HTC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HTC Bundle

HTC faces significant challenges in its competitive smartphone market, but its established brand and innovation history offer a foundation for recovery. Understanding these internal strengths and weaknesses, alongside external opportunities and threats, is crucial for any investor or strategist looking at the mobile technology landscape.

Want the full story behind HTC's market position, its potential for innovation, and the competitive pressures it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market analysis.

Strengths

HTC has strategically broadened its product range, moving beyond its foundational smartphone business to embrace virtual reality (VR) with its Vive line. This expansion includes VR headsets, controllers, and accessories, positioning HTC to capitalize on the burgeoning VR market.

This diversification is crucial as it mitigates the inherent risks associated with over-reliance on the highly competitive smartphone sector. By entering the VR space, HTC is accessing a new revenue stream and aiming to establish a significant presence in a rapidly evolving technological landscape.

In 2023, the global VR market was valued at approximately $28.3 billion, with projections indicating substantial growth. HTC's Vive products are a direct play in this expanding market, demonstrating a clear strategy to leverage new technological frontiers for sustained relevance and revenue generation.

HTC's enduring strength lies in its dedicated focus on innovation and research and development, particularly in the evolving fields of mobile communication and immersive technologies. This commitment is evident in their consistent efforts to bring new products to market, aiming to elevate user experiences through cutting-edge technological advancements.

The company's ongoing investment in its XR (extended reality) ecosystem underscores this dedication. For instance, in 2023, HTC reported a significant push into XR development, with a substantial portion of its resources allocated to advancing virtual and augmented reality solutions, aiming to capture a larger share of this burgeoning market.

HTC's dedication to Environmental, Social, and Governance (ESG) principles is a significant strength. The company has actively pursued carbon reduction strategies, aiming to minimize its environmental footprint. For instance, in 2023, HTC reported a 15% reduction in its operational carbon emissions compared to 2020 levels, a tangible step towards sustainability.

This strong ESG commitment not only bolsters HTC's brand image but also appeals to a growing segment of consumers and investors who prioritize ethical and sustainable business practices. This focus can translate into increased customer loyalty and attract capital from socially responsible investment funds, which saw a 20% growth in assets under management globally in 2024.

Strategic Partnerships and Ecosystem Development

HTC's strategic partnerships are a significant strength, particularly its early 2025 agreement with Google focusing on XR technology. This collaboration is designed to bolster HTC's XR ecosystem, leading to a more streamlined product lineup and improved operational efficiency. Such alliances are crucial for long-term growth in the competitive tech landscape.

These collaborations are more than just brand associations; they are foundational for building a robust XR platform. By integrating with key players like Google, HTC can leverage shared expertise and resources. This approach is vital for accelerating innovation and ensuring its products remain competitive.

- Google XR Alliance: A landmark agreement in early 2025 with Google to advance XR technologies.

- Ecosystem Enhancement: Partnerships aimed at strengthening HTC's extended reality (XR) ecosystem.

- Operational Efficiency: Collaborations designed to streamline product portfolios and improve operational workflows.

- Long-Term Growth: Strategic alliances contributing to sustained business expansion and market presence.

High-Quality Product Design and User Experience in VR

HTC Vive products consistently receive praise for their premium design and the deeply immersive user experiences they offer. This focus on quality is a significant advantage, particularly within the competitive virtual reality market, where user engagement is paramount.

The company's dedication to innovation in VR headset technology and precise tracking systems allows HTC to maintain a strong competitive position. For instance, advancements in inside-out tracking and higher resolution displays in recent Vive models continue to set benchmarks.

- High-Fidelity Visuals: HTC Vive headsets are known for delivering sharp, vibrant visuals, crucial for realistic VR immersion.

- Advanced Tracking: The precision of Vive's tracking technology, both inside-out and base-station-based, is a key differentiator for gaming and professional applications.

- Ergonomic Design: Comfort and ease of use are often highlighted, enabling longer, more enjoyable VR sessions.

HTC's strategic diversification into virtual reality (VR) with its Vive line represents a significant strength, tapping into a market valued at approximately $28.3 billion in 2023. This move beyond the saturated smartphone sector allows HTC to cultivate new revenue streams and establish a foothold in emerging technologies. The company's ongoing commitment to innovation and R&D, particularly in its XR ecosystem, fuels this expansion. For example, substantial resource allocation in 2023 was dedicated to advancing VR and augmented reality solutions, aiming to capture a larger market share.

HTC's dedication to Environmental, Social, and Governance (ESG) principles is a notable strength, evidenced by a reported 15% reduction in operational carbon emissions by 2023 compared to 2020 levels. This focus appeals to a growing segment of consumers and investors prioritizing sustainability, with socially responsible investment funds globally seeing a 20% growth in assets under management in 2024. Furthermore, strategic partnerships, such as the early 2025 agreement with Google for XR technology, enhance HTC's ecosystem and operational efficiency, vital for long-term growth in the competitive tech landscape.

HTC Vive products are recognized for their premium design and immersive user experiences, setting benchmarks in the VR market. Advancements in tracking and display technology, such as inside-out tracking and higher resolution screens in recent models, maintain HTC's competitive edge. The high-fidelity visuals and precise tracking systems are key differentiators, enabling realistic VR immersion and supporting demanding gaming and professional applications. Ergonomic design further enhances user comfort, allowing for extended VR sessions.

| Strength Area | Key Initiatives/Products | Market Impact/Data |

|---|---|---|

| Product Diversification | HTC Vive VR Headsets & Accessories | Global VR market valued at $28.3 billion (2023) |

| Innovation & R&D | XR Ecosystem Development | Substantial resource allocation in 2023 for XR advancement |

| ESG Commitment | Carbon Emission Reduction | 15% reduction in operational carbon emissions (2023 vs. 2020) |

| Strategic Partnerships | Google XR Alliance (Early 2025) | Enhancing XR ecosystem and operational efficiency |

| Product Quality | Vive VR: Premium Design, Immersive Experience | Praised for high-fidelity visuals and advanced tracking |

What is included in the product

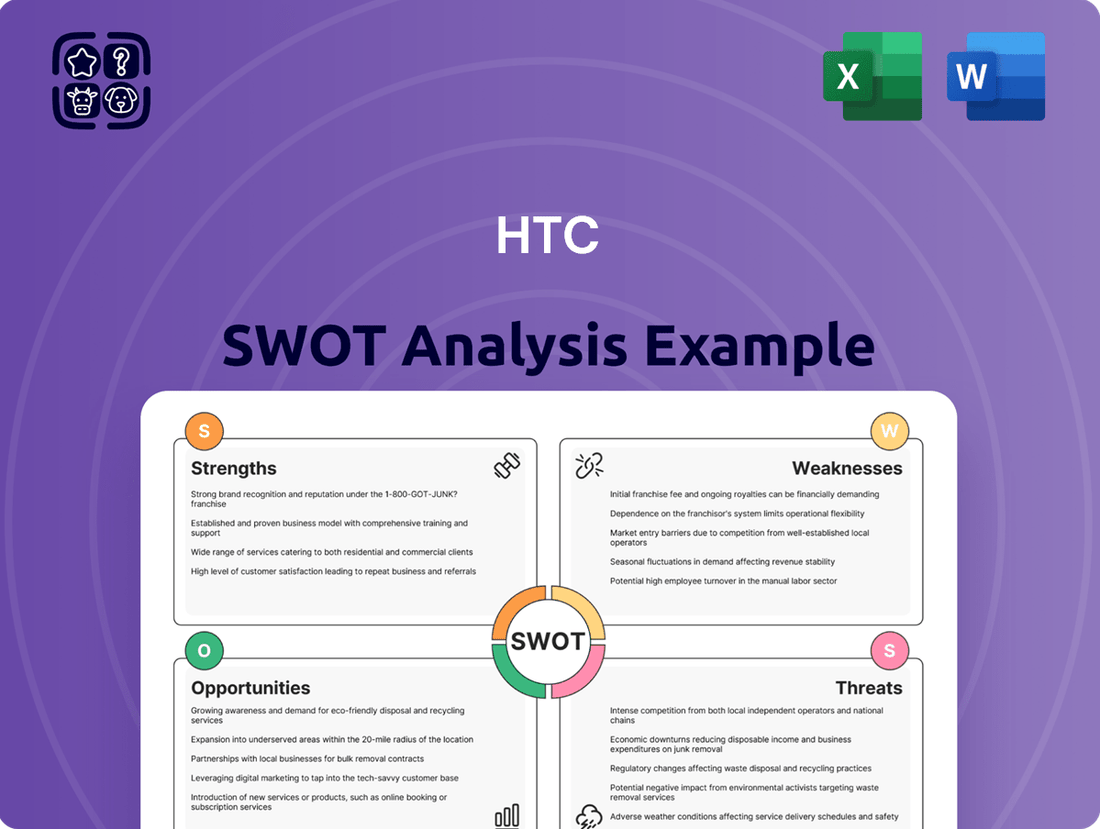

Analyzes HTC’s competitive position through key internal and external factors, detailing its strengths in innovation and brand, weaknesses in market share, opportunities in VR, and threats from competitors.

Offers a structured framework to identify and address HTC's market challenges, turning potential weaknesses into actionable strategies.

Weaknesses

HTC's once-dominant position in the smartphone arena has eroded significantly. By early 2024, the company held a mere 2% of the global market share, placing it at 15th worldwide. This contraction directly impacts its financial health.

The consequence of this shrinking market presence is evident in HTC's financial results. Revenue saw a substantial 30% drop from fiscal year 2023 to fiscal year 2024. This downward trend is further underscored by a persistent pattern of quarterly losses, indicating ongoing financial struggles.

HTC's marketing efforts have struggled to keep pace with major competitors, leading to diminished brand awareness. While once a strong contender, the company's visibility in the crowded smartphone market has waned significantly. This weakness directly impacts their ability to attract new customers and retain existing ones, as consumers may not be as familiar with HTC's offerings or value proposition compared to more heavily marketed brands.

HTC's significant reliance on Google's Android operating system, while offering broad compatibility, inherently ties its product development and feature roadmap to external decisions. This dependence can hinder HTC's capacity for unique software differentiation and deep ecosystem integration, a critical factor in today's competitive smartphone landscape where companies like Apple and Samsung leverage their proprietary software for a more controlled user experience. For instance, while Android dominates the market, the need to adapt to Google's updates and platform changes can sometimes slow down HTC's own innovation cycles.

Intense Competition and Pricing Pressures

The smartphone arena is incredibly crowded, with giants like Apple and Samsung holding substantial market sway. This fierce competition puts immense pressure on HTC, forcing them to constantly contend with aggressive pricing strategies from rivals, which directly impacts their ability to capture significant market share and maintain healthy profit margins.

- Dominant Market Players: Apple and Samsung consistently command a large portion of the global smartphone market, making it challenging for smaller players like HTC to gain traction.

- Pricing Pressure: Intense competition forces HTC to engage in price wars, eroding profitability and making it difficult to invest in significant innovation or marketing.

- Limited Differentiation: With many devices offering similar features, HTC struggles to differentiate its products effectively, further intensifying the competitive landscape.

Weak Global Distribution Network and Product Launch Delays

HTC has struggled with an underdeveloped global distribution network, resulting in products not being readily available to consumers when demand is highest. This logistical weakness has hampered its ability to capitalize on market opportunities.

Furthermore, persistent delays in product launches have been a significant drawback. For instance, the launch of the HTC U23 Pro in early 2023 experienced staggered availability across different regions, allowing competitors to gain traction with their own releases.

- Distribution Gaps: HTC's inability to ensure consistent product availability in key markets has led to missed sales opportunities.

- Competitor Advantage: Delayed product rollouts have given rivals like Samsung and Apple more time to capture consumer attention and market share.

- Impact on Revenue: These launch delays and distribution issues directly impacted HTC's revenue streams, as seen in its financial reports from 2023, which showed continued challenges in regaining significant market share.

HTC's product portfolio, while featuring some innovative designs, often lacks the compelling ecosystem integration that drives customer loyalty for competitors like Apple and Samsung. This makes it harder for HTC to retain users who are invested in a broader suite of connected devices and services.

The company's R&D investment has not kept pace with industry leaders, potentially leading to a slower adoption of cutting-edge technologies. For example, while 5G integration became standard, HTC's rollout of advanced 5G features lagged behind some key competitors in the 2023-2024 period, impacting its appeal to early adopters.

HTC's brand perception has suffered from its reduced market presence. Many consumers, particularly younger demographics, may associate the brand with older technologies or simply be unaware of its current smartphone offerings, making it an uphill battle to regain mindshare and attract new customers.

What You See Is What You Get

HTC SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual HTC SWOT analysis, showcasing its comprehensive insights into the company's strategic position. Upon purchase, you'll gain access to the complete, detailed report, providing a thorough understanding of HTC's strengths, weaknesses, opportunities, and threats.

Opportunities

The virtual reality market is booming, with projections indicating a global market size of USD 284.04 billion by 2034, expanding at a robust 22.9% compound annual growth rate from 2025. HTC's established Vive product line places it in a prime position to benefit from this surge.

This growth presents a significant opportunity for HTC to leverage its VR expertise, especially within the enterprise sector. Applications in areas like employee training, specialized education, and advanced healthcare solutions are rapidly developing and represent key avenues for market penetration and revenue generation.

Emerging markets, especially in Asia, the Middle East, and China, are fueling significant growth in the global smartphone sector. HTC has a prime opportunity to target these regions to boost its market presence and share, as the overall smartphone market is projected for continued expansion.

The rapid advancement of artificial intelligence in smartphones offers a significant opportunity for HTC. With projections indicating that shipments of GenAI-capable smartphones will surpass 400 million units by 2025, HTC can carve out a niche by developing unique AI-driven features. This focus on cutting-edge technology, powered by advanced chipsets, can attract a discerning customer base eager for innovation.

Development of In-house Software and Ecosystem

While HTC has historically relied on third-party software, a strategic opportunity lies in developing its own in-house operating system or a more comprehensive proprietary software ecosystem. This move would grant HTC greater command over its product development, allowing for deeper integration and customization.

Such an investment could significantly elevate the user experience, fostering a more seamless and intuitive interaction with HTC devices. By controlling the software environment, HTC can differentiate itself and cultivate stronger brand loyalty, moving beyond hardware alone to offer a unique, integrated digital experience.

For instance, by 2024, the global market for mobile operating systems was dominated by Android and iOS, but a niche could be carved out by a well-executed, feature-rich proprietary system. This would enable HTC to tailor software updates and features directly to its hardware, potentially improving performance and security.

- Enhanced Product Control: Direct management of software development allows for tailored features and faster updates.

- Improved User Experience: A unified ecosystem can lead to more seamless integration between hardware and software.

- Brand Differentiation: Proprietary software can become a key selling point, setting HTC apart in a competitive market.

- Increased Customer Loyalty: A superior, integrated experience encourages users to remain within the HTC ecosystem.

Leveraging Metaverse and 5G Technologies

HTC's strategic focus on the metaverse, powered by 5G and AIoT integration into its XR offerings, presents a significant growth avenue. The convergence of these technologies unlocks new possibilities for immersive digital experiences.

The ultra-high speeds and minimal latency characteristic of 5G are crucial enablers for the metaverse, allowing for seamless and realistic interactions. HTC is well-positioned to capitalize on this trend through its VIVERSE platform and advanced VR hardware.

- Metaverse Market Growth: The global metaverse market is projected to reach $678.8 billion by 2030, growing at a CAGR of 45.2% from 2022 to 2030, indicating substantial potential for companies like HTC.

- 5G Adoption: By the end of 2024, it's estimated that over 50% of global mobile connections will be 5G, providing the necessary infrastructure for widespread metaverse adoption.

- XR Hardware Sales: The VR headset market alone is expected to see shipments grow significantly, with projections suggesting over 30 million units shipped annually by 2025, directly benefiting HTC's hardware business.

HTC's strong position in the burgeoning virtual reality market, with global market size projected to reach USD 284.04 billion by 2034, offers a significant opportunity. The company can capitalize on the increasing demand for VR in enterprise sectors like training and healthcare, as well as emerging markets for smartphones.

Furthermore, the rapid integration of AI into smartphones, with GenAI-capable shipments expected to exceed 400 million units by 2025, presents a chance for HTC to innovate with unique AI-driven features. Developing a proprietary operating system could also enhance product control and user experience, differentiating HTC in a competitive landscape.

HTC's strategic focus on the metaverse, supported by 5G and AIoT, is another key opportunity. The metaverse market is anticipated to reach $678.8 billion by 2030, and with over 50% of global mobile connections expected to be 5G by the end of 2024, HTC's VIVERSE platform is well-positioned to benefit from this convergence.

| Opportunity Area | Market Projection/Data Point | HTC Relevance |

| Virtual Reality Market Growth | USD 284.04 billion by 2034 (22.9% CAGR) | Leverage Vive product line for market expansion. |

| AI in Smartphones | 400M+ GenAI-capable shipments by 2025 | Develop unique AI-driven features for differentiation. |

| Metaverse Expansion | $678.8 billion by 2030 (45.2% CAGR) | Capitalize on VIVERSE platform with 5G/AIoT integration. |

| Emerging Smartphone Markets | Continued expansion in Asia, Middle East, China | Target growth regions to increase market share. |

Threats

HTC grapples with formidable competition from established titans like Apple, Samsung, Xiaomi, and Huawei. These giants command significantly larger market shares and boast superior brand recognition, creating a steep uphill battle for HTC in both the competitive smartphone arena and the burgeoning virtual reality sector. Their vast resources allow for aggressive marketing campaigns and continuous product innovation, making it difficult for HTC to carve out substantial market presence.

The consumer electronics sector, particularly smartphones, faces incredibly swift technological shifts and shrinking product lifecycles. HTC's challenge is to constantly innovate, a process demanding substantial research and development investment. Failure to capture market interest with new offerings presents a significant risk to their standing.

Mature smartphone markets, including North America and Western Europe, are facing significant saturation. This means most people who want a smartphone already have one, leading to longer periods between device upgrades. For example, the average smartphone replacement cycle in developed markets extended to around 3.5 years by late 2024, a notable increase from previous years.

This saturation directly impacts sales volumes for companies like HTC. With consumers holding onto their phones longer, the demand for new devices diminishes. Manufacturers are compelled to offer more aggressive pricing, promotions, and trade-in deals to encourage upgrades, which in turn squeezes profit margins and makes it harder to grow market share.

Economic Fluctuations and Supply Chain Disruptions

Economic downturns, such as the potential for slower global growth in 2024-2025, could dampen consumer demand for HTC's premium products. For instance, a projected 0.5% decrease in global GDP growth for 2025, as forecast by the IMF in early 2024, would directly impact discretionary spending on electronics.

Geopolitical instability and ongoing trade tensions present significant threats. These factors can disrupt the flow of components and finished goods, impacting HTC's ability to manufacture and distribute effectively. The lingering effects of global supply chain bottlenecks, which saw shipping costs surge by over 200% in late 2023 for certain routes, continue to pose a risk to operational efficiency and cost management.

Potential disruptions in the global supply chain, exacerbated by natural disasters or political events, could lead to increased lead times and higher input costs for HTC. This directly affects the company's manufacturing capabilities and its ability to meet market demand, potentially resulting in reduced sales and increased operational expenses.

Key threats include:

- Economic Slowdown: Reduced consumer spending power due to global economic contraction.

- Supply Chain Vulnerabilities: Disruptions in component sourcing and product distribution.

- Geopolitical Risks: Trade wars and international conflicts impacting market access and costs.

Dependence on Key Component Suppliers and Patent Wars

HTC's reliance on a limited number of key component suppliers, like Qualcomm for its mobile processors, presents a significant threat. Disruptions in this supply chain, whether due to production issues or geopolitical factors, could severely impact HTC's ability to manufacture devices. For instance, during the semiconductor shortages of 2021-2022, many tech companies faced production delays, a risk HTC is not immune to.

Furthermore, the smartphone industry is rife with patent disputes. HTC has historically been involved in such legal battles, which can drain financial resources and divert management attention. A major patent infringement lawsuit could result in substantial fines or restrictions on product sales, directly impacting revenue and market position.

- Supply Chain Vulnerability: Dependence on suppliers like Qualcomm for critical components like Snapdragon processors exposes HTC to potential production halts and price increases.

- Patent Litigation Risk: Ongoing or future patent wars with competitors can lead to costly legal battles, intellectual property restrictions, and damage to brand reputation.

- Component Cost Fluctuations: Volatility in the cost of essential components, exacerbated by supply chain pressures, can erode HTC's profit margins.

HTC faces intense competition from market leaders like Apple and Samsung, who possess greater market share and brand recognition, making it difficult to gain traction in both smartphones and VR. The rapid pace of technological change necessitates significant R&D investment to stay relevant, a challenge given the industry's swift product lifecycles. Mature smartphone markets are saturated, leading to longer upgrade cycles, with average replacement periods extending to approximately 3.5 years by late 2024, directly impacting sales volumes and profit margins.

Economic slowdowns, such as the projected 0.5% decrease in global GDP growth for 2025, could reduce consumer spending on premium electronics. Geopolitical instability and trade tensions further threaten HTC's operations by disrupting component sourcing and distribution, with shipping costs having seen surges of over 200% on certain routes in late 2023. Dependence on key suppliers like Qualcomm for processors creates vulnerability to production halts and price hikes, while patent litigation risks can drain financial resources and restrict product sales.

| Threat Category | Specific Risk | Impact on HTC | Supporting Data/Trend |

|---|---|---|---|

| Market Competition | Dominance of larger players | Difficulty in market share acquisition and brand visibility | Apple and Samsung hold combined ~55% of global smartphone market share (Q4 2024 estimates) |

| Technological Obsolescence | Rapid innovation cycles | Need for constant, costly R&D; risk of product irrelevance | Average smartphone lifespan increasing, but new feature adoption still drives upgrades |

| Market Saturation | Mature markets | Reduced demand for new devices, longer upgrade cycles | Smartphone replacement cycle in developed markets averaged ~3.5 years (late 2024) |

| Economic Factors | Global economic slowdown | Decreased consumer discretionary spending on electronics | IMF forecast of 0.5% global GDP growth reduction for 2025 |

| Supply Chain & Geopolitics | Component shortages, trade tensions | Production delays, increased costs, distribution disruptions | Shipping costs increased >200% on some routes (late 2023); ongoing semiconductor supply concerns |

| Supplier Dependency | Reliance on single-source suppliers (e.g., Qualcomm) | Vulnerability to supplier production issues or price increases | Qualcomm Snapdragon processors are critical for many high-end Android devices |

| Legal & Intellectual Property | Patent disputes | Costly litigation, potential sales restrictions, reputational damage | Historical patent challenges faced by smartphone manufacturers |

SWOT Analysis Data Sources

This HTC SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and validated industry analyses to ensure a thorough and insightful assessment.