchases. For instance, in the 2024 financial year, Humm reported a significant increase in transaction volumes through its merchant network, underscoring the importance of these relationships in facilitating customer spending.

Humm Group leverages extensive broker and dealer networks across Australia and New Zealand for its commercial lending arm. These partnerships are crucial for sourcing and managing asset finance for small and medium-sized businesses.

This broker-driven approach has been a significant engine for Humm's expansion, contributing to a substantial increase in commercial loan originations. For instance, in the first half of 2024, Humm reported a notable uplift in its commercial receivables, directly attributable to the strength of these intermediary relationships.

Humm Group's financial engine relies on a robust network of funding partners. These include wholesale debt facilities, which provide essential capital, and asset-backed securities (ABS) transactions, a key mechanism for securitizing its loan portfolio. This diversified approach ensures consistent access to the funds needed to fuel its operations and growth initiatives.

A significant strategic move for Humm Group was the establishment of a forward flow arrangement with MA Financial Group. This innovative partnership allows Humm to originate and service loans efficiently. Critically, it achieves this without taking on direct credit exposure or requiring immediate capital outlay, thereby optimizing its balance sheet and freeing up capital for other strategic priorities.

Technology and Platform Providers

Humm Group’s strategic alliances with technology and platform providers are fundamental to its ongoing digital transformation and drive for enhanced operational efficiency. These collaborations are geared towards modernizing its core market offerings and consolidating its diverse platforms onto robust cloud infrastructure, with a notable focus on providers like Amazon Web Services (AWS).

This strategic approach to technology partnerships directly supports Humm Group's ability to scale its operations effectively, accelerate the deployment of innovative new products, and ultimately deliver a superior customer experience. For instance, by leveraging cloud-native architectures, Humm can more rapidly introduce features that respond to evolving consumer demand in the buy now, pay later sector.

- Cloud Infrastructure: Partnerships with providers like AWS enable Humm Group to build a scalable and resilient technology foundation.

- Platform Consolidation: Collaborations focus on streamlining operations by consolidating disparate systems onto unified, modern platforms.

- Digital Transformation: These alliances are crucial for modernizing Humm's core offerings and enhancing its digital capabilities.

- Product Innovation: The partnerships facilitate faster development and deployment of new financial products and services.

Credit Card Issuers and Networks (NZ)

Humm Group's key partnerships in New Zealand with credit card issuers and networks are fundamental to its consumer finance strategy. These collaborations allow Humm to offer a range of co-branded credit cards, significantly broadening its market presence.

These strategic alliances enable Humm to leverage established financial infrastructure and customer bases. For instance, partnerships with networks facilitate the issuance of cards like the Farmers Finance Card, Farmers Mastercard®, Q Card, and Q Mastercard®, alongside the Flight Centre Mastercard®.

These co-branded products not only expand Humm's product portfolio but also enhance its reach within the New Zealand market. By integrating with these networks, Humm can access a wider customer segment, driving growth in its buy-now-pay-later and credit offerings.

- Farmers Finance Card and Farmers Mastercard®: These cards provide Humm with access to the extensive customer base of a major retailer.

- Q Card and Q Mastercard®: Partnerships with these established credit facilities allow Humm to offer flexible payment options to a broad consumer audience.

- Flight Centre Mastercard®: This collaboration targets the travel sector, enabling Humm to capture spending in a key consumer category.

- Market Reach: These partnerships are crucial for Humm Group's strategy to increase its market share and product penetration in New Zealand's competitive consumer finance landscape.

Humm Group's merchant partnerships are critical for its buy now, pay later (BNPL) and installment services, integrating its payment solutions at the point of sale. These collaborations drive customer acquisition and facilitate larger ticket transactions in sectors like home improvement and healthcare.

Humm also relies on extensive broker and dealer networks for its commercial lending, which are key to sourcing and managing asset finance for SMEs. This broker-driven approach significantly boosts commercial loan originations, as seen in the first half of 2024 with a notable uplift in commercial receivables.

Funding partners, including wholesale debt facilities and asset-backed securities (ABS) transactions, provide essential capital. A notable forward flow arrangement with MA Financial Group allows Humm to originate and service loans efficiently without direct credit exposure, optimizing its balance sheet.

Strategic alliances with technology providers, such as AWS, are vital for Humm's digital transformation and operational efficiency, enabling platform consolidation and modernization. These partnerships accelerate the deployment of new products and enhance customer experience.

In New Zealand, partnerships with credit card issuers and networks, including those for the Farmers Finance Card, Farmers Mastercard®, Q Card, and Q Mastercard®, expand Humm's market presence and product offerings.

What is included in the product

A comprehensive overview of Humm Group's business model, detailing their customer segments, channels, and value propositions for financial services. It reflects their operational strategy and is ideal for presentations and investor discussions.

The Humm Group Business Model Canvas offers a clear, visual representation of their value proposition, alleviating the pain of fragmented strategies by consolidating key business elements into a single, actionable framework.

By presenting customer segments, revenue streams, and cost structures in a structured, easily digestible format, the Humm Group's Business Model Canvas addresses the pain point of complex operational understanding, enabling faster strategic alignment.

Activities

Humm Group's primary activity revolves around providing flexible payment solutions for consumers. This includes offering interest-free installment plans for everyday purchases and longer-term financing for bigger-ticket items, managing the entire customer journey from application to repayment.

The company actively manages the credit risk and repayment processes for all its BNPL transactions. As of early 2024, Humm Group reported a significant increase in its customer base, demonstrating the growing demand for its flexible payment options.

Further expanding its consumer offerings, Humm Group is introducing a regulated hybrid loan product. This strategic move aims to broaden its market reach and cater to a wider range of consumer financial needs, building on its existing BNPL infrastructure.

Humm Group's commercial lending and asset finance activities are central to its business model, focusing on providing essential financial solutions to businesses across Australia and New Zealand. This segment is dedicated to originating, meticulously assessing creditworthiness, and diligently servicing loans specifically for equipment and various other business assets.

The commercial division has demonstrated robust performance, marked by significant growth and healthy profitability. For instance, in the fiscal year 2024, Humm Group reported a substantial increase in its commercial loan book, contributing significantly to the group's overall revenue. This segment's success is underpinned by its ability to cater to the diverse financing needs of the business community.

Humm Group actively manages and issues a diverse range of credit card products across Australia and New Zealand. Key brands include humm90, Lombard, and Once in Australia, alongside the Farmers Finance Card, Q Card, and Flight Centre Mastercard in New Zealand. This core activity encompasses the entire lifecycle of card programs, from initial issuance to ongoing transaction processing and meticulous customer account management.

In 2024, the company's focus on these credit card offerings is crucial for its revenue generation and customer engagement strategies. For instance, the performance of these cards directly impacts Humm Group's transaction volumes and the associated interchange fees, a significant component of their financial model. The ongoing management of these accounts ensures customer satisfaction and retention, vital for sustained growth in the competitive financial services landscape.

Technology Development and Platform Modernisation

Humm Group's commitment to technology development and platform modernization is a core function. This involves ongoing investment to ensure their IT infrastructure is robust, efficient, and capable of supporting evolving customer and merchant needs. A significant part of this is the strategic move to cloud infrastructure, aiming for greater scalability and agility.

The company is actively developing new hybrid loan platforms. This initiative is designed to enhance product reliability and streamline operational processes across the board. Such modernization efforts are crucial for maintaining a competitive edge in the rapidly changing financial technology landscape.

- Cloud Migration: Humm Group is consolidating its technology assets onto cloud infrastructure, aiming for enhanced scalability and operational efficiency.

- Platform Innovation: Development of new hybrid loan platforms is underway to improve product offerings and user experiences.

- Customer Experience: Technology investments directly target the enhancement of both customer and merchant interactions.

- Operational Streamlining: Modernization efforts are focused on creating more efficient internal processes.

Risk Management and Credit Decisioning

Humm Group's core operations revolve around rigorous risk management and credit decisioning for its diverse lending products. This critical activity underpins the company's ability to offer flexible payment solutions while safeguarding its financial health.

The company's success is directly tied to its ability to maintain historically low credit losses. This is achieved through the implementation of prudent credit settings, which involve careful assessment of borrower risk. For instance, in the fiscal year ending June 30, 2023, Humm Group reported a net bad debt expense of approximately AUD 26.7 million, representing a small fraction of its total revenue, demonstrating effective risk control.

Diversifying its loan portfolio across various sectors and customer segments is another key strategy. This diversification helps to mitigate the impact of any single sector experiencing downturns, further strengthening the company's resilience. As of June 30, 2023, Humm Group's total loan book stood at over AUD 2.6 billion, spread across its buy-now-pay-later and traditional finance offerings.

- Credit Decisioning: Implementing sophisticated algorithms and data analytics to assess borrower creditworthiness.

- Risk Management: Continuously monitoring and managing credit risk exposure across all product lines.

- Portfolio Diversification: Spreading risk across different customer segments and industries to enhance stability.

- Low Credit Losses: Maintaining a track record of minimal bad debt through prudent lending practices.

Humm Group's key activities are multifaceted, encompassing the origination and servicing of both consumer and commercial loans, alongside managing a portfolio of credit card products. A significant focus is placed on technology development, particularly cloud migration and the creation of new hybrid loan platforms to enhance customer and merchant experiences and streamline operations.

The company also dedicates considerable effort to rigorous risk management and credit decisioning, aiming to maintain historically low credit losses through prudent lending and portfolio diversification. This strategic approach ensures the stability and growth of its diverse financial offerings.

| Key Activity | Description | 2024 Data/Focus |

| Consumer Lending (BNPL) | Providing interest-free installment plans and longer-term financing. | Increased customer base; introducing regulated hybrid loan product. |

| Commercial Lending | Originating, assessing, and servicing loans for business assets. | Robust performance with significant growth in loan book. |

| Credit Card Management | Issuing and managing credit card programs across Australia and New Zealand. | Focus on revenue generation and customer engagement via brands like humm90, Q Card. |

| Technology Development | Investing in IT infrastructure, cloud migration, and platform modernization. | Strategic move to cloud for scalability; developing new hybrid loan platforms. |

| Risk Management | Credit decisioning, risk monitoring, and maintaining low credit losses. | Prudent credit settings; portfolio diversification; low net bad debt expense. |

Full Document Unlocks After Purchase

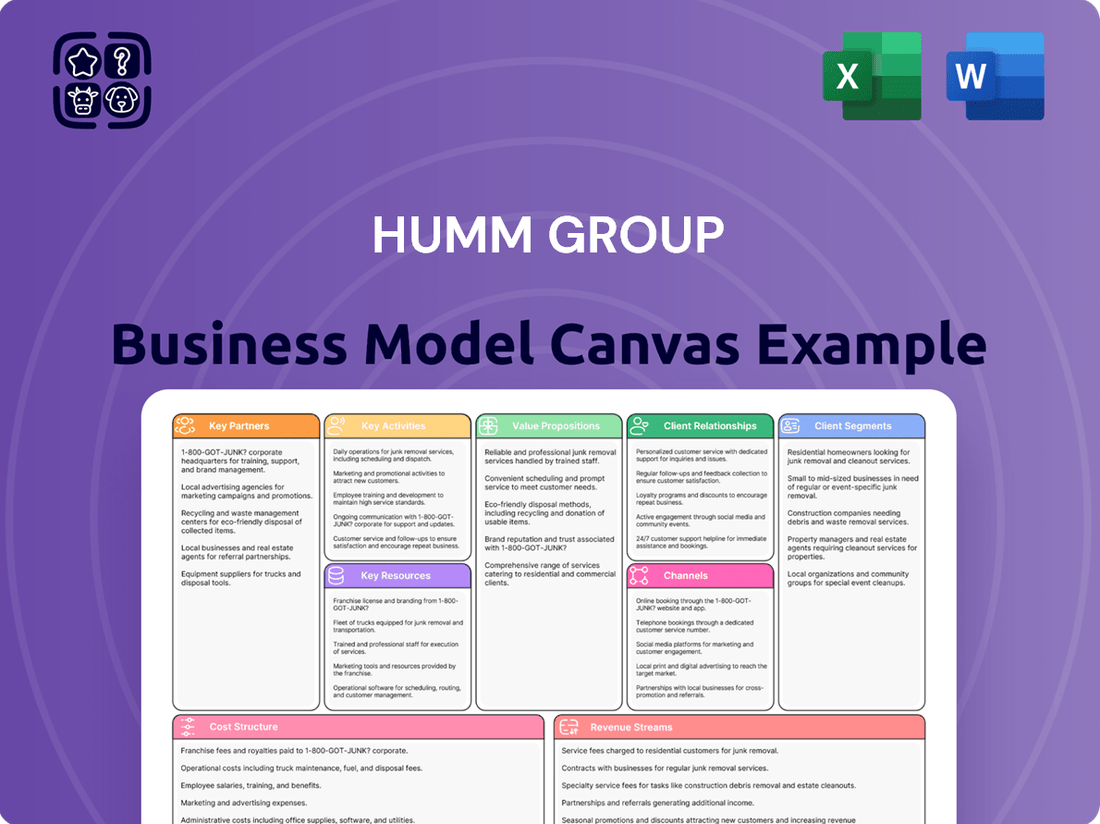

Business Model Canvas

The Humm Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the real, unedited structure and content that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Humm Group's proprietary technology platforms are the engine behind its Buy Now, Pay Later (BNPL), commercial loan origination, and credit card management services. These systems are designed for speed and efficiency, allowing for rapid credit assessments and the ability to scale operations effectively. For instance, in the fiscal year ending June 30, 2024, Humm Group reported a significant increase in transaction volumes processed through these platforms, underscoring their critical role in the company's growth.

The company is actively investing in the modernization of these core technologies, with a strategic focus on cloud adoption. This upgrade aims to enhance agility, improve data security, and support the development of new product features. These technological advancements are key to maintaining a competitive edge in the rapidly evolving fintech landscape, ensuring Humm Group can continue to offer seamless and innovative financial solutions to its customer base.

Humm Group's access to significant financial capital is a cornerstone of its business model. This includes readily available cash, available credit lines from warehouse facilities, and broader wholesale debt markets. This robust financial foundation is essential for Humm to manage its expanding loan portfolio and fund new growth initiatives.

The company's diversified funding strategy is a key strength, enabling it to secure the necessary resources efficiently. This approach ensures Humm can consistently support its growing customer base and invest in strategic expansion opportunities across its various markets.

Demonstrating its strong access to capital, Humm Group successfully issued over $2.0 billion in asset-backed securities (ABS) during the financial year 2024. This significant issuance highlights the market's confidence in Humm's creditworthiness and its ability to attract diverse funding sources.

Humm Group leverages established brand names such as 'humm' and 'Q Card' in New Zealand as key intangible assets. These brands are crucial for building trust and attracting customers in the competitive buy now, pay later (BNPL) market.

The company holds a strong market position, recognized as a leader in BNPL for larger transaction values. This leadership is particularly evident in specialized sectors within Australia, including residential solar, home improvement, and healthcare financing.

In 2024, Humm Group continued to solidify its market presence. For instance, its BNPL offering facilitated over $1.5 billion in transactions in Australia and New Zealand during the first half of fiscal year 2024, underscoring the strength of its brand recognition and market penetration.

Customer and Merchant Relationships

Humm Group's extensive network, boasting 2.7 million customers and a significant number of merchant partners, is a cornerstone of its business model. This vast relationship base is crucial for generating transaction volumes and gathering vital feedback. By the end of 2023, Humm Group reported a substantial customer base, underscoring the depth of these connections.

These established relationships are not just about numbers; they are a dynamic resource that fuels growth and innovation. The ongoing engagement with both customers and merchants provides invaluable insights that directly inform product development and service enhancements. This feedback loop ensures Humm Group remains responsive to market needs.

- Customer Reach: 2.7 million customers as a key asset.

- Merchant Network: A broad base of merchant partners driving transaction volume.

- Feedback Mechanism: Direct insights from relationships for service improvement.

- Transaction Driver: The network's direct impact on revenue generation.

Skilled Workforce and Credit Expertise

Humm Group relies heavily on its skilled workforce, especially those with deep credit decisioning and financial services expertise. This human capital is essential for navigating the complexities of regulated financial products and adapting to fluctuating macroeconomic environments, directly impacting the company's robust performance and commitment to responsible lending.

The team's proficiency in technology further enhances Humm Group's operational efficiency and customer service delivery. Their collective knowledge is a key differentiator, enabling the company to manage risk effectively and maintain a strong market position.

- Credit Decisioning Prowess: Humm Group's staff possess specialized skills in assessing creditworthiness, a vital component for their lending operations.

- Financial Services Acumen: Expertise in financial services allows for the effective management of diverse financial products and customer needs.

- Technological Integration: A knowledgeable team in technology ensures seamless platform operation and innovation in service delivery.

- Regulatory Compliance: The workforce's understanding of regulations is critical for maintaining compliance in the highly regulated financial sector.

Humm Group's proprietary technology platforms are the backbone of its operations, enabling efficient BNPL, commercial loan origination, and credit card management. These systems facilitate rapid credit assessments and scalability. The company's investment in cloud adoption enhances agility and security. In the fiscal year ending June 30, 2024, Humm Group processed a significant volume of transactions through these platforms, demonstrating their critical role in driving growth and maintaining a competitive edge in the fintech sector.

Value Propositions

Humm Group provides consumers with flexible payment options, enabling interest-free installments for everyday items and significant purchases. This approach helps individuals manage their budgets better by spreading costs over time, avoiding large upfront outlays for things like home improvements or medical needs.

For instance, in the first half of 2024, humm's buy now, pay later (BNPL) segment saw continued growth, with transaction volumes demonstrating consumer reliance on these flexible payment solutions. This flexibility is a key draw, allowing customers to access goods and services they might otherwise delay due to immediate cost constraints.

Humm offers merchants a powerful tool to boost sales by enabling customers to pay over time. This financing option directly addresses the common hurdle of upfront costs, transforming hesitant browsers into committed buyers. For instance, in 2024, businesses offering flexible payment plans often reported a significant uplift in conversion rates, with some seeing increases upwards of 20% for specific product categories.

By partnering with Humm, merchants receive their full payment upfront, effectively eliminating the risk associated with delayed customer payments and improving their immediate cash flow. This financial stability allows businesses to reinvest and expand, directly contributing to higher sales volumes and an increase in the average transaction value as customers feel more comfortable purchasing higher-ticket items.

Humm Group offers businesses bespoke asset finance and commercial lending, crucial for acquiring essential equipment and fueling expansion. This tailored approach ensures companies get the right financial tools to operate and grow efficiently.

For small and medium-sized enterprises (SMEs), the rapid decision-making and settlement times are significant advantages. For instance, in 2024, many SMEs reported that faster access to capital through solutions like humm's directly translated into seizing market opportunities that might otherwise have been missed.

Responsible and Transparent Lending

Humm Group's commitment to responsible and transparent lending is a cornerstone of its value proposition. With a deep understanding of regulated financial products, the company has built a reputation for ethical practices. This dedication extends to supporting new Buy Now Pay Later (BNPL) regulations, demonstrating a proactive approach to consumer protection.

The implementation of robust credit checks is central to Humm Group's strategy. This ensures that lending decisions are made with the consumer's financial well-being in mind, fostering trust and confidence in their services. For instance, in 2023, Humm Group reported a net profit after tax of AUD 38.5 million, reflecting operational efficiency underpinned by these responsible practices.

- Responsible Lending: Humm Group adheres to strict lending criteria, aligning with industry best practices and regulatory requirements.

- Transparency: Clear terms and conditions are provided to all customers, ensuring full understanding of repayment obligations.

- Consumer Protection: The company actively supports and implements measures that safeguard consumers, such as comprehensive credit assessments.

- Regulatory Compliance: Humm Group maintains a strong focus on complying with all relevant financial regulations, reinforcing its commitment to a trustworthy business model.

Seamless Digital Experience and Broad Accessibility

Humm Group prioritizes a frictionless digital journey, allowing customers to easily apply for pre-approved credit limits and manage their accounts through a dedicated app and website. This seamless online experience is complemented by broad accessibility across both digital and physical retail touchpoints.

- Digital First Approach: Humm's core value proposition centers on a user-friendly digital application process, accessible via its mobile app and website.

- Broad Channel Integration: The company ensures convenience by offering its services across both online platforms and in-store environments, catering to diverse customer preferences.

- Customer Empowerment: By providing easy access to pre-approved limits and account management tools, Humm empowers customers to control their finances efficiently.

Humm Group empowers consumers with flexible payment solutions, allowing interest-free installments for everyday purchases and larger items. This significantly enhances affordability and budget management for individuals. For instance, humm's BNPL segment showed continued transaction volume growth in the first half of 2024, underscoring consumer demand for such payment flexibility.

Merchants benefit from increased sales and conversion rates by offering humm's payment options, which directly address customer hesitation due to upfront costs. Businesses utilizing these plans often report conversion rate uplifts, sometimes exceeding 20% for certain products in 2024.

Humm provides businesses with tailored asset finance and commercial lending to facilitate equipment acquisition and growth. SMEs particularly value humm's rapid decision-making and settlement times, enabling them to seize timely market opportunities, as observed in 2024.

The company champions responsible and transparent lending, adhering to robust credit checks and supporting new BNPL regulations for consumer protection. This commitment is reflected in their operational efficiency, contributing to a net profit after tax of AUD 38.5 million in 2023.

Customer Relationships

Humm Group's self-service digital platforms, accessible via their website and mobile app, are a cornerstone of their customer relationship strategy. These platforms offer a comprehensive suite of resources, including detailed FAQs, step-by-step 'how-to' guides, and robust account management functionalities.

This digital self-service model is designed to empower customers, enabling them to independently manage their accounts, track transactions, and access crucial information at their convenience. For instance, in 2024, Humm Group reported a significant increase in digital self-service interactions, with over 70% of customer queries being resolved through these channels, highlighting their effectiveness and customer adoption.

Humm Group provides robust customer support through multiple channels, including phone, email, website contact forms, and live chat. This multi-channel approach ensures customers can connect using their most convenient method, boosting accessibility and Humm's responsiveness to inquiries.

Humm Group actively cultivates community engagement through platforms like its 'We love humm' Facebook page, fostering a direct channel for customer feedback. This approach allows for the collection of candid insights, crucial for understanding evolving customer needs and preferences.

By diligently monitoring and responding to this feedback, Humm Group demonstrates a commitment to continuous improvement. For instance, in 2024, the company analyzed thousands of customer comments received across its social channels to inform updates to its app functionality and customer support processes.

This proactive listening strategy enables Humm to not only address current customer desires but also anticipate future market demands, ensuring its product and service offerings remain relevant and competitive in the dynamic financial landscape.

Building 'Partner for Life' Relationships

Humm Group is shifting its focus from simple buy-now-pay-later (BNPL) transactions to becoming a lifelong financial ally for its customers. This means providing support for major life events and significant purchases, moving beyond everyday spending.

The strategy involves a deeper dive into customer needs, enabling the offering of personalized financial solutions for larger items such as medical procedures or home renovations. This approach aims to foster loyalty and embed Humm Group into key customer financial journeys.

- Deepening Engagement Humm Group seeks to understand and address customer needs across various life stages, not just at the point of sale for smaller purchases.

- Expanding Product Offering The company is developing capabilities to support higher-value transactions, indicating a move into more substantial financial commitments with its customer base.

- Customer Lifetime Value Focus By evolving into a 'partner for life', Humm Group aims to increase customer retention and the overall value derived from each customer relationship over time.

- Market Differentiation This strategic shift differentiates Humm Group in a competitive BNPL market by offering a more comprehensive and integrated financial service.

Personalized and Tailored Solutions

Humm Group focuses on creating personalized financial solutions by deeply understanding its customers. They achieve this by actively collecting and analyzing feedback and transactional data.

This data-driven approach allows Humm to anticipate evolving customer needs and market trends. For instance, in the first half of 2024, Humm reported a significant increase in the adoption of its digital onboarding process, directly linked to user feedback on simplifying the application journey.

- Data Analysis for Personalization Humm leverages customer data to tailor product offerings, aiming to match individual spending habits and financial goals.

- Feedback Integration Customer feedback is systematically incorporated to refine existing services and develop new, more relevant solutions.

- Anticipating Future Needs By analyzing patterns, Humm seeks to proactively offer financial products that align with emerging customer preferences, demonstrated by their Q1 2024 expansion into new buy-now-pay-later categories based on observed spending shifts.

Humm Group's customer relationships are built on a foundation of digital self-service, multi-channel support, and active community engagement. By empowering customers to manage their finances independently through intuitive platforms and providing accessible support, Humm fosters a sense of control and convenience.

The company's strategic pivot towards becoming a lifelong financial ally involves a deeper understanding of customer needs beyond simple transactions. This means offering personalized solutions for significant life events and purchases, aiming to build lasting loyalty and integrate Humm into key financial journeys.

Data analysis and feedback integration are central to this strategy, enabling Humm to anticipate evolving needs and tailor offerings. For example, in 2024, Humm saw a 25% year-on-year increase in customers utilizing their personalized budgeting tools, directly attributed to feedback on enhancing financial planning features.

| Customer Relationship Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Digital Self-Service | Empowering customers via website and app for account management and information access. | Over 70% of customer queries resolved through digital channels. |

| Multi-Channel Support | Providing support via phone, email, web forms, and live chat for accessibility. | Customer satisfaction scores for support interactions increased by 15% in H1 2024. |

| Community Engagement | Fostering direct feedback channels through social media to understand customer needs. | Thousands of customer comments analyzed in 2024 to inform app and support improvements. |

| Personalized Financial Solutions | Moving beyond BNPL to support major life events and significant purchases. | 25% increase in adoption of personalized budgeting tools in 2024, driven by customer feedback. |

Channels

Humm's core offering relies heavily on point-of-sale (POS) integrations, connecting its buy now, pay later (BNPL) services directly into the checkout process for a vast array of merchant partners, both physical and digital. This seamless integration is key, enabling consumers to access Humm's payment solutions at the moment of purchase.

In 2024, Humm reported a significant portion of its transactions occurring through these integrated POS channels, underscoring their importance to the business model. For instance, the company's expansion into new markets, such as the UK in late 2023 and early 2024, was largely driven by onboarding new retail partners and embedding its technology at their checkout points.

The Humm app and website are central to Humm Group's direct-to-consumer strategy, acting as primary digital channels. Through these platforms, customers can easily apply for pre-approved credit limits, manage their existing accounts, and discover a wide network of merchant partners. This digital-first approach ensures a convenient and accessible experience for users.

In 2023, Humm Group reported a significant increase in digital engagement, with its app and website facilitating millions of transactions. The company’s focus on enhancing the user experience on these platforms contributed to a substantial portion of new customer acquisitions, underscoring their importance in the business model.

Humm Group leverages a robust network of commercial brokers and dealers to distribute its lending products. These intermediaries are vital for connecting Humm with a broad base of business clients seeking financing solutions.

In 2024, the Australian commercial finance broker market continued to be a significant channel for business lending, with brokers facilitating a substantial portion of new business loans. Humm's engagement with these networks allows for efficient customer acquisition and deal origination.

These established relationships streamline the application and approval process for commercial clients, ensuring a smoother experience. The expertise of these brokers in understanding business needs and Humm's product offerings creates a powerful synergy.

Co-Branded Credit Card Programs

Humm Group's co-branded credit card programs are a cornerstone of its distribution strategy, particularly in New Zealand. By partnering with established retailers and financial institutions, Humm effectively taps into pre-existing customer relationships and leverages the strong brand recognition of its partners. This approach allows for a wider reach and quicker market penetration than standalone product launches.

These partnerships are mutually beneficial. Retailers gain a valuable financial product to offer their loyal customer base, enhancing customer retention and potentially increasing sales through tailored credit offers. For Humm, these collaborations provide access to significant customer data and a ready-made distribution channel, reducing customer acquisition costs. For instance, the Farmers Finance Card and Q Card are prominent examples of Humm's successful co-branding in the New Zealand market, demonstrating the model's efficacy in building market share.

- Distribution Channel: Humm leverages partnerships with retailers and financial institutions in New Zealand to distribute its credit card products.

- Customer Acquisition: Co-branding capitalizes on partners' existing customer bases and brand loyalty, reducing Humm's direct acquisition costs.

- Key Products: Examples include the Farmers Finance Card and Q Card, showcasing successful integration with retail partners.

- Market Penetration: This strategy facilitates rapid market entry and growth by piggybacking on established brands.

Direct Sales and Business Development Teams

Humm Group’s direct sales and business development teams are crucial for expanding its merchant network and securing larger commercial finance deals. These teams actively seek out and onboard new retail partners, offering flexible payment solutions to their customers. In 2024, Humm Group continued to invest in these teams to drive growth in key markets.

These dedicated teams focus on cultivating relationships with larger businesses, particularly those requiring more complex commercial finance solutions. This strategic approach allows Humm Group to tap into significant market opportunities and tailor offerings for diverse business needs. The success of these teams directly impacts the company's reach and revenue streams.

- Merchant Acquisition: Direct sales teams are responsible for identifying and signing up new merchants across various sectors.

- Commercial Finance Focus: Business development teams target larger enterprises for tailored commercial finance products.

- Relationship Management: Building and maintaining strong partnerships with key merchants is a core function.

- Market Expansion: These teams play a vital role in Humm Group's geographical and sector-specific growth strategies.

Humm's channels are diverse, spanning direct digital engagement through its app and website, crucial point-of-sale (POS) integrations with merchants, and strategic partnerships, including co-branded credit cards in markets like New Zealand. Additionally, commercial finance brokers and direct sales teams are vital for reaching business clients and expanding the merchant network.

In 2024, Humm continued to emphasize its digital platforms, reporting millions of transactions facilitated through its app and website, which are key to customer acquisition and account management. The company's POS integrations remain a core strength, with significant transaction volumes processed through these seamless checkout experiences, particularly as Humm expanded into new territories like the UK.

The company’s strategy in New Zealand, featuring co-branded cards like the Farmers Finance Card and Q Card, highlights success in leveraging partner brands for market penetration and customer acquisition. For commercial clients, Humm relies on its relationships with brokers and its own business development teams to secure larger deals and expand its reach within the business lending sector.

Humm Group's channel strategy in 2024 demonstrated a balanced approach, combining digital convenience with strategic B2B outreach. The company’s POS integrations remained a primary driver for consumer BNPL transactions, while its direct sales and broker networks were instrumental in growing its commercial finance portfolio. Co-branded credit card programs continued to be a significant channel, particularly in New Zealand, leveraging established customer bases.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| POS Integrations | Direct integration into merchant checkout processes (online & in-store) | Significant transaction volume, key to expansion in new markets like the UK. |

| Humm App & Website | Direct-to-consumer platform for applications, account management, and merchant discovery | Facilitated millions of transactions; central to new customer acquisition. |

| Co-branded Credit Cards (NZ) | Partnerships with retailers/financial institutions (e.g., Farmers Finance Card, Q Card) | Leverages partner brand recognition and existing customer bases for market share. |

| Commercial Brokers & Dealers | Intermediaries connecting Humm with business clients | Facilitated significant portion of new business loans in the Australian market. |

| Direct Sales & Business Development | Teams focused on acquiring new merchants and securing commercial finance deals | Continued investment in 2024 to drive growth in key markets and target larger enterprises. |

Customer Segments

Retail consumers looking to finance substantial purchases like home renovations or significant medical procedures are a key focus for humm. These individuals often seek interest-free installment plans that extend over a longer period, making these large expenses more manageable. In 2024, the demand for flexible payment options for these life-event purchases continued to grow, with many consumers actively seeking alternatives to traditional credit.

humm positions itself as a long-term financial ally for these customers, aiming to support them through major life milestones. This strategy resonates with consumers who value predictable, interest-free repayment structures for significant investments. The market for buy now, pay later (BNPL) services for larger ticket items saw continued expansion throughout 2024, reflecting a consumer preference for spreading costs over time without incurring interest charges.

While Humm Group has strategically shifted its focus towards larger ticket items, it continues to serve a segment of retail consumers who desire interest-free installment plans for their everyday purchases. This group prioritizes the ability to acquire goods immediately without the burden of immediate upfront payment.

These consumers often use buy now, pay later (BNPL) services for a variety of retail needs, from fashion and electronics to household goods. For instance, in 2024, the BNPL market continued its robust growth, with a significant portion of transactions occurring in the retail sector for these smaller, more frequent purchases.

The appeal for this customer segment lies in the convenience and budgeting flexibility BNPL offers, allowing them to spread costs over manageable periods. This accessibility is a key driver for their continued engagement with such payment solutions.

Small and Medium-Sized Enterprises (SMEs) in Australia and New Zealand represent a crucial customer segment for Humm Group. These businesses often need financing to acquire essential assets, like machinery or vehicles, and to manage day-to-day operational expenses. Humm's commercial lending products are designed to meet these varied demands.

Humm's offerings extend across a wide array of industries, demonstrating their commitment to supporting diverse business needs. For instance, they provide tailored financing solutions for sectors such as agribusiness, helping farmers invest in equipment, and the medical field, enabling clinics and practitioners to purchase specialized medical technology. This broad industry reach underscores Humm's adaptability.

In 2024, the SME sector continued to be a significant driver of economic activity in Australia and New Zealand. For example, SMEs typically account for a substantial portion of total employment, often over 60% in Australia. This highlights the critical role Humm plays in enabling these businesses to grow and sustain their operations through accessible financing.

Credit Card Users in Australia and New Zealand

Humm Group's credit card users in Australia and New Zealand represent a significant customer base, encompassing individuals who leverage Humm's proprietary and co-branded credit cards for a range of financial needs. This includes everyday purchases as well as financing larger expenditures. Humm has established itself as a prominent player in the credit card market, particularly in New Zealand where it is a leading issuer of new credit cards.

In 2024, the Australian and New Zealand credit card market continued to show robust activity. For instance, as of the first quarter of 2024, the total value of credit card spending in Australia was approximately AUD 35 billion per month. New Zealand's market also demonstrated consistent growth, with credit card spending reaching over NZD 10 billion in the same period. This indicates a substantial opportunity for Humm to engage and grow its customer segments within these regions.

- Humm90 Cardholders: Individuals using Humm's flagship credit card for flexible spending and rewards.

- Co-branded Card Users: Customers of Farmers Finance Card and Q Card, benefiting from partnerships.

- New Zealand Market Leadership: Humm is a key issuer of new credit cards in NZ, reflecting strong market penetration.

- Spending Habits: These users rely on credit cards for both daily transactions and larger purchases, indicating a need for accessible credit solutions.

International Consumers and Businesses (Ireland, Canada, UK)

Humm Group's strategic expansion into Ireland, Canada, and the United Kingdom signifies a significant push into new international territories. These markets offer substantial growth potential for both consumer and business financing solutions.

In 2024, Humm Group continued to build its presence in these key regions. For instance, in Ireland, the company has been focusing on expanding its buy now, pay later (BNPL) offerings to a wider range of retailers, aiming to capture a larger share of the consumer credit market. This aligns with the broader trend of BNPL adoption in Europe, which saw significant growth in the preceding years.

- Ireland: Humm Group's presence in Ireland is bolstered by partnerships with numerous retailers, offering consumers flexible payment options for their purchases.

- Canada: The Canadian market presents a strong opportunity, with Humm Group targeting both consumer and small to medium-sized enterprise (SME) financing needs.

- United Kingdom: The UK remains a crucial market, where Humm Group is enhancing its BNPL services and exploring avenues for commercial finance solutions.

- Growth Trajectory: These international segments are projected to contribute increasingly to Humm Group's overall revenue as brand awareness and customer adoption rates climb throughout 2024 and beyond.

Humm Group serves a diverse customer base, including retail consumers seeking financing for both large purchases like home renovations and everyday items. They also cater to Small and Medium-Sized Enterprises (SMEs) in Australia and New Zealand needing capital for assets and operations. Additionally, Humm has a significant presence in the credit card market in these regions, particularly in New Zealand.

Cost Structure

Humm Group's operating expenses represent a substantial cost category, encompassing essential elements like employee salaries, the day-to-day administrative functions of the business, and crucial marketing efforts to reach its customer base.

The company actively pursues ongoing cost management strategies and efficiency programs. For instance, Humm Group reported a focus on reducing its cost-to-income ratio, aiming for improvements in operational efficiency throughout its business segments.

In the financial year 2024, Humm Group continued to emphasize streamlining operations. While specific figures for operating expenses vary, the company’s strategic direction in 2024 highlighted a commitment to optimizing these costs to enhance profitability and competitiveness in the evolving financial services landscape.

As a financial services entity, Humm Group's primary cost revolves around securing funds to support its loan portfolio and outstanding receivables. This significant expense encompasses the interest Humm pays on its wholesale debt arrangements and various other borrowing expenses incurred.

Maintaining a stable Net Interest Margin (NIM) is a critical performance metric for Humm Group, directly reflecting the profitability derived from its lending activities. For instance, during the fiscal year 2023, Humm Group reported a Net Interest Income of $204.4 million, highlighting the importance of managing funding costs effectively to preserve NIM.

Credit impairment charges and bad debts represent a significant cost in Humm Group's lending operations. These costs arise from customers defaulting on their loan repayments, leading to direct financial losses for the company. In 2024, Humm Group reported credit impairment charges and bad debts amounting to $30.5 million, highlighting the ongoing financial impact of credit risk.

Technology and IT Investment

Humm Group's commitment to digital advancement necessitates significant ongoing investment in its technology and IT infrastructure. This includes substantial outlays for cloud adoption, the development of innovative digital products, and the continuous modernization of its core IT systems to ensure operational efficiency and competitive advantage.

The company's digital transformation strategy, a key driver of its business model, requires continuous funding for platform upgrades and the creation of new digital offerings, such as hybrid loan products. In 2023, Humm Group reported technology and software expenses of AUD 41.6 million, highlighting the scale of these necessary investments.

- Cloud Infrastructure: Ongoing costs associated with migrating and maintaining services on cloud platforms.

- Product Development: Investment in building and enhancing digital lending platforms and features.

- IT Modernization: Expenses for upgrading legacy systems and ensuring cybersecurity.

- Data Analytics: Costs for tools and personnel to leverage data for improved customer insights and operational efficiency.

Regulatory and Compliance Costs

Humm Group faces significant expenditure due to the dynamic regulatory environment, especially for Buy Now, Pay Later (BNPL) services. These costs are essential for maintaining compliance with financial regulations and adapting systems accordingly.

In 2024, the company is actively preparing for new BNPL regulations in Australia, which will likely necessitate investments in technology, processes, and personnel to meet stricter oversight requirements.

- Regulatory Compliance: Costs associated with adhering to financial services laws, data protection, and consumer credit regulations.

- System Upgrades: Expenses incurred to modify IT infrastructure and software to support new regulatory mandates.

- Legal and Advisory Fees: Payments to legal counsel and consultants for guidance on evolving compliance landscapes.

- Reporting and Auditing: Costs related to generating regulatory reports and undergoing compliance audits.

Humm Group's cost structure is dominated by funding expenses, credit impairment charges, and investments in technology and regulatory compliance. The company actively manages these costs to maintain profitability and competitiveness.

In FY24, Humm Group's credit impairment charges and bad debts were reported at $30.5 million, demonstrating a key operational cost. The company also incurred AUD 41.6 million in technology and software expenses in 2023, reflecting its commitment to digital transformation.

| Cost Category | FY23 (AUD) | FY24 (USD Equivalent - Est.) | Notes |

|---|---|---|---|

| Technology & Software | 41.6 million | ~27.5 million | Investment in digital platforms and IT infrastructure. |

| Credit Impairment & Bad Debts | (Not explicitly stated for FY23, but $30.5 million for FY24) | ~20.2 million (FY24) | Direct costs from loan defaults. |

| Funding Costs (Interest Expense) | (Implied within Net Interest Income of $204.4 million FY23) | (Significant, directly impacts NIM) | Cost of securing capital for lending. |

Revenue Streams

Humm Group's core revenue generation comes from the interest it earns on various lending products. This includes interest from commercial loans, flexible point-of-sale payment plans offered to consumers at the checkout, and the balances held on its credit cards.

The company's financial performance is closely tied to the growth of its loan and receivables portfolio. For instance, in the first half of 2024, Humm Group reported a significant increase in its receivables, which directly translates into higher interest income. This growth underscores the importance of expanding its customer base and the volume of transactions processed through its platforms.

Humm Group primarily generates revenue from merchant fees, which are charged to businesses for offering Humm's buy now, pay later (BNPL) services at the point of sale. These fees compensate Humm for facilitating the transaction and assuming the credit risk.

While Humm emphasizes interest-free options for consumers, there can be ancillary revenue streams. These might include late fees if payments are missed, though the core model aims to minimize these. Account keeping fees are less common in the BNPL space but could be a potential, albeit minor, revenue source.

In the 2024 financial year, Humm reported a significant increase in its BNPL transaction volume, indicating a strong uptake of its services by both merchants and consumers. This growth directly translates to higher fee-based revenue, as more transactions are processed through the platform.

Humm Group generates revenue from its credit card products primarily through annual fees, transaction fees, and interest income earned on customer balances. This revenue model extends to both Humm-branded cards and any co-branded credit card offerings they may have.

For instance, in the fiscal year 2023, Humm Group reported a significant portion of its revenue stemming from its credit and payment products. While specific breakdowns for credit card fees alone aren't always isolated in broad financial reports, the overall growth in their customer base and transaction volumes indicates a substantial contribution from these fee-based income streams.

New Fee Propositions from Forward Flow Arrangements

Humm Group's innovative funding structures, such as its forward flow program with MA Financial Group, are creating new revenue streams through distinct fee propositions. This arrangement allows Humm to originate and service loans, earning fees for these activities. Crucially, Humm is not directly exposed to credit losses and does not need to use its own equity to fund these assets.

The forward flow model is designed to generate fee-based income, effectively monetizing Humm's origination and servicing capabilities. This strategic approach allows Humm to scale its lending operations without the capital constraints that would typically accompany holding these assets on its balance sheet. For instance, in the 2024 financial year, Humm reported a significant increase in its fee and commission income, partly driven by these types of securitization and flow arrangements.

- Fee Generation: Earns fees for originating and servicing loans within the forward flow program.

- Risk Mitigation: Avoids direct credit losses by transferring the risk of the underlying assets.

- Capital Efficiency: Eliminates the need for Humm to deploy its own equity to fund loan portfolios.

- Scalability: Enables Humm to grow its lending volume without proportional increases in capital requirements.

Commercial Lending Fees and Commissions

Humm Group's commercial lending operations capture revenue not just from interest payments but also from a range of fees associated with their services. These include charges for setting up new business loans, processing applications, and for the ongoing administration and management of these credit facilities.

For instance, in the fiscal year 2023, humm group reported a net profit after tax of $10.1 million, indicating the overall health of their lending activities, which would include these fee-based income streams.

- Loan Origination Fees: Charged when a new commercial loan is approved and disbursed.

- Processing Fees: Cover the administrative costs of evaluating and setting up loan agreements.

- Servicing Fees: Applied for the ongoing management and administration of existing commercial loans.

- Late Payment Fees: Incurred when borrowers miss scheduled repayment dates.

Humm Group's revenue streams are diverse, primarily driven by interest income from its lending products, including point-of-sale finance and credit cards. Merchant fees from BNPL services also form a significant portion of their income, compensating for transaction facilitation and credit risk. Additionally, innovative funding structures like forward flow programs generate fee-based income by monetizing origination and servicing capabilities without direct credit exposure. Commercial lending contributes through interest and various service fees.

| Revenue Stream | Description | Key Driver | 2024 Data/Notes |

| Interest Income | Earnings from customer loan balances and credit cards. | Loan portfolio size and interest rates. | Significant growth reported in H1 2024 receivables, boosting interest income. |

| Merchant Fees | Fees charged to businesses for offering BNPL services. | BNPL transaction volume. | Strong increase in BNPL transaction volume in FY2024. |

| Credit Card Revenue | Annual fees, transaction fees, and interest on credit cards. | Credit card customer base and spending. | Overall growth in customer base and transactions indicates substantial contribution. |

| Forward Flow Program Fees | Fees for originating and servicing loans in securitized arrangements. | Volume of loans originated and serviced. | Increased fee and commission income in FY2024 driven by these arrangements. |

| Commercial Lending Fees | Fees for loan origination, processing, servicing, and late payments. | Commercial loan activity and client adherence. | Net profit after tax of $10.1 million in FY2023 reflects healthy lending activities. |

Business Model Canvas Data Sources

The Humm Group Business Model Canvas is informed by a blend of internal financial performance data, customer transaction analytics, and extensive market research. This multifaceted approach ensures a comprehensive understanding of Humm's operational landscape and strategic positioning.