Hub Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hub Group Bundle

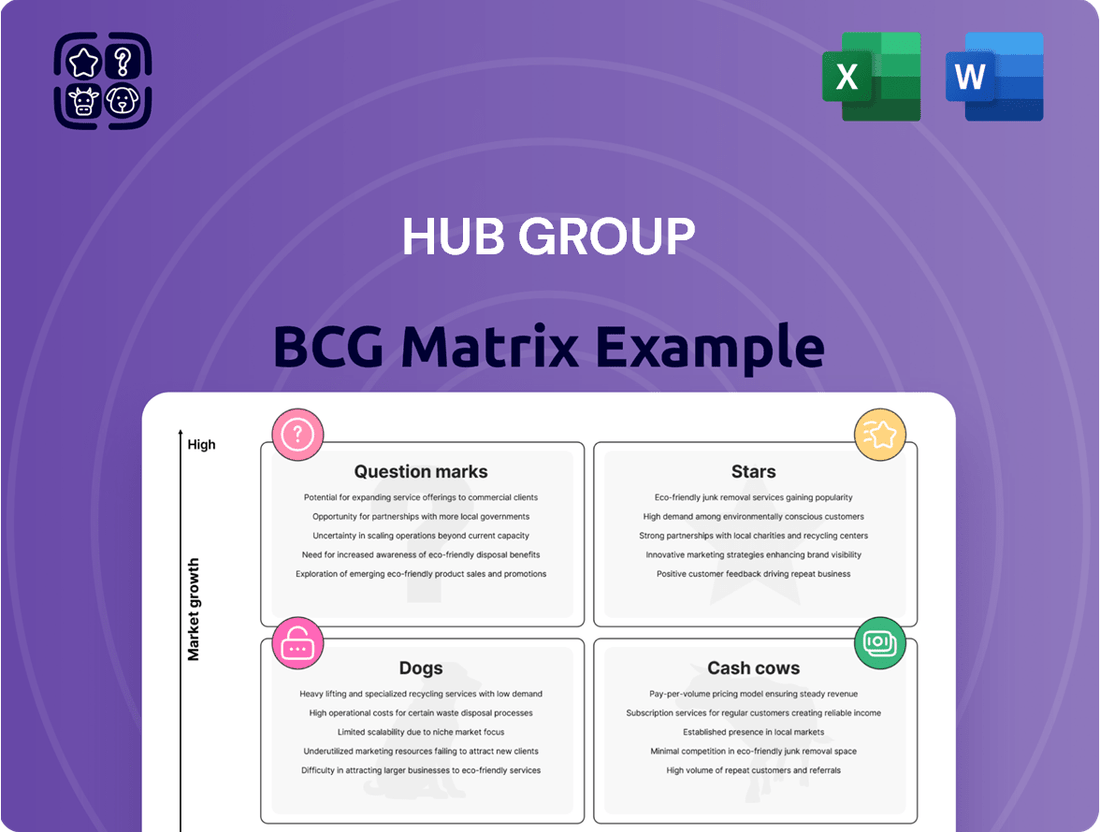

Curious about Hub Group's strategic positioning? This BCG Matrix preview offers a glimpse into their product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understand their current market standing and identify areas for growth.

Unlock the full potential of this analysis by purchasing the complete Hub Group BCG Matrix. Gain detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your investment and product strategies.

Don't miss out on the comprehensive view! The full report provides a granular breakdown of each product's market share and growth rate, empowering you to make informed decisions and drive future success.

Stars

The Intermodal & Transportation Solutions (ITS) segment is a star performer for Hub Group, demonstrating impressive growth in intermodal volumes. In Q1 2025, the segment achieved an 8% increase in total intermodal volume.

This expansion was significantly bolstered by double-digit growth in specific regions, with the Local East seeing a 13% surge and the Mexico region also experiencing robust gains. This strong volume performance highlights the increasing demand for ITS services, even amidst broader revenue fluctuations.

Hub Group's acquisition of Marten Transport's intermodal division, which included 1,200 refrigerated containers, significantly boosted its standing. This move made Hub Group the second-largest provider of temperature-controlled intermodal solutions across North America.

This strategic expansion directly targets the burgeoning temperature-controlled intermodal market, a segment experiencing robust growth, particularly within the vital food and beverage industries. The market is projected for substantial expansion, with forecasts indicating strong upward trends continuing through 2030.

Hub Group's strategic expansion into Mexico, particularly through its October 2024 joint venture with EASO, Mexico's largest intermodal carrier, positions it as a strong contender in the burgeoning North American logistics market. This partnership is designed to significantly enhance Hub Group's cross-border capabilities.

This venture directly capitalizes on the increasing trade volume between the U.S. and Mexico, a trend projected to see a 3% annual growth. By integrating EASO's extensive network, Hub Group is poised to capture a larger share of this vital trade corridor, reflecting a strategic move into a high-growth market segment.

Technology and Innovation Investments

Hub Group's strategic allocation towards technology and innovation places it firmly in the 'Star' category of the BCG Matrix. The company is actively investing in advanced solutions like real-time shipment tracking and AI-driven route optimization. These technological advancements are designed to boost operational efficiency and customer satisfaction.

These investments are crucial for maintaining Hub Group's competitive advantage in the logistics sector. For instance, their focus on predictive analytics helps anticipate potential disruptions, leading to more reliable transit times. This commitment to innovation is reflected in their continuous efforts to enhance on-time delivery performance, a key metric for success in the industry.

Hub Group's technology spending in 2024 is geared towards tangible improvements:

- Enhanced real-time visibility: Implementing advanced tracking systems to provide customers with precise location data for their shipments.

- AI-powered route optimization: Utilizing artificial intelligence to dynamically adjust delivery routes, minimizing mileage and fuel consumption.

- Predictive analytics for efficiency: Employing data analysis to forecast demand, potential delays, and optimize resource allocation.

- Digitalization of customer interactions: Streamlining booking, communication, and payment processes through integrated digital platforms.

Dedicated Trucking Operational Efficiency

Within Hub Group's Integrated Services (ITS) segment, the Dedicated Trucking business has been a standout performer. It experienced double-digit operating income growth year-over-year, a testament to its robust operational execution.

This impressive growth is directly linked to significant improvements in operational efficiencies. These enhancements allow the Dedicated segment to consistently deliver high-value, reliable transportation solutions to its customer base.

- Double-digit operating income growth within the ITS segment.

- Improved operational efficiencies are the primary driver of this success.

- Consistent, high-value solutions offered to customers.

- Strong performance in a key service area for Hub Group.

Hub Group's Intermodal & Transportation Solutions (ITS) segment, particularly its dedicated trucking operations, is a clear star. This segment demonstrated double-digit operating income growth year-over-year in 2024, fueled by enhanced operational efficiencies.

The company's strategic acquisition of Marten Transport's intermodal division in late 2024, adding 1,200 refrigerated containers, solidified its position as the second-largest provider of temperature-controlled intermodal solutions in North America. This move directly taps into the growing demand for specialized cold chain logistics.

Furthermore, Hub Group's joint venture in Mexico, established in October 2024 with EASO, Mexico's largest intermodal carrier, is poised to capture increased cross-border trade volume, projected to grow at 3% annually. This strategic expansion into a high-growth market segment underscores the star status of its international capabilities.

Hub Group's commitment to technology, including AI-driven route optimization and enhanced real-time tracking, further solidifies its star position by driving efficiency and customer satisfaction.

| Segment | BCG Category | Key Growth Drivers (2024) | Performance Metric |

|---|---|---|---|

| Intermodal & Transportation Solutions (ITS) - Dedicated Trucking | Star | Operational efficiencies, high-value solutions | Double-digit operating income growth |

| Intermodal & Transportation Solutions (ITS) - Temperature-Controlled Intermodal | Star | Marten Transport acquisition, growing cold chain demand | Market leadership (2nd largest in NA) |

| Intermodal & Transportation Solutions (ITS) - Mexico Operations | Star | Joint venture with EASO, increasing US-Mexico trade | Enhanced cross-border capabilities |

| Technology & Innovation Investments | Star | AI optimization, real-time tracking, predictive analytics | Improved operational efficiency, customer satisfaction |

What is included in the product

The Hub Group BCG Matrix offers a strategic framework to analyze its diverse business units.

It categorizes them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Hub Group BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Hub Group's financial strength is a cornerstone of its Cash Cow status. The company consistently demonstrates a strong balance sheet, evidenced by its low net debt to EBITDA ratio. For instance, this ratio stood at a mere 0.4x in the first quarter of 2025 and improved to 0.3x in the second quarter of 2025.

This leverage is comfortably below their target range, indicating a healthy financial structure. Such a robust liquidity position provides ample capacity to fund ongoing operations, pursue strategic growth opportunities, and return capital to shareholders without facing undue financial pressure.

Hub Group's commitment to shareholder returns is a hallmark of its Cash Cow status within the BCG Matrix. The company consistently deploys capital back to investors through strategic share repurchases and reliable dividend payments, reinforcing its mature and stable market position.

For instance, in the first quarter of 2025, Hub Group returned a notable $21 million to shareholders. This trend continued into the first half of 2025, with a total of $29 million being distributed, clearly illustrating the company's dedication to delivering tangible value to its owners even within a well-established industry.

Hub Group's Logistics segment, despite experiencing some revenue dips, has demonstrated a notable enhancement in its operating income margins. For instance, the segment saw a 70-basis point improvement in margins during Q1 2024 compared to the previous year. This positive trend suggests a strategic shift towards more profitable service offerings.

This margin expansion is largely attributed to the company's successful cost management initiatives and a deliberate emphasis on higher-margin services. Key areas contributing to this improvement include Managed Transportation, Consolidation & Fulfillment, and Final Mile delivery services, which are proving to be more lucrative for the company.

Effective Cost Management Initiatives

Hub Group's focus on cost management is a key driver of its performance, positioning it as a Cash Cow. The company has raised its cost savings target to $50 million for 2025, demonstrating a commitment to efficiency.

These initiatives have a tangible impact on the bottom line. Reductions in areas like purchased transportation, warehousing, insurance, and depreciation directly bolster margins and enhance free cash flow generation.

- Raised Cost Savings Target: Hub Group aims for $50 million in cost savings by 2025.

- Key Areas of Reduction: Initiatives target purchased transportation, warehousing, insurance, and depreciation.

- Impact on Financials: These measures significantly strengthen profit margins and free cash flow.

Established Intermodal Network and Customer Base

Hub Group's position as the second-largest intermodal marketing company is a testament to its robust infrastructure and market penetration. With access to roughly 50,000 containers, the company efficiently manages a significant portion of the intermodal freight capacity. This scale, combined with deep-seated relationships with Class I railroads, underpins its ability to offer reliable and consistent transportation solutions across North America.

This established network is a critical asset, translating directly into a stable and loyal customer base. Businesses relying on Hub Group benefit from predictable transit times and dependable capacity, fostering long-term partnerships. The consistent demand from these customers creates a predictable revenue stream, characteristic of a cash cow business.

The financial implications of this strong market position are significant. For instance, in 2024, Hub Group reported consistent revenue growth driven by its intermodal segment, reflecting the ongoing demand for efficient and integrated logistics services. This stability allows the company to generate substantial, reliable cash flow, which can then be reinvested into other areas of the business or returned to shareholders.

- Market Leadership: Second-largest intermodal marketing company in North America.

- Asset Base: Access to approximately 50,000 containers.

- Strategic Partnerships: Strong relationships with Class I railroads.

- Financial Stability: Generates consistent and reliable cash flow due to a stable customer base and network.

Hub Group's strong market position as the second-largest intermodal marketing company, coupled with its extensive container fleet and railroad partnerships, generates consistent and predictable revenue. This stability, a hallmark of cash cows, translates into reliable cash flow, allowing for capital returns to shareholders and operational funding without strain.

The company's financial health is further underscored by its low net debt to EBITDA ratio, which improved from 0.4x in Q1 2025 to 0.3x in Q2 2025, well within its target range. This robust liquidity supports operations and strategic initiatives, reinforcing its mature and stable market standing.

Hub Group's commitment to shareholder returns is evident in its consistent dividend payments and share repurchases. In the first half of 2025, the company distributed $29 million to shareholders, demonstrating its dedication to delivering value from its established business segments.

The Logistics segment's margin enhancement, with a 70-basis point improvement in Q1 2024, driven by cost management and a focus on higher-margin services like Managed Transportation, further solidifies its cash cow status.

| Metric | 2024 (H1) | 2025 (Q1) | 2025 (Q2) |

|---|---|---|---|

| Net Debt to EBITDA | N/A | 0.4x | 0.3x |

| Shareholder Distributions | N/A | $21 million | $29 million (H1) |

| Logistics Margin Improvement | 70 bps (Q1 YoY) | N/A | N/A |

Delivered as Shown

Hub Group BCG Matrix

The Hub Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic analysis. You can trust that the insights and layout you see now are precisely what will be delivered, allowing for immediate application in your business planning.

Dogs

Hub Group's intermodal and brokerage segments have seen a decrease in revenue per load. This trend, observed in 2024, is attributed to factors like reduced fuel surcharges and lower accessorial revenue, signaling increased pricing competition and a tougher market.

The decline in revenue per load directly impacts the profitability of these key service areas for Hub Group. In the first quarter of 2024, for instance, the company reported a decrease in operating income for its Intermodal segment, reflecting these revenue pressures.

Hub Group's strategic decision to exit unprofitable brokerage operations directly impacted its Logistics segment revenue, a move designed to bolster long-term financial health. This divestment targeted areas characterized by low market share and limited growth potential, which were previously draining valuable resources.

Transcon Intermodal, a key component of Hub Group's portfolio, experienced a 2% volume decline in the first quarter of 2025. This downturn occurred even as the broader intermodal market saw growth, suggesting specific challenges within the Transcon lane. The decline might be attributed to shifts in import patterns or increased competition impacting this particular route.

Seasonal Softness in Managed Transportation and Final Mile

Hub Group's Logistics segment, specifically its Managed Transportation and Final Mile services, has encountered periods of seasonal softness. This pattern suggests that revenue and profitability in these areas can fluctuate significantly depending on the time of year, impacting their overall performance within the BCG matrix. For instance, while peak seasons might see strong demand, off-peak periods can lead to underutilization of resources.

This seasonal dip means that these particular services might not consistently be high-growth, high-market-share stars. Instead, they could be categorized as question marks or even cash cows, depending on their current market position and growth trajectory. The company likely needs to explore strategies to mitigate this seasonality, perhaps through diversified service offerings or by optimizing operational costs during slower months.

In 2024, the logistics industry, including final mile delivery, faced evolving consumer demands and economic pressures. Reports indicated that while e-commerce continued to drive volume, the cost-per-delivery for final mile operations remained a critical concern for many providers. This environment exacerbates the impact of seasonal softness, making it crucial for companies like Hub Group to manage capacity and pricing effectively throughout the year.

- Seasonal Softness Impact: Managed Transportation and Final Mile services within Hub Group's Logistics segment experience predictable dips in demand and revenue during certain times of the year.

- BCG Matrix Implication: This seasonality can shift these services' positions in the BCG matrix, potentially moving them from star or cash cow status to question mark if growth slows significantly during off-peak periods.

- 2024 Industry Context: The broader logistics market in 2024 saw continued pressure on final mile delivery costs, making seasonal revenue fluctuations a more pronounced challenge for profitability and resource allocation.

Exposure to Macroeconomic and Trade Uncertainties

Hub Group's overall revenue, which reached approximately $5.1 billion in 2023, has been notably affected by broader macroeconomic shifts. These include concerns about potential slowdowns in consumer spending and ongoing instability in trade policies.

These external pressures, while not tied to specific product lines, disproportionately impact business segments that already hold a smaller market share. This vulnerability increases the risk of these segments becoming 'dogs' within the BCG matrix, indicating low growth and low market share.

- Macroeconomic Headwinds: In 2023, inflation and interest rate hikes in the US, a primary market for Hub Group, contributed to a cooling of consumer demand, impacting freight volumes.

- Trade Policy Volatility: Fluctuations in international trade agreements and tariffs create uncertainty for cross-border logistics, a segment where Hub Group operates.

- Impact on Lower-Share Segments: Business units with less established market positions struggle more to absorb the costs associated with economic downturns or trade disruptions, making them candidates for the 'dog' quadrant.

Hub Group's less dominant or declining business units, particularly those facing intense competition or structural market shifts, could be classified as Dogs in the BCG matrix. These segments typically exhibit low market share and low growth prospects, demanding careful strategic evaluation.

For instance, if specific niche brokerage services within Hub Group's Logistics segment have consistently underperformed and failed to gain traction against larger competitors, they would likely fall into this category. The company must decide whether to divest, harvest, or attempt a turnaround for such operations.

In 2024, the freight brokerage market continued to be highly fragmented, with many smaller players competing on price. This environment makes it challenging for any single brokerage operation within a larger company to achieve significant market share and high growth simultaneously, increasing the likelihood of some becoming Dogs.

The company's strategic exits from unprofitable operations in 2023 and early 2024, as mentioned previously, suggest a proactive approach to identifying and addressing potential Dogs before they become significant drains on resources.

Question Marks

Hub Group's strategic expansion into the Final Mile segment, projected to add $150 million in annualized revenue by late 2024, positions it as a star in the BCG matrix due to its high growth potential.

This aggressive growth, however, is accompanied by significant integration costs related to warehouse network realignments, which are anticipated to temporarily impact profit margins, creating a question mark around its immediate profitability despite the revenue boost.

Hub Group's Expedited Freight segment is actively correcting past pricing strategies. These initiatives are showing positive early results, with revenue per hundredweight seeing an uptick. For instance, in the first quarter of 2024, Hub Group reported that their expedited services were experiencing stronger pricing realization compared to the previous year.

While these pricing adjustments are contributing to improved EBITDA margins, the long-term success hinges on market acceptance. The company is closely monitoring customer adoption rates and competitive responses to ensure these revised prices are sustainable. The ongoing efforts aim to balance profitability with market share in this competitive sector.

The logistics sector is seeing a surge in new startups, particularly those focusing on the West Coast. This trend is fueled by increasing e-commerce and a desire for more efficient, specialized supply chain solutions. Hub Group's 2025 outlook acknowledges this dynamic, expecting robust demand from this region.

These emerging logistics players represent a potential growth engine, possibly accelerating peak season demand sooner than anticipated. However, the extent to which Hub Group can effectively integrate these new services or capture significant market share from these agile competitors is a key consideration for its BCG matrix positioning.

Acquisition-Led Growth Opportunities in Logistics

Hub Group is actively pursuing acquisition-led growth to broaden its logistics services. A prime example is the acquisition of Forward Air Final Mile in 2023, which was intended to bolster their capabilities in a key segment.

The success of such acquisitions hinges on effective integration and their ability to translate into tangible market share gains. While the Forward Air Final Mile deal closed in August 2023, its full impact on Hub Group's market positioning and revenue streams is still being assessed, with ongoing efforts to realize the projected synergies.

- Acquisition Strategy: Hub Group views acquisitions as a critical component of its expansion strategy, aiming to enhance service portfolios and market reach.

- Forward Air Final Mile: This 2023 acquisition was a strategic move to strengthen its presence in the final mile delivery sector, a rapidly growing area within logistics.

- Integration Focus: The company's current efforts are concentrated on successfully integrating acquired businesses to unlock their full potential and contribute to overall growth.

- Market Share Impact: The ultimate measure of success for these acquisitions will be their contribution to increasing Hub Group's market share and competitive standing.

Strategic Rail Partnerships and Potential Mergers

Strategic rail partnerships, like those Hub Group might pursue, alongside potential mergers such as the Union Pacific-Norfolk Southern consolidation, offer a pathway to more efficient transcontinental freight movement. These alignments could significantly cut down on transit times and operational expenses for Hub Group, a key player in intermodal logistics.

This evolving landscape presents a substantial opportunity for increased intermodal freight adoption. However, the actualization of these benefits hinges on navigating regulatory hurdles and understanding the precise impact on Hub Group's competitive positioning and market share.

- Streamlined Operations: Potential mergers could reduce transit times and costs for Hub Group by creating more integrated rail networks.

- Intermodal Growth: The consolidation trend signals a favorable environment for expanding intermodal services, a core business for Hub Group.

- Regulatory Uncertainty: Approval processes for major rail mergers can be lengthy and complex, introducing an element of risk.

- Market Share Impact: The ultimate outcome of these strategic moves will determine how Hub Group's market share is affected in the long term.

Hub Group's expansion into the Final Mile segment, though promising for revenue growth, presents a question mark due to the significant integration costs involved in realigning its warehouse network. These costs are expected to temporarily pressure profit margins, creating uncertainty about the immediate financial returns from this strategic move.

The Expedited Freight segment's efforts to improve pricing strategies are showing positive early signs, with increased revenue per hundredweight in Q1 2024. However, the long-term sustainability of these price adjustments remains a question mark, dependent on customer acceptance and competitive reactions in a dynamic market.

The emergence of new logistics startups, particularly on the West Coast, poses both an opportunity and a question mark for Hub Group. While these companies could drive demand, Hub Group's ability to effectively integrate their services or capture market share from these agile competitors is yet to be fully determined.

Hub Group's acquisition strategy, exemplified by the 2023 Forward Air Final Mile purchase, introduces a question mark regarding its full impact. The success of integrating acquired businesses and translating them into tangible market share gains is an ongoing assessment, with projected synergies still being realized.

Potential strategic rail partnerships and consolidations, while offering efficiency gains, introduce a question mark concerning Hub Group's long-term competitive positioning and market share. Navigating regulatory hurdles and understanding the precise market impact of such large-scale industry shifts remains a key consideration.

| Segment | Growth Potential | Profitability Concerns | Key Question Mark |

|---|---|---|---|

| Final Mile | High (projected $150M annualized revenue by late 2024) | Temporary margin pressure due to integration costs | Long-term profitability post-integration |

| Expedited Freight | Improving pricing realization (Q1 2024 uptick) | Market acceptance of revised pricing | Sustainability of price increases |

| New Startups/West Coast Logistics | Potential demand acceleration | Competition from agile players | Hub Group's integration and market share capture |

| Acquisitions (e.g., Forward Air Final Mile) | Enhanced service portfolio and market reach | Integration success and synergy realization | Tangible market share gains |

| Rail Partnerships/Consolidation | Operational efficiencies, reduced transit times | Regulatory hurdles, market impact uncertainty | Long-term competitive positioning |

BCG Matrix Data Sources

Our Hub Group BCG Matrix is powered by a blend of financial disclosures, operational data, and industry benchmarks to accurately assess market share and growth potential.