HSBC Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSBC Holding Bundle

HSBC Holdings' BCG Matrix offers a critical lens into its diverse portfolio, highlighting products with high growth potential and those that are stable cash generators. Understanding these dynamics is key to strategic resource allocation and future growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

HSBC's wealth management operations in Asia, especially in Hong Kong, are a major engine for growth, drawing in significant new invested assets. This region was responsible for most of the bank's wealth asset expansion in 2024, and this robust trend persisted into the first quarter of 2025.

This strategic emphasis on Asia reflects HSBC's deliberate shift towards the region, recognizing concentrated opportunities within its wealth management sector. The bank's commitment to Asia is a core element of its global strategy.

HSBC's Corporate and Institutional Banking (CIB) segment has been a powerhouse, particularly excelling in foreign exchange and debt and equity markets. This strong showing is a direct result of heightened client engagement and the dynamic, often volatile, market environments experienced throughout 2024, which boosted both profit and revenue streams.

The bank's strategic reorganization, set to take effect in January 2025, explicitly identifies CIB as a central pillar of its operations, underscoring its recognized importance and ongoing strategic focus.

Hong Kong, HSBC's foundational market, continues to show robust growth, making it a significant contributor to the bank's wealth performance and overall profitability. HSBC is focused on strengthening its leadership in this key region.

The segment's strong customer base and market-leading position are critical to HSBC's strategic objectives. For instance, in 2023, HSBC's Asia segment, heavily influenced by Hong Kong, reported a pre-tax profit of $15.5 billion, highlighting the region's importance.

International Wealth and Premier Banking (IWPB)

The International Wealth and Premier Banking (IWPB) segment, launched in January 2025, represents a significant strategic push for HSBC, aiming to capitalize on global connectivity and cross-border client needs. This initiative is designed to harness HSBC's extensive international network, targeting affluent and high-net-worth individuals worldwide. The early performance indicators are promising, with the segment reporting robust growth in the first quarter of 2025.

- Strategic Focus: Global connectivity and cross-border services for affluent clients.

- Market Position: Leveraging HSBC's international network to increase market share.

- Early Performance: Demonstrated strong growth in Q1 2025, indicating positive market reception.

- Clientele: Targeting high-net-worth and affluent individuals internationally.

Advanced Technology Adoption in Core Services

HSBC is strategically integrating advanced technologies, including artificial intelligence and quantum-secure solutions, to fortify its core banking operations. This focus enhances the security of tokenized transactions and drives operational efficiencies across the board.

These technological investments, while future-oriented, are crucial for maintaining a competitive edge. For instance, HSBC's commitment to AI in fraud detection aims to process billions of transactions securely, a key aspect of its core service delivery.

- AI-driven fraud detection: HSBC is leveraging AI to analyze vast datasets for real-time fraud identification, protecting customer assets.

- Quantum-secure solutions: The bank is exploring quantum-resistant cryptography to safeguard future digital transactions against emerging threats.

- Efficiency gains in core banking: Technology adoption is streamlining processes like customer onboarding and transaction processing, reducing operational costs.

- Competitive advantage: Early and effective integration of these advanced technologies positions HSBC favorably against competitors in the evolving financial landscape.

HSBC's wealth management in Asia, particularly Hong Kong, is a significant growth driver, attracting substantial new assets. This region fueled the majority of the bank's wealth asset expansion in 2024, a trend that continued into early 2025. This focus on Asia aligns with HSBC's broader strategy to concentrate on high-opportunity areas within its wealth management sector.

The International Wealth and Premier Banking (IWPB) segment, launched in January 2025, targets affluent and high-net-worth individuals globally by leveraging HSBC's extensive international network. Early performance in Q1 2025 shows robust growth, indicating a positive market reception to its cross-border service offerings.

HSBC's Corporate and Institutional Banking (CIB) has been a strong performer, especially in foreign exchange and debt/equity markets. This success stems from increased client engagement and dynamic market conditions throughout 2024, boosting revenue and profits. CIB is identified as a central pillar in HSBC's operational strategy from January 2025.

HSBC is enhancing its core banking operations with advanced technologies like AI for fraud detection and exploring quantum-secure solutions. These investments aim to improve security for tokenized transactions and boost operational efficiency, ensuring a competitive edge in the evolving financial landscape.

| Segment | 2024 Performance Highlight | Strategic Importance | Future Outlook |

|---|---|---|---|

| Wealth Management (Asia) | Major growth engine, most asset expansion in 2024. | Core to global strategy, concentrated opportunities. | Continued strong performance expected. |

| Corporate & Institutional Banking (CIB) | Powerhouse in FX, debt, equity markets; boosted by volatile markets. | Central pillar of operations from Jan 2025. | Leveraging market dynamics for continued revenue. |

| International Wealth & Premier Banking (IWPB) | Launched Jan 2025, showing robust Q1 2025 growth. | Targets global affluent/HNWIs via international network. | Capitalizing on cross-border client needs. |

| Technology Integration | AI for fraud detection, exploring quantum-secure solutions. | Enhancing security and operational efficiency. | Maintaining competitive advantage. |

What is included in the product

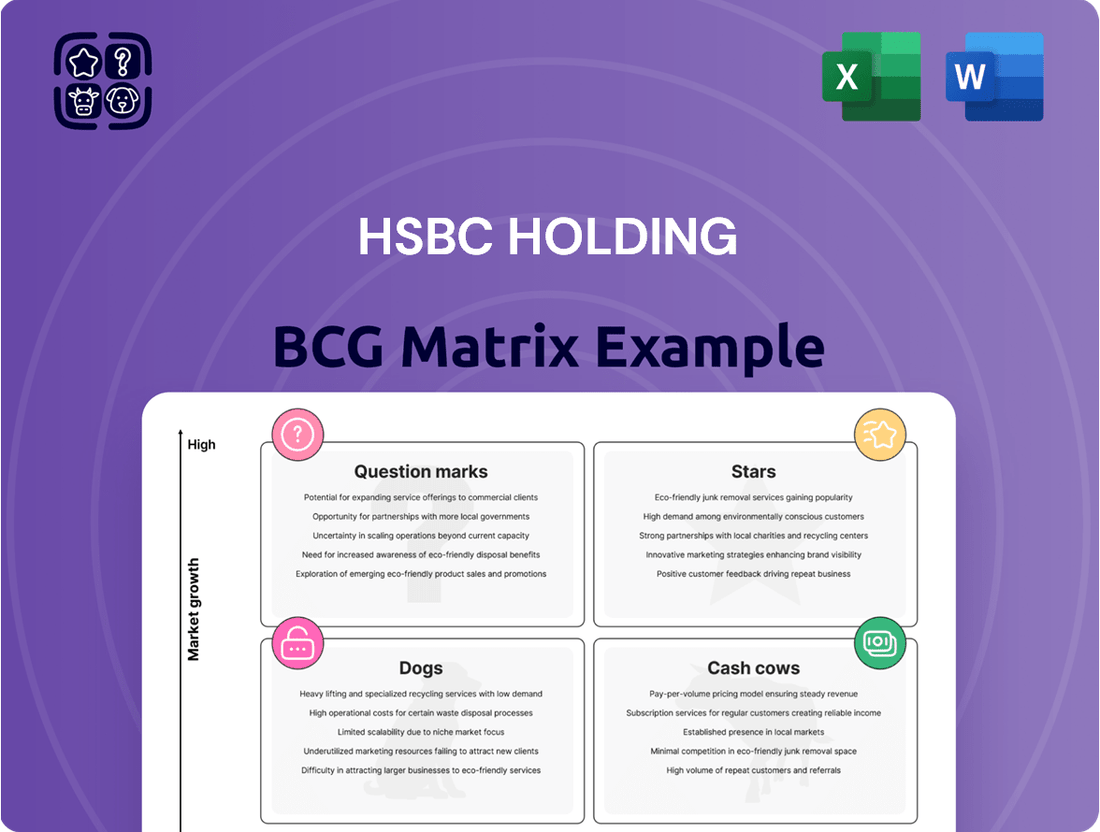

HSBC's BCG Matrix analysis would detail its business units as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, or divestiture for each unit.

A clear BCG Matrix visualizes HSBC's portfolio, identifying underperforming units for strategic divestment or turnaround, relieving the pain of resource misallocation.

Cash Cows

HSBC's UK retail and commercial banking operations are a prime example of a Cash Cow within its BCG Matrix. This segment benefits from the UK's stable, mature financial market, serving a broad customer base of individuals and SMEs.

These operations consistently generate substantial revenue through traditional banking services like deposits and loans. For instance, in 2023, HSBC reported a pre-tax profit of £1.5 billion from its UK operations, highlighting its strong and reliable performance in this core market.

HSBC's Net Interest Income (NII) firmly positions it as a Cash Cow within the BCG Matrix. The bank anticipates its banking NII to reach approximately $42 billion in 2025, a testament to its robust and dependable revenue generation from core lending activities. This substantial and consistent NII underscores a mature and effectively managed balance sheet, ensuring a stable influx of capital for ongoing operations and strategic investments.

HSBC's global payments solutions, a cornerstone of its wholesale transaction banking, represent a classic Cash Cow. This segment consistently generates robust fee income, a testament to its established market position and the bank's expansive international network.

In 2024, the global payments market continued its steady growth, with cross-border transactions forming a significant portion. HSBC's deep integration into this market allows it to capture a substantial share of this high-margin revenue, benefiting from economies of scale and a mature, predictable demand for its services.

Stable Global Deposit Base

HSBC's stable global deposit base is a significant strength, acting as a low-cost and reliable funding source. This stability underpins its lending operations and ensures consistent liquidity.

- Global Deposit Growth: HSBC reported total customer deposits of $2,074 billion as of December 31, 2023, reflecting a robust and stable funding platform.

- Low-Cost Funding Advantage: A substantial portion of these deposits represents current and savings accounts, offering a significantly lower cost of funds compared to wholesale funding.

- Liquidity and Lending Capacity: This vast deposit pool directly supports HSBC's lending activities, providing the necessary liquidity to meet customer demand and drive revenue generation.

- Financial Stability: The sheer size and stability of its deposit base contribute significantly to HSBC's overall financial resilience and its ability to navigate economic fluctuations.

Established Global Trade Finance

HSBC's established global trade finance business is a prime example of a Cash Cow within its BCG Matrix. This segment benefits from a long-standing, robust infrastructure and deep integration into the fabric of international commerce, consistently delivering stable revenue streams.

The business thrives by providing essential services that facilitate cross-border transactions, generating revenue primarily through fees and commissions. Despite operating in a mature market, its critical role in global trade ensures sustained demand and profitability, a hallmark of a Cash Cow.

HSBC's extensive international network is a key advantage, allowing it to efficiently serve a broad client base involved in global trade. This strong connectivity underpins its ability to maintain market leadership and consistent revenue generation.

- Revenue Generation: In 2023, HSBC reported trade finance income of approximately $3.5 billion, reflecting the segment's consistent revenue-generating capability.

- Market Position: HSBC remains one of the top global banks for trade finance, handling a significant volume of international trade transactions.

- Profitability: The trade finance business typically operates with healthy profit margins due to its fee-based revenue model and established operational efficiencies.

- Strategic Importance: It serves as a foundational business, supporting broader client relationships and offering cross-selling opportunities across HSBC's other financial services.

HSBC's wealth management services, particularly in Asia, are a significant Cash Cow. This segment benefits from the region's growing affluent population and HSBC's strong brand recognition, consistently generating substantial fee-based income.

The bank's ability to offer a comprehensive suite of investment products and advisory services to a large and expanding client base fuels its revenue. For example, HSBC's Wealth and Personal Banking division reported a profit before tax of $5.2 billion in 2023, with Asia contributing a significant portion.

HSBC's investment in digitalizing its wealth management platforms further solidifies its Cash Cow status. By enhancing online and mobile banking capabilities, the bank improves customer experience and operational efficiency, leading to sustained profitability.

| Segment | Description | 2023 Profit Before Tax (USD Billion) |

|---|---|---|

| Wealth and Personal Banking (Global) | Includes retail banking, wealth management, and credit cards. | 5.2 |

| Asia Contribution to Wealth and Personal Banking | Significant portion of the global profit, driven by strong wealth management growth. | N/A (Specific breakdown not publicly available for 2023) |

Full Transparency, Always

HSBC Holding BCG Matrix

The HSBC Holdings BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you get the exact same professionally analyzed and formatted report, ready for immediate strategic application, without any watermarks or demo content.

Dogs

HSBC's divestiture of its French retail banking operations in January 2024 places this segment firmly in the Dogs category of the BCG Matrix. This strategic move suggests the business possessed a low market share within a mature or declining market, offering limited growth potential.

The sale, completed for a nominal sum of $1, reflects the low profitability and anticipated future cash flows associated with these operations. HSBC's decision to exit France's retail banking sector underscores its focus on optimizing its global portfolio by shedding underperforming assets and concentrating resources on more promising markets and business lines.

HSBC's sale of its Canadian banking operations in March 2024 marked a significant strategic divestiture. This move, alongside the earlier sale of its Argentine business, impacted its financial reporting, contributing to a decline in Q1 2025 profits. The absence of one-time gains from these sales highlights HSBC's focus on optimizing its global footprint and concentrating on more profitable core markets.

HSBC's operations in Argentina were categorized as a 'Dog' within its business portfolio, indicating low market share and low growth potential. The bank's decision to divest this segment, finalized in early 2025, reflects a strategic move to streamline its global footprint and concentrate on more profitable markets.

The sale of its Argentine business had a noticeable impact on HSBC's financial reporting for the first quarter of 2025. Specifically, it led to a reduction in reported profits because the gains from the previous year's operations in Argentina were no longer present. This divestment is a key component of HSBC's strategy to simplify its structure and exit regions that do not align with its profitability and growth objectives.

Zing International Payments App

Zing International Payments App, launched in 2024 as HSBC's foray into the competitive digital payments market, was discontinued in January 2025.

This rapid shutdown after just over a year of operation indicates significant challenges in gaining traction and achieving profitability.

The app's failure to capture market share likely contributed to its swift discontinuation as part of HSBC's broader cost-optimization strategy.

- Market Entry: Launched in 2024 to challenge established payment platforms.

- Performance: Failed to achieve desired market share and profitability within its first year.

- Discontinuation: Shut down in January 2025 due to underperformance and cost-cutting measures.

- BCG Classification: Likely categorized as a Dog due to low market share and low growth potential.

Retained French Loan Portfolio for Sale

HSBC Holdings has strategically reclassified a €7.1 billion portfolio of French home and other loans. This move, effective January 1, 2025, positions these assets within the 'hold-to-collect-and-sell' category, anticipating a pre-tax fair value loss. This action aligns with the BCG Matrix by identifying these loans as potential 'Dogs' – assets with low growth and low market share, signaling HSBC's intention to divest or manage them down.

The reclassification suggests these French loans are not meeting performance expectations or strategic objectives. By moving them to a 'hold-to-collect-and-sell' status, HSBC is signaling a clear intent to exit this segment of its former French retail banking operations. This is a common strategy for financial institutions looking to streamline their portfolios and improve overall capital efficiency.

- Asset Reclassification: €7.1 billion French loan portfolio moved to 'hold-to-collect-and-sell' as of January 1, 2025.

- Expected Outcome: Anticipation of a pre-tax fair value loss on the portfolio.

- Strategic Rationale: Divestment of underperforming or non-strategic assets within the former French retail banking operations.

- BCG Matrix Alignment: Identification of these loans as potential 'Dogs' due to low growth and market share.

HSBC's divestiture of its French retail banking operations in January 2024, alongside the sale of its Canadian banking operations in March 2024, firmly places these segments in the Dogs category of the BCG Matrix. The discontinuation of the Zing International Payments App in January 2025 further exemplifies this classification. These moves highlight HSBC's strategy to shed underperforming assets with low market share and limited growth potential, focusing resources on more promising areas.

The reclassification of a €7.1 billion portfolio of French home and other loans to 'hold-to-collect-and-sell' as of January 1, 2025, also signals these as potential Dogs. This anticipates a pre-tax fair value loss, underscoring the intention to divest or manage down these non-strategic assets.

| Business Segment | BCG Category | Key Rationale |

|---|---|---|

| French Retail Banking Operations | Dogs | Divested Jan 2024; low market share, low growth potential. |

| Canadian Banking Operations | Dogs | Divested Mar 2024; part of portfolio optimization. |

| Zing International Payments App | Dogs | Discontinued Jan 2025; failed to gain market share and profitability. |

| €7.1bn French Loan Portfolio | Potential Dogs | Reclassified Jan 2025 to 'hold-to-collect-and-sell'; anticipated fair value loss. |

Question Marks

HSBC is channeling substantial resources into emerging technologies like artificial intelligence and quantum computing, aiming to bolster future growth and operational efficiency. These sectors offer considerable market potential, though HSBC's current standing and definitive leadership in these advanced applications are still in formative stages, necessitating continued significant investment.

HSBC's commitment to providing between $750 billion and $1 trillion in sustainable finance and investments by 2030 positions it to capture significant growth in the global decarbonization market. This ambitious target reflects a strategic pivot towards a high-growth, albeit competitive, sector.

While HSBC is actively building its market share in sustainable finance, its current position in this rapidly expanding and competitive landscape is still developing. This necessitates ongoing strategic investment and agility to adapt to evolving market demands and regulatory frameworks.

HSBC is strategically targeting Asian emerging markets like India and mainland China for wealth management expansion, often via acquisitions. These regions present substantial growth opportunities, but intense competition necessitates significant investment and precise strategy to gain market share.

In 2024, HSBC announced plans to invest billions in its Asian operations, particularly focusing on wealth and personal banking. India's wealth management market, for instance, is projected to grow significantly, with assets under management expected to reach over $3 trillion by 2027, presenting a compelling case for HSBC's strategic focus.

New Digital Banking Solutions

HSBC's new digital banking solutions, such as HSBC Trade Solutions (HTS) and Embedded Banking, are positioned as question marks in the BCG matrix. These innovations aim to seamlessly integrate banking services into client workflows and platforms, tapping into high-growth digital markets. The focus is on expanding market share in these nascent but promising digital segments, requiring significant investment in development and marketing to drive adoption.

These digital initiatives represent areas of potential future strength for HSBC. While the market for embedded finance and advanced trade solutions is experiencing rapid growth, with global embedded finance market expected to reach $7.2 trillion by 2030 according to some projections, HSBC's current market share within these specific niches is still developing. This necessitates substantial capital expenditure and strategic focus to build a dominant position.

- HSBC Trade Solutions (HTS): Enhancing digital trade finance and supply chain management.

- Embedded Banking: Integrating financial services into non-financial platforms.

- Market Position: High growth potential, but currently low market share.

- Strategic Imperative: Invest to build market leadership in digital offerings.

Modernization of Legacy IT Infrastructure

HSBC's extensive legacy IT infrastructure modernization is a significant undertaking, with the bank investing billions to bolster its digital offerings and ensure operational stability. This strategic move, while critical for future competitiveness, represents a substantial financial commitment and carries inherent risks.

The ongoing transformation aims to improve customer experience and operational efficiency, but the full realization of market benefits and competitive advantages from these upgrades is still unfolding. For example, in 2023, HSBC reported significant IT spending as part of its "pivot to the future" strategy, underscoring the scale of this investment.

- Digital Transformation Investment: HSBC continues to allocate substantial capital, often in the billions annually, towards upgrading its core banking systems and enhancing digital platforms.

- Risk and Reward: While modernization is essential for long-term growth and preventing service disruptions, it's a high-cost, high-risk initiative with benefits that are gradually materializing.

- Competitive Imperative: The upgrades are crucial for HSBC to keep pace with digitally native competitors and meet evolving customer expectations in the global financial services market.

HSBC's digital banking solutions like HSBC Trade Solutions (HTS) and Embedded Banking are classified as question marks. These initiatives target high-growth digital markets by integrating financial services into client workflows. Significant investment is required to build market share and establish leadership in these nascent, yet promising, digital segments.

The global embedded finance market is projected for substantial growth, with some estimates reaching $7.2 trillion by 2030. HSBC's current penetration in these specific niches is still developing, underscoring the need for continued capital expenditure and strategic focus to capture a dominant position.

These ventures represent potential future strongholds for HSBC, but their success hinges on significant investment to drive adoption and gain traction in rapidly evolving digital landscapes. The bank's commitment to these areas reflects a forward-looking strategy to capitalize on emerging digital trends.

HSBC's investments in digital transformation, including modernizing its IT infrastructure, are substantial, often amounting to billions annually. While crucial for long-term competitiveness and meeting customer expectations, these upgrades are high-cost, high-risk endeavors with benefits that are still emerging.

| BCG Category | HSBC Initiatives | Market Growth | HSBC Market Share | Strategic Focus |

| Question Marks | HSBC Trade Solutions (HTS), Embedded Banking | High | Low/Developing | Invest to build market leadership |

BCG Matrix Data Sources

Our HSBC Holding BCG Matrix leverages a robust blend of financial disclosures, global market research, and internal performance data to accurately assess each business unit's strategic position.