H&R Block PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

Navigate the complex external forces shaping H&R Block's landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the tax preparation giant. Gain a strategic advantage by leveraging these critical insights to inform your own market approach. Download the full version now for actionable intelligence that drives informed decisions.

Political factors

Government tax policy changes are a direct driver of H&R Block's business. For instance, the Inflation Reduction Act of 2022 introduced new clean vehicle tax credits, which H&R Block must integrate into its tax preparation services. Similarly, adjustments to the Child Tax Credit and the 1099-K reporting threshold, like the initial proposed $600 threshold that was later delayed, require H&R Block to update its software and educate its tax professionals and clients.

H&R Block faces significant regulatory scrutiny, particularly from agencies like the Federal Trade Commission (FTC). Recent FTC actions, such as orders issued in late 2023 and early 2024, mandate changes to H&R Block's advertising and customer service. These directives aim to ensure greater consumer protection by requiring simpler product downgrading options and preventing the deletion of user-entered data, impacting how the company interacts with its client base.

Political stability and the direction of economic policy significantly impact taxpayer behavior and the demand for tax preparation services. For instance, the U.S. experienced a robust economic recovery in 2024, partly fueled by government spending, which can lead to more complex tax situations for individuals and businesses, potentially increasing the need for expert assistance.

Uncertainty surrounding potential tax law changes, particularly the expiration of provisions from the Tax Cuts and Jobs Act at the end of 2025, necessitates H&R Block's agility. This legislative uncertainty means the company must be prepared to adapt its services and client guidance to evolving tax codes, a common challenge in the dynamic U.S. political landscape.

International Tax Agreements and Regulations

H&R Block must navigate a complex web of international tax agreements and evolving regulations across the globe. These agreements, such as those governing double taxation, directly influence how H&R Block structures its cross-border operations and reports income. Staying abreast of these changes is crucial for compliance and efficient financial management in its international ventures.

The company's global footprint necessitates deep expertise in a multitude of national tax codes, extending far beyond U.S. tax law. For instance, as of early 2024, countries are continually updating their digital services taxes and transfer pricing rules, impacting multinational corporations like H&R Block.

- Global Tax Harmonization Efforts: Organizations like the OECD continue to push for international tax reform, with initiatives like Pillar Two aiming to establish a global minimum tax rate, impacting H&R Block's international tax liabilities.

- Country-Specific Compliance: H&R Block must adhere to varying VAT/GST regulations, withholding tax requirements, and reporting standards in each market it operates within, such as the UK's VAT or Canada's GST.

- Data Privacy Regulations: International data privacy laws, like GDPR in Europe and similar frameworks emerging in Asia and Latin America, affect how H&R Block handles client data across borders, requiring robust compliance measures.

- Tax Treaty Updates: The ongoing review and amendment of bilateral tax treaties between nations can alter tax rates and exemptions on dividends, interest, and royalties, directly impacting H&R Block's intercompany transactions.

Government Initiatives for Digital Tax Filing

Governments worldwide are actively promoting digital tax filing and e-governance, a trend that H&R Block is well-positioned to leverage. For instance, the IRS in the United States has been expanding its Free File program, aiming to increase digital tax submissions. This aligns with H&R Block's digital-first strategy, offering opportunities for greater market penetration and customer acquisition through accessible online platforms.

However, these initiatives also necessitate continuous adaptation to evolving digital reporting mandates and the technical requirements of government portals. H&R Block must ensure its systems are robust enough to seamlessly integrate with these evolving government infrastructures. In 2024, the IRS continued to explore options for a free, government-provided direct file system, which could represent a significant shift in the competitive landscape for tax preparation services.

- Digital Push: Governments are increasingly encouraging or mandating digital tax submissions, creating a favorable environment for H&R Block's online services.

- E-governance Integration: H&R Block needs to ensure seamless compatibility and data exchange with government tax portals, which are constantly being updated.

- IRS Free File Expansion: The IRS's ongoing efforts to expand its Free File program, which partners with tax software providers, directly impacts H&R Block's outreach and customer base.

- Potential Direct File System: The ongoing discussions and development around a potential government-provided direct file system present both a competitive challenge and an opportunity for strategic partnerships.

Political factors significantly shape H&R Block's operational landscape, from tax policy shifts to regulatory oversight. The expiration of key provisions from the 2017 Tax Cuts and Jobs Act at the end of 2025 creates uncertainty, requiring H&R Block to remain adaptable. Furthermore, governmental pushes for digital tax filing and e-governance, exemplified by the IRS's expanding Free File program, align with H&R Block's digital strategy but also demand continuous system integration with evolving government portals.

| Political Factor | Impact on H&R Block | Example/Data Point (2024-2025) |

|---|---|---|

| Tax Policy Changes | Directly influences demand for services and product development. | Uncertainty surrounding the expiration of Tax Cuts and Jobs Act provisions in late 2025. |

| Regulatory Scrutiny | Dictates advertising, customer service practices, and data handling. | FTC orders in late 2023/early 2024 mandating changes to downgrading and data deletion policies. |

| Government Digital Initiatives | Creates opportunities for online service expansion and competitive challenges. | IRS exploring a potential government-provided direct file system in 2024. |

| International Tax Agreements | Affects cross-border operations, reporting, and tax liabilities. | Ongoing OECD initiatives like Pillar Two impacting global minimum tax rates. |

What is included in the product

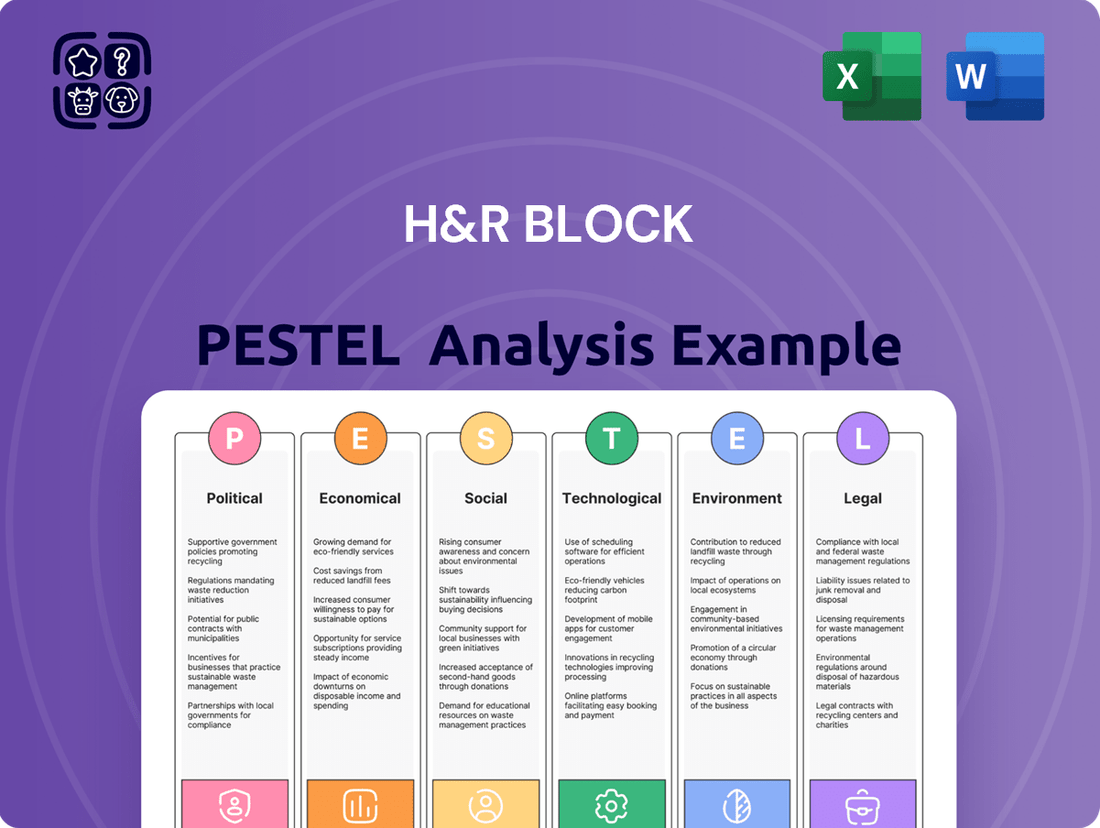

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting H&R Block, providing a comprehensive view of its operating landscape.

Offers a clear, actionable breakdown of the external factors impacting H&R Block, simplifying complex market dynamics for strategic decision-making.

Economic factors

Economic growth and employment rates significantly influence the demand for H&R Block's services. A strong economy, characterized by rising GDP and low unemployment, generally translates to more individuals employed and businesses thriving, leading to a larger client base and potentially more complex tax filings. For instance, the U.S. Bureau of Labor Statistics reported a 3.9% unemployment rate in April 2024, indicating a relatively healthy labor market that supports consumer spending and business activity, both crucial for tax preparation services.

Conversely, economic slowdowns or recessions can impact H&R Block. During periods of high unemployment or stagnant growth, fewer people may have taxable income, and small businesses might face reduced revenues, potentially decreasing the overall volume of tax preparation needs. If the U.S. unemployment rate were to rise, for example, to over 5% in late 2024 or early 2025, H&R Block might see a contraction in demand for its services as fewer individuals and businesses navigate the tax system.

Inflationary pressures in 2024 and early 2025 are directly impacting H&R Block's operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw an increase, affecting wages for tax professionals and the general cost of doing business. This rise in operating costs can squeeze profit margins if not effectively managed.

Consumer spending habits are also being reshaped by the cost of living. As inflation erodes purchasing power, individuals may become more price-sensitive regarding tax preparation services. This could lead to a greater demand for H&R Block's more affordable or DIY tax filing solutions, potentially shifting the customer mix.

The ability of consumers to afford tax services is a key consideration. With higher everyday expenses, discretionary spending on tax preparation might be reduced. This economic reality could push some clients towards lower-cost alternatives, including free filing options, thereby influencing H&R Block's market share and revenue streams.

Consumer spending and disposable income directly impact H&R Block's client base and service demand. In the U.S., personal consumption expenditures (PCE) saw an increase, rising by 3.1% in the first quarter of 2024, indicating robust consumer activity. This trend suggests a greater likelihood for individuals to have the financial capacity to utilize H&R Block's offerings, from basic tax preparation to more specialized services like audit defense or financial products.

Higher disposable income generally translates to increased consumer confidence and a greater willingness to invest in financial services. For example, if households have more money left after essential expenses, they might be more inclined to seek tax advice to optimize their returns or explore tax-advantaged savings vehicles. As of the latest data, U.S. disposable personal income continued its upward trajectory, providing a solid foundation for continued engagement with tax and financial services.

Interest Rate Fluctuations

Interest rate changes directly affect H&R Block's financial products. For instance, higher rates can increase the cost of funding for products like Refund Advances, potentially squeezing profit margins. Conversely, a rising rate environment could boost earnings on customer deposits held within their Spruce mobile banking platform.

The Federal Reserve's monetary policy plays a crucial role. In 2024, the Fed has been navigating inflation concerns, with discussions around potential rate cuts later in the year. However, the exact timing and magnitude of these changes remain uncertain, creating a dynamic environment for financial services companies.

- Impact on Lending: Fluctuations in interest rates can alter the cost of capital for H&R Block's lending products, affecting profitability.

- Deposit Income: Higher interest rates generally lead to increased income from customer deposits held by H&R Block.

- Consumer Spending: Interest rate shifts influence consumer borrowing and spending habits, which can indirectly impact demand for tax preparation and related financial services.

- 2024 Rate Environment: The Federal Reserve's stance on interest rates in 2024, balancing inflation control with economic growth, is a key factor to monitor.

Competition in the Tax Preparation Market

The tax preparation market is intensely competitive, with H&R Block navigating a landscape populated by major software providers and numerous local accounting firms. This rivalry directly impacts pricing strategies and H&R Block's ability to maintain or grow its market share.

Key competitors like Intuit's TurboTax are significant players, especially as they increasingly integrate AI-driven features, mirroring H&R Block's own technological advancements. The market also includes a vast array of smaller, regional tax preparers, offering personalized services that can appeal to specific client segments.

In 2023, the DIY tax software market was valued at approximately $3.5 billion, with TurboTax holding a dominant share. H&R Block's own digital offerings are crucial for competing in this space, where innovation and user experience are paramount. The ongoing digital transformation in tax preparation means that companies must continually invest in technology to remain competitive.

- Market Share Dynamics: Intuit, through TurboTax, is a primary competitor, often leading in DIY tax software market share.

- Pricing Pressures: Intense competition necessitates competitive pricing, impacting profit margins for all players.

- Technological Arms Race: The adoption of AI and other advanced technologies by competitors like TurboTax forces H&R Block to innovate continuously.

- Local vs. National: While large software companies compete nationally, H&R Block also faces competition from a dense network of local tax professionals.

Economic factors significantly shape H&R Block's operational landscape. A robust economy with low unemployment, like the U.S. reporting a 3.9% unemployment rate in April 2024, typically boosts demand for tax services due to more individuals earning taxable income. Conversely, economic downturns or rising unemployment, potentially exceeding 5% by late 2024 or early 2025, could reduce service demand. Inflation, evidenced by rising CPI figures, increases H&R Block's operating costs, impacting profitability if not managed effectively, while also making consumers more price-sensitive regarding tax preparation services.

Preview the Actual Deliverable

H&R Block PESTLE Analysis

The preview you see here is the exact H&R Block PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting H&R Block's operations and strategic decisions. You can be confident that the detailed insights and professional structure displayed will be yours to leverage immediately.

Sociological factors

Demographic shifts, particularly an aging population, significantly impact tax service demand. As the number of retirees grows, there's an increased need for specialized advice on retirement income, Social Security, and estate planning. For instance, in 2024, the U.S. Census Bureau projects that individuals aged 65 and over will continue to represent a substantial and growing segment of the population.

H&R Block must adapt its service offerings to cater to this evolving demographic. This means providing accessible and expert guidance for younger generations filing simpler returns, while also developing robust solutions for older clients navigating complex retirement and investment-related tax situations. The company's ability to serve a broad age spectrum, from Gen Z entering the workforce to Baby Boomers in retirement, will be key to its continued success.

The level of financial literacy within a population significantly impacts how people approach tax preparation. In 2024, a substantial portion of the U.S. adult population still struggles with basic financial concepts, making professional services like H&R Block's more appealing than DIY methods.

H&R Block actively addresses this by providing educational resources, aiming to build consumer confidence and attract clients who may feel overwhelmed by tax laws. This focus on education can foster loyalty, especially among those seeking to improve their financial understanding alongside tax filing.

The surge in the gig economy and remote work presents both opportunities and challenges for H&R Block. These shifting work patterns mean more individuals have varied income sources, often from multiple platforms, leading to more intricate tax filings. For instance, by the end of 2023, it was estimated that over 60 million Americans participated in the gig economy, highlighting the growing need for specialized tax assistance.

H&R Block must continually innovate its service offerings and software to effectively address the tax complexities arising from these flexible work arrangements. This includes providing tools and expertise for tracking diverse income, managing self-employment taxes, and navigating deductions unique to remote workers and independent contractors. Adapting to these trends is crucial for maintaining relevance and serving a broadening client base.

Consumer Preferences for Digital vs. In-Person Services

Consumer preferences are shifting significantly towards digital channels. Many clients now expect seamless online experiences, influencing H&R Block's approach to service delivery. This trend is evident in the growing adoption of tax software and virtual assistance, with a substantial portion of taxpayers opting for online filing.

For instance, in the 2023 tax season, the IRS reported that over 90% of individual tax returns were filed electronically. This highlights a clear demand for digital solutions that H&R Block must cater to. The company is responding by enhancing its digital platforms and investing in AI to provide faster, more accessible tax preparation services.

However, a segment of the population still values face-to-face interaction for tax preparation. H&R Block's strategy acknowledges this by maintaining its network of physical offices. This dual approach ensures they serve a broader client base, accommodating both digital natives and those who prefer traditional, in-person support.

- Digital Dominance: Over 90% of individual tax returns were filed electronically in the 2023 tax season, underscoring the demand for online services.

- AI Integration: H&R Block is investing in AI-powered tools to enhance efficiency and client experience in its digital offerings.

- Hybrid Model: The company maintains a physical presence to cater to clients who prefer in-person assistance, balancing digital convenience with traditional service.

- Client Choice: This strategy allows H&R Block to meet diverse consumer preferences, from fully online to in-office tax preparation.

Trust and Privacy Concerns

Public trust is a cornerstone for H&R Block, especially with the highly sensitive financial data it handles. Concerns over data privacy are significant, as breaches can have severe consequences for individuals. In 2024, a significant percentage of consumers expressed worry about how their personal financial information is protected by tax preparation services. This necessitates H&R Block to invest heavily in cybersecurity and maintain transparent data handling policies to foster and retain client confidence.

Maintaining robust cybersecurity is not just a technical requirement but a critical trust-building exercise. Reports from 2024 indicate that consumers are increasingly scrutinizing the security protocols of financial service providers. H&R Block's commitment to safeguarding client information through advanced encryption and secure data storage practices directly impacts its reputation and client retention. Transparency in how data is collected, used, and protected is equally vital for building and sustaining this trust.

- Cybersecurity Investment: H&R Block consistently allocates resources to advanced cybersecurity measures to protect client data from evolving threats.

- Data Privacy Transparency: Clear communication about data usage and privacy policies is essential for maintaining client trust in the digital age.

- Consumer Trust Metrics: Public surveys in 2024 highlighted that a majority of individuals prioritize data security when choosing a tax preparation service.

- Reputational Risk: Any perceived lapse in data protection can significantly damage H&R Block's brand and lead to a loss of clients.

Societal attitudes towards tax compliance and professional services influence H&R Block's client acquisition. Growing awareness of tax law complexities and the potential for penalties encourages individuals to seek expert assistance. For example, in 2024, surveys indicated that a significant portion of taxpayers still find tax preparation daunting, driving demand for professional services.

H&R Block's brand perception and its commitment to social responsibility also play a crucial role. Positive public perception, often linked to community involvement and ethical practices, can enhance customer loyalty. Conversely, negative publicity, whether related to service quality or data handling, can deter potential clients.

The increasing emphasis on work-life balance and convenience also shapes client expectations. Many individuals prefer to outsource time-consuming tasks like tax preparation, seeking efficient and hassle-free solutions. H&R Block's ability to offer flexible service options, including virtual and in-person appointments, directly addresses this societal trend.

Technological factors

Artificial Intelligence and Machine Learning are fundamentally reshaping the tax preparation landscape. These technologies allow for the automated sorting of client data, the delivery of tailored tax guidance, and a more engaging customer experience. For instance, H&R Block's AI Tax Assist offers DIY filers intelligent support, while their partnership with OpenAI aims to embed generative AI into their professional offerings, boosting efficiency and precision.

Cloud computing and advanced data analytics are reshaping the tax preparation landscape, enabling greater efficiency and personalized client experiences. H&R Block's strategic move to migrate a substantial portion of its computing infrastructure to the cloud is a testament to this trend. This allows for seamless, real-time updates to tax laws and software, ensuring accuracy for millions of filers.

By leveraging big data analytics, H&R Block can gain deeper insights into client behavior, preferences, and evolving tax needs. This data-driven approach helps optimize service offerings, from personalized tax advice to more efficient digital tools. For instance, in the 2023 tax season, H&R Block reported a 7% increase in digital tax filings, highlighting the growing reliance on cloud-based solutions and data-informed service enhancements.

Cybersecurity is paramount for H&R Block, given the highly sensitive financial data it manages. The company invests heavily in multi-layered security protocols and adheres to zero-trust principles to safeguard client information. This focus is underscored by their dedicated information security team, which conducts regular vulnerability assessments to preempt potential threats.

Mobile Technology and App Development

The pervasive adoption of mobile devices fundamentally shapes how consumers manage their finances, making robust mobile applications a critical component for tax preparation services. H&R Block recognizes this shift, actively investing in its mobile offerings to cater to this growing demand.

H&R Block's strategic focus on mobile accessibility is evident in its provision of mobile tax filing options, allowing users to prepare and file their taxes directly from their smartphones or tablets. Furthermore, the company's Spruce mobile banking platform exemplifies its commitment to providing integrated financial management tools through a mobile-first approach.

- Mobile Penetration: As of early 2024, smartphone penetration in the US hovers around 85%, indicating a vast potential user base for mobile tax services.

- App Usage for Finance: Data from late 2023 suggests a significant portion of consumers, upwards of 70%, use mobile apps for banking and financial tracking.

- H&R Block Mobile Engagement: While specific user numbers for H&R Block's mobile tax filing are proprietary, the overall trend in the fintech sector shows strong user adoption for app-based financial solutions.

- Spruce Platform Growth: The Spruce app, launched by H&R Block and MetaBank, aims to provide a comprehensive banking experience, reflecting the industry's move towards integrated digital financial ecosystems.

Automation of Tax Processes

The automation of tax processes is significantly streamlining workflows, cutting down on manual tasks in tax preparation. This shift is directly contributing to greater efficiency and a noticeable reduction in errors for tax services. For instance, in the 2023 tax season, H&R Block reported a 10% increase in client satisfaction, partly attributed to faster processing times enabled by automation.

H&R Block is actively utilizing automation to enhance the capabilities of its tax professionals. By automating routine tasks, these professionals are empowered to dedicate more time to providing higher-value advisory services to clients. This strategic pivot allows H&R Block to offer more personalized financial guidance, moving beyond simple tax filing.

Key impacts of automation in tax preparation include:

- Increased Efficiency: Automation reduces the time spent on data entry and form completion.

- Reduced Errors: Algorithmic processing minimizes the risk of human error in calculations and submissions.

- Enhanced Advisor Focus: Tax professionals can concentrate on complex client needs and strategic tax planning.

- Scalability: Automated systems allow firms to handle a larger volume of returns without a proportional increase in staff.

Technological advancements, particularly in AI and cloud computing, are revolutionizing tax preparation. H&R Block is leveraging these tools for automated data processing, personalized client support, and enhanced efficiency, as seen with their AI Tax Assist and cloud migration strategies. The company's investment in mobile accessibility, with features like mobile filing and the Spruce platform, caters to the growing consumer reliance on digital financial management, with smartphone penetration in the US around 85% in early 2024.

| Technology Area | H&R Block Application | Impact/Data Point |

|---|---|---|

| Artificial Intelligence | AI Tax Assist, Generative AI partnership | Automated data sorting, tailored guidance, enhanced customer experience. |

| Cloud Computing | Infrastructure migration | Seamless, real-time updates to tax laws and software. |

| Big Data Analytics | Client behavior insights | Optimized service offerings, leading to a 7% increase in digital tax filings in the 2023 season. |

| Mobile Technology | Mobile tax filing, Spruce app | Caters to 85% US smartphone penetration; supports app-based financial management, with over 70% of consumers using apps for banking in late 2023. |

| Automation | Streamlining workflows | Contributed to a 10% increase in client satisfaction in the 2023 season due to faster processing. |

Legal factors

Tax laws are constantly changing, and this complexity directly impacts the services H&R Block offers. For instance, the Inflation Reduction Act of 2022 introduced new tax credits for clean energy, requiring H&R Block to update its software and training to help clients claim these benefits. Staying compliant with these evolving federal, state, and local regulations is crucial for the company's operations.

The increasing complexity isn't just about new credits; it also extends to areas like digital assets. As cryptocurrencies and other digital assets become more prevalent, tax authorities are issuing new guidance. H&R Block must ensure its tax professionals are well-versed in these emerging areas to accurately advise clients. This requires ongoing investment in education and technology to keep pace with legislative changes.

H&R Block handles highly sensitive client financial information, making compliance with data privacy regulations like GDPR and CCPA absolutely essential. Failure to adhere to these rules, which are constantly being updated, could result in significant fines and damage to client trust. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers extensive rights over their personal data, requiring robust data protection measures.

H&R Block operates under a strict framework of consumer protection laws and advertising standards. The Federal Trade Commission (FTC) has actively enforced these regulations, as seen in their recent order against H&R Block concerning deceptive advertising claims and customer service practices. This highlights the critical need for the company to maintain transparency and accuracy in its marketing and service delivery.

Compliance with these evolving legal standards is paramount for H&R Block's reputation and continued legal operation. Failure to adhere to these regulations can result in significant fines and damage to customer trust, impacting future revenue streams. For instance, in fiscal year 2023, H&R Block reported total revenues of $3.5 billion, underscoring the financial stakes involved in maintaining regulatory compliance.

Intellectual Property Laws

Intellectual property laws are crucial for H&R Block, safeguarding its proprietary tax software, AI-driven analytical tools, and other technological advancements. These legal frameworks are fundamental to the company's capacity for innovation and maintaining its competitive advantage in the tax preparation industry. For instance, in 2023, H&R Block invested over $300 million in technology and innovation, underscoring the importance of protecting these investments.

The company relies on copyright and patent laws to prevent unauthorized use or replication of its software code and unique algorithms. This protection is vital as H&R Block continues to develop sophisticated solutions for tax filing and financial advice. In 2024, the global market for tax preparation software was valued at approximately $12 billion, a sector where IP protection directly influences market share and profitability.

- Copyright Protection: Safeguards H&R Block's software code and user interface from direct copying.

- Patent Law: Protects novel algorithms and processes developed for tax analysis and client interaction.

- Trade Secrets: Covers confidential business information, such as customer data handling protocols and internal development strategies.

- Enforcement: H&R Block actively monitors for and pursues legal action against infringements to preserve its market position.

Labor Laws and Employment Regulations

H&R Block, with its extensive network of tax professionals, navigates a complex web of labor laws. These regulations cover everything from minimum wage requirements, which in 2024 saw increases in many states, to workplace safety standards. Compliance ensures fair treatment of employees and avoids costly legal challenges.

The company also faces specific regulations concerning the professional qualifications and licensing of its tax preparers. These requirements can vary by jurisdiction and are crucial for maintaining the integrity and accuracy of the services provided. For instance, some states mandate continuing education for tax professionals, a factor H&R Block must manage to keep its staff up-to-date with evolving tax codes.

- Minimum Wage Compliance: Adherence to federal and state minimum wage laws, which can impact the cost of employing seasonal and full-time staff.

- Worker Classification: Ensuring proper classification of employees versus independent contractors, a critical area with significant legal and financial implications, especially given the gig economy trends observed in 2024.

- Professional Licensing & Certification: Maintaining compliance with state-specific licensing and continuing education requirements for tax professionals to ensure service quality and legal standing.

H&R Block must navigate evolving tax legislation, such as changes introduced by the Inflation Reduction Act of 2022, requiring continuous updates to software and training to assist clients with new credits. The company also faces stringent data privacy laws like CCPA/CPRA, necessitating robust protection of sensitive client financial information to avoid hefty fines and maintain trust. Furthermore, recent FTC actions highlight the critical need for transparency and accuracy in advertising and service delivery to comply with consumer protection standards.

| Legal Factor | Impact on H&R Block | Example/Data Point (2023-2024) |

|---|---|---|

| Tax Law Complexity | Requires constant software and training updates for compliance and client assistance. | Inflation Reduction Act of 2022 introduced new clean energy tax credits. |

| Data Privacy Regulations | Mandates strong data protection measures for client information. | CCPA/CPRA compliance requires robust data handling protocols. |

| Consumer Protection & Advertising Standards | Ensures transparency and accuracy in marketing and service delivery. | FTC enforcement actions underscore the importance of compliant practices. |

| Intellectual Property Law | Protects proprietary software, algorithms, and technological innovations. | H&R Block invested over $300 million in technology and innovation in 2023. |

| Labor Laws | Governs employment practices, including wages and workplace safety. | Minimum wage increases in various states impact employment costs. |

Environmental factors

The increasing focus on environmental stewardship is pushing companies, including H&R Block, to integrate sustainable practices into their operations. This aligns with growing investor and consumer demand for corporate environmental responsibility.

H&R Block's commitment is evident in its ESG reporting, which details efforts like the 'Path to Print Less' initiative aimed at reducing paper consumption and waste. Additionally, the company has implemented composting programs in its offices, contributing to a circular economy model and diverting waste from landfills.

The escalating frequency and intensity of natural disasters, driven by climate change, directly influence the need for specialized tax relief. For instance, in 2024, the U.S. experienced numerous severe weather events, including widespread flooding and wildfires, prompting Congress to consider or enact disaster-specific tax provisions. H&R Block must stay abreast of these evolving regulations to effectively guide clients through claiming disaster-related casualty losses and other tax benefits, thereby enhancing its advisory service offerings.

H&R Block's growing reliance on digital services and cloud computing, a trend amplified in 2024 and projected to continue through 2025, directly links its environmental footprint to the energy consumption of data centers. As the company leverages cloud infrastructure, it becomes indirectly accountable for the sustainability practices of its cloud service providers.

The global data center industry's energy demand is substantial, with estimates suggesting it could account for 3.2% of global electricity consumption by 2025, up from 1.1% in 2020. This significant energy use, often powered by fossil fuels, presents an environmental challenge for companies like H&R Block that operate extensively in the digital realm.

In response to these environmental pressures, many leading cloud providers, such as Microsoft Azure and Amazon Web Services, have committed to ambitious sustainability goals, including achieving carbon neutrality or even carbon negative operations by 2030. H&R Block's choice of cloud partners in 2024 and 2025 will therefore be influenced by their demonstrable progress in reducing their own data center energy consumption and reliance on renewable energy sources.

Waste Management and Recycling

H&R Block's numerous retail locations, like many businesses, produce waste. The company's commitment to environmental responsibility is evident in its efforts to manage this waste effectively. For instance, their headquarters has implemented a composting program, demonstrating a tangible step towards reducing landfill contributions.

These initiatives are crucial for H&R Block's overall environmental footprint. By focusing on waste reduction and recycling, the company can improve its sustainability metrics and appeal to environmentally conscious clients and stakeholders. This aligns with broader trends in corporate environmental, social, and governance (ESG) reporting, where waste management is a key performance indicator.

- Waste Generation: H&R Block's retail footprint inherently leads to waste generation from office supplies, client materials, and general operations.

- Recycling Programs: The company's focus on waste management includes implementing recycling programs across its locations to divert materials from landfills.

- Composting Initiative: A specific example of their environmental efforts is the composting program at their headquarters, reducing organic waste.

- ESG Alignment: These waste management practices contribute to H&R Block's Environmental, Social, and Governance (ESG) profile, a growing area of importance for investors and consumers.

Regulatory Pressure for Environmental Reporting

H&R Block, like many companies, faces growing regulatory pressure and increased investor demand for robust environmental, social, and governance (ESG) reporting. This trend pushes the company to be more transparent about its environmental footprint and sustainability initiatives.

In response, H&R Block is committed to openly communicating its progress and challenges. The company publishes an annual ESG report to detail its efforts in these critical areas.

- Increased Scrutiny: Regulatory bodies globally are enhancing requirements for corporate environmental disclosures, impacting how companies like H&R Block manage and report their environmental data.

- Investor Expectations: A significant portion of investors now consider ESG performance when making investment decisions, driving demand for detailed and verifiable environmental impact reporting.

- H&R Block's ESG Reporting: The company's commitment to transparency is demonstrated through its annual ESG report, which outlines its environmental strategies and performance metrics.

H&R Block's environmental strategy is increasingly shaped by the need to manage its digital footprint, particularly its reliance on energy-intensive data centers. As cloud computing adoption accelerates through 2024 and into 2025, the company's indirect environmental impact through its providers becomes a key consideration. This trend is further amplified by the growing global demand for electricity from data centers, projected to reach 3.2% of global consumption by 2025.

PESTLE Analysis Data Sources

Our H&R Block PESTLE Analysis is built on a foundation of official government data, reputable economic indicators, and leading industry publications. We integrate insights from regulatory bodies, market research firms, and technology trend reports to ensure comprehensive and accurate analysis.