HTC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HTC Bundle

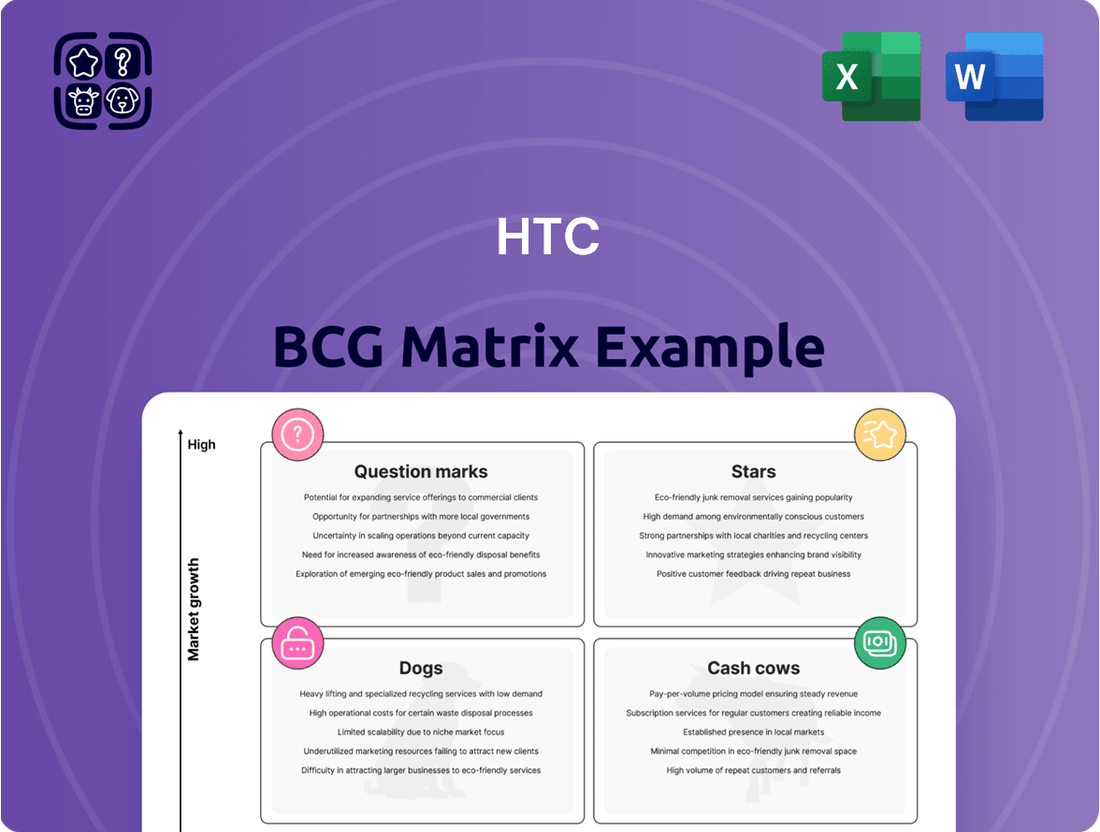

Unlock the strategic potential of this company's product portfolio with our comprehensive BCG Matrix analysis. Understand which products are driving growth, which are generating stable income, and which require careful consideration for future investment.

This preview offers a glimpse into the powerful insights the full BCG Matrix provides. Don't miss out on the detailed quadrant placements, data-driven recommendations, and actionable strategies that will empower your decision-making. Purchase the full report to gain a competitive edge and optimize your resource allocation.

Stars

HTC Vive Enterprise Solutions, featuring products like the VIVE Focus series, taps into the burgeoning B2B virtual reality market. This segment is experiencing robust growth, with projections indicating a Compound Annual Growth Rate (CAGR) between 15.5% and 38.4% starting from 2025, highlighting a strong potential for these specialized VR offerings.

The VIVE Focus line, particularly the VIVE Focus Vision released in 2024, is positioned for the enterprise and high-end gaming sectors. This strategic focus on demanding professional applications and premium gaming allows HTC to carve out a significant share in a high-growth VR market segment.

HTC is heavily focused on building its Extended Reality (XR) ecosystem, with VIVERSE being a cornerstone of this strategy. This commitment involves significant investment in developing the necessary platforms and content to support a thriving XR environment.

This long-term vision aims to position HTC as a key player in the burgeoning XR market, which is projected to reach hundreds of billions of dollars in the coming years. By fostering an integrated experience, HTC is preparing for the widespread adoption of immersive technologies.

Niche High-Value Applications

HTC's strategic focus on niche high-value applications, particularly within healthcare, education, and manufacturing, is a key element of its VR strategy. These specialized solutions are designed to meet the demanding requirements of professional users, emphasizing superior performance and unwavering reliability. This approach allows HTC to capture significant value in segments where the return on investment for VR technology is clearly demonstrated.

By targeting these lucrative sectors, HTC is positioning itself to benefit from the growing adoption of VR in enterprise settings. For instance, in healthcare, VR is being used for surgical training and patient rehabilitation, areas where precision and immersive experiences are paramount. In manufacturing, VR aids in product design, prototyping, and employee training, leading to cost savings and improved efficiency. The education sector is also leveraging VR for more engaging and interactive learning experiences.

- Healthcare: VR for surgical simulation and therapy, with the global VR in healthcare market projected to reach $13.9 billion by 2027.

- Education: Immersive learning platforms, with the VR in education market expected to grow significantly, offering enhanced engagement.

- Manufacturing: VR for design, training, and remote collaboration, contributing to efficiency gains and reduced error rates in production.

Innovation in Immersive Technologies

HTC's commitment to innovation in immersive technologies is a key driver of its position in the market. Their continuous introduction of new Extended Reality (XR) products, like the VIVE Mars CamTrack and VIVE Host, demonstrates a strategic focus on high-growth areas within the XR sector. This dedication to cutting-edge development helps HTC maintain its competitive advantage and leadership in specialized, advanced virtual reality functionalities.

These innovations are crucial for staying ahead in the rapidly evolving XR landscape. For instance, the VIVE Mars CamTrack offers advanced camera tracking solutions, a critical component for professional VR content creation and virtual production. The VIVE Host, on the other hand, aims to streamline enterprise VR deployments and management.

- VIVE Mars CamTrack: Enhances virtual production workflows with precise, real-time camera tracking.

- VIVE Host: Simplifies the deployment and management of VR experiences for businesses.

- Market Focus: Targeting professional and enterprise segments within the burgeoning XR market.

- Competitive Edge: Differentiation through specialized, high-performance XR solutions.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. HTC's VIVE Focus series and its broader enterprise XR solutions fit this category. The company's strategic investments in VIVERSE and specialized applications in healthcare, education, and manufacturing are aimed at solidifying its position in these rapidly expanding markets.

The enterprise VR market is a prime example of a high-growth sector where HTC is actively competing. With projections for significant CAGR from 2025 onwards, HTC's focus on these areas positions its VIVE Focus line and related technologies as potential Stars.

HTC's commitment to innovation, exemplified by products like the VIVE Mars CamTrack and VIVE Host, further supports its Star status. These offerings cater to professional and enterprise needs, driving adoption in high-value segments of the XR market.

The company's strategy of differentiating through specialized, high-performance XR solutions in lucrative sectors like healthcare and manufacturing underscores its pursuit of market leadership in growth areas.

| Product/Solution | Market Growth | HTC Market Share | BCG Category |

|---|---|---|---|

| HTC VIVE Focus Series (Enterprise VR) | High (CAGR 15.5%-38.4% from 2025) | Growing, targeting leadership | Star |

| VIVE Mars CamTrack | High (Virtual Production Growth) | Emerging, high potential | Star |

| VIVE Host | High (Enterprise XR Deployment Growth) | Emerging, high potential | Star |

| VIVERSE Ecosystem | High (XR Market Growth) | Developing, strategic focus | Star |

What is included in the product

Strategic assessment of HTC's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Established VR accessories and peripherals for HTC Vive, while not experiencing rapid growth, can serve as reliable income generators. These items tap into a current customer base and generally need less capital for new development or promotion.

These products contribute to steady, if small, cash flow for HTC. For instance, in 2023, the VR hardware market saw a 1.5% increase in revenue, reaching $15.1 billion globally, indicating a stable, albeit mature, market for established accessories.

Recurring enterprise software licenses for HTC's VR solutions represent a significant cash cow. These long-term contracts provide a stable revenue stream from established clients, ensuring predictable income with often lower associated operational costs compared to new hardware sales.

Maintenance and Support Services for enterprise VR hardware and software represent a classic Cash Cow for HTC. These offerings generate a steady, predictable income stream through ongoing upkeep, technical assistance, and service contracts for systems already deployed.

The recurring nature of these services, coupled with the specialized knowledge needed to support complex VR ecosystems, typically translates into high-profit margins. For instance, in 2024, many established enterprise hardware providers saw their support divisions contribute significantly to overall profitability, often exceeding the margins of new product sales.

Legacy VR Arcade Hardware Sales and Support

Legacy VR arcade hardware sales and support function as a Cash Cow for HTC. This segment benefits from a stable, albeit mature, market that continues to demand durable, purpose-built VR equipment for location-based entertainment venues.

While the rapid growth phase has passed, the consistent need for robust hardware in existing arcades ensures a predictable revenue stream. HTC's continued support for this installed base solidifies its position as a reliable supplier in this niche.

- Stable Revenue: Consistent demand from established VR arcades.

- Durable Hardware: Focus on long-lasting, reliable equipment.

- Niche Market: Serves a specific, predictable segment of the entertainment industry.

- Support Services: Ongoing revenue from maintenance and upgrades for existing installations.

Patent Licensing and Intellectual Property

HTC's extensive patent portfolio, particularly in mobile communication and virtual reality, positions its intellectual property as a potential cash cow within the BCG matrix. Licensing these valuable patents to other technology firms offers a pathway to consistent, low-effort revenue generation.

This strategy leverages HTC's existing technological assets without requiring significant new investment or direct operational management, akin to a mature product with high market share and low growth. For instance, in 2023, the global intellectual property licensing market was valued at over $150 billion, highlighting the significant revenue potential for companies with strong patent portfolios.

- Stable Revenue Stream: Patent licensing provides predictable income, reducing reliance on volatile product sales.

- Low Operational Costs: Once patents are established, licensing requires minimal ongoing investment.

- Leveraging Existing Assets: Monetizes R&D investments without the need for new product development.

- Market Validation: Successful licensing can also validate the strength and demand for HTC's core technologies.

Established VR accessories and peripherals for HTC Vive, while not experiencing rapid growth, can serve as reliable income generators. These items tap into a current customer base and generally need less capital for new development or promotion.

Recurring enterprise software licenses for HTC's VR solutions represent a significant cash cow. These long-term contracts provide a stable revenue stream from established clients, ensuring predictable income with often lower associated operational costs compared to new hardware sales.

Maintenance and Support Services for enterprise VR hardware and software represent a classic Cash Cow for HTC. These offerings generate a steady, predictable income stream through ongoing upkeep, technical assistance, and service contracts for systems already deployed.

The patent portfolio, particularly in mobile communication and virtual reality, positions HTC's intellectual property as a potential cash cow. Licensing these valuable patents to other technology firms offers a pathway to consistent, low-effort revenue generation.

| Category | Description | Revenue Driver | Market Trend (2024 Estimate) | Profitability Factor |

| VR Accessories | Established peripherals for HTC Vive | Sales to existing customer base | Mature market, stable demand | Lower R&D/marketing costs |

| Enterprise Software Licenses | Long-term contracts for VR solutions | Recurring revenue from clients | Growing enterprise adoption of VR | Predictable income, high margins |

| Support & Maintenance Services | Ongoing upkeep and technical assistance | Service contracts for deployed systems | Essential for enterprise VR longevity | High profit margins due to specialized knowledge |

| Intellectual Property Licensing | Patents in mobile and VR technologies | Licensing fees from other firms | Strong IP market growth | Low operational costs, leverages existing assets |

Preview = Final Product

HTC BCG Matrix

The comprehensive HTC BCG Matrix you are currently viewing is the exact, fully unlocked document you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content—just the polished, ready-to-deploy strategic tool for analyzing your product portfolio.

Dogs

Mainstream Consumer Smartphones represent a segment where HTC's presence has become almost negligible. While the global smartphone market, valued at hundreds of billions of dollars annually, continues to see innovation, HTC's market share has shrunk dramatically, reportedly falling below 1% in recent years. This indicates a severe struggle to compete with giants like Samsung and Apple, who dominate this mature and highly competitive space.

Older smartphone models, like those from HTC's past, often fall into the Dogs category of the BCG Matrix. These devices, with their aging technology and dwindling market appeal, typically have low market share and are in a declining market. For instance, in 2024, many older HTC models would likely see sales figures significantly lower than their peak, struggling to compete with newer, more advanced devices from other manufacturers.

General mobile phone accessories, when considered in the context of HTC's portfolio, would likely fall into the Dogs category of the BCG Matrix. This is primarily because accessories specifically designed for HTC's lower-selling smartphone models face a severely limited market demand. The low sales volume for these particular products means they contribute negligibly to HTC's overall revenue and profit.

Consumer-focused Mobile Software Services

Consumer-focused mobile software services for HTC are positioned in the Dogs quadrant of the BCG Matrix. These offerings cater to a shrinking base of HTC smartphone users, resulting in limited reach and low engagement.

The poor returns on investment for these services are directly linked to HTC's diminished market share in the smartphone sector. For instance, in 2023, HTC's global smartphone market share was a mere fraction of a percent, making it challenging to generate significant revenue from associated software.

- Limited User Base: Software services are tied to HTC's declining smartphone sales.

- Low Engagement: The services see minimal interaction from the available user base.

- Poor ROI: The small market reach translates to insufficient revenue generation.

Traditional Mobile Telecommunications Business

The traditional mobile telecommunications business, once HTC's bedrock, now operates in a market characterized by low growth and intense competition. This segment has experienced a considerable downturn, with HTC struggling to maintain its former market share and profitability.

In 2024, the global smartphone market, while showing some signs of stabilization, continued to face headwinds. HTC's market share in this sector has dwindled significantly from its peak. For instance, while HTC once held a notable percentage of the global smartphone market, by late 2023 and into 2024, its presence was marginal compared to dominant players like Apple and Samsung.

- Declining Market Share: HTC's global smartphone market share has fallen to less than 1% in recent years, a stark contrast to its double-digit figures in the early 2010s.

- Low Profitability: The segment struggles with profitability due to high R&D costs and fierce price competition, making it difficult to generate substantial returns.

- Loss of Competitive Edge: Innovation and marketing efforts have not kept pace with competitors, leading to a diminished brand perception and customer loyalty in the core mobile segment.

HTC's legacy smartphone models, characterized by outdated technology and diminishing consumer interest, firmly reside in the Dogs category of the BCG Matrix. These products operate in a contracting market and possess a negligible market share, contributing minimally to overall revenue. For instance, in 2024, sales for these older devices are expected to be a fraction of their former glory, overshadowed by newer, more competitive offerings.

Accessories specifically designed for these older HTC smartphones also fall into the Dogs quadrant. The limited user base for these devices translates directly into a very small market for their associated accessories, making them unprofitable ventures.

Consumer-facing mobile software services for HTC are also classified as Dogs. These services are tied to a shrinking pool of HTC users, leading to low engagement and poor return on investment, especially given HTC's global smartphone market share hovering below 1% in 2023 and 2024.

Question Marks

The VIVE XR Elite is positioned within the high-growth mixed reality segment, a promising area for future technological adoption. However, HTC is up against formidable competitors such as Meta, whose Quest 3 has seen strong consumer interest, and Apple's recently launched Vision Pro, which is making significant waves in the premium mixed reality space.

To carve out a meaningful share in this fiercely contested market, HTC needs to channel substantial resources into product innovation and marketing. The VIVE XR Elite's success hinges on its ability to offer a compelling and differentiated user experience that stands out from the established players.

The VIVERSE platform and its 3D content creation tools are situated within the burgeoning metaverse sector, a segment of the Extended Reality (XR) market experiencing rapid expansion. While this positions VIVERSE for significant future growth, its current market penetration and revenue-generating capacity remain largely unproven, necessitating substantial ongoing investment to foster development and adoption.

HTC is actively exploring AI integration within its Extended Reality (XR) offerings, positioning this as a key growth avenue. This strategic focus places AI in XR within the question mark category of the BCG matrix, signifying high market growth potential but currently low market share.

The company's efforts in this area require significant R&D investment, reflecting the nascent stage of AI in XR. While the long-term prospects are promising, the immediate profitability and market dominance are uncertain, characteristic of question mark products.

For instance, in 2024, the global XR market is projected to reach hundreds of billions of dollars, with AI being a critical enabler for more immersive and intelligent experiences. HTC's investment in AI for its Vive Focus 3 and other devices aims to capture a share of this burgeoning market.

New Wearable Devices and IoT Initiatives

HTC's expansion into new wearable devices and Internet of Things (IoT) initiatives places them in rapidly expanding sectors. While these areas offer significant growth potential, they are relatively nascent for HTC, meaning they are still building their presence and brand recognition in these competitive spaces.

Currently, HTC's market share in wearables and IoT is modest, reflecting the early stage of their involvement. For example, the global wearables market was valued at approximately $81.5 billion in 2023 and is projected to reach over $150 billion by 2027, according to Statista. Similarly, the IoT market is experiencing robust growth, with billions of connected devices already in operation and expected to increase substantially in the coming years.

- Low Market Share: HTC's current penetration in the burgeoning wearables and IoT markets remains relatively low compared to established players.

- Significant Investment Required: To effectively compete and capture a meaningful share, HTC needs to allocate substantial capital for research, development, marketing, and strategic partnerships in these segments.

- Growth Market Potential: Despite the challenges, these sectors represent high-growth opportunities that could diversify HTC's revenue streams and future profitability if successful.

- Strategic Focus: The company's ventures here are indicative of a strategy to tap into emerging technology trends, aiming to establish a foothold before these markets mature further.

Blockchain Phones (e.g., Exodus Series)

Blockchain phones, such as HTC's Exodus series, represent a category with high potential but currently limited market penetration. While the blockchain sector itself is experiencing significant growth, the demand for dedicated blockchain smartphones remains a niche within the broader mobile market.

These devices are positioned as high-risk, high-reward products. Their success hinges on achieving wider consumer acceptance, which has not yet materialized on a large scale. This uncertainty makes predicting their future market share challenging, placing them in a precarious position within a strategic portfolio analysis.

- Market Niche: Despite blockchain's overall growth, blockchain-specific phones cater to a small segment of consumers.

- Adoption Uncertainty: Widespread consumer adoption for devices like the Exodus series has not been achieved, creating market risk.

- High-Risk, High-Reward: These ventures offer significant upside if they capture a larger market share, but face substantial challenges.

- Strategic Positioning: Their current status suggests a need for careful evaluation regarding investment and future development.

HTC's ventures into AI-enhanced XR, new wearables, IoT, and blockchain phones all fall into the Question Mark category of the BCG matrix. These represent areas with high market growth potential but currently low market share for HTC.

Significant investment in research, development, and marketing is crucial for these nascent products to gain traction and establish a competitive position. The success of these initiatives is uncertain, making them high-risk, high-reward propositions for the company.

For example, the global XR market is expected to see substantial growth, with AI playing a key role in driving more sophisticated experiences. Similarly, the wearables market, valued at approximately $81.5 billion in 2023, presents a significant opportunity, though HTC's current share is modest.

The company's strategy appears focused on tapping into these emerging technology trends to build future revenue streams, despite the current low market penetration and the need for substantial capital allocation.

| Product/Service Area | Market Growth Potential | HTC Market Share | Investment Needs | Risk/Reward Profile |

|---|---|---|---|---|

| AI in XR | High | Low | High (R&D, integration) | High Risk, High Reward |

| Wearables | High (e.g., $81.5B in 2023) | Low | High (Marketing, product dev) | High Risk, High Reward |

| IoT | High | Low | High (Platform, partnerships) | High Risk, High Reward |

| Blockchain Phones | Niche/Emerging | Very Low | Moderate (Targeted marketing) | High Risk, High Reward |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, alongside internal financial reports and industry expert opinions.