HSBC Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSBC Holding Bundle

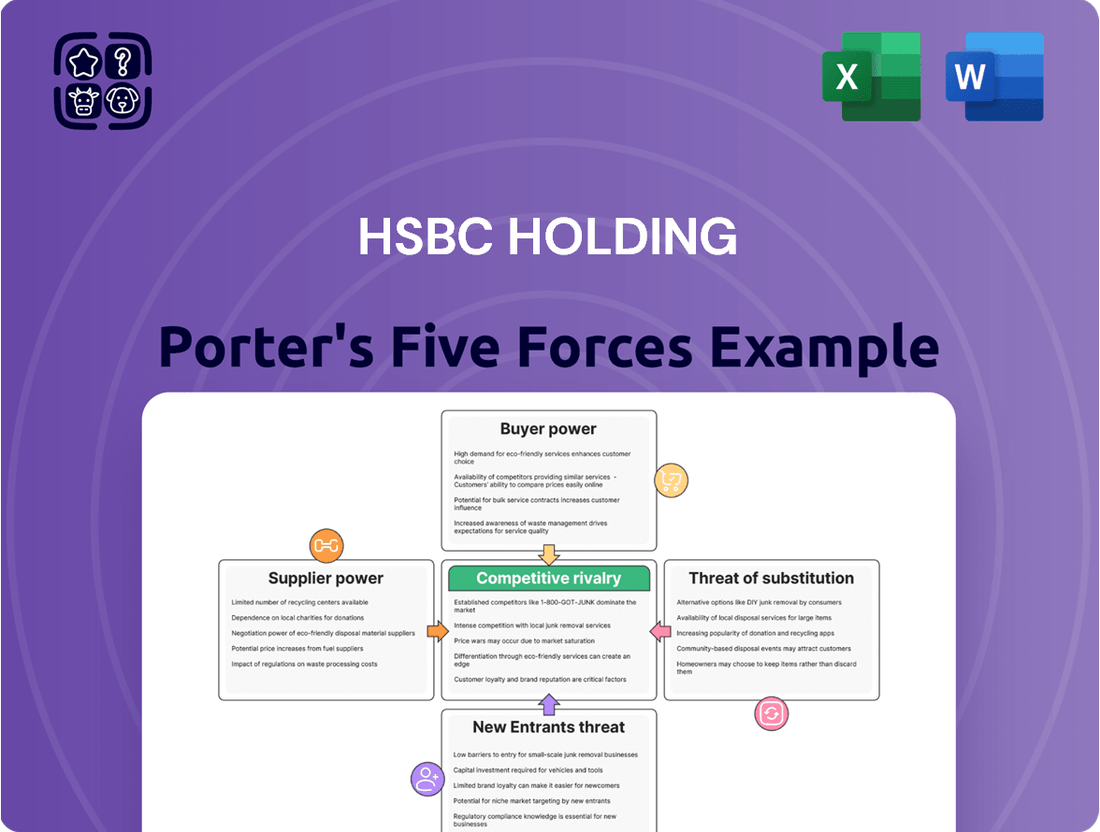

HSBC Holding navigates a complex financial landscape where buyer power, particularly from large institutional clients, exerts significant influence. The threat of new entrants is moderate, mitigated by high capital requirements and regulatory hurdles, yet digital disruptors pose an evolving challenge. Supplier power, primarily from technology providers and data services, is a key consideration.

The full analysis reveals the real forces shaping HSBC Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers wield considerable influence over HSBC. The bank’s reliance on complex core banking systems, cloud services, and advanced data analytics means that key vendors for these critical infrastructures possess significant bargaining power. This is amplified by the high costs and technical expertise involved in switching providers, making it difficult for HSBC to easily change its technology partners.

In 2024, the global IT spending by financial services firms was projected to reach over $600 billion, highlighting the substantial investment in technology and the importance of these supplier relationships. For HSBC, disruptions from a major technology supplier or increased pricing on essential services could directly impede its operational efficiency and its ambitious digital transformation goals, underscoring the suppliers' strong position.

HSBC's reliance on specialized talent in areas like AI and cybersecurity grants significant bargaining power to skilled professionals. In 2024, the demand for AI specialists saw salaries rise by an average of 15-20% globally, impacting operational costs for financial institutions.

The global competition for top-tier financial engineers and compliance experts means these individuals can negotiate favorable compensation packages. This can increase HSBC's labor expenses, potentially affecting profitability and the speed of new service development.

Suppliers of critical financial market infrastructure, like payment networks (Visa, Mastercard) and clearing houses, hold significant sway. These providers often operate as monopolies or in tight oligopolies, offering services that are indispensable for global banking operations like HSBC's. Their fee structures and operational terms directly influence HSBC's cost of doing business and its ability to serve international clients.

Information and Data Providers

Information and data providers wield considerable bargaining power over HSBC. Access to real-time market data, financial intelligence, credit ratings, and regulatory updates are absolutely essential for HSBC's daily operations, robust risk management, and informed strategic choices. Without this critical data, HSBC would struggle to execute trades, assess counterparty risk, or comply with evolving financial regulations.

Key players like Bloomberg and Refinitiv, along with major credit rating agencies, possess significant leverage. This stems from the proprietary, often exclusive, nature of their data and the sheer indispensability of these services to financial institutions. Banks like HSBC become heavily reliant on these providers, which in turn allows the providers to dictate terms and pricing.

- Data Dependency: Financial institutions, including HSBC, are highly dependent on specialized data vendors for market-moving information.

- Proprietary Nature: The data provided is often unique and difficult or impossible for banks to replicate internally, creating a natural barrier to entry for competitors.

- Cost of Disruption: Switching data providers can be a complex and costly undertaking, involving system integration and retraining, which further entrenches existing relationships.

- Market Concentration: A few dominant players often control significant portions of the financial data market, limiting alternatives for large banking corporations.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, such as specialized law firms and consulting agencies, wield significant influence over HSBC. These entities offer critical expertise in navigating the labyrinth of global financial regulations, a necessity for any major banking institution. Their specialized knowledge and the critical nature of their services, which directly impact HSBC's legal standing and operational continuity, grant them considerable bargaining power.

The cost of these services can be substantial, directly affecting HSBC's operating expenses. For instance, the global financial services industry spent an estimated $250 billion on compliance in 2023, reflecting the high demand for these specialized skills. This figure underscores the financial leverage these providers possess.

- High Demand for Expertise: The increasing complexity of financial regulations worldwide means a constant need for specialized legal and compliance advice, making these providers indispensable.

- Significant Cost of Non-Compliance: The penalties for regulatory breaches are severe, often running into millions or even billions of dollars, which incentivizes banks like HSBC to retain top-tier compliance services.

- Limited Number of Specialized Firms: The niche nature of financial regulatory consulting means there are fewer providers compared to other service sectors, concentrating bargaining power.

Suppliers of critical financial market infrastructure, like payment networks and clearing houses, hold significant sway over HSBC. These entities often operate with limited competition, offering indispensable services that directly impact HSBC's cost of doing business and its ability to serve international clients.

In 2024, global transaction volumes continued to surge, reinforcing the critical nature of these infrastructure providers. For instance, Visa and Mastercard processed trillions of dollars in transactions worldwide, making their network fees a substantial cost for banks like HSBC.

| Supplier Type | HSBC Reliance | Bargaining Power Factor | 2024 Impact Consideration |

|---|---|---|---|

| Payment Networks (e.g., Visa, Mastercard) | High (Global transaction processing) | Network effects, limited alternatives | Transaction fees directly impact revenue and operational costs. |

| Clearing Houses | High (Settlement of trades) | Regulatory mandate, essential for market function | Service charges and operational stability are critical for risk management. |

What is included in the product

This analysis delves into the competitive forces shaping HSBC Holding's operating environment, examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes within the global banking sector.

Instantly assess competitive pressures across the banking landscape, from buyer bargaining power to the threat of substitutes, with a clear Porter's Five Forces analysis for HSBC.

Customers Bargaining Power

HSBC's large corporate and institutional clients, such as multinational corporations and governments, wield considerable bargaining power. Their substantial transaction volumes and the potential to shift business across multiple banking partners create a competitive environment where HSBC must offer favorable terms and pricing to retain them.

For retail and small to medium-sized enterprise (SME) banking clients, individual bargaining power is typically subdued. This is largely due to the perceived costs associated with switching providers and the largely uniform nature of many fundamental banking services. However, the surge in digital banking platforms and the greater clarity on fees and interest rates have collectively given customers more leverage, making it simpler to shop around for better deals.

High Net Worth Individuals (HNWIs) and Ultra HNWIs, the core clientele for HSBC's private banking and wealth management, possess considerable bargaining power. Their substantial asset bases, often in the tens of millions or even billions, enable them to negotiate favorable terms. For instance, in 2024, the average assets under management for clients in top-tier private banking segments globally often exceed $5 million, giving them leverage.

These sophisticated clients demand highly personalized services, including bespoke investment strategies and dedicated relationship managers. They are also acutely aware of fees and actively seek competitive pricing, often comparing offerings across multiple institutions. Access to exclusive, often illiquid, investment opportunities is another key demand that strengthens their negotiating position.

Furthermore, the mobility of these wealthy individuals amplifies their bargaining power. Many HNWIs and Ultra HNWIs work with several wealth managers simultaneously, diversifying their portfolios and ensuring they receive the best possible advice and returns. This diversification means they are not tied to a single provider, making it easier to switch if their needs aren't met or if better opportunities arise elsewhere.

Digital Empowerment and Information Asymmetry

The digital age has truly shifted the balance, making customers much more informed. Think about how many comparison websites and apps exist now. These tools allow anyone to easily see what different banks, including HSBC, are offering in terms of loans, savings accounts, and fees. This transparency means customers are less likely to overpay or accept subpar services.

This increased access to information directly impacts HSBC's bargaining power. Customers can now readily compare features, interest rates, and customer service reviews. For instance, by mid-2024, a significant percentage of banking customers reported using digital channels for most of their transactions, highlighting a preference for convenience and readily available information.

- Reduced Information Asymmetry: Digital platforms have leveled the playing field, giving customers unprecedented access to comparative data on financial products and services.

- Heightened Price Sensitivity: Easy comparison of pricing and fees makes customers more likely to switch providers for better deals, pressuring banks like HSBC on margins.

- Demand for Digital Excellence: Customers expect seamless, intuitive digital experiences, pushing banks to invest heavily in user-friendly apps and online services to retain business.

- Increased Switching Propensity: With readily available information and often lower switching costs in digital banking, customers are more empowered to move their business to competitors offering superior value or experience.

Low Switching Costs for Certain Services

Customers can easily switch between providers for services like credit cards and personal loans, especially with streamlined digital onboarding. This ease of transition means HSBC faces pressure to offer competitive rates and terms to retain business. For instance, in 2024, many digital banks continued to offer attractive introductory rates on savings accounts, directly impacting customer retention for traditional banks.

- Low Switching Costs for Certain Services

- Customers can easily move their business for credit cards, personal loans, and basic savings accounts due to low switching costs.

- Digital onboarding processes further reduce the friction associated with changing financial providers.

- This empowers customers to seek better rates and terms, compelling HSBC to maintain competitive pricing and service offerings.

The bargaining power of customers for HSBC is significant, particularly for its affluent clientele and in segments where digital offerings have reduced switching costs. This power stems from increased transparency, easy comparison of services, and the ability to demand personalized solutions, forcing HSBC to remain competitive on pricing and service quality.

| Customer Segment | Bargaining Power Drivers | Impact on HSBC |

|---|---|---|

| Large Corporate & Institutional Clients | High transaction volumes, potential to shift business | Requires competitive pricing and favorable terms to retain |

| High Net Worth Individuals (HNWIs) | Substantial asset bases, demand for bespoke services | Negotiate lower fees, premium services, and exclusive investment access |

| Retail & SME Clients (Digital Banking) | Ease of switching, access to comparative data | Pressure on margins due to readily available better deals |

Same Document Delivered

HSBC Holding Porter's Five Forces Analysis

This preview showcases the complete HSBC Holdings Porter's Five Forces analysis, providing an in-depth examination of competitive forces within the global banking sector. The document you see here is precisely what you'll receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any alterations or placeholders.

Rivalry Among Competitors

HSBC operates in a fiercely competitive landscape, facing strong rivalry from major global universal banks like JPMorgan Chase and Citigroup. These giants compete across all major banking segments, from retail and commercial to global markets and wealth management, driving intense price wars and rapid product development.

The battle for market share is evident in their aggressive strategies for geographic expansion and innovation. For instance, in 2023, JPMorgan Chase reported total revenue of $158.1 billion, showcasing its significant scale and reach, while Citigroup's revenue for the same period was $78.1 billion, highlighting the substantial resources deployed by key rivals.

HSBC faces intense rivalry from domestic and regional banks in its core European, Asian, and North American markets. These competitors often boast stronger local ties, deeply ingrained brand loyalty, and highly specialized strategies tailored to their home turf. This localized competition is especially sharp in retail and small-to-medium enterprise (SME) banking, where a strong physical presence and intimate understanding of local needs are paramount.

The competitive landscape for HSBC is intensified by fintech firms and digital challengers. These agile players, like Revolut and Monzo, are rapidly gaining market share by offering specialized, user-friendly digital services and often operating with significantly lower cost structures. For instance, by the end of 2023, the global fintech market was valued at over $2.4 trillion, demonstrating the scale of this disruption.

These digital disruptors are forcing established institutions like HSBC to prioritize their own digital transformation. By focusing on superior customer experience and innovative business models, fintechs are compelling traditional banks to invest heavily in technology and streamline operations to remain competitive. This pressure is particularly evident in areas like payments and lending, where new entrants are capturing significant volumes.

Product and Service Differentiation

Competitive rivalry in banking extends far beyond just price wars. HSBC, like its peers, faces intense competition based on the quality and distinctiveness of its products and services. This includes the sheer range of financial solutions offered, the caliber of customer support, the sophistication of digital banking interfaces, and the depth of specialized knowledge available to clients.

Banks must actively innovate to stay ahead. For instance, in 2024, the demand for sustainable finance options continued to surge, with global sustainable bond issuance reaching significant figures, creating a key area for differentiation. Similarly, personalized wealth management and frictionless cross-border payment solutions are becoming critical competitive battlegrounds. HSBC's ability to excel in these evolving customer needs directly impacts its market standing.

- Breadth of Offerings: Banks compete on the variety of products from basic accounts to complex investment vehicles.

- Customer Service Quality: Superior service is a major differentiator, impacting customer loyalty and retention.

- Digital Platform Strength: User-friendly and feature-rich online and mobile banking platforms are essential.

- Specialized Expertise: Offering niche expertise, such as in emerging markets or specific industries, attracts discerning clients.

Regulatory and Capital Environment

The banking sector is heavily regulated, with stringent capital requirements serving as a significant barrier to new entrants and influencing the intensity of competition. For instance, as of early 2024, major international banks like HSBC are subject to Basel III (and evolving Basel IV) capital adequacy ratios, such as a Common Equity Tier 1 (CET1) ratio typically above 10.5%, which demands substantial capital reserves.

While these regulations offer a degree of protection for established players, they also translate into considerable compliance costs and operational complexities. These ongoing expenses require constant investment in technology and personnel to ensure adherence to evolving rules, impacting profitability and requiring strategic resource allocation.

Banks must therefore balance the need to meet these regulatory demands with the imperative to compete effectively. This often means focusing on operational efficiency, innovation in service delivery, and strategic agility to maintain market share and profitability amidst a demanding regulatory landscape.

- High Capital Requirements: Banks must maintain robust capital buffers, such as CET1 ratios, to absorb potential losses, limiting the ability of less capitalized firms to compete.

- Compliance Costs: Significant investments are needed for regulatory reporting, risk management systems, and legal compliance, which can be a substantial operating expense.

- Regulatory Scrutiny: Constant oversight from bodies like the Bank of England or the European Central Bank necessitates transparency and adherence to a wide array of rules, impacting strategic decision-making.

HSBC faces intense rivalry from global banking giants like JPMorgan Chase and Citigroup, who compete across all segments with significant scale and resources. The pursuit of market share is fueled by aggressive expansion and innovation, as demonstrated by JPMorgan Chase's 2023 revenue of $158.1 billion and Citigroup's $78.1 billion.

Domestic and regional banks also pose a strong competitive threat, leveraging local ties and specialized strategies, particularly in retail and SME banking where understanding local needs is crucial. Furthermore, fintech firms like Revolut and Monzo are rapidly disrupting the market with user-friendly digital services and lower cost structures, forcing traditional banks to accelerate their digital transformation efforts.

Competition extends beyond price to product quality, customer service, digital platforms, and specialized expertise. The demand for sustainable finance, as seen in the significant global sustainable bond issuance figures in 2024, presents a key area for differentiation, alongside personalized wealth management and efficient cross-border payments.

The banking sector's high capital requirements, such as Common Equity Tier 1 ratios typically above 10.5% for major banks as of early 2024, act as a barrier to entry but also increase compliance costs. These ongoing expenses necessitate strategic resource allocation to balance regulatory adherence with competitive effectiveness.

| Competitor Type | Key Characteristics | Example | 2023 Revenue (USD Billions) | Key Competitive Factor |

| Global Universal Banks | Scale, broad service offering, global reach | JPMorgan Chase | 158.1 | Innovation, digital capabilities |

| Global Universal Banks | Scale, broad service offering, global reach | Citigroup | 78.1 | Customer experience, digital platforms |

| Regional/Domestic Banks | Local market knowledge, brand loyalty | Various (e.g., Lloyds Banking Group in UK) | N/A (specific to region) | Personalized service, local presence |

| Fintech/Digital Challengers | Agility, user experience, lower cost structure | Revolut | N/A (private) | Digital innovation, specialized services |

SSubstitutes Threaten

The threat of substitutes for HSBC is significant, primarily from non-bank payment solutions. Companies like PayPal, Stripe, Alipay, and WeChat Pay provide increasingly popular alternatives to traditional banking services for payments and remittances. These platforms often boast greater convenience and lower transaction fees, especially for online and person-to-person transfers, directly impacting HSBC's revenue from these core services.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes for traditional banking services. These platforms offer alternative channels for both borrowing and investing, directly challenging the core offerings of institutions like HSBC. For instance, the global P2P lending market was valued at approximately $85 billion in 2023 and is projected to reach over $300 billion by 2030, indicating a substantial shift in capital access.

These digital marketplaces allow individuals and businesses to secure loans or raise funds by connecting directly with investors, bypassing the need for intermediary banks. Crowdfunding, in particular, has seen robust growth, with platforms facilitating billions in capital raises annually across various sectors. This disintermediation means that potential borrowers and investors may opt for these more agile and often lower-cost alternatives, reducing the reliance on conventional banking products and services.

The rise of cryptocurrencies and Decentralized Finance (DeFi) presents a significant threat of substitutes for traditional banking. These technologies offer alternative avenues for payments, lending, borrowing, and even asset management, bypassing established financial intermediaries.

For instance, the total value locked in DeFi protocols reached over $200 billion in early 2024, demonstrating a growing user base and substantial capital flow outside of traditional banking systems. This disintermediation capability directly challenges HSBC's core business models, particularly in areas like cross-border payments and retail lending.

Direct Investment Platforms and Robo-Advisors

The rise of direct investment platforms and robo-advisors presents a significant threat of substitutes for traditional banking services like wealth management. These digital alternatives offer lower fees and greater accessibility, allowing individuals to manage their portfolios with minimal human interaction. For instance, by 2024, the global robo-advisor market was projected to reach hundreds of billions of dollars, demonstrating a clear shift in investor preference towards these cost-effective solutions.

These platforms empower retail investors to bypass traditional financial advisors for many of their investment needs. This disintermediation means that banks like HSBC face competition not just from other banks, but from technology-driven financial service providers. The convenience and reduced cost associated with these substitutes directly challenge the value proposition of traditional, higher-fee advisory services.

Key aspects of this threat include:

- Lower Cost Structures: Robo-advisors typically charge significantly lower management fees compared to traditional human advisors, often ranging from 0.25% to 0.50% annually, whereas traditional advisors can charge 1% or more.

- Increased Accessibility: Online platforms and apps allow individuals to start investing with much smaller amounts, often with no minimum balance, democratizing investment access.

- User-Friendly Interfaces: Many direct investment apps boast intuitive designs and automated features, simplifying the investment process for novice investors and reducing the perceived need for expert guidance.

Corporate Treasury Self-Management

Large corporations are increasingly adept at managing their treasury functions internally, a trend that intensifies the threat of substitutes for traditional banking services. Companies are leveraging technology and direct access to capital markets to handle cash, liquidity, and financing, bypassing intermediaries. This shift reduces their dependence on bank treasury services, credit lines, and investment banking advice as they optimize operations independently.

The growing sophistication of corporate treasury self-management directly impacts revenue streams for banks like HSBC. For instance, the U.S. non-financial corporate bond market saw issuance of approximately $1.6 trillion in 2023, demonstrating a significant alternative to bank loans for corporate financing needs. This indicates a substantial portion of potential treasury business that banks might otherwise capture is being handled internally or through direct market access.

- Reduced Reliance on Bank Credit Lines: Companies are increasingly using commercial paper and corporate bonds for funding, diminishing the need for traditional bank credit facilities.

- Direct Capital Market Access: Sophisticated treasuries can directly access global capital markets, bypassing banks for debt issuance and investment opportunities.

- Internal Cash and Liquidity Management: Advanced treasury management systems allow corporations to optimize cash flow and liquidity internally, reducing the need for external treasury services.

- Cost Optimization: Self-management often presents a more cost-effective solution for large corporations compared to the fees associated with traditional banking treasury services.

The threat of substitutes for HSBC is multifaceted, spanning digital payment solutions, alternative lending platforms, cryptocurrencies, and direct investment channels. These substitutes often offer lower costs, greater convenience, and increased accessibility, directly challenging HSBC's traditional revenue streams and customer base.

The increasing adoption of non-bank payment solutions like PayPal and Alipay, along with the growth of P2P lending and crowdfunding, signifies a significant shift. For example, the global P2P lending market was valued at approximately $85 billion in 2023 and is projected for substantial growth. Similarly, the total value locked in DeFi protocols exceeded $200 billion in early 2024, highlighting a move away from traditional banking services.

Furthermore, robo-advisors are gaining traction, with the global market projected to reach hundreds of billions of dollars by 2024, offering lower-fee wealth management alternatives. This trend, coupled with large corporations managing treasury functions internally and accessing capital markets directly, as evidenced by the $1.6 trillion in U.S. non-financial corporate bond issuance in 2023, underscores the broad and evolving nature of substitute threats.

Entrants Threaten

Fintech startups pose a significant threat to established institutions like HSBC. These agile companies, often operating with lower overheads and leveraging cutting-edge technology, are adept at carving out profitable niches. For instance, in 2024, the global fintech market was projected to reach over $1.1 trillion, demonstrating the rapid growth and disruptive potential of these new entrants.

Their ability to innovate quickly allows them to target specific areas within financial services, such as digital lending or payments, where they can offer enhanced user experiences or more competitive pricing than traditional banks. This can lead to a rapid erosion of market share for incumbents if they fail to adapt.

Big Tech firms like Apple, Google, Amazon, and Meta represent a substantial long-term threat to HSBC. Their immense customer reach, sophisticated data analytics, and strong brand loyalty provide a significant advantage. For instance, Apple Pay alone boasts over 500 million users globally as of early 2024, showcasing their vast potential to integrate financial services.

These tech giants often begin with payment solutions, but their ambition extends to lending, insurance, and other core banking offerings. This expansion could quickly disrupt traditional banking models, challenging HSBC's established market position. Google's foray into offering checking accounts through partnerships with banks in the US highlights this trend, demonstrating their ability to leverage existing infrastructure for new financial products.

Neobanks and challenger banks, operating with minimal overhead due to their digital-only models, present a significant threat. Their lower operational costs allow them to offer attractive pricing and user-friendly digital interfaces, directly competing with traditional players like HSBC.

These agile competitors are particularly successful in attracting younger demographics and small to medium-sized enterprises (SMEs). For instance, in 2023, digital banks continued to gain traction, with some reporting substantial year-over-year customer growth, forcing established institutions to bolster their digital offerings to remain competitive.

Regulatory Environment and Open Banking Initiatives

The banking industry, while traditionally shielded by significant regulatory hurdles, is experiencing a shift. Initiatives like Open Banking, particularly prominent in regions such as the UK and Europe, are actively dismantling these barriers. By mandating secure data sharing through Application Programming Interfaces (APIs), these frameworks allow new players, including FinTech companies, to build innovative financial services by leveraging existing bank infrastructure. This fosters a more competitive landscape, making it considerably easier for non-traditional entities to offer financial products and services.

For instance, the UK's Open Banking has seen a significant uptake, with over 7 million consumers and businesses actively using Open Banking-enabled services by early 2024. This demonstrates the tangible impact of these regulations in lowering entry barriers. These API-driven frameworks are not just about data sharing; they are fundamentally enabling new business models that can compete directly with incumbent banks by offering specialized, often more user-friendly, financial solutions.

- Open Banking Mandates: Regulations in key markets like the UK and EU require banks to share customer data securely with third-party providers via APIs, reducing the need for new entrants to build their own infrastructure from scratch.

- FinTech Innovation: This regulatory push has spurred the growth of FinTech companies, enabling them to offer services such as account aggregation, payment initiation, and personalized financial advice by accessing data from established banks.

- Increased Competition: By lowering traditional barriers, Open Banking and similar initiatives directly increase the threat of new entrants, forcing established players like HSBC to innovate and improve their own offerings to remain competitive.

Capital Requirements and Brand Trust

Historically, the banking sector demanded immense capital and a deeply ingrained brand trust, creating substantial hurdles for newcomers. For instance, in 2024, the average Tier 1 capital ratio for major global banks remained robust, underscoring the ongoing need for significant financial backing.

However, the landscape is shifting. New entrants can now leverage Banking-as-a-Service (BaaS) models, partnering with existing licensed institutions to bypass direct licensing and capital burdens. This approach allows fintechs to offer banking services without holding a full banking license themselves, significantly lowering the initial capital outlay.

- BaaS Partnerships: Fintechs can offer services like payments and lending by integrating with established banks, reducing capital requirements.

- Niche Focus: Entrants can target specific, less capital-intensive market segments, such as digital-only savings accounts or specialized lending platforms.

- Digital Trust Building: Superior user experience, transparent fee structures, and robust cybersecurity measures are key to rapidly establishing customer trust in the digital age, as demonstrated by the rapid growth of neobanks in 2024 that prioritized these aspects.

The threat of new entrants for HSBC is amplified by regulatory shifts and technological advancements that lower traditional barriers. Open Banking, for example, allows third-party providers access to customer data via APIs, facilitating specialized financial services. This has fueled the rise of agile fintechs and neobanks, which often operate with lower overheads and can offer competitive pricing and superior digital experiences, particularly to younger demographics and SMEs.

| New Entrant Type | Key Disruptive Factor | 2024 Market Impact Indicator |

|---|---|---|

| Fintech Startups | Agile innovation, lower overheads | Global Fintech Market projected > $1.1 trillion |

| Big Tech Firms | Vast customer reach, data analytics | Apple Pay users > 500 million globally |

| Neobanks/Challenger Banks | Digital-only models, attractive pricing | Continued substantial customer growth reported |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for HSBC Holdings is built upon a foundation of credible data, including HSBC's annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable financial news outlets, industry-specific research reports, and macroeconomic data providers to offer a comprehensive view of the competitive landscape.