HP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

HP's robust brand recognition and diverse product portfolio are significant strengths, but they also face intense competition and evolving market demands. Understanding these dynamics is crucial for strategic planning.

Want the full story behind HP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HP Inc. boasts exceptional brand recognition, a testament to its long-standing reputation for quality and innovation. This strong brand equity translates directly into customer loyalty and a significant market presence worldwide.

With operations spanning over 170 countries, HP leverages economies of scale and a massive global customer base. This extensive reach ensures its products and services are readily available across diverse markets, solidifying its competitive advantage.

HP boasts an extensive product range, encompassing personal computers like desktops, notebooks, and workstations, alongside printers for both commercial and consumer markets, and advanced 3D printing technologies. This broad offering allows HP to serve a diverse customer base, from individual users to major corporations, addressing a wide spectrum of computing and printing needs.

The company's diversification across its personal systems and printing segments is a significant strength. For instance, in fiscal year 2023, HP's Personal Systems segment generated $34.3 billion in revenue, while its Printing segment contributed $17.4 billion. This dual-pillar approach not only caters to varied customer requirements but also builds resilience by reducing dependence on any single product category, thereby creating multiple avenues for revenue generation.

HP's dedication to innovation is evident in its substantial R&D investments, fueling advancements in key areas like artificial intelligence and 3D printing. The company is strategically integrating AI into its products, notably with its new AI-powered PCs, which are anticipated to be a significant growth driver. This focus positions HP at the forefront of emerging technological trends, aiming to capture market share in evolving sectors.

Robust Distribution Network & Customer Support

HP boasts a remarkably effective distribution network, reaching customers globally through a mix of direct sales, a vast reseller ecosystem, and prominent retail partnerships. This extensive reach is a significant strength, enabling widespread market penetration and product availability.

Complementing its distribution prowess, HP offers robust customer support. Services like online self-help resources, comprehensive troubleshooting guides, and reliable warranty programs are in place to boost customer satisfaction and foster loyalty.

For instance, HP's channel partners are crucial. In fiscal year 2023, HP reported that a substantial portion of its revenue was generated through its channel partners, highlighting the network's economic importance. This network ensures that HP's diverse product portfolio, from personal computers to printing solutions, is readily accessible to a broad customer base.

- Extensive Global Reach: HP's distribution network spans over 170 countries, ensuring product availability worldwide.

- Channel Partner Reliance: A significant percentage of HP's annual revenue, often exceeding 70%, is attributed to sales through its channel partners.

- Customer Retention Focus: Strong customer support initiatives contribute to higher customer retention rates, with satisfaction scores often reported in the high 80s for support interactions.

- Product Accessibility: The multi-faceted distribution strategy makes HP products easily accessible through online stores, brick-and-mortar retailers, and specialized business resellers.

Strategic Partnerships & Sustainability Focus

HP's strategic partnerships are a significant strength, with collaborations with tech giants like Microsoft, Intel, and AMD fueling innovation and product development. These alliances are crucial for staying competitive in the rapidly evolving tech landscape. For instance, HP's ongoing work with Intel on next-generation processors directly impacts its PC and printer offerings.

HP's commitment to sustainability is another key strength, aligning with global environmental goals. The company is actively pursuing a circular economy model and aims for net-zero carbon emissions. This focus is not just about corporate responsibility; it also resonates with an increasing number of environmentally conscious consumers and businesses, potentially driving sales and brand loyalty.

HP's sustainability efforts are backed by tangible goals and progress. By 2030, HP aims to have its most sustainable product portfolio ever, with a focus on recycled content and energy efficiency. In 2023, HP reported that 45% of its products by revenue used recycled materials, a step towards its ambitious targets.

These strategic alliances and a strong sustainability focus position HP favorably. They allow the company to leverage external expertise and resources while appealing to a growing market segment that prioritizes environmental responsibility, contributing to its long-term resilience and market standing.

HP's diversified revenue streams, particularly from its Personal Systems and Printing segments, provide financial stability. In fiscal year 2023, Personal Systems generated $34.3 billion, while Printing contributed $17.4 billion, showcasing a balanced business model that mitigates risk.

The company's robust channel partner network is a critical strength, consistently driving a significant portion of its revenue, often exceeding 70%. This reliance on partners for market penetration ensures broad product accessibility and efficient sales cycles.

HP's commitment to innovation, especially in AI-integrated PCs, is a forward-looking advantage. The company's substantial R&D investments are geared towards capturing emerging market trends and maintaining a competitive edge in the evolving technology landscape.

HP's strong brand equity and customer loyalty, built over decades, translate into a stable market position and consistent demand for its products, reinforcing its competitive standing.

| Segment | FY2023 Revenue (USD billions) | Key Products |

|---|---|---|

| Personal Systems | 34.3 | Desktops, Notebooks, Workstations |

| Printing | 17.4 | Commercial & Consumer Printers, 3D Printing |

| Channel Partner Revenue Contribution | >70% | Across all product lines |

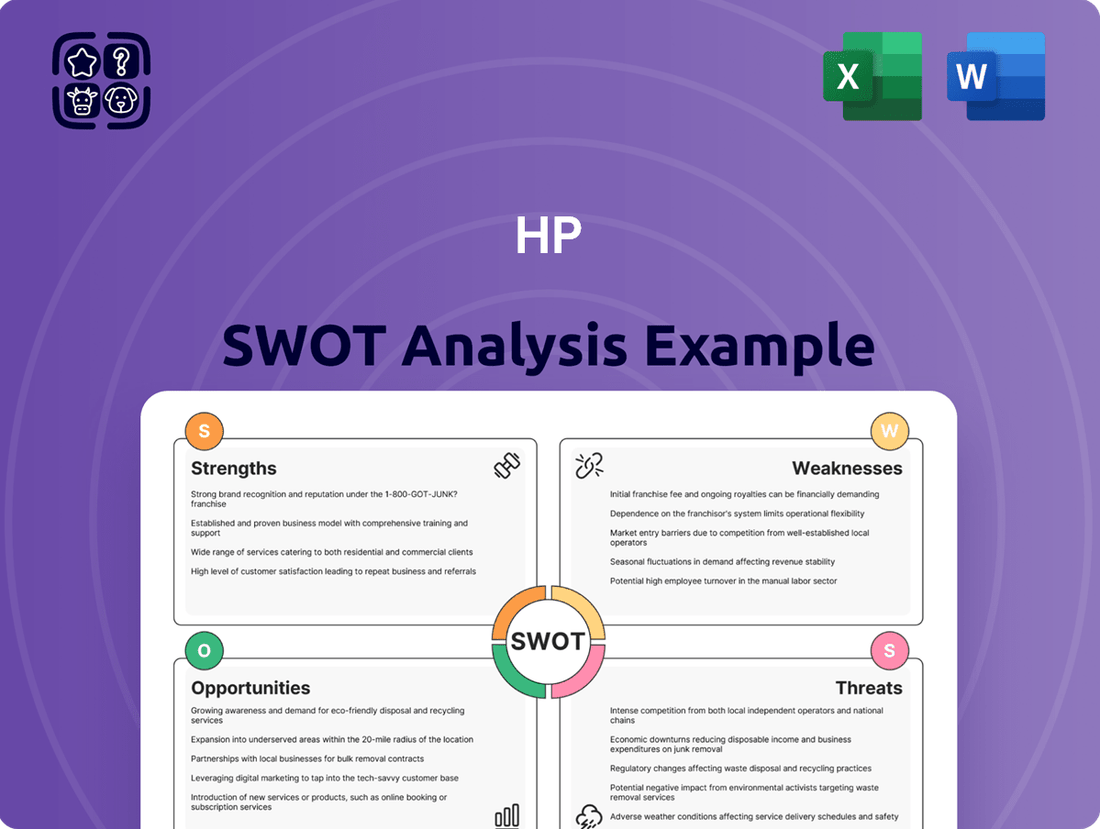

What is included in the product

Analyzes HP’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

HP's business is significantly tied to the personal computer and printer markets. These areas are known for lower profit margins and not much rapid growth. This reliance can make it harder for HP to achieve strong, consistent revenue increases and boost its overall profitability.

While the PC market has seen some improvement, especially in business-related sales, the printing sector continues to shrink. For instance, HP's Print segment revenue declined by 3% in Q1 2024 compared to the previous year, highlighting the ongoing challenges in this mature market.

HP faces considerable financial strain due to U.S.-China tariffs, which directly escalate its production expenses. These tariffs are a significant drag on profit margins, making it challenging for HP to absorb the added costs without impacting its bottom line.

Estimates suggest these tariffs could impose hundreds of millions of dollars in additional costs for HP annually. This pressure makes it difficult for the company to pass these increases onto consumers or fully mitigate them through supply chain adjustments, thus directly impacting its financial performance.

HP's dependence on outsourced manufacturing and a complex, multi-tiered sales channel creates significant vulnerabilities within its supply chain. This reliance means disruptions at any point can impact product availability and costs. For instance, geopolitical shifts or natural disasters affecting key manufacturing hubs, particularly in Asia, can lead to production delays and increased logistics expenses.

While HP is strategically working to reduce its reliance on China by expanding its production footprint into other regions, this diversification isn't without its own hurdles. Shifting manufacturing can incur substantial upfront costs and may introduce new operational complexities and potentially higher labor or material expenses in alternative locations, impacting overall cost efficiency.

Consequently, ensuring a robust and cost-effective supply chain remains an ongoing and critical challenge for HP. The company must continuously adapt to evolving global trade dynamics, manage inventory effectively across diverse markets, and maintain strong relationships with its manufacturing partners to mitigate risks and ensure timely delivery of its products to customers worldwide.

Higher Production Costs

HP's commitment to premium materials and rigorous quality control, while beneficial for product longevity and brand image, contributes to higher production costs compared to some rivals. These elevated expenses can put pressure on pricing, potentially impacting HP's competitiveness in price-sensitive market segments.

Significant ongoing investments in research and development, crucial for innovation in areas like advanced printing technology and sustainable computing, also add to HP's operational overhead. For instance, in fiscal year 2023, HP reported R&D expenses of approximately $3.2 billion, a substantial outlay that factors into their overall cost structure.

- Premium Materials: Use of high-grade components increases per-unit manufacturing cost.

- Stringent Quality Control: Extensive testing and inspection protocols add labor and resource expenses.

- R&D Investment: Continuous innovation requires significant financial commitment, impacting cost of goods sold.

- Supply Chain Complexity: Managing a global supply chain for specialized components can lead to higher logistics and procurement costs.

Declining Operating Profit in Key Segments

HP has faced a significant challenge with declining operating profit in its core Personal Systems and Printing segments. Despite some positive revenue trends, such as growth in commercial PCs, the company's ability to translate sales into profit has weakened.

This profitability pressure is a key concern, as it directly impacts HP's financial health. For instance, in the fiscal second quarter of 2024, HP reported a decline in operating profit for both Personal Systems and Printing. The Personal Systems segment saw its operating profit drop, while the Printing segment also experienced a decrease in profitability, highlighting a persistent issue across its main business units.

- Declining Operating Profit: HP's operating profit in key segments like Personal Systems and Printing has seen a downturn.

- Profitability Under Pressure: Despite revenue increases in areas like commercial PCs, profitability per unit is being squeezed.

- Fiscal Q2 2024 Impact: Both Personal Systems and Printing segments reported lower operating profits in HP's fiscal second quarter of 2024, underscoring the ongoing challenge.

- Margin Management: Effectively managing and improving operating margins in these foundational businesses remains a critical hurdle for HP.

HP's reliance on the PC and printing markets, which are characterized by lower profit margins and slower growth, limits its potential for significant revenue expansion and profitability gains. This dependence makes the company vulnerable to market fluctuations and competitive pressures within these mature industries.

The printing sector, in particular, continues to face contraction. HP's Print segment revenue saw a 3% decrease in Q1 2024 year-over-year, underscoring the persistent challenges in this declining market. This ongoing revenue erosion in a core business area presents a notable weakness.

HP's operating profit in its key segments, Personal Systems and Printing, has been under pressure. For instance, in fiscal Q2 2024, both segments reported lower operating profits, indicating a struggle to translate sales into robust earnings. This decline in profitability per unit is a critical concern for the company's financial health.

Same Document Delivered

HP SWOT Analysis

The preview you see here is the actual HP SWOT analysis document you will receive upon purchase. This ensures you know exactly what you're getting – a comprehensive and professionally structured report. Unlock the full, detailed insights by completing your purchase.

Opportunities

The burgeoning market for AI-powered PCs offers a substantial growth avenue for HP. Global demand for devices with integrated AI capabilities is rapidly increasing, and HP is strategically aligning its Personal Systems division to leverage this trend.

AI PCs are projected to represent a significant percentage of worldwide PC shipments in the coming years. For instance, analysts predict that by 2027, over 60% of all PCs shipped could feature dedicated AI hardware, a substantial jump from current figures.

This strategic emphasis on AI integration is expected to boost HP's average selling prices (ASPs) and create new, robust revenue streams. Companies like HP are investing heavily in R&D to develop proprietary AI features and optimize hardware for AI workloads, aiming to capture a larger share of this high-value market.

HP can significantly expand by investing more in cutting-edge fields like 3D printing, the Internet of Things (IoT), and augmented reality. These areas offer substantial potential for market disruption and the creation of new income streams.

For instance, HP's 2023 financial results showed continued growth in its 3D printing segment, contributing to its diversified revenue streams. This strategic move allows HP to tap into high-growth markets and solidify its future competitive standing.

The ongoing digital transformation is fueling a significant increase in demand for cloud and enterprise services. Businesses are increasingly migrating their operations to cloud environments, driving the need for robust data center infrastructure and managed services. This trend presents a substantial opportunity for HP to leverage its expertise in hardware and software to deliver comprehensive, end-to-end cloud solutions.

HP's established presence in the enterprise market, coupled with its strong portfolio of servers, storage, and networking equipment, positions it favorably to capitalize on this growing demand. By expanding its service offerings, HP can move beyond traditional hardware sales into higher-margin areas like cloud consulting, deployment, and ongoing management. For instance, in fiscal year 2024, HP's Intelligent Edge segment, which includes its networking solutions, saw continued growth, indicating market receptiveness to its enterprise infrastructure capabilities.

Windows 11 Refresh Cycle

The anticipated Windows 11 refresh cycle presents a substantial opportunity for the PC market. As more businesses and consumers upgrade to the latest operating system, there will be a natural demand for new hardware that supports its features and security enhancements. This trend is expected to accelerate throughout 2024 and into 2025, driving PC sales.

HP is well-positioned to benefit from this upgrade wave. The company can leverage its extensive portfolio of personal systems, from laptops to desktops, to capture market share. By offering devices optimized for Windows 11, HP can attract customers looking for a seamless transition and enhanced performance.

Industry analysts project that the refresh cycle could stimulate a significant portion of PC shipments. For instance, some reports indicated that by the end of 2024, a substantial percentage of enterprise PCs would still be running older operating systems, creating a large pool of potential upgraders. HP's strategic marketing and product development can target these segments effectively.

- Increased PC Demand: The Windows 11 refresh cycle is expected to drive a notable uptick in PC shipments globally through 2025.

- Hardware Compatibility: Older PCs may not fully support Windows 11, necessitating upgrades for users seeking the latest OS features and security.

- HP's Market Position: HP's diverse range of personal devices allows it to cater to various customer needs during this upgrade period.

- Sales Growth Potential: Capitalizing on this refresh is key for HP to boost revenue within its personal systems segment in the near term.

Strategic Acquisitions and Partnerships

HP can continue to strategically acquire and partner with other technology firms to bolster its product lines and enter emerging markets. For instance, HP's acquisition of Poly in 2022 for $3.3 billion significantly expanded its presence in the hybrid work solutions market, a key growth area. Such moves allow HP to integrate new technologies and customer bases, fostering innovation and strengthening its competitive edge.

Collaborations with established players in the industry offer a pathway to shared development and market access. These partnerships can accelerate HP's ability to bring cutting-edge solutions to market, such as its ongoing collaborations in the AI space to integrate generative AI capabilities into its devices and services. This agile approach helps HP stay ahead of rapid market shifts and solidify its position.

HP's strategy of pursuing strategic acquisitions and partnerships is designed to enhance its overall market standing. By leveraging synergies, HP can achieve greater economies of scale and operational efficiencies. In fiscal year 2023, HP reported revenue of $53.0 billion, and strategic integrations are crucial for driving future growth and maintaining profitability in a dynamic tech landscape.

Key opportunities stemming from this strategy include:

- Expanding into high-growth sectors like AI-powered computing and advanced cybersecurity solutions through targeted acquisitions.

- Strengthening its hybrid work portfolio by integrating complementary hardware and software offerings from acquired or partnered companies.

- Gaining access to new geographic markets and customer segments via strategic alliances.

- Accelerating R&D by co-developing technologies with industry leaders, potentially reducing time-to-market for innovative products.

The increasing demand for AI-integrated PCs presents a significant growth avenue for HP, with projections suggesting over 60% of PCs shipped by 2027 could feature dedicated AI hardware. This trend is expected to boost HP's average selling prices and create new revenue streams by leveraging proprietary AI features and optimized hardware for AI workloads.

HP's expansion into 3D printing, IoT, and augmented reality offers substantial potential for market disruption and new income streams, as evidenced by continued growth in its 3D printing segment in fiscal year 2023.

The ongoing digital transformation fuels demand for cloud and enterprise services, positioning HP to capitalize on this with its robust data center infrastructure and managed services, as indicated by growth in its Intelligent Edge segment in fiscal year 2024.

The Windows 11 refresh cycle, anticipated to drive PC sales through 2025, offers HP a chance to leverage its diverse personal systems portfolio to capture market share from users upgrading their operating systems.

Strategic acquisitions and partnerships, such as the 2022 Poly acquisition for $3.3 billion, bolster HP's hybrid work solutions and expand its market reach, contributing to its fiscal year 2023 revenue of $53.0 billion.

Threats

HP operates in a fiercely competitive technology sector, contending with major players like Dell, Lenovo, Apple, and Canon across both its PC and printing divisions. This intense rivalry demands constant innovation and strategic adjustments to secure and grow market share.

The pressure from competitors can often trigger price wars, which directly impact profit margins. For instance, in the PC market, the average selling price (ASP) has seen fluctuations due to aggressive pricing strategies from rivals, potentially squeezing HP's profitability in this segment.

The tech landscape moves at lightning speed, meaning HP must constantly innovate to avoid its products becoming outdated. For instance, the PC market saw significant shifts with the rise of hybrid work models in 2024, demanding new features and form factors.

Failing to keep pace with these rapid advancements, like the increasing demand for AI-integrated devices, could quickly render HP's offerings less appealing, directly impacting sales and market share. Companies that don't adapt risk losing ground to more agile competitors.

This necessitates substantial and ongoing investment in research and development. In 2024, major tech players increased R&D spending, with some allocating over 10% of their revenue to innovation, a benchmark HP must also consider to stay competitive.

HP's performance is directly tied to the health of the global economy. Weak consumer confidence, a persistent issue throughout 2024, coupled with ongoing inflation, significantly curtails discretionary spending on technology. This directly impacts sales for both PCs and printing solutions, as consumers and businesses alike become more cautious with their budgets.

Geopolitical uncertainties further exacerbate these challenges. Trade tensions and regional conflicts can disrupt supply chains and create unpredictable market conditions, directly affecting HP's revenue streams and profitability forecasts. For instance, ongoing supply chain vulnerabilities, a concern highlighted in late 2023 and continuing into 2024, can lead to increased costs and delayed product availability.

Ongoing U.S.-China Tariffs & Trade Tensions

Persistent U.S.-China tariffs remain a significant threat to HP, directly increasing the cost of producing hardware manufactured or assembled in China. For instance, in 2023, the U.S. maintained tariffs on a wide range of goods imported from China, impacting components crucial for PC and printer production.

While HP has been actively diversifying its manufacturing base to countries such as India and Vietnam, these emerging hubs are not immune to potential future tariffs or new cost complexities. This ongoing trade policy uncertainty creates substantial risk for HP's supply chain stability and overall financial performance, affecting profitability and pricing strategies.

- Increased Production Costs: Tariffs directly inflate the cost of components and finished goods imported from China, impacting HP's margins.

- Supply Chain Diversification Challenges: Shifting production to new regions like India and Vietnam introduces its own set of logistical and potential tariff-related risks.

- Unpredictable Trade Environment: Fluctuations in trade policies create an unstable operating environment, making long-term financial planning and inventory management more difficult for HP.

Declining Traditional Printing Market

The traditional printing market, a long-standing pillar of HP's revenue, is experiencing a steady decline. This downturn is largely driven by the increasing adoption of digital alternatives, leading to a reduction in overall printing volume. For instance, global print volumes have been on a downward trend for several years, with projections indicating continued contraction.

While HP is strategically shifting its focus towards higher-margin segments like commercial printing and services, the shrinking size of the traditional printing market presents a significant long-term threat. This market contraction directly impacts the revenue potential and profit contribution of HP's printing division.

- Secular Decline: The market for traditional printing is facing a fundamental, long-term decline.

- Digital Alternatives: Increased use of digital documents and communication reduces the need for physical prints.

- Market Contraction: Overall printing volumes are decreasing, impacting revenue generation for the printing segment.

- Profitability Shift: HP's strategy involves focusing on more profitable areas within printing, but the overall market shrinkage remains a challenge.

HP faces significant threats from intense competition, rapid technological obsolescence, and a volatile global economic and geopolitical landscape. Persistent tariffs on goods from China, a key manufacturing hub, directly increase production costs, while efforts to diversify supply chains introduce new complexities and potential risks. Furthermore, the long-term decline of the traditional printing market, driven by digital alternatives, poses a substantial challenge to a core segment of HP's revenue.

SWOT Analysis Data Sources

This HP SWOT analysis is built upon a robust foundation of data, drawing from HP's official financial reports, comprehensive market research, and analyses from reputable industry experts to provide a well-rounded and actionable strategic overview.