H&R Block Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

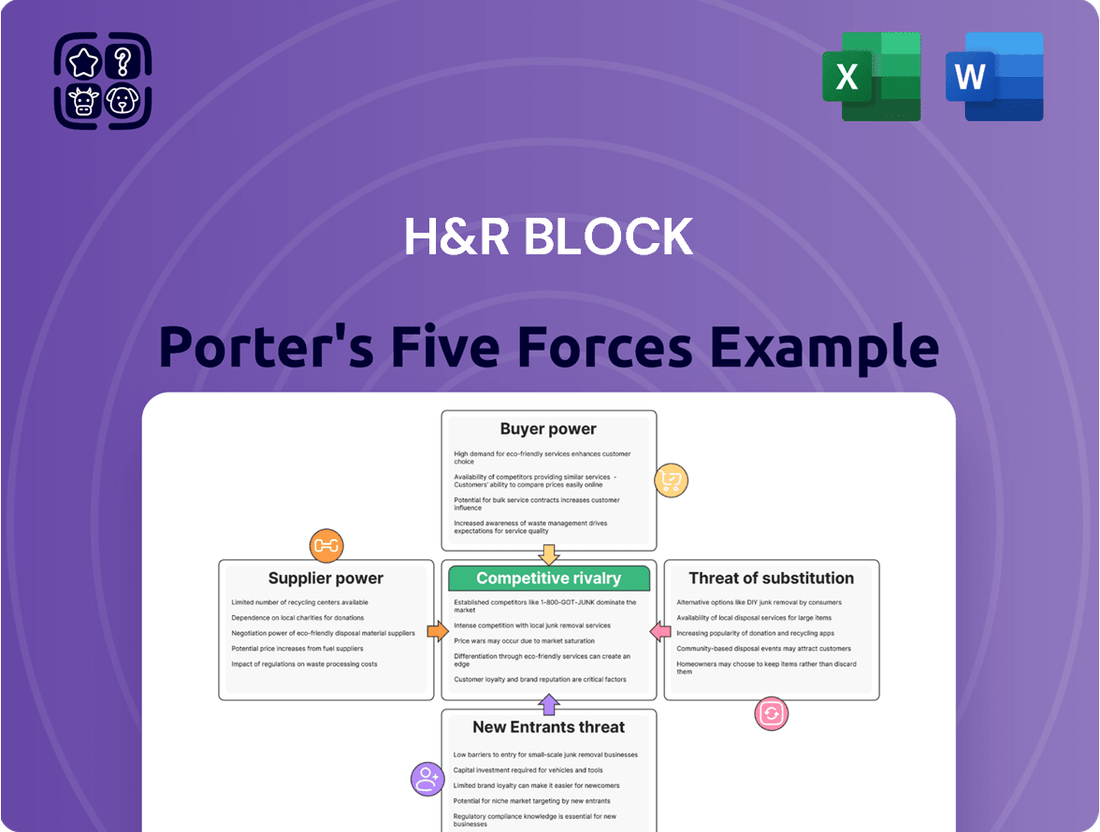

H&R Block faces significant competitive pressure from rivals, while the threat of new entrants is moderate due to high brand recognition and established infrastructure. Buyer power is considerable, as customers can easily switch between tax preparation services.

The full analysis reveals the strength and intensity of each market force affecting H&R Block, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

H&R Block's bargaining power of suppliers is notably low, largely due to its reliance on readily available software and public tax data. This means individual software or data providers have limited influence because their products are often standardized and easily replaceable within the industry. For instance, in 2024, the tax preparation software market features numerous vendors, making it difficult for any single one to exert significant pricing power over a large entity like H&R Block.

While H&R Block provides DIY tax software, a substantial portion of its revenue comes from its vast network of tax professionals. The bargaining power of these individual tax preparers is typically low because H&R Block has access to a large pool of qualified candidates and offers standardized training and branding, which limits individual leverage.

However, in areas experiencing a shortage of skilled tax professionals, their individual bargaining power might see a slight increase. For instance, during peak tax seasons, the demand for experienced preparers can outstrip supply in specific geographic locations, potentially leading to higher compensation demands from those professionals.

Regulatory bodies like the IRS and state tax authorities function as powerful 'suppliers' by dictating the rules of engagement for tax preparation services. H&R Block, along with its competitors, must adhere to these externally imposed frameworks, making them highly dependent on these governmental entities.

Changes in tax legislation, such as those enacted through annual budget bills or significant overhauls like the Tax Cuts and Jobs Act of 2017, directly influence the complexity of tax filings and the services H&R Block offers. For instance, the IRS processed over 150 million individual income tax returns in 2024, highlighting the sheer volume of transactions governed by these regulations.

The bargaining power of these regulatory bodies is exceptionally high because their rules are non-negotiable for all tax preparers. H&R Block cannot influence these mandates; instead, it must adapt its business model and service offerings to comply with evolving tax laws, which can increase operational costs and necessitate continuous investment in software and training.

Technology and AI Development for Internal Tools

As the tax preparation sector rapidly adopts AI and automation, H&R Block's dependence on external tech vendors for sophisticated AI solutions and infrastructure presents a potential area of supplier influence. For instance, the increasing demand for specialized AI talent and advanced computing resources could drive up costs for these essential services.

However, H&R Block is actively bolstering its internal digital competencies and enhancing customer experience through strategic investments. This internal development, including its ongoing digital transformation efforts, aims to reduce reliance on outside providers for critical technology advancements.

- H&R Block's Digital Investment: The company has been investing in its digital platform, aiming to improve user experience and efficiency, which can lessen the need for certain external AI tools.

- AI Integration in Tax Prep: The broader industry trend shows a significant increase in AI adoption, with companies like Intuit reporting substantial growth in their AI-powered offerings, indicating a strong market demand for these technologies.

- Internal Development vs. External Sourcing: H&R Block's strategy balances building in-house capabilities with leveraging external expertise, a common approach to managing supplier power in rapidly evolving tech landscapes.

Low Switching Costs for Core Operational Supplies

For generic operational necessities like office supplies, utilities, and fundamental IT infrastructure, H&R Block experiences minimal friction when changing suppliers. The market for these goods and services is characterized by a large number of providers, with offerings that are typically standardized and lack significant differentiation. This abundance of choice means H&R Block can readily shift its business if a supplier attempts to impose unfavorable terms or price increases.

The low switching costs for these core operational supplies significantly diminish the bargaining power of suppliers. For instance, in the realm of office supplies, companies can often secure competitive pricing through bulk purchasing agreements and readily available alternatives. Similarly, utility providers operate in regulated markets, and while switching might involve some administrative steps, the core service remains largely the same across providers, limiting their leverage.

- Low switching costs for generic office supplies: H&R Block can easily find alternative vendors for items like paper, pens, and printer ink, as these are widely available from numerous distributors.

- Utility provider flexibility: While essential, the ability to switch between utility providers (electricity, gas) is often dictated by regional availability and regulation, but the core service is standardized, capping supplier power.

- Basic IT infrastructure: For standard hardware like computers or networking equipment, H&R Block can leverage competitive bids from multiple vendors, preventing any single supplier from dictating terms due to the commoditized nature of these products.

The bargaining power of suppliers for H&R Block is generally low, primarily due to the availability of standardized software and data, and the large pool of tax professionals. However, regulatory bodies like the IRS hold significant power as they dictate the operational framework for the entire industry.

While H&R Block invests in internal tech capabilities, the increasing reliance on specialized AI and advanced computing resources could empower external tech vendors. This is a dynamic area where supplier influence might grow, especially as AI integration becomes more critical for competitive advantage in the tax preparation sector.

For basic operational needs, H&R Block faces minimal supplier power due to low switching costs and a highly competitive market for goods like office supplies and standard IT infrastructure.

| Supplier Type | Bargaining Power | Key Factors Influencing Power | Example for H&R Block (2024) |

|---|---|---|---|

| Tax Law & Regulatory Bodies (e.g., IRS) | Very High | Mandatory compliance, non-negotiable rules, significant impact on operations | IRS dictates filing formats and deadlines, requiring H&R Block to adapt its software and processes. |

| Tax Professionals (Individual) | Low to Moderate | Large pool of qualified candidates, standardized training, but potential shortages in specific regions | While H&R Block has many preparers, a localized shortage during peak season could slightly increase individual leverage. |

| Tax Software & Data Providers | Low | Standardized products, easy substitutability, numerous vendors | Numerous tax software vendors exist, making it hard for one to command significant pricing power over H&R Block. |

| AI & Advanced Tech Vendors | Moderate to High | Specialized expertise, increasing demand for AI, potential for high switching costs | Dependence on advanced AI solutions for competitive edge could grant these vendors more influence. |

| Generic Operational Suppliers (Office Supplies, Utilities) | Low | Commoditized products, numerous providers, low switching costs | H&R Block can easily switch providers for office supplies or basic IT hardware due to market saturation. |

What is included in the product

This analysis of H&R Block's competitive landscape identifies the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand competitive pressures with a clear, visual breakdown of each force, enabling swift strategic adjustments.

Customers Bargaining Power

Customers wield significant bargaining power due to a wide array of choices for tax preparation. This includes established professional services, a growing number of online software solutions, and even free government-sponsored or commercial filing options, giving individuals ample alternatives to H&R Block.

Furthermore, the low switching costs associated with tax preparation services empower customers. Taxpayers can often easily import their financial data into new software or services, and many providers compete aggressively on price, with some offering free basic filing, making it simple to move between providers.

A significant shift towards DIY tax preparation, particularly through online platforms, is empowering customers. This trend allows individuals to bypass traditional tax services, opting for more cost-effective solutions. For instance, the IRS Free File program, which offers free federal tax preparation to eligible taxpayers, saw a substantial increase in usage, with over 20 million returns filed through the program in the 2023 tax season. This directly impacts companies like H&R Block by increasing customer leverage, pushing them to innovate and offer competitive pricing and enhanced services to retain their market share.

Many H&R Block customers are quite sensitive to price, particularly those with straightforward tax needs. This means they are likely to shop around for the best deal, giving them significant leverage.

H&R Block's frequent use of promotional discounts and price matching initiatives directly acknowledges this customer bargaining power. For instance, in the 2023 tax season, many competitors offered free basic filing, forcing H&R Block to respond with competitive pricing to retain market share.

Beyond just filing, customers are increasingly demanding comprehensive financial advice and personalized insights. This trend pushes H&R Block and its competitors to offer more value-added services, shifting the focus from mere transaction to holistic financial support.

Regulatory Protections for Consumers

Regulatory actions significantly bolster the bargaining power of customers in the tax preparation industry. For instance, the Federal Trade Commission (FTC) has taken steps to ensure fairer practices. In late 2023, the FTC issued orders against H&R Block, addressing concerns about deceptive advertising related to free tax filing and the complexity of downgrading services. This increased scrutiny by bodies like the FTC directly empowers consumers by demanding greater transparency and simpler processes.

These regulatory mandates reduce the ability of tax preparation companies to retain customers through opaque practices or by making it difficult to switch services. By enforcing clearer communication and easier cancellation or service change options, regulators level the playing field. This means customers are more informed and have a greater ability to seek out the best value and service, thereby increasing their overall bargaining power.

- FTC Orders Against H&R Block: The FTC's 2023 actions specifically targeted H&R Block's marketing of 'free' filing and its customer retention tactics.

- Increased Transparency: Regulatory interventions aim to make service terms and costs more understandable to consumers.

- Simplified Downgrading: Mandates are in place to prevent companies from making it overly difficult for customers to switch to lower-cost or different service tiers.

- Enhanced Consumer Choice: These protections ultimately give consumers more leverage to choose and switch tax preparation providers based on merit and price.

Availability of Free IRS Direct File

The expansion of the IRS Direct File program to more states in 2025 significantly bolsters customer bargaining power for H&R Block. This free, government-provided service offers a direct alternative for millions of taxpayers, especially those with straightforward returns, diminishing the perceived need for paid tax preparation services.

For instance, in 2024, the IRS piloted Direct File in 12 states, processing over 1 million returns. This pilot demonstrated the program's viability and user acceptance, setting the stage for broader adoption. As more states are added in 2025, H&R Block faces increased pressure to compete on price and value.

- Increased Competition: Direct File provides a free, credible alternative, directly challenging H&R Block's core business for a segment of its customer base.

- Price Sensitivity: The availability of a free option will likely make customers more sensitive to H&R Block's pricing, potentially driving down average revenue per customer.

- Shift in Demand: Taxpayers with simpler returns may migrate to Direct File, forcing H&R Block to focus on more complex or advisory services to retain market share.

Customers' bargaining power is substantial, driven by numerous alternatives like online DIY software, free government programs, and other professional services. This abundance of choice, coupled with low switching costs, means customers can easily move to competitors offering better prices or services, directly impacting H&R Block's ability to retain clients.

The increasing availability of free tax filing options, such as the IRS Direct File program which processed over 1 million returns in its 2024 pilot, further empowers consumers. This free alternative, especially for those with simpler tax situations, intensifies price sensitivity and encourages customers to seek the most cost-effective solutions, pressuring H&R Block to remain competitive.

Regulatory scrutiny, exemplified by the FTC's 2023 actions against H&R Block regarding deceptive advertising for free services, also enhances customer leverage. These interventions promote transparency and simplify service changes, making it easier for consumers to compare and switch providers, thereby increasing their overall bargaining power.

Same Document Delivered

H&R Block Porter's Five Forces Analysis

This preview showcases the complete H&R Block Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the tax preparation industry. What you see here is the exact, professionally formatted document you will receive immediately after your purchase, ensuring no discrepancies or missing information. This detailed analysis is ready for your immediate use, providing valuable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

The tax preparation market, especially for do-it-yourself filers, sees fierce competition. Intuit's TurboTax is a major force online, and H&R Block directly contends with it and other software providers. These rivals often use competitive pricing and cutting-edge artificial intelligence to attract customers.

H&R Block encounters robust competition from established tax preparation services, including national brands and numerous local accounting firms. This traditional sector continues to command a significant portion of the market, especially among individuals with intricate tax needs or those who value face-to-face consultations. In 2024, the tax preparation industry remained highly competitive, with firms like Intuit TurboTax and Jackson Hewitt also vying for market share.

The tax preparation industry, including H&R Block, faces intense competition, driving significant pricing pressures. Companies frequently resort to discounts, price matching, and even offering free filing for basic tax returns to attract and retain customers. This aggressive pricing strategy is a direct result of the crowded market where differentiating on service alone is challenging.

This constant battle for market share directly impacts profitability. For instance, in the 2023 tax season, many online tax preparation services continued to offer free federal filing for simple returns, a trend that has persisted for several years. H&R Block itself offers various pricing tiers, with their DIY online products often competing with these free or low-cost options, forcing them to balance market penetration with margin preservation.

Focus on Digital Transformation and AI Integration

Rival tax preparation services are aggressively pursuing digital transformation and AI integration. Companies like Intuit, with its TurboTax platform, are heavily investing in machine learning to automate data entry, identify potential deductions, and personalize the tax filing experience. This technological arms race means H&R Block must continually enhance its own digital offerings and AI capabilities to stay relevant and efficient.

H&R Block's hybrid model, blending do-it-yourself (DIY) software with in-person assistance, is a key differentiator but also a point of intense competition. As rivals push the boundaries of AI-powered self-service tax preparation, H&R Block faces pressure to ensure its digital tools are not only user-friendly but also demonstrably superior in accuracy and time-saving features. For instance, in fiscal year 2023, H&R Block reported a 7% increase in DIY submissions, highlighting the growing importance of its digital segment.

- Rival Investment: Competitors are channeling significant capital into AI and digital platforms, aiming to capture market share through enhanced efficiency and user experience.

- AI in Tax Prep: Technologies like natural language processing and predictive analytics are being deployed to automate complex tax scenarios and improve accuracy.

- H&R Block's Challenge: Continuous innovation in H&R Block's hybrid model is crucial to match the pace of digital advancements and maintain a competitive edge.

- DIY Growth: The increasing adoption of DIY tax software, as seen in H&R Block's own DIY submission growth, underscores the need for robust digital solutions.

Market Share Dynamics and Customer Retention

The tax preparation industry is fiercely competitive, with H&R Block constantly vying for market share against numerous players, including national chains, local firms, and DIY software providers. This intense rivalry necessitates continuous innovation and a strong focus on customer value.

H&R Block's strategic initiatives, such as reinventing the client experience and expanding its digital offerings, directly address the need to retain existing customers and attract new ones. The acquisition of Wave Financial Inc. in 2019, a cloud-based accounting and payroll software for small businesses, exemplifies this commitment to broadening its digital ecosystem and serving a wider customer base.

- Market Share Focus: H&R Block faces significant competition from Intuit's TurboTax, particularly in the DIY tax software segment, alongside a vast array of smaller tax preparers and accounting firms.

- Customer Retention Strategies: The company emphasizes client experience improvements and digital platform expansion, such as the integration of Wave, to foster loyalty and attract new users.

- Digital Ecosystem Growth: H&R Block's investment in digital tools and services is a direct response to evolving consumer preferences and the need to compete effectively in an increasingly digital marketplace.

Competitive rivalry is a defining characteristic of the tax preparation market, forcing H&R Block to constantly innovate and adapt. The landscape includes established national brands, numerous local accounting firms, and a growing number of DIY software providers, all vying for customer attention. In 2024, this intense competition means companies like H&R Block must balance aggressive pricing strategies with investments in technology and customer service to maintain market share.

The digital arena, in particular, is a battleground where companies like Intuit's TurboTax heavily invest in AI and user experience to attract DIY filers. H&R Block's own digital segment growth, evidenced by a 7% increase in DIY submissions in fiscal year 2023, highlights the critical need for robust online offerings. This digital push is not just about convenience; it's about leveraging AI for accuracy and efficiency, a trend H&R Block is actively pursuing to stay competitive.

| Competitor | Key Offering | 2023/2024 Focus |

|---|---|---|

| Intuit (TurboTax) | DIY Tax Software, AI Integration | Enhanced AI features, user-friendly interface |

| Jackson Hewitt | In-person and Online Tax Prep | Digital expansion, hybrid service models |

| Local Accounting Firms | Personalized, In-person Services | Client relationship management, specialized tax advice |

SSubstitutes Threaten

The most significant substitute for H&R Block's services is the burgeoning market of do-it-yourself (DIY) tax software. Platforms like TurboTax, FreeTaxUSA, and Cash App Taxes empower individuals to prepare and file their taxes independently, directly bypassing the need for professional tax preparation assistance.

This trend is particularly strong among younger demographics and those with simpler tax situations. For instance, in the 2023 tax season, a substantial portion of individual tax returns were filed using tax software, highlighting its widespread adoption and effectiveness as a substitute.

The IRS's Direct File program, set to significantly expand in 2025, offers a compelling substitute for taxpayers with straightforward tax returns. This government-backed service directly competes with commercial tax preparation, especially for individuals with simpler financial lives.

This free, digital service bypasses the need for paid tax software or professional assistance, directly impacting the customer base of companies like H&R Block. For instance, in its initial pilot phase in 2024, Direct File served a limited number of states and taxpayers, but the planned 2025 expansion signals a substantial increase in its reach and potential to capture market share.

Manual tax preparation using pen and paper, while declining, still exists as a substitute for services like H&R Block. This is especially true for individuals with very simple tax returns or those who are hesitant to adopt digital solutions. For instance, even in 2024, a segment of the population, particularly older demographics or those in rural areas with limited internet access, might still opt for this method.

Personal Accountants and CPAs

For individuals and small businesses facing intricate tax scenarios, personal accountants and Certified Public Accountants (CPAs) represent a significant substitute for services like those offered by H&R Block. These professionals provide tailored advice and deep expertise that automated software or even the assisted services from larger tax preparation firms may not fully match.

The value proposition of a personal CPA lies in their ability to offer customized tax planning, identify complex deductions, and provide ongoing financial guidance. This level of personalized attention can be particularly appealing to those with unique income streams, investment portfolios, or business structures.

- Personalized Advice: CPAs offer bespoke tax strategies tailored to an individual's or business's specific financial situation, going beyond standardized software solutions.

- Specialized Expertise: Many CPAs specialize in niche areas like international taxation, estate planning, or specific industry regulations, offering a depth of knowledge often unavailable through general tax preparation services.

- Client Retention: The personalized relationship built with a CPA often fosters strong client loyalty, making it harder for large tax preparation chains to capture these clients.

Integrated Financial Management Software

Integrated financial management software presents a significant threat of substitutes for H&R Block, particularly for small businesses. As accounting platforms like QuickBooks and Xero enhance their capabilities, they increasingly offer direct tax preparation or seamless data export features. This integration allows small businesses to manage their finances and taxes within a single system, potentially bypassing the need for a dedicated tax preparation service.

For instance, by 2024, a substantial portion of small businesses were already leveraging cloud-based accounting software. Many of these platforms are actively developing or have already integrated tax filing functionalities. This trend means that a business owner can often prepare and file their taxes directly through their accounting software, which consolidates all their financial data. This convenience and cost-saving potential make these software solutions a compelling alternative to traditional tax preparation services.

- Growing Integration: Accounting software is increasingly bundling tax preparation features, making it a one-stop shop for financial management.

- Small Business Adoption: Cloud accounting software adoption among small businesses is high, creating a large user base for integrated tax solutions.

- Cost and Convenience: Businesses can save time and money by handling tax preparation within their existing financial management systems.

- Data Consolidation: Integrated platforms streamline the tax process by consolidating financial data, reducing manual input and potential errors.

The threat of substitutes for H&R Block is substantial, primarily driven by DIY tax software and the IRS's own Direct File program. These alternatives offer cost savings and convenience, particularly for individuals with simpler tax situations. For instance, the IRS Direct File program, expanded in 2025, directly challenges commercial tax preparers by offering a free, digital filing option for eligible taxpayers.

Furthermore, integrated financial management software is increasingly becoming a substitute, especially for small businesses. Platforms like QuickBooks and Xero are embedding tax preparation features, allowing users to manage finances and file taxes within a single system. This trend is amplified by the high adoption rate of cloud accounting software among small businesses, with many already leveraging these integrated solutions by 2024.

| Substitute Category | Key Characteristics | Impact on H&R Block |

|---|---|---|

| DIY Tax Software | Cost-effective, user-friendly, accessible online | Captures individuals with simpler tax returns, reducing demand for assisted services. |

| IRS Direct File | Free, government-backed, direct filing for eligible taxpayers | Offers a zero-cost alternative, directly competing with paid software and assisted preparation. |

| Personal Accountants/CPAs | Specialized expertise, personalized advice, complex tax planning | Attracts clients with intricate tax needs who prioritize tailored guidance over standardized solutions. |

| Integrated Financial Software | Bundles tax prep with accounting, data consolidation, cost/time savings for businesses | Threatens H&R Block's small business segment by offering a one-stop financial management solution. |

Entrants Threaten

The digital landscape of online tax preparation significantly lowers the hurdles for new competitors. Companies with adequate funding and technological know-how can launch basic, budget-friendly filing services without facing substantial initial infrastructure costs. For instance, in 2024, the cost for cloud hosting and development tools remains accessible, allowing nimble startups to offer straightforward tax filing solutions.

The fundamental technology powering simple tax returns is largely commoditized, meaning it's not a unique differentiator. Consequently, the primary challenge for new entrants isn't technological innovation but rather cultivating customer trust and establishing a recognizable brand in a crowded market. This emphasis on brand building, rather than complex patents, defines the competitive entry landscape.

Offering comprehensive tax preparation services, particularly those involving human assistance and complex tax scenarios, demands considerable capital for infrastructure, employee training, and ongoing compliance. For instance, maintaining a nationwide network of offices and skilled tax professionals represents a substantial upfront cost.

Furthermore, the ever-changing landscape of tax laws and the critical need for stringent data security create significant regulatory barriers. New players must invest heavily to ensure they meet all compliance requirements, a cost that can deter market entry.

Established players like H&R Block benefit from decades of brand recognition and customer trust, formidable barriers for new entrants aiming to quickly replicate this. In 2024, the tax preparation landscape continues to be dominated by trusted names, with consumers prioritizing security and reliability when entrusting sensitive financial data.

Expertise in Complex Tax Laws and Advisory Services

New entrants face a significant hurdle in replicating H&R Block's established expertise in complex tax laws and advisory services. The ability to navigate intricate tax codes and provide valuable financial guidance is a critical differentiator, not easily replicated by newcomers.

Developing this level of specialized knowledge and building a network of qualified professionals represents a substantial investment and time commitment, acting as a strong barrier to entry. This contrasts sharply with simply offering basic tax preparation services.

- Expertise Barrier: New entrants must acquire deep knowledge of evolving tax legislation.

- Advisory Demand: The market increasingly seeks comprehensive tax advisory, not just filing.

- Network Requirement: Building a trusted network of tax professionals is crucial.

- Competitive Edge: H&R Block's long-standing reputation in advisory services provides a distinct advantage.

Integration with Financial Ecosystems and AI Development

The threat of new entrants for H&R Block is elevated by the increasing necessity for tax services to integrate seamlessly with broader financial management ecosystems. This integration, coupled with the advanced application of Artificial Intelligence (AI) for enhanced efficiency and data-driven insights, presents a significant hurdle for newcomers. For instance, by mid-2024, many FinTech companies were actively developing AI-powered financial planning tools, indicating a trend towards comprehensive financial solutions where tax preparation is just one component.

Establishing these sophisticated capabilities and forging necessary strategic partnerships demands considerable capital investment and a significant time commitment. New players must not only master tax preparation but also build robust platforms that can interoperate with banking, investment, and budgeting applications, a complex undertaking. The ongoing advancements in AI, with companies like Intuit QuickBooks investing heavily in AI features for small businesses throughout 2024, underscore the technological bar new entrants must clear.

- Integration Complexity: New entrants must build or acquire technology to connect with various financial platforms, a costly and time-consuming process.

- AI Development Costs: Significant investment is required to develop and implement advanced AI for personalized tax advice and financial planning.

- Partnership Acquisition: Securing partnerships with financial institutions and technology providers is crucial but challenging for new, unproven entities.

- Data Security & Compliance: Meeting stringent data security and regulatory compliance standards for financial and tax data adds another layer of difficulty and expense.

While basic online tax filing has a low barrier to entry due to commoditized technology, H&R Block's threat from new entrants is moderate. Startups can offer simple filing services cost-effectively, as seen with accessible cloud hosting in 2024. However, building trust and brand recognition remains a significant challenge for these newcomers.

The real barrier for new entrants lies in replicating H&R Block's established expertise in complex tax laws and advisory services, which requires substantial investment in training and compliance. Furthermore, the increasing demand for integrated financial management ecosystems, powered by AI, presents a high technological and capital hurdle for any new player aiming to compete comprehensively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for H&R Block is built upon a foundation of publicly available financial statements, industry-specific market research reports, and competitor disclosures. This blend of data allows for a comprehensive understanding of industry dynamics and competitive pressures.