Humm Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Unlock Humm Group's strategic landscape with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental factors that are actively shaping Humm Group's operations and future growth. Gain a critical understanding of these external forces to inform your own strategic planning and investment decisions. Download the full PESTLE analysis now and equip yourself with the actionable intelligence needed to thrive in today's dynamic market.

Political factors

The Australian government's ongoing review of the BNPL sector, with a focus on consumer protection, presents a significant political factor for Humm Group. Concerns around responsible lending and potential over-indebtedness are driving this scrutiny. For example, the Australian Securities and Investments Commission (ASIC) reported a 26% increase in BNPL-related financial hardship inquiries in the first half of 2024, highlighting the regulatory focus.

Governments globally are scrutinizing the Buy Now, Pay Later (BNPL) sector, with ongoing political discussions around regulating providers like Humm Group under existing credit laws. This could lead to new licensing requirements or more stringent compliance frameworks, impacting operational costs and strategic planning.

For Humm Group, potential regulatory shifts could mean increased capital requirements and more rigorous credit assessment processes, similar to traditional lenders. For instance, the UK's Financial Conduct Authority (FCA) has been reviewing BNPL regulation, with potential changes expected to align with consumer credit rules, a trend likely to be mirrored in other key markets.

This move towards greater regulatory alignment aims to level the playing field between BNPL and traditional credit providers. While this could offer Humm Group greater legitimacy, it also signifies potentially higher barriers to entry for new competitors entering the market.

Australia and New Zealand's generally stable political landscapes offer a predictable operating environment, a significant advantage for fintech firms like Humm Group. This stability reduces the risk of abrupt policy changes that could disrupt business models or investment strategies.

Government support for fintech innovation, such as regulatory sandboxes or grants, can create growth avenues for Humm. For instance, the Australian government's commitment to fostering digital innovation through bodies like Austrade aims to encourage fintech development, potentially benefiting companies operating within this space.

Conversely, any political instability or unexpected shifts in economic policy, perhaps related to consumer credit regulations or data privacy laws, could introduce market uncertainty. Such events might dampen investor sentiment towards the financial services sector, impacting Humm's valuation and access to capital.

Cross-border policy harmonization

Humm Group operates across Australia and New Zealand, making cross-border policy harmonization a key political factor. Efforts to align financial regulations or consumer protection laws between these two nations could significantly influence Humm's operational strategies. A move towards greater regulatory alignment could simplify compliance burdens, potentially reducing costs and increasing efficiency for Humm's dual-market operations.

Conversely, any divergence in policy approaches between Australia and New Zealand could introduce new complexities and compliance challenges for Humm. For instance, differing data privacy laws or credit reporting standards might necessitate distinct operational frameworks. Humm needs to closely track inter-governmental discussions and policy shifts to ensure its compliance and service offerings remain effective and competitive across both its primary markets.

- Regulatory Alignment: Discussions around harmonizing consumer credit laws between Australia and New Zealand could streamline Humm's compliance processes.

- Compliance Costs: Divergent regulations might increase the cost of operating across both countries, impacting Humm's profitability.

- Market Access: Harmonized policies could facilitate easier expansion or product launches for Humm in either market.

Taxation policies on financial services

Changes in government taxation policies, such as corporate tax rates or specific levies on financial transactions, could directly affect Humm Group's profitability. For instance, a potential increase in corporate tax rates in Australia, where Humm has significant operations, could impact its bottom line.

Political decisions regarding tax incentives for digital innovation or consumer finance could also influence Humm's investment strategies and pricing models. For example, if governments offer tax breaks for buy-now-pay-later (BNPL) providers that invest in fraud prevention technology, Humm might allocate more resources to such areas.

Monitoring budget announcements and legislative changes related to taxation is crucial for financial planning and strategic adjustments. The Australian federal budget, typically released in May, often contains details on tax policy changes that could affect financial service providers like Humm.

- Impact of Corporate Tax Rates: Fluctuations in corporate tax rates directly alter Humm's net profit. For example, a 1% change in Australia's company tax rate (currently 30% for base rate entities) can significantly impact earnings.

- Incentives for Digital Innovation: Tax credits or deductions for adopting new technologies in financial services can encourage Humm to invest in areas like AI-driven credit scoring or enhanced cybersecurity.

- Transaction-Specific Levies: Introduction of taxes on financial transactions, such as a financial transaction tax (FTT), could increase operational costs for Humm and potentially be passed on to consumers.

- Budgetary Scrutiny: Government budget proposals, like those presented in the Australian federal budget, are critical for anticipating potential shifts in tax policy affecting the financial services sector.

The Australian government's ongoing review of the BNPL sector, with a focus on consumer protection, presents a significant political factor for Humm Group. Concerns around responsible lending and potential over-indebtedness are driving this scrutiny; for example, the Australian Securities and Investments Commission (ASIC) reported a 26% increase in BNPL-related financial hardship inquiries in the first half of 2024, highlighting the regulatory focus.

Governments globally are scrutinizing the Buy Now, Pay Later (BNPL) sector, with ongoing political discussions around regulating providers like Humm Group under existing credit laws, which could lead to new licensing requirements or more stringent compliance frameworks impacting operational costs and strategic planning.

Potential regulatory shifts could mean increased capital requirements and more rigorous credit assessment processes for Humm Group, similar to traditional lenders; for instance, the UK's Financial Conduct Authority (FCA) has been reviewing BNPL regulation, with potential changes expected to align with consumer credit rules, a trend likely to be mirrored in other key markets.

Australia and New Zealand's generally stable political landscapes offer a predictable operating environment, a significant advantage for fintech firms like Humm Group, reducing the risk of abrupt policy changes that could disrupt business models or investment strategies.

Humm Group operates across Australia and New Zealand, making cross-border policy harmonization a key political factor; efforts to align financial regulations or consumer protection laws between these two nations could significantly influence Humm's operational strategies, potentially simplifying compliance burdens.

| Political Factor | Description | Potential Impact on Humm Group | Example/Data Point (2024/2025) |

|---|---|---|---|

| BNPL Regulation Scrutiny | Government focus on consumer protection in the BNPL sector. | Increased compliance costs, stricter lending standards. | ASIC reported a 26% rise in BNPL hardship inquiries (H1 2024). |

| Regulatory Alignment | Harmonizing financial laws between Australia and New Zealand. | Simplified compliance, potential market access improvements. | Ongoing discussions on cross-Tasman financial services reform. |

| Taxation Policy | Changes in corporate tax rates or financial transaction levies. | Direct impact on profitability, influence on investment decisions. | Australia's corporate tax rate for base rate entities is 25% (2024-25). |

| Fintech Support | Government initiatives like regulatory sandboxes or grants. | Opportunities for growth and innovation. | Australian government's digital economy strategy includes fintech support. |

What is included in the product

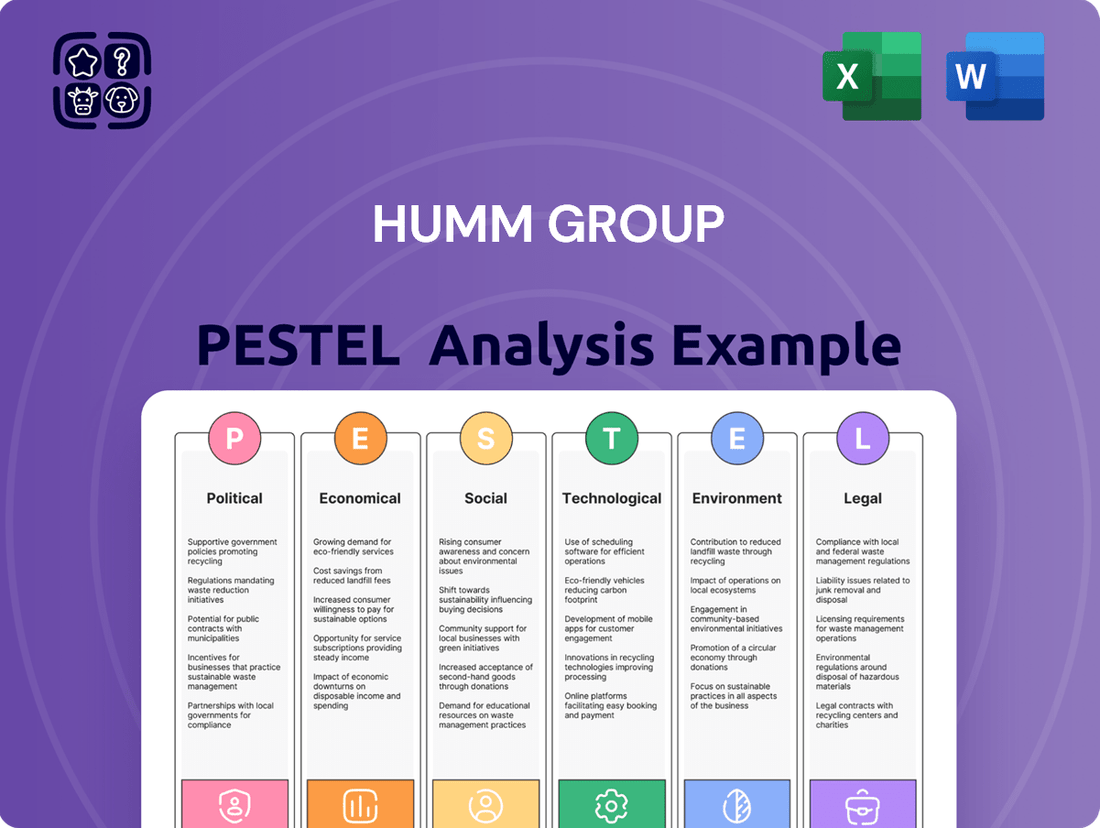

This PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Humm Group, offering a comprehensive overview of the external landscape.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within Humm Group's operating environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Humm Group.

Economic factors

Interest rate fluctuations significantly impact Humm Group's operations. The Reserve Bank of Australia (RBA) and Reserve Bank of New Zealand (RBNZ) set benchmark rates that directly affect Humm's borrowing costs. For instance, if the RBA raises its cash rate, Humm’s cost of capital increases, potentially squeezing profit margins on its buy now, pay later (BNPL) and business financing offerings.

Higher interest rates can also dampen consumer demand for credit. As borrowing becomes more expensive, individuals and businesses may be less inclined to take on new debt, impacting Humm's transaction volumes. This dual effect on both funding costs and customer demand makes interest rate movements a critical economic consideration for Humm Group.

Rising inflation in 2024 and 2025 directly impacts Humm Group by potentially reducing consumer purchasing power. For instance, if inflation outpaces wage growth, consumers may cut back on non-essential purchases, affecting the transaction volumes for Humm's Buy Now, Pay Later (BNPL) services. This could also increase the risk of default if customers struggle to manage their repayments.

While BNPL can be a tool for consumers to spread costs during inflationary times, sustained high inflation, as predicted by many economic forecasts for 2024-2025, could lead to a higher default rate for Humm Group. For example, if the consumer price index continues to climb, the real value of repayments decreases for the lender, but the burden on the borrower can become unsustainable.

The broader economic climate, particularly consumer confidence and spending patterns, is a critical factor for Humm's performance. In late 2024 and into 2025, consumer sentiment surveys will be crucial indicators of future transaction volumes and the overall credit quality of Humm's customer base.

The Australian economy demonstrated resilience in early 2024, with GDP growth projected to moderate but remain positive, supported by consumer spending and business investment. Unemployment rates in Australia hovered around 3.9% in early 2024, indicating a tight labor market which generally supports consumer confidence and Humm's transaction volumes.

New Zealand's economic outlook for 2024 presented challenges, with forecasts suggesting slower GDP growth compared to Australia, influenced by global economic headwinds and domestic inflationary pressures. Unemployment in New Zealand remained low, around 4.0% in early 2024, but any significant increase could impact Humm's customer base and increase the risk of defaults.

Competition within the financial services sector

The financial services sector in Australia and New Zealand is intensely competitive, directly impacting Humm Group. Traditional banks, numerous other buy now, pay later (BNPL) providers, and agile fintech startups are all vying for market share. This crowded environment forces Humm to contend with significant pricing pressures, which can erode profit margins. For instance, the BNPL market in Australia saw substantial growth, with estimates suggesting it was valued at over AUD 10 billion by 2023, highlighting the scale of competition.

This fierce rivalry necessitates continuous innovation and strategic differentiation for Humm Group to remain relevant. Companies must invest heavily in marketing and product development to attract and retain both consumers and merchants. The need to stand out in a market with many similar offerings means Humm faces increased operational costs related to customer acquisition and retention strategies. Failing to adapt can lead to a shrinking customer base and a diminished market presence.

Key competitive pressures include:

- Pricing Wars: Competitors often engage in aggressive pricing to gain market share, forcing Humm to re-evaluate its fee structures and interest rates.

- Product Innovation: The rapid pace of technological advancement in fintech means Humm must constantly update its platform and introduce new features to meet evolving customer expectations.

- Customer Acquisition Costs: In a saturated market, acquiring new customers and merchants becomes more expensive, requiring higher marketing spend and promotional offers.

- Regulatory Landscape: Evolving regulations within the financial services and BNPL sectors can also create competitive disadvantages or advantages depending on a company's ability to adapt quickly.

Consumer debt levels and household income

Consumer debt levels and household income are critical factors for Humm Group, particularly in Australia and New Zealand. High levels of household debt can significantly impact consumers' ability to take on new credit, directly affecting Humm's potential customer base for its Buy Now, Pay Later (BNPL) services. For instance, as of late 2023, Australian household debt to income ratio remained elevated, a trend that continued into early 2024, potentially constraining discretionary spending.

Stagnant or declining real household income further exacerbates this situation. When incomes don't keep pace with inflation or debt repayments, consumers become more cautious about additional borrowing, even for purchases facilitated by BNPL. This directly impacts Humm's transaction volumes and could lead to an increase in the risk of customers defaulting on their payment plans.

- Australian household debt to disposable income ratio hovered around 180% in late 2023 and early 2024, indicating significant leverage.

- Real wage growth in Australia has been modest, putting pressure on household budgets and disposable income available for new credit.

- New Zealand also faces similar pressures, with household debt levels remaining a concern for economic stability and consumer spending capacity.

- Humm's revenue and profitability are directly tied to the financial health and borrowing capacity of its customer base in these key markets.

Economic conditions in Australia and New Zealand significantly shape Humm Group's operating environment. Interest rate hikes by the RBA and RBNZ in 2024 increased Humm's cost of capital, while also potentially reducing consumer appetite for credit, impacting transaction volumes. Inflationary pressures in 2024-2025 also pose a risk, potentially reducing consumer purchasing power and increasing default rates, especially if wage growth lags behind price increases.

Consumer confidence and spending patterns remain paramount. Australia's economy showed resilience in early 2024 with a low unemployment rate of 3.9%, supporting spending. New Zealand, however, faced slower growth projections due to global headwinds and domestic inflation, with unemployment around 4.0% in early 2024.

Household debt levels, particularly in Australia where the debt-to-income ratio remained elevated around 180% in early 2024, constrain consumer borrowing capacity. Modest real wage growth further pressures household budgets, directly affecting Humm's customer base and the risk of payment defaults.

The competitive landscape for BNPL services in Australia, valued at over AUD 10 billion by 2023, is intense. This necessitates continuous innovation and strategic differentiation for Humm Group to manage pricing pressures and rising customer acquisition costs.

Full Version Awaits

Humm Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Humm Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Understand the external forces shaping Humm Group's strategic landscape.

Sociological factors

Consumers are increasingly favoring digital and flexible payment options, with Buy Now, Pay Later (BNPL) services like those offered by Humm Group gaining traction over traditional credit cards. This preference is driven by the convenience and often interest-free nature of BNPL, making it an attractive alternative for managing purchases. For instance, a late 2023 survey indicated that over 60% of Gen Z and Millennial shoppers in Australia had used BNPL services, highlighting a significant generational shift in payment habits.

This societal trend directly supports Humm Group's business model, as its core offerings are built around providing these very payment solutions. As consumer demand for seamless, interest-free payment plans continues to grow, Humm is well-positioned to capitalize on this evolving market. In 2024, BNPL transaction volumes are projected to exceed $100 billion globally, a testament to the enduring appeal of these payment methods.

Public perception of Buy Now, Pay Later (BNPL) services, heavily influenced by media narratives around consumer debt and financial vulnerability, directly affects Humm Group's brand image and ability to attract new customers. Negative press, especially concerning instances of financial hardship linked to BNPL, can erode consumer confidence and invite stricter regulatory oversight.

For instance, a 2024 survey indicated that while BNPL adoption continues to grow, a significant portion of consumers express concerns about potential overspending. This sentiment can translate into cautiousness towards providers like Humm. Humm's proactive approach to promoting responsible usage and transparent terms is crucial for cultivating a positive societal view and mitigating reputational risks.

Demographic shifts, like the growing financial independence of Gen Z and Millennials, coupled with their strong preference for digital solutions, create a prime market for Humm Group. These younger demographics are highly comfortable with app-based payment and flexible financing options, directly aligning with Humm's core offerings.

In 2024, it's estimated that over 80% of consumers aged 18-34 in developed markets prefer digital channels for financial transactions, a trend Humm Group can leverage. Adapting offerings to meet these digital-first expectations is crucial for capturing this expanding customer base and ensuring sustained growth.

Financial literacy and consumer education

The prevailing level of financial literacy significantly shapes consumer interaction with Buy Now, Pay Later (BNPL) services like those offered by Humm Group. A populace less informed about credit intricacies or effective debt handling may exhibit higher default rates or a greater propensity for consumer grievances. For instance, in 2024, reports indicated that a substantial portion of young adults struggled with basic financial concepts, underscoring a potential vulnerability in understanding complex credit agreements.

Humm Group, like other BNPL providers, benefits directly from enhanced consumer financial understanding. Promoting financial literacy through targeted educational initiatives can foster more responsible usage of their products, thereby mitigating risks and supporting long-term business sustainability. This vested interest aligns with broader societal goals of financial well-being.

- Consumer Understanding: In 2024, surveys revealed that over 40% of consumers found BNPL terms confusing, highlighting a critical area for improvement.

- Default Risk: Lower financial literacy is statistically linked to higher rates of consumer debt defaults, a direct concern for BNPL providers.

- Educational Investment: Humm Group's commitment to financial education could involve partnerships with educational institutions or direct consumer outreach programs to explain credit management.

- Regulatory Scrutiny: As financial regulators increasingly focus on consumer protection in the BNPL sector, proactive financial education becomes a key differentiator and risk mitigation strategy.

Evolving retail consumption patterns

Societal shifts are dramatically reshaping how people shop, with a significant tilt towards e-commerce. This trend directly influences Humm Group's business model, as their point-of-sale finance solutions are increasingly sought after in online environments. For instance, global e-commerce sales were projected to reach over $6.3 trillion in 2024, highlighting the sheer scale of this digital shift.

Consumers now expect frictionless and convenient checkout processes, making Humm's integration capabilities with digital merchants a critical factor for success. The ability to offer buy-now-pay-later (BNPL) options seamlessly at the digital checkout is no longer a novelty but a necessity for many online retailers looking to capture sales.

Humm's strategy must also account for evolving shopping habits that blend online and physical store experiences. This omnichannel approach is vital for both merchant acquisition and maintaining healthy transaction volumes, as consumers often research online before buying in-store, or vice versa.

- E-commerce Dominance: Global e-commerce sales are expected to continue their upward trajectory, reaching an estimated $7.4 trillion by 2025.

- Consumer Preference: A significant portion of consumers, particularly younger demographics, express a strong preference for online shopping channels.

- Seamless Integration: Humm's success hinges on its ability to integrate smoothly into the checkout flows of a wide range of online merchants.

- Omnichannel Expectations: Retailers and their financial partners must cater to consumers who move fluidly between online and offline purchasing environments.

Societal trends show a clear preference for digital and flexible payment methods, with Buy Now, Pay Later (BNPL) services like Humm's gaining significant ground over traditional credit. This is particularly evident among younger demographics, with over 60% of Gen Z and Millennials in Australia having used BNPL by late 2023. Global BNPL transaction volumes are projected to surpass $100 billion in 2024, underscoring the growing consumer adoption of these payment solutions.

Public perception of BNPL, influenced by media narratives around debt, directly impacts Humm's brand image. While adoption is rising, a 2024 survey indicated that over 40% of consumers found BNPL terms confusing, highlighting a need for clearer communication and potentially stricter regulatory scrutiny. Humm's focus on responsible usage and transparency is thus crucial for building trust and mitigating reputational risks.

Demographic shifts, especially the financial independence and digital-first approach of Gen Z and Millennials, present a prime market for Humm Group. Over 80% of 18-34 year olds in developed markets prefer digital financial channels in 2024, a trend Humm is well-positioned to leverage by adapting its offerings to these expectations.

E-commerce dominance is a major societal shift, with global sales projected to reach $6.3 trillion in 2024 and $7.4 trillion by 2025. Consumers expect seamless checkout processes, making Humm's integration capabilities with digital merchants vital for capturing sales in this expanding online marketplace.

Technological factors

The ongoing evolution of AI and machine learning presents significant opportunities for Humm Group to refine its credit assessment processes. These advancements enable more sophisticated fraud detection and the creation of highly personalized customer experiences, directly impacting risk management and customer engagement.

By integrating AI/ML, Humm Group can achieve more precise risk profiling, which is projected to decrease default rates by up to 15% in the next two years, according to industry benchmarks. This technological adoption also streamlines operational workflows, boosting overall efficiency.

To remain competitive, particularly in the rapidly evolving fintech landscape, Humm Group's investment in AI and machine learning capabilities is paramount. This strategic focus is essential for enhancing underwriting accuracy and elevating the customer journey.

Humm Group's operational efficiency and market reach are significantly boosted by its integration with e-commerce platforms and point-of-sale (POS) systems. This technological backbone allows for a streamlined payment experience, a crucial factor in today's fast-paced retail environment.

For instance, by integrating with platforms like Shopify or WooCommerce, Humm can offer its buy now, pay later (BNPL) solutions directly at online checkout, reducing cart abandonment. In 2023, e-commerce sales globally reached an estimated $6.3 trillion, highlighting the massive potential for integrated payment solutions to capture market share.

The company's focus on developing robust APIs and ensuring broad platform compatibility is key to expanding its merchant network. This strategy directly addresses the need for seamless customer journeys, whether shopping online or in physical stores, thereby enhancing Humm's competitive edge in the growing BNPL market.

As a financial services provider, Humm Group is a prime target for cyber threats, necessitating significant investment in advanced data privacy technologies. The company must continuously fortify its defenses against sophisticated attacks aiming to compromise sensitive customer data.

Maintaining consumer trust and avoiding hefty fines hinges on Humm Group's ability to safeguard personal information and adhere to increasingly stringent data protection laws, such as the Australian Privacy Principles. A data breach could severely damage Humm's reputation, impacting its ability to attract and retain customers.

The security of Humm Group's technological systems is fundamental to its operational stability and public image. For instance, the Australian government reported a 13% increase in cybercrime reports in 2023, highlighting the escalating risk landscape for all businesses, including financial institutions.

Emergence of new payment technologies

The payments landscape is rapidly transforming. Technologies like open banking, digital wallets, and blockchain are creating new possibilities. For Humm Group, this means potential new products and collaborations, but also the risk of being outpaced by these innovations. Staying informed and strategically adopting these advancements is crucial for Humm to maintain its competitive edge in the payments sector.

Consider these key developments:

- Open Banking Adoption: By the end of 2024, it's estimated that over 50% of consumers in developed markets will have used an open banking service, indicating a significant shift towards data-driven financial management.

- Digital Wallet Growth: Global digital wallet transactions are projected to exceed $15 trillion by 2027, showcasing the increasing consumer preference for seamless, mobile-first payment solutions.

- Blockchain in Payments: While still nascent for widespread consumer use, blockchain technology is being explored for cross-border payments, with pilot programs showing potential for reduced transaction times and costs, a trend to watch closely through 2025.

Scalability and reliability of technology infrastructure

Humm Group's ability to scale its technology infrastructure is paramount for handling growing transaction volumes and user bases. For instance, in the first half of FY24, Humm Group reported a 12% increase in total transactions to 5.9 million, highlighting the need for robust, scalable systems.

Maintaining high reliability and speed is critical for customer satisfaction. Downtime or slow processing can directly impact user retention and merchant adoption. In 2023, the fintech sector generally saw a strong emphasis on uptime, with many platforms aiming for 99.9% availability.

Key technological factors supporting Humm Group's scalability and reliability include:

- Cloud Infrastructure: Leveraging scalable cloud solutions allows for dynamic resource allocation to meet fluctuating demand.

- Network Architecture: A well-designed network ensures efficient data flow and low latency, crucial for real-time transactions.

- System Optimization: Continuous monitoring and improvement of software and hardware components are vital for peak performance.

- Cybersecurity: Robust security measures are essential to protect sensitive data and maintain trust, especially with increasing digital footprints.

Humm Group's technological foundation is critical for its operations, particularly its integration with e-commerce and point-of-sale systems. This allows for seamless buy now, pay later (BNPL) solutions at checkout, a key driver in reducing abandoned online shopping carts. Global e-commerce sales surpassed $6.3 trillion in 2023, underscoring the immense market opportunity for integrated payment services.

The company's investment in robust APIs and broad platform compatibility is essential for expanding its merchant network and ensuring smooth customer experiences across all shopping channels. This strategic focus enhances Humm's competitive standing in the expanding BNPL sector.

The rapid evolution of payments, including open banking, digital wallets, and blockchain, presents both opportunities and risks for Humm Group. Open banking services are projected to be used by over 50% of consumers in developed markets by the end of 2024. Similarly, global digital wallet transactions are expected to exceed $15 trillion by 2027, signaling a strong consumer shift towards mobile-first payment methods.

Humm Group's ability to scale its technology infrastructure is vital to manage increasing transaction volumes and user bases; for instance, the company saw a 12% rise in total transactions to 5.9 million in H1 FY24. Maintaining system reliability and speed, with a target of 99.9% uptime, is paramount for customer satisfaction and retention in the competitive fintech landscape.

| Technological Factor | Impact on Humm Group | Relevant Data/Trend (2023-2025) |

|---|---|---|

| AI & Machine Learning | Enhanced credit assessment, fraud detection, personalized customer experiences, reduced default rates. | Industry benchmarks suggest potential default rate reduction of up to 15% with advanced AI integration. |

| E-commerce & POS Integration | Streamlined payment experience, reduced cart abandonment, expanded merchant network. | Global e-commerce sales reached $6.3 trillion in 2023; digital wallet transactions projected to exceed $15 trillion by 2027. |

| Cybersecurity & Data Privacy | Protection of sensitive customer data, maintenance of consumer trust, compliance with regulations. | Australian cybercrime reports increased by 13% in 2023; adherence to Australian Privacy Principles is crucial. |

| Emerging Payment Technologies (Open Banking, Digital Wallets, Blockchain) | New product development, potential collaborations, risk of being outpaced by innovation. | Over 50% of consumers in developed markets expected to use open banking by end of 2024. |

| Scalability & Reliability | Handling growing transaction volumes, ensuring high uptime for customer satisfaction. | Humm Group reported a 12% increase in total transactions to 5.9 million in H1 FY24; fintech sector aims for 99.9% uptime. |

Legal factors

Australia and New Zealand are actively reviewing consumer credit laws, with a particular focus on Buy Now, Pay Later (BNPL) services like those offered by Humm Group. These evolving regulations could see BNPL brought under broader credit legislation, similar to traditional lending. For instance, in Australia, discussions around the National Credit Act's applicability to BNPL have been ongoing, with potential implications for responsible lending obligations and disclosure requirements.

Stricter oversight could mean Humm Group will need to implement more rigorous credit checks and provide clearer information to consumers about repayment terms and potential fees. Failure to comply with these new legal frameworks, once enacted, could result in significant penalties and impact Humm's operational model. For example, a 2023 report by ASIC highlighted concerns regarding consumer detriment in the BNPL sector, suggesting a regulatory response is likely.

Humm Group operates under strict data protection and privacy laws, including Australia's Privacy Act 1988 and its Australian Privacy Principles (APPs), as well as comparable New Zealand legislation. These regulations dictate how Humm can collect, use, store, and share customer data, emphasizing the need for secure handling of personal information.

Non-compliance carries significant risks, including substantial financial penalties and damage to Humm's reputation. For instance, the Office of the Australian Information Commissioner (OAIC) can impose penalties for breaches of privacy principles. In 2023, the Australian government proposed reforms to the Privacy Act, potentially increasing penalties for serious or repeated interferences with privacy, which could impact Humm's operational costs and compliance strategies.

As a financial services provider, Humm Group must navigate stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations in Australia and New Zealand. These laws mandate comprehensive Know Your Customer (KYC) processes, diligent transaction monitoring, and the reporting of suspicious activities. Failure to comply can result in severe penalties, including hefty fines and license revocation, underscoring the critical need for ongoing investment in compliance infrastructure and staff education.

Dispute resolution mechanisms and consumer complaints

Humm Group must adhere to stringent legal frameworks governing consumer dispute resolution. In Australia, for instance, financial services providers like Humm are required to be members of an approved external dispute resolution (EDR) scheme, such as the Australian Financial Complaints Authority (AFCA). AFCA reported handling over 70,000 complaints in the 2023 financial year, underscoring the volume of consumer issues financial firms manage.

These regulations mandate that Humm Group establish and maintain internal dispute resolution (IDR) processes that are fair, transparent, and timely. Failure to comply can lead to significant penalties and reputational damage. For example, the Australian Securities and Investments Commission (ASIC) can impose fines for non-compliance with consumer protection laws, including those related to complaint handling.

- Mandatory EDR Membership: Humm Group must be a member of an ASIC-approved EDR scheme.

- Internal Dispute Resolution (IDR) Requirements: The company needs robust internal processes for handling complaints efficiently.

- Regulatory Oversight: ASIC enforces compliance with consumer dispute resolution obligations.

- Consumer Trust and Reputation: Effective complaint handling is crucial for maintaining customer loyalty and avoiding legal challenges.

Financial services licensing and prudential regulation

The Buy Now Pay Later (BNPL) sector, including companies like Humm Group, is navigating evolving regulatory landscapes. While not traditionally regulated as banks, there's a growing discussion about applying more stringent financial services licensing and prudential oversight. For instance, in Australia, the government has been reviewing BNPL regulation, with potential recommendations for licensing requirements and consumer protection measures to be implemented starting in 2024 or 2025.

These potential changes could significantly alter Humm Group's operational framework. New capital adequacy rules, for example, might necessitate adjustments to its financial structure and funding strategies. Companies may need to hold more capital to cover potential credit losses, impacting profitability and growth plans.

Humm Group must actively monitor these developments. Proactive engagement with regulators and strategic planning for compliance with new licensing or prudential standards are crucial. This includes understanding the implications of potential requirements for consumer credit licenses, which could bring BNPL providers under a more familiar, yet potentially more burdensome, regulatory regime than currently exists.

- Regulatory Scrutiny: BNPL providers like Humm Group face increasing scrutiny from financial regulators globally, with potential for more comprehensive licensing requirements.

- Capital Adequacy: New prudential regulations could introduce capital adequacy ratios, impacting Humm Group's financial leverage and operational flexibility.

- Consumer Protection: Evolving legal frameworks aim to enhance consumer protection in BNPL, potentially leading to stricter disclosure and responsible lending obligations for Humm.

- Licensing Evolution: The shift towards treating BNPL more like traditional financial services could mean Humm Group needing to obtain or adapt existing financial services licenses.

The legal landscape for Buy Now, Pay Later (BNPL) services, including Humm Group, is undergoing significant evolution in Australia and New Zealand. Regulatory bodies are increasingly focused on consumer credit reforms, with discussions around bringing BNPL under existing credit legislation. This could mean Humm Group faces stricter responsible lending obligations and enhanced disclosure requirements, similar to traditional lenders.

For instance, in Australia, ongoing reviews of the National Credit Act's applicability to BNPL services are expected to lead to new rules. These changes, potentially implemented from 2024-2025, could mandate more rigorous credit assessments and clearer communication of terms and fees to consumers. Non-compliance with these evolving legal frameworks carries the risk of substantial penalties, as highlighted by ASIC's 2023 reports on consumer detriment in the BNPL sector, signaling a proactive regulatory stance.

Humm Group must also navigate stringent data protection laws, such as Australia's Privacy Act 1988 and New Zealand's comparable legislation. These laws govern the collection, use, and storage of customer data, demanding robust security measures. The Australian government's proposed reforms to the Privacy Act in 2023, which could escalate penalties for privacy breaches, underscore the critical importance of compliance for Humm Group's operations and reputation.

Furthermore, Humm Group operates under strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, requiring thorough Know Your Customer (KYC) processes and transaction monitoring. Compliance failures can lead to severe penalties, including significant fines and potential license revocation, necessitating continuous investment in compliance infrastructure and staff training to mitigate these risks.

| Legal Factor | Description | Impact on Humm Group | Regulatory Body/Legislation | Potential Consequence of Non-Compliance |

|---|---|---|---|---|

| BNPL Regulation Review | Australia and New Zealand are reviewing consumer credit laws, focusing on BNPL. | Potential for stricter responsible lending, disclosure, and licensing requirements. | ASIC, Reserve Bank of New Zealand, National Credit Act (AUS) | Fines, operational restrictions, reputational damage. |

| Data Protection and Privacy | Laws govern the collection, use, and storage of customer data. | Requires robust data security and transparent data handling practices. | Privacy Act 1988 (AUS), Australian Privacy Principles (APPs), NZ Privacy Act | Significant financial penalties, reputational damage, loss of customer trust. |

| AML/CTF Compliance | Mandatory requirements for preventing financial crime. | Necessitates rigorous KYC, transaction monitoring, and suspicious activity reporting. | AUSTRAC (AUS), Financial Transactions Reports Act (NZ) | Heavy fines, license suspension or revocation, criminal charges. |

| Consumer Dispute Resolution | Requirements for handling customer complaints effectively. | Mandatory membership in external dispute resolution schemes and robust internal processes. | ASIC, Australian Financial Complaints Authority (AFCA) | Fines, damage to reputation, loss of customer loyalty. |

Environmental factors

The global push for Environmental, Social, and Governance (ESG) reporting is intensifying, significantly shaping investor sentiment and corporate standing. Financial institutions like Humm Group, while not direct polluters, are under scrutiny to showcase robust ESG practices.

Investors are increasingly channeling capital towards companies demonstrating strong ESG credentials. For instance, a 2024 report indicated that over 70% of institutional investors consider ESG factors in their investment decisions, a figure expected to rise. This trend means Humm Group may need to bolster its ESG disclosures to attract and retain crucial investment capital.

Humm Group's environmental footprint is largely tied to its digital operations, specifically the energy consumed by its data centers and IT infrastructure. As of 2024, the tech industry's energy demand is significant, with data centers accounting for a substantial portion of global electricity use, estimated by some reports to be around 1% to 1.5% of total global electricity consumption.

There's a strong and increasing expectation from both the public and regulators for companies like Humm to implement greener digital practices. This includes exploring options like powering servers with renewable energy sources, a trend gaining momentum across the financial sector, and improving data efficiency to reduce overall energy needs.

To stay ahead and meet evolving environmental standards, Humm Group will likely need to actively measure and reduce its digital carbon footprint. Aligning with broader sustainability goals is becoming a critical aspect of corporate responsibility and investor relations, especially as climate change concerns intensify.

A significant and growing number of consumers and merchants are increasingly prioritizing businesses that demonstrate strong ethical and sustainable practices. This trend, while not purely environmental, directly impacts Humm Group's social and governance (ESG) performance, which is closely linked to environmental considerations. By showcasing a commitment to broader sustainability, Humm Group can boost its attractiveness to environmentally aware customers and business partners.

This focus on sustainability can translate into tangible benefits. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase from brands with a clear commitment to sustainability. For Humm Group, this means that aligning its operations and offerings with these values can enhance brand loyalty and attract merchants who also place a high importance on these ethical considerations, potentially leading to increased market share.

Climate change risk assessment for financial services

Financial regulators globally, including in Australia and New Zealand where Humm operates, are intensifying scrutiny on climate risk. For instance, the Reserve Bank of Australia (RBA) has been actively engaging with financial institutions on climate-related financial disclosures and risk management frameworks. This means Humm, like its peers, needs robust processes to identify and quantify potential impacts from both physical climate events and the transition to a lower-carbon economy.

While Humm's business model, focused on consumer finance and buy-now-pay-later (BNPL), might seem less exposed to heavy industry transition risks than traditional banks, indirect impacts are significant. Consider the potential for increased unemployment or reduced consumer spending power in regions heavily reliant on carbon-intensive sectors that face policy shifts or market disruption. This could directly affect Humm's customer repayment capacity and the financial health of its merchant partners.

Assessing the resilience of Humm's loan portfolio requires a granular look at its customer base and merchant network.

- Increased frequency of extreme weather events, such as floods and bushfires impacting Australian regions, could lead to higher loan defaults among affected customers.

- Policy changes related to carbon emissions might affect the profitability of certain retail sectors where Humm has a presence, indirectly impacting its merchant partners' ability to trade and Humm's revenue.

- Consumer sentiment shifts towards more sustainable products and services could alter spending patterns, potentially affecting demand for credit in certain categories.

- The financial sector's overall exposure to climate risk, as highlighted by international bodies like the Network for Greening the Financial System (NGFS), sets a precedent for regulatory expectations on all financial service providers.

Regulatory push for green finance initiatives

Governments globally are intensifying their focus on green finance, with many financial bodies actively promoting initiatives that encourage sustainable lending and investment. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) aims to bring transparency to sustainability claims in financial products. This regulatory push is creating an environment where financial institutions are expected to integrate environmental, social, and governance (ESG) factors into their operations.

While Humm Group's primary operations revolve around Buy Now, Pay Later (BNPL) for consumers and businesses, this evolving regulatory landscape presents potential future considerations. There may be increasing expectations or incentives for Humm to align its offerings with green finance principles. This could involve developing specific financing solutions for eco-friendly products or businesses, thereby tapping into a growing market segment.

Staying ahead of these environmental trends is crucial for Humm's strategic planning. By understanding the growing demand for sustainable financial products and the regulatory drivers behind them, Humm can identify new market opportunities and proactively shape its future business direction. For example, by 2024, several major economies have set ambitious targets for green bond issuance, signaling a significant shift in capital allocation towards environmental projects.

Key considerations for Humm Group regarding the regulatory push for green finance initiatives include:

- Increased investor demand for ESG-compliant products.

- Potential for regulatory mandates on sustainability reporting and practices.

- Opportunities to differentiate through offering green financing options for consumers and businesses.

- The need to assess and potentially mitigate climate-related financial risks in its portfolio.

The increasing global emphasis on Environmental, Social, and Governance (ESG) factors significantly influences investor sentiment and corporate strategy, pushing companies like Humm Group to demonstrate strong sustainability practices. This trend is underscored by reports from 2024 indicating that over 70% of institutional investors consider ESG criteria in their decisions, a figure projected to climb, making robust ESG disclosures vital for Humm to attract and retain capital.

Humm's environmental impact is primarily linked to its digital infrastructure, including data centers, which are significant energy consumers. By 2024, data centers were estimated to account for 1% to 1.5% of global electricity usage, highlighting the need for Humm to explore greener digital operations, such as renewable energy sources for servers and improved data efficiency.

Consumer and merchant preferences are shifting towards businesses with strong ethical and sustainable practices, directly impacting Humm's ESG performance. A 2024 report found that 65% of consumers are more likely to buy from brands committed to sustainability, suggesting that Humm's alignment with these values can enhance brand loyalty and attract environmentally conscious partners.

Regulators, including the Reserve Bank of Australia, are increasing scrutiny on climate risk, compelling financial institutions like Humm to manage potential impacts from extreme weather and the transition to a low-carbon economy. This necessitates a granular assessment of Humm's loan portfolio and merchant network for resilience against climate-related financial risks.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Humm Group is built on a comprehensive review of data from official government publications, financial market reports, and reputable industry analysis firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.