H&R Block Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

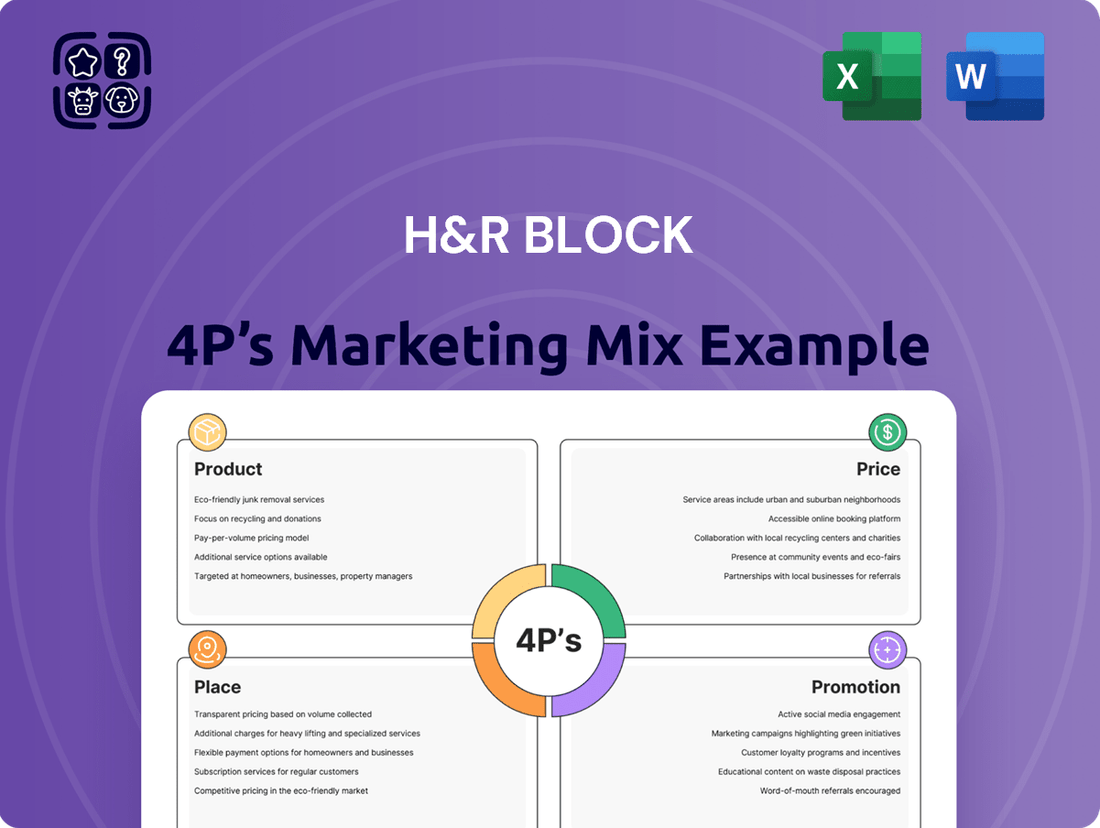

H&R Block's marketing success is built on a strategic integration of its Product, Price, Place, and Promotion. From their diverse tax preparation services to accessible pricing and widespread availability, every element is designed to meet customer needs.

Discover the intricate details of how H&R Block leverages each of the 4Ps to maintain its market leadership. This analysis goes beyond the surface, offering a comprehensive look at their winning strategy.

Ready to elevate your own marketing game? Get the full, editable 4Ps Marketing Mix Analysis for H&R Block and unlock actionable insights for your business or studies.

Product

Assisted Tax Preparation is a core offering from H&R Block, allowing clients to connect with a tax professional either in-person or virtually. This service is designed for both individuals and small businesses, offering tailored advice and accuracy, especially for intricate tax scenarios. For instance, H&R Block reported assisting over 20 million taxpayers in the 2023 tax season, highlighting the significant demand for their expertise.

The service emphasizes personalized guidance, ensuring clients understand their tax obligations and maximizing their returns. A key feature is the complimentary Second Look® review, which helps identify potential missed credits and deductions from previous tax years. This commitment to accuracy and client support is a major draw for those navigating complex tax laws or seeking peace of mind.

H&R Block's DIY software offerings cater to a broad range of taxpayers, from those with straightforward returns to individuals managing complex financial situations like investments and self-employment income. This product strategy directly addresses the 'Product' element of the marketing mix by providing accessible, user-friendly tools.

The tiered software options, including Free Online, Deluxe, Premium, and Self-Employed, ensure that clients can select a solution that matches their specific tax needs. This segmentation allows H&R Block to capture a wider market share, appealing to both novice and experienced tax preparers. For instance, in the 2024 tax season, the IRS reported over 160 million individual tax returns filed, highlighting the vast potential customer base for DIY solutions.

H&R Block extends its financial services beyond traditional tax preparation, offering a suite of tools designed to support clients' financial well-being. Their mobile banking app, Spruce, provides a comprehensive platform for managing everyday finances, including budgeting and savings features. In 2024, Spruce reported a significant increase in user engagement, with over 1.5 million active users leveraging its capabilities for better financial control.

Furthermore, H&R Block provides crucial financial services like Refund Advance Loans, offering clients access to funds before their tax refunds are processed. This service is particularly vital for individuals needing immediate financial assistance. In the 2024 tax season, H&R Block provided over $500 million in Refund Advance loans, demonstrating its commitment to offering timely financial solutions to its customer base.

Small Business Solutions (Block Advisors & Wave)

Block Advisors and Wave represent H&R Block's strategic expansion into the small business market, offering comprehensive year-round financial support. These services go beyond traditional tax preparation, providing essential tools for bookkeeping, payroll, and advisory services, aiming to empower entrepreneurs.

The product strategy focuses on meeting the diverse needs of small business owners, acknowledging that their financial management extends far beyond annual tax filing. By offering integrated solutions, H&R Block positions itself as a consistent partner in a business's growth journey.

In 2024, H&R Block reported that its small business segment, including Block Advisors and Wave, saw continued growth, reflecting the increasing demand for accessible and integrated financial management tools. Wave, acquired by H&R Block in 2019, has been instrumental in this digital transformation, serving hundreds of thousands of small businesses with its intuitive platform.

- Block Advisors offers personalized, in-person and virtual tax and advisory services for small business owners.

- Wave provides a digital platform for accounting, invoicing, payroll, and payments, catering to freelancers and small businesses.

- H&R Block's small business solutions aim to simplify financial operations, allowing owners to focus on core business activities.

- The company's investment in these services underscores a commitment to supporting the small business ecosystem throughout the year, not just during tax season.

Audit Support and Identity Theft Protection

H&R Block bolsters client trust through robust audit support, including complimentary in-person assistance. For enhanced peace of mind, clients can opt for 'Worry-Free Audit Support,' which provides comprehensive representation during audits. This commitment to client security extends to safeguarding against tax-related identity theft with their 'Tax Identity Shield' service.

The demand for such protective services is significant. In 2023, the Federal Trade Commission reported over 1.4 million identity theft reports, with tax-related identity theft remaining a persistent concern for individuals filing their returns. H&R Block's offerings directly address this market need, providing tangible solutions for clients navigating the complexities of tax season and potential security breaches.

- Audit Support: Free in-person assistance and optional 'Worry-Free Audit Support' for full representation.

- Identity Theft Protection: 'Tax Identity Shield' service to safeguard against tax-related identity theft.

- Market Relevance: Addresses growing concerns over identity theft, with millions of reports annually.

- Client Confidence: Aims to enhance client trust by offering reliable protection and support.

H&R Block's product strategy encompasses a wide array of tax preparation and financial services, ranging from DIY software to expert-assisted preparation and small business solutions. Their offerings are segmented to meet diverse taxpayer needs, from simple returns to complex business finances. For instance, in the 2024 tax season, H&R Block’s DIY software saw significant adoption, complementing their in-person and virtual assisted services.

The company also provides complementary financial products like the Spruce mobile banking app and Refund Advance Loans, demonstrating a commitment to year-round financial support. Block Advisors and Wave specifically target the small business sector, offering integrated accounting, payroll, and advisory services. This multifaceted product portfolio aims to capture a broad market share by addressing various financial management needs.

| Product Category | Key Offerings | Target Audience | 2023/2024 Data Point |

|---|---|---|---|

| Assisted Tax Preparation | In-person and virtual tax help | Individuals, Small Businesses | Assisted over 20 million taxpayers (2023 season) |

| DIY Tax Software | Free Online, Deluxe, Premium, Self-Employed | Broad taxpayer base | IRS filed over 160 million individual returns (2024 season) |

| Small Business Services | Block Advisors, Wave (accounting, payroll) | Small businesses, freelancers | Wave serves hundreds of thousands of small businesses |

| Financial Services | Spruce app, Refund Advance Loans | Everyday consumers, those needing quick funds | Spruce: Over 1.5 million active users (2024); Refund Advance: Over $500 million provided (2024 season) |

What is included in the product

This analysis provides a comprehensive deep dive into H&R Block's marketing mix, examining their Product offerings, Pricing strategies, Place of distribution, and Promotion efforts to understand their market positioning.

Simplifies complex marketing strategies by clearly outlining H&R Block's 4Ps, alleviating the pain of understanding how they address customer needs.

Provides a clear, actionable framework for identifying and resolving customer pain points related to tax preparation and financial services.

Place

H&R Block boasts an extensive physical office network, a cornerstone of its marketing strategy. With more than 8,800 locations worldwide, including coverage in every U.S. state, the company ensures accessibility. This vast footprint means that over 90% of Americans live within a five-mile radius of an H&R Block office, facilitating convenient, in-person tax assistance.

H&R Block leverages its online platforms and software distribution to make tax preparation accessible. Their do-it-yourself services are available via their website and downloadable software, allowing users to file from any internet-connected device.

This digital approach aligns with the growing preference for online solutions. For the tax year 2023, H&R Block reported that a significant portion of its DIY clients utilized their online products, reflecting strong adoption of these digital channels.

H&R Block's Spruce mobile banking app is a key component of its distribution strategy, making financial products accessible through app stores and direct downloads. This mobile-first approach ensures clients can manage their finances conveniently from their smartphones, offering a modern and efficient banking experience.

Direct Sales and Professional Assistance

H&R Block's direct sales approach centers on providing clients with direct access to their tax professionals. This can happen in person at one of their many offices, or virtually through chat, phone, or video consultations. This strategy highlights the value of personalized service and expert advice throughout the tax preparation process.

This direct engagement model is crucial for building client trust and ensuring accurate tax filings. In the 2023 tax season, H&R Block served over 20 million clients, underscoring the effectiveness of their direct service channels. Their network of over 60,000 tax professionals offers a significant advantage in delivering this personalized support.

- Direct Office Visits: Clients can walk into any of H&R Block's physical locations for face-to-face assistance.

- Virtual Assistance: Options include live chat, phone support, and video conferencing for remote consultations.

- Expert Guidance: The core of this strategy is the direct interaction with trained tax professionals.

- Client Trust: Personalized service aims to build strong relationships and confidence in their tax services.

International Presence

H&R Block extends its tax preparation services beyond the United States, establishing a presence in key international markets. This global reach includes operations in Canada, Australia, India, and Germany.

This international footprint is crucial for serving a diverse clientele, particularly expatriates who require assistance with U.S. federal and state tax obligations while living abroad. The company's expansion into these regions reflects a strategy to tap into new customer segments and provide localized support.

- Canada: H&R Block has a significant presence in Canada, offering tax services tailored to Canadian tax laws.

- Australia: The company also operates in Australia, catering to the Australian tax system.

- India: H&R Block has explored opportunities in India, focusing on the needs of individuals and potentially businesses.

- Germany: Operations in Germany allow H&R Block to serve clients within the European market.

H&R Block's "Place" strategy emphasizes broad accessibility through a multi-channel approach. Their extensive physical office network, with over 8,800 locations globally, ensures that a vast majority of potential clients can access in-person assistance. This is complemented by robust online platforms and mobile applications, like the Spruce banking app, which cater to the growing demand for digital tax solutions and financial management tools.

| Channel | Description | Reach/Impact |

|---|---|---|

| Physical Offices | In-person tax preparation and advice | Over 8,800 locations worldwide; 90%+ of Americans within 5 miles |

| Online Platforms/Software | DIY tax filing via website and downloadable software | Significant portion of DIY clients utilized online products for Tax Year 2023 |

| Mobile App (Spruce) | Financial products and banking services | App store availability for smartphone users |

| Virtual Consultations | Remote assistance via chat, phone, video | Supports direct engagement with tax professionals |

What You See Is What You Get

H&R Block 4P's Marketing Mix Analysis

The preview you see here is the actual, complete H&R Block 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means you're viewing the exact content you'll download, ensuring no surprises and immediate usability. You can trust that the comprehensive analysis presented is precisely what you'll own and can begin utilizing right away.

Promotion

H&R Block consistently deploys integrated brand campaigns, like the recent 'It's Better With Block' initiative, to underscore their diverse filing solutions, clear pricing structures, and service assurances. These efforts are strategically designed to refresh the brand's image and capitalize on consumer needs precisely when tax season peaks.

H&R Block heavily invests in digital advertising, leveraging platforms like Google Display Network and social media channels to connect with potential clients. In 2023, their digital ad spend reached significant figures, supporting campaigns focused on tax preparation services and financial advice.

The company's online presence is further amplified through targeted video advertising and strategic content initiatives. Efforts like the "Responsibility Island" series aim to boost engagement and relevance with younger demographics, a key growth area for the tax preparation industry.

H&R Block actively uses promotional offers to attract and retain customers. For instance, they frequently provide free online tax filing for straightforward returns, a significant draw for budget-conscious individuals. Their price matching policy further incentivizes new clients by ensuring competitive service costs.

Beyond initial offers, H&R Block backs its services with strong guarantees. The 100% accuracy guarantee and the maximum refund guarantee are key pillars in building customer confidence. These assurances aim to alleviate common taxpayer anxieties and encourage loyalty, especially in a competitive tax preparation market.

Public Relations and Media Engagement

H&R Block actively manages its public perception through strategic public relations and media engagement. This includes issuing press releases to announce significant developments, such as the introduction of new tax preparation software features or updates on evolving tax legislation. Their media appearances further amplify these messages, ensuring a broad audience is informed about the company's innovations and its role in navigating complex tax environments.

These efforts are crucial for maintaining a positive public image and educating consumers and investors alike. For instance, in the lead-up to the 2024 tax season, H&R Block highlighted its advancements in AI-powered tax assistance, aiming to position itself as a leader in technological innovation within the industry. This proactive communication strategy also extends to financial results, providing transparency and building trust with stakeholders.

- Press Releases: H&R Block uses press releases to share news about new services, tax law changes, and financial performance, fostering transparency.

- Media Appearances: Company spokespeople regularly feature in media outlets to discuss tax-related topics, enhancing brand visibility and authority.

- Public Image Management: These activities collectively aim to cultivate and maintain a favorable public image, positioning H&R Block as a trusted tax expert.

- Market Information Dissemination: Engaging with the media ensures that key information about H&R Block's offerings and financial health reaches a wide market audience.

Partnerships and Community Outreach

H&R Block actively cultivates partnerships and engages in community outreach to strengthen its brand and foster customer loyalty. A prime example is the Block Advisors 'Fund Her Future' grant program, which directly supports small businesses. This initiative, launched by Block Advisors, a division of H&R Block, demonstrates a commitment to empowering entrepreneurs, particularly women, within the communities H&R Block serves.

These community-focused efforts go beyond simple brand building. By investing in programs like 'Fund Her Future,' H&R Block enhances its public image and cultivates a sense of goodwill. This strategic approach not only attracts new clients but also solidifies relationships with existing ones, creating a more robust and loyal customer base. The program's impact is measured by the success of the businesses it supports, reflecting H&R Block's dedication to community economic development.

Key aspects of H&R Block's partnerships and community outreach include:

- Strategic Alliances: Collaborating with organizations that align with H&R Block's values to expand reach and impact.

- Community Investment: Direct support for small businesses through programs like the 'Fund Her Future' grant, fostering local economic growth.

- Brand Perception Enhancement: Showcasing a commitment to community well-being, which positively influences how consumers view the H&R Block brand.

- Customer Loyalty Building: Initiatives that resonate with community needs help create deeper connections and encourage repeat business.

H&R Block's promotional strategy centers on a multi-faceted approach to attract and retain clients, emphasizing value and trust. They leverage integrated campaigns like "It's Better With Block" and significant digital ad spend, particularly on platforms like Google and social media, to reach consumers during peak tax season. Promotional offers, such as free online filing for simple returns and a price matching policy, directly incentivize new customer acquisition. Furthermore, strong guarantees like the 100% accuracy and maximum refund guarantees build confidence and encourage repeat business.

Price

H&R Block employs a tiered pricing strategy for its do-it-yourself online tax solutions, catering to varying taxpayer needs. This approach ensures customers pay only for the features and support they require, making tax preparation more accessible and cost-effective. For instance, the Free Online option is ideal for simple returns, while the Premium and Self-Employed tiers offer more advanced features and support for complex financial situations, reflecting a clear value proposition.

H&R Block champions transparent, upfront pricing across its assisted tax preparation and DIY software offerings. This commitment ensures clients understand the full cost before engaging services, fostering a sense of trust and predictability.

The company’s 'No Surprises Guarantee' directly addresses client concerns about hidden fees, reinforcing its dedication to clarity. For instance, in the 2023 tax season, H&R Block maintained competitive pricing structures, with DIY software starting at accessible price points, while assisted services offered clear tiered options based on tax complexity.

H&R Block's pricing for assisted tax preparation is designed to be flexible, reflecting the diverse needs of its clients. The cost of in-person or virtual assistance can change depending on how complicated your tax situation is and if you need extra forms or specialized services. For instance, a simple return might have a lower starting price, but if you have investments, rental property income, or other complex deductions, the final bill will be higher. This variable pricing model means the exact cost is determined after a thorough consultation with a tax professional.

State Filing Fees

H&R Block, like most tax preparation services, charges a fee for state tax return preparation in addition to federal filing. These state fees are not fixed and can differ significantly depending on the complexity of the state's tax laws and the specific forms required. For the 2024 tax season, H&R Block's state filing fees typically ranged from $35 to $60 per state return, with some states or more complex returns potentially incurring higher charges.

These state filing fees are a crucial component of H&R Block's pricing strategy within its Product element of the marketing mix. They represent a direct revenue stream that contributes to the overall profitability of the service. The variability in these fees allows H&R Block to tailor its pricing to the specific market demands and competitive landscape of each state.

- State Filing Fee Range: H&R Block's state filing fees for the 2024 tax year generally fell between $35 and $60 per state.

- Variability Factor: Fees vary based on state tax laws, return complexity, and the specific forms needed.

- Revenue Contribution: State fees are a significant part of H&R Block's revenue, directly impacting profitability.

- Competitive Pricing: The pricing structure allows for adaptation to individual state market conditions and competitor offerings.

Promotional Discounts and Add-ons

H&R Block actively uses promotional discounts to draw in new customers, with initiatives like price matching becoming a common tactic to secure market share. For instance, during the 2024 tax season, they highlighted competitive pricing to attract clients who might otherwise choose a rival service.

Beyond initial discounts, H&R Block offers a suite of add-on services designed to generate additional revenue and provide enhanced value. These include options such as Refund Transfers, which allow clients to have their tax preparation fees deducted directly from their refund, and Worry-Free Audit Support, offering peace of mind for an extra charge.

These add-ons represent a significant revenue stream, with many clients opting for them to manage potential tax complexities. For example, Refund Transfers are popular among taxpayers seeking immediate access to their refund funds, even though they incur an additional fee. This strategy allows H&R Block to cater to diverse client needs while simultaneously increasing the average revenue per customer.

- Price Matching: H&R Block's 2024 tax season promotions included price matching to attract new clients.

- Refund Transfers: An add-on service allowing fees to be deducted from tax refunds.

- Audit Support: Optional service providing assistance in case of an IRS audit.

- Revenue Generation: Add-ons contribute to increased average revenue per client.

H&R Block's pricing strategy for its DIY tax software is tiered, with options like Free Online, Deluxe, Premium, and Self-Employed, each offering different levels of features and support. For the 2024 tax season, the Free Online service remained available for simple returns, while paid tiers started at competitive price points, reflecting value for complexity.

Assisted tax preparation pricing is variable, dependent on the complexity of the tax situation and any additional forms or specialized services required. This ensures clients pay for the specific expertise needed, with costs adjusted accordingly after an initial consultation.

State tax return filing fees typically ranged from $35 to $60 per state for the 2024 tax year, with variations based on state tax laws and return complexity, contributing significantly to overall revenue.

Promotional discounts, including price matching, were utilized during the 2024 tax season to attract new customers. Additionally, add-on services like Refund Transfers and Audit Support are offered to enhance client value and generate further revenue.

| Service Tier (DIY) | Approximate Starting Price (2024 Tax Season) | Key Differentiator |

|---|---|---|

| Free Online | $0 | Simple federal and state returns |

| Deluxe | ~$40 | Deductions and credits, investments |

| Premium | ~$60 | Self-employment, rental property |

| Self-Employed | ~$90 | Small business, freelance income |

| State Filing Fee | $35 - $60+ per state | Complexity of state tax laws |

4P's Marketing Mix Analysis Data Sources

Our H&R Block 4P's analysis is grounded in a comprehensive review of their official website, recent annual reports, and investor relations materials. We also incorporate data from industry publications and competitive intelligence to capture their product offerings, pricing strategies, distribution channels, and promotional activities.