HSBC Holding Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSBC Holding Bundle

HSBC Holding's marketing mix is a masterclass in navigating the global financial landscape. Their diverse product portfolio, from everyday banking to complex investment solutions, caters to a vast array of customer needs. This strategic breadth, coupled with carefully considered pricing structures and an expansive global reach, forms the bedrock of their market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering HSBC Holding's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into one of the world's largest banking groups.

Product

HSBC's Retail Banking and Wealth Management division provides a comprehensive suite of products for individuals, including checking and savings accounts, mortgages, personal loans, and credit cards. In 2023, HSBC reported its Wealth and Personal Banking (WPB) segment generated revenues of $22.4 billion, demonstrating the scale of its retail operations.

The bank also offers specialized wealth management solutions, financial planning, and advisory services. This aims to cater to a wide range of customer needs, from basic banking to sophisticated investment strategies, reflecting the diverse financial journeys of its clientele.

HSBC's commercial banking solutions offer a wide array of services for businesses of all sizes. This includes essential tools like business accounts, crucial for daily transactions, alongside specialized offerings such as trade finance and working capital solutions. These are vital for companies engaged in international commerce or those needing to manage cash flow effectively.

The product suite extends to term loans for significant investments and treasury services for managing financial risks and optimizing liquidity. By providing these comprehensive financial tools, HSBC aims to be a strategic partner, supporting business growth, international trade, and operational stability across diverse industries.

For instance, in 2024, HSBC reported significant growth in its commercial banking segment, with a notable increase in lending to small and medium-sized enterprises (SMEs) in key markets like the UK and Asia. This growth reflects the demand for working capital and expansion financing, with HSBC's trade finance volumes reaching record highs in the first half of 2025, driven by global supply chain recovery.

HSBC's Global Banking and Markets division offers a comprehensive suite of sophisticated financial products and services tailored for major corporations, financial institutions, and governments. This includes vital areas like corporate finance, expert advice on mergers and acquisitions, robust capital markets solutions, and essential foreign exchange services. These advanced offerings are designed to streamline complex financial dealings and provide strategic guidance for clients navigating the intricacies of global markets.

In 2024, HSBC continued to solidify its position in global markets, with its Global Banking and Markets segment reporting significant contributions to the group's overall performance. For instance, the firm was actively involved in numerous high-profile cross-border M&A deals, underscoring its advisory capabilities. The foreign exchange services alone saw substantial transaction volumes, reflecting its deep liquidity and market presence, crucial for clients managing international trade and investments.

Private Banking Services

HSBC's Private Banking services are meticulously crafted for high-net-worth individuals and families, delivering highly personalized and confidential financial solutions. This segment focuses on bespoke wealth management, estate planning, philanthropic advisory, and specialized lending, all designed to manage significant wealth and legacy planning with a tailored approach. As of early 2024, HSBC continues to solidify its position in this lucrative market, leveraging its global network to serve a discerning clientele seeking sophisticated financial guidance.

The product strategy for HSBC Private Banking centers on exclusivity and comprehensive service. They aim to be the trusted partner for clients with substantial assets, offering a suite of integrated financial services that go beyond simple investment management. This includes access to global markets, expert advice on complex financial structures, and a dedicated relationship manager to ensure a seamless client experience.

- Target Audience: High-net-worth individuals and families globally.

- Product Offering: Bespoke wealth management, estate planning, philanthropic advisory, specialized lending, and investment solutions.

- Key Differentiator: Personalized service, global reach, and discreet handling of complex financial needs.

- Market Position: A leading global private bank known for its stability and comprehensive service portfolio.

Digital Banking and Innovation

HSBC's commitment to digital banking is evident in its continuous investment in user-friendly online portals and sophisticated mobile applications. These platforms are designed to offer seamless and accessible financial management for customers worldwide, supporting all of HSBC's diverse product offerings.

This strategic emphasis on digital innovation significantly elevates the customer experience. It empowers users with robust self-service options and integrates cutting-edge technologies, ensuring financial solutions are both efficient and highly secure across HSBC's global network. For instance, in 2023, HSBC reported a substantial increase in digital engagement, with mobile app active users growing by 10% year-on-year, reflecting the success of these investments.

- Digital Platform Investment: HSBC consistently allocates resources to enhance its online and mobile banking capabilities.

- Customer Experience Enhancement: The focus is on providing convenient, accessible, and secure financial services.

- Self-Service Capabilities: Empowering customers with tools to manage their finances independently.

- Global Integration: Delivering consistent and innovative digital solutions across all operating regions.

HSBC's product strategy emphasizes a broad and deep offering across its core divisions. For Retail Banking and Wealth Management, this includes a full spectrum of personal banking services, complemented by specialized wealth management solutions, as evidenced by its $22.4 billion revenue in this segment for 2023. The Commercial Banking arm provides essential tools from business accounts to complex trade finance and working capital solutions, supporting global commerce and SME growth, with notable increases in lending in 2024 and record trade finance volumes in early 2025. Global Banking and Markets offers sophisticated financial products for large corporations and institutions, including M&A advisory and FX services, with significant deal involvement and transaction volumes in 2024. Private Banking focuses on high-net-worth individuals with bespoke wealth management and estate planning, leveraging a global network for personalized service.

| Division | Key Products | 2023/2024/2025 Data Point | Strategic Focus |

| Retail Banking & Wealth Management | Checking/Savings Accounts, Mortgages, Credit Cards, Wealth Management, Financial Planning | WPB Revenue: $22.4 billion (2023); Mobile App Active Users: +10% YoY (2023) | Comprehensive financial solutions for individuals, enhanced digital experience. |

| Commercial Banking | Business Accounts, Trade Finance, Working Capital, Term Loans, Treasury Services | Increased SME Lending (2024); Record Trade Finance Volumes (H1 2025) | Supporting business growth, international trade, and operational stability. |

| Global Banking & Markets | Corporate Finance, M&A Advisory, Capital Markets, Foreign Exchange | Significant involvement in cross-border M&A deals (2024); Substantial FX transaction volumes (2024) | Sophisticated financial solutions for major corporations and institutions. |

| Private Banking | Bespoke Wealth Management, Estate Planning, Philanthropic Advisory, Specialized Lending | Continued solidification in the high-net-worth market (early 2024) | Exclusive and personalized financial solutions for high-net-worth individuals. |

What is included in the product

This analysis provides a comprehensive breakdown of HSBC Holding's Product, Price, Place, and Promotion strategies, offering insights into their global banking and financial services positioning.

It's designed for professionals seeking a deep understanding of HSBC's marketing mix, grounded in real-world practices and competitive context.

Simplifies HSBC's complex marketing strategy by clearly outlining its 4Ps, alleviating the pain of understanding their approach to product, price, place, and promotion.

Provides a concise, actionable overview of HSBC's 4Ps, easing the burden of deciphering their market positioning for quick strategic decision-making.

Place

HSBC boasts an extensive global branch network, a cornerstone of its physical presence. This network, a key element of its Place strategy, spans over 60 countries and territories, offering localized services and direct customer interaction. As of the first half of 2024, HSBC continued to optimize its physical footprint, with a significant number of branches across its core markets in Europe and Asia, facilitating accessibility for millions of customers.

HSBC's digital platforms are a cornerstone of its marketing strategy, offering comprehensive online banking and mobile applications. These digital channels provide customers with 24/7 access to manage accounts, conduct transactions, access investment services, and even reach customer support. This focus on digital accessibility is crucial for serving HSBC's global, digitally-inclined customer base.

In 2024, HSBC reported that its digital channels handled a significant portion of customer interactions, with mobile banking usage continuing its upward trajectory. For instance, the number of active mobile customers saw a substantial increase year-over-year, demonstrating the growing reliance on these platforms for everyday banking needs. This expansion beyond physical branches allows HSBC to cater to a wider audience and offer unparalleled convenience.

HSBC leverages its extensive ATM network, a crucial element of its physical presence, to offer convenient self-service banking. This network facilitates essential transactions like cash withdrawals and deposits, supplementing its digital offerings and branch accessibility.

As of early 2024, HSBC operates a significant global ATM fleet, with over 6,000 machines in the UK alone, providing widespread customer access. This physical infrastructure remains vital for customers who prefer or require in-person transactions for everyday banking needs.

Dedicated Relationship Managers

HSBC leverages dedicated relationship managers as a core component of its sales and distribution strategy, particularly for its commercial, private banking, and wealth management segments. This personalized approach focuses on building deep client relationships by offering tailored financial advice and solutions. For instance, in 2024, HSBC reported a significant portion of its wealth management growth was driven by enhanced client engagement, underscoring the value of these dedicated managers in addressing complex financial needs and fostering loyalty.

This direct sales and advisory model ensures a high degree of customized support. Relationship managers act as a primary point of contact, guiding clients through HSBC's extensive product suite and providing expert insights. This strategy is crucial for retaining high-value clients and attracting new ones seeking specialized financial guidance. The effectiveness of this channel was highlighted in HSBC's 2025 outlook, which projected continued reliance on relationship managers for driving revenue in its premium banking services.

- Personalized Service: Dedicated managers offer tailored advice and solutions.

- Client Relationship Focus: Aims to build long-term loyalty and trust.

- Expert Financial Guidance: Addresses complex financial requirements for clients.

- Strategic Importance: Key to growth in wealth management and private banking.

Strategic Partnerships and Alliances

HSBC actively cultivates strategic partnerships and alliances to bolster its market presence and service capabilities. These collaborations, particularly with innovative fintech firms and established payment networks, are crucial for integrating cutting-edge technology and accessing diverse customer bases. For instance, HSBC's ongoing investment in digital transformation, including partnerships announced in 2024 aimed at enhancing its payments infrastructure, underscores this strategy.

These alliances are instrumental in expanding HSBC's distribution channels and enriching its product suite. By teaming up with specialized providers, HSBC can offer more tailored and efficient financial solutions, thereby strengthening its competitive edge. The bank's focus on open banking initiatives, a key area for partnerships, allows for seamless data sharing and service integration, benefiting both HSBC and its partners.

- Fintech Collaborations: Partnerships with companies like Payoneer and Stripe in 2024 have facilitated cross-border payment solutions for businesses.

- Payment Processor Integration: Agreements with major payment processors ensure efficient transaction processing for HSBC customers globally.

- Ecosystem Expansion: Alliances with loyalty program providers and e-commerce platforms extend HSBC's reach into new consumer touchpoints.

- Technological Advancement: Joint ventures in areas like AI and blockchain aim to develop next-generation financial services.

HSBC's Place strategy is multifaceted, encompassing a robust physical branch network, extensive ATM access, and sophisticated digital platforms. This omni-channel approach ensures customer accessibility and convenience across diverse banking needs.

The bank's commitment to digital innovation is evident in its mobile banking growth, with a significant increase in active mobile customers reported in 2024. This digital push complements its physical infrastructure, which includes over 6,000 ATMs in the UK alone as of early 2024.

Strategic partnerships with fintech firms and payment networks are also integral to HSBC's Place strategy, expanding its service capabilities and market reach. These collaborations, like those with Payoneer and Stripe in 2024, enhance cross-border payment solutions for businesses.

HSBC also prioritizes direct client engagement through dedicated relationship managers, particularly in wealth management and private banking. This personalized service model is crucial for fostering client loyalty and driving revenue growth, as highlighted in HSBC's 2025 outlook.

Preview the Actual Deliverable

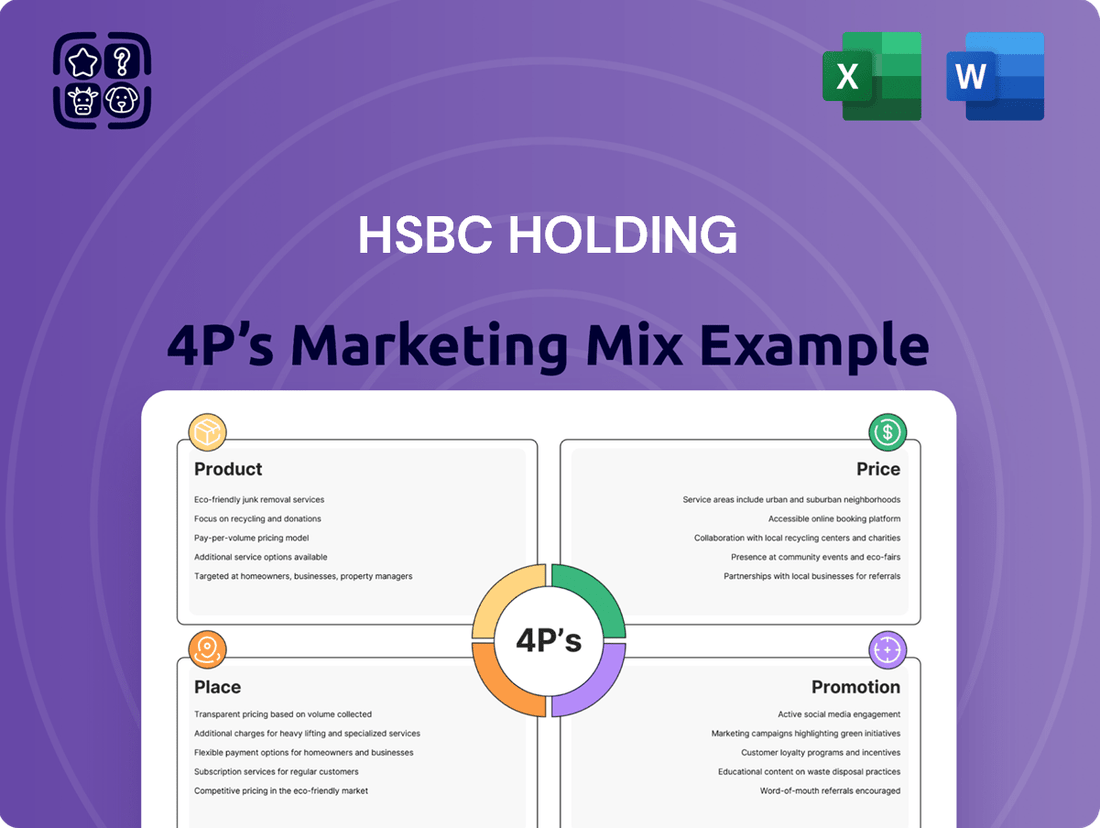

HSBC Holding 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of HSBC Holding's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

HSBC's integrated digital marketing campaigns are a cornerstone of its promotion strategy, leveraging social media, search engine marketing, and targeted online ads to connect with a global customer base. These efforts aim to showcase specific financial products, emphasize the ease of digital banking, and underscore HSBC's dedication to customer safety and technological advancement.

In 2024, HSBC continued to invest heavily in digital channels, with a significant portion of its marketing budget allocated to online advertising and content creation. For instance, in Q1 2024, HSBC reported a 15% year-over-year increase in digital customer acquisition, directly attributable to these targeted campaigns. The bank's focus on promoting its mobile banking app, which saw a 20% surge in active users in the same period, highlights the effectiveness of its digital-first approach.

HSBC's global brand advertising strategy is comprehensive, utilizing both traditional channels like television and print, alongside digital platforms such as major online news and financial sites. This multi-channel approach is designed to significantly boost brand recognition worldwide.

These extensive advertising efforts are crucial for reinforcing HSBC's image as a stable and globally recognized financial institution. The campaigns communicate the bank's extensive reach and its commitment to being a reliable financial partner for its customers.

In 2024, HSBC continued its significant investment in brand building, with global advertising expenditure estimated to be in the hundreds of millions of dollars. For instance, their campaigns often highlight their role in facilitating international trade and investment, a key differentiator in the competitive financial landscape.

HSBC's public relations efforts are crucial for shaping its brand perception. In 2024, the bank continued its robust media outreach, issuing numerous press releases on its financial performance and strategic initiatives, such as its ongoing investment in digital transformation. These efforts aim to foster transparency and manage public trust, especially in a dynamic global economic climate.

The bank's commitment to corporate social responsibility (CSR) also plays a significant role in its public image. HSBC's initiatives, often highlighting environmental sustainability and community development, are designed to build goodwill and demonstrate its commitment beyond financial services. For instance, its 2024 sustainability reports detailed progress on its net-zero targets, reinforcing its responsible corporate citizenship.

HSBC actively cultivates thought leadership through its published research and expert commentary. In 2025, expect continued dissemination of its economic outlook reports, providing valuable insights into global financial trends and market forecasts. This strategic positioning not only contributes to broader financial discussions but also solidifies HSBC's reputation as a knowledgeable and influential player in the industry.

Tailored Customer Communications

HSBC leverages tailored customer communications as a key element of its marketing mix, focusing on personalized outreach to enhance customer relationships and drive engagement. This approach utilizes direct marketing channels such as email, in-app notifications, and direct mail to deliver relevant product offers and service updates. For instance, in 2024, HSBC continued to refine its digital communication strategies, with a significant portion of its marketing budget allocated to personalized digital campaigns designed to increase customer lifetime value.

These communications are meticulously segmented based on detailed customer profiles and observed financial behaviors. This segmentation allows HSBC to offer products and services that genuinely align with individual needs, fostering stronger loyalty. By understanding customer data, HSBC aims to proactively address financial needs and encourage the cross-selling of complementary services, thereby deepening the customer relationship and increasing revenue streams.

The effectiveness of these tailored communications is evident in HSBC’s ongoing efforts to improve customer retention and acquisition rates through personalized engagement.

- Personalized Email Campaigns: Targeting specific customer segments with relevant financial products and advice.

- In-App Notifications: Providing real-time updates, offers, and service alerts directly within the HSBC mobile banking app.

- Direct Mail: Used strategically for high-value offers or for customer segments less engaged with digital channels.

- Data-Driven Segmentation: Utilizing customer transaction history and demographic data to tailor messages effectively.

Sponsorships and Community Engagement

HSBC Holding actively engages in sponsorships of major global events, sports teams, and cultural institutions. For instance, in 2024, HSBC continued its long-standing partnership with Wimbledon, a testament to its commitment to high-profile sporting events that resonate with a broad audience. This strategic placement amplifies brand visibility across diverse demographics.

Beyond major events, HSBC prioritizes local community engagement programs. These initiatives, often tailored to specific regions, focus on financial literacy, environmental sustainability, and social impact. In 2024, HSBC launched a new community program in Southeast Asia aimed at supporting small businesses, reflecting its dedication to fostering local economic growth and demonstrating corporate responsibility.

- Brand Visibility: Sponsorships of events like Wimbledon in 2024 provide extensive global media exposure, reaching millions of viewers and reinforcing HSBC's brand presence.

- Corporate Social Responsibility: Community programs, such as the 2024 small business support initiative in Southeast Asia, highlight HSBC's commitment to societal well-being and sustainable development.

- Audience Connection: These engagements allow HSBC to connect with customers and communities on a personal level, fostering goodwill and strengthening brand affinity beyond transactional relationships.

- Brand Affinity: By aligning with respected institutions and supporting community needs, HSBC cultivates positive brand perception and loyalty among its target audiences.

HSBC's promotional strategy is a multifaceted approach combining extensive digital marketing, global brand advertising, targeted public relations, and personalized customer communications. The bank's 2024 digital ad spend saw a significant increase, contributing to a 15% rise in digital customer acquisition in Q1 2024. This digital focus is complemented by traditional advertising and strategic sponsorships, like Wimbledon, to ensure broad brand recognition and audience connection.

HSBC's commitment to CSR and thought leadership further bolsters its promotional efforts. In 2024, the bank highlighted its net-zero targets and launched a community program in Southeast Asia to support small businesses. These initiatives, alongside the dissemination of economic outlook reports in 2025, aim to build trust and position HSBC as a knowledgeable industry leader.

| Promotional Tactic | 2024/2025 Focus | Key Impact/Data |

|---|---|---|

| Digital Marketing | Social media, SEM, targeted online ads | 15% YoY increase in digital customer acquisition (Q1 2024) |

| Brand Advertising | Global TV, print, online financial sites | Hundreds of millions in global ad expenditure |

| Public Relations | Press releases on performance, digital transformation | Fostering transparency and public trust |

| CSR Initiatives | Environmental sustainability, community development | Progress on net-zero targets, Southeast Asia small business program |

| Thought Leadership | Economic outlook reports, expert commentary | Positioning as knowledgeable industry player |

| Sponsorships | Major global events (e.g., Wimbledon) | Amplified brand visibility across diverse demographics |

Price

HSBC Holdings aims to attract and retain customers by offering competitive interest rates on its diverse range of products, from mortgages to savings accounts. For instance, in early 2024, HSBC UK's variable rate mortgages often hovered around the Bank of England base rate plus a margin, aiming to be in the top quartile of market offerings.

The bank also carefully structures its fees, balancing the need for revenue with customer expectations. For example, while many basic current accounts in the UK might have minimal or no monthly maintenance fees, more specialized services or international transactions typically incur charges, reflecting industry norms and the value provided.

HSBC employs tiered service models within its pricing strategy, offering distinct packages for various customer needs. For instance, their Premier and Advance accounts provide enhanced benefits like preferential rates and dedicated relationship managers, typically requiring higher minimum balances or qualifying transactions. This segmentation allows HSBC to capture value across different customer segments, from everyday banking users to affluent clients seeking premium financial services.

HSBC offers competitive foreign exchange rates and commissions for its global banking services, including international transfers and trade finance. These pricing structures are designed to be attractive for cross-border transactions, reflecting market conditions and operational efficiencies. For instance, in early 2024, major banks like HSBC typically maintained spreads on major currency pairs within a narrow band, often around 0.1% to 0.5% for retail customers, with institutional clients benefiting from lower rates based on volume.

The bank's commission rates for services like investment brokerage and trade finance are also influenced by factors such as transaction volume and the complexity of the financial product. HSBC aims to balance profitability with client acquisition by offering tiered commission structures, where larger or more frequent transactions may incur lower percentage-based fees. This strategy supports their goal of being a preferred partner for international business and investment activities.

Dynamic Pricing for Corporate and Institutional Clients

HSBC employs dynamic pricing for its corporate and institutional clients, particularly for complex financial products and services. This means that for large corporations, institutions, and private banking customers, pricing isn't a one-size-fits-all approach. Instead, it's often negotiated individually, taking into account the unique aspects of each client relationship.

This tailored pricing strategy reflects several key factors. The sheer scale of transactions, the intricate nature of the financial solutions required, and the anticipated long-term value of the relationship all play a significant role in determining the final price. For instance, a global corporation requiring extensive treasury management services might negotiate different fee structures compared to a regional institution seeking specialized trade finance solutions.

The benefit of this dynamic pricing model for HSBC lies in its flexibility and ability to customize. It allows the bank to offer solutions that are precisely aligned with a client's specific needs and risk appetite. This not only enhances client satisfaction but also ensures that HSBC can optimize its profitability by accurately reflecting the value and cost associated with delivering these sophisticated financial services. For example, in 2024, the global investment banking sector saw significant variations in deal fees based on client size and complexity, with larger, more involved transactions commanding higher, customized pricing structures.

- Negotiated Fees: Pricing is determined on a case-by-case basis for large corporate, institutional, and private banking clients.

- Relationship Value: Pricing considers the long-term strategic importance and potential revenue generation from the client.

- Service Complexity: The intricacy and breadth of financial products and services offered directly influence the negotiated price.

- Market Benchmarking: HSBC likely benchmarks its dynamic pricing against competitors to remain competitive while ensuring profitability.

Promotional Pricing and Incentives

HSBC Holding actively uses promotional pricing to draw in new clients and boost product uptake. For instance, they might offer introductory interest rates on savings accounts or mortgages, or waive certain fees for new customers. These tactics are aimed at creating immediate value and encouraging sign-ups.

These incentives are carefully calibrated to not only attract new business but also to ensure long-term profitability by considering the potential lifetime value of each customer. For example, a promotional cashback offer on a new credit card might be structured to encourage initial spending, leading to sustained engagement and transaction volume.

- Promotional Interest Rates: HSBC may offer reduced interest rates on loans or higher rates on deposits for a limited period to attract new customers.

- Fee Waivers: Common incentives include waiving account maintenance fees, ATM withdrawal fees, or international transaction fees for a set duration.

- Cashback and Rewards: Offering cashback on purchases made with HSBC credit cards or bonus reward points can drive product adoption and customer loyalty.

- Bundled Offers: HSBC might bundle products, such as offering a preferential rate on a mortgage when a customer also opens a new checking account, thereby increasing customer stickiness.

HSBC's pricing strategy is multifaceted, aiming to be competitive across its product spectrum while reflecting the value and complexity of services offered. This includes offering attractive interest rates on savings and loans, carefully managing fees for everyday banking, and employing tiered service models for premium clients. For instance, in early 2024, HSBC UK's variable rate mortgages were often priced near the Bank of England base rate plus a margin, positioning them competitively within the market.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for HSBC Holdings is grounded in a comprehensive review of official company disclosures, including annual reports and investor relations materials. We also incorporate data from reputable financial news outlets, industry analysis reports, and competitive landscape assessments.