H&R Block Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

Unlock the core components of H&R Block's success with a comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

H&R Block collaborates with financial institutions like Pathward N.A. to deliver essential financial products to its clients. These alliances are fundamental for services such as Refund Transfers, enabling clients to have their tax preparation fees deducted directly from their refunds, and the H&R Block Emerald Prepaid Mastercard, offering a secure and accessible way to manage funds.

H&R Block actively collaborates with technology providers to bolster its digital offerings and customer support. A notable example is their partnership with Atomic, which powers the Spruce mobile banking app, enhancing financial management tools for users. This strategic alliance, alongside collaborations with firms like NiCE to implement AI for customer service, particularly during the intense tax season, underscores H&R Block's commitment to innovation and a superior digital client journey.

H&R Block relies heavily on its franchise owners, who operate a substantial part of its business. These independent operators are crucial for extending H&R Block's reach into local communities and delivering personalized tax services.

Franchise agreements are a cornerstone of H&R Block's revenue model. Franchise owners pay royalties to the company, which provides H&R Block with a consistent income stream. This partnership model also allows for rapid market expansion and increased brand presence across numerous locations.

Software and Platform Integrations

H&R Block leverages key partnerships for software and platform integrations to enrich its DIY tax offerings. These collaborations enable seamless data import, allowing clients to easily bring in prior year tax returns, W-2s, and various 1099 forms from financial institutions. This significantly streamlines the tax preparation process for users.

These integrations directly enhance client convenience and boost the efficiency of H&R Block's digital products. For instance, the ability to import data from over 10,000 financial institutions in 2024 alone underscores the breadth of these partnerships. This reduces manual data entry, minimizing errors and saving valuable time for taxpayers.

- Streamlined Data Import: Partnerships facilitate the import of prior year returns, W-2s, and 1099s from numerous financial institutions, simplifying data aggregation for clients.

- Enhanced User Experience: Integrations contribute to a more intuitive and efficient DIY tax filing process, reducing user frustration and potential errors.

- Increased Efficiency: By automating data entry, these partnerships allow H&R Block to process tax returns more quickly and accurately, benefiting both the company and its clients.

- Broad Financial Institution Reach: The ability to connect with thousands of financial entities in 2024 demonstrates the extensive network supporting these integration efforts.

Audit Support & Identity Protection Service Providers

H&R Block partners with specialized third-party firms to deliver crucial post-filing services such as audit defense and identity theft protection. These collaborations are vital for offering clients a complete support ecosystem beyond the initial tax preparation.

While H&R Block provides a baseline of free audit support, their strategic alliances allow for the offering of enhanced services. For instance, their Worry-Free Audit Support, available for purchase, leverages external expertise to provide clients with greater assurance and dedicated representation should an audit arise.

- Audit Support: Partnerships ensure clients have access to professional representation and guidance in the event of an IRS or state tax audit.

- Identity Protection: Collaborations with identity protection service providers offer clients safeguards against tax-related identity theft, a growing concern.

- Extended Services: These partnerships enable H&R Block to offer premium services like Worry-Free Audit Support, adding value and peace of mind for clients.

H&R Block's key partnerships are vital for expanding its service offerings and enhancing client experience. Collaborations with financial institutions like Pathward N.A. enable essential services such as Refund Transfers and the Emerald Prepaid Mastercard. Strategic alliances with technology providers, including Atomic for the Spruce app and NiCE for AI customer service, bolster digital capabilities and customer support, especially during peak tax seasons.

Furthermore, H&R Block relies on its extensive network of franchise owners, who are crucial for local market penetration and personalized client service. These franchise agreements provide a consistent revenue stream through royalties and facilitate rapid brand expansion. The company also partners with third-party firms to offer specialized post-filing services, such as enhanced audit defense and identity theft protection, adding significant value and peace of mind for clients.

In 2024, H&R Block's commitment to seamless data import was evident, with integrations allowing clients to easily access data from over 10,000 financial institutions. This significantly streamlines the DIY tax preparation process, reducing manual entry and minimizing errors.

| Partnership Type | Key Collaborators | Services Provided | Impact on H&R Block |

|---|---|---|---|

| Financial Institutions | Pathward N.A. | Refund Transfers, Emerald Prepaid Mastercard | Facilitates core financial products, enhances client access to funds. |

| Technology Providers | Atomic, NiCE | Spruce mobile banking app, AI for customer service | Improves digital offerings, customer support efficiency, and client journey. |

| Franchise Owners | Independent Operators | Local tax preparation services | Drives market reach, brand presence, and provides a significant revenue stream via royalties. |

| Third-Party Service Providers | Specialized Firms | Audit defense, identity theft protection | Extends service portfolio, offers enhanced client value and security. |

| Software/Platform Integrations | Various Financial Data Aggregators | Data import (W-2s, 1099s, prior returns) | Streamlines DIY filing, improves accuracy, and enhances user experience. |

What is included in the product

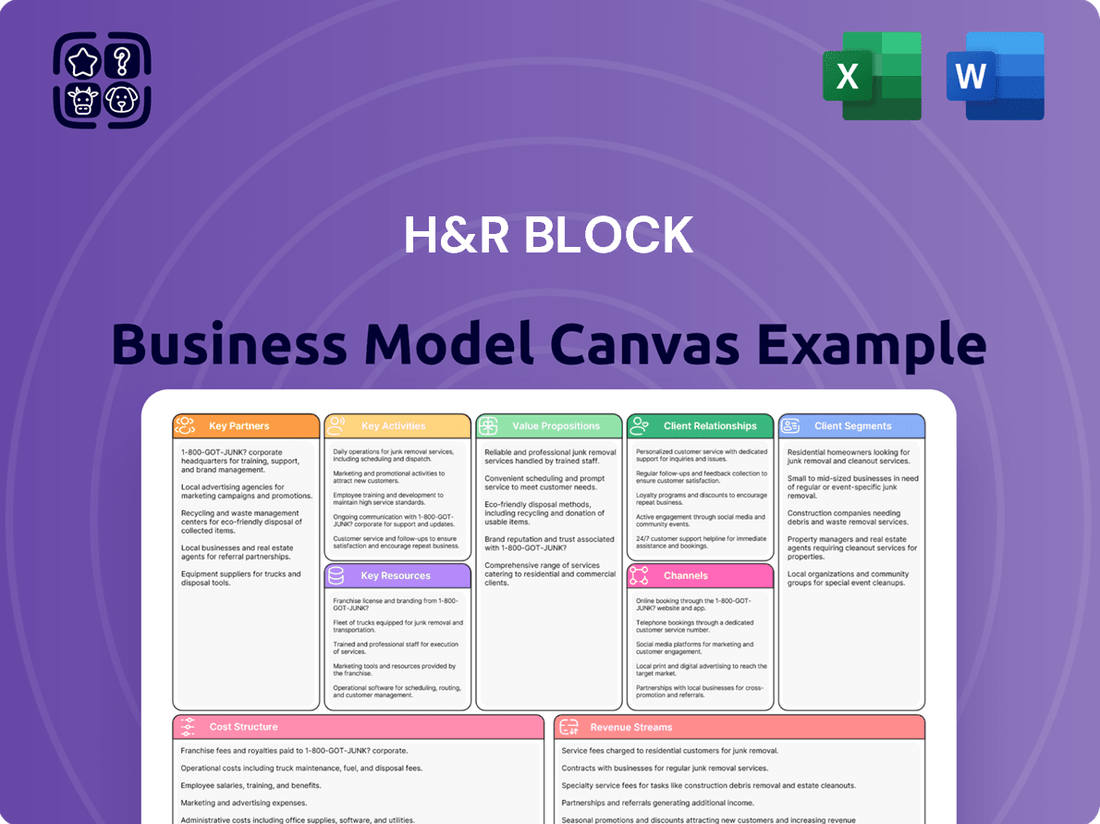

A comprehensive business model for H&R Block, detailing customer segments, value propositions, and revenue streams, all organized within the 9 classic BMC blocks.

This model reflects H&R Block's strategy, outlining key resources, activities, and partnerships to support its tax preparation services and financial solutions.

H&R Block's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to address the complexities of tax preparation for individuals and businesses.

It simplifies the process of understanding and optimizing their service delivery, customer relationships, and revenue streams, thereby easing the burden of tax compliance.

Activities

H&R Block's primary activity revolves around delivering extensive tax preparation services. This encompasses in-person assistance from skilled tax professionals and accessible do-it-yourself software and online platforms for individuals, covering a broad range of tax complexities.

In the 2023 tax season, H&R Block assisted approximately 24 million tax returns across its various service channels, highlighting the significant demand for its core offerings.

H&R Block actively drives product development and innovation, focusing on enhancing its digital tax preparation offerings. This commitment extends to refining their online platforms, desktop software, and mobile applications, including the MyBlock and Spruce tools, to better serve clients.

A key recent innovation is the integration of AI Tax Assist, designed to offer immediate client support and boost conversion rates. This AI-powered feature aims to streamline the tax filing process, making it more efficient and user-friendly.

In fiscal year 2024, H&R Block reported a 3% increase in total revenues to $3.5 billion, partly driven by advancements in their digital products and services, demonstrating the positive impact of their innovation efforts on financial performance.

H&R Block invests heavily in marketing and sales to attract and keep clients. They run advertising campaigns and offer promotions, like price matching for new customers, to stand out. Their focus on guarantees for maximum refunds and accuracy is a key selling point.

In 2024, H&R Block continued its aggressive marketing efforts. For the fiscal year ending April 30, 2024, the company reported a 4% increase in total revenues, largely driven by new client acquisition and retention strategies. Their digital marketing spend saw a significant uptick, aiming to capture a larger share of the online tax preparation market.

Tax Law Research & Compliance

H&R Block's core activities revolve around meticulously researching and adhering to tax laws. This is crucial given how frequently tax regulations change. For instance, in 2024, the debate and potential adjustments to the 1099-K reporting threshold continued to be a significant area of focus, impacting how businesses and freelancers report income.

To maintain compliance, H&R Block actively updates its tax professionals and software. This ensures that clients benefit from the most current tax treatments, including any new or modified tax credits available. Staying ahead of these changes, such as those affecting small business deductions or specific industry tax incentives, is paramount for providing accurate filing services.

- Continuous Monitoring: H&R Block dedicates resources to track legislative changes and IRS guidance throughout the year, not just during tax season.

- Software Updates: Their proprietary tax software is regularly updated to incorporate new tax forms, calculations, and compliance rules.

- Professional Training: Tax professionals undergo ongoing training to understand and apply complex tax law changes, ensuring client advice is current and accurate.

- Compliance Assurance: The firm's processes are designed to ensure all tax filings meet current federal, state, and local requirements, mitigating risk for clients.

Customer Support & Advisory

H&R Block's commitment to customer support and advisory is a cornerstone of its business. They offer a multi-channel approach, including live assistance from tax professionals both online and in physical locations, ensuring clients have access to expert help when they need it. For quicker resolutions, chatbots and AI handle straightforward inquiries, freeing up human advisors for more complex issues.

This dedication to support extends beyond tax season. H&R Block provides crucial audit assistance, offering peace of mind to clients facing scrutiny. Furthermore, through specialized services like Block Advisors and their digital banking platform, Spruce, they deliver year-round financial advice and support, aiming to be a comprehensive financial partner for their customers.

In 2024, H&R Block continued to invest in its support infrastructure. For instance, during the 2023 tax season (filed in 2024), they reported millions of client interactions across all support channels, highlighting the scale of their customer engagement. Their focus on accessibility means clients can reach out via phone, online chat, or in-person appointments, catering to diverse preferences.

- Live Expert Support: Access to tax professionals for personalized guidance.

- Digital Assistance: Utilization of chatbots and AI for efficient handling of basic queries.

- Audit Support: Providing assistance and representation for clients undergoing tax audits.

- Year-Round Financial Advice: Services like Block Advisors and Spruce offer ongoing financial guidance.

H&R Block's key activities center on providing expert tax preparation and financial services. They continuously update their software and train professionals to stay current with evolving tax laws. This ensures accurate filings and client satisfaction.

The company also focuses on innovation, particularly in digital offerings like AI Tax Assist, to enhance user experience and efficiency. Marketing and sales are crucial for client acquisition and retention, with a strong emphasis on guarantees for refund maximization and accuracy.

Customer support is a vital activity, encompassing live assistance, digital tools, and audit support. H&R Block aims to be a year-round financial partner through services like Block Advisors and Spruce.

| Key Activity | Description | 2024 Impact/Data |

| Tax Preparation Services | In-person and digital tax filing assistance. | Assisted ~24 million tax returns in the 2023 tax season. |

| Product Development & Innovation | Enhancing digital platforms and introducing new features like AI Tax Assist. | Fiscal year 2024 revenues increased 3% to $3.5 billion, partly due to digital advancements. |

| Marketing & Sales | Attracting and retaining clients through advertising, promotions, and guarantees. | Fiscal year 2024 revenues increased 4%, driven by new client acquisition and retention. |

| Compliance & Research | Monitoring tax law changes and updating professionals/software. | Ongoing focus on 1099-K reporting threshold changes and small business deductions. |

| Customer Support & Advisory | Providing live assistance, audit support, and year-round financial guidance. | Millions of client interactions across support channels in the 2023 tax season. |

Delivered as Displayed

Business Model Canvas

The H&R Block Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This ensures complete transparency, allowing you to see the exact structure, content, and professional formatting before committing. Upon completing your order, you'll gain full access to this identical, ready-to-use Business Model Canvas.

Resources

H&R Block's vast network of over 60,000 tax professionals forms a cornerstone of its business. These individuals are not just preparers; they are certified experts offering crucial tax advice and preparation services.

This human capital is a significant differentiator for H&R Block, enabling them to provide tailored, personalized assistance that technology alone cannot replicate. For instance, in the 2023 tax season, these professionals navigated complex tax laws for millions of clients.

H&R Block's business model heavily leverages proprietary software and technology, including its online filing system and desktop software. These digital assets are crucial for enabling efficient do-it-yourself tax preparation.

The company continuously innovates with features like AI Tax Assist, enhancing the user experience for both DIY filers and those utilizing assisted services. This technological foundation underpins their ability to serve a broad customer base.

In 2024, H&R Block reported strong digital growth, with a significant portion of tax returns filed through their online platforms, demonstrating the effectiveness of their proprietary technology investments in driving customer engagement and market share.

H&R Block's brand recognition and reputation are cornerstones of its business model, cultivated over more than six decades. This deep-rooted trust makes it a go-to for millions seeking tax assistance. In 2023, H&R Block served approximately 24 million clients, a testament to its enduring appeal and the confidence consumers place in its services.

Extensive Retail Office Network

H&R Block operates an extensive retail office network, boasting over 8,800 locations worldwide. This significant physical footprint ensures clients have convenient access to in-person tax preparation services, a crucial element for many individuals. These offices are more than just tax preparation centers; they act as vital touchpoints for a range of supplementary services and client support.

The sheer scale of H&R Block's retail presence is a core asset, facilitating client acquisition and retention through accessibility. For instance, in the 2023 tax season, H&R Block served 23.4 million tax returns, with a substantial portion likely utilizing these physical locations. This widespread network also supports the delivery of other financial products and advice, reinforcing customer relationships.

- Global Reach: Over 8,800 retail offices worldwide.

- Client Convenience: Facilitates easy access for in-person tax services.

- Service Hubs: Points of contact for additional financial offerings and support.

Customer Data & Insights

H&R Block leverages the vast amount of customer data from millions of tax filings to gain deep insights into client needs and emerging tax trends. This information is a cornerstone for tailoring services and enhancing product development.

By analyzing this extensive dataset, H&R Block can create more personalized experiences and refine its offerings. For instance, understanding common deductions or credits used by specific demographics allows for more targeted advice and product features.

The company's ability to understand customer behavior is a critical driver for ongoing business improvement and innovation. This data-driven approach helps them stay ahead of market changes and client expectations.

- Customer Data Volume: H&R Block processes millions of tax returns annually, generating a rich dataset.

- Insight Generation: This data provides granular insights into client needs, tax behaviors, and market trends.

- Personalization: Insights enable personalized service offerings, from tailored advice to customized product features.

- Strategic Marketing: Customer data informs targeted marketing campaigns, increasing their effectiveness and ROI.

H&R Block's key resources include its extensive network of over 60,000 tax professionals, proprietary technology like its online filing system, strong brand recognition built over decades, a vast retail office footprint with over 8,800 locations, and the immense customer data generated from millions of tax filings. These elements collectively enable H&R Block to deliver personalized tax services and financial solutions efficiently and reliably.

| Resource | Description | Impact |

|---|---|---|

| Tax Professionals | Over 60,000 certified experts providing advice and preparation. | Enables personalized, expert assistance; differentiator against tech-only solutions. |

| Proprietary Technology | Online filing, desktop software, AI Tax Assist. | Drives efficient DIY preparation and enhances user experience; strong digital growth in 2024. |

| Brand Recognition | Decades of trust and established reputation. | Facilitates client acquisition and retention; served ~24 million clients in 2023. |

| Retail Office Network | Over 8,800 physical locations worldwide. | Ensures convenient client access for in-person services; vital touchpoints for support. |

| Customer Data | Insights from millions of tax filings. | Enables personalized service, product development, and targeted marketing. |

Value Propositions

H&R Block stands behind its tax preparation with a strong commitment to accuracy, offering a 100% accuracy guarantee. This means if they make a mistake, they'll cover the penalties and interest. Furthermore, they promise to help clients get the maximum refund possible, ensuring all eligible deductions and credits are claimed. This dual focus on precision and financial benefit is designed to build significant client trust.

H&R Block offers unmatched convenience by providing tax filing through thousands of physical locations, a user-friendly online platform, and downloadable software, catering to diverse client needs and preferences.

In 2024, H&R Block continued to emphasize its multi-channel approach, with millions of clients utilizing their services. The MyBlock app, launched to provide year-round access to tax documents and financial insights, saw significant user engagement, reinforcing the company's commitment to ongoing client support beyond tax season.

Clients gain access to a deep bench of seasoned tax professionals offering invaluable guidance and support. This network ensures that individuals and businesses receive expert advice tailored to their unique financial circumstances.

For users of H&R Block's digital products, assistance is readily available through features like AI Tax Assist, providing instant answers to common questions, and live chat with tax professionals for more complex queries. This dual approach means help is always within reach.

In 2023, H&R Block reported that over 90% of their tax clients rated their experience with a tax professional as good or excellent, highlighting the effectiveness of their expert guidance. Furthermore, their AI Tax Assist tool handled over 5 million queries in the 2023 tax season, demonstrating its significant role in providing immediate support.

Financial Products & Solutions

H&R Block extends its services beyond tax preparation by offering a suite of financial products. These include Refund Transfers, which allow clients to have their tax preparation fees deducted from their refund, and the Emerald Card, a prepaid debit card for accessing refunds and managing daily expenses. For those needing immediate funds, Emerald Advance loans are available, providing short-term liquidity.

The Spruce mobile banking app is a key component of H&R Block's strategy to engage clients throughout the year, not just during tax season. It offers tools for budgeting, saving, and spending, aiming to foster better financial habits. This digital solution supports H&R Block's goal of becoming a more comprehensive financial partner.

These supplementary offerings are designed to enhance customer loyalty and generate additional revenue streams. For instance, in the 2023 tax season, H&R Block reported a significant number of Emerald Card activations, demonstrating the uptake of their financial products. The company continues to invest in digital tools like Spruce to meet evolving consumer needs.

- Refund Transfers: Facilitate fee payment from tax refunds.

- Emerald Card: A prepaid debit card for fund access and management.

- Emerald Advance: Short-term loan options for clients.

- Spruce App: A mobile banking tool for year-round financial management.

Peace of Mind & Audit Support

H&R Block offers a significant value proposition centered on providing peace of mind and robust audit support to its clients. This is crucial for individuals and businesses navigating the complexities of tax regulations. Their Peace of Mind® Extended Service Plan and Tax Identity Shield® are designed to directly address anxieties surrounding potential tax issues and identity theft, offering a tangible sense of security.

Furthermore, H&R Block's commitment extends to providing free in-person audit support. This service is particularly valuable, as it removes a significant burden from clients who might otherwise face daunting and potentially costly audit processes alone. This direct assistance reinforces their role as a trusted partner, not just a tax preparer.

- Peace of Mind Services: H&R Block's Peace of Mind® Extended Service Plan and Tax Identity Shield® provide clients with enhanced security against tax-related identity theft and audit issues.

- Free Audit Support: Clients receive complimentary in-person assistance should they face an IRS or state tax audit, reducing client stress and potential financial exposure.

- Client Trust: These offerings are designed to build and maintain client trust by demonstrating a commitment to support beyond initial tax preparation.

- Reduced Anxiety: By proactively addressing potential tax and identity theft concerns, H&R Block helps alleviate client anxiety, enhancing their overall experience.

H&R Block's value proposition centers on delivering accuracy and maximizing refunds, backed by a 100% accuracy guarantee and a commitment to claiming all eligible deductions. They also provide unparalleled convenience through a vast network of physical offices, a user-friendly online platform, and downloadable software, ensuring accessibility for all clients. Furthermore, H&R Block offers peace of mind with robust audit support and identity protection services, solidifying their role as a trusted financial partner.

Customer Relationships

H&R Block builds strong customer bonds through its assisted service model, allowing clients to interact directly with tax professionals, either in person or virtually. This personalized touch cultivates trust and offers significant guidance and support, making clients feel confident and well-supported throughout their tax preparation journey.

H&R Block's self-service online platforms cater to clients who value independence in managing their tax preparation. These digital tools empower users with intuitive interfaces and clear guidance, fostering a sense of control and accomplishment.

While clients navigate these platforms largely on their own, relationships are still cultivated through accessible help resources, including AI-powered chatbots and comprehensive FAQs. This approach ensures users feel supported even when opting for a do-it-yourself experience.

In 2024, H&R Block reported a significant portion of its tax filings were completed through its digital channels, reflecting the growing preference for self-service options. This trend highlights the success of their investment in user-friendly technology and readily available online assistance.

H&R Block offers robust customer support through multiple avenues like phone, live chat, and increasingly, AI-powered tools. This multi-channel approach ensures clients can find help quickly, whether they prefer direct interaction or self-service options. For instance, in the 2023 tax season, H&R Block reported a significant increase in digital interactions, highlighting the importance of these accessible support channels for client satisfaction and issue resolution.

Loyalty Programs & Retention Initiatives

H&R Block actively cultivates customer loyalty through a suite of retention initiatives. These programs are designed to keep clients engaged throughout the year, not just during tax season. For instance, the MyBlock app offers features that extend its utility beyond immediate tax filing needs, fostering continuous interaction.

The company also employs strategies like the free Second Look® tax review. This service allows existing clients to have their previous tax returns examined at no cost, reinforcing H&R Block's commitment to accuracy and client satisfaction. Such offerings aim to build enduring relationships and encourage repeat business, as evidenced by their consistent client base.

- Year-Round Engagement: MyBlock app functionality extends beyond tax season for continuous client interaction.

- Client Retention Through Value: The free Second Look® tax review provides added value and reinforces trust.

- Building Long-Term Relationships: Initiatives focus on fostering loyalty and encouraging repeat business from existing clients.

Financial Advisory and Year-Round Support

H&R Block cultivates enduring client connections through services like the Spruce mobile banking app and Block Advisors, extending engagement well past tax season. This approach transforms the relationship from a one-time tax filing event into a continuous financial partnership.

These offerings provide essential year-round support, encompassing financial management, bookkeeping, and payroll for both individuals and small businesses. For instance, H&R Block reported that for fiscal year 2023, Block Advisors served 1.3 million clients, highlighting the significant adoption of their extended services.

- Year-Round Engagement: Services like Spruce and Block Advisors move beyond tax filing to offer ongoing financial management.

- Comprehensive Solutions: H&R Block provides bookkeeping, payroll, and advisory services, catering to diverse client needs throughout the year.

- Partnership Focus: The strategy aims to build deeper, lasting relationships, evolving from transactional tax services to a broader financial advisory role.

H&R Block fosters deep customer relationships through a dual approach: personalized assisted services and empowering self-service digital platforms. This strategy ensures clients feel supported and valued, whether they prefer direct interaction with tax professionals or independent online management. The company actively works to retain clients by offering year-round financial tools and services that extend beyond tax season, aiming for a continuous financial partnership.

| Service/Initiative | Description | Client Impact | 2023 Data/Context |

|---|---|---|---|

| Assisted Tax Services | In-person and virtual consultations with tax professionals. | Builds trust and provides expert guidance. | Core offering for clients seeking personalized support. |

| Digital Platforms | Online tax preparation software and tools. | Empowers self-sufficiency and convenience. | Significant portion of filings completed digitally in 2024. |

| Customer Support | Phone, live chat, AI-powered tools, FAQs. | Ensures quick access to help and issue resolution. | Digital interaction volume increased in 2023 tax season. |

| MyBlock App | Year-round financial management features. | Encourages continuous client engagement. | Designed for ongoing interaction beyond tax filing. |

| Block Advisors | Specialized services for small businesses and individuals. | Extends relationship into broader financial advisory. | Served 1.3 million clients in fiscal year 2023. |

Channels

H&R Block's physical retail offices are a cornerstone of its business model, serving as the primary channel for tax preparation services. These locations offer clients the comfort of in-person interaction with experienced tax professionals, a crucial element for those who value a traditional and hands-on approach to their tax needs. As of the 2023 tax season, H&R Block operated approximately 7,000 company-owned and franchise locations across the United States, underscoring the significant investment in this tangible, client-facing channel.

H&R Block leverages its robust online platforms, including its website and dedicated web-based tax filing solutions, as a primary digital channel. These platforms are designed for maximum convenience, enabling clients to prepare and file their taxes from virtually any location, enhancing accessibility. In 2024, H&R Block reported a significant portion of its tax filings were completed through its digital channels, reflecting a strong shift towards online services among its customer base.

H&R Block provides downloadable desktop software, a key channel for tax preparation. This option appeals to customers who prefer offline work or have specific needs for managing their tax information locally. The software offers robust tools designed to handle a wide array of tax scenarios, ensuring comprehensive support for filers.

Mobile Applications

Mobile applications are a crucial channel for H&R Block, offering clients convenient access to tax services and financial management tools. The MyBlock app allows users to manage their tax preparation, track refunds, and connect with tax professionals anytime, anywhere. This digital accessibility is vital for meeting client expectations for immediate service and information.

The Spruce app, H&R Block's banking and financial management tool, further strengthens this channel by fostering year-round client engagement beyond tax season. It provides features like budgeting, savings tools, and easy access to funds, making it a comprehensive financial hub. This multi-faceted approach through mobile platforms enhances customer loyalty and provides continuous value.

H&R Block’s commitment to its mobile channels is evident in their ongoing development and promotion. For instance, in the 2023 tax season, a significant portion of tax returns were filed digitally, underscoring the growing reliance on mobile and online platforms. This trend is expected to continue, with mobile apps playing an even larger role in client acquisition and retention.

- MyBlock App: Facilitates on-the-go tax preparation, refund tracking, and communication with tax experts.

- Spruce App: Offers banking, budgeting, and savings features for year-round financial management.

- Client Engagement: Mobile channels enable continuous interaction, enhancing convenience and service accessibility.

- Digital Adoption: Reflects the increasing trend of clients preferring digital solutions for tax and financial needs.

Partnership Networks

H&R Block leverages a robust ecosystem of partnership networks to broaden its service delivery and product offerings. These collaborations are crucial for extending its market reach beyond its physical locations and direct digital channels.

Key partnerships include those with financial institutions, facilitating the integration of H&R Block’s tax services with banking and financial products. For instance, collaborations with banks often allow for tax refund anticipation loans or direct deposit options, enhancing customer convenience. Additionally, H&R Block actively partners with technology firms to integrate cutting-edge tools and platforms, improving the efficiency and user experience of its digital tax preparation services. In 2023, H&R Block reported that over 90% of its tax filings were completed digitally, underscoring the importance of these tech partnerships.

- Financial Institutions: Collaborations with banks and credit unions for integrated financial products and refund services.

- Technology Partners: Integration of advanced software and data analytics for enhanced digital tax preparation.

- Affiliate Marketing: Partnerships with financial bloggers and websites to drive customer acquisition.

- Workplace Programs: Collaborations with employers to offer tax services as an employee benefit.

H&R Block utilizes a multi-channel approach to reach its diverse customer base. Its physical offices remain a core channel, complemented by extensive online platforms and user-friendly mobile applications. These digital avenues cater to the growing preference for convenience and self-service, with a significant portion of filings occurring online.

The company also offers downloadable desktop software for those who prefer an offline experience. Partnerships with financial institutions and technology firms further expand its reach and enhance service integration. This blended strategy ensures accessibility and caters to various client preferences.

| Channel | Description | Key Features/Data |

|---|---|---|

| Physical Offices | In-person tax preparation services. | Approx. 7,000 locations (2023); offers direct client interaction. |

| Online Platforms | Website and web-based tax filing solutions. | High convenience, accessible from anywhere; significant portion of filings in 2024. |

| Desktop Software | Downloadable software for offline tax preparation. | Appeals to users preferring local data management and offline work. |

| Mobile Apps (MyBlock, Spruce) | On-the-go tax prep, financial management, banking. | Year-round engagement, refund tracking, budgeting tools; growing digital adoption. |

| Partnerships | Collaborations with financial institutions, tech firms, employers. | Integrated financial products, enhanced digital tools, employee benefits. |

Customer Segments

Individual taxpayers with simple returns represent a significant portion of the market, often characterized by straightforward Form 1040 filings without complex investments or numerous deductions. H&R Block offers free online filing for these individuals, which is particularly beneficial for those claiming common credits like the earned income tax credit and child tax credit.

This segment is crucial for H&R Block’s customer acquisition strategy, acting as an entry point to potentially higher-value services. In 2023, for instance, H&R Block reported that millions of taxpayers utilized their free online services, highlighting the broad appeal and accessibility of their offerings for simpler tax needs.

Individual taxpayers with complex returns, including those who itemize deductions or report investment and retirement income, represent a significant customer segment for H&R Block. For the 2023 tax year, approximately 45% of taxpayers itemized deductions, highlighting the need for specialized tax preparation services. H&R Block addresses this by offering tiered online products like Deluxe and Premium, alongside in-person assistance from tax professionals, ensuring these individuals receive expert support for their intricate tax situations.

H&R Block directly supports the backbone of the economy: small business owners and the self-employed. These individuals, including freelancers and gig workers, often grapple with the complexities of reporting self-employment income and a multitude of deductible business expenses, typically on Schedule C. For instance, in 2024, millions of Americans operate as independent contractors, underscoring the significant market H&R Block targets.

To cater to this vital segment, H&R Block offers tailored solutions. Their Self-Employed online tax preparation package simplifies the process for those managing their own taxes. Furthermore, their Block Advisors service and the recently acquired Wave platform provide integrated tax preparation, essential bookkeeping, payroll management, and crucial advisory services specifically designed to meet the unique needs of entrepreneurs and small business operators.

Clients Seeking Assisted Preparation

Clients seeking assisted preparation are individuals and small businesses who value expert help with their tax filings. They often prefer the reassurance of working directly with a tax professional, whether in person or virtually, to ensure accuracy and compliance.

This segment prioritizes the peace of mind that comes from having their taxes handled by experienced H&R Block tax professionals, especially when dealing with intricate tax situations. H&R Block has observed a growing preference within this client base for their guided services.

- Preference for Expertise: Clients in this segment actively seek out the knowledge and experience of H&R Block's tax professionals to navigate complex tax laws and ensure their returns are filed correctly.

- Value of Peace of Mind: A primary driver for this segment is the assurance that their tax obligations are met accurately, reducing the stress and potential penalties associated with self-preparation.

- Shift in Client Behavior: H&R Block has noted a discernible trend, with an increasing number of clients opting for assisted preparation services, indicating a growing reliance on professional guidance.

Clients Preferring Do-It-Yourself

Clients preferring a do-it-yourself (DIY) approach are typically tech-savvy and budget-minded individuals. They are comfortable navigating digital platforms and want to manage their tax preparation themselves. H&R Block caters to this segment by offering a range of software solutions, from free basic tax filing to more comprehensive paid versions, providing flexibility and control.

This segment values the autonomy and cost savings associated with preparing their own taxes. For example, in 2024, millions of taxpayers utilized tax preparation software, a testament to the growing preference for DIY solutions. H&R Block's digital offerings, such as its online tax software, are designed to be user-friendly, guiding users through the process with clear instructions and built-in error checking, ensuring accuracy without the need for professional assistance.

- Digital Convenience: Access tax preparation tools anytime, anywhere.

- Cost Savings: Avoid professional fees by filing independently.

- Control and Transparency: Manage the entire tax filing process directly.

- Software Options: Choose from free or paid H&R Block software based on tax complexity.

H&R Block serves a diverse range of individual taxpayers, from those with simple returns benefiting from free online filing to individuals with complex situations requiring itemized deductions or investment income. This broad base is crucial for customer acquisition, with millions utilizing their free services annually. For the 2023 tax year, around 45% of taxpayers itemized, underscoring the need for H&R Block's tiered online products and in-person professional assistance.

Cost Structure

H&R Block's substantial investment in its tax professionals, encompassing wages and benefits, represents a core component of its cost structure. This is a significant expenditure, especially considering the vast network of preparers they employ across the nation.

During the intense tax season, typically from January through April, these personnel costs escalate considerably. This is driven by the need for increased staffing levels and often involves overtime pay or bonuses to retain and motivate their skilled tax experts, impacting profitability directly.

For fiscal year 2024, H&R Block reported total salaries, wages, and benefits expenses of approximately $1.2 billion. Efficiently managing these labor costs while ensuring high-quality service is a constant operational challenge and a key lever for maintaining strong financial performance.

H&R Block's commitment to its digital infrastructure is a significant cost driver. In fiscal year 2024, the company continued to invest heavily in developing and maintaining its proprietary software, including its online tax preparation platforms and the AI Tax Assist tool. These investments are crucial for ensuring system reliability, enhancing user experience, and staying competitive in the digital tax preparation market.

Expenses encompass software development cycles, robust IT infrastructure, and ongoing cybersecurity measures to protect sensitive client data. Regular updates and maintenance are essential to keep these systems functional and secure, representing a substantial portion of the company's operational costs. This continuous technological investment underpins H&R Block's ability to offer innovative digital solutions to its customers.

H&R Block invests heavily in marketing and advertising to draw in new customers and highlight its tax preparation services. These efforts encompass traditional advertising channels, online marketing strategies, and special promotions such as price matching, reflecting a significant portion of their operational costs.

For fiscal year 2023, H&R Block reported selling, general, and administrative expenses of $1.36 billion, a substantial portion of which is allocated to marketing and advertising. This spending is crucial for client acquisition and ensuring the brand remains prominent in the competitive tax services landscape.

Office Lease & Operational Costs

H&R Block's extensive network of physical offices incurs substantial costs. These include leasing expenses for numerous locations, along with associated utilities, ongoing maintenance, and general operational overhead. These fixed expenses are essential for supporting clients who value face-to-face interactions and personalized tax preparation services.

Optimizing the physical office footprint remains a continuous strategic focus for the company. For instance, in 2023, H&R Block operated approximately 11,000 company-owned and franchise locations globally, highlighting the scale of their real estate commitments. Managing these leases and operational expenses efficiently is crucial for profitability, especially as the company balances its physical presence with digital service offerings.

- Lease Agreements: Significant portion of the cost structure is dedicated to securing and maintaining leases for tax offices across various markets.

- Utilities and Maintenance: Ongoing expenses for electricity, water, internet, and upkeep of these physical locations contribute to operational costs.

- Operational Overheads: Includes costs for office supplies, cleaning services, security, and other administrative necessities to keep offices functional.

- Footprint Optimization: Continuous evaluation of office locations to ensure cost-effectiveness and alignment with client service needs, potentially leading to consolidation or relocation strategies.

Legal & Compliance Costs

H&R Block navigates a heavily regulated tax industry, necessitating significant investment in legal and compliance functions. These expenditures are crucial for maintaining operational integrity and adhering to evolving tax legislation and data privacy mandates.

The company's commitment to compliance is underscored by its proactive engagement with regulatory bodies and its investment in systems to ensure accuracy and security. For instance, in fiscal year 2023, H&R Block reported legal settlements and related expenses, including a notable agreement with the FTC concerning advertising and customer service practices, which amounted to $10 million.

- Adherence to Tax Laws: Ongoing costs associated with understanding and implementing complex federal, state, and local tax regulations.

- Data Privacy Compliance: Expenses for safeguarding client information in line with regulations like GDPR and CCPA, critical in the digital age.

- Regulatory Filings and Audits: Costs incurred for preparing and submitting required regulatory reports and undergoing audits.

- Legal Defense and Settlements: Funds allocated for addressing legal challenges and resolving disputes, such as the FTC settlement, to ensure continued business operations.

H&R Block's cost structure is heavily influenced by its human capital, with significant outlays for tax professional wages and benefits, totaling approximately $1.2 billion in fiscal year 2024. This investment is critical for delivering expert tax preparation services, especially during peak seasons. The company also dedicates substantial resources to its digital platforms and marketing efforts, with selling, general, and administrative expenses reaching $1.36 billion in fiscal year 2023, reflecting a commitment to technological advancement and client acquisition. Furthermore, maintaining its extensive network of over 11,000 physical locations globally incurs significant lease, utility, and operational overhead costs, alongside essential investments in legal and compliance functions to navigate the complex tax landscape.

| Cost Category | Fiscal Year 2024 (Approx.) | Fiscal Year 2023 (Approx.) | Key Drivers |

|---|---|---|---|

| Salaries, Wages, and Benefits | $1.2 billion | N/A | Tax professional compensation, seasonal staffing |

| Selling, General, and Administrative (SG&A) | N/A | $1.36 billion | Marketing, advertising, technology development, general operations |

| Real Estate & Office Operations | N/A | Included in SG&A, significant lease costs | Leasing, utilities, maintenance for ~11,000 locations |

| Legal & Compliance | N/A | $10 million (FTC Settlement) | Regulatory adherence, legal defense, data privacy |

Revenue Streams

H&R Block earns a substantial amount from charging clients for help with their taxes. This includes when people go to an office or use the service online with a tax expert. For the fiscal year 2023, H&R Block reported that its tax preparation segment, which heavily relies on these assisted services, brought in over $2 billion in revenue.

H&R Block generates revenue through its do-it-yourself tax preparation software and online filing options. While a free version is available for straightforward tax situations, customers with more complex returns are encouraged to upgrade to paid packages such as Deluxe, Premium, or Self-Employed. This tiered approach offers a flexible and growing income source from digitally inclined customers.

H&R Block generates income from fees linked to its additional financial products, enhancing its revenue streams beyond core tax preparation. These include charges for Refund Transfers, a service enabling clients to settle tax preparation costs directly from their tax refund, and potential interest or fees from financial tools such as the Emerald Card and Emerald Advance loans.

Small Business Services

H&R Block generates revenue from its small business services, primarily through its Block Advisors and Wave platforms. These offerings provide crucial year-round support for entrepreneurs, including bookkeeping, payroll processing, and strategic financial advice.

This segment is a significant growth driver, offering a stable, recurring revenue stream that extends well beyond the typical tax preparation season. For instance, Wave, acquired by H&R Block, has been instrumental in expanding this digital-first service offering.

- Block Advisors: Offers personalized tax and financial advice for small business owners.

- Wave: Provides integrated accounting, invoicing, and payroll software for freelancers and small businesses.

- Recurring Revenue: Services like monthly bookkeeping and payroll create predictable income.

- Growth Potential: This segment diversifies H&R Block's income beyond seasonal tax filings.

Franchise Royalties

H&R Block generates significant revenue through franchise royalties, where its franchisees pay a percentage of their gross income from tax preparation and associated services back to the parent company. This model is a cornerstone of their expansion strategy.

In fiscal year 2023, H&R Block reported that its franchise network contributed substantially to its financial performance. These royalty fees are a consistent income stream, directly tied to the success of its independent operators. For instance, the company's fiscal 2023 results highlighted the ongoing strength of its franchise model, with franchise revenue playing a key role in the overall financial picture.

- Franchise Royalties: A primary revenue source derived from a percentage of gross revenue generated by H&R Block's franchisee locations.

- Market Expansion: The franchise model enables H&R Block to maintain a wide geographic presence without bearing all operational costs directly.

- Revenue Contribution: These royalties are a critical component of H&R Block's total revenue, reflecting the volume of tax returns processed by its franchisees.

H&R Block's revenue streams are diverse, encompassing assisted tax preparation, do-it-yourself software, small business services, and franchise royalties.

Assisted services, both in-office and online, are a major contributor, with the tax preparation segment generating over $2 billion in fiscal year 2023. Their DIY software caters to various tax complexities with tiered pricing, while financial products like Refund Transfers and the Emerald Card offer additional income.

The company also leverages its Block Advisors and Wave platforms for small business accounting and payroll, creating recurring revenue. Franchise royalties, a percentage of gross income from franchisee locations, are a consistent and vital income stream, supporting their broad market presence.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approximate) |

|---|---|---|

| Assisted Tax Preparation | In-office and online tax help from professionals. | Over $2 Billion (Tax Preparation Segment) |

| DIY Tax Software | Online software for self-filers, with tiered paid versions. | Significant, driven by software upgrades. |

| Financial Products | Fees from Refund Transfers, Emerald Card, Emerald Advance. | Ancillary income supporting core services. |

| Small Business Services | Block Advisors and Wave for accounting, payroll, etc. | Growing recurring revenue, diversifying income. |

| Franchise Royalties | Percentage of gross income from franchisee locations. | Key contributor to overall financial performance. |

Business Model Canvas Data Sources

The H&R Block Business Model Canvas is informed by a blend of internal financial data, extensive market research on consumer tax needs, and insights from competitor analysis. This multi-faceted approach ensures a robust and accurate representation of the business.