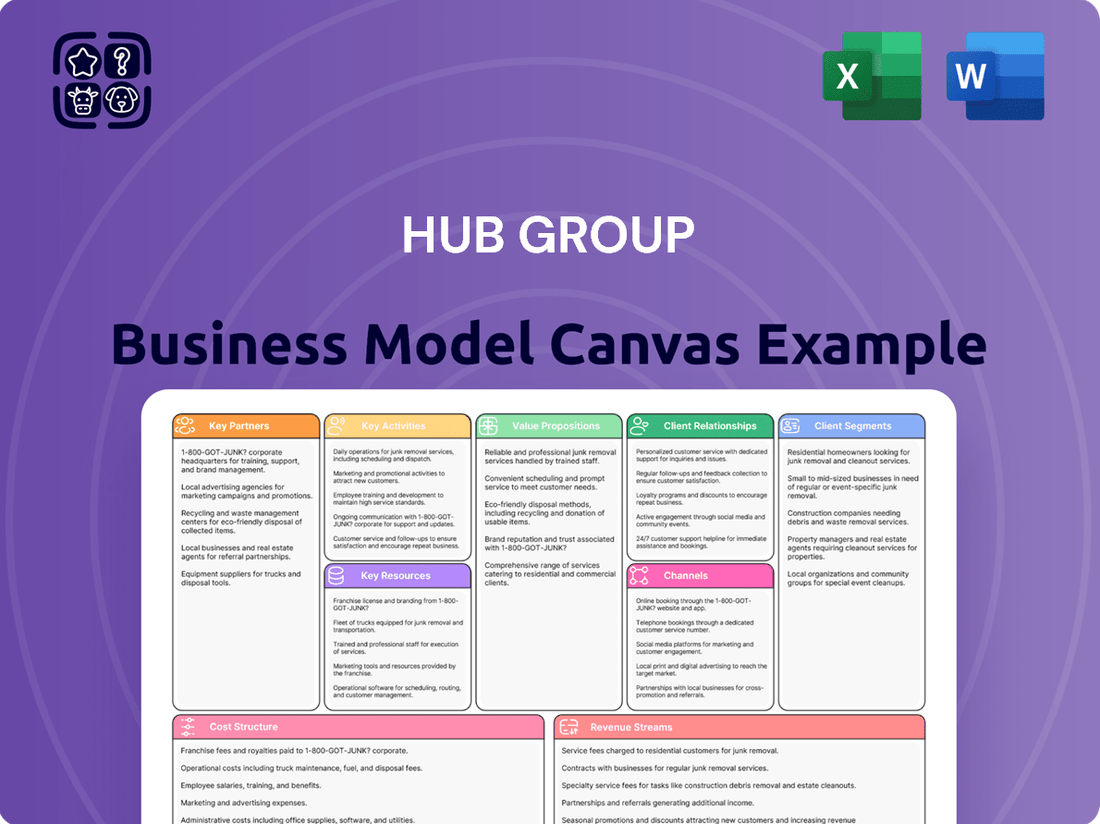

Hub Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hub Group Bundle

Unlock the strategic DNA of Hub Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect shippers with carriers, optimize logistics, and create value across their network.

Dive deeper into Hub Group’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Hub Group's exclusive partnerships with major North American railroads, including Union Pacific and Norfolk Southern, are foundational to its intermodal operations. These relationships facilitate the efficient movement of freight over long distances throughout North America.

The potential merger between Union Pacific and Norfolk Southern represents a significant opportunity for Hub Group. This consolidation is anticipated to enhance network efficiency, reduce transit times, and broaden market reach for intermodal freight.

Hub Group relies heavily on a robust network of local trucking companies to execute the critical first and last-mile legs of its intermodal transportation services. These partnerships are vital for ensuring efficient and reliable door-to-door delivery for customers, effectively extending Hub Group's operational footprint across diverse geographic areas.

In 2024, Hub Group continued to leverage these local trucking alliances to bridge the final distance between rail yards and customer facilities, a fundamental component of their intermodal strategy. This collaborative approach allows Hub Group to offer a complete solution, managing the entire journey from origin to final destination.

Hub Group's strategic alliances with technology and software providers are crucial for elevating its supply chain capabilities. These partnerships enable the integration of advanced solutions for enhanced visibility, real-time tracking, and sophisticated data analytics, directly benefiting their customer base.

These collaborations are instrumental in developing and deploying cutting-edge tools that optimize load management and provide granular insights into logistics operations. For instance, Hub Group's investment in technology platforms aims to streamline processes and offer a competitive edge through superior data-driven decision-making.

A significant aspect of Hub Group's strategy involves continuous investment in technology, underscoring its commitment to operational excellence and market leadership. This focus ensures they remain at the forefront of logistics innovation, driving efficiency and customer satisfaction.

Warehouse and Fulfillment Centers

Hub Group collaborates with a network of third-party warehousing and fulfillment centers to extend its service offerings. These partnerships are crucial for providing integrated logistics solutions that go beyond traditional transportation, encompassing vital services like storage, efficient cross-docking, and specialized e-commerce fulfillment.

By leveraging these external capabilities, Hub Group can deliver comprehensive third-party logistics (3PL) services, effectively acting as a one-stop shop for clients' supply chain needs. This strategic approach allows them to manage a broader spectrum of logistics operations without the capital investment of owning all facilities.

The company also places a significant emphasis on maximizing the utilization of its own strategically located warehouse network. This internal focus is key to improving operational efficiency and ultimately enhancing profit margins by reducing underutilized space and optimizing inventory flow.

- Strategic Alliances: Partnerships with diverse warehousing and fulfillment centers are fundamental to Hub Group's integrated logistics model.

- Expanded Service Portfolio: These collaborations enable the provision of storage, cross-docking, and e-commerce fulfillment, broadening their 3PL capabilities.

- Network Optimization: Hub Group actively works to improve the utilization of its owned warehouse infrastructure to boost profitability.

- Market Reach: In 2024, Hub Group continued to expand its service footprint, with warehouse partnerships playing a vital role in supporting growing e-commerce demands and supply chain complexities.

Acquired Entities and Joint Ventures

Hub Group's strategic growth is significantly fueled by key partnerships, including acquired entities and joint ventures. A prime example is their 51% controlling interest in EASO in Mexico, a move that bolsters their presence in cross-border logistics.

Furthermore, the acquisition of Marten Transport's intermodal division in 2023, for instance, was a substantial step in enhancing their network and capabilities. These strategic integrations are designed to broaden service portfolios and expand geographic footprints, particularly in temperature-controlled and cross-border freight.

- EASO Acquisition: Gained a controlling stake, enhancing cross-border Mexico operations.

- Marten Transport Deal: Acquired intermodal division to boost network capacity and service offerings.

- Strategic Goals: These moves aim to increase scale, improve profitability, and expand into critical logistics segments.

Hub Group's key partnerships are the bedrock of its expansive intermodal network, connecting major railroads like Union Pacific and Norfolk Southern for efficient long-haul transit. These alliances are critical for seamless first and last-mile execution through a network of local trucking companies, ensuring reliable door-to-door service.

In 2024, Hub Group continued to strengthen its technology partnerships, integrating advanced solutions for enhanced visibility and data analytics, which directly benefits customer operations and optimizes logistics. They also collaborate with third-party warehousing and fulfillment centers to offer comprehensive 3PL services, expanding their reach and capabilities.

Strategic acquisitions and joint ventures, such as their controlling interest in EASO in Mexico, further bolster Hub Group's market presence and cross-border capabilities. These integrations are designed to increase scale, improve profitability, and gain access to critical logistics segments.

| Partnership Type | Key Partners | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Railroads | Union Pacific, Norfolk Southern | Core intermodal network, long-haul efficiency | Leveraging potential UP/NS merger for enhanced network efficiency |

| Trucking Companies | Numerous local providers | First and last-mile execution, door-to-door service | Bridging final distance, supporting e-commerce growth |

| Technology Providers | Various software & analytics firms | Supply chain visibility, data analytics, operational optimization | Integrating advanced solutions for competitive edge |

| Warehousing & Fulfillment | Third-party centers | Expanded 3PL services, storage, cross-docking | Supporting growing e-commerce demands and supply chain complexities |

| Acquisitions/JVs | EASO (Mexico), Marten Transport's intermodal division | Geographic expansion, service portfolio enhancement | Strengthening cross-border logistics and network capacity |

What is included in the product

A detailed Hub Group Business Model Canvas outlining its integrated logistics and supply chain solutions, focusing on customer segments, value propositions, and key partnerships.

This model reflects Hub Group's strategy of providing intermodal, drayage, and dedicated truck services, supported by a robust technology platform.

Hub Group's Business Model Canvas provides a clear, visual roadmap that simplifies complex logistics, alleviating the pain of scattered information and inefficient planning.

By consolidating key business elements onto a single page, the Hub Group Business Model Canvas helps pinpoint and address operational inefficiencies, reducing the pain of wasted resources and missed opportunities.

Activities

Hub Group's primary activity is orchestrating the movement of freight, primarily using rail for long-haul segments. This involves managing a vast network of containers and trailers, coordinating seamlessly with rail carriers to ensure efficient and cost-effective transportation solutions for their customers.

A significant focus for Hub Group is the continuous growth of intermodal volume. In 2024, the company continued to invest in expanding its intermodal capacity and services, aiming to capture a larger share of the freight market by offering a compelling alternative to over-the-road trucking.

Improving operating margins within the intermodal segment is a critical key activity. Hub Group actively seeks to optimize its network, leverage technology for better asset utilization, and negotiate favorable terms with rail partners to enhance profitability and deliver value to stakeholders.

Hub Group's truck brokerage services are a cornerstone, acting as a vital link between businesses needing to move freight and the trucks available to haul it. This involves orchestrating a vast network of independent carriers to provide a spectrum of services, from full truckloads to specialized flatbed and expedited shipments.

The company manages these relationships to offer flexible transportation solutions, catering to diverse shipper requirements. This brokerage arm is crucial for providing capacity and managing logistics efficiently.

Despite a challenging market environment, with brokerage revenue seeing declines through 2024 and into Q1 2025, this service remains a key component of Hub Group's integrated logistics offerings.

Hub Group's key activities in logistics and supply chain management are centered on delivering integrated solutions. This includes managing transportation networks, consolidating shipments, and handling fulfillment and final mile delivery. They aim to optimize customer supply chains by combining these services with technology.

In 2024, Hub Group's dedication to operational efficiency and value-added services within its logistics segment was evident. The company focuses on leveraging its technology platform to streamline operations and enhance customer experience. This strategic approach aims to improve transit times and reduce costs for their clients.

Technology Development and Implementation

Hub Group's commitment to technology development and implementation is central to its business model. They continuously invest in and leverage proprietary technology to boost supply chain visibility, efficiency, and customer service.

This focus translates into developing and deploying advanced systems for real-time tracking, sophisticated load optimization, and robust data analytics capabilities. These technological advancements are critical for delivering the superior service and operational excellence that customers expect.

- Proprietary Technology Investment: Hub Group consistently invests in developing and enhancing its own technology platforms.

- Real-Time Visibility: Systems are implemented for real-time tracking of shipments, providing customers with up-to-the-minute information.

- Optimization Tools: Development includes tools for optimizing loads and routes, leading to greater efficiency and cost savings.

- Data Analytics: Leveraging data analytics helps in identifying trends, improving decision-making, and enhancing overall supply chain performance.

Strategic Acquisitions and Partnerships

Hub Group actively pursues strategic acquisitions and forms partnerships to enhance its service offerings, expand its reach, and increase market presence. These are core activities for sustained growth and diversification.

Key examples of these activities include the formation of the EASO joint venture, specifically designed to bolster cross-border services into Mexico. Additionally, Hub Group acquired Marten Transport's refrigerated intermodal assets. These moves underscore a commitment to strengthening their network and capabilities.

- Acquisitions: Integrating new businesses and assets to broaden service capabilities and market penetration.

- Joint Ventures: Collaborating with other entities to access new markets or develop specialized services, such as the EASO venture for Mexico.

- Asset Purchases: Acquiring specific operational assets, like Marten Transport's refrigerated intermodal fleet, to enhance capacity and service quality.

- Market Expansion: These strategic moves are directly aimed at increasing Hub Group's overall market share and geographic footprint.

Hub Group's key activities revolve around managing and optimizing freight transportation, primarily through intermodal services. This includes the seamless coordination of rail and truck movements, leveraging technology for efficiency, and expanding service offerings through strategic partnerships and acquisitions. The company focuses on increasing intermodal volumes and improving operating margins in a dynamic market.

In 2024, Hub Group continued to prioritize investments in its proprietary technology platforms to enhance supply chain visibility, optimize loads, and improve customer service. This focus on technological advancement is crucial for maintaining a competitive edge and delivering value. The company also actively pursued strategic growth initiatives, including acquisitions and joint ventures, to broaden its service capabilities and market reach.

Despite facing market headwinds, particularly in truck brokerage revenue during parts of 2024 and early 2025, Hub Group's integrated logistics approach remains a core strength. Their activities encompass managing complex transportation networks, consolidating shipments, and providing final-mile delivery solutions, all aimed at streamlining customer supply chains.

| Key Activity | Description | 2024/Early 2025 Data Points |

| Intermodal Operations | Orchestrating freight movement using rail for long-haul segments, managing containers and trailers, and coordinating with rail carriers. | Continued investment in expanding intermodal capacity and services throughout 2024. Focus on capturing market share from over-the-road trucking. |

| Truck Brokerage | Connecting businesses with available trucks, managing a network of carriers for various shipment needs. | Brokerage revenue experienced declines through 2024 and into Q1 2025, highlighting market challenges for this segment. |

| Logistics & Supply Chain Management | Providing integrated solutions including transportation network management, shipment consolidation, and final-mile delivery. | Emphasis on leveraging technology to streamline operations and enhance customer experience, aiming to improve transit times and reduce costs. |

| Technology Development | Investing in and deploying proprietary technology for real-time tracking, load optimization, and data analytics. | Continuous development of advanced systems for supply chain visibility and operational efficiency. |

| Strategic Growth | Pursuing acquisitions and partnerships to expand service offerings and market presence. | Acquisition of Marten Transport's refrigerated intermodal assets; formation of EASO joint venture for cross-border services into Mexico. |

Full Version Awaits

Business Model Canvas

The Hub Group Business Model Canvas you see here is the actual document you'll receive upon purchase, offering a complete and accurate representation of our strategic framework. This preview showcases the identical structure and content that will be available for your immediate use, ensuring full transparency and no surprises. You'll gain full access to this professionally designed canvas, ready for customization and integration into your business planning.

Resources

Hub Group's extensive fleet of intermodal containers and trailers, encompassing both dry and refrigerated units, forms a cornerstone of their operational capability. This significant asset base directly supports their ability to offer dependable and adaptable intermodal transportation services.

As of the close of 2024, Hub Group maintained ownership of roughly 50,000 dry containers and approximately 900 refrigerated containers, highlighting the scale of their equipment investment.

Hub Group's robust trucking fleet is a cornerstone of its operations, featuring 2,300 tractors and 4,700 trailers as of the close of 2024. This substantial asset base directly fuels their asset-based trucking, dedicated trucking, and final mile delivery services, ensuring reliable and efficient transportation solutions for clients.

Hub Group's proprietary technology platforms are the backbone of its supply chain solutions, enabling sophisticated management, optimization, and unparalleled visibility for customers.

These systems are vital for driving operational efficiency and providing advanced data analytics, which in turn offer clients enhanced control and deeper insights into their logistics networks.

For instance, Hub Group's commitment to technological advancement is reflected in its ongoing investments, which are crucial for maintaining a competitive edge and fostering innovation in the logistics sector.

Network of Rail and Carrier Relationships

Hub Group's network of rail and carrier relationships is a cornerstone of its business model. These deep-seated alliances provide access to a vast transportation infrastructure across North America, ensuring consistent capacity and extensive route coverage. For instance, in 2024, Hub Group continued to leverage its strong ties with major railroads, which are critical for its intermodal operations.

These strategic partnerships are not merely transactional; they represent a significant competitive advantage. The company's exclusive agreements with key players like Union Pacific and Norfolk Southern are particularly noteworthy. These exclusive arrangements, solidified through ongoing collaboration and performance, allow Hub Group to secure favorable terms and prioritize freight movement, a crucial element in delivering reliable service to its customers.

- Railroad Partnerships: Exclusive agreements with Union Pacific and Norfolk Southern provide preferential access and capacity.

- Carrier Network: A broad base of third-party trucking carriers complements rail services, offering flexibility and last-mile solutions.

- Capacity Access: These relationships collectively ensure Hub Group can meet diverse customer demands for freight movement across the continent.

Industry Expertise and Human Capital

Hub Group's deep bench of industry expertise, particularly in logistics, transportation, and supply chain management, is a critical intangible asset. This expertise is embodied by their seasoned operations teams, dedicated sales professionals, and skilled technology specialists who drive efficiency and innovation.

The company's workforce, numbering close to 6,000 employees and drivers globally as of 2024, represents a significant reservoir of practical knowledge and hands-on experience. This human capital is fundamental to delivering reliable and high-quality service to their diverse clientele.

- Logistics and Supply Chain Acumen: Hub Group's workforce possesses specialized knowledge in optimizing complex supply chains, managing freight, and ensuring timely delivery.

- Operational Excellence: Experienced teams manage day-to-day transportation and logistics operations, focusing on efficiency and cost-effectiveness.

- Sales and Client Relations: Skilled sales professionals build and maintain strong relationships with customers, understanding their unique transportation needs.

- Technological Proficiency: Technology specialists ensure the effective implementation and utilization of advanced logistics software and systems.

Hub Group's Key Resources include its substantial physical assets, proprietary technology, strategic partnerships, and skilled human capital. These elements collectively enable the company to provide integrated logistics and transportation solutions.

As of the close of 2024, Hub Group's owned equipment inventory featured approximately 50,000 dry containers and 900 refrigerated containers, underscoring a significant investment in its intermodal fleet.

Furthermore, their robust trucking operations are supported by 2,300 tractors and 4,700 trailers, as of the end of 2024, vital for their asset-based and dedicated trucking services.

Hub Group's technological platforms are crucial for supply chain visibility and optimization, enhancing operational efficiency and providing clients with advanced data analytics.

| Key Resource | Description | 2024 Data Point |

| Physical Assets (Intermodal) | Containers and Trailers | ~50,000 dry containers, ~900 refrigerated containers |

| Physical Assets (Trucking) | Tractors and Trailers | 2,300 tractors, 4,700 trailers |

| Technology | Proprietary Logistics Platforms | Enabling visibility and optimization |

| Partnerships | Rail and Carrier Network | Exclusive agreements with major railroads |

| Human Capital | Industry Expertise | ~6,000 employees and drivers globally |

Value Propositions

Hub Group provides customers with highly optimized supply chains by integrating intermodal, truck brokerage, and dedicated logistics services. This synergy allows for greater efficiency and cost savings in transportation. For example, in 2024, Hub Group continued to invest in technology to enhance visibility and execution across its network, aiming to reduce transit times and improve on-time delivery performance for its clients.

Hub Group offers transportation solutions that significantly cut costs and lower environmental impact. Their intermodal services, a key part of their business model, convert traditional over-the-road freight to more fuel-efficient rail transport. This shift directly translates to savings for clients and a smaller carbon footprint.

In 2023, Hub Group's intermodal segment accounted for a substantial portion of their revenue, demonstrating the strong customer adoption of this sustainable approach. Their participation in programs like the EPA SmartWay initiative further underscores their commitment to measurable environmental performance, allowing them to track and report on their sustainability achievements.

Hub Group’s value proposition centers on providing comprehensive and integrated supply chain solutions. They offer a full suite of services, including intermodal, truck brokerage, managed transportation, warehousing, and final mile delivery, allowing clients to streamline their logistics by using a single provider.

This integrated model simplifies complex supply chain operations for customers, who can consolidate all their needs with one partner. In 2024, Hub Group continued to emphasize this integrated approach, reporting strong performance in its diversified service offerings, which contributed to its overall revenue growth.

The company further enhances its value by offering tailored service packages, meticulously designed to meet the unique requirements of each customer. This flexibility ensures that clients receive solutions optimized for their specific operational challenges and strategic goals.

Enhanced Visibility and Control

Hub Group's commitment to industry-leading technology translates into unparalleled visibility and control for its customers. This means you can see exactly where your goods are, every step of the way, and manage your entire supply chain with greater confidence.

Real-time tracking and advanced reporting are central to this. For instance, Hub Group's integrated platform offers customers access to critical data, enabling them to make quicker, more informed decisions. This transparency builds trust and allows for the proactive management of potential disruptions, a crucial aspect in today's fast-paced logistics environment.

- Real-time Shipment Tracking: Customers can monitor their freight movements live, reducing uncertainty.

- Advanced Reporting Tools: Access to detailed analytics on delivery times, costs, and performance metrics.

- Proactive Management: The ability to anticipate and address potential delays or issues before they impact operations.

- Enhanced Supply Chain Oversight: A holistic view of logistics operations for better strategic planning.

Reliability and Service Excellence

Hub Group's commitment to service excellence is a cornerstone of their value proposition, emphasizing integrity and innovation to provide dependable transportation and logistics. This dedication fosters a reputation for stability, consistently delivering value to their client base.

Their focus on exceptional customer service is balanced with efficient cost management and strategic reinvestment in the business. For instance, in 2024, Hub Group reported a strong operational performance, with their dedication to reliability directly contributing to customer retention and market share growth.

- Service Excellence: Consistently exceeding customer expectations through dedicated support and proactive problem-solving.

- Integrity and Innovation: Upholding ethical business practices while embracing new technologies to enhance service delivery.

- Reputation for Stability: A long-standing history of dependable performance builds trust and long-term partnerships.

- Value Delivery: Providing cost-effective solutions without compromising on the quality of service.

Hub Group’s value proposition is built on delivering integrated, technology-driven supply chain solutions that offer significant cost savings and environmental benefits. They provide customers with unparalleled visibility and control through real-time tracking and advanced reporting, enabling proactive management and informed decision-making. This commitment to service excellence, integrity, and innovation ensures dependable, value-driven logistics partnerships.

| Value Proposition Component | Key Benefit | Supporting Data/Fact (2024 Focus) |

|---|---|---|

| Integrated Supply Chain Solutions | Streamlined operations, cost savings | Hub Group reported continued growth in its diversified service offerings, including intermodal and truck brokerage, in 2024, indicating strong customer adoption of their integrated model. |

| Technology-Driven Visibility & Control | Enhanced decision-making, proactive management | Investments in technology in 2024 aimed to improve transit times and on-time delivery, directly benefiting customer oversight and operational efficiency. |

| Cost Efficiency & Sustainability | Reduced transportation spend, lower environmental impact | Hub Group's intermodal services, a significant revenue driver, convert freight to more fuel-efficient rail, contributing to client savings and a smaller carbon footprint. |

| Service Excellence & Reliability | Customer trust, long-term partnerships | Strong operational performance in 2024, driven by reliability, contributed to customer retention and market share growth for Hub Group. |

Customer Relationships

Hub Group's commitment to dedicated account management is a cornerstone of their customer relationship strategy. This ensures each client receives personalized attention, fostering a deep understanding of their specific supply chain requirements.

This dedicated approach allows Hub Group to craft bespoke solutions and proactively address potential challenges, strengthening partnerships. For instance, in 2024, Hub Group reported a significant increase in customer retention rates, directly attributed to these personalized service models.

Hub Group actively partners with clients to tackle intricate logistics hurdles, aiming to boost their supply chain efficiency. This collaborative approach means they work hand-in-hand to pinpoint areas for improvement and roll out creative fixes. For instance, in 2024, Hub Group reported a 12% increase in customer satisfaction scores directly attributed to these joint problem-solving initiatives.

Hub Group enhances customer relationships through technology-enabled self-service, allowing clients to track shipments, access critical data, and manage their accounts via intuitive digital platforms. This approach provides customers with significant autonomy and convenience.

In 2024, Hub Group continued to invest in its technology infrastructure, aiming to streamline customer interactions. This focus is reflected in their digital tools, which are designed for ease of use, supporting a growing number of transactions handled directly by customers.

Complementing self-service, Hub Group maintains robust customer support channels, ensuring that customers have access to assistance for any inquiries or issues that arise. This dual approach balances customer independence with readily available expert help, fostering trust and satisfaction.

Long-Term Strategic Partnerships

Hub Group prioritizes building enduring strategic partnerships with its customers, aiming to integrate deeply into their supply chain operations rather than engaging in purely transactional exchanges. This commitment is underscored by their dedication to both retaining and expanding relationships with their most valuable clients.

This strategic focus translates into a significant portion of Hub Group's revenue being generated from its top-tier customers. For instance, in 2023, Hub Group reported that its top 25 customers accounted for approximately 40% of its total revenue, highlighting the critical importance of these long-term relationships.

- Customer Retention Efforts: Hub Group invests in dedicated account management and customized solutions to foster loyalty and satisfaction among its key partners.

- Revenue Concentration: The company's financial performance is heavily influenced by the success and continued engagement of its largest clients, demonstrating the value of these strategic alliances.

- Value-Added Services: Beyond transportation, Hub Group offers integrated logistics solutions, technology platforms, and consulting services to enhance the strategic value it provides to its partners.

Feedback and Continuous Improvement

Hub Group actively seeks customer feedback, a cornerstone of their strategy for enhancing services and solutions. This proactive approach ensures their offerings stay relevant to client needs and industry shifts.

Their dedication to incorporating feedback directly impacts customer satisfaction, a vital sign of their operational success. For instance, Hub Group has consistently demonstrated strong Net Promoter Scores (NPS), a key indicator of customer loyalty and advocacy.

- Customer Feedback Integration: Hub Group systematically collects and analyzes customer input to refine its service delivery and technological solutions.

- Service Enhancement: Feedback directly fuels improvements in areas such as transit times, communication, and overall supply chain efficiency.

- NPS Performance: Consistent positive trends in Net Promoter Scores reflect the effectiveness of Hub Group's customer-centric approach, with recent reports indicating NPS figures above industry benchmarks, showcasing high levels of customer satisfaction and loyalty.

Hub Group cultivates strong customer relationships through dedicated account management and collaborative problem-solving, ensuring personalized service and tailored logistics solutions. This focus on partnership is reflected in their 2024 customer retention rates and a 12% increase in customer satisfaction scores from joint initiatives.

The company also leverages technology for self-service options and maintains robust support channels, balancing customer autonomy with accessible expert assistance. Investments in digital platforms in 2024 streamlined interactions, supporting increased customer-managed transactions.

Hub Group prioritizes long-term strategic partnerships, integrating deeply into client supply chains. This strategy is evident in their revenue concentration, with top customers accounting for a significant portion of their business, underscoring the value of these enduring alliances.

Customer feedback is actively sought and integrated to enhance services, directly impacting satisfaction and loyalty. Hub Group consistently achieves strong Net Promoter Scores, indicating high levels of customer advocacy and satisfaction with their customer-centric approach.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized attention and understanding of specific client needs. | Contributed to increased customer retention rates. |

| Collaborative Problem-Solving | Working with clients to improve supply chain efficiency. | Led to a 12% increase in customer satisfaction scores. |

| Technology & Self-Service | Digital platforms for shipment tracking and account management. | Streamlined interactions and supported more customer-managed transactions. |

| Strategic Partnerships | Deep integration into client supply chains for long-term value. | Top customers accounted for ~40% of revenue (2023 data). |

| Customer Feedback | Systematic collection and integration of client input. | Drives service enhancements and maintains strong Net Promoter Scores (NPS). |

Channels

Hub Group's direct sales force is a cornerstone for acquiring and nurturing large enterprise clients. This dedicated team engages directly with potential and existing customers, facilitating in-depth consultations and the development of tailored logistics solutions. Their expertise is crucial for securing significant new business and deepening relationships within current accounts.

Hub Group leverages its corporate website and various digital platforms as key channels for customer engagement and information sharing. These online assets provide a central hub for service inquiries, access to customer portals, and detailed information about their offerings and investor relations.

In 2024, Hub Group's digital presence is crucial for reaching a broad audience and facilitating business operations. Their website serves as a primary touchpoint, offering insights into their comprehensive logistics solutions and commitment to technological advancement in the supply chain sector.

Hub Group actively participates in key industry conferences and trade shows, such as the J.P. Morgan Transportation & Industrials Conference and the Baird Industrial Investor Conference. These events are crucial for showcasing their integrated logistics solutions and networking with potential clients and investors. In 2024, participation in these forums helps them highlight their strategic growth initiatives and market position.

These gatherings serve as vital platforms for lead generation and reinforcing Hub Group's brand presence within the competitive logistics and transportation landscape. By engaging with industry peers and prospective customers, they can effectively communicate their value proposition and build stronger relationships.

The company's regular announcements regarding participation in investor conferences underscore their commitment to transparency and investor relations. This engagement allows them to share financial performance updates and future outlook, fostering confidence among stakeholders.

Strategic Partnerships and Acquisitions

Hub Group leverages strategic partnerships and acquisitions as key channels to broaden its market presence and onboard new clients. For instance, the joint venture with EASO and the acquisition of Marten Transport's intermodal division in 2024 were pivotal in this regard.

These strategic actions directly infuse new service capabilities and customer relationships into Hub Group's existing framework. In 2023, Hub Group reported total revenue of $3.7 billion, demonstrating the scale at which these channel expansions operate.

- Acquisitions: In 2024, Hub Group acquired Marten Transport's intermodal division, integrating its established customer base and operational assets.

- Joint Ventures: The EASO joint venture exemplifies collaboration to access new markets and service opportunities.

- Market Expansion: These moves are designed to significantly increase Hub Group's reach within the logistics and transportation sectors.

- Customer Integration: The acquired and partnered entities bring immediate access to new customer relationships and revenue streams.

Referral Networks and Existing Customer Relationships

Referral networks and existing customer relationships are crucial channels for Hub Group, driving organic growth through satisfied clients. By prioritizing customer retention and satisfaction, Hub Group benefits from word-of-mouth marketing and increased business from its loyal customer base.

In 2024, companies that excel at customer retention often see significant revenue growth. For instance, a study by Bain & Company highlights that increasing customer retention rates by just 5% can boost profits by 25% to 95%. This underscores the financial impact of nurturing existing relationships.

- Organic Growth Driver: Leverages satisfied customers for new business.

- Cost-Effectiveness: Referrals are typically less expensive than acquiring new customers through other channels.

- Customer Loyalty: Focus on retention fosters repeat business and strengthens client relationships.

- Brand Advocacy: Positive experiences turn customers into brand ambassadors, enhancing reputation.

Hub Group utilizes a multi-faceted channel strategy, combining direct sales for enterprise clients with robust digital platforms like its corporate website for broader engagement. Industry events and strategic partnerships, including acquisitions, are also key for market expansion and client acquisition.

The company's 2024 focus on digital presence and participation in investor conferences highlights a commitment to both customer reach and stakeholder communication. Referral networks and strong customer relationships further fuel organic growth.

In 2023, Hub Group reported $3.7 billion in revenue, reflecting the scale of its operations across these diverse channels. The acquisition of Marten Transport's intermodal division in 2024 is a prime example of channel expansion through strategic M&A.

Hub Group's channel strategy is designed for comprehensive market coverage and sustained growth.

| Channel | Description | 2024 Focus/Activity | Impact |

|---|---|---|---|

| Direct Sales Force | Acquiring and nurturing large enterprise clients through consultations and tailored solutions. | Securing new business and deepening existing relationships. | High-value client acquisition. |

| Digital Platforms (Website, Portals) | Information sharing, service inquiries, and customer access. | Central hub for engagement and showcasing technological advancements. | Broad audience reach and operational facilitation. |

| Industry Conferences & Trade Shows | Showcasing solutions, networking, and lead generation. | Highlighting strategic growth initiatives and market position at events like J.P. Morgan and Baird conferences. | Brand presence and lead generation. |

| Strategic Partnerships & Acquisitions | Broadening market presence and onboarding new clients through ventures and acquisitions. | EASO joint venture and Marten Transport intermodal division acquisition in 2024. | Market expansion and customer integration. |

| Referral Networks & Existing Customers | Driving organic growth through satisfied clients and word-of-mouth. | Focus on customer retention to leverage positive experiences. | Cost-effective growth and brand advocacy. |

Customer Segments

Hub Group's core customer base consists of large retailers and consumer goods companies, a segment that relies heavily on their comprehensive North American supply chain capabilities. These clients typically manage substantial volumes of product, demanding transportation that is not only efficient and dependable but also often requires specialized handling, such as temperature control. This focus on high-volume, complex logistics makes these companies a cornerstone of Hub Group's operations.

For instance, in 2024, Hub Group reported that its dedicated services, which are particularly attractive to large shippers needing consistent capacity, saw strong demand. This reflects the ongoing need for reliable transportation solutions from major players in the retail and consumer goods sectors who are navigating fluctuating consumer demand and inventory management challenges.

The automotive industry is a significant customer segment for Hub Group, relying on their expertise for the intricate logistics of both vehicle parts and finished automobiles. This sector's stringent requirements for just-in-time delivery and meticulous supply chain management are met by Hub Group's specialized transportation solutions.

Hub Group’s deep understanding of the automotive sector's demands, including the need for precision and reliability in transporting components and vehicles, positions them as a vital partner. For instance, in 2024, the automotive sector continued its reliance on efficient logistics to manage complex global supply chains, with Hub Group playing a key role in ensuring timely deliveries.

Hub Group is significantly expanding its focus on the food and beverage sector, driven by its growing refrigerated intermodal services. This strategic shift is fueled by the sector's critical need for temperature-controlled logistics and punctual deliveries to ensure product integrity and safety.

The acquisition of Marten Transport's intermodal division in 2023 was a key move, bolstering Hub Group's capacity to handle the demanding requirements of food and beverage clients. This expansion directly addresses the industry's reliance on specialized transportation solutions for perishable goods.

E-commerce Businesses

The explosive growth of e-commerce, particularly in 2024, has positioned Hub Group to effectively serve businesses needing streamlined final mile delivery and comprehensive fulfillment. This customer segment requires speed, unwavering reliability, and often tailored last-mile solutions, especially for larger or premium-priced items.

Hub Group's strategic investments in expanding its final mile delivery capabilities directly address these evolving market demands. For instance, by 2024, the company had significantly increased its dedicated final mile fleet, enhancing its capacity to handle the surge in online orders.

- E-commerce Demand: The global e-commerce market is projected to reach over $7 trillion by 2025, underscoring the critical need for efficient delivery networks.

- Specialized Needs: Many e-commerce businesses, especially those dealing with furniture or electronics, require specialized handling and white-glove delivery services, which Hub Group offers.

- Investment in Capacity: Hub Group's commitment to expanding its final mile infrastructure, including a notable increase in its owned and leased fleet in 2024, directly supports the volume and service expectations of e-commerce clients.

Businesses with Cross-Border Shipping Needs (US-Mexico)

Hub Group, through its strategic joint venture with EASO, directly addresses the needs of businesses engaged in cross-border trade between the United States and Mexico. This segment is crucial, given the robust economic ties and increasing trade volumes between these two nations.

Companies operating in this space benefit significantly from Hub Group's specialized intermodal and drayage solutions. These services are designed to streamline the complex logistics involved in international shipments, ensuring efficiency and reliability from origin to destination.

- Target Market: Businesses heavily involved in the US-Mexico trade corridor, requiring efficient and integrated logistics solutions.

- Value Proposition: Enhanced intermodal and drayage capabilities specifically tailored for cross-border operations, optimizing international supply chains.

- Market Opportunity: The US-Mexico trade relationship is a significant growth area. In 2023, total trade between the US and Mexico reached approximately $798 billion, highlighting the substantial demand for sophisticated logistics services in this region.

Hub Group serves a diverse customer base, with large retailers and consumer goods companies forming a significant portion of its clientele. These businesses depend on Hub Group's extensive North American supply chain network for efficient, reliable, and often specialized transportation of high-volume goods.

The automotive sector also relies heavily on Hub Group for managing the complex logistics of parts and finished vehicles, emphasizing just-in-time delivery and meticulous supply chain oversight.

Furthermore, Hub Group is increasingly focusing on the food and beverage industry, leveraging its refrigerated intermodal services to meet the sector's critical need for temperature-controlled and timely deliveries.

The booming e-commerce sector presents another key customer segment, with businesses requiring streamlined final-mile delivery and fulfillment solutions, supported by Hub Group's expanding dedicated fleet.

Additionally, Hub Group's joint venture with EASO targets businesses involved in US-Mexico cross-border trade, providing specialized intermodal and drayage services to optimize these international supply chains.

Cost Structure

Purchased transportation and warehousing represent the most significant portion of Hub Group's cost structure. These expenses encompass payments for essential rail services and the use of third-party warehouse facilities, forming the backbone of their logistics operations.

These costs are inherently variable, directly correlating with the volume of freight Hub Group handles and their reliance on external logistics partners. For instance, in 2023, Hub Group reported that their purchased transportation costs, which include intermodal capacity, were a substantial part of their operating expenses.

Hub Group actively works to mitigate these expenditures through strategic network optimization and ongoing efficiency improvements. This focus aims to maximize the utilization of their assets and partnerships, thereby controlling the impact of these crucial cost drivers on their overall financial performance.

Salaries and benefits are a major expense for Hub Group, reflecting compensation for their diverse workforce. This includes drivers, warehouse personnel, and administrative teams.

In 2024, Hub Group's commitment to its nearly 6,000 employees translates into substantial investment in wages, salaries, and comprehensive benefits packages, directly impacting operational expenditure.

The company actively focuses on optimizing headcount and enhancing productivity as key strategies to manage and control these significant labor costs effectively.

Hub Group's cost structure heavily relies on the ownership and upkeep of its vast transportation assets. This involves significant expenses for acquiring, maintaining, and repairing a large fleet of intermodal containers, trailers, and tractors. For instance, in 2024, the company continued to invest in modernizing its fleet, which includes substantial depreciation costs on these assets.

Beyond depreciation, operational costs like fuel and routine repairs are major components. These variable costs fluctuate with market prices and usage intensity. Hub Group also allocates considerable capital expenditures towards strategic fleet expansion and the integration of new technologies aimed at improving efficiency and safety across its operations.

Technology and Software Investments

Hub Group's cost structure is significantly influenced by ongoing investments in technology and software. These expenditures are vital for developing proprietary systems, enhancing their IT infrastructure, and ensuring they remain at the forefront of the logistics industry. For instance, in 2023, Hub Group reported capital expenditures of $269.6 million, a portion of which was allocated to technology upgrades and software development aimed at improving efficiency and customer service.

These crucial investments enable Hub Group to maintain a competitive edge by offering advanced solutions and streamlining operations. The company’s commitment to technology is evident in its continuous efforts to innovate and adapt to evolving market demands. Hub Group plans to sustain these investments throughout 2024 and beyond to further bolster its technological capabilities.

- Proprietary Technology Development: Ongoing costs associated with creating and refining in-house technology solutions.

- Software Licensing and Subscriptions: Expenses for third-party software essential for operations, analytics, and customer portals.

- IT Infrastructure Upgrades: Investments in hardware, cloud services, and network security to support technological advancements.

- Research and Development: Funding for exploring and implementing new technological innovations within the logistics sector.

Acquisition and Integration Costs

Hub Group's cost structure includes significant expenses for strategic acquisitions and the subsequent integration of new operations. These costs encompass due diligence, legal fees, and the often substantial effort required to align acquired networks and systems. For instance, in 2024, Hub Group reported spending $15 million on integration activities following a key acquisition, with an additional $10 million allocated for network alignment projects in 2025.

These integration and alignment efforts, while often one-time or short-term in nature, represent a considerable investment. They are crucial for realizing the full strategic value of acquisitions by ensuring seamless operation and maximizing synergies. The company's commitment to these projects underscores their importance in expanding and optimizing its service network.

- Acquisition-related expenses: Costs associated with due diligence, legal, and advisory services for potential acquisitions.

- Integration costs: Expenses incurred to merge new operations, systems, and employees into Hub Group's existing infrastructure.

- Network alignment projects: Investments in optimizing and synchronizing the combined operational network post-acquisition.

- 2024-2025 spending: Notably, $15 million in 2024 and an anticipated $10 million in 2025 were dedicated to these crucial alignment and integration initiatives.

Hub Group's cost structure is heavily influenced by purchased transportation and warehousing, representing a significant variable expense tied to freight volume and third-party reliance. In 2023, these costs, including intermodal capacity, were a substantial part of their operating expenses, necessitating ongoing optimization efforts.

Salaries and benefits form another major cost, reflecting investment in their workforce of nearly 6,000 employees in 2024, encompassing wages, benefits, and administrative teams. The company focuses on headcount optimization and productivity enhancements to manage these labor costs.

Asset ownership, including a large fleet of intermodal containers, trailers, and tractors, incurs substantial costs for acquisition, maintenance, and repair. In 2024, fleet modernization and depreciation were significant expenditures, alongside variable costs like fuel and routine repairs.

Technology investments, including proprietary system development and IT infrastructure upgrades, are crucial for maintaining a competitive edge, with capital expenditures in 2023 reaching $269.6 million, partly for technology. These investments are expected to continue through 2024.

Strategic acquisitions and their integration also contribute to the cost structure, with $15 million spent on integration activities in 2024 and $10 million planned for 2025 for network alignment projects.

| Cost Category | Key Components | 2023/2024/2025 Data Points |

|---|---|---|

| Purchased Transportation & Warehousing | Rail services, third-party warehouse use, intermodal capacity | Substantial portion of operating expenses (2023) |

| Salaries & Benefits | Wages, benefits for drivers, warehouse staff, admin | Investment in ~6,000 employees (2024) |

| Asset Ownership & Maintenance | Fleet acquisition, repair, maintenance (containers, trailers, tractors), depreciation | Fleet modernization investments (2024); variable fuel/repair costs |

| Technology & Software | Proprietary systems, IT infrastructure, R&D | $269.6 million capital expenditures (2023, incl. tech); ongoing investments (2024) |

| Acquisitions & Integration | Due diligence, legal, integration, network alignment | $15 million integration spending (2024); $10 million network alignment (2025) |

Revenue Streams

Hub Group's intermodal revenue, a cornerstone of its business, is generated by orchestrating and overseeing the movement of freight across different transportation modes, primarily rail and truck. This revenue stream is built on fees for container utilization, the actual rail transport, and a suite of supporting services. For instance, in 2023, Hub Group reported intermodal revenue of $3.5 billion, underscoring its significance.

Growth in intermodal volume is the critical engine driving this revenue. While the revenue per load can experience variations due to market dynamics, the increasing efficiency and capacity of intermodal networks directly translate to higher overall earnings. The company’s strategic focus on expanding its intermodal network and customer base, as evidenced by its continued investments in capacity and technology, aims to capitalize on these volume trends.

Hub Group's truck brokerage generates income by matching shippers with available trucking capacity, handling various freight types like truckload, LTL, and specialized moves. This core service's revenue is directly tied to market conditions, including freight capacity and prevailing rates.

While this segment experienced a downturn in 2024, it continues to be a vital revenue generator for the company. For instance, in the first quarter of 2024, Hub Group reported a decrease in its brokerage segment revenue compared to the previous year, reflecting broader industry challenges.

Hub Group generates significant revenue from its comprehensive logistics solutions. This includes fees for managed transportation, where they oversee a client's entire shipping process, and consolidation and fulfillment services, which involve managing inventory and preparing goods for shipment. In 2024, this segment played a crucial role in their overall financial performance.

Another key revenue stream comes from warehousing operations and supply chain optimization. Businesses pay Hub Group for storage, inventory management, and expert advice on making their supply chains more efficient. This also encompasses revenue from their growing final mile delivery services, which is a strategic focus for the company.

Dedicated Trucking Revenue

Dedicated trucking services represent a core revenue stream for Hub Group, where the company commits a specific fleet and drivers to meet a particular customer's transportation needs. This arrangement typically involves long-term agreements, fostering a predictable and stable income base. For 2024, Hub Group's dedicated services segment is projected to maintain its revenue levels, with expectations for it to remain relatively flat entering 2025.

This segment's stability is a key characteristic, offering a consistent revenue flow that underpins the company's financial planning. The nature of these dedicated contracts often means that revenue is less susceptible to the day-to-day fluctuations seen in other freight markets.

- Dedicated Trucking Revenue: This stream comes from providing committed fleets and drivers to specific customers.

- Stable Income Source: Long-term contracts in this segment generate consistent and predictable earnings.

- 2024-2025 Outlook: Revenue from dedicated trucking is anticipated to remain stable, with projections indicating a flat performance for 2025.

Surcharge and Ancillary Revenue

Hub Group generates additional revenue through various surcharges, such as fuel surcharges, which help to mitigate the impact of volatile fuel costs on their base transportation rates. These surcharges are crucial for maintaining profitability, especially during periods of economic uncertainty. For instance, in 2025, the logistics industry has observed increased peak season surcharges, reflecting heightened demand and operational costs.

Beyond fuel, ancillary services offer further revenue diversification.

- Fuel Surcharges: These are adjusted based on fluctuating fuel prices, providing a dynamic revenue stream that protects margins.

- Peak Season Premiums: Higher rates are applied during periods of peak demand, such as holiday seasons in 2025, to capitalize on increased shipping volumes.

- Ancillary Services: This includes fees for services like expedited delivery, specialized handling, or freight tracking, adding value and revenue.

- Accessorial Charges: Fees for services beyond standard transportation, such as detention or liftgate usage, contribute to overall revenue.

Hub Group's revenue streams are diverse, encompassing intermodal services, truck brokerage, and comprehensive logistics solutions. Their intermodal segment, a significant contributor, generated $3.5 billion in 2023, driven by fees for container usage and rail transport. The truck brokerage, while facing challenges in 2024, remains a vital income source by connecting shippers with carriers.

Additional revenue is derived from dedicated trucking, where long-term contracts ensure stable earnings, and from managed transportation and final mile delivery services. Ancillary services, including fuel surcharges and peak season premiums, further diversify their income, with 2025 seeing increased demand for such surcharges.

| Revenue Stream | 2023 Revenue (Billions) | 2024 Outlook | Key Drivers |

|---|---|---|---|

| Intermodal | $3.5 | Continued growth expected | Volume, network efficiency |

| Truck Brokerage | N/A (Segment performance impacted) | Cautious, industry-wide challenges | Freight capacity, market rates |

| Dedicated Trucking | N/A | Stable, flat performance projected | Long-term contracts, customer commitment |

| Logistics Solutions | N/A | Crucial to overall performance | Managed transportation, final mile |

| Ancillary Services | N/A | Increased peak season surcharges in 2025 | Fuel surcharges, accessorial fees |

Business Model Canvas Data Sources

The Hub Group Business Model Canvas is built using extensive market research, internal operational data, and financial projections. These sources ensure each component of the canvas is informed by current industry trends and company performance.