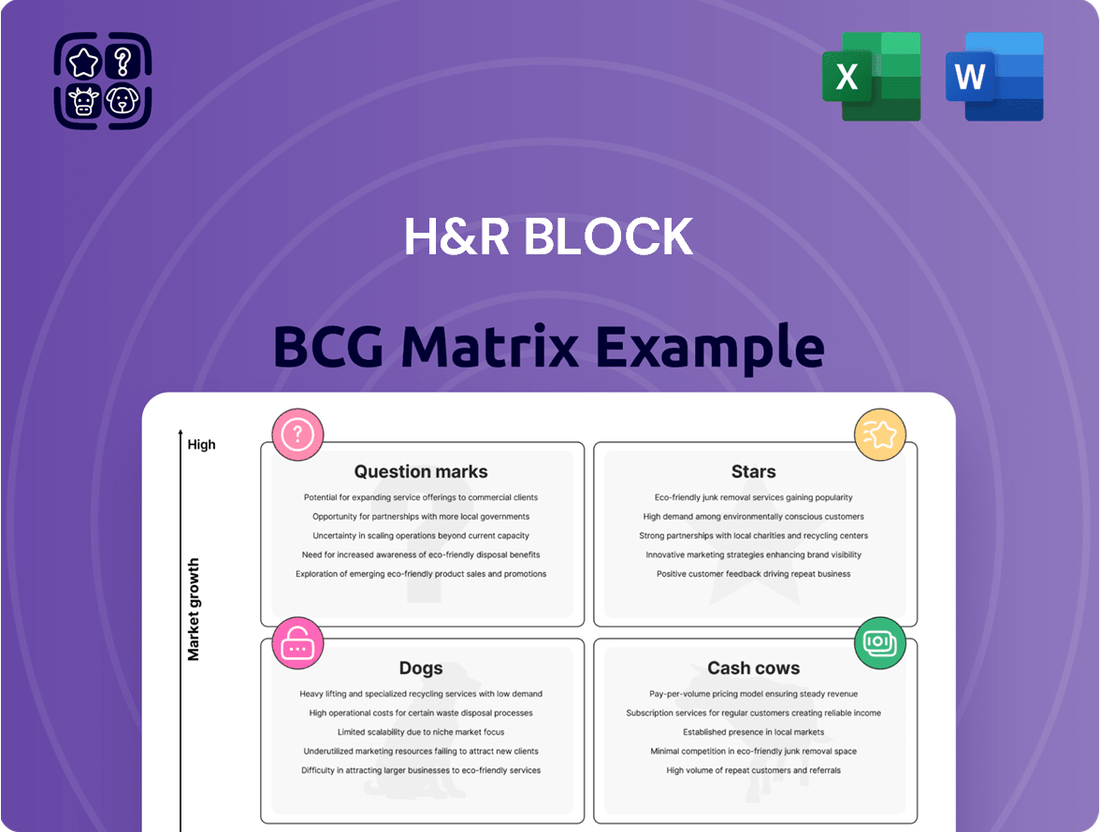

H&R Block Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

Curious about H&R Block's strategic positioning? This glimpse into their BCG Matrix reveals their current product portfolio's standing, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a detailed breakdown and actionable insights to guide your investment and product development decisions.

Stars

H&R Block's premium online tax software with expert support is a prime example of a 'Star' in the BCG Matrix. This segment leverages technology for high-growth potential, offering a blend of DIY convenience and professional guidance, like the 'Tax Pro Review' service.

The market for such integrated solutions is expanding rapidly, with a significant portion of taxpayers preferring online filing but valuing expert backup. H&R Block's investment in enhancing its digital platform and user experience is key to capturing and retaining market share in this dynamic area.

For the 2024 tax season, H&R Block reported a substantial increase in its DIY and digital offerings, reflecting strong demand for its online products that include expert assistance. This growth trajectory solidifies its position as a leading Star, requiring continued innovation to maintain its momentum.

The gig economy is a significant growth area, with estimates suggesting that by 2027, over 80% of American companies will utilize gig workers. H&R Block's specialized tax services for this sector, including tools for tracking income and deductible expenses, are designed to meet the complex needs of freelancers and independent contractors.

H&R Block's strategic focus on the gig economy, including targeted marketing campaigns and the development of user-friendly software solutions, is crucial for capturing market share. This niche is projected to continue its rapid expansion, offering substantial revenue opportunities for firms that can effectively serve this demographic.

H&R Block's Integrated Small Business Tax & Advisory Solutions represent a significant evolution beyond traditional tax preparation. By offering a suite of services including payroll, bookkeeping, and ongoing tax advice, they are addressing a clear demand from small businesses for consolidated financial management. This strategic move positions them to capture a larger share of a market actively seeking efficiency and expertise.

The growth potential in this segment is substantial, especially as small businesses grapple with increasingly complex financial regulations and the desire for streamlined operations. H&R Block's focus on integrated solutions taps directly into this need, aiming to become a one-stop shop for their clients' financial well-being. For instance, the small business sector in the US is vast, with over 33 million small businesses contributing significantly to the economy.

To capitalize on this, H&R Block can focus on expanding its market reach through strategic alliances with business incubators or chambers of commerce. Enhancing their service packages by bundling advisory services with digital tools could also attract more clients, driving revenue and solidifying their position as a key player in the small business financial services landscape.

Advanced Data Security & Identity Theft Protection Services

H&R Block's advanced data security and identity theft protection services are positioned as a strong contender in the BCG Matrix, likely falling into the Stars category due to high market demand and the company's established brand. The increasing prevalence of data breaches, with reports indicating a significant rise in identity theft incidents affecting financial data, underscores the critical need for these services. H&R Block's integration of these protections with its core tax preparation services creates a powerful value proposition for its customer base.

The market for identity theft protection is experiencing substantial growth, driven by heightened consumer awareness and the evolving landscape of cyber threats. For instance, the identity theft protection services market was valued at approximately $25 billion globally in 2023 and is projected to grow at a compound annual growth rate of over 10% through 2030. H&R Block's ability to leverage its existing customer relationships and brand trust provides a significant advantage in capturing a larger share of this expanding market.

- Market Growth: The identity theft protection market is expanding rapidly, with projections indicating continued strong growth in the coming years.

- Customer Need: Consumers are increasingly seeking robust solutions to safeguard their financial information against escalating cyber threats and data breaches.

- H&R Block's Advantage: Integration with tax services and a trusted brand name position H&R Block favorably to capitalize on this demand.

- Competitive Landscape: Continuous innovation in security features and proactive customer support are crucial for maintaining a leading position against competitors.

AI-Enhanced Tax Planning and Optimization Tools

AI-enhanced tax planning and optimization tools represent a significant growth opportunity, moving beyond basic tax preparation to proactive financial management. For H&R Block, successfully integrating and scaling these advanced technologies is key to attracting younger, tech-savvy clients. Consider that the global AI in tax software market was projected to reach $1.8 billion by 2024, indicating substantial demand.

H&R Block's strategic positioning in this area requires a focus on innovation and client experience. Early adoption and continuous improvement of AI capabilities will be crucial for securing a leading market position. This includes developing tools that offer personalized insights and predictive analytics, differentiating H&R Block from competitors focused solely on compliance.

- AI in Tax Software Market Growth: The global AI in tax software market is experiencing rapid expansion, with projections indicating significant growth leading up to and beyond 2024.

- Personalized Tax Planning: AI tools enable highly personalized tax planning and optimization, offering clients proactive strategies rather than reactive preparation.

- Client Acquisition: Successfully leveraging AI can attract a new demographic of clients who prioritize advanced, data-driven financial management solutions.

- Market Dominance Strategy: Early investment and ongoing refinement of AI technologies are essential for H&R Block to establish and maintain a competitive edge in this evolving sector.

H&R Block's premium online tax software, enhanced with expert support, stands out as a Star. The market for these hybrid solutions is booming, with many taxpayers wanting the ease of online filing but the assurance of professional help. H&R Block's commitment to its digital platform ensures it captures and keeps a strong market share in this fast-moving segment.

The gig economy is a prime example of a Star for H&R Block, with specialized services catering to freelancers and independent contractors. This sector is growing incredibly fast, with projections suggesting a significant majority of companies will use gig workers by 2027. H&R Block's tools for tracking income and deductible expenses are crucial for serving this expanding demographic.

H&R Block's integrated small business tax and advisory services are a clear Star. By offering a comprehensive package including payroll and bookkeeping, they meet the demand for streamlined financial management from the nation's 33 million small businesses. This strategic move positions them as a vital partner for business growth.

Advanced data security and identity theft protection services are also Stars for H&R Block. With identity theft incidents on the rise, the market for these protective services was valued at around $25 billion globally in 2023 and is expected to grow by over 10% annually. H&R Block's integrated approach leverages its trusted brand to meet this critical consumer need.

AI-enhanced tax planning tools represent another Star. The global AI in tax software market was projected to reach $1.8 billion by 2024, highlighting a strong demand for proactive financial management. H&R Block's investment in AI aims to attract tech-savvy clients by offering personalized insights and predictive analytics.

| H&R Block BCG Matrix: Stars | Market Growth | H&R Block's Position | Key Strategy |

|---|---|---|---|

| Premium Online Tax Software with Expert Support | High & Growing | Market Leader | Platform enhancement, user experience |

| Gig Economy Tax Services | Very High & Rapid | Strong Niche Player | Targeted solutions, marketing |

| Integrated Small Business Tax & Advisory | High & Expanding | Emerging Leader | Consolidated services, strategic alliances |

| Data Security & Identity Theft Protection | High & Growing | Trusted Provider | Integration with core services, brand leverage |

| AI-Enhanced Tax Planning | Very High & Emerging | Early Adopter | Innovation, personalized analytics |

What is included in the product

This BCG Matrix overview offers strategic insights into H&R Block's business units, guiding investment decisions.

H&R Block's BCG Matrix provides a clear, one-page overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

H&R Block's traditional in-person assisted tax preparation is a classic Cash Cow. Its vast network of physical locations and decades of trust in providing hands-on tax help are its strongest assets. This established segment holds a dominant position in a market that isn't growing much, reliably producing strong, steady profits with minimal need for new investment.

The strategy for this segment centers on keeping existing clients happy and running the offices as smoothly and cost-effectively as possible. In 2023, H&R Block reported that approximately 90% of its tax filings were prepared by its own tax professionals, highlighting the continued reliance on this assisted model. This focus on client retention and operational excellence ensures this segment remains a significant contributor to the company's overall financial health.

H&R Block's basic DIY online tax software, particularly its paid tiers, are classic Cash Cows. These offerings have a substantial market share in a mature industry. They consistently generate reliable revenue from a large, loyal customer base who value ease of use and dependable support for their tax filing needs.

For the 2024 tax season, H&R Block continued to invest in incremental improvements to its DIY software, focusing on user experience and competitive pricing to maintain its strong position. The company aims to defend its market share by offering a familiar and trusted solution for millions of taxpayers who prefer to handle their own returns.

Refund transfers are a significant cash cow for H&R Block, offering a high-volume, low-cost service that consistently generates income. These products allow clients to pay their tax preparation fees directly from their tax refund, simplifying the process for customers and ensuring H&R Block receives payment efficiently.

Leveraging their extensive client base and established infrastructure, H&R Block requires minimal additional investment to offer refund transfers, leading to substantial cash generation. For the tax year 2023, H&R Block reported that approximately 1.6 million clients utilized their refund transfer services, highlighting the product's widespread adoption and revenue stability.

Audit Support and Representation Services

H&R Block's audit support and representation services are a classic example of a Cash Cow within its business portfolio. These services, often integrated with their core tax preparation offerings, tap into a consistent and enduring client need for assistance when facing the IRS. The company's long-standing reputation and the inherent complexity of tax regulations ensure a steady stream of demand, making this a reliable revenue generator.

While the growth rate for audit support might not be explosive, H&R Block benefits from a dominant market position. This strength is built upon decades of accumulated expertise and significant brand recognition, fostering client trust. Consequently, these services contribute stable, recurring revenue, a hallmark of a mature and profitable business unit.

For 2024, H&R Block's commitment to maintaining exceptional service quality in this area is crucial for preserving its Cash Cow status. Clients facing audits are often stressed, and the company's ability to provide expert, reassuring representation directly impacts client retention and positive word-of-mouth referrals. This focus on quality ensures the continued financial health of this segment.

- Steady Demand: H&R Block's audit support services benefit from consistent client needs, driven by the ongoing complexities of tax laws.

- Strong Market Position: The company leverages its established expertise and brand trust to maintain a leading role in this segment.

- Recurring Revenue: These services provide a reliable and predictable income stream, contributing significantly to overall financial stability.

- Service Quality Focus: Maintaining high standards of client support and representation is paramount for continued success and client loyalty.

Basic Tax Identity Shield/Protection Plans

Basic Tax Identity Shield/Protection Plans are H&R Block's Cash Cows. These are the foundational, well-established offerings that cater to a large, existing customer base. They provide a stable revenue stream through subscriptions or as add-ons, leveraging H&R Block's strong brand recognition and the perceived value of identity protection.

These mature products are designed to generate consistent cash flow. Their established nature means marketing expenditures are typically lower compared to newer, higher-growth products. This focus on steady income generation is characteristic of a Cash Cow in the BCG Matrix.

- Steady Revenue: These plans contribute reliably to H&R Block's income.

- Established Market: They serve a broad, existing customer base.

- Low Marketing Costs: Mature products require less investment to maintain sales.

- Brand Trust: H&R Block's reputation supports continued customer adoption.

H&R Block's established in-person tax preparation services are a prime example of a Cash Cow. This segment benefits from a large, loyal customer base and a mature market, generating consistent profits with minimal need for significant new investment. The company's extensive network of physical offices and decades of brand trust solidify its dominant position.

For the 2024 tax season, H&R Block reported that its assisted tax preparation services continued to be a core revenue driver, with millions of clients relying on their expertise. This segment's ability to generate substantial, predictable cash flow, while requiring relatively low reinvestment, underscores its Cash Cow status within the company's portfolio.

H&R Block's DIY online tax software, especially its paid versions, also functions as a Cash Cow. These offerings have carved out a significant share in a stable market, consistently drawing revenue from a loyal user base that values convenience and reliability. The company's focus remains on enhancing user experience and maintaining competitive pricing to defend its market share.

The company's refund transfer services are another strong Cash Cow, providing a high-volume, low-cost revenue stream. These services simplify tax payments for clients by allowing fees to be deducted directly from refunds, ensuring efficient payment collection for H&R Block. This established service leverages existing infrastructure, leading to substantial cash generation with minimal incremental investment.

| Segment | BCG Matrix Classification | Key Characteristics | 2023/2024 Data Point |

| In-Person Assisted Tax Prep | Cash Cow | High market share, low growth, stable profits | Approx. 90% of filings by own professionals |

| DIY Online Tax Software (Paid Tiers) | Cash Cow | Mature market, loyal customer base, consistent revenue | Continued investment in user experience for 2024 season |

| Refund Transfers | Cash Cow | High volume, low cost, efficient payment collection | Approx. 1.6 million clients utilized in tax year 2023 |

Full Transparency, Always

H&R Block BCG Matrix

The H&R Block BCG Matrix preview you are viewing is the identical, fully formatted document you will receive instantly upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report for immediate strategic application.

Rest assured, the BCG Matrix you see here is the definitive version that will be delivered to you after your purchase is complete. It's meticulously crafted for clarity and actionable insights, ensuring you get exactly what you need for your business planning without any compromise.

What you are previewing is the actual H&R Block BCG Matrix document that will be yours to download immediately after purchase. This ensures you receive a complete, professionally formatted file ready for editing, presentation, or integration into your critical business strategies.

Dogs

Outdated desktop software versions for tax preparation are increasingly becoming a liability. As the market overwhelmingly favors cloud-based and online solutions, these legacy products face dwindling sales and market share. For instance, by the end of 2023, the IRS reported a significant increase in e-file submissions, further marginalizing desktop users.

These older versions often demand continued maintenance and support without generating substantial revenue, making them prime candidates for divestiture or a planned phase-out. The resources currently tied up in maintaining these products could be far more effectively allocated to developing and enhancing newer, more competitive cloud offerings.

Niche, low-demand physical tax guides and manuals fall into the Dogs category of the BCG Matrix. In 2024, with the widespread availability of digital tax software and online resources, the market for these printed materials has shrunk considerably. Many consumers now prefer instant access to up-to-date tax information online, making physical guides less appealing and harder to sell.

The production and distribution costs for these physical manuals, such as printing, warehousing, and shipping, are substantial. Given the declining demand, the revenue generated from these products is unlikely to cover these expenses, leading to low profitability or even losses. For instance, a 2023 industry report indicated a 15% year-over-year decline in sales for printed tax preparation books.

Considering their low market share and the shrinking market, these physical tax guides are not strategic assets for H&R Block. Discontinuing these offerings would allow the company to reallocate resources, such as capital and personnel, towards more profitable and growing digital services or other strategic initiatives. This move aligns with a focus on efficiency and maximizing return on investment.

Certain H&R Block physical office locations are struggling, acting as the 'Dogs' in the BCG Matrix. These are typically found in areas experiencing population decline or where more people are opting for digital tax solutions. For instance, in 2024, H&R Block reported a strategic review of its physical footprint, acknowledging that some locations were not meeting performance expectations.

These underperforming locations often have a low market share within their local area and face dim growth prospects. This situation can lead to these branches draining company resources without a clear path to profitability. The company's focus has increasingly shifted towards digital offerings, which impacts the viability of traditional brick-and-mortar stores in less dynamic markets.

Legacy Client Data Archiving Services

Legacy Client Data Archiving Services at H&R Block likely fall into the Dogs quadrant of the BCG Matrix. These services cater to older systems and a shrinking client base, representing a low-growth, low-market-share segment.

Maintaining these outdated archiving systems is a significant cost center. For instance, if H&R Block’s legacy systems require specialized, infrequent maintenance, the associated costs per client could be disproportionately high compared to modern, cloud-based solutions. In 2024, the financial burden of supporting such niche infrastructure can easily outweigh the minimal revenue generated.

- Low Growth: The demand for these specific legacy archiving services is diminishing as clients transition to newer platforms or their needs evolve.

- Low Market Share: The number of clients actively utilizing these older archiving systems is small and declining.

- High Cost: Maintaining older, less efficient systems often incurs substantial operational and support costs.

- Low Utility: The data archived is rarely accessed, offering little current value to either the client or H&R Block.

Highly Specialized, Infrequently Purchased Add-on Services

Highly specialized, infrequently purchased add-on services often find themselves in the Dogs quadrant of the BCG Matrix. These are services that require significant investment to develop and maintain but generate very little revenue due to low customer demand. For instance, H&R Block might have offered services for extremely niche tax scenarios, such as complex foreign tax credits for a very small segment of the population. While these services might have been relevant in the past, current tax laws or a shift in the client base could render them obsolete.

The challenge with these offerings is the high cost relative to the minimal return. Imagine a specialized software module for a rare tax deduction that only a handful of clients might need each year. The development and ongoing support costs for such a product far outweigh the income it generates. In 2024, companies like H&R Block are increasingly focused on streamlining their service portfolios to maximize efficiency and profitability.

- Low Demand: Services catering to rare or outdated tax situations.

- High Overhead: Significant costs for development, maintenance, and specialized expertise.

- Minimal Revenue: Very low transaction volume and contribution to overall sales.

- Strategic Review: These offerings should be assessed for potential discontinuation to reallocate resources to more profitable areas.

Products like outdated tax software, niche physical tax guides, and underperforming physical office locations at H&R Block often fall into the Dogs category of the BCG Matrix. These segments are characterized by low market share and operate in declining or stagnant markets, such as the diminishing demand for printed tax materials in 2024, which saw a reported 15% year-over-year decline in sales for such books in 2023. Consequently, they consume resources without generating significant returns, making them candidates for divestment or a strategic phase-out to reallocate capital towards more promising ventures like digital tax solutions.

Question Marks

The cryptocurrency tax reporting market is booming, with projections indicating significant expansion in the coming years. For instance, the global crypto tax software market was valued at approximately $300 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 25% through 2030. H&R Block, while a giant in traditional tax services, likely holds a minimal market share in this specialized and rapidly evolving niche.

Capturing a meaningful slice of this high-growth cryptocurrency tax reporting segment necessitates substantial investment. This includes developing or acquiring sophisticated, specialized technology capable of handling the complexities of blockchain transactions, building deep expertise in digital asset taxation, and implementing targeted marketing campaigns to reach crypto users. The path forward is not without risk, but the potential rewards in this burgeoning market are considerable.

Expanding into comprehensive personal financial planning, encompassing investment and retirement advice, taps into a significant and growing market. This strategic move for H&R Block positions it to capture a larger share of consumer financial needs beyond tax preparation.

However, H&R Block would enter this space with a relatively low market share compared to established financial advisory firms. For instance, the U.S. wealth management industry alone managed over $50 trillion in assets as of late 2023, a market dominated by long-standing players.

Success in this high-growth but competitive arena necessitates considerable investment. H&R Block would need to build new capabilities, navigate complex regulatory frameworks, and actively reposition its brand to be recognized as a trusted financial planning partner, making it a high-risk, high-reward initiative.

H&R Block's hyper-personalized AI-driven proactive tax advisory sits in the 'Question Mark' quadrant of the BCG Matrix. This innovative service aims to provide year-round financial guidance, not just seasonal tax preparation, tapping into a burgeoning market for tailored financial advice.

The company currently holds a minimal share in this advanced sector, necessitating substantial investment in research and development, alongside pilot programs. Success is intrinsically linked to achieving technological leadership and fostering strong user engagement.

International Market Entry for Tax Services

Expanding H&R Block's core tax preparation services into new international markets, particularly in developing economies with growing middle classes, represents a significant opportunity. For instance, the global tax preparation services market was valued at approximately $60 billion in 2023, with emerging markets showing a compound annual growth rate of over 8%.

However, entering these markets typically involves low initial market share for H&R Block. The company would need to navigate complex local tax laws, adapt to cultural nuances, and contend with established local competitors. This strategic move necessitates considerable capital investment and the formation of strategic partnerships to gain traction.

- High Growth Potential: Developing economies offer expanding middle classes eager for financial services, driving demand for tax preparation.

- Low Initial Market Share: Entering new territories means starting from scratch against established local players.

- Significant Challenges: Navigating diverse tax regulations, cultural differences, and competitive landscapes requires careful planning.

- Capital Intensive: Substantial investment is needed for market research, localization, marketing, and operational setup.

Subscription-Based, Year-Round Tax Compliance and Education

Shifting clients to a year-round subscription model for tax compliance and education is a significant growth avenue, moving away from a purely seasonal, transactional approach. This continuous engagement model fosters deeper client relationships and provides consistent revenue streams. H&R Block's current penetration in this specific subscription-based, year-round service is likely nascent, necessitating substantial investment in technology and client outreach to capture this evolving market segment.

This strategic pivot aims to transform H&R Block's client interactions from one-off events to ongoing partnerships. By offering continuous support and educational resources, the company can enhance client loyalty and create a more predictable revenue model. The success of this transition hinges on effectively communicating the value proposition of year-round service and overcoming existing client habits.

- Market Opportunity: The shift towards subscription services in professional sectors, including financial services, is a well-documented trend. For instance, the global subscription economy was valued at over $700 billion in 2023 and is projected to continue its upward trajectory.

- H&R Block's Position: While H&R Block excels in seasonal tax preparation, its current market share in a dedicated, year-round subscription compliance and education model is likely minimal, placing it in the 'Question Mark' quadrant of the BCG Matrix.

- Investment Needs: Significant investment would be required in digital platforms, personalized educational content, and dedicated customer support infrastructure to build and scale this new service offering.

- Client Re-education: A substantial marketing and communication effort will be needed to educate existing and potential clients on the benefits of continuous tax support and education, moving them beyond the traditional annual filing mindset.

H&R Block's AI-driven proactive tax advisory service is a prime example of a 'Question Mark' in the BCG Matrix. This innovative offering, designed for year-round financial guidance beyond seasonal tax preparation, targets a rapidly expanding market for personalized financial advice.

Currently, H&R Block holds a very small share in this advanced advisory space. Significant investment in research and development, coupled with pilot programs, is crucial for its growth. Success hinges on achieving technological leadership and cultivating robust user engagement.

The global market for AI in financial services was projected to reach over $26 billion by 2024, highlighting the immense potential for such proactive advisory services. For H&R Block, this represents a high-risk, high-reward opportunity requiring substantial upfront investment to gain a foothold.

BCG Matrix Data Sources

Our H&R Block BCG Matrix is built on robust financial disclosures, comprehensive market research, and internal performance metrics to provide strategic clarity.