Humm Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Humm Group operates within a dynamic financial services landscape, where understanding the interplay of competitive forces is crucial for success. Our analysis reveals how buyer power, the threat of substitutes, and the intensity of rivalry significantly shape Humm's strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Humm Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Humm Group's funding providers, encompassing a mix of local and global banks and investment managers, represent a key element in assessing supplier bargaining power. This diversification strategy is designed to mitigate the influence of any single funding source. For instance, in 2023, Humm Group actively managed its funding mix to optimize costs and ensure stability.

While diversification lessens the leverage of individual lenders, the overall cost of capital remains a critical factor. Rising interest rates, as observed throughout 2023 and into early 2024, can directly impact Humm Group's profitability by increasing the expense of borrowed funds. This sensitivity highlights the ongoing importance of maintaining strong relationships with a broad base of funding partners.

Technology and software vendors, particularly those providing core platforms, payment processing, and cybersecurity, exert a degree of bargaining power over Humm Group. Humm's ongoing re-platforming of its credit card systems and review of consumer IT platforms highlights its dependence on these external technology providers. The proprietary nature of certain software solutions can further amplify supplier leverage.

Merchant acquisition and integration partners, such as payment gateways and e-commerce platforms, wield significant bargaining power. These partners are crucial for Humm Group's ability to onboard merchants and offer its buy-now-pay-later (BNPL) services seamlessly at the point of sale or online. Their influence stems from their existing merchant networks and technological capabilities.

For instance, a partner with a vast network of retailers can demand more favorable terms from Humm, potentially impacting Humm's revenue per transaction or its ability to expand its merchant base efficiently. In 2023, the BNPL market saw continued growth, with transaction volumes in Australia alone reaching billions, highlighting the importance of these integration partners in accessing this market.

Data and Analytics Providers

The bargaining power of data and analytics providers for companies like Humm Group is on the rise. Access to sophisticated credit assessment tools and advanced fraud detection services is absolutely essential for any player in the financial services sector. These capabilities directly impact risk management and operational efficiency.

Suppliers offering highly specialized or proprietary AI-driven fraud prevention and data analytics solutions can wield significant influence. Their ability to provide a distinct competitive edge makes their services indispensable. For instance, in 2024, the global market for fraud detection and prevention solutions was valued at approximately $40 billion, with a projected compound annual growth rate of over 20% in the coming years, highlighting the increasing reliance on these specialized providers.

- Increasing reliance on specialized AI for fraud detection.

- Data analytics providers offer crucial credit assessment tools.

- High demand for advanced solutions drives supplier power.

- The fraud detection market's significant growth underscores this trend.

Regulatory Compliance Service Providers

The bargaining power of regulatory compliance service providers for Humm Group is likely to be moderate, especially as Australia's Buy Now Pay Later (BNPL) sector faces increased regulation starting June 2025. These specialized firms, offering legal, licensing, and responsible lending adherence, are essential for Humm Group's continued operation and growth.

The necessity of these services, particularly in navigating complex new rules, grants these providers a degree of leverage. For instance, the Australian government's proposed reforms, expected to be legislated by mid-2025, will impose stricter consumer protection measures on BNPL providers, increasing demand for expert compliance support.

- Increased Regulatory Scrutiny: The upcoming regulatory changes in Australia, particularly from June 2025, will significantly heighten the need for specialized legal and compliance expertise within the BNPL sector.

- Essential Service Provision: Firms offering regulatory technology (RegTech) and legal advisory services related to licensing and responsible lending are critical for Humm Group to maintain operational legitimacy and avoid penalties.

- Market Demand for Expertise: As compliance becomes more stringent, the demand for specialized knowledge in this area will rise, potentially strengthening the bargaining position of these service providers.

Humm Group's reliance on technology and software vendors, particularly for core platforms, payment processing, and cybersecurity, grants these suppliers a notable degree of bargaining power. The proprietary nature of some solutions and the ongoing need for system upgrades, such as Humm's re-platforming of credit card systems, underscore this dependence. For example, the global market for cybersecurity solutions, critical for financial services, was projected to reach over $200 billion in 2024, indicating significant investment and reliance on specialized providers.

| Supplier Type | Bargaining Power Factor | Example Impact on Humm Group | Relevant Market Data (2024 Estimates) |

|---|---|---|---|

| Funding Providers | Diversification vs. Cost of Capital | Optimizing funding mix to manage interest rate sensitivity. | Global interest rates remained a key consideration throughout 2023-2024. |

| Technology Vendors | Proprietary Solutions & System Dependence | Impact on operational efficiency and platform costs. | Cybersecurity market valued at over $200 billion globally. |

| Merchant Integrators | Network Reach & Technological Capability | Access to merchant base and seamless service delivery. | BNPL transaction volumes in Australia reached billions in 2023. |

| Data & Analytics Providers | Specialized AI & Fraud Prevention Tools | Enhancing risk management and operational efficiency. | Fraud detection market valued at ~$40 billion globally. |

| Compliance Service Providers | Regulatory Expertise & Licensing Needs | Ensuring adherence to evolving BNPL regulations. | Australian BNPL sector facing increased regulation from mid-2025. |

What is included in the product

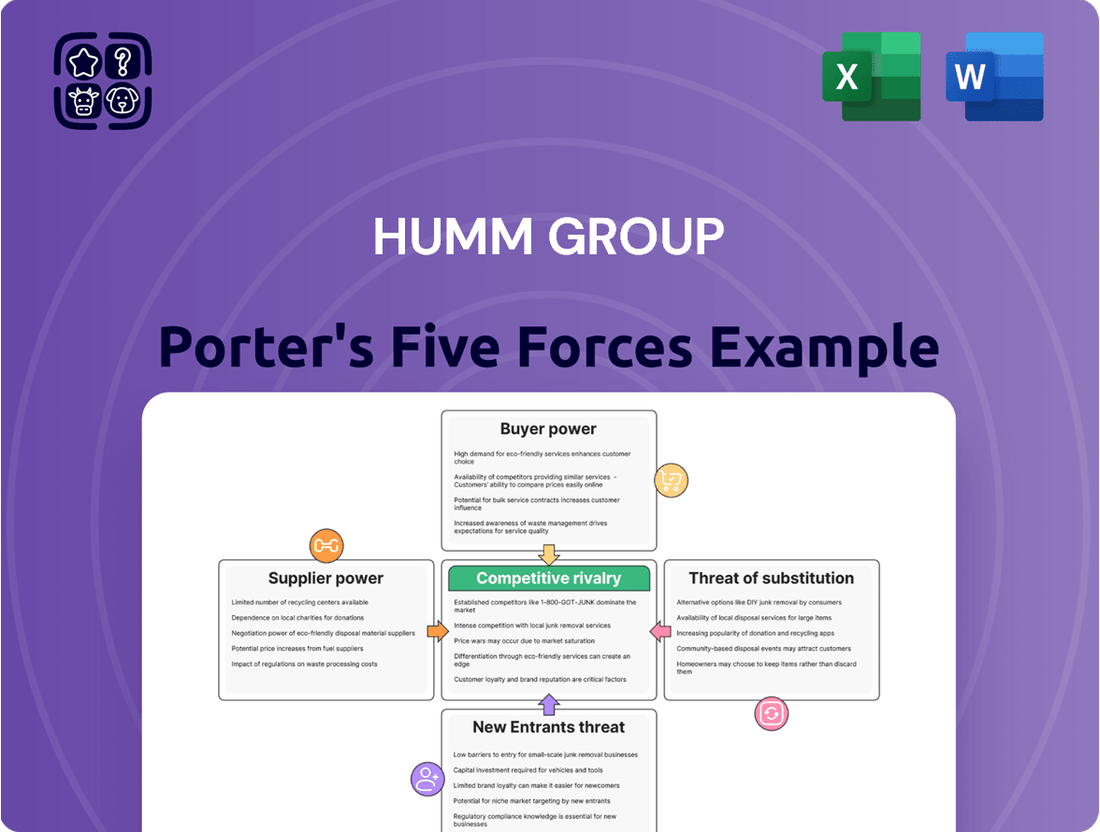

Humm Group's Porter's Five Forces analysis reveals the competitive intensity within the buy now, pay later sector, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing players.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

The bargaining power of individual consumers for Buy Now Pay Later (BNPL) services like Humm Group is typically low. This is because BNPL offerings are often standardized, and the convenience factor is a significant draw for users. For instance, in 2023, BNPL transactions globally reached an estimated $1.6 trillion, highlighting consumer adoption driven by ease of use.

However, the BNPL landscape is becoming increasingly crowded. With numerous providers vying for market share, consumers gain a degree of leverage as they can easily switch between services offering similar benefits. This heightened competition means providers must focus on customer retention and value propositions.

Furthermore, the growing acceptance of BNPL as a viable alternative to traditional credit cards, particularly among younger demographics, amplifies consumer power. As more consumers opt for BNPL, their collective influence on pricing and service terms may gradually increase.

Merchants, particularly retailers and businesses, wield substantial bargaining power over Buy Now Pay Later (BNPL) providers like Humm Group. Their ability to choose which BNPL services to offer at the point of sale directly impacts a provider's market penetration and transaction volume. For instance, a retailer can negotiate terms or even switch providers if they find a more attractive offering, especially concerning merchant fees or integration support.

Humm Group's business model, which includes point-of-sale finance for larger ticket items and tailored business financing, inherently makes strong merchant relationships vital. Merchants are looking for partners that can demonstrably boost sales by removing upfront cost barriers for consumers. In 2024, the competitive landscape for BNPL providers means that Humm Group must continually demonstrate value to its merchant partners, ensuring seamless integration and a positive impact on their bottom line.

For Humm Group's commercial lending operations, businesses seeking financing typically wield moderate bargaining power. These businesses are adept at comparing loan terms, interest rates, and the overall flexibility offered by different financial institutions. In 2024, the competitive landscape for commercial lending remained robust, with numerous alternative lenders entering the market, further empowering borrowers to negotiate favorable conditions.

Customers with Strong Credit Profiles

Customers with strong credit profiles often hold significant bargaining power. They have access to a wider array of financial products, including traditional credit lines that may offer lower interest rates or more flexible repayment structures compared to some Buy Now Pay Later (BNPL) options.

The evolving regulatory landscape, with an increased emphasis on responsible lending, further strengthens the position of creditworthy consumers. This environment encourages BNPL providers to offer more competitive terms and potentially lower fees to attract and retain these valuable customers.

- Increased Choice: Creditworthy customers can readily compare offerings from various BNPL providers and traditional lenders, driving competition for their business.

- Negotiating Leverage: Their ability to secure favorable terms elsewhere gives them the power to negotiate better rates or conditions with BNPL services.

- Regulatory Influence: Stricter lending regulations can push BNPL providers to align their offerings more closely with traditional credit products to remain competitive.

Awareness of Fees and Alternatives

Customers are increasingly informed about the fees and potential charges linked to Buy Now, Pay Later (BNPL) services, which significantly amplifies their bargaining power. This heightened awareness allows them to scrutinize terms and seek out providers offering more transparent and cost-effective options.

The competitive landscape for BNPL is robust, with numerous alternative providers and established payment methods readily available. This abundance of choice empowers consumers to easily switch to a competitor if Humm Group's terms are perceived as unfavorable or if better deals are found elsewhere.

- Increased Consumer Savvy: A growing number of consumers are actively comparing BNPL offerings, looking beyond initial promotions to understand the full cost implications.

- Competitive BNPL Market: In 2024, the BNPL sector continues to see new entrants and aggressive marketing from existing players like Klarna, Afterpay, and Affirm, creating a price-sensitive environment.

- Traditional Payment Options: Credit cards and debit cards remain strong alternatives, often offering rewards or loyalty programs that can sway consumer preference away from BNPL if fees become a deterrent.

- Regulatory Scrutiny: Ongoing discussions around BNPL regulation, particularly concerning consumer protection and fee transparency, further equip customers with knowledge and leverage.

The bargaining power of customers for Humm Group is influenced by several factors, primarily the increasing availability of alternative payment solutions and growing consumer awareness of costs. As more providers enter the Buy Now Pay Later (BNPL) market, consumers can more easily compare terms and switch if they find better deals, especially given that in 2024, the BNPL market is highly competitive, with many players offering similar functionalities.

Creditworthy customers, in particular, hold significant leverage. They have access to a wider range of financial products, including traditional credit lines that may offer more attractive rates or flexible repayment terms. This allows them to negotiate more effectively with BNPL providers, pushing for better conditions or opting for alternatives altogether.

The collective power of informed consumers is also on the rise. With greater transparency regarding fees and potential charges, customers are better equipped to scrutinize BNPL offerings. This heightened financial literacy, coupled with the ease of switching between providers, means that Humm Group must continually offer competitive and transparent terms to retain its customer base.

| Factor | Impact on Humm Group Customer Bargaining Power | Supporting Data/Trend (as of 2024) |

|---|---|---|

| Market Competition | Increases Power | Numerous BNPL providers and traditional payment options available. |

| Consumer Financial Literacy | Increases Power | Growing awareness of fees and comparison shopping behavior. |

| Availability of Alternatives | Increases Power | Credit cards, debit cards, and other financing options offer choice. |

| Creditworthiness of Customer | Increases Power | Access to better terms from other financial institutions. |

What You See Is What You Get

Humm Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Humm Group, detailing the competitive landscape and strategic positioning of the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. It offers an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products, all formatted professionally for immediate use.

Rivalry Among Competitors

The Australian Buy Now Pay Later (BNPL) market is a dynamic and rapidly expanding sector, which naturally attracts a multitude of competitors. This robust growth, with the Australian BNPL market projected to reach $94.2 billion by 2027, fuels intense rivalry as established players and new entrants alike battle for customer acquisition and transaction volume.

The Australian buy now, pay later (BNPL) market is fiercely competitive, with major fintech players like Afterpay, Zip Co, Klarna, and PayPal holding significant sway. These established companies boast strong brand recognition and have cultivated extensive merchant networks, creating a formidable competitive landscape for Humm Group.

In 2023, the BNPL sector in Australia continued its rapid expansion, with transaction volumes reaching billions of dollars. Afterpay, for instance, reported a substantial increase in its customer base and merchant partnerships, reflecting its dominant market position. This intense rivalry means Humm Group must continually innovate and differentiate its offerings to capture market share.

Traditional financial institutions are stepping into the Buy Now, Pay Later (BNPL) space, intensifying competition for companies like Humm Group. For instance, Commonwealth Bank of Australia, a major player, has been integrating BNPL functionalities into its existing banking platforms. This move leverages their extensive customer relationships and established regulatory frameworks, presenting a formidable challenge to standalone BNPL providers.

Regulatory Landscape Evolution

The regulatory landscape for Buy Now, Pay Later (BNPL) providers in Australia is undergoing a significant transformation. New regulations, set to take effect in June 2025, mandate that BNPL entities must obtain credit licenses and adhere to responsible lending obligations. This is a substantial shift from the previously less regulated environment.

This regulatory evolution is poised to reshape the competitive dynamics within the Australian BNPL sector. The requirement for credit licenses and stricter compliance measures is likely to drive market consolidation. Larger, well-established players with the resources to navigate these new requirements will likely gain an advantage, potentially leading to increased competitive pressure on smaller or less prepared firms.

- Increased Compliance Burden: BNPL providers must now invest in obtaining credit licenses and implementing robust responsible lending frameworks, adding operational costs.

- Market Consolidation Expected: The new rules are anticipated to favor larger entities capable of meeting stringent regulatory demands, potentially leading to mergers and acquisitions.

- Competitive Pressure on Smaller Players: Firms that struggle to adapt to the new compliance standards may face significant challenges or exit the market.

- Enhanced Consumer Protection: The regulations aim to bolster consumer protections, which could influence customer trust and provider reputation.

Product Diversification and Innovation

Competitive rivalry intensifies as companies like Humm Group focus on product diversification and continuous innovation to stand out. Humm Group's planned launch of a regulated hybrid loan product in 2024 exemplifies this strategy, aiming to broaden its customer appeal in a saturated buy now, pay later (BNPL) market.

Competitors are not standing still; they are actively enhancing their services. This includes offering extended repayment periods and integrating their solutions across a wider array of retail sectors to capture more market share. For instance, some BNPL providers are reporting significant growth in merchant partnerships, indicating a push for broader accessibility.

- Product Innovation: Humm Group's introduction of a regulated hybrid loan product in 2024 aims to differentiate its offerings.

- Competitive Response: Rivals are enhancing services with longer repayment terms and cross-sector integration.

- Market Dynamics: Continuous innovation and diversification are key drivers of competitive intensity in the BNPL space.

The competitive landscape for Humm Group is characterized by intense rivalry from established fintech giants and traditional banks entering the Buy Now Pay Later (BNPL) space. Companies like Afterpay and Zip Co, with their strong brand recognition and extensive merchant networks, present significant challenges. The Australian BNPL market's projected growth to $94.2 billion by 2027 further fuels this competition, pushing providers to innovate and differentiate their offerings to secure market share.

| Competitor | Market Position | Key Strategies |

|---|---|---|

| Afterpay | Dominant | Customer acquisition, merchant partnerships, brand loyalty |

| Zip Co | Strong | Product diversification, international expansion |

| Klarna | Growing | E-commerce integration, flexible payment options |

| PayPal | Established | Leveraging existing user base, seamless checkout integration |

| Commonwealth Bank | Emerging | Integrating BNPL into banking platforms, leveraging customer relationships |

SSubstitutes Threaten

Traditional credit cards represent a significant threat of substitutes for Buy Now Pay Later (BNPL) services like Humm Group. They offer a familiar and widely accepted form of revolving credit, often coupled with attractive rewards programs and purchase protection. As of early 2024, credit card penetration remains high, with a substantial portion of consumer spending still channeled through these established payment methods.

While BNPL services have seen rapid growth, particularly among younger consumers drawn to their transparent, interest-free installment plans, credit cards continue to command a dominant market share. The perceived convenience and established infrastructure of credit cards, alongside their broader acceptance across various merchant types, maintain their position as a powerful substitute, especially for larger purchases or for consumers who prioritize accumulating rewards points.

For consumers looking to finance larger purchases or spread payments over extended periods, traditional personal loans from banks and credit unions present a significant substitute for Buy Now Pay Later (BNPL) services like those offered by Humm Group. These established financial institutions often conduct more rigorous credit assessments, which can lead to more favorable interest rates for borrowers with strong credit histories, potentially undercutting the cost of some BNPL plans that include interest charges.

For smaller transactions, direct payment methods like debit cards and cash represent significant substitutes for Humm Group's offerings. Consumers may choose these if they wish to avoid credit or installment plans, particularly for everyday purchases where the convenience of immediate payment outweighs the benefits of deferred payment. In 2023, debit card spending in Australia continued to be robust, with transactions often exceeding credit card volumes for everyday retail, highlighting the persistent appeal of these direct payment methods.

Lay-by and Store Credit

Traditional lay-by schemes, where customers pay for goods in installments before receiving them, represent a substitute for buy now, pay later (BNPL) services. While less immediate, these methods offer a way for consumers to manage payments without incurring interest, thereby reducing the perceived need for BNPL. For instance, many Australian retailers still offer lay-by, particularly for high-value items like electronics or furniture, allowing customers to budget effectively.

Store-specific credit accounts and loyalty programs also function as substitutes. These often provide deferred payment options or discounts, incentivizing customers to remain within a particular retailer's ecosystem rather than using a third-party BNPL provider. In 2024, many retailers continued to enhance their loyalty programs to retain customers, offering exclusive payment terms or rewards that compete with the convenience of BNPL.

- Lay-by: A traditional payment method allowing installment purchases before item possession.

- Store Credit/Loyalty Programs: Retailer-specific financial incentives and payment options.

- Consumer Behavior: Substitution is driven by a desire for interest-free payment options and retailer loyalty.

- Market Impact: These substitutes can limit the market share and pricing power of BNPL providers like Humm Group.

Other Emerging Payment Technologies

The broader fintech landscape is a constant source of potential disruption. New payment technologies and digital wallets continue to emerge, and while they may not be direct buy-now-pay-later (BNPL) alternatives today, they possess the capability to reshape consumer payment preferences in the future. For instance, the growth of real-time payment systems, like those being adopted globally, could offer consumers faster and more integrated ways to pay, potentially reducing the need for deferred payment options.

These evolving technologies represent a subtle yet significant threat. As consumers become more accustomed to seamless digital transactions, the friction associated with traditional BNPL services might become more apparent. By July 2025, we can expect to see further advancements in areas like embedded finance, where payment solutions are integrated directly into the purchasing journey, potentially bypassing dedicated BNPL providers.

- Emerging Payment Technologies: The rapid development of new digital payment solutions and platforms poses a threat by offering alternative ways for consumers to manage their transactions.

- Digital Wallets: Increased adoption and functionality of digital wallets can consolidate payment methods, potentially reducing reliance on specialized BNPL services.

- Consumer Preference Shifts: As fintech innovation progresses, consumer payment habits may evolve, favoring more integrated or instant payment solutions over deferred payment models.

- Real-Time Payments: The expansion of real-time payment networks offers an alternative for immediate settlement, which could diminish the appeal of BNPL for certain transactions.

The threat of substitutes for Humm Group's Buy Now Pay Later (BNPL) services is multifaceted, encompassing traditional financial products and evolving payment technologies. Established options like credit cards and personal loans continue to hold significant sway, particularly among consumers with strong credit histories or those seeking rewards. Furthermore, simpler methods like debit cards and cash remain relevant for everyday transactions, offering a direct alternative to credit. Retailer-specific financing and lay-by schemes also provide interest-free payment avenues, directly competing with BNPL's core value proposition.

| Substitute Type | Key Features | Market Relevance (Early 2024) | Impact on BNPL |

|---|---|---|---|

| Traditional Credit Cards | Revolving credit, rewards programs, purchase protection | High penetration, dominant market share for many consumer segments | Limits BNPL adoption for general spending and larger purchases |

| Personal Loans | Fixed repayment terms, potentially lower interest for good credit | Established banking infrastructure, competitive rates for prime borrowers | Offers an alternative for longer-term financing needs |

| Debit Cards & Cash | Immediate payment, no credit involved | Robust usage for everyday retail transactions | Reduces need for deferred payment for small-value purchases |

| Lay-by & Store Credit | Interest-free installments, retailer-specific benefits | Still offered by many retailers, particularly for high-value goods | Provides an alternative to third-party BNPL, fosters retailer loyalty |

Entrants Threaten

The Australian government's decision to mandate credit licenses for Buy Now Pay Later (BNPL) providers, effective from June 2025, acts as a substantial hurdle for potential new entrants. This new regulatory landscape imposes significant compliance costs and operational complexities, making it more challenging for newcomers to establish themselves compared to incumbent firms like Humm Group, which already possess established regulatory frameworks and expertise.

Establishing a financial services entity, particularly one involved in lending like Humm Group, demands considerable capital. This funding is essential for initiating loan portfolios, covering operational expenses, and meeting stringent regulatory requirements. For instance, in 2023, the Australian Prudential Regulation Authority (APRA) maintained its capital adequacy ratios, emphasizing the ongoing need for robust financial backing for lenders.

New market entrants face a significant hurdle in accumulating the necessary seed capital. Beyond initial investment, securing diverse and stable funding sources, akin to Humm Group's established relationships with banks and securitization markets, proves a complex and time-consuming endeavor for newcomers. This reliance on external funding makes the threat of new entrants moderate, as only well-capitalized and resourceful entities can realistically enter the market.

Established players in the buy now, pay later (BNPL) sector, such as Humm Group, Afterpay, and Zip Co, have cultivated significant brand recognition and consumer trust through years of operation and marketing efforts. This strong brand equity makes it difficult for new entrants to quickly gain traction.

For instance, as of early 2024, Afterpay reported over 3.6 million active customers in Australia and New Zealand alone, highlighting the depth of its established user base. Newcomers must invest heavily in marketing and customer acquisition to build a comparable level of credibility and persuade consumers to switch from trusted providers.

This challenge is amplified by the need to demonstrate reliability and security in financial transactions, a hurdle that requires time and consistent positive customer experiences to overcome. The existing market leaders have already navigated these initial trust-building phases.

Merchant Network and Integration

The threat of new entrants into the Buy Now, Pay Later (BNPL) market, particularly concerning merchant networks and integration, is moderate. Established players like Humm Group have already invested significantly in building extensive networks of merchant partners, both online and in physical stores. For a new entrant to compete effectively, they would need to replicate this vast network, which requires substantial capital investment in sales teams and integration technologies to onboard merchants.

The challenge for newcomers lies in overcoming the established relationships and the perceived value proposition that existing BNPL providers offer to merchants, such as access to a large customer base and streamlined payment solutions.

- Merchant Network Size: Humm Group reported a significant merchant network, with thousands of partners across various sectors. For instance, by the end of the 2023 financial year, Humm Group had a substantial merchant base, underscoring the difficulty for new entrants to quickly establish comparable reach.

- Integration Costs: Integrating BNPL solutions into a merchant's existing Point of Sale (POS) or e-commerce platform can be complex and costly. New entrants must offer robust, easy-to-implement solutions to attract merchants away from established providers.

- Customer Acquisition: New entrants also face the hurdle of acquiring customers. Established BNPL providers benefit from brand recognition and existing user bases, making it harder for new players to gain traction.

Technological Infrastructure and Expertise

The threat of new entrants in the buy now, pay later (BNPL) sector, particularly concerning technological infrastructure and expertise, is significant but not insurmountable. Developing and maintaining the sophisticated, secure, and scalable technology platforms essential for payment processing, real-time credit assessment, and seamless customer service demands substantial upfront investment and ongoing technical prowess. For instance, in 2024, the average cost for developing a robust fintech platform can range from hundreds of thousands to millions of dollars, depending on the complexity and feature set. New players entering the market must possess or acquire considerable technological expertise to compete with established companies like Humm Group, which have already invested heavily in their digital ecosystems.

This high barrier to entry is amplified by the need for continuous innovation and adaptation to evolving regulatory landscapes and consumer expectations. For example, the increasing demand for AI-driven credit scoring models and sophisticated data analytics requires specialized skills that are not readily available. In 2023, companies in the fintech space reported spending an average of 15-20% of their revenue on technology development and maintenance to stay competitive. Therefore, new entrants face a considerable challenge in matching the technological capabilities and operational efficiency of incumbents.

- High Development Costs: Building secure and scalable payment processing and credit assessment platforms requires millions in investment.

- Specialized Expertise Needed: Accessing and retaining talent with deep fintech and AI knowledge is crucial.

- Continuous Innovation Demands: Staying ahead necessitates ongoing investment in R&D and platform upgrades.

- Regulatory Compliance Burden: New entrants must also invest in technology to ensure adherence to financial regulations.

The threat of new entrants in the Buy Now Pay Later (BNPL) market remains a significant consideration, though several factors create substantial barriers. The upcoming mandatory credit licensing for BNPL providers in Australia from June 2025, for instance, will increase compliance costs and complexity, favoring established players like Humm Group who already navigate regulatory frameworks. Furthermore, the substantial capital required to establish lending operations, maintain adequate capital adequacy ratios as emphasized by regulators like APRA, and build diverse funding sources makes market entry challenging for undercapitalized firms.

The established brand recognition and trust enjoyed by incumbents, exemplified by Afterpay's over 3.6 million active customers in Australia and New Zealand as of early 2024, necessitates significant marketing investment for newcomers to gain traction. Building comparable credibility requires time and consistent positive customer experiences. Additionally, the extensive merchant networks developed by companies like Humm Group present a hurdle, as new entrants must invest heavily in sales and integration technology to onboard merchants and offer them value comparable to existing providers.

Technological infrastructure and expertise also pose a considerable barrier. Developing secure, scalable payment platforms and advanced credit assessment tools can cost millions of dollars, requiring specialized fintech and AI talent. Companies in the fintech sector, for example, allocated an average of 15-20% of their revenue to technology development and maintenance in 2023 to remain competitive, highlighting the ongoing investment required to match incumbent capabilities.

| Barrier | Description | Impact on New Entrants | Example Data/Fact |

| Regulatory Compliance | Mandatory credit licensing for BNPL providers from June 2025. | Increases operational complexity and costs. | Australian government mandate. |

| Capital Requirements | Need for significant capital for loan portfolios and operations. | Favors well-capitalized entities; limits smaller players. | APRA's maintained capital adequacy ratios for lenders. |

| Brand Recognition & Trust | Established customer bases and brand loyalty. | Requires substantial marketing investment for customer acquisition. | Afterpay: >3.6 million active customers (ANZ, early 2024). |

| Merchant Network | Extensive existing partnerships with merchants. | Demands significant investment in sales and integration to compete. | Humm Group's thousands of merchant partners. |

| Technological Infrastructure | Sophisticated, secure, and scalable payment platforms. | High development costs and need for specialized expertise. | Fintech R&D spending: 15-20% of revenue (2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Humm Group leverages data from Humm Group's annual reports, investor presentations, and ASX filings. We also incorporate industry-specific research from financial institutions and market intelligence providers to assess competitive dynamics.