Hub Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hub Group Bundle

Navigate the complex external forces impacting Hub Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the logistics landscape and influencing Hub Group's strategic decisions. Gain a critical advantage by downloading the full report, packed with actionable insights for your own business planning.

Political factors

Government transportation policies are a significant driver for Hub Group. Increased infrastructure spending, like the Biden administration's Infrastructure Investment and Jobs Act (IIJA) which allocated $1.2 trillion in 2021, directly benefits companies involved in freight movement by improving road and rail networks. For instance, IIJA funding for intermodal rail projects can enhance Hub Group's capacity and operational efficiency.

Changes in regulations, such as potential adjustments to truck weight limits or emissions standards, can also impact Hub Group's cost structure and service offerings. For example, if regulations favor more fuel-efficient or lower-emission vehicles, Hub Group might need to invest in fleet upgrades, affecting their capital expenditure plans.

Strategic planning for Hub Group necessitates a keen understanding of these evolving political factors. The company's ability to adapt to new transportation policies, whether they involve increased investment in freight corridors or changes in operational mandates, will be crucial for maintaining its competitive edge and maximizing returns on its asset base.

International trade agreements and tariffs significantly impact the volume and flow of goods across North America, directly influencing the demand for Hub Group's logistics services. For instance, the USMCA (United States-Mexico-Canada Agreement), implemented in 2020, continues to shape cross-border freight movements, with total trade between the US and its North American partners reaching approximately $1.4 trillion in 2023, according to U.S. government data.

Shifts in trade relations or the imposition of new tariffs can alter established supply chain routes and introduce volatility in freight volumes. For example, ongoing discussions and potential adjustments to tariffs on goods imported from China, even if not directly impacting North American trade, can create ripple effects by rerouting global supply chains and influencing overall transportation demand.

Hub Group must actively monitor these geopolitical and economic developments to adapt its service capacity and pricing strategies effectively. The company's ability to navigate changes in trade policy, such as potential tariff adjustments or new trade pacts, will be crucial for maintaining its competitive edge and ensuring efficient operations in the dynamic logistics landscape.

The regulatory landscape significantly shapes Hub Group's operations, particularly concerning safety standards, driver hours, and emissions. For instance, the Federal Motor Carrier Safety Administration (FMCSA) within the Department of Transportation (DOT) continuously updates rules impacting trucking, such as Hours of Service (HOS) regulations which affect driver availability and delivery schedules. In 2024, ongoing discussions around potential adjustments to HOS rules, aimed at improving driver well-being while maintaining freight movement efficiency, remain a key area of focus for the industry.

Stricter environmental regulations, like those from the Environmental Protection Agency (EPA) regarding emissions for diesel engines, can necessitate substantial capital expenditures for fleet upgrades, impacting Hub Group's cost structure. Conversely, periods of deregulation could theoretically reduce compliance burdens, potentially unlocking operational efficiencies. Hub Group's proactive monitoring and adaptation to these evolving legal frameworks are crucial for sustained compliance and competitive positioning in the logistics sector.

Geopolitical Stability

Geopolitical stability in North America significantly influences Hub Group's operations. For instance, disruptions stemming from regional conflicts or trade disputes, as seen with ongoing discussions around North American trade agreements impacting cross-border freight, can create considerable uncertainty. In 2024, the stability of trade routes and border operations remains a critical factor, with potential impacts on the cost and efficiency of Hub Group's intermodal and trucking services. The company's ability to navigate these evolving political landscapes is key to maintaining its service reliability.

Shifts in border policies and international relations directly affect freight movement. For example, changes in customs procedures or the imposition of new tariffs, which were a recurring theme in 2023 and continue to be monitored in 2024, can lead to delays and increased operational costs. Hub Group must remain agile in adapting to these policy changes to mitigate potential bottlenecks and ensure the smooth flow of goods for its clientele across North America.

- Supply Chain Vulnerability: Geopolitical events in 2024 continue to highlight the fragility of global supply chains, directly impacting Hub Group's intermodal network.

- Trade Policy Impact: Fluctuations in trade agreements and border security measures can alter freight costs and transit times for Hub Group's North American operations.

- Regional Stability: Political unrest or instability in key North American regions could disrupt established freight corridors, requiring Hub Group to develop contingency plans.

Labor Union Influence

Labor unions wield significant influence within the transportation sector, impacting Hub Group's operations through rail and port labor agreements. Potential strikes or protracted contract negotiations can directly disrupt intermodal services, leading to delays and increased costs. For instance, the International Brotherhood of Teamsters, representing a substantial portion of transportation workers, has been actively engaged in contract talks across various logistics segments in 2024 and 2025, highlighting the ongoing relevance of union influence.

Labor disputes can manifest as service disruptions, capacity reductions, and upward pressure on wages and benefits, directly impacting Hub Group's cost structure and service reliability. The potential for work stoppages, as seen in past rail labor disputes, necessitates careful monitoring of union activities and upcoming contract expirations. In 2024, the U.S. freight rail industry continued to navigate complex labor relations, with ongoing discussions around work rules and compensation that could set precedents for future negotiations.

- Unionized Workforce: A significant percentage of Hub Group's operational workforce, particularly in rail and drayage, may be subject to union contracts.

- Negotiation Cycles: Key union contracts, especially within the rail sector, often have staggered expiration dates, requiring continuous engagement and forecasting.

- Potential for Disruption: Strikes or slowdowns by unionized workers can halt or severely impede the movement of goods, directly affecting Hub Group's intermodal network.

- Cost Implications: Union-negotiated wage increases, benefits, and work rules can directly influence Hub Group's operating expenses and profitability.

Government transportation policies significantly shape Hub Group's operational landscape. The Biden administration's Infrastructure Investment and Jobs Act, with its $1.2 trillion allocation in 2021, continues to drive improvements in road and rail networks, directly benefiting companies like Hub Group. For instance, funding for intermodal rail projects enhances capacity and efficiency, a critical factor for Hub Group's business model. In 2024, ongoing discussions around potential adjustments to Hours of Service (HOS) regulations by the FMCSA aim to balance driver well-being with freight movement efficiency, impacting driver availability and delivery schedules.

International trade agreements and tariffs are pivotal for Hub Group, influencing cross-border freight volumes. The USMCA, in effect since 2020, continues to shape North American trade, with total trade between the US and its North American partners reaching approximately $1.4 trillion in 2023. Shifts in trade relations or new tariffs can reroute supply chains, creating volatility in freight demand. Hub Group must actively monitor these developments to adapt its service capacity and pricing strategies effectively.

The regulatory environment, including safety standards and emissions rules from agencies like the EPA, necessitates continuous adaptation and potential capital investment for fleet upgrades. Geopolitical stability in North America is also crucial, as regional unrest or trade disputes can disrupt freight corridors and create operational uncertainty. In 2024, the stability of border operations remains a critical factor influencing the cost and efficiency of Hub Group's services.

Labor unions, particularly in the rail and drayage sectors, hold considerable sway over Hub Group's operations. Potential strikes or protracted contract negotiations, such as those involving the International Brotherhood of Teamsters in 2024 and 2025, can lead to service disruptions and increased costs. The U.S. freight rail industry in 2024 continued to navigate complex labor relations, with ongoing discussions on work rules and compensation that could impact future negotiations and Hub Group's operating expenses.

What is included in the product

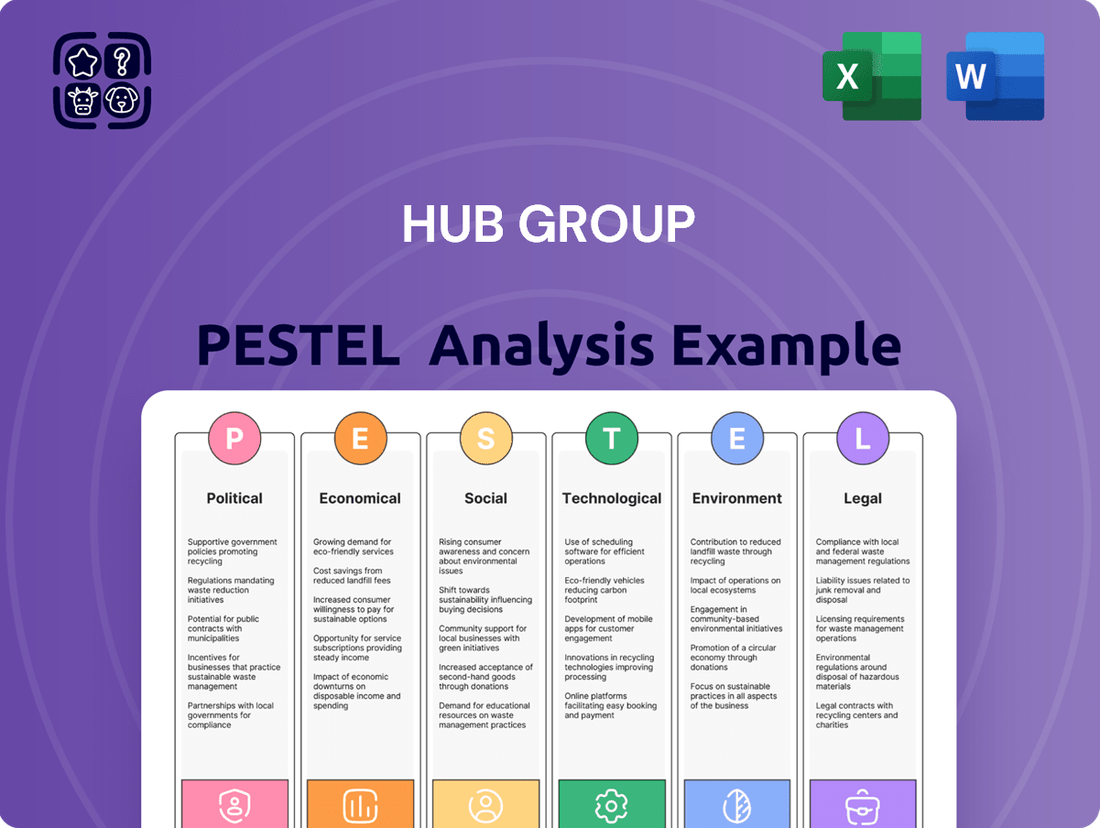

This PESTLE analysis unpacks the external forces impacting Hub Group, examining Political, Economic, Social, Technological, Environmental, and Legal factors to reveal strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hub Group's external landscape to inform strategic decisions.

Economic factors

The overall health of the North American economy is a primary driver for Hub Group. For instance, in the first quarter of 2024, the U.S. GDP grew at an annualized rate of 1.3%, indicating a moderating expansion. This economic climate directly impacts freight demand and transportation volumes, as consumer spending, a key component of GDP, influences the movement of goods.

During economic expansions, Hub Group typically benefits from increased freight volumes and stronger pricing power. Conversely, economic downturns, or recessions, can significantly reduce demand for transportation services, leading to lower volumes and intensified competition as companies vie for a smaller pool of available freight.

For Hub Group, robust economic forecasting is not just beneficial but critical. Accurate predictions of GDP growth and consumer spending trends allow the company to effectively manage its capacity, optimize its network, and maintain strong financial performance by anticipating shifts in demand and potential pricing pressures.

Fluctuations in fuel prices, particularly diesel, are a major operational cost for Hub Group's truck brokerage and intermodal services. For instance, the U.S. national average for on-highway diesel prices saw significant swings in 2024, impacting transportation expenses directly.

High and volatile fuel costs can squeeze profit margins for Hub Group if not managed through effective fuel surcharges or hedging. In 2024, diesel prices often exceeded $4.00 per gallon nationally at various points, creating a direct cost pressure.

Hub Group must therefore closely track global energy markets and employ agile pricing strategies to mitigate the impact of these price swings on its financial performance.

Fluctuations in interest rates directly impact Hub Group's cost of capital. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, this translates to higher borrowing costs for Hub Group's fleet expansion and technology upgrades.

Elevated interest rates can significantly increase the expense of securing new loans or refinancing existing debt, potentially dampening investment in growth initiatives or increasing the burden of debt servicing.

Beyond interest rates, the general availability of credit is a crucial factor. Hub Group relies on consistent access to credit lines to manage its day-to-day cash flow and to finance potential strategic acquisitions, ensuring operational stability and opportunities for expansion.

Inflation and Cost Pressures

Inflationary pressures significantly impact Hub Group's operational costs, with rising expenses for essential components like equipment, labor, and ongoing maintenance. For instance, the Producer Price Index (PPI) for transportation and warehousing services saw a notable increase throughout 2024, reflecting these broader cost escalations.

Hub Group faces the challenge of translating these increased expenditures into customer pricing without losing market competitiveness. Successfully navigating this requires strategic adjustments to service fees and freight rates. The ability to pass on these costs efficiently is paramount for preserving healthy profit margins amidst economic volatility.

Managing these inflationary impacts is a critical determinant of Hub Group's financial performance. The company's success hinges on its capacity to absorb or effectively mitigate these rising costs, directly influencing its profitability and competitive standing in the logistics sector.

- Rising Equipment Costs: The cost of new trucks and trailers, crucial assets for Hub Group, saw an average increase of 7-10% in 2024 compared to the previous year, driven by supply chain constraints and material costs.

- Labor Wage Inflation: The demand for skilled truck drivers and warehouse personnel continued to drive up wages, with average driver compensation increasing by approximately 5-8% in 2024, impacting Hub Group's labor expenses.

- Maintenance and Fuel Costs: Fluctuations in diesel prices and the cost of replacement parts for fleet maintenance directly affect operational expenditures, with fuel surcharges often adjusted to reflect these changes.

- Impact on Profitability: Failure to adequately pass on these increased costs could lead to a reduction in Hub Group's operating margins, potentially impacting earnings per share and overall financial health.

Consumer Spending and E-commerce Trends

Consumer spending patterns are increasingly shaped by digital convenience, with e-commerce continuing its robust expansion. This shift directly impacts logistics providers like Hub Group, who must optimize for faster, more complex delivery networks to meet evolving customer expectations and secure market share. For instance, U.S. e-commerce sales are projected to reach $2.17 trillion in 2024, a 7.7% increase from 2023, highlighting the sustained demand for efficient fulfillment.

Hub Group's strategic advantage lies in its agility to adapt services, supporting expedited shipping and intricate distribution models. The company's investment in technology and network enhancements is vital for capitalizing on these consumer-driven trends. By aligning service offerings with the demand for speed and reliability, Hub Group can solidify its position in the competitive logistics landscape.

- E-commerce Growth: U.S. e-commerce sales are expected to grow by 7.7% in 2024, reaching an estimated $2.17 trillion.

- Last-Mile Demand: Increased online shopping fuels the need for efficient and cost-effective last-mile delivery solutions.

- Consumer Expectations: Buyers anticipate faster delivery times, pushing logistics companies to innovate their distribution strategies.

- Network Complexity: The rise of omnichannel retail and direct-to-consumer models necessitates more sophisticated and flexible logistics networks.

The U.S. economy's health is a significant factor for Hub Group, with GDP growth influencing freight demand. For example, Q1 2024 saw a 1.3% annualized GDP growth, signaling a moderating expansion that directly affects transportation volumes and consumer spending's impact on goods movement.

Economic downturns can reduce transportation demand, leading to lower volumes and increased competition. Hub Group must therefore rely on robust economic forecasting to manage capacity and optimize its network effectively.

Fuel prices, particularly diesel, are a major operational cost. In 2024, national average diesel prices frequently exceeded $4.00 per gallon, directly pressuring transportation expenses and requiring agile pricing strategies from Hub Group to mitigate these swings.

Interest rates affect Hub Group's cost of capital. With the Federal Reserve's federal funds rate target range at 5.25%-5.50% in early 2024, borrowing costs for fleet expansion and technology upgrades are elevated.

Inflationary pressures increase operational costs for Hub Group, impacting equipment, labor, and maintenance. The Producer Price Index for transportation and warehousing services saw a notable increase in 2024, necessitating strategic adjustments to pricing to maintain profitability.

| Economic Factor | 2024 Data/Trend | Impact on Hub Group |

|---|---|---|

| GDP Growth (US) | Q1 2024: 1.3% annualized | Influences freight demand and transportation volumes. |

| Diesel Prices (US Avg) | Exceeded $4.00/gallon at points in 2024 | Increases operational costs; requires fuel surcharge adjustments. |

| Federal Funds Rate | 5.25%-5.50% (early 2024) | Raises cost of capital for investments and debt servicing. |

| PPI (Transportation & Warehousing) | Notable increase in 2024 | Drives up operational expenses for equipment, labor, and maintenance. |

Same Document Delivered

Hub Group PESTLE Analysis

The Hub Group PESTLE Analysis preview you're seeing is the exact document you'll receive after purchase—fully formatted and ready to use. This comprehensive report breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hub Group's operations and strategic positioning.

Sociological factors

Demographic shifts are significantly impacting Hub Group's labor force. An aging workforce, coupled with a persistent shortage of qualified truck drivers, presents a considerable challenge. For instance, the American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a number projected to grow.

Hub Group must prioritize robust recruitment, comprehensive training programs, and effective retention strategies. This is crucial to attract new talent and maintain a stable operational team capable of meeting demand. Furthermore, understanding and adapting to the evolving generational preferences for work environments, including flexibility and technology integration, is becoming increasingly vital for talent acquisition and employee satisfaction.

Growing consumer and corporate awareness of environmental impact is a significant sociological driver, pushing for more sustainable transportation solutions. This societal shift means businesses are actively seeking greener supply chains.

Hub Group's strategic emphasis on intermodal services, which inherently offer greater fuel efficiency compared to traditional long-haul trucking, directly addresses this rising demand. For instance, intermodal transport can reduce greenhouse gas emissions by up to 60% compared to trucking alone, a compelling statistic for environmentally conscious clients.

Consequently, companies are increasingly prioritizing partnerships with logistics providers that can demonstrably reduce their carbon footprints. This trend positions Hub Group favorably as it aligns with the growing corporate responsibility initiatives seen throughout 2024 and projected into 2025.

Recent global events, like the lingering effects of the COVID-19 pandemic and geopolitical instability, have significantly amplified societal and business demands for supply chains that are not only efficient but also remarkably resilient. Consumers and businesses alike now expect goods to be available without interruption, placing a premium on reliability.

Hub Group's integrated network, offering a diverse range of transportation modes including intermodal, truckload, and final mile delivery, directly addresses these heightened expectations. Their ability to provide agile logistics solutions allows clients to navigate disruptions more effectively, ensuring that products reach their destinations even in challenging circumstances. This flexibility is crucial for maintaining customer satisfaction and operational continuity.

In 2024, for instance, many companies reported that supply chain disruptions cost them an average of 10% of their annual revenue, underscoring the critical need for resilience. Hub Group's commitment to demonstrating reliability and adaptability through its comprehensive service offerings and technological investments is therefore paramount in fostering client trust and ensuring their business continuity in an unpredictable market.

Health and Safety Standards

Public and regulatory attention to health and safety in transportation is intensifying, with a particular focus on driver well-being and overall operational safety. Hub Group, like its peers, faces heightened scrutiny, necessitating adherence to rigorous safety protocols and investment in technologies that bolster safety for both its workforce and the general public. A robust safety record is paramount for maintaining a positive reputation and ensuring ongoing regulatory compliance.

The transportation sector is experiencing increased regulatory oversight and public demand for improved safety measures. For instance, in 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued its focus on Hours of Service (HOS) regulations and commercial driver health initiatives. Hub Group's commitment to safety directly impacts its operational efficiency and its ability to attract and retain qualified drivers, a critical factor in the current labor market. A strong safety culture can translate into fewer accidents, lower insurance premiums, and enhanced brand image.

- Driver Fatigue Management: Implementing advanced fatigue monitoring systems and promoting better work-life balance for drivers.

- Vehicle Safety Technology: Investing in collision avoidance systems, advanced braking, and telematics for real-time safety monitoring.

- Workplace Safety Programs: Ensuring comprehensive training and protocols for warehouse and yard operations to prevent injuries.

- Regulatory Compliance: Proactively adapting to evolving safety regulations and maintaining meticulous record-keeping.

Urbanization and Traffic Congestion

Urbanization continues to concentrate populations and economic activity in metropolitan areas, directly fueling traffic congestion. This trend poses significant challenges for Hub Group's last-mile delivery operations, potentially increasing transit times and operational costs. For instance, in 2024, major urban centers across the US experienced an average of 119 hours of traffic delay per driver annually, a figure expected to rise as cities grow.

To counter these effects, Hub Group must proactively implement advanced routing algorithms and dynamic scheduling systems. Leveraging real-time traffic data and predictive analytics is crucial for navigating increasingly dense urban landscapes efficiently. This includes exploring innovative solutions like off-peak delivery windows or utilizing smaller, more agile vehicles for urban routes.

- Increased Urban Delays: By 2025, it's projected that urban traffic congestion could cost the US economy an additional $200 billion annually in lost productivity and fuel costs.

- Last-Mile Efficiency: Congestion directly impacts the speed and cost of delivering goods within cities, affecting customer satisfaction and Hub Group's competitive edge.

- Technological Solutions: Investing in AI-powered logistics platforms and route optimization software is paramount for mitigating the impact of urbanization on delivery networks.

- Strategic Partnerships: Collaborating with city planners and other logistics providers to advocate for infrastructure improvements and smart city initiatives can offer long-term benefits.

Societal expectations for ethical business practices and corporate social responsibility are increasingly influencing consumer and investor decisions. Hub Group's commitment to sustainability, fair labor practices, and community engagement is therefore critical for brand reputation and long-term viability. A 2024 survey indicated that 70% of consumers consider a company's environmental and social impact when making purchasing decisions.

Hub Group's focus on intermodal transport directly aligns with environmental sustainability goals, reducing carbon footprints. Furthermore, investing in driver well-being and safety programs addresses societal demands for ethical treatment of the workforce. By prioritizing these areas, Hub Group can enhance its appeal to socially conscious stakeholders and mitigate reputational risks.

Technological factors

Hub Group's fleet is increasingly benefiting from advanced telematics and IoT integration, enabling real-time tracking and performance monitoring. This technology is crucial for predictive maintenance, which helps reduce downtime and operational costs.

The adoption of these systems directly translates to enhanced operational efficiency and improved safety across Hub Group's logistics network. For instance, in 2024, companies in the logistics sector leveraging advanced telematics reported an average reduction of 15% in fuel consumption through optimized routing.

Furthermore, the valuable data generated by IoT devices allows for meticulous optimization of routes and asset utilization, a critical factor in the competitive transportation market. This data-driven approach is essential for modernizing operations and maintaining a competitive edge.

Hub Group can leverage artificial intelligence (AI) and machine learning (ML) to significantly improve its logistics operations. These technologies can optimize routing, predict freight demand with greater accuracy, and streamline inventory management, leading to substantial cost savings and enhanced efficiency. For instance, AI-powered route optimization alone can reduce fuel consumption and transit times, critical factors in the competitive transportation sector.

AI-driven analytics are instrumental in uncovering hidden efficiencies and cost-saving opportunities within Hub Group's intricate supply chains. By processing vast amounts of data, these systems can identify bottlenecks and suggest improvements that human analysis might miss. This capability is vital for maintaining a competitive edge and delivering more responsive logistics solutions to clients.

The integration of AI and ML is not just about efficiency; it's about providing smarter, more adaptive logistics. As of early 2024, the global AI in logistics market is projected to grow significantly, with many companies investing heavily to gain an advantage. Hub Group's adoption of these technologies positions them to offer superior service, anticipating customer needs and proactively addressing potential disruptions.

The freight industry is rapidly shifting towards digital brokerage platforms and online marketplaces, fundamentally changing how companies find and manage shipping capacity. These platforms offer greater transparency and efficiency in procurement. For instance, the digital freight market in North America was projected to reach approximately $150 billion by the end of 2024, highlighting its significant growth and impact.

Hub Group's competitive edge hinges on its ability to enhance its own digital offerings and integrate seamlessly with critical industry systems. This ensures customers benefit from effortless booking and real-time tracking. Digitalization is not just a trend; it's a core strategy for elevating customer satisfaction and accelerating operational velocity, with companies investing heavily in these technologies to streamline their supply chains.

Automation in Warehousing and Logistics

Automation technologies, such as robotics and automated guided vehicles (AGVs), are significantly enhancing the speed and accuracy of freight handling within warehouses and distribution centers. For instance, the global warehouse automation market was valued at approximately $20 billion in 2023 and is projected to reach over $50 billion by 2030, showing a compound annual growth rate (CAGR) of around 14%.

While Hub Group's core business is transportation, its operations are deeply intertwined with automated warehousing solutions provided by its clients and partners. This integration directly impacts overall supply chain efficiency, as faster and more accurate inbound and outbound processing at automated facilities translates to smoother transit for Hub Group's freight. The company's ability to adapt to and leverage these advancements is crucial for delivering seamless, end-to-end logistics solutions.

- Increased Throughput: Automated systems can process goods significantly faster than manual labor, reducing dwell times.

- Reduced Errors: Robotics and AGVs minimize human error in picking, sorting, and loading, improving data accuracy.

- Enhanced Safety: Automation reduces the need for human interaction with heavy machinery and repetitive tasks, lowering workplace injury rates.

- Scalability: Automated solutions offer greater flexibility to scale operations up or down based on demand fluctuations.

Cybersecurity and Data Protection

Hub Group's increasing reliance on digital platforms for operations and data exchange makes robust cybersecurity a critical technological factor. The constant threat of cyberattacks, which cost the global economy an estimated $10.5 trillion annually by 2025, demands continuous investment in advanced security infrastructure and protocols to safeguard sensitive client and operational data. Maintaining data integrity and privacy is not just about preventing breaches but is fundamental to preserving client trust and ensuring compliance with evolving data protection regulations.

The company must prioritize security investments to mitigate risks associated with increasingly sophisticated cyber threats. For instance, the average cost of a data breach in the logistics sector reached $4.73 million in 2023, highlighting the significant financial implications of security failures.

- Cybersecurity Investment: Hub Group needs to allocate substantial resources towards cutting-edge security technologies and expert personnel.

- Data Protection Compliance: Adherence to regulations like GDPR and CCPA is crucial for maintaining customer trust and avoiding hefty fines.

- Threat Mitigation: Proactive measures against ransomware, phishing, and other evolving cyber threats are essential for business continuity.

- Data Integrity: Ensuring the accuracy and reliability of data is paramount for operational efficiency and informed decision-making.

Hub Group's technological advancement is heavily influenced by the rapid integration of AI and machine learning, promising to optimize routing, demand forecasting, and inventory management, leading to significant cost reductions and efficiency gains. The global AI in logistics market is experiencing robust growth, with many companies making substantial investments to secure a competitive advantage.

Digital brokerage platforms and online marketplaces are transforming freight procurement, offering enhanced transparency and efficiency. The North American digital freight market was projected to reach approximately $150 billion by the end of 2024, underscoring the critical need for Hub Group to bolster its own digital capabilities and ensure seamless integration with industry systems.

Automation in warehousing, including robotics and AGVs, is boosting freight handling speed and accuracy. The warehouse automation market, valued around $20 billion in 2023, is expected to exceed $50 billion by 2030, with a CAGR of approximately 14%. Hub Group's synergy with these automated facilities directly impacts its overall supply chain efficiency.

Robust cybersecurity is paramount given the increasing reliance on digital platforms, with cyberattacks costing the global economy an estimated $10.5 trillion annually by 2025. The average cost of a data breach in logistics reached $4.73 million in 2023, emphasizing the need for continuous investment in advanced security to protect data and maintain client trust.

| Technology Area | Impact on Hub Group | Key Data/Projections |

|---|---|---|

| AI & Machine Learning | Optimized routing, demand forecasting, inventory management, cost reduction | AI in logistics market growth significant; companies investing heavily (early 2024) |

| Digital Brokerage Platforms | Enhanced transparency, efficiency in freight procurement | North American digital freight market projected ~$150 billion (end of 2024) |

| Automation (Warehousing) | Increased speed & accuracy in freight handling | Warehouse automation market ~$20 billion (2023), projected >$50 billion (2030) (14% CAGR) |

| Cybersecurity | Data protection, client trust, operational continuity | Global cyberattack cost ~$10.5 trillion (by 2025); Avg. data breach cost $4.73 million (logistics, 2023) |

Legal factors

Hub Group navigates a dense regulatory landscape, encompassing federal mandates like the Federal Motor Carrier Safety Administration's (FMCSA) hours-of-service rules and state-specific weight limits. In 2024, the FMCSA continued its focus on safety, issuing millions in fines for violations, underscoring the financial risks of non-compliance. Adherence to these rules is not just a legal necessity but a core operational pillar for Hub Group.

Environmental protection laws are becoming more rigorous, directly affecting Hub Group's operational expenses. For instance, stricter emissions standards for their trucking fleet, a core part of their logistics operations, necessitate investments in newer, more fuel-efficient vehicles or alternative fuel technologies. In 2024, the transportation sector faced increased scrutiny regarding its carbon footprint, with many regions implementing or proposing tighter regulations on greenhouse gas emissions.

Compliance with these evolving environmental mandates is non-negotiable for Hub Group to avoid significant penalties and maintain a positive corporate image. Failure to adhere to waste disposal regulations, for example, could result in substantial fines. As of early 2025, many environmental agencies are enhancing enforcement, making proactive adaptation crucial.

Hub Group must therefore maintain a vigilant approach to monitoring and adapting to changes in environmental legislation. This includes staying abreast of new regulations concerning fuel efficiency, emissions, and sustainable business practices across the various jurisdictions in which they operate, ensuring their business model remains compliant and competitive.

Hub Group, a significant employer, navigates a complex landscape of labor laws. These regulations cover minimum wage, working conditions, employee benefits, and the right to unionize. For instance, as of January 1, 2024, the federal minimum wage in the United States remained at $7.25 per hour, though many states and cities have implemented higher rates, impacting Hub Group's labor costs.

Evolving employment regulations, such as potential adjustments to overtime rules or new collective bargaining frameworks, directly influence operational expenses and human resource strategies. The Fair Labor Standards Act (FLSA) continues to be a cornerstone, dictating pay and work hour standards across the nation, with ongoing discussions about potential updates that could affect companies like Hub Group.

Maintaining equitable labor practices is paramount for fostering positive employee relations and safeguarding the company's legal standing. Adherence to laws like the National Labor Relations Act (NLRA) ensures that employees' rights to organize and bargain collectively are respected, which is critical for a large workforce.

Data Privacy and Security Regulations

Hub Group must navigate a complex landscape of data privacy and security regulations. As digital platforms and data analytics become increasingly central to operations, adherence to laws like the California Consumer Privacy Act (CCPA) and potentially the General Data Protection Regulation (GDPR) for any European data flows is critical. These regulations mandate strict controls over how customer and operational data is collected, stored, and used, with significant penalties for non-compliance. For instance, CCPA violations can result in fines of $2,500 per unintentional violation and up to $7,500 per intentional violation, as of 2024. This underscores the necessity for robust data governance policies to safeguard sensitive information and maintain stakeholder trust.

Protecting customer and operational data is paramount for Hub Group, not just to avoid legal repercussions but also to preserve its reputation and competitive edge. In 2024, data breaches continue to be a significant concern across industries, with the average cost of a data breach reaching $4.45 million globally, according to IBM’s 2023 Cost of a Data Breach Report. Implementing comprehensive data security measures and clear data governance frameworks are therefore essential. This involves:

- Implementing robust encryption for all sensitive data.

- Establishing clear data retention and deletion policies.

- Conducting regular security audits and employee training.

- Developing incident response plans for data breaches.

Antitrust and Competition Laws

Hub Group operates in a highly competitive transportation and logistics sector, necessitating strict adherence to antitrust and competition laws. These regulations are designed to prevent monopolistic behavior and ensure a level playing field for all market participants, impacting everything from pricing strategies to potential mergers and acquisitions.

Failure to comply can result in significant penalties and legal scrutiny. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively investigate and prosecute anti-competitive practices. In 2023, the FTC reported over 1,000 investigations into potential antitrust violations across various industries, underscoring the rigorous enforcement environment.

Key areas of compliance for Hub Group include:

- Pricing Collusion: Avoiding agreements with competitors that fix prices or allocate markets.

- Mergers and Acquisitions: Ensuring that any proposed acquisitions do not substantially lessen competition in relevant markets. For example, the FTC's review of the proposed $2.6 billion acquisition of Yellow Corporation by Old Dominion Freight Line in late 2023 highlights the scrutiny applied to consolidation in the trucking industry.

- Abuse of Dominant Position: Preventing the exploitation of any market power to disadvantage rivals or consumers.

Maintaining compliance safeguards Hub Group from costly litigation and reputational damage, fostering trust and stability within the industry.

Hub Group's legal framework is heavily influenced by transportation-specific regulations, including FMCSA mandates on driver hours and vehicle safety, with continued enforcement in 2024 leading to substantial fines for non-compliance. Furthermore, evolving environmental laws, particularly those targeting emissions and waste disposal, require ongoing investment in fleet modernization and sustainable practices to avoid penalties, a trend intensified by heightened regulatory scrutiny in early 2025. Labor laws governing wages, working conditions, and unionization, such as the FLSA and NLRA, directly impact operational costs and HR strategies, especially with varying state minimum wage laws in effect as of 2024. The company also faces stringent data privacy laws like CCPA, with significant fines for violations, necessitating robust data security measures to protect sensitive information and maintain trust, a critical concern given the rising costs of data breaches, averaging $4.45 million globally in 2023.

Environmental factors

Growing global awareness of climate change is significantly influencing the transportation sector, pushing for solutions that minimize carbon emissions. Hub Group's strategic focus on intermodal rail, a method inherently more fuel-efficient than traditional long-haul trucking, directly addresses this demand. For instance, intermodal transport can reduce greenhouse gas emissions by as much as 75% compared to truck-only transport, a critical advantage in the current market.

Hub Group is actively investing in technologies and operational strategies aimed at further reducing its environmental impact. This includes exploring alternative fuels and optimizing logistics to decrease idling times and improve fuel economy across its fleet. By prioritizing these initiatives, the company aims to not only meet regulatory requirements but also to appeal to a growing segment of customers who value sustainability in their supply chain partners.

The drive for better fuel efficiency and the adoption of alternative fuels like electric, natural gas, and hydrogen represent a major environmental consideration for Hub Group. By focusing on route optimization and modernizing its fleet, Hub Group can lessen its environmental footprint and potentially lower operating expenses. The company's investment in research and development for these cleaner technologies is therefore quite important.

Hub Group's commitment to effective waste management and recycling initiatives directly impacts its environmental footprint across its offices, terminals, and maintenance facilities. By properly disposing of hazardous materials and actively recycling operational waste like tires and oil, the company demonstrates strong environmental stewardship.

In 2023, Hub Group reported a significant focus on reducing its environmental impact, with waste reduction strategies being a key component. While specific figures for recycling rates across all operational waste streams are not publicly detailed, the company's ongoing investment in sustainable practices underscores the importance of these programs for its overall ESG performance.

Resource Scarcity and Supply Chain Resilience

Hub Group faces potential disruptions from resource scarcity, especially concerning fuel and materials vital for its transportation equipment. For instance, the trucking industry, a key sector for Hub Group, relies heavily on diesel fuel, and fluctuating prices or availability can directly affect operating expenses. In 2024, projections indicated continued volatility in diesel prices, with analysts forecasting an average of $4.00-$4.50 per gallon in the US, impacting logistics costs significantly.

Ensuring supply chain resilience is paramount. This involves strategies like diversifying energy sources, such as exploring alternative fuels for its fleet, and optimizing resource consumption. Hub Group's commitment to sustainability, including investments in intermodal solutions which reduce reliance on long-haul trucking, directly addresses these concerns by lowering the overall environmental footprint and mitigating fuel-related risks.

The company must also focus on the resilience of its critical supplies, which extends beyond fuel to include parts for fleet maintenance and technology components for its logistics platforms. Potential shortages or price hikes for these materials, driven by global demand or geopolitical events, could hinder operational capacity. For example, the semiconductor shortage that impacted various industries in recent years also affected the availability of advanced tracking and management systems crucial for modern logistics operations.

- Fuel Price Volatility: US diesel prices were projected to average between $4.00-$4.50 per gallon in 2024, directly impacting Hub Group's transportation costs.

- Material Sourcing: Availability and cost of materials for manufacturing and maintaining transportation assets, like trucks and intermodal containers, pose a risk.

- Energy Transition: Shifting towards alternative fuels and optimizing energy consumption are critical for long-term operational continuity and cost management.

- Supply Chain Dependencies: Ensuring a steady supply of essential components, from truck parts to technology hardware, is vital for uninterrupted service delivery.

Stakeholder Pressure for Sustainability Reporting

Stakeholder pressure for sustainability reporting is a significant environmental factor for Hub Group. Investors, customers, and regulators are increasingly demanding transparency regarding environmental, social, and governance (ESG) performance. This translates into an expectation for Hub Group to provide detailed data on its sustainability metrics.

Hub Group is expected to report on key areas such as greenhouse gas emissions, energy consumption, and the impact of its environmental initiatives. For instance, the transportation and logistics sector, where Hub Group operates, is under scrutiny for its carbon footprint. By mid-2024, many companies in this sector are aiming to disclose Scope 1 and Scope 2 emissions, with a growing push for Scope 3 reporting as well.

- Investor Demand: A significant majority of institutional investors, often exceeding 80% in major markets by late 2024, now consider ESG factors in their investment decisions, directly influencing companies like Hub Group to demonstrate strong sustainability practices.

- Customer Expectations: Consumers are increasingly favoring businesses with demonstrable environmental responsibility. Studies in 2024 indicate that over 60% of consumers are willing to pay more for products and services from sustainable brands.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations and disclosure requirements. For example, in the US, the Securities and Exchange Commission (SEC) has been developing climate disclosure rules, which will impact reporting for publicly traded companies.

- Reputation and Confidence: Transparent and robust ESG reporting not only enhances Hub Group's reputation but also builds investor confidence, potentially leading to a lower cost of capital and improved access to funding for sustainability-focused projects.

Hub Group's environmental strategy is heavily influenced by the global push for reduced carbon emissions. Their focus on intermodal transport, which is significantly more fuel-efficient than trucking alone, directly addresses this. For instance, intermodal shipping can cut greenhouse gas emissions by up to 75% compared to truck-only options, a key advantage for sustainability-conscious clients.

The company is actively investing in cleaner technologies and operational efficiencies to minimize its environmental footprint. This includes exploring alternative fuels and optimizing logistics to reduce fuel consumption and idling times. These efforts are crucial for meeting regulatory demands and attracting customers who prioritize sustainable supply chain partners.

Hub Group's commitment to sustainability extends to waste management and recycling across its facilities. By properly handling hazardous materials and recycling operational waste, the company demonstrates strong environmental stewardship. This focus on responsible practices is vital for its overall ESG performance.

| Environmental Factor | Impact on Hub Group | 2024/2025 Data/Projections |

|---|---|---|

| Climate Change & Emissions | Demand for lower carbon footprint solutions | Intermodal transport reduces emissions by up to 75% vs. truck-only. Growing investor focus on Scope 1, 2, and 3 emissions reporting. |

| Fuel Price Volatility | Direct impact on operating costs | US diesel prices projected to average $4.00-$4.50 per gallon in 2024, affecting logistics expenses. |

| Resource Scarcity | Risk of shortages for fuel and maintenance materials | Semiconductor shortages in recent years impacted availability of logistics technology. |

| Stakeholder Pressure (ESG) | Need for transparency and strong sustainability practices | Over 80% of institutional investors consider ESG factors; 60%+ consumers prefer sustainable brands (2024 data). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Hub Group is meticulously crafted using data from official government publications, reputable financial news outlets, and comprehensive industry-specific market research reports. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the logistics sector.