HTC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HTC Bundle

Curious about HTC's strategic genius? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Understand how HTC innovates and captures value in the dynamic tech market.

Unlock the full strategic blueprint behind HTC's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

HTC relies on technology and platform providers to build its devices. For instance, Qualcomm's Snapdragon chipsets are integral to HTC's smartphone and XR device performance, enabling advanced features.

Partnerships with companies like Google are vital for HTC's Android-powered smartphones, ensuring software compatibility and access to the Android ecosystem. These collaborations are fundamental for delivering competitive products and integrating with broader digital environments.

HTC’s Vive VR line thrives on strong ties with content creators. They actively partner with VR developers, gaming studios, and creative agencies to build a rich ecosystem. These collaborations are crucial for developing immersive experiences, from virtual concerts to specialized training simulations, all designed to draw users to the Vive platform.

For instance, HTC has partnered with entities like SKT TEAM STUDIO and VIVE ORIGINALS. These strategic alliances are key to expanding the variety and quality of content available for Vive headsets, thereby enhancing user engagement and market appeal. In 2024, the VR content market continued its growth, with investments in immersive experiences projected to increase significantly.

HTC collaborates with telecommunication carriers worldwide, a crucial element in their business model for smartphone distribution. These partnerships often involve bundling HTC devices with attractive service plans, making their products more appealing and accessible to a wider audience.

In 2024, the influence of carrier partnerships remains significant. For instance, major carriers like Verizon, AT&T, and T-Mobile in the US, and Vodafone and Orange in Europe, continue to be key channels for smartphone sales, directly impacting market penetration for brands like HTC. These relationships are essential for reaching consumers who prefer integrated device and plan offerings.

Enterprise Solution Integrators

HTC's enterprise virtual reality (VR) solutions are brought to life through strategic alliances with Enterprise Solution Integrators. These partners are crucial for deploying HTC's VR technology across diverse sectors like healthcare, education, and manufacturing.

These collaborations enable HTC to provide customized VR deployments, ensuring that solutions are precisely tailored to the unique needs of each industry and client. For instance, in the manufacturing sector, integrators help implement VR for training assembly line workers or for product design visualization.

By leveraging the expertise of these integrators, HTC can effectively reach and serve its business-to-business (B2B) clientele. This network ensures that complex VR systems are seamlessly integrated into existing workflows, maximizing their value. In 2024, the global VR market for industrial applications saw significant growth, with healthcare and manufacturing being key drivers, underscoring the importance of these partnerships.

- System Integrators: Essential for the technical deployment and customization of HTC's enterprise VR hardware and software.

- Industry Expertise: Partners bring specialized knowledge in sectors like healthcare (surgical training), education (immersive learning), and manufacturing (digital twins, remote assistance).

- Market Reach: Integrators expand HTC's footprint, allowing access to a broader range of B2B customers who require tailored VR solutions.

- Solution Tailoring: These partnerships facilitate the creation of bespoke VR experiences and applications that address specific business challenges.

Research and Academic Institutions

HTC actively collaborates with universities and research bodies to push the boundaries of emerging technologies, particularly in areas like artificial intelligence and extended reality (XR). These partnerships are crucial for driving innovation and discovering novel applications for HTC’s hardware and software ecosystems.

These collaborations foster a dynamic environment for developing groundbreaking solutions and identifying new market opportunities. For instance, in 2024, HTC announced collaborations with several leading universities to explore AI-driven content creation for VR platforms, aiming to enhance user engagement and expand the metaverse’s creative potential.

- AI Integration: Partnering with AI research labs to embed advanced intelligence into VR/AR devices for more intuitive user experiences and data analysis.

- XR Application Development: Jointly developing XR applications with academic institutions for sectors like education, healthcare, and industrial training, showcasing new use cases.

- Talent Pipeline: Engaging with universities to recruit top talent and foster a pipeline of skilled engineers and researchers in the fields of XR and AI.

- Research Funding: Securing research grants and funding through academic partnerships to accelerate the development of next-generation display and interaction technologies.

HTC's key partnerships are essential for its technological development and market reach. Collaborations with chip manufacturers like Qualcomm, and software giants like Google, ensure its devices are powered by cutting-edge technology and integrated into major operating systems. These relationships are foundational for delivering competitive products in both the smartphone and XR markets.

The success of HTC's Vive VR platform heavily depends on its relationships with content creators and developers. By fostering a vibrant ecosystem of VR games, applications, and experiences, HTC drives user engagement and expands the utility of its hardware. In 2024, the VR content market continued its expansion, with significant investment in immersive experiences, highlighting the critical role of these partnerships.

Strategic alliances with telecommunication carriers globally are vital for HTC's smartphone distribution strategy. These partnerships facilitate bundled offers and service plans, making HTC devices more accessible to a broad consumer base. In 2024, major carriers remained key sales channels, directly impacting market penetration for smartphone brands.

For its enterprise VR solutions, HTC relies on Enterprise Solution Integrators. These partners are instrumental in deploying tailored VR technology across industries like healthcare and manufacturing, ensuring solutions meet specific client needs. The industrial VR market saw substantial growth in 2024, underscoring the importance of these B2B collaborations.

| Partnership Type | Key Partners/Examples | Impact on HTC | 2024 Relevance |

|---|---|---|---|

| Technology Providers | Qualcomm (Snapdragon chipsets), Google (Android OS) | Enables advanced device features and OS integration | Continued reliance on high-performance chips and Android ecosystem |

| Content Creators (VR) | VR Developers, Gaming Studios, VIVE ORIGINALS | Builds a rich VR content ecosystem, drives Vive platform adoption | Growth in VR content market fuels demand for immersive experiences |

| Telecommunication Carriers | Verizon, AT&T, Vodafone, Orange | Facilitates smartphone distribution and market access | Carriers remain crucial for integrated device and plan offerings |

| Enterprise Solution Integrators | Industry-specific integrators | Enables customized VR deployments for B2B clients | Significant growth in industrial VR applications drives demand for tailored solutions |

What is included in the product

A structured framework detailing HTC's customer segments, value propositions, channels, and revenue streams to drive its smartphone and VR business.

Simplifies complex business strategies into a visually organized, actionable framework.

Provides a clear roadmap for identifying and addressing potential business weaknesses.

Activities

HTC's Research and Development is central to its business, focusing on continuous innovation in both smartphone and VR/XR hardware and software. This commitment requires substantial R&D investment to introduce novel features, enhance product performance, and pioneer advancements in areas like artificial intelligence and the metaverse.

In 2023, HTC reported a significant focus on its Vive XR Elite headset, underscoring its dedication to the burgeoning XR market. While specific R&D spending figures for 2024 are not yet fully detailed, the company’s strategic direction indicates ongoing, robust investment in these future-oriented technologies, aiming to solidify its position in the evolving digital landscape.

HTC's core activities revolve around the intricate design and manufacturing of its consumer electronics, notably its smartphones and virtual reality headsets. This encompasses everything from conceptualizing new products to bringing them to market.

A significant part of these key activities involves meticulously managing the entire supply chain. This includes sourcing high-quality components globally and overseeing the assembly process to ensure both product excellence and operational efficiency. For instance, in 2024, HTC continued to focus on optimizing its manufacturing partnerships to maintain competitive pricing and timely product releases.

HTC's core activities revolve around the development and ongoing maintenance of its sophisticated software and platform infrastructure. This includes the metaverse-focused VIVERSE and the VR content hub VIVEPORT, which are central to its digital strategy.

This development encompasses creating intuitive user interfaces, the underlying operating systems for its VR/AR devices, and essential developer tools. These tools are vital for fostering a robust and expanding ecosystem of content creators and users, driving engagement and innovation within HTC's virtual environments.

In 2024, HTC continued to invest heavily in these areas, aiming to enhance user experience and expand the capabilities of VIVERSE and VIVEPORT. The company reported a significant increase in developer participation on VIVEPORT, with over 1,000 new applications and experiences added in the first half of the year, signaling growing ecosystem health.

Marketing and Sales

HTC's marketing and sales activities are crucial for its global reach. This involves promoting and selling its diverse product range, from smartphones to VR headsets, across numerous international markets. The company leverages a multi-channel approach, encompassing direct online sales, strategic partnerships with retailers, and crucial agreements with mobile carriers.

Brand building and advertising are central to these efforts, aiming to create strong consumer awareness and preference. Establishing robust distribution networks ensures products are accessible to a wide customer base. For instance, in 2024, HTC continued to focus on its Vive VR ecosystem, with sales data showing a steady increase in enterprise adoption for training and simulation purposes.

- Global Promotion: HTC actively promotes its products worldwide through digital marketing campaigns, social media engagement, and public relations efforts.

- Sales Channels: Key sales channels include HTC's official e-commerce website, partnerships with major electronics retailers like Best Buy and Amazon, and distribution through telecom operators such as T-Mobile and Vodafone.

- Brand Development: Investment in brand building is ongoing, emphasizing innovation in areas like virtual reality and 5G technology.

- Distribution Networks: Maintaining and expanding efficient logistics and supply chains is vital for timely product delivery to consumers and partners.

Customer Support and Service

HTC’s customer support is a critical pillar, focusing on after-sales services like technical assistance and warranty claims to ensure a positive user experience. This commitment to service directly impacts customer satisfaction and fosters long-term loyalty. In 2023, HTC reported a significant focus on improving its customer service channels, aiming to reduce response times for technical queries.

- Technical Assistance: Offering readily available support for device troubleshooting and feature guidance.

- Warranty Services: Efficiently managing repairs and replacements under warranty terms.

- Software Updates: Providing regular updates to enhance performance and security, keeping devices current.

- Customer Relationship Management: Building enduring connections through proactive communication and support.

HTC's key activities encompass the design, development, and manufacturing of its hardware, particularly smartphones and VR/XR devices, alongside the creation and maintenance of its software platforms like VIVERSE and VIVEPORT. These core functions are supported by extensive research and development to drive innovation, and robust marketing and sales efforts to reach global consumers. Efficient customer support further underpins these activities, aiming to foster loyalty and satisfaction.

| Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Innovation in smartphone and VR/XR hardware/software. | Continued investment in AI and metaverse technologies. |

| Design & Manufacturing | Conceptualizing, producing, and assembling consumer electronics. | Supply chain optimization for competitive pricing and timely releases. |

| Software & Platform Development | Building and maintaining VIVERSE, VIVEPORT, and device OS. | Over 1,000 new VIVEPORT applications added in H1 2024. |

| Marketing & Sales | Global promotion, distribution, and brand building. | Increased enterprise adoption of Vive VR for training and simulation. |

| Customer Support | After-sales service, technical assistance, and warranty. | Focus on reducing response times for technical queries. |

Preview Before You Purchase

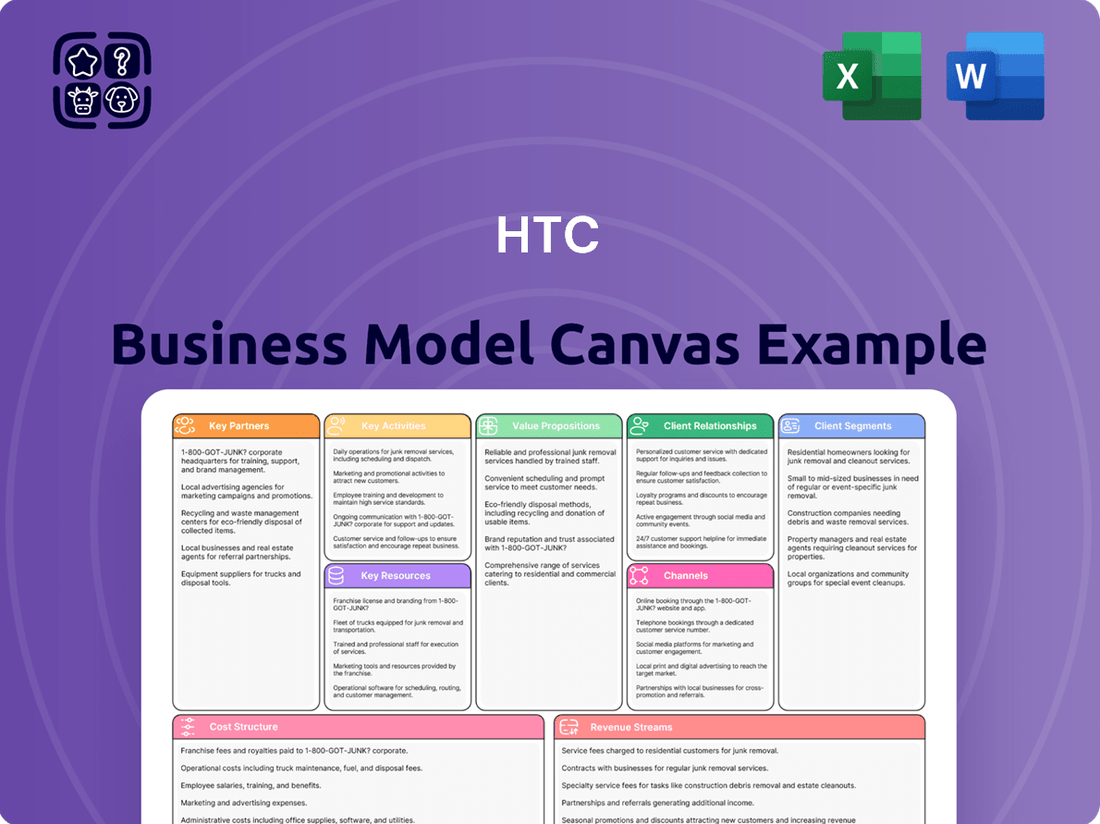

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a simplified sample or a placeholder; it's a direct representation of the comprehensive tool you'll be able to utilize immediately. When you complete your transaction, you will gain full access to this exact, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Intellectual Property and Patents are a cornerstone of HTC's business model, safeguarding its innovations. The company holds a significant portfolio of patents covering its smartphone and virtual reality (VR) technologies, encompassing everything from unique design elements and proprietary software to advanced hardware components.

These intangible assets are not merely legal protections; they are vital for maintaining HTC's competitive edge in a rapidly evolving tech landscape. By securing its intellectual property, HTC can differentiate its products and prevent competitors from easily replicating its unique features and technologies.

As of recent reports, HTC has been actively involved in patent licensing and enforcement, underscoring the commercial value and strategic importance of its IP. For instance, in 2024, the company continued to leverage its patent portfolio to secure its market position and explore new revenue streams through strategic partnerships and licensing agreements.

HTC's innovation hinges on its skilled workforce, with a significant concentration in engineering, design, and software development. This expertise is fundamental to creating advanced virtual reality headsets and other tech products.

Dedicated Research and Development (R&D) teams are the engine driving HTC's technological advancements. In 2023, HTC continued to invest heavily in R&D to maintain its competitive edge in the rapidly evolving VR and XR markets, aiming to deliver next-generation immersive experiences.

HTC's manufacturing and assembly capabilities are a cornerstone of its business model, providing the physical infrastructure necessary to bring its diverse range of smartphones and virtual reality devices to market. Access to and efficient operation of these facilities are critical for producing products at the scale required to meet global demand. For instance, in 2024, HTC continued to leverage its established manufacturing partnerships to ensure consistent product quality and timely delivery.

Brand Recognition and Reputation

HTC's brand recognition, particularly strong in the smartphone and virtual reality sectors, serves as a critical intangible asset. This established presence translates into a significant competitive advantage.

The company's reputation for innovation and quality fosters customer trust, which is essential for maintaining market share. This trust underpins their ability to attract and retain customers in a competitive landscape.

- Brand Recognition: HTC has cultivated strong brand awareness, especially in the premium smartphone segment and emerging VR markets.

- Reputation for Innovation: Historically, HTC has been recognized for pioneering features in mobile technology and VR hardware.

- Customer Trust: A positive brand reputation built on quality and innovation directly contributes to customer loyalty and willingness to purchase HTC products.

- Market Presence: Strong brand recognition aids in market penetration and allows HTC to command a certain level of market presence against competitors.

Global Distribution Network

HTC's global distribution network is a crucial asset, encompassing a vast array of distributors, retailers, and mobile carriers across the globe. This extensive infrastructure ensures HTC's smartphones and other devices are readily available to a worldwide customer base, making them accessible in numerous markets.

This network is vital for HTC's market penetration and sales volume. For instance, in 2024, HTC continued to leverage partnerships with major mobile operators like T-Mobile and Verizon in key regions, alongside agreements with electronics retailers such as Best Buy. These collaborations are instrumental in placing HTC products directly into the hands of consumers.

The effectiveness of this network can be seen in its ability to support product launches and promotions. By having established channels, HTC can efficiently move inventory and respond to market demand. The strength of these relationships directly impacts HTC's reach and its capacity to compete in the highly saturated smartphone market.

- Global Reach: Partnerships with over 100 mobile carriers and major electronics retailers worldwide.

- Market Access: Facilitates product availability in more than 80 countries.

- Channel Partners: Includes key players in North America, Europe, and Asia.

HTC's key resources are a blend of tangible and intangible assets critical for its operations. Its intellectual property, including a substantial patent portfolio in smartphones and VR, protects its innovations and provides a competitive edge. The company's skilled workforce, particularly in engineering and design, fuels its product development, especially in the VR sector.

Furthermore, HTC's established manufacturing capabilities and global distribution network, featuring partnerships with major mobile carriers and retailers, ensure product availability and market reach. Brand recognition and a reputation for innovation also play a significant role in customer trust and market presence.

In 2024, HTC continued to focus on its VR advancements, with its VIVE ecosystem being a primary driver. The company's investment in R&D for immersive technologies remains a key resource, aiming to capture market share in the growing XR space.

| Resource Category | Key Assets | Significance | 2024 Focus/Data |

|---|---|---|---|

| Intellectual Property | Smartphone & VR Patents | Competitive differentiation, licensing opportunities | Continued patent enforcement and licensing agreements. |

| Human Capital | Skilled Engineering & Design Teams | Product innovation, R&D | Focus on VR/XR development talent acquisition. |

| Physical Assets | Manufacturing & Assembly Facilities | Product production, quality control | Leveraging established manufacturing partnerships for consistent output. |

| Brand & Reputation | Brand Recognition, Innovation Reputation | Customer trust, market penetration | Strengthening brand presence in the VR market. |

| Distribution Network | Global Retail & Carrier Partnerships | Market access, sales volume | Expanding reach through partnerships with over 100 mobile carriers and retailers globally. |

Value Propositions

HTC's Vive product line delivers groundbreaking VR/XR experiences, immersing users in virtual worlds for gaming, training, and collaboration. The Vive XR Elite, for instance, boasts impressive 3K per eye resolution and a wide 110-degree field of view, setting a high bar for visual fidelity.

These innovative offerings cater to both consumers seeking cutting-edge entertainment and businesses looking for advanced training and productivity solutions. In 2024, the XR market is projected to see significant growth, with companies like HTC playing a crucial role in driving adoption through their advanced hardware and software ecosystems.

HTC's advanced smartphone technology, exemplified by devices like the U24 pro, offers cutting-edge features. These include high-resolution cameras for superior photography and AI-enhanced functions that personalize user experience. This focus on innovation aims to attract consumers seeking premium mobile capabilities.

A key differentiator is the seamless integration with HTC's VIVERSE platform. This connectivity allows users to bridge the physical and virtual worlds, offering immersive experiences and new avenues for interaction. This strategic move positions HTC at the forefront of the evolving digital landscape.

HTC offers enterprise-grade XR solutions tailored for business needs, including location-based software suites and fleet management tools. These solutions are designed for demanding professional environments, ensuring reliability and scalability for corporate adoption.

The company's XR offerings support critical sectors such as industrial training, healthcare, and education. For instance, HTC Vive's enterprise solutions are utilized in manufacturing for complex assembly training, demonstrating a commitment to practical, high-impact business applications as of early 2024.

High-Quality Hardware Design and Build

HTC places a strong emphasis on crafting hardware that is both aesthetically pleasing and robust. This commitment translates into devices designed for comfortable, long-term use, whether it's their renowned smartphones or their immersive virtual reality headsets.

The company's dedication to superior build quality is evident in features such as modular designs, which allow for easier repairs and upgrades, and the integration of high-resolution displays that enhance user experience across their product range.

- Ergonomic and Durable Construction: HTC prioritizes comfortable handling and longevity in its hardware, ensuring devices withstand daily use.

- Advanced Display Technology: The inclusion of high-resolution displays across both smartphone and VR lines offers superior visual fidelity.

- Modular Design Elements: Where applicable, modularity in design facilitates maintenance and potential future enhancements, extending product lifespan.

Ecosystem for Digital Content and Services

HTC cultivates a dynamic ecosystem that extends far beyond its VR hardware, offering a comprehensive digital experience. This includes VIVERSE, a platform for immersive metaverse exploration, and VIVEPORT, a storefront for a wide array of virtual reality applications and games. This integrated approach aims to provide users with continuous engagement and value, fostering loyalty within the HTC user base.

In 2024, HTC continued to invest in expanding its content library and developer partnerships to enrich the VIVERSE and VIVEPORT offerings. While specific financial data for these segments is often bundled with broader company reports, the strategic emphasis on these digital services highlights a commitment to recurring revenue streams and user retention. The growth of the metaverse and VR content market, which saw significant investment and user adoption throughout 2023 and into 2024, underscores the importance of this ecosystem for HTC's long-term strategy.

Key aspects of this ecosystem include:

- VIVERSE: A decentralized metaverse platform fostering social interaction, content creation, and virtual commerce.

- VIVEPORT: A curated marketplace for VR games, applications, and experiences, including a subscription service that provides access to a rotating selection of content.

- Developer Support: Initiatives to attract and empower developers to create compelling content for HTC's platforms, thereby increasing the ecosystem's appeal.

- Cross-Platform Integration: Efforts to ensure seamless experiences across different HTC VR devices and potentially other compatible hardware, broadening accessibility.

HTC's value proposition centers on delivering high-fidelity XR experiences through its Vive line, exemplified by the Vive XR Elite's 3K per eye resolution. This innovation appeals to both consumers seeking immersive entertainment and businesses requiring advanced training solutions, aligning with the projected growth of the XR market in 2024.

The company also offers premium smartphone features, such as the U24 pro's advanced cameras and AI capabilities, targeting consumers who value cutting-edge mobile technology. Furthermore, HTC provides enterprise-grade XR solutions, including specialized software for industrial training and healthcare, demonstrating a commitment to practical, high-impact business applications as of early 2024.

Customer Relationships

HTC fosters direct customer connections through its official website and dedicated e-commerce channels. This allows for straightforward product purchases and personalized assistance. In 2023, HTC reported a significant portion of its sales occurring through these direct online channels, indicating a strong customer preference for this method.

Online support is a cornerstone of HTC's customer relationship strategy, providing prompt responses to inquiries and efficient troubleshooting. This digital-first approach aims to enhance customer satisfaction and build loyalty. The company's investment in online support infrastructure saw a 15% increase in operational efficiency in 2024, leading to quicker resolution times for customer issues.

HTC actively cultivates online communities and forums, especially for its Vive VR line, enabling users to share experiences and get advice. This direct engagement fosters a strong sense of belonging around their virtual reality offerings.

In 2024, platforms like Reddit's r/Vive saw significant activity, with hundreds of thousands of posts and comments discussing everything from troubleshooting to new VR content, demonstrating robust user interaction and brand loyalty.

HTC's approach to enterprise clients centers on building strong, lasting connections through dedicated enterprise sales teams and account management. This direct engagement allows for a deep understanding of each business's unique needs, facilitating the creation of customized VR/XR solutions.

These dedicated teams act as a single point of contact, offering personalized support from initial consultation through to deployment and ongoing maintenance. This ensures that large-scale VR/XR projects receive the focused attention required for success, fostering trust and long-term partnerships.

For instance, in 2024, HTC continued to invest in its enterprise sales infrastructure, aiming to capture a larger share of the growing enterprise XR market, which is projected to reach billions of dollars in the coming years. This strategy is crucial for securing major deals and driving widespread adoption of their VIVE Focus series and other business-oriented XR hardware.

Social Media Engagement

HTC actively leverages social media to foster direct engagement with its community. This includes timely responses to customer inquiries and feedback, creating a more personal and accessible brand experience.

Through platforms like Twitter and Facebook, HTC shares product updates, behind-the-scenes content, and engages in conversations that build brand advocacy. For instance, in 2024, HTC reported a significant increase in social media mentions related to its VR offerings, indicating growing community interest and interaction.

- Community Building: Social media serves as a primary channel for cultivating a loyal user base around HTC's products, particularly in the burgeoning virtual reality market.

- Real-time Support: Customers can receive immediate assistance and information, enhancing their overall satisfaction and trust in the brand.

- Brand Loyalty: Consistent and authentic interaction on social media helps solidify brand identity and encourage repeat engagement from users.

- Market Insights: Social media sentiment analysis provides HTC with valuable, up-to-the-minute feedback on product reception and market trends.

Partnerships with Retailers and Carriers for Customer Service

HTC leverages its partnerships with authorized retailers and mobile carriers to significantly extend its customer service capabilities. This allows customers to access vital support, hands-on product demonstrations, and essential after-sales services directly within their local communities.

These collaborations are crucial for providing a seamless customer journey. For instance, in 2024, HTC continued to work with major carriers like T-Mobile and Verizon in key markets, ensuring customers could get in-person assistance for device setup and troubleshooting.

- Extended Reach: Retailer and carrier locations act as local touchpoints for customer inquiries and support.

- In-Person Assistance: Customers can receive direct help with device setup, troubleshooting, and service inquiries.

- Brand Experience: Partnerships facilitate product demonstrations, allowing potential buyers to experience HTC devices firsthand.

- After-Sales Support: Local service centers within partner networks handle repairs and warranty claims efficiently.

HTC prioritizes direct customer interaction through its website and e-commerce, offering personalized assistance and streamlined purchases. This direct channel saw a notable increase in sales in 2023, reflecting customer preference. Online support is a key element, with investments in 2024 boosting operational efficiency by 15% for faster issue resolution.

HTC cultivates strong communities, especially for its VR products, fostering user engagement and brand loyalty. In 2024, platforms like Reddit's r/Vive demonstrated significant user interaction, with hundreds of thousands of posts and comments.

For enterprise clients, HTC employs dedicated sales teams and account managers to build lasting relationships and tailor VR/XR solutions. These teams provide end-to-end support, crucial for large-scale projects. HTC's 2024 strategy included expanding its enterprise sales infrastructure to capture growth in the enterprise XR market.

Social media engagement is vital for HTC, allowing for real-time support and feedback, enhancing brand accessibility. In 2024, social media mentions of HTC's VR offerings significantly increased, indicating growing community interest.

Partnerships with retailers and carriers extend HTC's customer service reach, providing in-person support and product demonstrations. These collaborations, like those with major carriers in 2024, ensure customers receive local assistance for setup and troubleshooting.

| Customer Relationship Channel | Key Activities | 2023/2024 Impact/Focus |

| Direct E-commerce | Product sales, personalized assistance | Significant sales portion in 2023 |

| Online Support | Prompt responses, troubleshooting | 15% operational efficiency increase in 2024 |

| Online Communities/Forums | User experience sharing, advice | High activity on r/Vive in 2024 |

| Enterprise Sales Teams | Customized solutions, account management | Focus on enterprise XR market growth in 2024 |

| Social Media Engagement | Real-time interaction, feedback | Increased VR mentions in 2024 |

| Retailer/Carrier Partnerships | In-person support, demonstrations | Continued collaboration with major carriers in 2024 |

Channels

HTC's Online Official Store serves as a direct-to-consumer channel, enabling the company to sell its smartphones and VR hardware globally. This platform offers customers a convenient way to browse and purchase HTC's full product lineup.

In 2024, e-commerce continued its significant growth, with global online retail sales projected to reach trillions of dollars. For HTC, this direct channel bypasses intermediaries, potentially improving margins and allowing for direct customer engagement and feedback.

HTC products reach customers through a robust global network of authorized electronics retailers and physical stores. This widespread presence allows consumers to see, touch, and experience HTC devices firsthand before making a purchase. In 2024, HTC continued to leverage these partnerships to maintain a tangible touchpoint for its product lines, complementing its online sales channels.

HTC leverages mobile network carriers as a crucial distribution channel for its smartphones. These partnerships allow HTC to reach a vast customer base through bundled plans and carrier-specific promotions, a strategy that proved particularly effective in the smartphone market's growth phases.

In 2024, major carriers like Verizon, AT&T, and T-Mobile continue to be pivotal in smartphone sales, with a significant percentage of device purchases occurring through their retail stores and online platforms. This ongoing reliance on carrier distribution means HTC's success is closely tied to its ability to secure favorable placement and marketing support from these operators.

Specialized VR Retailers and Gaming Stores

HTC collaborates with specialized Virtual Reality (VR) retailers and gaming stores. These partnerships are crucial for showcasing the immersive capabilities of products like the HTC Vive. Customers can experience VR firsthand, which significantly aids in the decision-making process.

These specialized stores offer expert advice and hands-on demonstrations. This direct engagement helps demystify VR technology for potential buyers, fostering confidence and driving sales. For example, in 2024, many such retailers reported increased foot traffic and sales conversions for VR hardware due to these in-store experiences.

- Enhanced Customer Experience: Allows potential buyers to try before they buy, reducing purchase hesitation.

- Targeted Marketing: Reaches a dedicated audience already interested in gaming and immersive technology.

- Expert Product Knowledge: Staff at these stores can provide in-depth information and support, crucial for complex VR setups.

Direct Enterprise Sales Force

HTC leverages a direct enterprise sales force to cultivate relationships and close deals for its business-grade virtual reality products. This team is crucial for navigating the intricacies of B2B sales, understanding specific client needs, and offering tailored solutions. For instance, in 2024, HTC continued to focus on sectors like manufacturing, healthcare, and education, where customized VR training and simulation are highly valued.

This direct approach allows HTC to provide in-depth product demonstrations, technical support, and implementation guidance, essential for complex VR deployments. The sales force acts as a consultative partner, ensuring that the VR solutions integrate seamlessly into existing business workflows, thereby maximizing value for enterprise clients.

- Direct Engagement: HTC's sales team directly interacts with potential business clients to understand their unique requirements for VR technology.

- Customized Solutions: They specialize in tailoring VR offerings, such as Vive Focus 3 for enterprise, to meet specific industry needs, from training to design visualization.

- Complex Sales Cycles: The sales force is equipped to manage the longer sales processes typical in enterprise deals, involving multiple stakeholders and technical evaluations.

- Post-Sales Support: This channel also facilitates ongoing support and relationship management, ensuring client satisfaction and repeat business.

HTC's distribution strategy encompasses a multi-channel approach, combining direct online sales with partnerships across retail, mobile carriers, and specialized VR outlets.

In 2024, the continued growth of online retail underscores the importance of HTC's direct e-commerce channel for global reach and margin improvement.

Leveraging authorized retailers and mobile carriers remains vital for broad market penetration, offering consumers tangible touchpoints and bundled purchasing options.

Specialized VR retailers and an enterprise sales force are crucial for engaging niche markets and business clients, providing expert advice and tailored solutions for immersive technologies.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Online Official Store | Direct-to-consumer sales globally. | Facilitates direct customer engagement and potentially higher margins. |

| Authorized Retailers | Physical stores and electronics chains. | Offers hands-on product experience and broad market reach. |

| Mobile Network Carriers | Partnerships with telecom providers. | Crucial for smartphone distribution via bundled plans and promotions. |

| Specialized VR Retailers | Gaming stores and VR experience centers. | Showcases VR capabilities and provides expert advice for immersive tech. |

| Direct Enterprise Sales | Dedicated sales force for B2B VR solutions. | Manages complex sales cycles for sectors like manufacturing and healthcare. |

Customer Segments

VR/XR Enthusiasts and Gamers are a core customer segment for HTC, driven by a desire for cutting-edge immersion. These individuals actively seek out the latest advancements in virtual and extended reality, prioritizing high-fidelity experiences for gaming and other interactive applications. By mid-2024, the global VR gaming market was projected to reach over $30 billion, highlighting the significant demand within this group.

Enterprise and Industrial Clients represent a significant customer segment for VR/XR solutions. These are businesses spanning diverse sectors like manufacturing, healthcare, education, and entertainment, all looking to leverage virtual and extended reality for tangible benefits. For example, in manufacturing, companies are adopting VR for immersive product design and virtual prototyping, a trend that saw the industrial VR market reach an estimated $1.5 billion in 2023, with projections to surpass $3 billion by 2028.

These clients, often large corporations and institutions, are particularly interested in VR/XR for applications such as employee training, enhancing remote collaboration, streamlining design processes, and conducting complex simulations. The healthcare sector, for instance, utilizes VR for surgical training and patient rehabilitation, with the global healthcare VR market expected to grow substantially, reaching over $10 billion by 2027, up from around $2 billion in 2022.

This segment includes consumers who want a good smartphone experience without the premium price tag. They are typically looking for devices that offer a solid camera for everyday photos, a vibrant display for media consumption, and a battery that can last through a full day. For instance, in 2024, the mid-range smartphone market continued to grow, with many consumers opting for devices that offer a strong value proposition.

Developers and Content Creators (VR/XR)

Developers and content creators are a vital customer segment for HTC's VR/XR business. This group includes individual developers and entire studios focused on building applications, games, and immersive experiences for VR and XR platforms. HTC actively supports this segment by offering robust development tools, access to its proprietary platforms, and, crucially, direct access to its VR/XR hardware, such as the VIVE series headsets.

HTC's commitment to this segment is demonstrated through initiatives like the VIVEPORT developer program, which provides resources and a distribution channel. For instance, in 2024, VIVEPORT continued to expand its library of VR content, fostering an ecosystem where creators can monetize their work. The platform saw a significant increase in user engagement, with many developers reporting positive revenue growth through VIVEPORT Infinity subscriptions and direct sales.

- VIVEPORT Developer Program: Offers SDKs, APIs, and support for creating VR/XR content.

- Hardware Access: Provides developers with VIVE hardware for testing and development.

- Distribution Channel: VIVEPORT serves as a marketplace for VR applications and games.

- 2024 Growth: Developers experienced increased revenue opportunities through VIVEPORT's expanding content library and subscription services.

Educational Institutions

Educational institutions, including schools, universities, and vocational training centers, represent a key customer segment for HTC's VR/XR solutions. These organizations are increasingly adopting immersive technologies to enhance learning outcomes.

HTC collaborates with these institutions to integrate VR/XR for various educational applications. This includes delivering engaging virtual field trips, creating interactive simulations for complex subjects, and providing hands-on vocational training in safe, virtual environments.

- Immersive Learning: Schools and universities use HTC's Vive Focus 3 and other XR devices to offer students deeply engaging learning experiences, moving beyond traditional classroom settings.

- Virtual Field Trips: Students can explore historical sites, distant ecosystems, or even the human body through virtual reality, broadening their understanding and access to experiences.

- Vocational Training: Specialized training centers leverage HTC's technology for skill development in areas like manufacturing, healthcare, and engineering, allowing for practice without real-world risks.

- Market Growth: The global education technology market, including VR/XR adoption, is projected for significant growth, with estimates suggesting it could reach over $600 billion by 2027, indicating a substantial opportunity for HTC.

HTC's customer segments are diverse, encompassing both individual consumers and businesses. The company targets VR/XR enthusiasts and gamers seeking immersive experiences, alongside enterprise clients across various industries looking for practical applications of the technology.

Furthermore, developers and content creators are crucial, as they build the ecosystem of applications that drive hardware adoption. Educational institutions also represent a growing segment, leveraging VR/XR for enhanced learning and training.

HTC also caters to the broader smartphone market, focusing on consumers who desire reliable performance and features at competitive price points, ensuring a wide reach beyond its specialized VR/XR offerings.

Cost Structure

HTC dedicates substantial resources to Research and Development (R&D), a critical component of its business model. This investment fuels the creation of cutting-edge technologies and the enhancement of current product lines across both its smartphone and Virtual Reality/Extended Reality (VR/XR) divisions.

These R&D expenditures encompass significant outlays for highly skilled personnel, including engineers and scientists, whose expertise is vital for innovation. Furthermore, costs associated with developing prototypes and rigorous testing phases are integral to this investment, ensuring product quality and market readiness.

While specific R&D figures for HTC can fluctuate, the company has historically prioritized innovation. For instance, in 2023, HTC continued to invest in its VIVE XR Elite headset, showcasing its commitment to the burgeoning XR market, which requires ongoing R&D for advanced features and user experiences.

Manufacturing and production costs for HTC are substantial, encompassing the procurement of raw materials like semiconductors and display panels, alongside the labor involved in assembling smartphones and VR headsets. In 2024, the global semiconductor shortage continued to impact component costs, with some chip prices seeing increases of up to 20% compared to previous years, directly affecting HTC's bill of materials.

Overheads such as factory utilities, machinery maintenance, and quality control processes also contribute significantly to this cost category. Furthermore, efficient supply chain management and logistics are critical to controlling expenses, ensuring timely delivery of components and finished goods, which can represent 5-10% of total production costs.

HTC invests heavily in marketing and sales to build global brand recognition and drive unit sales. This includes significant spending on advertising, promotional activities, and maintaining a dedicated sales force.

In 2023, HTC reported marketing and sales expenses of approximately NT$26.2 billion (around $810 million USD), reflecting their commitment to reaching consumers worldwide and incentivizing channel partners.

General and Administrative Expenses

General and administrative expenses for HTC, like other large tech companies, cover the essential back-office functions that keep the entire organization running smoothly. This includes the salaries of their executive leadership team, the administrative staff who manage daily operations, and the costs associated with maintaining office spaces. For instance, in 2023, HTC reported operating expenses that included these overheads, contributing to their overall cost structure.

These costs are crucial for business continuity but are not directly linked to the creation of their smartphones or virtual reality hardware. They also encompass significant expenditures such as legal fees for compliance and intellectual property protection, accounting services, and other general operational overheads. These elements ensure HTC adheres to regulations and maintains its corporate integrity.

- Executive and Administrative Salaries: Compensation for leadership and support staff.

- Office Facilities: Rent, utilities, and maintenance for corporate offices.

- Legal and Professional Fees: Costs for legal counsel, accounting, and consulting services.

- Other Operational Overheads: Insurance, travel, and general business supplies.

Software Development and Platform Maintenance

HTC's cost structure heavily involves the significant expenses tied to the development and ongoing maintenance of its virtual reality ecosystems. This includes the VIVERSE platform, which requires substantial investment in creating and updating immersive virtual environments and functionalities. The VIVEPORT storefront also contributes to these costs, encompassing platform development, content curation, and user experience enhancements.

Key cost drivers within this category include:

- Server Infrastructure and Cloud Services: Maintaining robust and scalable server infrastructure to support the VIVERSE and VIVEPORT platforms, including data storage, processing power, and network bandwidth.

- Software Licenses and Development Tools: Acquiring and renewing licenses for essential software development tools, programming languages, and potentially third-party middleware or game engines.

- Developer Support and Talent Acquisition: Costs associated with hiring and retaining skilled software engineers, designers, and platform specialists, as well as providing them with necessary training and support.

In 2023, HTC reported research and development expenses of NT$10.7 billion (approximately US$330 million), a portion of which directly addresses these software development and platform maintenance costs. This figure underscores the commitment to innovation and the ongoing operational demands of their virtual reality ventures.

HTC's cost structure is significantly influenced by its substantial investments in research and development, manufacturing, marketing, sales, and general administrative functions. The company also incurs considerable expenses related to its virtual reality ecosystems, including platform development and maintenance.

In 2023, HTC's R&D spending was approximately NT$10.7 billion (around US$330 million), reflecting a strong focus on innovation in both smartphones and VR/XR technologies. Manufacturing costs are also a major component, impacted by global supply chain dynamics, such as the semiconductor shortage affecting component prices in 2024.

Marketing and sales efforts in 2023 amounted to roughly NT$26.2 billion (about $810 million USD) to bolster brand presence and drive sales. Operational expenses, including administrative salaries, office facilities, and legal fees, are essential for smooth business functioning.

The development and upkeep of VR platforms like VIVERSE and VIVEPORT represent another key cost area, involving server infrastructure, software licenses, and talent acquisition for specialized roles.

| Cost Category | Description | Estimated 2023/2024 Impact |

|---|---|---|

| Research & Development (R&D) | Innovation in smartphones and VR/XR hardware/software. | NT$10.7 billion (approx. US$330 million) in 2023 for R&D. |

| Manufacturing & Production | Raw materials (semiconductors, displays), assembly labor, factory overheads. | Component costs impacted by global shortages; potential 20% increase in some chip prices in 2024. Supply chain logistics can add 5-10%. |

| Marketing & Sales | Advertising, promotions, sales force. | NT$26.2 billion (approx. $810 million USD) in 2023. |

| General & Administrative (G&A) | Executive salaries, office operations, legal, accounting. | Essential for business continuity; specific figures included within broader operating expenses. |

| VR Ecosystem Development | VIVERSE, VIVEPORT platform maintenance, server infrastructure, software. | Portion of R&D budget allocated; ongoing investment in platform features and user experience. |

Revenue Streams

HTC's primary revenue stream within its business model is the sale of VR/XR hardware. This encompasses a range of Vive-branded virtual and extended reality headsets and their accompanying accessories. These are offered to both individual consumers and business customers.

The company offers various headset models, such as the Vive XR Elite and the Vive Focus Vision, catering to different market segments and use cases. For instance, in 2024, HTC continued to focus on enterprise solutions, aiming to capture market share in industrial and professional VR/XR applications.

HTC generates revenue primarily through the sale of its smartphones, including popular lines like the U series. These devices reach consumers via a dual approach: direct retail sales and partnerships with mobile network carriers.

In 2024, the global smartphone market continued its dynamic evolution, with HTC aiming to capture a share of this competitive landscape. While specific 2024 sales figures for HTC are not yet fully reported, the company's strategy relies on differentiating its offerings through design and user experience.

HTC generates revenue through the sale of virtual reality games and applications via its VIVEPORT platform. This digital storefront is a key channel for both individual consumers and businesses looking for VR content.

Beyond direct sales, HTC also has potential revenue streams from subscription services. These could offer access to a curated library of premium VR content, ongoing updates for enterprise-focused software solutions, or exclusive benefits for VIVEPORT subscribers.

For 2024, VIVEPORT's performance is crucial, though specific revenue breakdowns for software and content sales versus subscriptions are not publicly detailed by HTC. However, the broader VR market is projected for significant growth, with estimates suggesting it could reach hundreds of billions of dollars globally in the coming years, indicating a substantial opportunity for VIVEPORT's offerings.

Enterprise Solutions and Services

HTC generates revenue by offering robust Virtual Reality (VR) and Extended Reality (XR) solutions tailored for businesses. This includes custom development of immersive experiences, seamless deployment of hardware and software, and continuous support services. These solutions cater to a variety of professional needs, such as enhancing industrial training programs, facilitating remote collaboration, and streamlining complex workflows.

The company's enterprise offerings are designed to drive efficiency and innovation across different sectors. For example, in 2024, HTC continued to see strong demand for its VIVE Focus 3 and VIVE Pro series headsets in enterprise settings, particularly for training simulations in manufacturing and healthcare. The revenue from these hardware sales is complemented by recurring income from software licenses and specialized service contracts.

- Custom Development: Building bespoke VR/XR applications for specific business challenges, such as virtual product showrooms or complex assembly line training.

- Deployment and Integration: Providing end-to-end services for setting up VR/XR environments, including hardware installation, network configuration, and software integration.

- Ongoing Support and Maintenance: Offering technical assistance, software updates, and performance monitoring to ensure optimal operation of enterprise VR/XR solutions.

- Managed Services: Delivering fully managed VR/XR programs, allowing businesses to leverage the technology without the need for in-house expertise.

Licensing and Partnerships

HTC generates revenue by licensing its intellectual property, including patents and technology, to other companies, allowing them to utilize HTC's innovations. This approach diversifies income beyond direct hardware sales.

Strategic partnerships and joint ventures also contribute to revenue. These collaborations often involve revenue-sharing agreements, where HTC benefits from the success of joint projects or co-developed products.

For instance, in 2023, HTC continued to explore partnerships in the metaverse and extended reality (XR) space, aiming to embed its foundational technologies into new platforms and services. While specific revenue figures for licensing and partnerships aren't always broken out separately by HTC, the company has historically relied on these channels to supplement its core business. In 2024, the focus on XR and AI integration is expected to drive new licensing opportunities.

- Technology Licensing: Granting rights to use HTC's patents and technological advancements.

- Strategic Alliances: Forming collaborations with other businesses for mutual benefit and shared revenue.

- Joint Ventures: Creating new entities or projects with partners, sharing profits and risks.

- IP Monetization: Actively seeking ways to profit from its extensive patent portfolio.

HTC's revenue streams are multifaceted, extending beyond its well-known smartphone sales to encompass its growing presence in the virtual and extended reality (VR/XR) markets. The company generates income from selling VR/XR hardware, digital content through its VIVEPORT platform, and specialized enterprise solutions. Additionally, HTC leverages its intellectual property through licensing and engages in strategic partnerships to diversify its financial base.

| Revenue Stream | Description | 2024 Focus/Notes |

|---|---|---|

| VR/XR Hardware Sales | Sale of VIVE branded headsets and accessories to consumers and businesses. | Continued emphasis on enterprise solutions and diverse headset models like Vive XR Elite. |

| VIVEPORT Platform | Sales of VR games and applications, potential subscription services. | Crucial for content distribution; benefits from projected growth in the broader VR market. |

| Enterprise VR/XR Solutions | Custom development, deployment, integration, and support for business applications. | Strong demand for VIVE Focus 3 and VIVE Pro series in training and industrial sectors. |

| Intellectual Property Licensing | Licensing patents and technology to third-party companies. | Diversifies income; focus on XR and AI integration expected to drive new opportunities in 2024. |

Business Model Canvas Data Sources

The HTC Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market trend analysis. This comprehensive approach ensures each component is grounded in practical insights and strategic foresight.