Hub Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hub Group Bundle

Hub Group's robust network and diversified service offerings present significant strengths in the logistics sector. However, understanding the full scope of their competitive landscape, potential challenges, and strategic opportunities requires a deeper dive.

Want the full story behind Hub Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hub Group's diverse service portfolio is a significant strength, encompassing intermodal, truck brokerage, and comprehensive logistics solutions. This breadth allows them to serve a wide array of customer needs and adapt effectively to shifting market dynamics, fostering more consistent revenue generation. For instance, their intermodal services, a core offering, saw continued demand in 2024, contributing to overall operational stability.

Hub Group has strategically bolstered its capabilities through key acquisitions and partnerships. A prime example is their October 2024 investment, securing a 51% stake in EASO. This move significantly enhanced their Intermodal and Transportation Solutions (ITS) segment, especially benefiting from the growing trade volume between Mexico and the United States.

Further strengthening their market position, Hub Group acquired Marten Transport's refrigerated assets in July 2025. This acquisition effectively doubled their reefer fleet, cementing their status as a top-tier provider in temperature-controlled logistics and demonstrating a clear strategy for growth and diversification.

Hub Group demonstrates exceptional financial health, underscored by a remarkably low net debt to adjusted EBITDA ratio, standing at just 0.3x as of June 30, 2025. This figure comfortably sits below their internal target, signaling robust financial stability and prudent leverage management.

This strong financial footing is further bolstered by a proactive approach to cost management, with the company targeting $50 million in savings for the 2025 fiscal year. Such efficiency directly contributes to healthy operating margins, providing the capacity for significant capital returns to shareholders via dividends and share repurchases.

Extensive Network and Asset Base

Hub Group boasts a formidable network and asset base, crucial for its operational strength. As of recent reporting, this includes a substantial fleet of over 32,000 53-foot freight containers and more than 90,300 rail assets. This vast infrastructure underpins their ability to manage complex logistics and provide reliable transportation services.

Their strategically located network of 25 drayage terminals across North America further enhances their competitive edge. This extensive reach allows Hub Group to efficiently manage the first and last mile of freight movement, optimizing supply chains for their clients and ensuring timely deliveries.

- Extensive Asset Fleet: Over 32,000 53-foot freight containers and more than 90,300 rail assets.

- North American Presence: 25 drayage terminals strategically positioned across the continent.

- Operational Efficiency: Enables optimized supply chains and reliable transportation solutions.

Commitment to Technology and Sustainability

Hub Group's dedication to cutting-edge technology significantly bolsters its supply chain operations. By integrating real-time tracking and advanced load optimization tools, the company enhances efficiency and provides unparalleled visibility, directly translating to improved customer satisfaction. This technological focus is a key differentiator in a competitive logistics landscape.

Furthermore, Hub Group’s strong commitment to sustainability resonates with current market demands. Their participation in initiatives like the EPA SmartWay program and their proactive pursuit of greenhouse gas-friendly transportation solutions demonstrate a forward-thinking approach. This aligns with the increasing preference of both customers and investors for environmentally responsible partners.

- Technology Integration: Hub Group leverages industry-leading technology for real-time tracking and load optimization, boosting supply chain efficiency and customer satisfaction.

- Sustainability Focus: The company actively participates in programs like EPA SmartWay, promoting greenhouse gas-friendly transportation alternatives.

- Market Alignment: These efforts cater to growing customer and investor demand for environmentally conscious business practices.

Hub Group's diversified service offerings, spanning intermodal, truck brokerage, and comprehensive logistics, provide a resilient revenue base. Their strategic acquisitions, such as the 51% stake in EASO in October 2024 and Marten Transport's refrigerated assets in July 2025, have significantly expanded their capabilities and market reach, particularly in temperature-controlled logistics.

The company exhibits robust financial health, evidenced by a net debt to adjusted EBITDA ratio of just 0.3x as of June 30, 2025, well within their target. This financial strength, coupled with a targeted $50 million in cost savings for fiscal year 2025, supports healthy margins and capital returns.

Hub Group possesses a substantial asset base, including over 32,000 53-foot freight containers and more than 90,300 rail assets, supported by 25 strategically located drayage terminals across North America. This infrastructure ensures operational efficiency and reliable service delivery.

Their commitment to technology, with real-time tracking and advanced load optimization, enhances supply chain efficiency and customer visibility. Furthermore, Hub Group's focus on sustainability, including participation in EPA SmartWay, aligns with growing market demand for environmentally responsible logistics partners.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Services | Broad portfolio including intermodal, truck brokerage, and logistics. | Continued demand for intermodal services in 2024. |

| Strategic Acquisitions | Expansion of capabilities and market share through key investments. | 51% stake in EASO (Oct 2024), Marten Transport reefer assets (July 2025). |

| Financial Strength | Low leverage and effective cost management. | Net debt to adjusted EBITDA of 0.3x (June 30, 2025); targeting $50M savings (FY2025). |

| Asset & Network Base | Extensive owned assets and strategically located terminals. | 32,000+ 53-foot containers, 90,300+ rail assets, 25 drayage terminals. |

| Technology & Sustainability | Leveraging tech for efficiency and focusing on eco-friendly solutions. | Real-time tracking, EPA SmartWay participation. |

What is included in the product

Offers a full breakdown of Hub Group’s strategic business environment, detailing its internal capabilities and external market dynamics.

Hub Group's SWOT analysis provides a clear roadmap for navigating industry challenges, enabling proactive risk mitigation and capitalizing on emerging opportunities.

Weaknesses

Hub Group has seen its revenue dip in recent quarters. For instance, in the second quarter of 2025, revenue decreased by 8.2% compared to the same period in 2024. This trend continued into the first quarter of 2025, with an 8% year-over-year revenue decline, both figures missing market forecasts.

Several factors are contributing to this revenue shortfall. Lower volumes in their brokerage services, coupled with reduced revenue per load in both intermodal and brokerage operations, have impacted earnings. Additionally, a decrease in fuel surcharges and weaker-than-expected demand, often described as sub-seasonal, are key drivers behind this challenging period for the company.

Hub Group's reliance on broader economic health and trade agreements presents a notable weakness. Fluctuations in macroeconomic indicators, such as GDP growth and consumer spending, directly impact freight volumes, creating an inherent vulnerability. For instance, in 2023, while the overall economy showed resilience, specific sectors experienced slowdowns that affected freight demand.

Trade policies and the imposition of tariffs can significantly disrupt shipping patterns and increase operational costs. Uncertainty surrounding these policies, particularly concerning import volumes on the West Coast, has historically led to revenue volatility for companies like Hub Group. These external factors can create unpredictable challenges, impacting revenue streams and necessitating agile strategic adjustments.

While Hub Group's intermodal volumes saw a healthy increase, its logistics segment, especially truck brokerage, experienced revenue dips. This was driven by reduced volumes and persistent margin pressures, reflecting a challenging brokerage market in 2024. The company reported that its brokerage operations faced significant headwinds, contributing to the segment's underperformance.

Integration Challenges of Acquisitions

While acquisitions such as Marten Transport's intermodal operations and the Final Mile business are strategically sound, their integration presents significant challenges. These can include substantial upfront costs and a temporary dampening of profit margins as new systems and processes are assimilated. For instance, the integration of Marten Transport, a deal valued at approximately $220 million, requires careful management to realize its full potential.

Managing the inherent complexities of integrating diverse operations, including potential realignments within the warehouse network and ensuring continuity of service, is a key weakness. This process demands considerable resources and can lead to operational disruptions if not executed flawlessly. Hub Group's focus on optimizing its network post-acquisition highlights the ongoing effort to mitigate these integration hurdles.

- Integration Costs: Acquisitions require significant investment beyond the purchase price for system alignment, training, and operational adjustments, potentially impacting short-term profitability.

- Operational Complexity: Merging different business units, IT systems, and workforces can lead to inefficiencies and service disruptions if not managed meticulously.

- Synergy Realization: Achieving projected cost savings and revenue enhancements from acquisitions can be delayed or fall short if integration is not smooth and effective.

Competitive Market Share

Hub Group faces a crowded transportation and logistics landscape, contending with industry giants such as Union Pacific Corp, C.H. Robinson Worldwide Inc., and J.B. Hunt Transport Services Inc. This intense competition can limit its ability to capture a larger portion of the market.

While Hub Group holds a notable position, its market share, reported at 3.18% in the first quarter of 2025, underscores the significant competitive pressures it navigates. This smaller relative share compared to some larger rivals presents a consistent challenge to growth and market dominance.

- Intense Competition: Hub Group operates in a highly fragmented market with many established players.

- Market Share Dynamics: As of Q1 2025, Hub Group's market share stood at 3.18%, highlighting the dominance of larger competitors.

- Pressure on Pricing: The competitive environment can lead to price wars, potentially impacting Hub Group's profit margins.

- Customer Acquisition Costs: Gaining new customers in this crowded space can be costly and resource-intensive.

Hub Group's logistics segment, particularly its truck brokerage operations, experienced a revenue decline in 2024, driven by lower volumes and persistent margin pressures. This segment's underperformance, attributed to challenging market conditions, contributed to the company's overall revenue shortfall. The company reported that its brokerage operations faced significant headwinds, impacting profitability.

The company's reliance on broader economic health and trade agreements poses a significant vulnerability. Fluctuations in GDP growth and consumer spending directly impact freight volumes, creating inherent instability. For example, in 2023, while the overall economy showed resilience, specific sectors experienced slowdowns that affected freight demand, directly impacting Hub Group's revenue streams.

Hub Group's market share, reported at 3.18% in the first quarter of 2025, underscores the intense competitive pressures it navigates. This relatively smaller share compared to larger rivals presents a consistent challenge to growth and market dominance, necessitating continuous efforts to capture a larger portion of the market against established players.

Acquisitions, while strategically beneficial, introduce integration challenges and costs. The assimilation of new systems, processes, and workforces can lead to operational complexities and potentially dampen short-term profit margins. For instance, the integration of Marten Transport, a deal valued around $220 million, requires careful management to realize its full potential and mitigate integration hurdles.

Preview Before You Purchase

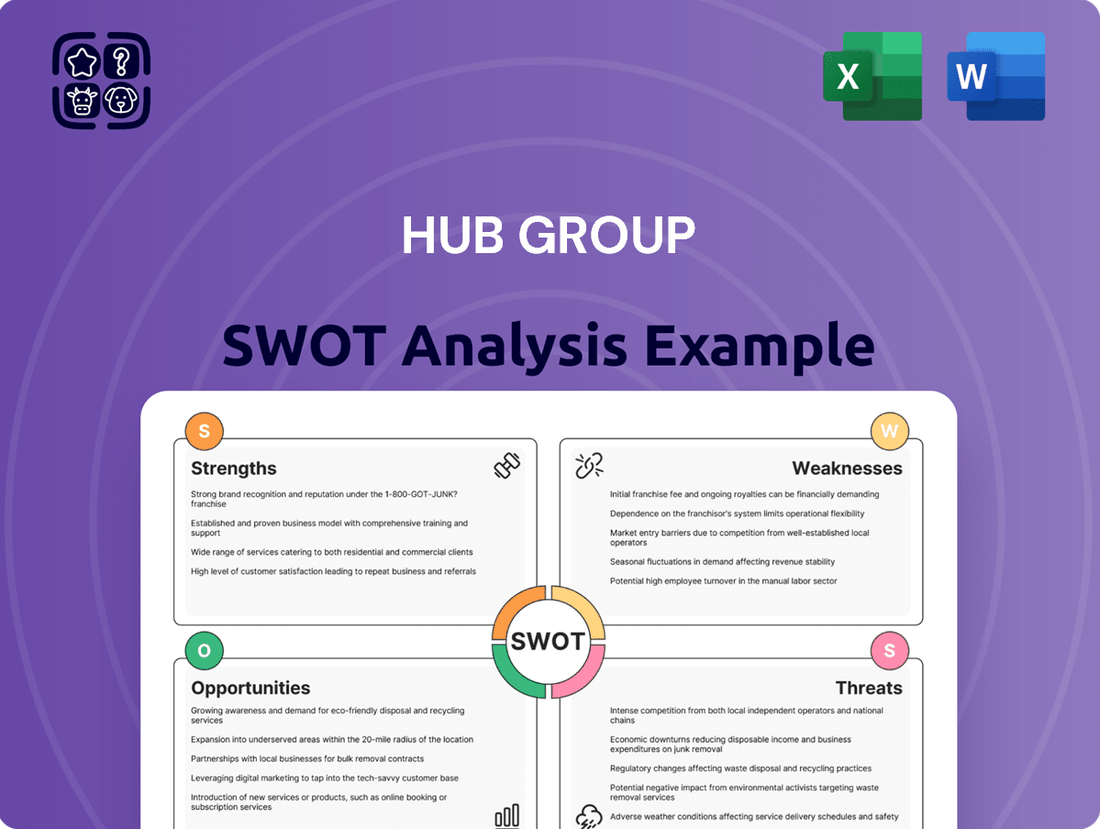

Hub Group SWOT Analysis

This is the actual Hub Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Hub Group's strategic position.

This is a real excerpt from the complete document, showcasing the detailed breakdown of Hub Group's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version.

Opportunities

Hub Group's strategic moves, including acquiring Marten Transport's refrigerated assets and forming a joint venture with EASO in Mexico, are well-positioned to tap into the expanding refrigerated intermodal and cross-border logistics markets. This dual approach allows the company to leverage growth in temperature-controlled freight and capture increasing trade volumes between the U.S. and Mexico.

The refrigerated intermodal sector presents a substantial opportunity, driven by consumer demand for fresh and frozen goods. Furthermore, Hub Group's Mexican expansion aligns perfectly with the projected 3% annual growth in U.S.-Mexico trade, a trend expected to continue through 2025 and beyond, thereby diversifying revenue and capitalizing on this vital trade corridor.

The potential merger between Union Pacific and Norfolk Southern could significantly benefit Hub Group by creating a more efficient transcontinental rail network. This consolidation may lead to reduced transit times and improved overall network efficiency, directly impacting Hub Group's intermodal operations. For instance, in 2024, Hub Group reported a focus on reducing empty miles, a key metric that could see further improvement with a streamlined rail infrastructure.

Hub Group's ongoing commitment to network optimization and enhancing asset utilization is crucial in capitalizing on such industry shifts. By actively working to reduce empty miles, as evidenced by their operational strategies throughout 2024, Hub Group is positioning itself to benefit from any increased efficiencies brought about by major rail consolidations. This proactive approach aims to boost margins and operational performance.

Hub Group's expansion into final mile delivery presents a significant growth avenue. The company secured $150 million in net new annualized revenue in late 2024, largely fueled by the booming e-commerce sector and consumer expectations for expedited shipping.

While there are upfront costs associated with integrating these new services, the final mile, alongside managed transportation and contractual logistics, is poised to drive substantial revenue increases and improve overall market performance for Hub Group.

Leveraging Technology for Efficiency and Customer Value

Hub Group's continued investment in technology presents a significant opportunity. By enhancing real-time tracking, load optimization, and digital platforms, the company can boost operational efficiency and customer satisfaction. These advancements are crucial for maintaining a competitive edge in the logistics sector.

These technological upgrades translate into tangible benefits for clients. Hub Group can offer superior service, increased efficiency, and complete visibility throughout the supply chain. For instance, their digital solutions aim to streamline freight management, providing customers with up-to-the-minute updates and predictive analytics.

- Enhanced Operational Efficiency: Technology allows for better route planning and asset utilization, reducing downtime and fuel costs.

- Improved Customer Experience: Real-time tracking and digital platforms offer customers greater transparency and control over their shipments.

- Competitive Differentiation: Advanced digital solutions can attract and retain clients seeking modern, integrated logistics services.

- Data-Driven Decision Making: Investments in analytics provide insights for optimizing network performance and identifying new service opportunities.

Shareholder Returns and Capital Deployment

Hub Group's robust cash flow and minimal net debt position them well to continue rewarding shareholders. This financial strength supports consistent dividend payouts and strategic share buybacks, as evidenced by the $29 million returned to shareholders in the first half of 2025.

This financial flexibility is a significant opportunity, allowing Hub Group to not only return capital but also to selectively invest in growth initiatives. The company can pursue long-term expansion strategies, including potential acquisitions, without jeopardizing its financial stability.

- Continued Shareholder Returns: Hub Group's strong financial health facilitates ongoing dividend payments and share repurchases, enhancing shareholder value.

- Capital for Growth: The company's low net debt provides the capacity to fund strategic investments and explore opportunistic acquisitions for long-term expansion.

- Financial Flexibility: A healthy cash flow generation allows for both shareholder distributions and strategic capital deployment, creating a balanced approach to financial management.

Hub Group is strategically positioned to capitalize on the growing demand for refrigerated transport, especially with its acquisition of Marten Transport's assets. This move directly addresses the increasing consumer need for temperature-controlled goods, a market segment that saw significant expansion through 2024.

The company's joint venture in Mexico, EASO, is designed to benefit from the projected 3% annual growth in U.S.-Mexico trade through 2025. This expansion into cross-border logistics offers a substantial opportunity to diversify revenue streams and capture increased trade volumes.

Potential rail network consolidation, such as a Union Pacific and Norfolk Southern merger, could streamline operations and reduce transit times, directly benefiting Hub Group's intermodal efficiency. This aligns with their 2024 focus on reducing empty miles, a key performance indicator that could see further improvement.

Hub Group's expansion into final mile delivery, which secured $150 million in net new annualized revenue in late 2024, is a direct response to the e-commerce boom and consumer demand for faster delivery. This sector, along with managed transportation, is expected to drive significant revenue growth.

Threats

The logistics industry is inherently tied to the broader economy, making it susceptible to economic downturns. For Hub Group, a significant slowdown or recession in 2024 or 2025 could directly reduce freight volumes. For instance, if consumer spending contracts, the demand for transporting goods, a core business for Hub Group, will likely decline, impacting revenue and profitability.

Trade policy instability, especially concerning the United States and Mexico, creates significant uncertainty for Hub Group. Fluctuations in trade agreements and the potential imposition of tariffs can directly impact cross-border shipping volumes, a key segment for the company. For instance, during periods of heightened trade tensions, like those experienced in 2018-2019, freight volumes can become unpredictable, affecting Hub Group's network utilization and revenue forecasts.

Tariffs, in particular, can act as a drag on demand by increasing the cost of goods, potentially leading to lower import volumes. This directly challenges Hub Group's ability to meet volume targets and maintain consistent service levels. The unpredictability of these policies makes long-term strategic planning and investment decisions more challenging, as future operational costs and revenue streams become less certain.

Hub Group faces significant competitive pressures in the transportation and logistics sector. Major competitors are investing heavily in digital transformation and expanding their infrastructure, creating a challenging environment. For instance, in 2024, many logistics firms are enhancing their technology platforms to improve visibility and efficiency, directly impacting traditional intermodal services.

These rival strategies, focused on innovation and asset enhancement, are likely to intensify pricing competition and squeeze profit margins for Hub Group. Companies are increasingly leveraging advanced analytics and automation to gain an edge, forcing all industry participants to adapt or risk losing market share.

Fuel Price Volatility and Surcharge Impact

Hub Group's reliance on fuel surcharges makes it vulnerable to energy market fluctuations. When fuel prices drop, the revenue generated from these surcharges also decreases, directly impacting the company's top line. This was evident in recent quarters where lower fuel revenue contributed to overall revenue declines, underscoring the sensitivity of their business model to energy price volatility.

The impact of fuel price volatility can be significant:

- Decreased Surcharge Revenue: Lower average fuel costs in early 2024, for instance, directly reduced the revenue generated from fuel surcharges compared to periods with higher fuel prices.

- Revenue Decline Contribution: In the first quarter of 2024, Hub Group reported a 6% decrease in total revenue, partly attributed to lower fuel surcharges, demonstrating a clear link between energy prices and financial performance.

- Exposure to Energy Markets: The company's financial results are increasingly tied to the unpredictable nature of global oil and gas markets, creating an ongoing challenge for revenue stability.

- Operational Cost Management: While surcharges aim to offset costs, significant drops in fuel prices can create a lag effect, impacting profitability until pricing models fully adjust.

Regulatory and Integration Risks of Rail Mergers

Potential rail mergers, like the proposed Union Pacific and Norfolk Southern combination, introduce significant regulatory hurdles and integration challenges. These complex processes can lead to extended review periods and uncertainty, impacting Hub Group's strategic planning and operational adjustments. For instance, the Surface Transportation Board's (STB) scrutiny of past merger proposals highlights the potential for lengthy approval processes.

The successful or unsuccessful integration of major rail carriers could reshape the competitive dynamics within the freight transportation sector, directly affecting Hub Group's market position and service offerings. A merger might lead to altered service levels, pricing structures, or network access, requiring Hub Group to adapt its business model to maintain its competitive edge. The STB's role in approving such mergers means that regulatory outcomes are a critical factor in the evolving landscape.

- Regulatory Scrutiny: Mergers face stringent review by bodies like the STB, potentially causing delays and requiring concessions.

- Integration Complexity: Combining large rail networks involves massive operational and IT system overhauls, creating execution risks.

- Market Impact: Shifts in rail capacity, pricing, and service reliability due to mergers directly influence Hub Group's intermodal and trucking operations.

Hub Group's financial performance is sensitive to economic downturns, with a potential recession in 2024-2025 directly impacting freight volumes and revenue. Trade policy shifts, particularly concerning North American trade, introduce significant uncertainty, affecting cross-border shipping and creating planning challenges. Increased competition from digitally advanced rivals and the volatility of fuel prices, which impact surcharge revenue, also pose substantial threats to the company's profitability and market position.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Hub Group's official financial reports, comprehensive market intelligence, and insights from industry experts. These sources provide a well-rounded view of the company's operational landscape and competitive positioning.