HP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

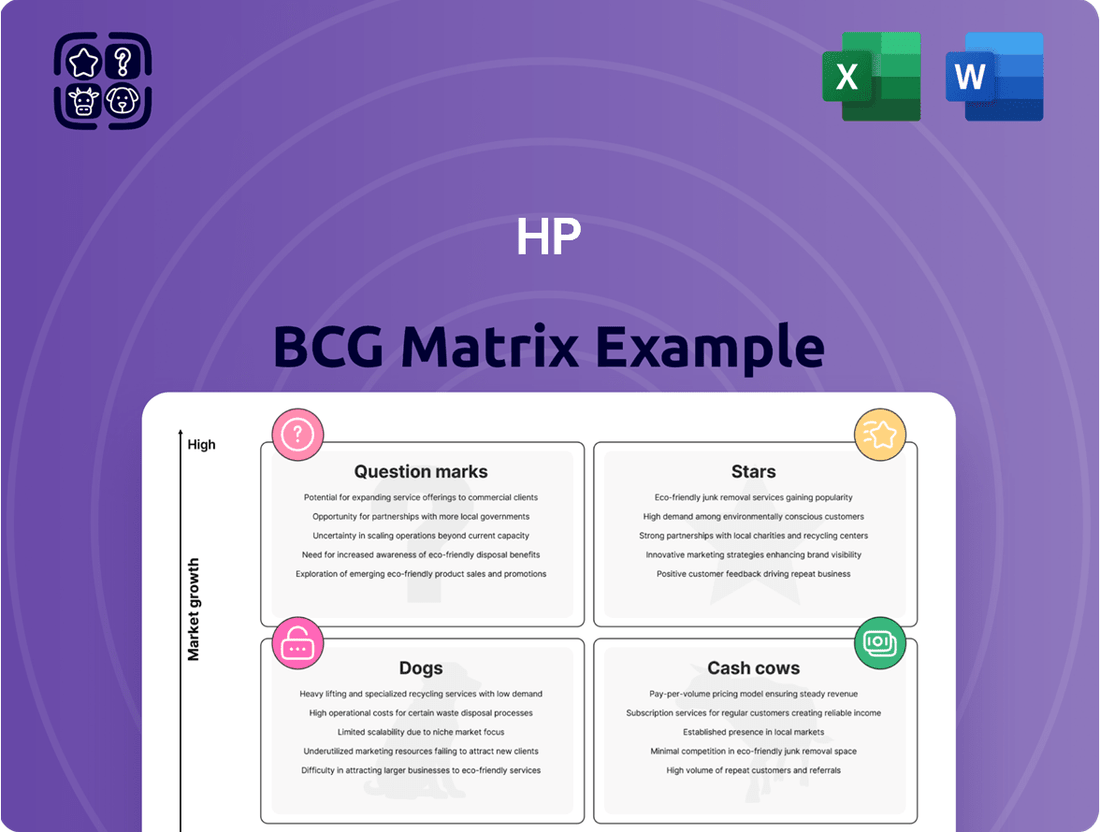

Uncover the strategic positioning of this company's product portfolio with the BCG Matrix. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse into the power of the BCG Matrix. Purchase the full report for in-depth analysis, actionable insights, and a clear roadmap to optimize your company's resource allocation and future investments.

Stars

Gaming PCs, including HP's Omen and Victus lines, represent a Stars category within the BCG Matrix. This segment is experiencing strong, sustained growth, and HP is a key player, aiming for market dominance. The demand for high-performance gaming hardware fuels substantial sales and healthy profit margins for the company. In 2024, the global gaming PC market was projected to reach over $40 billion, with HP's gaming division showing consistent year-over-year growth.

While the broader PC market experiences slower growth, the demand for high-performance workstations, like HP's Z series, is on the rise. These machines cater to demanding professional fields such as content creation, engineering, and data science, where power and reliability are paramount.

HP's Z by HP workstations hold a dominant position in this premium segment. Their advanced capabilities allow them to command higher price points, ensuring substantial revenue contributions from a market segment that is less sensitive to price fluctuations and continues to expand.

In 2024, the professional workstation market is projected to see continued growth, driven by advancements in AI and immersive technologies. HP's Z series is well-positioned to capitalize on this trend, with innovations focused on enhanced processing power and specialized graphics capabilities.

The industrial 3D printing sector is booming, with projections indicating a market size of over $20 billion by 2027, driven by demand in automotive, aerospace, and healthcare. HP's Multi Jet Fusion (MJF) technology is a significant player, offering rapid production speeds and high-quality parts that are crucial for industrial applications. In 2024, HP continued to push the boundaries of MJF, aiming to capture a larger share of this rapidly expanding market.

AI-Powered PCs

AI-Powered PCs are positioned as a Star in HP's BCG Matrix. The integration of AI into everyday computing is driving demand for PCs with specialized NPUs, creating a high-growth market. HP's strategic introduction of AI-enabled devices aims to secure a substantial portion of this emerging sector.

- Market Growth: The AI PC market is projected to grow significantly, with some estimates suggesting that by 2027, over 80% of PCs shipped could feature AI capabilities.

- HP's Strategy: HP has launched its new line of AI-powered laptops, such as the HP Spectre x360 14, featuring Intel Core Ultra processors designed for AI tasks.

- Competitive Landscape: While a nascent market, competitors like Dell and Lenovo are also investing heavily in AI-enabled hardware, making early market capture crucial for HP.

- Future Potential: Continued innovation and strong market penetration in this segment could position HP as a leader as AI integration becomes standard in personal computing.

Premium Commercial Laptops (EliteBook/Spectre Business)

Premium Commercial Laptops, encompassing HP's EliteBook and Spectre business lines, represent a significant growth area within the broader commercial PC market. Demand is particularly strong from enterprises and hybrid workforces seeking advanced security, performance, and specialized features.

These premium laptops command high market share among corporate clients, reflecting their appeal for demanding professional environments. HP's strong positioning in this segment is bolstered by the high margins these devices generate, making them crucial to the company's overall financial health and competitive standing in the business computing sector.

- Market Growth: The global commercial laptop market is projected to see continued expansion, driven by digital transformation initiatives and the need for robust mobile workstations.

- HP's Share: HP consistently holds a leading position in the premium commercial laptop segment, with devices like the EliteBook and Spectre lines often cited for their innovation and reliability.

- Profitability: These high-end business laptops contribute significantly to HP's profitability due to their premium pricing and strong demand from enterprise clients who prioritize security and performance.

HP's gaming PCs, including Omen and Victus, are Stars due to strong market growth and HP's dominant position. The global gaming PC market exceeded $40 billion in 2024, with HP's gaming division showing consistent expansion.

AI-Powered PCs are also Stars, driven by demand for specialized hardware. By 2027, over 80% of PCs shipped are expected to feature AI capabilities, and HP's new AI-enabled laptops, like the Spectre x360 14, are positioned to capture this growth.

Premium Commercial Laptops, such as HP's EliteBook and Spectre lines, are Stars. This segment is expanding due to digital transformation, and HP maintains a leading share with devices prized for security and performance, contributing significantly to profitability.

| Product Category | BCG Matrix Status | Market Growth | HP's Market Position | Key Factors |

| Gaming PCs (Omen, Victus) | Star | High | Leading | Strong demand, HP's focus on performance |

| AI-Powered PCs | Star | Very High (Emerging) | Emerging Leader | AI integration, specialized hardware demand |

| Premium Commercial Laptops (EliteBook, Spectre) | Star | High | Leading | Enterprise demand, security & performance focus |

What is included in the product

The HP BCG Matrix analyzes products based on market share and growth, guiding investment decisions.

Quickly visualize your portfolio's strengths and weaknesses, eliminating the confusion of where to focus resources.

Cash Cows

HP's traditional inkjet printers represent a classic Cash Cow within the BCG matrix. Despite the overall consumer printer market showing signs of maturity and slight decline, HP continues to hold a commanding global market share, particularly in homes and small offices. This strong position allows them to leverage a business model that generates consistent revenue from high-margin ink cartridges and other supplies, even with lower initial printer costs.

HP's LaserJet printers are firmly established as Cash Cows within the BCG Matrix, dominating the enterprise and SMB laser printer market. This segment, while experiencing stable demand, offers limited growth opportunities.

The enduring appeal of LaserJet printers lies in their robust build, advanced security features, and essential network capabilities, which consistently drive sales to business clients. This reliability translates into predictable revenue streams.

A significant portion of the consistent cash flow for HP's LaserJet division comes from the recurring sales of toner cartridges and ongoing maintenance services. In 2024, the printer supplies market, including toner, continued to be a substantial revenue driver for the company.

Printer supplies, particularly ink and toner cartridges, represent HP's quintessential cash cow. This segment boasts a dominant market share and enjoys remarkably stable demand, largely independent of fluctuations in new printer sales.

The proprietary nature of HP's cartridges, coupled with the inherent need for regular replacement, generates a consistent and high-margin revenue stream. This reliable income fuels investments in other business units with relatively low marketing expenditure.

For instance, in fiscal year 2023, HP's Personal Systems segment, which includes printers, generated $53.8 billion in revenue, with a significant portion attributable to ongoing supplies. The company's focus on maintaining a strong installed base of printers ensures continued demand for these high-profit consumables.

Managed Print Services (MPS)

HP's Managed Print Services (MPS) are a prime example of a cash cow within their business portfolio. These services allow companies to outsource their printing infrastructure and day-to-day print management, a mature segment characterized by strong client loyalty and consistent, recurring revenue streams.

HP capitalizes on its vast installed base of printers and robust service network to deliver these solutions. This strategic advantage translates into predictable and stable cash flows, largely secured through multi-year contracts.

- Recurring Revenue: MPS contracts typically involve monthly fees for device leasing, maintenance, and consumables, creating a reliable income stream.

- High Client Retention: The complexity of switching print vendors and the integrated nature of MPS solutions foster high customer retention rates.

- Stable Cash Flows: Long-term contracts and predictable service demands contribute to the stability and predictability of cash generated by MPS.

- Leveraging Install Base: HP's existing printer footprint provides a significant advantage in securing and servicing MPS contracts, reducing acquisition costs.

Mainstream Consumer PCs (Pavilion/Envy)

HP's Pavilion and Envy lines represent significant cash cows within the mainstream consumer PC market. This segment, while mature with modest growth projections, is characterized by high sales volumes, and HP commands a substantial market share.

Despite potentially lower margins compared to high-end offerings, the consistent demand and established brand loyalty for Pavilion and Envy products generate a reliable and considerable revenue stream. This financial stability is crucial for HP's overall operations and future investments.

- Market Maturity: The global PC market saw a slight decline in shipments in early 2024, but the consumer segment remains a bedrock for many manufacturers.

- Market Share: HP consistently ranks among the top PC vendors, with its consumer lines contributing significantly to this position.

- Revenue Generation: The sheer volume of Pavilion and Envy sales, even with competitive pricing, translates into substantial and predictable revenue for HP.

- Brand Loyalty: Established customer bases for these lines foster repeat purchases and brand advocacy, reinforcing their cash cow status.

HP's printer supplies, particularly ink and toner, are quintessential cash cows. This segment benefits from a dominant market share and stable demand, largely independent of new printer sales. The proprietary nature of HP's cartridges, coupled with the necessity for regular replacement, generates a consistent, high-margin revenue stream. This reliable income, with relatively low marketing expenditure, fuels investments in other business units.

In fiscal year 2023, HP's Personal Systems segment, which includes printers, generated $53.8 billion in revenue. A significant portion of this was attributable to ongoing supplies, highlighting the critical role of consumables in maintaining demand. The company's focus on its extensive installed base of printers ensures continued demand for these high-profit items.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Market Dynamics |

|---|---|---|---|---|

| Ink & Toner Cartridges | Cash Cow | High margins, proprietary technology, recurring demand | Significant portion of Personal Systems revenue | Stable, mature market with consistent replacement needs |

| LaserJet Printers & Supplies | Cash Cow | Dominant market share, robust build, essential network capabilities | Substantial, predictable revenue | Stable demand in enterprise/SMB, limited growth |

| Managed Print Services (MPS) | Cash Cow | Recurring revenue via contracts, high client retention, stable cash flows | Consistent, predictable income | Mature segment leveraging installed base and service network |

Delivered as Shown

HP BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon purchase, offering immediate strategic insights. This means no watermarks, no demo content, and no hidden surprises – just the fully formatted, analysis-ready BCG Matrix ready for your business planning. You are seeing the exact file that will be delivered, allowing you to assess its quality and utility before committing. Once acquired, this professionally designed tool is yours to edit, present, or integrate into your strategic decision-making processes without delay.

Dogs

The market for basic, non-commercial desktop PCs, often referred to as legacy desktops, has seen a consistent downturn. This decline is largely attributed to consumers increasingly favoring more portable and versatile devices like laptops, tablets, and smartphones for their everyday computing needs.

HP's engagement in this shrinking segment, especially with older, less innovative desktop models, likely results in a modest market share and limited profit margins. Consequently, these products are prime candidates for a strategic re-evaluation, potentially leading to reduced investment or even complete phasing out to better allocate resources.

For context, the global PC market, while showing some resilience in certain segments, saw a notable decline in desktop shipments in recent years. For instance, in 2023, desktop shipments continued to face headwinds compared to the growth seen in the mobile computing sector, reinforcing the trend away from traditional desktop form factors for basic consumer use.

Within HP's extensive peripheral lineup, certain older or less competitive niche consumer electronics, such as basic monitors and older webcams, likely occupy the Dogs quadrant. These products often struggle with low market share in mature or declining market segments.

These niche items typically contribute very little to HP's overall revenue. Furthermore, they might necessitate a disproportionate amount of marketing investment to achieve minimal returns, making them candidates for divestment or careful cost management.

Outdated software suites and bundled applications represent HP's potential 'Dogs' in the BCG matrix. These are proprietary programs or applications that HP previously developed but have since lost their relevance or seen significantly diminished user adoption. For instance, if a legacy productivity suite offered by HP in the early 2010s now faces stiff competition from more innovative and feature-rich cloud-based alternatives, it would likely be categorized here.

These offerings typically exhibit a low market share, meaning they capture a small portion of the overall software market. Furthermore, their growth potential is minimal, as the demand for such outdated solutions is unlikely to increase. In 2024, many tech companies are divesting or sunsetting older software to focus resources on more promising, high-growth areas, a trend HP would likely follow with its legacy software.

Basic Consumer Printers (Older Models, Non-Connected)

Older, non-connected consumer printers, often lacking Wi-Fi or mobile printing, are experiencing a significant downturn in demand as consumers gravitate towards more integrated and convenient solutions.

HP's market share within this shrinking niche for these legacy models is consequently quite low, contributing minimal profit and therefore warranting little to no further strategic investment or development.

- Declining Demand: Consumer preference has shifted away from basic, non-connected printers.

- Low Market Share: HP's presence in this legacy segment is minimal.

- Minimal Profitability: These older models generate very little revenue.

- Reduced Investment: Future investment in this category is unlikely.

Low-End Servers (if any remaining non-strategic offerings)

Should HP Inc. retain any residual low-end server offerings, these would likely reside in the 'Dogs' quadrant of the BCG Matrix. This segment typically represents markets with low growth prospects and minimal competitive advantage for HP Inc. in this space.

Given that HP Enterprise (HPE) manages the core server business, any remaining low-end products from HP Inc. would likely cater to very small businesses or highly specialized, niche applications. These markets are often saturated and characterized by intense price competition from specialized vendors.

In 2024, the global server market, while growing, sees its most significant expansion in high-performance computing and cloud infrastructure, areas where HP Inc.'s legacy low-end offerings would not compete effectively. For instance, the overall server market is projected to grow, but the specific segment for basic, low-end servers is expected to be stagnant or even decline as businesses migrate to cloud solutions or more robust on-premises systems.

- Market Position: Low market share in a low-growth segment.

- Strategic Fit: Minimal strategic importance to HP Inc.'s core business, which focuses on PCs and printing.

- Financial Performance: Likely low profitability and minimal revenue contribution.

- Recommendation: Divestment or discontinuation to reallocate resources to more promising business areas.

Products categorized as 'Dogs' in HP's BCG Matrix are those with low market share in industries experiencing minimal growth or decline. These often include legacy product lines or niche offerings that no longer align with market trends or consumer preferences.

For example, older, less feature-rich desktop PCs and basic, non-connected printers fall into this category, as demand for these has significantly decreased. In 2024, the continued shift towards mobile computing and integrated smart home devices further diminishes the relevance of such legacy products.

These 'Dog' products typically generate low profits and require substantial resources for marketing and support relative to their returns. Consequently, HP often considers divesting or discontinuing these items to reallocate capital towards more promising and high-growth areas of its business.

The strategic approach for 'Dogs' usually involves minimizing investment, managing costs efficiently, or outright phasing them out to improve overall portfolio performance.

Question Marks

Device as a Service (DaaS) is a rapidly growing area for small and medium-sized businesses (SMBs) looking for predictable IT costs and flexible hardware solutions. This subscription model allows companies to lease devices, often bundled with IT support and lifecycle management, rather than purchasing them outright. The global DaaS market was valued at approximately $4.7 billion in 2023 and is projected to reach over $13.7 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 23.8%.

HP, a dominant force in the PC market, is also actively participating in the DaaS space. However, for the SMB segment specifically, HP’s market share in DaaS might be less pronounced than its overall PC market share. Capturing a larger portion of this expanding SMB DaaS market will likely necessitate significant strategic investments by HP in dedicated sales channels, targeted marketing campaigns, and robust service delivery networks tailored to the unique needs and budgets of smaller businesses.

HP is actively expanding beyond its successful Instant Ink program to encompass subscription models for PCs and printers, aiming to capture recurring revenue from hardware-as-a-service and bundled solutions. This strategic pivot targets a high-growth segment within the tech industry.

While HP is exploring these service-centric offerings, its current market share in these emerging areas remains relatively low. This presents a clear need for strategic investment to effectively scale these new subscription-based business models and gain traction.

The market for advanced materials in 3D printing is experiencing robust growth, projected to reach $3.5 billion by 2024, driven by demand for specialized polymers, ceramics, and composites. HP's strategic focus on developing and commercializing these materials is key to unlocking new applications for its Multi Jet Fusion technology, particularly in sectors like aerospace and healthcare. While HP has made strides, its market share in niche advanced material segments is still developing, necessitating continued investment in research and development to solidify its competitive position.

Digital Manufacturing Services (beyond hardware sales)

As 3D printing matures, the demand for integrated digital manufacturing services, encompassing design, prototyping, and small-batch production, is experiencing significant expansion. HP is actively building its presence within this burgeoning sector.

While HP offers a suite of solutions supporting these services, its direct market share in providing end-to-end manufacturing services may currently be modest. This necessitates substantial strategic investment to effectively challenge established specialized service providers.

The global additive manufacturing market, which includes these services, was valued at approximately $19.5 billion in 2023 and is projected to reach over $60 billion by 2030, indicating a strong growth trajectory.

- Market Growth: The digital manufacturing services segment within additive manufacturing is expanding rapidly, driven by demand for faster prototyping and customized production.

- HP's Position: HP is strategically investing in this area, aiming to leverage its 3D printing hardware and software capabilities to offer comprehensive solutions.

- Competitive Landscape: The market includes specialized service bureaus with established expertise, requiring HP to differentiate through integrated offerings and technological innovation.

- Investment Needs: Significant strategic investment is required for HP to capture a larger share of the end-to-end digital manufacturing services market.

Specialized Software for Hybrid Work Environments

The evolving hybrid work model has significantly boosted the need for smart software that improves teamwork, cybersecurity, and how devices are managed. HP is actively investing in and acquiring software for this expanding market.

While HP is building its presence in these specialized software areas, its current market share might be modest when compared to established software providers. This necessitates strategic investments to build a stronger position.

- Collaboration Tools: Software enabling seamless communication and project management for distributed teams.

- Security Solutions: Advanced cybersecurity software to protect data and devices in hybrid setups.

- Device Management: Platforms for IT departments to monitor, update, and secure a diverse range of endpoints.

Question Marks in the BCG matrix represent products or business units with low market share in a high-growth industry. They require significant investment to improve their market position. Without sufficient investment, they are likely to become Dogs.

For HP, Question Marks could represent emerging technologies or new market entries where the company has a small foothold but sees substantial future potential. Successfully nurturing these Question Marks is crucial for future growth and portfolio diversification.

The challenge with Question Marks is the uncertainty of their future success; they are high-risk, high-reward propositions. HP must carefully evaluate which Question Marks warrant further investment, considering market trends and competitive dynamics.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial performance, market share, industry growth rates, and competitive analysis, to provide a robust strategic overview.