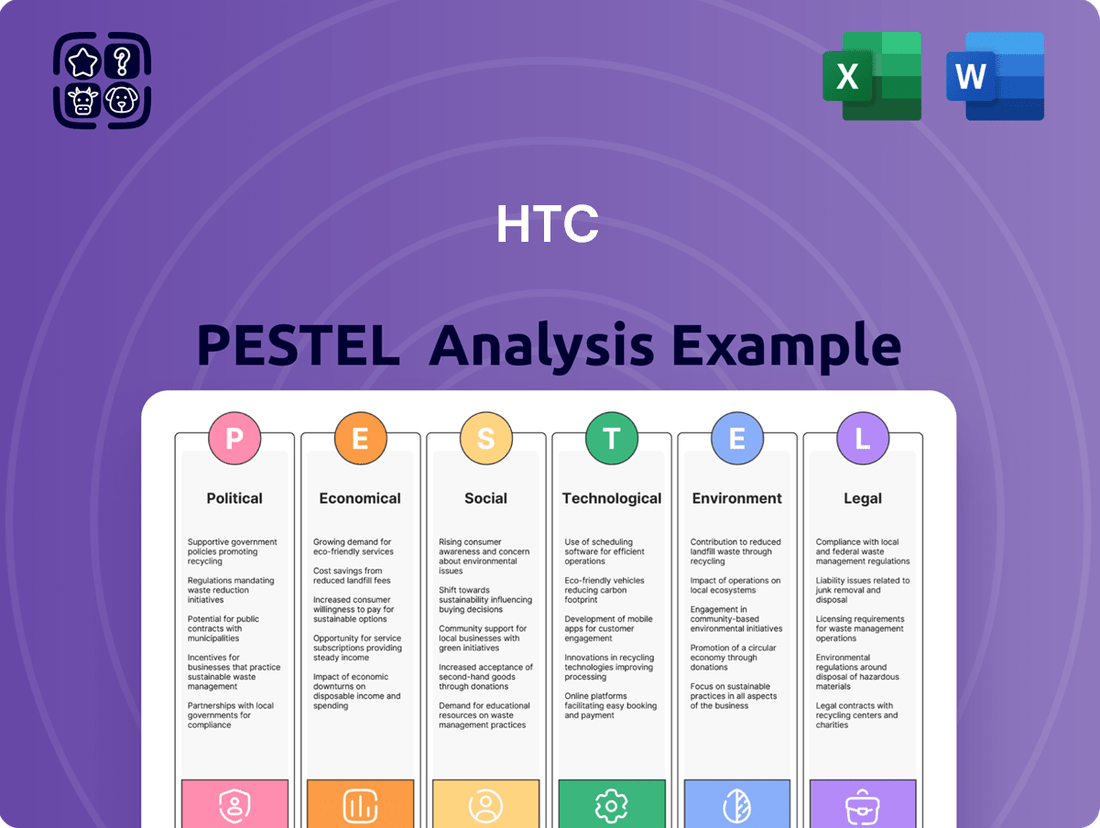

HTC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HTC Bundle

Unlock the strategic landscape of HTC with our comprehensive PESTLE analysis. Discover how political, economic, social, technological, legal, and environmental factors are shaping its future, providing you with the critical intelligence needed to navigate the market. Download the full report now and gain a decisive advantage.

Political factors

Geopolitical tensions, particularly those surrounding Taiwan and mainland China, significantly influence HTC's operational environment. These cross-strait relations directly affect supply chain stability, a critical concern given HTC's reliance on components like semiconductors, with global chip shortages persisting into 2024 and 2025. For instance, disruptions in the semiconductor supply chain, exacerbated by geopolitical events, could lead to production delays and increased costs for HTC's smartphone and VR headset manufacturing.

Government policies in Taiwan and key global markets actively encourage tech innovation through incentives, subsidies, and research grants, particularly benefiting high-tech sectors like VR where HTC operates. These initiatives aim to cultivate a supportive ecosystem for R&D, directly impacting HTC's ability to develop cutting-edge products and maintain its competitive advantage.

International trade agreements and tariffs significantly influence HTC's global supply chain and market access. For instance, the US-China trade tensions in recent years have created uncertainty for technology companies, impacting component sourcing and the cost of goods sold. HTC's ability to navigate these evolving trade landscapes, including potential shifts in US-Taiwan economic relations, directly affects its pricing power and competitive positioning in key markets.

Data Privacy and Cybersecurity Regulations

Governments globally are intensifying scrutiny over data privacy, with new regulations like the proposed American Privacy Rights Act (APRA) set to significantly alter how companies, including HTC, handle customer information. This legislation, expected to be a major focus in 2024 and 2025, will likely impose stricter rules on data collection, storage, and usage across all digital platforms, including HTC's smartphone and VR ecosystems.

Compliance is paramount. Failure to adhere to these evolving data privacy mandates could result in substantial fines and damage consumer trust, especially when dealing with sensitive neural data gathered from advanced VR devices. For instance, under the EU's GDPR, fines can reach up to 4% of global annual revenue, a significant deterrent for any tech company.

- Increased Compliance Costs: Businesses must invest in robust data protection measures and legal counsel to navigate complex privacy laws.

- Data Localization Requirements: Some regulations may mandate that data be stored within specific geographic regions, impacting HTC's global data infrastructure.

- Consumer Data Rights: APRA, for example, is anticipated to grant consumers more control over their personal data, requiring clear consent mechanisms for data processing.

- Cybersecurity Mandates: Alongside privacy, cybersecurity is a key concern, with governments pushing for stronger defenses against data breaches, particularly for connected devices like VR headsets.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws significantly impact HTC's business, especially in its development of smartphones and virtual reality (VR) hardware. Strong IP protection is vital for HTC to shield its unique designs, software, and proprietary technologies from being copied, thereby preserving its competitive edge. This protection also encourages continued investment in research and development, which is crucial for staying ahead in the fast-paced tech industry.

For instance, in 2023, the global IP market continued to see significant activity, with patent filings remaining robust across technology sectors. Countries with strong IP regimes, like the United States and South Korea, offer a more secure environment for companies like HTC to innovate and protect their creations. Conversely, regions with weaker IP enforcement can pose risks, potentially leading to costly legal battles and erosion of market share due to counterfeit products or unauthorized use of technology.

- Global IP Filings: In 2023, patent filings in the technology sector remained high, indicating ongoing innovation and the importance of IP protection.

- Enforcement Variation: The effectiveness of IP enforcement varies greatly by country, directly affecting the risk profile for tech companies.

- Competitive Advantage: Robust IP protection is directly linked to maintaining a competitive advantage and fostering continued R&D investment.

Government support for technological advancement, particularly in areas like 5G and virtual reality, directly benefits HTC. Taiwan's government has actively promoted R&D, with initiatives like the National Science and Technology Council's funding for emerging technologies. These policies create a favorable environment for HTC's innovation in VR and mobile communications.

Geopolitical stability, especially concerning cross-strait relations between Taiwan and China, is a critical factor for HTC's supply chain and market access. Any escalation of tensions could disrupt component sourcing and sales in key markets, impacting production costs and revenue streams. The ongoing semiconductor shortage, persisting through 2024 and into 2025, further highlights the vulnerability of tech supply chains to geopolitical events.

Trade policies and tariffs significantly influence HTC's global operations. For example, the US-China trade dynamic has previously created uncertainty regarding component costs and market entry. Navigating these evolving trade landscapes, including potential shifts in international trade agreements, is crucial for HTC's pricing strategies and competitive positioning.

Regulatory environments concerning data privacy, such as the proposed American Privacy Rights Act (APRA), will increasingly shape HTC's operations. Compliance with stricter data handling and consumer rights mandates, expected to be a major focus in 2024-2025, is essential to avoid penalties and maintain customer trust, especially with sensitive VR data.

| Political Factor | Impact on HTC | Supporting Data/Trend |

| Government R&D Support | Facilitates innovation in VR and 5G | Taiwan's National Science and Technology Council funding for emerging tech. |

| Geopolitical Stability (Taiwan Strait) | Affects supply chain and market access | Persistent semiconductor shortages through 2024-2025 highlight supply chain sensitivity. |

| Trade Policies & Tariffs | Influences operational costs and market entry | Past US-China trade tensions created cost and market uncertainty. |

| Data Privacy Regulations | Requires enhanced compliance and data protection | Proposed APRA in the US to increase scrutiny on data handling in 2024-2025. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing HTC, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and challenges.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for HTC.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the pain of navigating a dynamic global landscape for HTC.

Economic factors

Global economic growth and consumer spending are critical drivers for HTC. A robust global economy typically fuels demand for consumer electronics, as people have more disposable income. Conversely, economic downturns or high inflation, such as those experienced in parts of 2024, can dampen consumer spending, leading to reduced purchases of non-essential items like smartphones and VR devices.

The consumer electronics market is expected to see continued expansion. Projections indicate a steady rise in the overall market size, with online channels playing an increasingly dominant role in sales. This trend suggests that HTC's digital strategy and e-commerce presence will be vital for capturing market share.

HTC, as a global player, faces significant exposure to currency fluctuations. Changes in exchange rates directly impact the value of its international sales when translated back into its reporting currency, the New Taiwan Dollar (NTD). This volatility can affect revenue streams and overall profitability.

For instance, a strengthening NTD against major currencies like the US Dollar or Euro could make HTC's products more expensive in those markets, potentially dampening demand. Conversely, a weaker NTD might boost reported revenues but increase the cost of imported components. In early 2024, the NTD experienced periods of volatility against the USD, trading around the 31-32 NTD per USD mark, highlighting the ongoing challenge for HTC.

The consumer electronics sector, especially smartphones, faces fierce competition. Giants like Apple and Samsung command significant market share, creating immense pressure on companies like HTC. This intense rivalry often translates into pricing challenges, directly impacting profit margins and demanding constant product innovation to stand out, particularly for those targeting prosumers.

Research and Development (R&D) Costs

Innovation in mobile and virtual reality (VR) technologies, key areas for HTC, necessitates significant investment in research and development. These upfront costs are substantial, impacting a company's bottom line.

For HTC, high R&D expenditures can indeed strain financial resources, particularly considering its financial performance in recent years. For instance, in the first quarter of 2024, HTC reported a net loss, highlighting the challenges of funding extensive innovation.

Despite these financial pressures, these R&D investments are absolutely vital. They are the engine for developing next-generation products and ensuring HTC can maintain a competitive edge in the fast-paced and ever-changing tech landscape.

- Substantial R&D Investment: Mobile and VR innovation demands significant capital outlay.

- Financial Strain: High R&D costs can pressure HTC's financial stability, especially after periods of lower revenue.

- Competitive Necessity: Continued investment is critical for product differentiation and market relevance.

- Future Growth Driver: Successful R&D is key to unlocking future revenue streams and market share.

Market Demand for VR/AR and Smartphones

The virtual reality (VR) and augmented reality (AR) markets are experiencing robust growth, presenting a significant opportunity for companies like HTC. Projections suggest the global VR market could reach $100 billion by 2025, with AR following a similar upward trajectory. This expansion is driven by increasing consumer adoption, advancements in hardware, and the development of new applications across gaming, entertainment, and enterprise sectors.

Despite this promising market outlook, HTC's overall revenue has seen a decline in recent years, indicating challenges in translating market potential into financial success. The company's strategic pivot towards VR, exemplified by its Vive product line, aims to capitalize on this burgeoning sector. However, success is not guaranteed, and HTC must effectively compete for market share.

In parallel, the smartphone market, a traditional stronghold for HTC, continues to face slower growth and intense competition. While still a vital revenue stream, the smartphone sector demands constant innovation and aggressive market positioning to maintain relevance. HTC's ability to navigate these dual market dynamics – leveraging VR growth while defending its smartphone presence – will be critical for its future performance.

Key considerations for HTC include:

- VR Market Expansion: The VR market is projected for substantial growth, creating a fertile ground for new entrants and established players.

- HTC's Revenue Trend: Despite market opportunities, HTC's recent revenue figures have shown a downward trend, highlighting operational or strategic challenges.

- Smartphone Market Saturation: The smartphone industry is mature and highly competitive, requiring significant differentiation to capture market share.

- Strategic Focus: HTC's future success is intrinsically linked to its ability to gain a stronger foothold in the expanding VR/AR ecosystem while stabilizing its position in the smartphone market.

Global economic conditions significantly influence HTC's performance, with consumer spending directly impacting demand for its electronics. Economic slowdowns or high inflation, as seen in various regions during 2024, can reduce discretionary spending on items like smartphones and VR headsets. Conversely, a strong global economy generally boosts sales for companies like HTC.

Currency fluctuations present a notable risk for HTC, affecting the value of its international earnings when converted to its reporting currency. For example, the New Taiwan Dollar's movement against major currencies like the US Dollar, which saw fluctuations around 31-32 NTD per USD in early 2024, directly impacts HTC's reported revenue and the cost of its imported components.

The intense competition within the consumer electronics sector, particularly in smartphones, places significant pressure on HTC. Major players like Apple and Samsung dominate market share, forcing companies like HTC to innovate constantly and manage pricing carefully to maintain profitability and relevance, especially when targeting prosumers.

HTC's strategic focus on the burgeoning virtual reality (VR) and augmented reality (AR) markets, with projections indicating the global VR market could reach $100 billion by 2025, offers substantial growth potential. However, the company must effectively navigate this competitive landscape and address its recent revenue decline, which stood at a net loss in Q1 2024, to capitalize on these opportunities.

Same Document Delivered

HTC PESTLE Analysis

The preview you see here is the exact HTC PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HTC.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumer willingness to embrace new technologies like virtual reality is a crucial driver for HTC. For instance, the VR market saw significant growth, with global VR headset shipments projected to reach 27.4 million units in 2024, a notable increase from previous years, indicating a growing consumer appetite for immersive experiences.

Factors such as the perceived value proposition, user-friendliness, and how seamlessly a technology integrates into daily routines heavily influence adoption rates. HTC's Vive line, aiming to capitalize on this trend, faces the challenge of demonstrating clear benefits and ease of use to accelerate market penetration for its VR hardware and software.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024 and into 2025, has significantly reshaped how people work and interact. This shift fuels a demand for sophisticated collaboration tools and immersive digital environments, areas where HTC's VIVE ecosystem, including VIVE Desk and VIVERSE for Business, can find substantial traction.

Consumer habits are also evolving, with an increased emphasis on portability, versatility, and seamless integration across devices for both work and leisure. This trend suggests a continued market for high-quality smartphones and other personal electronics that can adapt to diverse user needs, from professional productivity to entertainment.

The digital divide remains a significant sociological factor impacting HTC's market penetration. In 2024, an estimated 2.6 billion people globally still lacked reliable internet access, a figure that disproportionately affects developing economies where HTC might seek growth. This disparity in access to technology and high-speed internet directly limits HTC's potential market reach, as a substantial portion of the population cannot fully engage with or afford its products and services.

Addressing this accessibility gap is crucial for HTC's long-term strategy. By focusing on more affordable device options and supporting initiatives that expand internet infrastructure, HTC can tap into previously underserved markets. For instance, partnerships with local governments or NGOs to improve digital literacy and connectivity in rural areas could unlock new customer segments, fostering social inclusion while simultaneously broadening HTC's consumer base.

Impact of Social Media and Influencer Culture

Social media and the rise of influencer culture are profoundly impacting consumer electronics choices. Brands like HTC must strategically engage on platforms where their target audiences, especially Gen Z and Millennials, spend their time. For instance, in 2024, influencer marketing spend in the tech sector is projected to reach billions, demonstrating its sway over purchasing habits.

HTC's marketing needs to integrate authentic influencer collaborations to build brand trust and showcase product benefits. This approach can resonate more strongly than traditional advertising, particularly for younger demographics who value peer recommendations. A significant portion of consumers, often cited around 60-70% in recent surveys, report that social media influences their tech buying decisions.

- Platform Dominance: TikTok, Instagram, and YouTube are key battlegrounds for consumer attention in electronics.

- Influencer ROI: Brands are increasingly measuring return on investment from influencer campaigns, with successful tech collaborations showing high engagement rates.

- Authenticity Premium: Consumers are more receptive to influencers who genuinely use and believe in the products they promote.

- Targeted Reach: Influencer marketing allows HTC to pinpoint specific demographic segments with tailored messaging.

Health and Wellness Trends

The increasing focus on health and wellness is a significant sociological trend. In 2024, the global wearable technology market, which includes fitness trackers, was projected to reach over $150 billion, demonstrating a strong consumer demand for health monitoring tools. This presents a clear opportunity for HTC to leverage its expertise in virtual reality and smartphone technology to develop integrated health features or entirely new health-focused devices.

Furthermore, virtual reality (VR) is gaining traction in therapeutic applications. By 2025, the VR in healthcare market is anticipated to grow substantially, with estimates suggesting it could exceed $20 billion. HTC's existing VR platforms, like the VIVE, are well-positioned to explore partnerships or internal development for mental health support, physical rehabilitation programs, and other wellness-related VR experiences, aligning with a mission to improve lives through technology.

- Wearable technology market growth: Projected to exceed $150 billion globally in 2024.

- VR in healthcare market expansion: Expected to surpass $20 billion by 2025.

- Consumer interest in health tracking: Driving demand for integrated and specialized health tech.

- Therapeutic VR applications: Growing acceptance for mental health and rehabilitation use cases.

Societal attitudes towards data privacy and ethical technology use are increasingly shaping consumer behavior and regulatory landscapes. As of 2024, a significant portion of consumers express concerns about how their personal data is collected and utilized by tech companies, influencing their willingness to adopt new devices and services.

HTC's approach to data security and transparency is therefore paramount, especially as it ventures further into immersive technologies like VR and AR. Building trust through robust privacy policies and clear communication about data handling practices will be critical for sustained market acceptance and brand loyalty in the coming years.

The growing demand for sustainable and ethically produced goods is another key sociological factor. Consumers, particularly younger demographics, are increasingly scrutinizing the environmental impact and labor practices of technology manufacturers. HTC's commitment to corporate social responsibility, from supply chain management to product lifecycle, can significantly influence brand perception and purchasing decisions.

For instance, in 2024, many consumers are actively seeking out brands with strong environmental, social, and governance (ESG) credentials. Companies that demonstrate a commitment to reducing their carbon footprint and ensuring fair labor practices are often rewarded with greater consumer trust and market share.

Technological factors

HTC's success hinges on continuous innovation in virtual and augmented reality hardware and software. This means pushing the boundaries of display quality, minimizing lag, and making headsets more comfortable for extended use. For instance, advancements in micro-OLED displays, as seen in some 2024 VR headset prototypes, aim to deliver sharper visuals and deeper blacks, crucial for immersive experiences.

Developing more sophisticated software, including intuitive platforms and robust development tools, is equally vital. This enables the creation of richer, more interactive content and applications. The growth of the metaverse ecosystem, with companies investing billions in 2024 and projected to reach over $500 billion by 2028, underscores the demand for compelling VR/AR experiences that HTC's software ecosystem must support.

HTC is actively integrating AI and spatial computing into its VIVERSE and VIVE Desk platforms. This technological fusion is designed to significantly elevate user experiences by introducing capabilities like real-time language translation and intelligent virtual assistants, thereby boosting productivity within immersive virtual settings.

The company's strategic focus on these advancements is evident in its ongoing development efforts, aiming to create more intuitive and powerful virtual interactions. For instance, AI-driven analytics within VIVERSE could provide users with personalized insights and adaptive learning environments, a trend gaining traction across the metaverse sector.

The ongoing expansion of 5G networks is a significant technological driver for HTC, particularly for its virtual reality (VR) and augmented reality (AR) offerings. Faster speeds and reduced latency are critical for delivering immersive and responsive XR experiences, enabling smoother streaming of high-resolution content and more interactive applications. By the end of 2024, global 5G subscriptions are projected to surpass 1.5 billion, a figure expected to climb significantly by mid-2025, underscoring the growing infrastructure that supports these advancements.

HTC's strategic investments in 5G technology, such as its private 5G solutions for enterprise use, directly leverage this trend. These solutions aim to provide businesses with dedicated, high-performance connectivity for applications like industrial automation, remote collaboration, and advanced training simulations, all of which benefit from the reliability and speed of 5G. The company's revenue from its Vive XR Elite, a key product in its XR portfolio, is expected to see continued growth as 5G adoption accelerates, creating a more robust ecosystem for its advanced hardware.

Competition in Chip Manufacturing and Supply

HTC's reliance on advanced semiconductor chips places it directly in the path of intense global competition within chip manufacturing. This competition, often influenced by geopolitical dynamics, particularly concerning Taiwan's pivotal role in chip production, directly affects HTC's supply chain stability and the cost of its components. For instance, in 2024, TSMC, a key Taiwanese foundry, continued to be the dominant player, but the increasing demand and strategic importance of advanced nodes led to price adjustments and allocation challenges for many companies, including those in the smartphone sector.

These technological factors create significant hurdles for HTC in bringing new products to market efficiently. Disruptions or increased costs in chip procurement can delay product launches and impact profit margins. The ongoing global push for semiconductor self-sufficiency by various nations, including the US and EU, while aiming to diversify supply, also introduces new complexities and potential trade barriers that could further influence HTC's operational costs and product development timelines through 2025.

Battery Technology and Miniaturization

Advancements in battery technology, particularly solid-state batteries, are promising significant leaps in energy density and safety, crucial for HTC's portable devices. For instance, by 2025, some projections suggest solid-state batteries could offer double the energy density of current lithium-ion batteries. This directly translates to lighter, more powerful, and longer-lasting VR headsets and smartphones, enhancing user experience and device practicality.

Miniaturization of electronic components, driven by innovations in semiconductor manufacturing, allows for more sophisticated features within smaller form factors. This trend is vital for HTC as it enables the integration of advanced sensors and processing power into sleeker, more ergonomic VR headsets and mobile devices. The ongoing push towards smaller chip sizes, like those nearing 2 nanometer process nodes by 2024-2025, directly supports these design goals.

- Battery Density: Projections indicate solid-state batteries could achieve 400-500 Wh/kg by 2025, a substantial increase from current lithium-ion capabilities.

- Component Size: Semiconductor advancements are enabling chip sizes to shrink, with leading foundries aiming for 2nm processes around 2024-2025.

- Device Impact: These technological improvements directly influence the weight, comfort, and operational duration of HTC's portable and VR offerings.

Technological advancements in VR/AR hardware, such as improved display technologies like micro-OLEDs and more intuitive software platforms, are critical for HTC's immersive experiences. The growing metaverse, with significant investment in 2024, highlights the demand for compelling VR/AR content that HTC's software must support.

HTC's integration of AI and spatial computing into its VIVERSE and VIVE Desk platforms aims to enhance user experience through features like real-time translation and virtual assistants. AI-driven analytics within VIVERSE could offer personalized insights, aligning with metaverse trends.

The expansion of 5G networks, with over 1.5 billion global subscriptions projected by the end of 2024, is vital for delivering low-latency, high-resolution XR experiences. HTC's private 5G solutions for enterprises leverage this infrastructure for applications like industrial automation and remote collaboration.

HTC's reliance on advanced semiconductor chips is subject to global competition and geopolitical influences, impacting supply chain stability and costs. Semiconductor advancements enabling smaller chip sizes, such as 2nm processes by 2024-2025, are crucial for miniaturizing HTC's devices.

| Advancement | Projected Impact | Relevance to HTC |

| Micro-OLED Displays | Sharper visuals, deeper blacks | Enhanced VR headset immersion |

| Metaverse Growth | Over $500 billion by 2028 | Demand for HTC's VR/AR content |

| 5G Subscriptions | 1.5 billion+ globally by end of 2024 | Enables low-latency XR experiences |

| Semiconductor Nodes | 2nm processes by 2024-2025 | Miniaturization of devices |

Legal factors

HTC must navigate a complex web of product safety and compliance standards across its global markets. This involves adhering to regulations like CE marking in Europe for electromagnetic compatibility and electrical safety, and FCC certification in the United States, ensuring its consumer electronics and VR devices meet stringent safety requirements.

For instance, the European Union's General Product Safety Regulation (GPSR), updated in 2024, places increased responsibility on manufacturers like HTC to ensure product safety throughout the supply chain. Failure to comply can result in significant fines and market withdrawal, impacting HTC's ability to reach its target audience of diverse financially-literate decision-makers.

Consumer protection laws, such as those governing warranties, return policies, and advertising, significantly shape how HTC can market and sell its products. For instance, stringent warranty requirements can increase operational costs for device repairs and replacements.

Compliance is not just a legal necessity but also crucial for brand trust; a single violation, like misleading advertising, could lead to substantial fines and damage HTC's reputation. In 2024, regulatory bodies globally continued to focus on transparency in product lifecycles and data privacy, impacting how HTC communicates product features and handles customer data.

Import and export regulations significantly shape HTC's global operations. For instance, in 2023, the World Trade Organization reported that average tariffs on manufactured goods remained relatively stable, but specific electronics components could face fluctuating duties depending on bilateral trade agreements. These regulations, including customs duties and licensing, directly impact HTC's supply chain costs and the speed at which products reach international markets.

Changes in trade policies, such as those seen with increasing protectionist measures in certain regions, can introduce significant operational complexities and unexpected cost increases for HTC. For example, a sudden imposition of higher tariffs on smartphone components in a key market could necessitate a costly reallocation of manufacturing or sourcing strategies, potentially impacting profit margins and market competitiveness.

Labor Laws and Employment Regulations

HTC, as a global entity with around 12,500 employees as of early 2024, navigates a complex web of labor laws and employment regulations across its various operating regions. These regulations dictate everything from minimum wage requirements and working hours to employee benefits and termination procedures, ensuring fair treatment and safe working environments. Failure to comply can lead to significant penalties and reputational damage.

The company must remain vigilant in adapting to evolving labor standards worldwide. For instance, recent trends in 2024 and projections for 2025 indicate a continued focus on issues like remote work policies, gig economy worker rights, and the implementation of diversity and inclusion mandates within corporate structures. HTC's adherence to these legal frameworks is crucial for maintaining operational stability and attracting and retaining talent.

- Compliance with International Labor Standards: HTC must adhere to International Labour Organization (ILO) conventions and recommendations, alongside national labor laws in countries like Taiwan, China, and India.

- Wage and Hour Regulations: Adherence to minimum wage laws, overtime pay rules, and maximum working hours is a constant requirement, varying significantly by jurisdiction.

- Employee Rights and Protections: This includes ensuring non-discrimination, providing safe working conditions, and upholding rights to collective bargaining where applicable.

- Data Privacy in Employment: With increasing data protection laws, HTC must manage employee data responsibly and in compliance with regulations like GDPR or similar national frameworks.

Environmental Regulations and E-waste Legislation

HTC, like all electronics manufacturers, must navigate a complex web of environmental regulations. These rules are primarily focused on minimizing the impact of electronic waste, or e-waste, and restricting the use of hazardous materials in their products. This is a significant consideration for their global operations and supply chains.

Taiwan, HTC's home base, has particularly stringent environmental laws. For instance, Taiwan's Waste Management Act includes provisions for Extended Producer Responsibility (EPR), meaning HTC is responsible for the end-of-life management of its products. This includes ensuring proper collection and recycling of mobile phones and other electronic devices. In 2023, Taiwan's Environmental Protection Administration reported that over 70% of collected e-waste was processed according to these regulations, highlighting the operational framework HTC must adhere to.

Key legal factors impacting HTC include:

- Compliance with Extended Producer Responsibility (EPR) laws: HTC must establish and fund systems for collecting and recycling its products at the end of their lifecycle.

- Restrictions on Hazardous Substances: Regulations like the EU's Restriction of Hazardous Substances (RoHS) directive limit the use of specific chemicals, requiring careful material sourcing and product design.

- E-waste Management Targets: HTC needs to meet specific targets for e-waste collection and recycling rates, as mandated by Taiwanese and international environmental agencies.

- Reporting and Auditing Requirements: Companies are often required to report on their environmental performance and may be subject to audits to ensure compliance with e-waste legislation.

HTC must navigate a complex legal landscape concerning product safety and consumer protection across its global markets. Regulations like the EU's General Product Safety Regulation (GPSR), updated in 2024, and the US FCC certification demand strict adherence to ensure device safety, with non-compliance leading to significant penalties and market access issues.

Consumer protection laws governing warranties and advertising directly influence HTC's operational costs and marketing strategies. For instance, robust warranty requirements can increase expenses related to device repairs and replacements, while adherence to advertising standards is critical to avoid fines and maintain brand integrity.

Trade policies and import/export regulations significantly impact HTC's supply chain and profitability. Fluctuating tariffs on electronic components, as observed in 2023 trade data, can necessitate costly adjustments to sourcing and manufacturing strategies, affecting market competitiveness.

HTC must also comply with diverse labor laws and employment standards globally, covering minimum wages, working hours, and employee rights, with a growing emphasis in 2024-2025 on remote work policies and diversity mandates.

Environmental factors

The escalating global generation of electronic waste, or e-waste, poses a considerable environmental hurdle for companies like HTC. In 2024, the United Nations Environment Programme reported that global e-waste reached an estimated 62 million metric tons, a figure projected to climb significantly in the coming years.

Adhering to stringent e-waste management regulations, such as Taiwan's Waste Disposal Act which enforces producer responsibility and recycling mandates, is paramount for HTC's operational continuity and its commitment to sustainability. Non-compliance can lead to substantial fines and reputational damage.

HTC is actively working to shrink its environmental impact, aiming for net-zero emissions by 2050. This commitment translates into concrete actions like reducing carbon emissions throughout its entire operational chain, from manufacturing to the end-of-life of its products.

To achieve these ambitious goals, HTC is investing in cleaner energy sources. A significant part of this strategy involves adopting renewable energy, with a notable focus on solar power, to fuel its operations and reduce reliance on fossil fuels.

HTC's commitment to sustainable sourcing is crucial, especially as consumer and regulatory pressure for eco-friendly products intensifies. By ensuring raw materials are sourced responsibly and promoting environmentally sound practices across its supply chain, HTC can enhance its brand reputation and mitigate potential disruptions. For instance, a significant portion of the electronics industry is actively working to reduce its carbon footprint, with many aiming for substantial emissions reductions by 2030, a trend HTC must align with.

Working with suppliers to measure and mitigate climate risks is becoming a standard practice. Implementing carbon management platforms allows companies like HTC to track their environmental impact more effectively. This proactive approach not only addresses environmental concerns but also positions HTC favorably in a market increasingly valuing corporate social responsibility. The global market for carbon management software, for example, was projected to reach billions by 2024, indicating a strong industry trend towards such solutions.

Energy Consumption of Products and Operations

The energy consumption inherent in manufacturing HTC's smartphones and other electronic devices, along with the energy used in its operational activities, significantly shapes its overall environmental impact. This is a key consideration for the company as it navigates sustainability challenges.

HTC's environmental strategy places a strong emphasis on creating products that are more energy-efficient, aiming to reduce the power draw during their use by consumers. Simultaneously, the company is focused on optimizing the energy usage within its own manufacturing facilities and corporate offices.

For instance, in 2024, the consumer electronics industry, including smartphone manufacturers, faced increasing scrutiny regarding the lifecycle energy consumption of their products. While specific HTC operational energy data for 2024-2025 isn't publicly detailed in a way that allows for direct comparison, industry trends highlight a push towards:

- Reduced standby power consumption in devices.

- Increased use of renewable energy sources in manufacturing plants.

- Supply chain efforts to improve energy efficiency in component production.

Resource Depletion and Material Scarcity

The electronics industry, including companies like HTC, faces significant challenges from the finite nature of key raw materials. For instance, the availability of rare earth elements, crucial for smartphone components, is a growing concern, with China dominating global supply. In 2023, global demand for critical minerals like cobalt and lithium, essential for battery technology, continued to rise, impacting production costs.

HTC must proactively address resource depletion by implementing robust strategies. This includes investing in research and development for alternative, more sustainable materials to reduce reliance on scarce resources. Furthermore, embracing circular economy principles by designing for repairability, recyclability, and incorporating recycled content into new products is vital for long-term viability. For example, the European Union's focus on a circular economy is driving innovation in e-waste recycling, with targets to increase collection and processing rates for electronic devices.

- Finite Resources: Critical materials like rare earth elements and precious metals used in smartphones are becoming increasingly scarce, impacting supply chains and costs.

- Rising Demand: Global demand for materials like cobalt and lithium, essential for battery technology, surged in 2023, putting pressure on availability.

- Circular Economy Focus: Companies are encouraged to design products for longevity, repair, and recycling to mitigate resource depletion and waste.

- E-waste Challenges: Effective recycling and recovery of valuable materials from electronic waste remain a significant environmental and economic hurdle for the industry.

Environmental factors significantly influence HTC's operations, particularly concerning e-waste and resource management. The escalating global generation of e-waste, estimated at 62 million metric tons in 2024, presents a substantial challenge, necessitating adherence to regulations like Taiwan's Waste Disposal Act. HTC's commitment to net-zero emissions by 2050 drives investments in renewable energy, such as solar power, and emphasizes sustainable sourcing and circular economy principles to mitigate resource depletion and waste.

| Environmental Factor | 2024/2025 Data & Trends | Impact on HTC |

|---|---|---|

| E-waste Generation | Global e-waste reached 62 million metric tons in 2024, projected to rise. | Requires robust recycling and disposal strategies, compliance with regulations. |

| Carbon Emissions | Industry trend towards net-zero by 2050; focus on reducing operational footprint. | Drives investment in renewable energy (e.g., solar) and energy-efficient manufacturing. |

| Resource Scarcity | Rising demand for critical minerals (cobalt, lithium) in 2023; scarcity of rare earth elements. | Necessitates R&D for alternative materials and adoption of circular economy models (repair, recycle). |

| Energy Consumption | Industry scrutiny on product lifecycle energy use; focus on device efficiency and manufacturing energy. | Requires optimization of energy usage in production and promotion of energy-efficient devices. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. This ensures that every aspect of the macro-environment is analyzed with accuracy and up-to-date information.