Humm Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

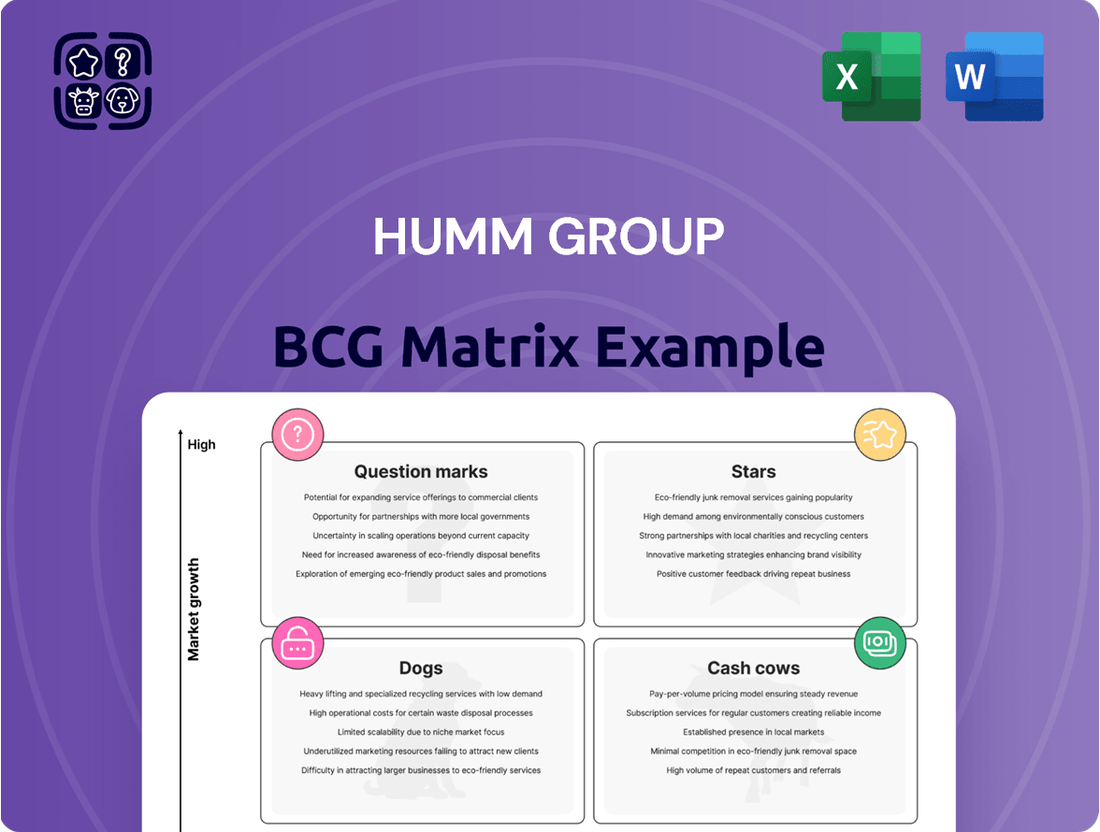

Understand Humm Group's strategic positioning by exploring its BCG Matrix, revealing which products are market leaders (Stars), reliable income generators (Cash Cows), underperformers (Dogs), or potential growth opportunities (Question Marks).

This preview offers a glimpse into Humm Group's portfolio dynamics. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investment and product strategies.

Gain a competitive edge by diving deep into Humm Group's complete BCG Matrix. It provides quadrant-by-quadrant clarity and strategic takeaways, streamlining your path to market dominance.

Stars

Commercial Finance, or Flexicommercial, is a shining example of a Star within Humm Group's BCG matrix. This segment has shown impressive growth, with assets under management climbing 18% in the first half of 2025 and a further 10% in the third quarter of 2025. This robust performance solidifies its position as a key growth engine for the company.

Humm Group's Commercial Finance division is the second-largest Non-Bank Financial Institution (NBFI) commercial asset finance lender. This significant market share highlights its strong competitive standing. Even with a generally slowing Small and Medium-sized Enterprise (SME) market, this business unit continues to gain market share, a testament to its effective strategies and customer focus.

The success of Commercial Finance is further bolstered by high broker satisfaction and a streamlined, efficient deal approval process. These factors contribute to its ability to thrive and expand, even in challenging economic conditions, reinforcing its status as a Star performer.

Humm Group is a leader in the high-value Buy Now Pay Later (BNPL) space, particularly in residential solar and home improvement. In 2024, the Australian BNPL market was estimated to be worth over AUD 20 billion, with high-value purchases forming a significant and growing segment.

This strong market position in larger ticket items like solar installations, which can range from AUD 5,000 to AUD 20,000, and home renovations, often exceeding AUD 10,000, highlights Humm's ability to cater to substantial consumer financing needs. The company's focus on these specific verticals, including health services such as audiology and dental treatments, positions it well within a growing market segment.

Humm Group's new regulated hybrid loan product, slated for launch in Australia in Q4 FY25, is poised to be a significant growth driver. This product targets larger transaction values, aiming for enhanced profitability and return metrics within the evolving Australian Buy Now, Pay Later (BNPL) market.

The strategic introduction of this product allows Humm to capture new market share by leveraging its established experience in regulated financial environments. Its potential to unlock new customer channels and boost overall profitability firmly positions it as a Star in the BCG Matrix.

Irish Business Expansion

Humm Group's Irish business is a clear Star in its BCG Matrix. This segment experienced a robust 23% volume growth, indicating strong customer adoption and transaction activity. Furthermore, a significant Net Interest Margin (NIM) expansion of 220 basis points highlights improved profitability on its lending portfolio.

The Irish operations are characterized by low losses and a high return on equity, underscoring efficient risk management and effective capital deployment. This performance suggests Humm is capturing substantial market share within a growing regional market.

- Strong Volume Growth: 23% increase in transaction volumes.

- NIM Expansion: 220 basis points improvement in Net Interest Margin.

- Profitability Metrics: Low losses and high return on equity.

- Market Position: Gaining significant market share in a growing region.

Overall Assets Under Management (AUM) Growth

Humm Group has demonstrated impressive growth in its overall Assets Under Management (AUM). In the first half of 2025, AUM climbed by 14%, reaching $5.3 billion. This upward trajectory continued into the third quarter of 2025, with a sustained 10% growth, highlighting the company's strong market position.

This consistent expansion in AUM, especially within its continuing product lines, signals Humm Group's effectiveness in securing and growing its market share. It’s a testament to the resilience of its core offerings, performing well even amidst economic headwinds.

- 14% AUM Growth in 1H25 to $5.3 billion.

- 10% AUM Growth in 3Q25.

- Sustained growth indicates strong market capture.

- Robust performance of core products despite economic challenges.

Humm Group's Commercial Finance division stands out as a Star, showing substantial growth in assets under management, up 18% in H1 2025 and another 10% in Q3 2025. This segment, the second-largest commercial asset finance lender among NBFIs, continues to gain market share despite a slower SME market, driven by high broker satisfaction and efficient deal approvals.

The company's focus on high-value BNPL, particularly in solar and home improvement, positions it strongly. In 2024, the Australian BNPL market exceeded AUD 20 billion, with Humm excelling in larger ticket items, often over AUD 5,000 to AUD 10,000. The upcoming regulated hybrid loan product, targeting larger transactions, is expected to further boost profitability and market capture.

Humm's Irish operations are another clear Star, marked by 23% volume growth and a 220 basis point Net Interest Margin expansion. With low losses and high returns on equity, this segment demonstrates efficient risk management and strong market share acquisition in a growing region.

| Business Segment | BCG Category | Key Performance Indicators (2025 Data) |

|---|---|---|

| Commercial Finance | Star | 18% AUM growth (H1), 10% AUM growth (Q3), gaining market share in SME finance |

| High-Value BNPL (Solar/Home Improvement) | Star | Strong performance in >AUD 5,000 transactions, new regulated hybrid loan launch expected to drive growth |

| Irish Operations | Star | 23% volume growth, 220 bps NIM expansion, low losses, high ROE |

What is included in the product

The Humm Group BCG Matrix analyzes its business units based on market share and growth, guiding investment and divestment decisions.

Clear visual mapping of Humm Group's portfolio, simplifying strategic decisions.

Cash Cows

Humm Group's 'Big Things' Buy Now Pay Later (BNPL) segment, focusing on larger purchases, is a cornerstone of its business. This established area shows strong market leadership, particularly for transactions up to $30,000. The company's significant market share in this niche translates into reliable and substantial cash flow generation.

The consistent profitability of the 'Big Things' segment stems from deep-rooted merchant relationships and a loyal customer base. Compared to emerging BNPL sectors, this mature segment demands less in terms of promotional spending, contributing to its foundational financial strength for Humm Group.

The Q Card in New Zealand is a dominant force in the credit card market, boasting a significant 31% market share as of August 2024. This high penetration in a mature market translates into a consistent and dependable cash flow for Humm Group.

Despite a modest 2.3% volume growth projected for 3Q25, the Q Card's strong brand recognition and deep market roots guarantee sustained profitability. It functions as a stable generator of funds, supporting other business initiatives.

Humm Group's stable Net Interest Margin (NIM) of 5.5% throughout FY24 and into 3Q25 highlights its robust pricing and cost management. This consistency ensures predictable cash flow from lending operations, forming a solid financial foundation.

This stable NIM is a key characteristic of a Cash Cow, providing reliable earnings that can be reinvested in other business units or returned to shareholders. It signifies a mature and profitable business line for Humm Group.

Improved Cost-to-Income Ratio

Humm Group's focus on an improved cost-to-income ratio is a key driver for its Cash Cows. As of March 2025, the company achieved a noteworthy year-to-date cost-to-income ratio of 53.5%. This figure represents a substantial 10% enhancement compared to the previous year, showcasing effective operational management and successful cost-saving measures.

This efficiency gain is crucial for maximizing the cash generated from Humm's established business segments. By diligently reducing operating expenses and optimizing its overall cost structure, Humm is directly bolstering its profit margins and strengthening its cash flow.

- Cost-to-Income Ratio (YTD March 2025): 53.5%

- Year-on-Year Improvement: 10%

- Impact: Maximized cash generation through operational efficiency

- Benefit: Higher profit margins and stronger cash flow

Robust Balance Sheet and Funding Platform

Humm Group's robust balance sheet and funding platform are key strengths, positioning its core businesses as cash cows. In 1H25, the company reported $113.6 million in unrestricted cash, complemented by a substantial $1.4 billion in undrawn warehouse capacity. This financial foundation provides significant liquidity, enabling Humm Group to comfortably fund its operations and growth without immediate reliance on external capital for routine activities.

This financial resilience directly supports the cash-generating capabilities of its established business units. The ample liquidity ensures consistent dividend distributions to shareholders and facilitates strategic investments in future growth opportunities. Furthermore, Humm Group's access to funding across diverse market conditions serves as a crucial competitive differentiator.

- Strong Liquidity Position: $113.6 million in unrestricted cash as of 1H25.

- Significant Funding Capacity: $1.4 billion in undrawn warehouse capacity in 1H25.

- Operational Independence: Ample liquidity reduces reliance on external capital for daily operations.

- Strategic Financial Flexibility: Supports consistent dividends and investment in growth initiatives.

Humm Group's established BNPL segments, particularly the 'Big Things' offering and the Q Card in New Zealand, function as its primary Cash Cows. These mature businesses exhibit strong market positions and consistent profitability, generating reliable cash flow for the company.

The Q Card's 31% market share in New Zealand as of August 2024 underscores its dominance, while the 'Big Things' segment benefits from deep merchant relationships and a loyal customer base. These factors contribute to their low reliance on promotional spending, enhancing their cash-generating efficiency.

Humm Group's stable Net Interest Margin (NIM) of 5.5% throughout FY24 and into 3Q25, coupled with an improved cost-to-income ratio of 53.5% year-to-date March 2025 (a 10% improvement), directly bolsters the cash flow from these core operations.

The company's robust liquidity, with $113.6 million in unrestricted cash and $1.4 billion in undrawn warehouse capacity as of 1H25, further supports the sustained cash generation and financial flexibility of these Cash Cow segments.

| Business Segment | BCG Matrix Category | Key Performance Indicators |

|---|---|---|

| Big Things BNPL | Cash Cow | Strong market leadership, deep merchant relationships, consistent profitability |

| Q Card (NZ) | Cash Cow | 31% market share (Aug 2024), dominant credit card presence, stable cash flow |

| Overall Financials | Cash Cow Support | NIM 5.5% (FY24-3Q25), Cost-to-Income 53.5% (YTD Mar 2025) |

| Liquidity | Cash Cow Support | $113.6M unrestricted cash (1H25), $1.4B undrawn warehouse capacity (1H25) |

What You’re Viewing Is Included

Humm Group BCG Matrix

The Humm Group BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and immediately usable analysis of Humm Group's business portfolio.

Dogs

Humm Group has strategically exited several underperforming products, including bundll®, its original UK operations, BPAY, and the 'Little Things' offering in Australia. These products were previously identified as cash traps, generating minimal growth and incurring losses, thus impacting overall profitability.

The company has successfully completed the collection of outstanding receivables for these discontinued segments, effectively removing associated operational costs and liabilities. This move is a clear indicator of Humm Group's commitment to streamlining its portfolio and focusing on more profitable ventures.

The legacy unprofitable consumer finance operations within Humm Group, prior to its significant turnaround in the first half of 2025, posted a $6.1 million loss in the first half of 2024. This clearly signals that certain parts of the business were not performing well.

Even with the segment now being profitable, these older, underperforming areas could still hinder overall company success if they aren't fixed or improved. The company's actions to sort these problems out suggest they were once considered a problem area needing a strategic plan to stop them from losing money.

Humm Group's strategic review has streamlined its brand portfolio, likely leaving behind certain sub-scale or non-core assets. These operations, characterized by low market share and minimal growth contribution, are prime candidates for divestment. For instance, if a non-core portfolio generated only AUD 5 million in revenue in 2024, compared to the group's total revenue of AUD 500 million, it represents a mere 1% contribution.

Specific Regional Underperformers

Within Humm Group's portfolio, certain specific regional underperformers might exist even as broader international segments show promise. These could be smaller market entries or ventures that haven't captured significant market share. If these operations lack clear indicators of improvement or future growth, they would be classified as dogs. They tie up valuable resources without generating adequate returns, making them candidates for resource reallocation or divestment.

For instance, Humm Group's 2024 financial reports could highlight a particular country or region where their buy-now-pay-later (BNPL) services are struggling to gain traction against established local competitors. This could be due to regulatory hurdles, lower consumer adoption rates, or intense price competition. Such a segment would represent a classic 'dog' in the BCG matrix.

- Underperforming Markets: Identification of specific geographic regions with low market penetration and revenue generation.

- Resource Drain: These segments consume capital and management attention without contributing significantly to overall profitability.

- Strategic Review: Operations showing no clear path to recovery or growth potential are prime candidates for strategic review, including potential divestment.

- 2024 Data Focus: Analysis of Humm Group's 2024 performance data to pinpoint specific regional segments exhibiting these 'dog' characteristics.

Underperforming Niche Lending Areas

Within Humm Group's diverse lending operations, certain specialized niches might grapple with elevated credit losses or diminishing customer interest. A prime example of this is the transport sector within Victoria for their Commercial business, which has seen a notable uptick in losses.

While these specific sub-segments may not impact the entirety of a broader lending category, their persistent underperformance and resource drain could position them as question marks within a strategic framework. Such areas often necessitate substantial strategic adjustments or even eventual phasing out to bolster the overall financial health of the portfolio.

- Niche Lending Underperformance: Specific segments within Humm Group's lending portfolios can experience disproportionately high credit losses or declining demand.

- Illustrative Example: The transport sector in Victoria for Humm Group's Commercial business has reported increased credit losses.

- Strategic Implications: Consistently underperforming niche areas can drain resources and may require restructuring or discontinuation.

- Portfolio Health: Addressing these underperforming niches is crucial for improving the overall health and efficiency of Humm Group's lending portfolios.

Dogs in Humm Group's portfolio represent business segments with low market share and low growth potential. These operations consume resources without generating substantial returns, often requiring strategic divestment or restructuring. For instance, the legacy unprofitable consumer finance operations posted a $6.1 million loss in the first half of 2024, exemplifying a 'dog' characteristic due to its negative contribution.

The company's divestment of bundll®, original UK operations, BPAY, and the 'Little Things' offering in Australia highlights a proactive approach to shedding these low-performing assets. These exits aim to streamline the business and focus capital on more promising ventures, improving overall portfolio efficiency.

Identifying and addressing these 'dog' segments is crucial for Humm Group's turnaround strategy. By eliminating cash traps and underperforming niches, such as the transport sector in Victoria experiencing increased credit losses for the Commercial business, the company can reallocate resources towards growth areas.

The strategic review likely identified and is addressing sub-scale or non-core assets that contribute minimally to overall revenue, potentially representing only a small percentage of the group's total earnings, as seen with a hypothetical AUD 5 million revenue segment out of AUD 500 million in 2024.

| Segment | Market Share (2024) | Growth Rate (2024) | Profitability (H1 2024) | BCG Classification |

|---|---|---|---|---|

| Legacy Consumer Finance | Low | Low | -$6.1M Loss | Dog |

| Specific Regional BNPL | Low | Low | Low/Negative | Dog |

| Transport Sector (Victoria Commercial) | Niche/Low | Declining | High Credit Losses | Dog |

Question Marks

Humm Group's Canadian operations are currently in a challenging position, classified as a Question Mark within the BCG Matrix. The business is experiencing losses, reflecting a limited presence in the Canadian market.

To address this, Humm is implementing substantial operational adjustments aimed at generating $4 million in annualized savings. This strategic restructuring signals management's belief in the Canadian market's future potential, though it necessitates considerable investment and effective turnaround execution to secure profitability and market share.

The UK business of Humm Group, after a strategic wind-down of its prior unprofitable ventures, is projected to reach breakeven by June 2025. This recovery trajectory places it firmly in a re-establishment or growth phase, characterized by a currently low market share but significant ongoing investment aimed at market penetration.

This impending breakeven point is a crucial milestone, signaling the transition from a loss-making operation to one expected to contribute positively to the group's overall performance. While promising, it underscores that the business's future market dominance and sustained profitability are still under development, necessitating continued strategic support and capital infusion.

The Australian Cards business experienced a decline in cash profit for the first half of 2025 compared to the same period in 2024. This performance reflects a deliberate slowdown in growth, driven by reduced marketing expenditures and adjustments to credit policies as part of a strategic 'rebuild' initiative.

This strategic pivot suggests that Humm Group's Australian Cards product currently holds a modest market share and is in a phase of transformation. The company is carefully managing investments to enhance its competitive standing and profitability, acknowledging that future market share gains are not assured, thus positioning it as a Question Mark in the BCG matrix.

General Australian BNPL (Smaller Transactions)

While Humm Group excels in larger purchases, the general Australian Buy Now Pay Later (BNPL) market, especially for smaller, everyday transactions, is incredibly crowded. Major players like Afterpay, Zip, Klarna, and PayPal dominate this space, meaning Humm likely has a smaller slice of this rapidly expanding pie.

To truly capture a larger share of this high-growth segment and gain broader consumer traction, Humm would need to commit substantial resources to marketing and forging new partnerships. Given this intense competition and the need for further investment, Humm's standing in the smaller transaction BNPL market is best characterized as a Question Mark.

- Market Saturation: The Australian BNPL market for smaller transactions is highly competitive, with established leaders.

- Humm's Position: Humm likely holds a relatively low market share in this specific, yet growing, segment.

- Strategic Needs: Significant investment in marketing and partnerships is crucial for Humm to compete effectively.

- BCG Classification: Humm's position in this segment is considered a Question Mark due to its potential but uncertain future growth and market share.

New Geographical Expansions or Niche Product Trials

Humm Group's strategic exploration into new geographical territories and testing of niche product lines aligns with the Question Marks quadrant of the BCG Matrix. These ventures, such as potential pilot programs in Southeast Asian markets or specialized financing solutions for emerging domestic industries, represent significant investments with initially low market share. For instance, Humm Group's 2024 focus on expanding its buy-now-pay-later (BNPL) services into new international markets, while still in early stages, exemplifies this strategy.

The success of these initiatives hinges on their ability to gain traction and capture market share, potentially transforming them into Stars. Conversely, if these new ventures fail to resonate with consumers or face insurmountable competition, they could stagnate and become Dogs. Humm Group's reported investment in technology infrastructure to support these expansions underscores the high capital outlay typical for Question Mark strategies.

- Geographic Expansion: Targeting new international markets, potentially in Asia Pacific, to diversify revenue streams.

- Niche Product Trials: Piloting specialized financing products, for example, in the sustainable goods sector or for small business lending.

- Investment Profile: Characterized by high investment costs and low initial market share, reflecting their speculative nature.

- Future Potential: Successful trials could lead to significant future growth and market leadership, moving them to the Stars quadrant.

Humm Group's Canadian operations are a prime example of a Question Mark, marked by losses and a limited market presence. The company is actively restructuring, targeting $4 million in annualized savings, demonstrating a belief in the market's future potential despite the current need for significant investment and effective turnaround execution to achieve profitability and market share.

Similarly, Humm's Australian Cards business is navigating a strategic 'rebuild' phase. A reported decline in cash profit for the first half of 2025 compared to 2024, stemming from reduced marketing and credit policy adjustments, positions it as a Question Mark. This indicates a modest market share and a transformation period where careful investment is crucial for enhancing competitiveness and future profitability, with no guarantee of market share gains.

The broader Australian Buy Now Pay Later (BNPL) market, especially for smaller transactions, is intensely competitive, dominated by major players like Afterpay and Zip. Humm likely holds a smaller share in this expanding segment, requiring substantial investment in marketing and partnerships to gain traction. This competitive landscape and the need for further investment solidify its Question Mark status in this area.

| Business Segment | BCG Quadrant | Key Characteristics | Strategic Implications |

|---|---|---|---|

| Humm Canada | Question Mark | Loss-making, limited market presence, undergoing restructuring for savings. | Requires significant investment and effective execution for turnaround to gain profitability and market share. |

| Humm Australia (Cards) | Question Mark | Declining cash profit (H1 2025 vs H1 2024), deliberate slowdown in growth, strategic 'rebuild'. | Modest market share, requires careful investment to enhance competitiveness and profitability; future market share gains are uncertain. |

| Australian BNPL (Small Transactions) | Question Mark | Highly competitive market, dominated by established players, Humm likely has low market share. | Needs substantial investment in marketing and partnerships to gain traction and market share in a growing segment. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.