HP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

HP's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for navigating HP's market. The full Porter's Five Forces Analysis reveals the real forces shaping HP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

HP's reliance on a select group of manufacturers for essential components, such as Intel and AMD for processors, significantly shapes supplier bargaining power. This dependence is amplified when these components are highly specialized or involve substantial costs for HP to switch to alternative suppliers.

The limited number of suppliers for critical parts like memory modules and display panels can grant them considerable leverage. For instance, a major memory shortage in 2023-2024, driven by increased demand and production constraints, led to price hikes that directly affected PC manufacturers like HP.

Consequently, any adverse actions from these key suppliers, including price increases or supply disruptions, can directly translate into higher production expenses and reduced profit margins for HP. This was evident in early 2024 when certain advanced chip shortages impacted the availability and cost of premium HP laptops.

The standardization of certain components, like basic memory modules or hard drives, can indeed lessen supplier bargaining power for companies like HP. When many suppliers can produce these parts, HP can more easily switch or negotiate better terms due to a wider array of choices. For instance, in 2024, the global market for solid-state drives (SSDs), a key standardized component, saw intense competition with numerous manufacturers vying for market share, putting downward pressure on prices.

HP's commitment to supply chain diversification is a key strategy in managing supplier bargaining power. By cultivating relationships with a broad network of vendors for critical components, HP reduces its dependence on any single supplier. This approach, evident in their ongoing efforts, aims to create a more robust and resilient supply chain.

This diversification directly impacts supplier leverage. When multiple suppliers can fulfill similar component needs, HP gains increased negotiation power, potentially leading to more favorable pricing and terms. For instance, in 2023, HP reported working with over 1,200 suppliers globally, a testament to their broad sourcing strategy.

Impact of technological advancements by suppliers

Suppliers who are at the forefront of technological innovation, like those developing more efficient processors or next-generation display technologies, can wield considerable power. This is especially true if these advancements are vital for HP to differentiate its products in a crowded market. For instance, a supplier offering a breakthrough in battery technology could significantly impact HP's laptop competitiveness.

Maintaining robust, collaborative relationships with these leading-edge suppliers is paramount for HP. It ensures continued access to the newest and most impactful technological advancements. Without this access, HP risks falling behind competitors who are quicker to integrate superior components.

- Supplier Innovation Impact: Suppliers introducing critical technologies like advanced AI chips or novel cooling systems can command higher prices or dictate terms, boosting their bargaining power.

- HP's Dependency: If HP's product roadmap heavily relies on a specific supplier's proprietary technology, that supplier's power increases substantially.

- Competitive Landscape: In 2024, the semiconductor industry, a key supplier base for HP, saw intense competition and innovation, with companies like TSMC pushing the boundaries of chip manufacturing, giving them significant leverage.

Supplier's ability to forward integrate

A supplier's theoretical ability to forward integrate, meaning they could start manufacturing or selling directly, could indeed boost their leverage. While this is less common in the PC and printer sectors, it's a potential threat. For instance, a key component supplier could theoretically move into producing their own branded devices, directly competing with HP.

However, the significant capital investment and technical expertise required to enter HP's established manufacturing and distribution channels present substantial hurdles for most suppliers. This complexity makes direct forward integration a high-risk, high-reward strategy that few can realistically pursue. For example, establishing global supply chains and marketing networks for PCs requires billions of dollars in investment.

Consequently, the primary risk for HP stems less from direct competitive integration and more from suppliers leveraging unique or proprietary components. If a supplier offers a critical part that is difficult to source elsewhere, they can dictate terms, even without integrating forward. In 2024, the semiconductor shortage highlighted how a lack of alternative suppliers for specialized chips could give those suppliers considerable power, impacting production costs and timelines for companies like HP.

- Supplier Forward Integration Threat: While theoretically possible, suppliers entering HP's PC and printer manufacturing or direct sales is a high-barrier strategy due to capital intensity.

- Complexity as a Barrier: The sheer scale and technical demands of HP's operations make it difficult for component suppliers to effectively forward integrate and compete directly.

- Leverage from Unique Offerings: The greater risk for HP lies in suppliers with proprietary or difficult-to-replicate components dictating terms, rather than direct competitive integration.

- Real-World Impact (2024): Supply chain disruptions, particularly in semiconductors, demonstrated how reliance on specialized components can grant suppliers significant bargaining power, affecting production and pricing for device manufacturers.

Suppliers can exert significant power over HP when they offer unique, critical components vital for product differentiation, especially if switching costs are high. This leverage is amplified by limited alternative suppliers, as seen in 2024 with specialized chip shortages impacting pricing and availability for HP's premium products. While forward integration by suppliers is a theoretical concern, the greater immediate threat comes from suppliers controlling proprietary technologies, allowing them to dictate terms and influence HP's production costs and timelines.

| Factor | Impact on HP | Example (2023-2024) |

|---|---|---|

| Component Uniqueness | High bargaining power for suppliers | Advanced AI chips or proprietary cooling systems |

| Switching Costs | Increased supplier leverage | Significant investment needed for HP to change suppliers |

| Supplier Innovation | Potential for higher prices/stricter terms | Breakthroughs in battery technology |

| Market Concentration | Greater power for fewer suppliers | Limited manufacturers for specialized memory modules |

What is included in the product

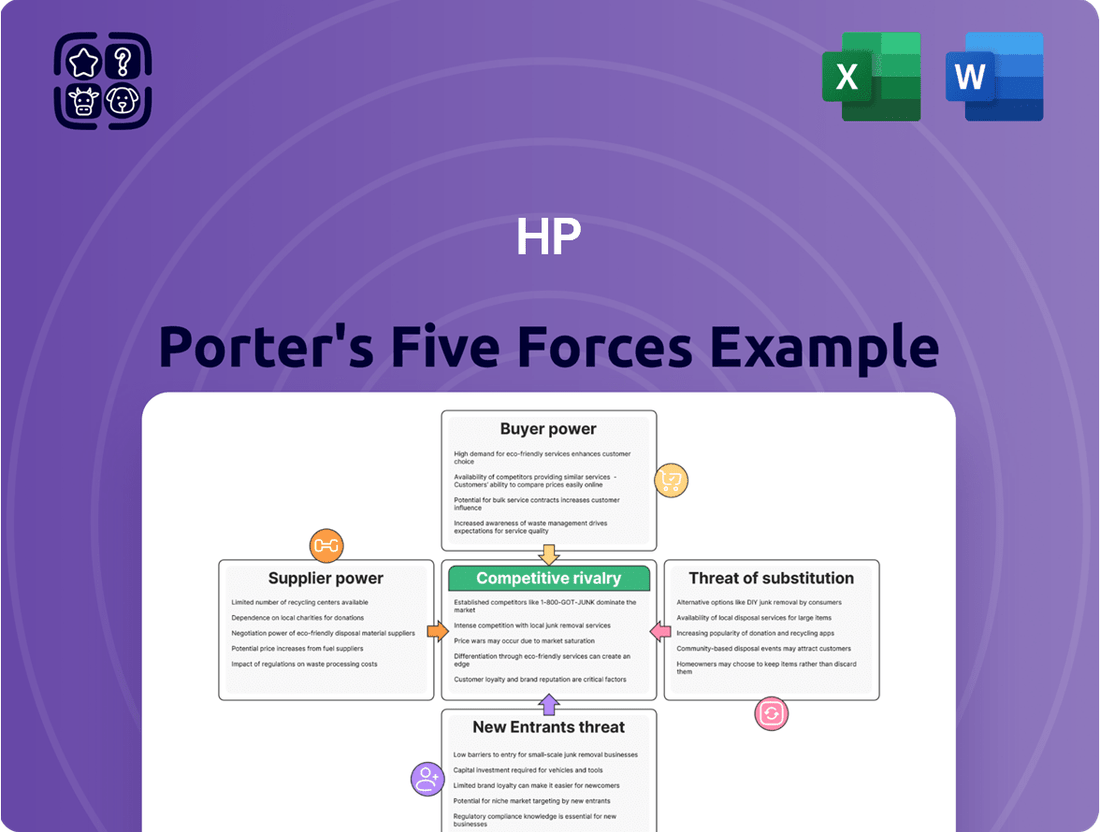

This analysis examines the five forces shaping HP's competitive environment: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Customers, particularly individuals and small to medium-sized businesses (SMBs), exhibit strong price sensitivity. This is largely due to the wide array of comparable products available from competitors, creating an environment where buyers can readily negotiate for lower prices or more favorable terms. For instance, in 2024, the PC market saw intense competition, with average selling prices for laptops fluctuating significantly based on features and brand, forcing companies like HP to constantly evaluate their pricing strategies.

The personal systems and printing solutions market is incredibly crowded, with numerous companies offering a vast selection of products. This abundance of choices means customers have significant power because they can readily find alternatives if they're not happy with HP. For instance, in 2024, the global PC market saw shipments from various vendors like Lenovo, Dell, and Apple, all competing for market share, underscoring the wide availability of diverse options.

Brand loyalty plays a significant role in mitigating customer bargaining power, especially within HP's enterprise sector. Customers invested in HP's existing infrastructure and service agreements face considerable switching costs, making them less likely to seek alternatives based solely on price.

HP actively cultivates customer loyalty by integrating its hardware, software, and services into a cohesive ecosystem. This strategic approach aims to increase switching costs, thereby diminishing the customer's leverage to easily transition to competing offerings, particularly in large-scale business deployments.

Large enterprise and public sector purchasing power

Large enterprises and public sector entities wield significant bargaining power due to their substantial purchasing volumes. This allows them to negotiate favorable terms, secure deep discounts, and demand customized solutions from vendors like HP. For instance, in 2024, major government contracts and large corporate IT procurement deals often involve extensive competitive bidding processes where price and service level agreements are heavily scrutinized.

HP frequently enters into long-term agreements with these major clients, often accompanied by dedicated support teams and tailored service offerings. These extensive partnerships are vital for HP's financial stability, contributing a significant portion of its annual revenue. However, this reliance on large clients also means that HP must accept lower profit margins on these deals, a direct consequence of the customers' considerable leverage.

- Volume-driven Negotiations: Large clients can commit to massive orders, enabling them to dictate pricing and terms.

- Customization Demands: Enterprises often require specific configurations or integrations, which HP must accommodate to secure business.

- Long-Term Commitments: While providing revenue stability, these contracts can lock HP into pricing structures that may become less profitable over time.

- Margin Pressure: The inherent power of these buyers forces HP to operate with reduced margins on their business compared to smaller, less influential customers.

Access to information and online reviews

Customers today possess an unparalleled ability to access product details, compare prices, and read reviews from other buyers online. This level of transparency significantly strengthens their bargaining power, enabling them to make well-informed choices and push companies like HP to deliver superior products and services at competitive prices.

For instance, in 2024, a significant majority of consumers, often exceeding 80%, reported relying on online reviews before making a purchase decision, especially for electronics. Negative feedback can spread rapidly, impacting sales and brand perception almost instantaneously.

- Information Accessibility: Consumers can easily research product specifications, features, and pricing from multiple sources.

- Price Transparency: Online comparison tools allow customers to find the best deals, putting pressure on sellers to remain competitive.

- Peer Influence: Online reviews and social media discussions heavily influence purchasing decisions, making customer satisfaction critical.

- Brand Reputation: A company's ability to manage online feedback directly affects its market standing and customer loyalty.

The bargaining power of customers is a significant force impacting HP's profitability. High price sensitivity, driven by a crowded market and readily available alternatives, allows buyers to negotiate lower prices. For example, in 2024, intense competition in the PC market led to fluctuating laptop prices, forcing HP to adapt its strategies. This power is amplified by the ease of online price comparison and access to reviews, with over 80% of consumers in 2024 relying on online feedback before purchasing electronics.

Large enterprise clients, in particular, leverage their substantial purchasing volumes to secure deep discounts and favorable terms, a trend evident in 2024's major government and corporate IT procurement deals. While these long-term commitments provide revenue stability, they often result in reduced profit margins for HP, as seen in the negotiation of extensive service agreements and customized solutions.

| Factor | Impact on HP | 2024 Example |

|---|---|---|

| Price Sensitivity | Forces competitive pricing, reducing margins | Fluctuating PC prices due to market competition |

| Availability of Alternatives | Weakens customer loyalty, increases switching | Numerous PC vendors like Lenovo and Dell competing for market share |

| Information Accessibility | Empowers customers to demand better value | Over 80% of consumers using online reviews for electronics purchases |

| Large Volume Buyers | Enables significant negotiation power on price and terms | Major government and corporate IT procurement deals with competitive bidding |

Full Version Awaits

HP Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive Porter's Five Forces Analysis for HP, detailing industry competition, buyer and supplier power, and the threat of new entrants and substitutes. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The personal computing and printing sectors are incredibly crowded, with a vast array of global and regional companies vying for dominance. This intense competition is a defining characteristic of these markets.

In the personal computer space, major players like Dell, Lenovo, Apple, Acer, and Asus constantly battle for consumer and enterprise attention. Similarly, the printing industry sees fierce competition from established brands such as Canon, Epson, Brother, and Xerox, all striving to capture market share.

This crowded landscape naturally fuels aggressive competition, as each company works to differentiate its products and capture a larger piece of the market. For instance, in 2024, the global PC market saw shipments fluctuate, with companies like Lenovo and HP consistently ranking among the top vendors, highlighting the ongoing struggle for leadership.

In many of HP's core markets, products have become increasingly similar, leading to intense price wars and aggressive marketing efforts. Competitors frequently slash prices and ramp up advertising to capture market share, a trend that significantly impacts HP's profitability.

This constant pressure on pricing can severely erode profit margins across the industry. For instance, in the PC market, which saw significant demand shifts in 2024, intense competition often forces companies to compete on price, making innovation and differentiation absolutely critical for HP to avoid being solely a price-driven competitor.

Companies like HP are locked in a constant battle for product differentiation, pouring resources into innovation, unique design elements, and integrated ecosystems. This drive is fueled by the rapid pace of technological change, which forces frequent product updates and substantial research and development spending. For example, in 2024, the personal computer market saw intense competition with new AI-powered laptops being a major focus for brands like HP, Dell, and Lenovo, highlighting the need for continuous innovation to avoid obsolescence.

Global market reach and regional specificities

HP faces intense competition not only from global tech giants but also from formidable regional players who understand local market nuances. This dual competitive pressure demands that HP's strategies are both globally consistent and locally adaptable.

HP's global operations mean it must navigate a complex web of regional specificities. This includes catering to diverse consumer preferences, establishing robust local distribution networks, and complying with varied regulatory frameworks across markets. For instance, in 2024, the personal systems market saw significant regional variations in demand, with emerging markets like India showing robust growth while mature markets like North America experienced more moderate expansion.

- Global Presence, Local Challenges: Major competitors like Dell and Lenovo also boast extensive global reach, intensifying rivalry.

- Regional Strength: Strong local brands in specific markets, such as Acer in parts of Asia, can capture significant market share by leveraging deep regional understanding.

- Market Adaptation: HP's success hinges on its ability to tailor product offerings, marketing campaigns, and sales strategies to distinct regional tastes and economic conditions.

- Regulatory Landscape: Navigating differing data privacy laws, import/export regulations, and environmental standards across continents adds another layer of complexity to HP's competitive environment.

Mergers, acquisitions, and strategic alliances

The technology sector, including companies like HP, frequently witnesses significant consolidation through mergers and acquisitions (M&A). For instance, in 2024, the tech industry saw continued M&A activity, with major players acquiring smaller innovative firms to bolster their product portfolios and market reach. These strategic moves can reshape competition by creating larger, more formidable entities or by integrating new technologies that disrupt existing market dynamics.

Strategic alliances are also a common tactic, allowing companies to share resources, co-develop technologies, or access new geographic markets. These partnerships can create powerful collaborative threats, forcing competitors to adapt or risk falling behind. HP's strategy must account for these shifting alliances, as they can introduce new competitive pressures or opportunities for collaboration.

- M&A Activity: In 2024, the global M&A market showed resilience, with technology deals remaining a significant component, driven by the pursuit of innovation and market share.

- Strategic Alliances: Companies are increasingly forming partnerships to navigate complex market demands, such as joint ventures for cloud computing or AI development.

- Competitive Landscape Impact: Successful M&A or alliances can lead to the emergence of stronger competitors, requiring HP to continually reassess its market position and strategic responses.

- HP's Response: HP must maintain vigilance regarding industry consolidation and partnership trends to identify potential threats and opportunities for strategic engagement.

The personal computing and printing sectors are intensely competitive, characterized by numerous global and regional players. This rivalry is driven by product similarity, leading to aggressive pricing and marketing strategies, as companies strive to differentiate and gain market share.

HP faces a crowded market with established competitors like Dell, Lenovo, Apple, Canon, and Epson, all vying for dominance. In 2024, the PC market saw intense competition, particularly around AI-powered laptops, forcing companies like HP to prioritize continuous innovation to avoid being solely price-driven.

The constant pressure on pricing significantly impacts profit margins, making product differentiation through innovation, unique design, and integrated ecosystems crucial for HP's success. Companies are also actively engaged in mergers, acquisitions, and strategic alliances, reshaping the competitive landscape and demanding continuous reassessment of market positions.

| Competitor | 2024 PC Market Share (Approx.) | Key Competitive Tactics |

|---|---|---|

| Lenovo | 23% | Aggressive pricing, diverse product lines, strong enterprise focus |

| HP | 21% | Innovation (e.g., AI PCs), brand loyalty, strong retail presence |

| Dell | 19% | Direct sales model, customization options, enterprise solutions |

| Apple | 9% | Premium branding, ecosystem integration, strong consumer appeal |

SSubstitutes Threaten

The growing prevalence of cloud computing and remote work presents a significant threat of substitution for traditional personal computers. As more applications and data become accessible through web browsers and mobile devices, the need for dedicated PCs for certain tasks diminishes. For instance, by late 2023, over 80% of businesses globally were utilizing cloud services, indicating a substantial shift away from on-premise hardware dependency.

Smartphones and tablets increasingly fulfill basic computing needs like browsing, media consumption, and communication, directly challenging the traditional PC market. For many users, these devices offer sufficient functionality and superior portability, reducing the perceived necessity of a laptop or desktop. In 2024, global smartphone shipments continued to show resilience, with IDC reporting over 1.17 billion units shipped, underscoring their widespread adoption as primary computing devices for a significant portion of the population.

The relentless march towards digitalization and paperless operations presents a substantial threat to HP's traditional printing business. As organizations and educational institutions increasingly embrace digital workflows for document creation, sharing, and archiving, the fundamental need for physical printing is diminishing. This shift directly impacts the demand for printers and related consumables, HP's core revenue streams.

For instance, in 2024, many businesses reported significant reductions in their paper consumption, with some aiming for near-zero paper usage by 2025. This trend is driven by cost savings, environmental concerns, and the efficiency of digital collaboration tools, all of which directly substitute the need for printed materials.

HP is actively mitigating this threat by pivoting towards managed print services, which optimize printing environments and reduce waste, and by investing heavily in the burgeoning 3D printing market. These strategic moves aim to leverage their expertise in imaging and materials while adapting to evolving customer needs beyond traditional 2D printing.

Alternative communication and collaboration tools

The rise of alternative communication and collaboration tools presents a significant threat of substitutes for traditional hardware-centric offerings from companies like HP. Software-based solutions such as Zoom, Microsoft Teams, and Asana streamline workflows that previously demanded physical documents or specific office equipment. For instance, the global video conferencing market was valued at approximately $7.8 billion in 2023 and is projected to grow substantially, indicating a strong shift towards digital communication. This trend directly impacts the demand for printing and traditional PC peripherals as businesses increasingly adopt these virtual alternatives.

These digital platforms substitute for many functions historically reliant on HP's hardware. Project management software, for example, reduces the need for printed reports and physical task tracking, while cloud-based document sharing minimizes the reliance on local printing and storage. By 2024, it's estimated that over 300 billion emails are sent daily, highlighting the dominance of digital communication channels over paper-based ones. HP must therefore adapt by integrating its hardware and services with these evolving digital workflows, offering solutions that complement rather than compete with these powerful software substitutes.

- Software substitutes reduce reliance on printing and traditional office hardware.

- The global video conferencing market was valued at $7.8 billion in 2023.

- Over 300 billion emails are sent daily in 2024.

- HP needs to integrate its offerings with digital collaboration workflows.

3D printing services and alternative manufacturing

The rise of 3D printing services presents a nuanced threat to HP. While HP itself is involved in 3D printing, readily available third-party 3D printing services can substitute for traditional prototyping and small-batch production needs that might otherwise utilize HP's larger format printers or specialized computing solutions. This is an evolving landscape, with the threat more nascent than a direct, broad replacement for HP's core offerings.

Alternative manufacturing methods, beyond just 3D printing, also contribute to this threat. For instance, advancements in CNC machining or even novel material science could offer competitive solutions for specific production runs. As of early 2024, the global additive manufacturing market, which includes 3D printing, was projected to reach over $30 billion, indicating significant growth and potential for these alternatives to capture market share from traditional methods.

- Emerging Threat: 3D printing services offer alternatives for prototyping and small-batch production.

- HP's Position: HP is a player in 3D printing, but external services can still compete.

- Broader Alternatives: Other manufacturing methods like advanced CNC machining also pose a challenge.

- Market Growth: The additive manufacturing market is expanding rapidly, signaling increased competition from substitutes.

The increasing adoption of cloud-based productivity suites and collaborative platforms directly substitutes for the need for traditional office hardware and printing. As more work is done digitally and shared virtually, the demand for physical documents and the devices to produce them declines. For example, by 2024, many enterprises reported a significant reduction in their print volumes, with some aiming for paperless operations by 2025.

Smartphones and tablets are also powerful substitutes, handling many tasks previously requiring a PC, such as browsing, communication, and media consumption. Global smartphone shipments remained robust in 2024, with over 1.17 billion units shipped, highlighting their role as primary computing devices for a large segment of the population.

The threat of substitutes is amplified by the growth of digital communication tools like video conferencing and project management software, which reduce reliance on printed reports and physical collaboration. The video conferencing market alone was valued at approximately $7.8 billion in 2023, demonstrating a clear shift towards digital alternatives.

HP faces competition from these digital solutions, necessitating a strategy to integrate its hardware with evolving digital workflows. By 2024, over 300 billion emails were sent daily, underscoring the dominance of digital channels over paper-based ones.

Entrants Threaten

Entering the personal systems and printing hardware sectors demands significant capital. HP, for instance, invests heavily in research and development, advanced manufacturing capabilities, and intricate global supply chains. This financial commitment acts as a formidable deterrent for potential new players.

The cost of establishing robust manufacturing facilities and sophisticated R&D centers can easily run into hundreds of millions, if not billions, of dollars. For example, setting up a new semiconductor fabrication plant, crucial for advanced computing hardware, can cost upwards of $20 billion as of 2024.

Furthermore, building a widespread global distribution network and cultivating strong brand recognition requires extensive marketing budgets and logistical infrastructure. Companies need to secure shelf space, manage inventory across diverse markets, and invest in advertising campaigns, all of which necessitate substantial upfront financial resources.

Established brand loyalty and distribution networks present a significant barrier for new entrants. HP, for instance, benefits from decades of building trust and recognition, meaning customers often gravitate towards familiar and reliable brands. This deep-seated customer loyalty is not easily swayed by newcomers, even with competitive pricing.

Furthermore, HP's extensive global distribution channels, encompassing retail partnerships, online sales platforms, and enterprise-level supply chains, are incredibly difficult and costly for new players to replicate. In 2024, HP continued to leverage these robust networks, ensuring product availability and accessibility that new entrants would find challenging to match quickly.

Existing players in the technology sector, including giants like HP, often benefit from substantial economies of scale. This means they can produce goods and services at a much lower cost per unit due to their large-scale operations in manufacturing, purchasing raw materials in bulk, and spreading research and development expenses across a vast output. For instance, HP’s extensive global supply chain and high-volume production of PCs and printers allow them to negotiate better prices with suppliers and optimize production efficiency, a feat difficult for newcomers to replicate quickly.

New entrants face a significant hurdle in matching these cost advantages. Without the established infrastructure and massive production volumes, startups or smaller companies would operate at a higher per-unit cost. This cost disadvantage makes it challenging to compete on price with established brands like HP, which can afford to offer more competitive pricing due to their lower operational expenses. Overcoming this initial cost barrier often requires substantial upfront investment, potentially leading to prolonged periods of unprofitability for new market participants.

Intellectual property and technological complexity

The personal computer and printing industries are characterized by intricate technologies and a substantial amount of intellectual property. This includes a wide array of patents, trade secrets, and proprietary designs that are crucial for product development and manufacturing.

New companies entering these markets face a significant hurdle in developing their own unique intellectual property or securing licenses for existing technologies. This process is not only time-consuming but also demands substantial financial investment, acting as a considerable deterrent to potential new entrants.

- Intellectual Property Landscape: The PC and printing sectors are built upon decades of innovation, resulting in a dense web of patents covering everything from microprocessors and operating systems to printer mechanisms and ink formulations.

- Licensing Costs: Acquiring licenses for essential technologies can be prohibitively expensive, especially for startups lacking established revenue streams. For instance, obtaining patents for advanced display technologies or specialized printing components could run into millions of dollars.

- Technological Sophistication: The sheer complexity of designing, manufacturing, and supporting these products requires deep technical expertise and significant R&D capabilities. Companies like HP invest billions annually in research and development to maintain their technological edge. In 2023, HP Inc. reported R&D expenses of approximately $1.5 billion, highlighting the ongoing investment needed to stay competitive.

Regulatory hurdles and environmental compliance

Operating globally in hardware manufacturing means HP Porter must contend with a formidable array of international regulations, stringent environmental standards, and product certifications. Newcomers would be immediately hit with substantial compliance costs and intricate legal complexities, making market entry a daunting prospect. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive and the Waste Electrical and Electronic Equipment (WEEE) directive impose significant compliance burdens that require substantial investment in process and supply chain management.

Established companies like HP Porter have already invested heavily in building robust compliance frameworks and securing necessary certifications, giving them a significant advantage. This existing infrastructure acts as a powerful barrier, deterring potential new entrants who would need to replicate these complex systems from scratch. The ongoing evolution of these regulations, such as updates to energy efficiency standards or material sourcing requirements, further increases the cost and difficulty for any new player attempting to enter the market.

- Regulatory Complexity: Navigating diverse international regulations (e.g., FCC, CE, RoHS) requires specialized legal and technical expertise, adding significant upfront costs.

- Environmental Compliance: Meeting evolving environmental standards, such as those related to e-waste recycling and carbon emissions, necessitates substantial investment in sustainable manufacturing practices and supply chain transparency.

- Certification Costs: Obtaining product certifications for different markets can be time-consuming and expensive, with costs often running into hundreds of thousands of dollars for comprehensive global coverage.

- Established Infrastructure: Existing players have already amortized these compliance costs and possess established relationships with certification bodies, creating a significant cost disadvantage for new entrants.

The threat of new entrants in the personal systems and printing hardware sectors is significantly mitigated by the immense capital required to establish operations. HP's substantial investments in R&D, advanced manufacturing, and global supply chains create a high barrier to entry. For instance, the cost of setting up cutting-edge semiconductor fabrication plants, critical for modern hardware, can exceed $20 billion as of 2024, a prohibitive sum for most newcomers.

Furthermore, building a strong brand presence and an extensive distribution network demands considerable marketing expenditure and logistical infrastructure. HP's established customer loyalty, cultivated over decades, and its comprehensive global distribution channels, including retail and online platforms, are difficult and costly for new players to replicate. In 2024, HP continued to leverage these robust networks, ensuring product availability that new entrants would struggle to match quickly.

Economies of scale achieved by established players like HP present another major hurdle. Their large-scale production, bulk purchasing of raw materials, and spread of R&D costs result in lower per-unit costs. This cost advantage makes it challenging for new entrants to compete on price. HP's 2023 R&D spending of approximately $1.5 billion underscores the continuous investment needed to maintain a competitive technological edge, a significant barrier for startups.

The technology-intensive nature of these industries, coupled with a dense intellectual property landscape, further deters new entrants. Developing proprietary technologies or licensing existing ones is both time-consuming and financially demanding. Navigating complex international regulations and environmental standards, such as EU's RoHS and WEEE directives, also imposes substantial compliance costs and legal complexities, creating a formidable challenge for any new market participant.

| Barrier Category | Description | Example/Data Point (2024) |

|---|---|---|

| Capital Requirements | High upfront investment needed for R&D, manufacturing, and supply chains. | Semiconductor plant costs exceeding $20 billion. |

| Brand Loyalty & Distribution | Established customer trust and extensive global networks are hard to replicate. | HP's decades of brand building and comprehensive sales channels. |

| Economies of Scale | Lower per-unit costs due to high-volume production and bulk purchasing. | HP's competitive pricing enabled by efficient operations. |

| Intellectual Property | Dense patent landscape and proprietary technologies require significant investment. | HP's R&D investment of ~$1.5 billion in 2023 for technological edge. |

| Regulatory Compliance | Navigating international regulations and certifications incurs substantial costs. | Costs for obtaining global product certifications can reach hundreds of thousands of dollars. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive intensity and market dynamics.