Hub Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hub Group Bundle

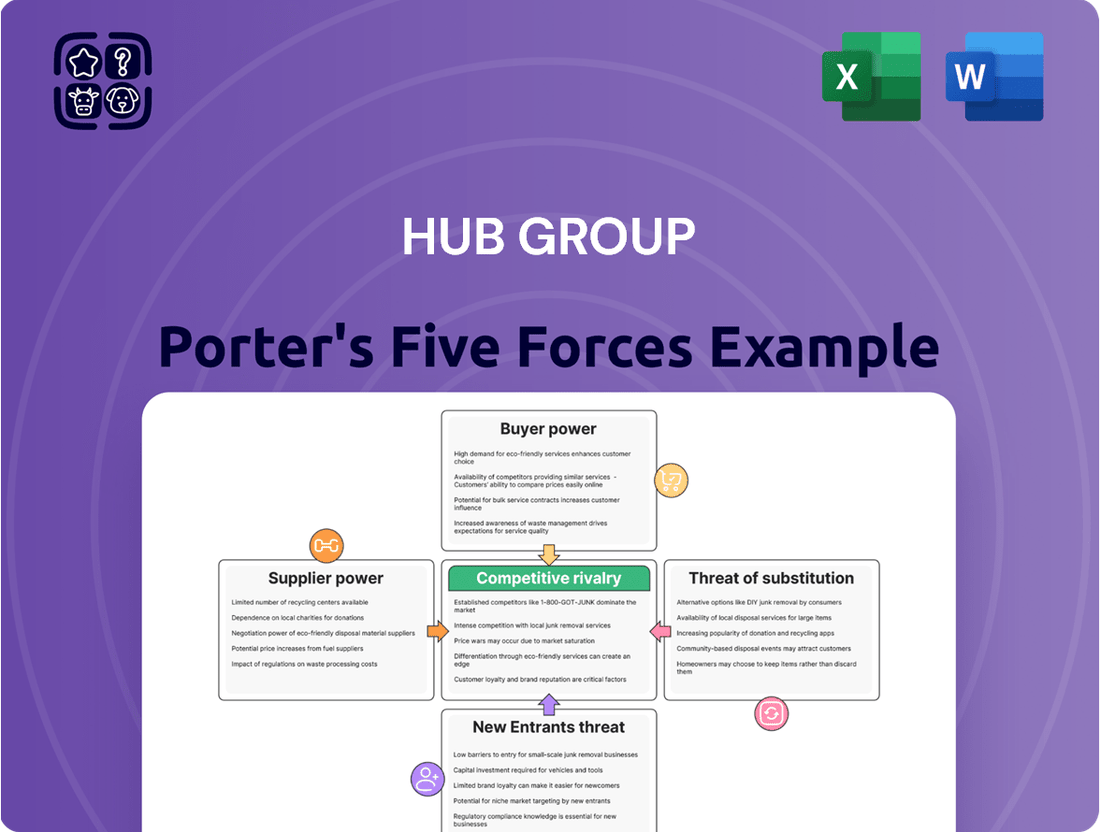

Hub Group operates within a dynamic logistics landscape, where understanding the five key competitive forces is crucial for strategic success. This analysis reveals the intricate interplay of buyer power, supplier bargaining, the threat of new entrants, the intensity of rivalry, and the impact of substitutes on Hub Group’s operations.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hub Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The transportation and logistics sector, particularly intermodal, is characterized by a high concentration of key suppliers. Hub Group's reliance on railroads for its core intermodal operations means that the limited number of Class I railroads in North America wield significant influence. This scarcity of major rail providers grants them substantial bargaining power, allowing them to dictate terms and pricing for essential services.

Switching costs for Hub Group, if they were to change logistics or technology suppliers, could be quite significant. These costs often involve the time and financial resources needed to integrate new operational systems, renegotiate complex contracts, and potentially adapt their existing infrastructure to accommodate a new provider. For instance, adopting a new transportation management system (TMS) can take months and cost hundreds of thousands of dollars in licensing, implementation, and training.

These high switching costs effectively increase the bargaining power of Hub Group's existing suppliers. Because Hub Group would face substantial expenses and operational disruptions by switching providers, current suppliers can leverage this situation to maintain favorable contract terms or even increase prices. This dynamic is particularly relevant in the logistics sector, where specialized equipment and integrated IT platforms create strong dependencies.

The uniqueness of supplier offerings significantly impacts bargaining power. For Hub Group, reliance on specialized equipment or advanced logistics technology from a limited pool of vendors can give those suppliers leverage. For instance, if a particular proprietary route optimization software or a specialized intermodal container technology is only available from one or two providers, Hub Group's dependence on these unique solutions allows those suppliers to potentially dictate terms and pricing.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Hub Group's core business, known as forward integration, is a key consideration. In the rail sector, this threat is typically low because of the substantial capital investment required for owning and maintaining railcars and locomotives. For instance, acquiring a single new freight locomotive can cost upwards of $2 million, making it a significant barrier to entry for most suppliers.

However, in less asset-heavy segments of the logistics industry, such as technology solutions or specialized transportation services, suppliers might possess the capability and incentive to integrate forward. If a technology provider, for example, were to offer direct logistics management platforms to Hub Group's clients, it could diminish Hub Group's role and increase the supplier's leverage.

- Rail Industry Barrier: The high capital expenditure for rail assets like locomotives (costing millions) significantly limits supplier forward integration in this core area.

- Technology & Specialized Services: Suppliers in technology or niche trucking could more readily enter logistics solution markets, potentially impacting Hub Group.

- Supplier Power Increase: Successful forward integration by suppliers would reduce Hub Group's reliance on them, thereby boosting supplier bargaining power.

Importance of Hub Group to Suppliers

Hub Group's significance as a customer directly impacts its suppliers' bargaining power. For major railroads, Hub Group's substantial intermodal freight volume can offer some negotiation leverage.

Conversely, smaller trucking firms or specialized technology providers might find Hub Group's business constitutes a larger share of their revenue, potentially increasing Hub Group's influence in pricing and terms.

- Hub Group's intermodal volume: Hub Group moved approximately 1.7 million intermodal containers in 2023, representing a significant portion of business for Class I railroads.

- Supplier reliance: For niche service providers, Hub Group's consistent demand can be crucial, giving Hub Group an advantage in negotiations.

- Contractual terms: The nature of contracts with suppliers, whether long-term or spot-based, also shapes the bargaining dynamic.

The bargaining power of suppliers for Hub Group is notably influenced by the concentrated nature of the North American rail industry. With only a handful of Class I railroads dominating the intermodal freight network, these carriers hold significant leverage due to the limited alternatives available to Hub Group for its core transportation needs.

Hub Group's substantial freight volumes, exceeding 1.7 million intermodal containers in 2023, provide some counter-leverage against major rail suppliers. However, the high switching costs associated with changing rail partners, including integration of new systems and renegotiating complex contracts, further solidify the suppliers' advantageous position.

The uniqueness of certain supplier offerings, such as proprietary route optimization software or specialized intermodal equipment, can also amplify supplier power. This dependence on specialized solutions from a limited vendor pool allows these suppliers to potentially dictate terms and pricing, impacting Hub Group's operational costs and efficiency.

| Factor | Impact on Hub Group | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | High Bargaining Power | Limited number of Class I railroads in North America. |

| Switching Costs | Increased Supplier Power | Significant time and financial resources for system integration and contract renegotiation. |

| Uniqueness of Offerings | Elevated Supplier Leverage | Reliance on proprietary technology or specialized equipment from a narrow vendor base. |

| Hub Group's Volume | Moderate Counter-Leverage | Hub Group moved ~1.7 million intermodal containers in 2023. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hub Group's logistics and supply chain operations.

Instantly identify and address competitive threats with a visualized breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

The concentration of Hub Group's customers plays a crucial role in their bargaining power. If a small number of major clients represent a substantial portion of Hub Group's overall revenue, these large shippers, often with significant freight volumes, can exert considerable influence. This leverage allows them to negotiate for reduced pricing or more advantageous service agreements, directly impacting Hub Group's profitability.

Switching costs significantly influence customer bargaining power within the logistics sector, and Hub Group is no exception. When customers integrate their supply chains deeply with Hub Group's technology and services, the complexity and expense of transitioning to a competitor rise substantially. For instance, if a major client relies on Hub Group's proprietary tracking software and customized delivery management systems, the cost of reconfiguring their entire operation to a new provider could run into hundreds of thousands, if not millions, of dollars, thereby diminishing their leverage.

Customer price sensitivity is a significant factor for Hub Group, particularly within the highly competitive logistics industry. Businesses actively seek the most cost-effective transportation and supply chain solutions. This is especially true when considering the impact of volatile fuel prices and broader economic instability.

This inherent sensitivity directly influences Hub Group's pricing strategies and profit margins. Customers have numerous options and can readily compare rates from various logistics providers, intensifying the pressure to offer competitive pricing to secure and retain business.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they manage their logistics internally, poses a challenge for Hub Group. Large clients with substantial shipping volumes might consider acquiring their own trucking fleets or developing in-house logistics operations to gain more control and potentially reduce costs. This is especially true for businesses that consistently move large quantities of goods.

For instance, a major retail chain with tens of thousands of shipments annually might evaluate the cost-effectiveness of operating its own transportation division versus outsourcing to a provider like Hub Group. The decision often hinges on the scale of their operations and their ability to achieve economies of scale in logistics management.

- Customer Backward Integration: Customers may bring logistics functions in-house, reducing reliance on third-party providers.

- Impact on Hub Group: This can lead to a loss of business for Hub Group if large clients opt for self-management.

- Key Drivers: High-volume, consistent shipping needs and the potential for cost savings incentivize backward integration.

Availability of Substitute Services for Customers

The bargaining power of customers is significantly shaped by the availability of substitute services. For Hub Group, this means customers can opt for direct truckload shipping instead of intermodal solutions, or choose from a range of other intermodal providers and truck brokerage firms.

This abundance of alternatives empowers customers to compare pricing and service levels across various providers, driving down the potential margins for any single company. In 2024, the freight transportation market continued to see robust competition, with spot market rates for truckload often fluctuating, providing a direct benchmark for intermodal pricing.

- Customer Choice: Customers can easily switch between Hub Group, other intermodal carriers, or traditional truckload services.

- Price Sensitivity: The availability of substitutes makes customers more sensitive to price differences.

- Competitive Landscape: Hub Group faces direct competition from numerous trucking companies and other intermodal marketing companies.

- Service Differentiation: While price is key, customers also evaluate reliability and transit times when choosing between options.

The bargaining power of Hub Group's customers is substantial, driven by factors like customer concentration, high switching costs, and price sensitivity. The availability of numerous substitute services and the potential for customers to integrate logistics functions in-house further amplify this power. In 2024, the logistics industry experienced continued competitive pressures, impacting pricing strategies for providers like Hub Group.

| Factor | Impact on Hub Group | 2024 Context |

|---|---|---|

| Customer Concentration | High for large clients, enabling price negotiation. | Major shippers' freight volumes remained significant drivers of carrier relationships. |

| Switching Costs | Can be high due to system integration, reducing customer leverage. | Investments in supply chain technology by clients often lock them into existing providers. |

| Price Sensitivity | Customers actively seek cost-effective solutions. | Spot rates in the trucking market in 2024 provided benchmarks, pressuring intermodal pricing. |

| Substitute Services | Abundant alternatives (truckload, other intermodal) empower customers. | The freight market offered a wide array of options, from dedicated fleets to brokerage services. |

| Backward Integration | Potential for large clients to bring logistics in-house. | Companies with substantial shipping needs continuously evaluate the cost-benefit of internal logistics operations. |

Same Document Delivered

Hub Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hub Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or alterations. You are looking at the actual document, which is ready for download and immediate use the moment you buy, providing a complete and ready-to-use understanding of Hub Group's market position.

Rivalry Among Competitors

Hub Group faces intense competition in the North American transportation and logistics sector, which is characterized by its fragmentation and the presence of a wide array of players. This includes both asset-light and asset-heavy providers, alongside emerging technology-focused logistics solutions.

Within its core intermodal services, Hub Group competes directly with giants like J.B. Hunt, which reported approximately $11.3 billion in revenue for 2023, and Schneider National, with revenues around $7.1 billion in the same year. The truck brokerage segment sees competition from a multitude of smaller, specialized firms, while the broader logistics market includes companies offering integrated supply chain solutions.

The diversity of competitors means Hub Group must constantly innovate and adapt across its service offerings. This includes differentiating itself from traditional carriers and demonstrating the value of its technology-driven platforms against agile, specialized competitors.

The industry growth rate significantly shapes competitive rivalry in logistics. While the broader logistics sector anticipates steady expansion, specific areas like intermodal volume have experienced variability.

For 2025, intermodal volume is expected to increase, yet a decrease in revenue per unit for both intermodal and brokerage services has intensified the competition for market share among industry players like Hub Group.

Product and service differentiation is key for Hub Group to truly stand out in a competitive logistics landscape. While basic transportation can often feel like a commodity, Hub Group actively carves out its niche by offering integrated supply chain solutions. This means they go beyond just moving freight, focusing on providing a seamless experience for their clients.

A significant part of this differentiation strategy involves leveraging technology. Hub Group invests in systems that provide customers with enhanced visibility into their shipments, optimize routes for efficiency, and even track sustainability metrics. For example, in 2024, they continued to emphasize their digital platforms, aiming to deliver real-time data and predictive analytics, which is a clear departure from purely transactional service providers.

Ultimately, Hub Group's commitment to efficient and sustainable transportation solutions forms the bedrock of its unique value proposition. By focusing on these areas, they aim to create tangible benefits for their customers, fostering loyalty and setting themselves apart from competitors who may only offer a limited scope of services.

Exit Barriers

Exit barriers for Hub Group are substantial, largely driven by the significant capital investment required to maintain and operate its vast fleet. For instance, Hub Group's ownership of approximately 50,000 containers represents a considerable fixed asset base that is difficult to liquidate without significant loss. This, coupled with specialized logistics technology and strong, long-term customer contracts, makes exiting the market exceptionally challenging.

These high exit barriers mean that companies like Hub Group may continue to operate even when profitability is low, as the cost of leaving is prohibitive. This can lead to prolonged periods of intense competition, as firms strive to cover their fixed costs by maintaining market presence, potentially driving down prices and margins for all players in the sector.

The financial commitment to assets and customer relationships creates a situation where companies are incentivized to stay and compete rather than cease operations. This dynamic directly impacts competitive rivalry by keeping more players active in the market than might otherwise be the case.

- High Asset Investment: Hub Group's ownership of around 50,000 containers is a prime example of substantial capital tied up in physical assets.

- Customer Relationships: Established contracts and loyal customer bases are difficult to divest, acting as a barrier to exit.

- Operational Continuity: The need to recoup large investments encourages companies to remain operational, even in adverse market conditions.

- Intensified Competition: High exit barriers can lead to a more crowded and competitive market as firms avoid the costs associated with leaving.

Cost Structure of Competitors

Competitors' cost structures significantly shape their pricing power and overall profitability. Companies that achieve lower operating costs, perhaps through better asset utilization, adopting advanced technology, or optimizing their logistics networks, are better positioned to offer more attractive pricing to customers. This can put pressure on rivals with higher cost bases.

Hub Group's own focus on cost control and operational efficiency is therefore a crucial element in its ability to compete effectively. By managing its expenses diligently, Hub Group can maintain healthier profit margins even when facing price competition from rivals with different cost advantages.

- Lower operating costs allow competitors to engage in aggressive pricing, potentially eroding market share for less efficient players.

- Hub Group's commitment to operating efficiency is a key differentiator, enabling it to offer competitive pricing while safeguarding profitability.

- For instance, in the intermodal sector, efficient drayage operations and optimized backhaul utilization can drastically reduce per-unit costs for competitors.

The competitive rivalry within the North American transportation and logistics industry is fierce, marked by a large number of diverse players, including asset-light and asset-heavy providers, as well as technology-driven disruptors. Hub Group, a significant player, faces direct competition from industry giants like J.B. Hunt, which reported approximately $11.3 billion in revenue for 2023, and Schneider National, with revenues around $7.1 billion in the same year.

This intense competition necessitates continuous innovation and differentiation. Hub Group's strategy to leverage technology for enhanced shipment visibility and route optimization, as seen in its 2024 emphasis on digital platforms, directly counters competitors who may offer more transactional services. The industry's growth, while generally positive, has seen variability in specific segments like intermodal volumes, further intensifying the fight for market share, especially with reported decreases in revenue per unit for both intermodal and brokerage services in 2025.

High exit barriers, such as Hub Group's substantial investment in approximately 50,000 containers and long-term customer contracts, contribute to sustained rivalry by discouraging companies from leaving the market, even during periods of lower profitability. This dynamic keeps the market crowded, forcing all participants to focus on cost efficiency and service differentiation to maintain their competitive edge.

Competitors with lower operating costs, achieved through superior asset utilization or technological adoption, can offer more aggressive pricing, directly impacting Hub Group's market position. Hub Group's own commitment to operational efficiency is therefore critical for its ability to compete on price while safeguarding its profit margins, especially as efficient drayage and optimized backhaul utilization significantly reduce per-unit costs for rivals in the intermodal sector.

| Key Competitors | 2023 Revenue (Approx.) | Primary Service Focus |

| J.B. Hunt | $11.3 Billion | Intermodal, Truckload, Logistics |

| Schneider National | $7.1 Billion | Truckload, Intermodal, Logistics |

| XPO Logistics | $7.0 Billion | Less-Than-Truckload (LTL), Truck Brokerage |

| Knight-Swift Transportation | $6.4 Billion | Truckload, Intermodal |

SSubstitutes Threaten

The threat of direct substitutes for Hub Group's services is significant, particularly for its intermodal and truck brokerage offerings. For intermodal, traditional truckload shipping serves as a readily available alternative, especially for shorter distances or when expedited delivery is the top priority. This means customers can bypass the rail component if trucking offers a more compelling solution for their specific needs.

Similarly, in the truck brokerage space, shippers have direct access to a vast network of individual carriers. They can bypass intermediaries like Hub Group and establish direct relationships, or even manage their own private fleets. This direct engagement bypasses the need for a brokerage service altogether, increasing competitive pressure.

The threat of substitutes for Hub Group's intermodal services is significantly shaped by the price-performance ratio of alternatives. If traditional truckload services become substantially more cost-effective or quicker, customers might indeed pivot away from intermodal solutions. For instance, a sustained increase in fuel surcharges for trucking could make intermodal more attractive, but a decrease would strengthen the substitute threat.

Customer propensity to substitute for Hub Group's services is significantly shaped by shipment characteristics. For urgent or small, specialized loads, direct trucking often presents a more appealing alternative due to its speed and directness, potentially bypassing intermodal transit times. This means that when speed is paramount, customers may be more inclined to seek out trucking-only solutions.

However, for larger, less time-sensitive shipments covering long distances, intermodal transport, as offered by Hub Group, becomes a compelling choice. The cost efficiencies and environmental benefits associated with moving freight by rail for the long haul, combined with truck for the first and last mile, make it harder for customers to justify substituting. For instance, in 2024, the cost savings for intermodal versus long-haul trucking can range from 10-20%, making it an attractive proposition for volume shippers.

Perceived Switching Costs for Customers to Substitutes

The perceived switching costs for customers moving to substitute services, such as shifting from Hub Group's intermodal solutions to pure truckload, are generally considered low. This is because the core function of freight transportation remains consistent, even if operational details differ. For instance, a shipper might need to adjust their booking platforms or carrier relationships, but the fundamental need to move goods is unchanged.

Hub Group actively works to mitigate this threat by providing integrated logistics solutions that encompass various transportation modes. This approach aims to create stickiness by offering a more comprehensive and streamlined service, making it less appealing for customers to break apart their supply chain and manage individual modes with different providers.

In 2024, the freight transportation market continued to see dynamic shifts. While specific switching cost data for Hub Group's customers isn't publicly detailed, industry trends suggest that the ease of switching between intermodal and dedicated truckload services can be influenced by factors like existing carrier contracts and the complexity of a customer's supply chain. The availability of readily accessible truckload capacity in many regions in 2024 made it a viable alternative for shippers seeking flexibility.

- Lower Switching Costs: Customers can often switch from intermodal to truckload with relatively minor operational adjustments.

- Service Integration as a Mitigator: Hub Group's strategy of offering integrated solutions aims to increase customer loyalty and deter switching.

- Market Dynamics: The competitive landscape and availability of alternative services in 2024 influenced the perceived ease of switching.

Innovation and Technological Advancements in Substitutes

Innovation and technological advancements in substitute services directly amplify their threat to Hub Group's core business. For instance, the burgeoning field of autonomous trucking, with projections suggesting a significant market presence by the late 2020s, presents a potent alternative to traditional, driver-reliant freight transportation. Similarly, drone delivery systems, while still in early stages for large-scale freight, are rapidly evolving and could offer faster, more cost-effective solutions for certain types of shipments.

The increasing integration of artificial intelligence (AI) and automation within the logistics sector is a prime example of this evolving threat. These technologies are not only streamlining existing operations but also paving the way for entirely new service models. For example, AI-powered route optimization can reduce transit times and fuel costs for alternative carriers, making them more competitive. In 2024, the global logistics market saw substantial investment in these areas, with companies like Waymo Via and Aurora Innovation making strides in autonomous freight technology, potentially reshaping the competitive landscape.

- Autonomous Trucking: Companies are investing billions, with projections indicating a significant increase in autonomous truck deployments by 2027.

- Drone Delivery: While currently focused on smaller packages, advancements in payload capacity and flight range are expanding potential applications.

- AI in Logistics: AI is projected to optimize supply chains, reduce operational costs by up to 20% in some segments by 2025.

- New Service Models: These technological shifts enable the creation of more agile, on-demand, and potentially lower-cost freight solutions that can bypass traditional intermodal networks.

The threat of substitutes for Hub Group is primarily driven by traditional truckload services and the potential impact of emerging technologies. While intermodal offers cost and environmental advantages for long-haul, trucking remains a direct competitor, especially for shorter hauls or when speed is critical. The ease with which shippers can engage directly with carriers or utilize brokerage platforms without an intermodal component underscores this threat.

Technological advancements like autonomous trucking and AI-driven logistics are poised to further intensify this threat. These innovations promise greater efficiency and potentially lower costs for substitute services, directly challenging Hub Group's intermodal model. For instance, the ongoing development in autonomous freight, with significant investments in 2024, could reshape the competitive landscape by offering more direct and potentially faster transit times, bypassing the rail segment of intermodal.

The cost-effectiveness and speed of substitute options remain key determinants for customer adoption. In 2024, the freight market saw fluctuating fuel prices and capacity availability, which directly influenced the attractiveness of truckload versus intermodal. For example, a 15% difference in per-mile costs between intermodal and truckload could shift customer preference depending on market conditions and shipment profiles.

| Substitute Service | Key Characteristics | Threat Level to Hub Group (2024) |

|---|---|---|

| Traditional Truckload | Direct transit, flexibility, speed for shorter hauls | High |

| Brokerage Platforms (Direct Carrier Access) | Bypasses intermediaries, direct relationships | Medium-High |

| Autonomous Trucking | Potential for cost reduction, increased efficiency | Emerging High |

| Drone Delivery | Speed for specialized, lighter loads | Low (currently) |

Entrants Threaten

The capital required to establish a significant presence in the transportation and logistics sector, particularly in asset-intensive areas like intermodal freight, presents a formidable barrier. Newcomers must acquire substantial fleets of specialized equipment, invest heavily in advanced tracking and management technologies, and secure necessary infrastructure, all of which demand considerable upfront investment. For instance, Hub Group's strategic investments in its own container fleet and cutting-edge logistics technology underscore the high capital outlays inherent in this industry.

Established players like Hub Group leverage significant economies of scale, creating a formidable barrier for potential new entrants. Their massive operational volumes translate into superior bargaining power with railroads and trucking companies, securing more favorable rates and capacity. This scale also enables more efficient asset utilization, such as maximizing trailer and container loads, which directly lowers per-unit operating costs.

Access to established distribution channels, encompassing relationships with shippers, carriers, and rail networks, stands as a significant barrier for potential new entrants in the logistics sector. Hub Group has cultivated extensive networks and robust customer relationships over many years, making it challenging for newcomers to quickly replicate this established infrastructure and market presence.

Brand Identity and Customer Loyalty

Hub Group's strong brand identity and deep customer loyalty act as a significant barrier to new entrants. With over five decades in the industry, the company has cultivated a reputation for reliability and service excellence. This established trust means that newcomers must invest heavily in marketing and consistently outperform on service quality to even begin to compete.

For instance, in 2024, Hub Group continued to leverage its brand recognition, a key factor in retaining its customer base amidst a dynamic logistics market. New companies entering the freight transportation and logistics sector would face the considerable challenge of building a similar level of brand equity and customer commitment, a process that typically requires substantial time and resources.

- Established Brand Recognition: Hub Group benefits from over 50 years of market presence, fostering widespread recognition.

- Customer Loyalty: Long-standing relationships translate into a loyal customer base that is less susceptible to switching to new providers.

- High Entry Costs for Reputation Building: New entrants need to allocate significant capital towards marketing and service improvements to challenge Hub Group's established reputation.

- Competitive Differentiation: Hub Group's brand identity differentiates it, making it harder for new, unproven entities to gain market share.

Government Policy and Regulations

Government policy and regulations significantly shape the transportation sector, acting as a formidable threat of new entrants for companies like Hub Group. Stringent safety standards, for instance, necessitate substantial capital expenditure on vehicle maintenance and driver training. In 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued to emphasize compliance with Hours of Service regulations, which, while promoting safety, can also limit operational flexibility for new carriers.

Environmental regulations, such as emissions standards for trucks and intermodal equipment, also present a barrier. Companies must invest in newer, more fuel-efficient fleets or emissions control technologies to comply. For example, the transition towards cleaner fuel sources and electrification, encouraged by government incentives and mandates, requires upfront investment that can be prohibitive for startups. This was a key consideration in 2024 as the industry grappled with evolving EPA guidelines.

Licensing and permitting requirements further complicate entry. Obtaining the necessary operating authority, state-specific permits, and adherence to various transportation laws can be a complex and time-consuming process. These regulatory hurdles, coupled with the capital needed for compliance, effectively raise the cost and difficulty for new players to enter the market, thus mitigating the threat of new entrants for established firms like Hub Group.

- Safety Standards: FMCSA's continued focus on Hours of Service regulations in 2024 impacts operational capacity and requires investment in compliance.

- Environmental Regulations: The push for cleaner fleets and adherence to EPA guidelines necessitates significant capital outlay for new equipment.

- Licensing and Permitting: The complex and lengthy process of obtaining operating authority and state-specific permits acts as a deterrent for new entrants.

The threat of new entrants for Hub Group is generally low due to significant barriers. High capital requirements for fleets and technology, coupled with established economies of scale, make it difficult for newcomers to compete on cost. Furthermore, strong brand recognition and customer loyalty cultivated over decades mean new players must invest heavily to gain market traction.

Regulatory hurdles, including safety and environmental standards, also increase the cost and complexity of entry. For example, in 2024, compliance with FMCSA Hours of Service regulations and evolving EPA emission guidelines necessitated substantial investment in newer fleets and training, posing a challenge for startups.

The logistics sector demands extensive distribution networks and established relationships with carriers and shippers. Hub Group's long-standing presence has allowed it to build these crucial connections, which are difficult and time-consuming for new entrants to replicate, further solidifying its market position.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | Substantial investment needed for assets (trucks, containers) and technology. | High deterrent; requires significant upfront funding. | Hub Group's continued investment in its intermodal fleet and technology solutions in 2024. |

| Economies of Scale | Lower per-unit costs due to high operational volume. | New entrants struggle to match cost efficiency. | Hub Group's large freight volumes provide superior bargaining power with carriers. |

| Brand Recognition & Loyalty | Established trust and reputation built over time. | New entrants need extensive marketing and superior service to gain customers. | Hub Group's 50+ year history fostering reliability and customer commitment. |

| Regulatory Compliance | Adherence to safety, environmental, and licensing regulations. | Increases operational costs and complexity for new firms. | FMCSA regulations and EPA guidelines impacting fleet investments in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hub Group is built upon a foundation of reliable data, including Hub Group's annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and Armstrong & Associates.

We also leverage macroeconomic data from government agencies and financial databases such as S&P Capital IQ to provide a comprehensive understanding of the competitive landscape.