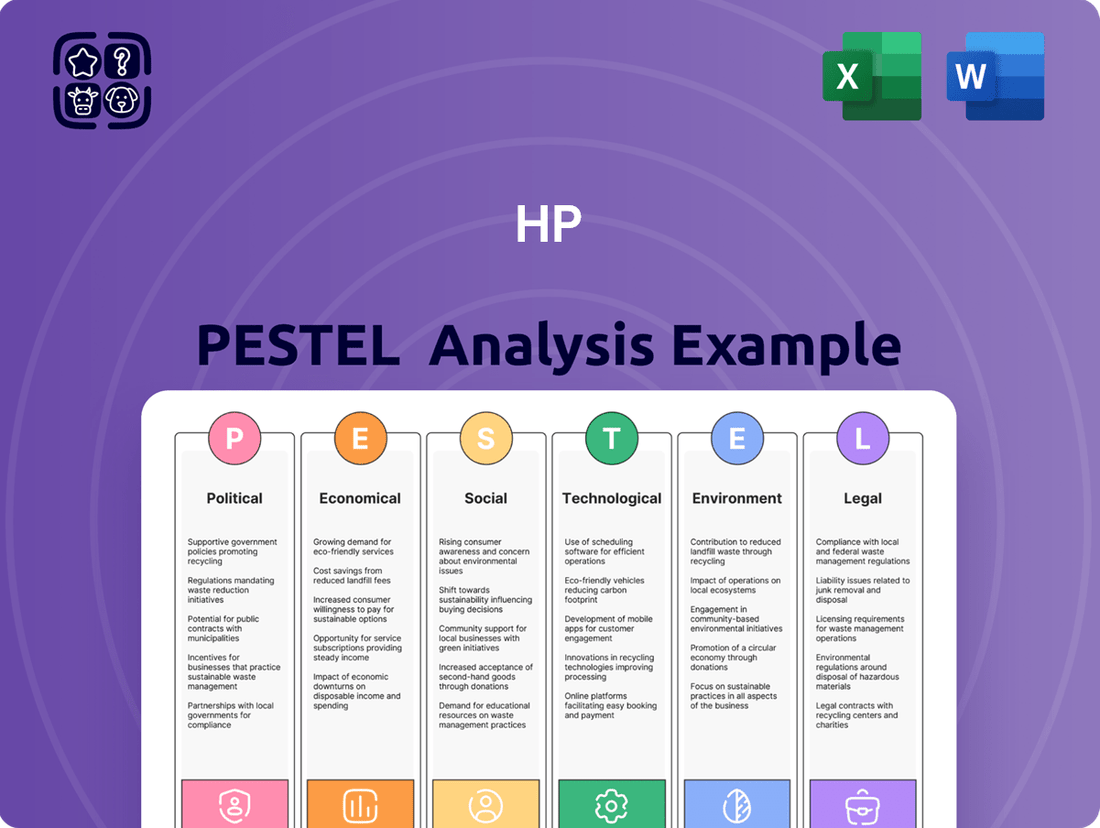

HP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

Unlock the strategic advantages of HP's external environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing HP's operations and future growth. Download the full version now to gain actionable intelligence and refine your market strategy.

Political factors

Global trade policies, especially the complex relationship between the US and China, directly influence HP's operations and bottom line. Shifting production is a key strategy to navigate these challenges.

HP is making significant moves to reduce its reliance on China, with plans for over 90% of its North America-bound products to be manufactured outside of China by the close of fiscal year 2025. This proactive approach aims to buffer against potential tariffs and trade disruptions.

While this diversification, with locations like Vietnam becoming more prominent, offers resilience, it also presents new cost considerations. Managing these evolving manufacturing landscapes is crucial for maintaining profitability.

HP navigates a complex web of global regulations, impacting everything from product safety standards to data privacy laws like the GDPR. In 2024, for instance, the ongoing enforcement of environmental regulations, such as those concerning e-waste and hazardous materials in electronics, requires significant investment in compliance and sustainable manufacturing practices. Failure to meet these diverse national and international requirements can result in substantial fines and damage to HP's brand reputation.

Antitrust scrutiny remains a persistent political factor for HP, particularly concerning its printer ink and toner cartridge business model. Regulatory bodies worldwide continue to examine practices that may limit competition or consumer choice. For example, investigations into printer manufacturers' policies on third-party ink cartridges, which have been ongoing for years, could lead to new compliance burdens or market access restrictions for HP in 2024 and beyond.

Geopolitical instability, particularly in regions with significant manufacturing operations or key markets, poses a direct threat to HP's operational continuity and supply chain integrity. Conflicts or political unrest can lead to production halts, increased logistical costs, and reduced consumer demand, impacting sales performance.

HP's strategic diversification of its manufacturing and assembly operations across numerous countries, including those in Asia and the Americas, is a crucial mitigation strategy. This geographical spread enhances resilience, allowing HP to shift production or sourcing if one region experiences significant geopolitical disruption, thereby safeguarding its global supply chain.

For instance, in 2024, ongoing geopolitical tensions in Eastern Europe and the Middle East continued to create supply chain vulnerabilities for many technology companies. HP's proactive approach to managing these risks through its distributed operational footprint is vital for maintaining market stability and meeting customer demand amidst global uncertainties.

Government Procurement Policies

Government agencies represent a substantial customer base for technology firms like HP. Favorable procurement policies, especially those prioritizing sustainable or locally sourced technology, can unlock significant growth avenues for HP. For instance, in 2023, the US federal government's IT spending was projected to reach over $130 billion, with a growing emphasis on cybersecurity and cloud solutions, areas where HP actively competes.

HP's strategic alignment with digital equity initiatives and its established relationships with public sector clients position it well to capitalize on government spending trends. Many governments are actively seeking to bridge the digital divide, which translates into demand for affordable computing devices and network infrastructure. In 2024, many nations are expected to continue or increase their investments in digital transformation projects within their public sectors.

- Government agencies are major purchasers of technology, representing a significant revenue stream for companies like HP.

- Policies favoring sustainable or domestically produced tech can create substantial opportunities for HP's product lines.

- HP's commitment to digital equity aligns with government efforts to expand access to technology, potentially leading to increased public sector contracts.

- The global public sector IT market is expected to see continued growth, driven by digital transformation and modernization efforts.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws significantly impact HP's ability to safeguard its innovations, particularly in areas like 3D printing and artificial intelligence. Strong legal protections are crucial for preventing the counterfeiting of HP's proprietary hardware and software, thereby preserving its market advantage and revenue streams.

For instance, the global IP landscape is constantly evolving, with countries like the United States and members of the European Union generally offering robust IP protection. However, enforcement can vary. In 2024, reports indicated ongoing challenges in certain regions regarding the effective prosecution of IP infringement cases, which can directly impact companies like HP that invest heavily in research and development.

- Global IP Enforcement Disparities: Uneven enforcement of IP laws across different jurisdictions presents a risk to HP's technological innovations.

- Counterfeiting and Piracy: Weak IP protection can lead to increased counterfeiting of HP's products, impacting sales and brand reputation.

- R&D Investment Protection: Robust IP laws are vital for HP to protect its substantial investments in developing new technologies, such as advanced 3D printing materials and AI-driven solutions.

- Legal Frameworks for AI and 3D Printing: The adequacy of existing IP frameworks to cover emerging technologies like AI algorithms and novel 3D printing processes is a key consideration for HP.

Government procurement is a significant revenue driver for HP, with substantial IT spending by public sector entities worldwide. In 2023, the US federal government alone was projected to spend over $130 billion on IT, with a growing emphasis on cybersecurity and cloud solutions, areas where HP actively competes. HP's engagement with digital equity initiatives further strengthens its position, aligning with government efforts to expand technology access and potentially leading to increased public sector contracts in 2024.

What is included in the product

This HP PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the pain of uncertainty.

Economic factors

HP's financial performance is intrinsically linked to the health of the global economy and the spending habits of both consumers and businesses. When the economy is robust, people and companies are more likely to invest in personal systems and printing solutions, which directly benefits HP's top line. This relationship was evident in 2023, where a slowdown in global GDP growth, coupled with tighter consumer budgets, led to a moderation in demand for personal computers, impacting HP's sales figures in its Personal Systems segment.

Conversely, periods of economic expansion and increased disposable income tend to stimulate demand for HP's products. For instance, as economies recover and confidence returns, consumers may upgrade their devices, and businesses might refresh their IT infrastructure, including printers and PCs. Projections for 2024 and 2025 suggest a gradual global economic recovery, with the IMF forecasting global growth to be around 3.2% in 2024, potentially creating a more favorable environment for HP's sales, although regional variations will remain a key factor.

Rising inflation and increased costs for raw materials, components, and logistics are directly impacting HP's cost of goods sold (COGS). For instance, in the fiscal second quarter of 2024, HP reported a slight increase in its COGS for the Personal Systems segment, reflecting these persistent inflationary pressures.

To counter these rising expenses, HP has strategically implemented price increases on its personal systems and printing hardware. This move aims to mitigate the impact of tariffs and other escalating costs, thereby protecting its profit margins in a challenging economic environment.

As a global technology giant, HP's financial health is significantly influenced by the ebb and flow of currency exchange rates. These fluctuations can directly impact the cost of its products for international customers and the value of revenue earned abroad when converted back to US dollars.

For instance, a strengthening US dollar in 2024 could make HP's laptops, printers, and other devices more expensive for consumers in Europe or Asia. This price increase might dampen demand in those regions, potentially leading to lower sales volumes and reduced revenue generated from overseas markets. In late 2023, the US dollar saw periods of strength against major currencies like the Euro and Yen, a trend that analysts anticipated would continue to pose a challenge for US-based exporters like HP into 2024.

Competition and Pricing Pressure

The technology sector, where HP operates, is notoriously competitive. Companies like Dell, Lenovo, and Apple consistently offer comparable products, intensifying the battle for market share. This crowded landscape frequently translates into significant pricing pressure, directly impacting HP's revenue streams and profit margins. For instance, in Q1 2024, HP reported a year-over-year revenue decline in its Personal Systems segment, partly attributed to a challenging pricing environment.

HP's strategy to navigate this intense competition hinges on its capacity for differentiation. This involves not just offering hardware but also providing value-added services and fostering innovation. By focusing on areas like hybrid work solutions and advanced printing services, HP aims to create a unique selling proposition that transcends mere price competition. Their commitment to R&D, evidenced by significant investments in new product development throughout 2024, is crucial for maintaining relevance and market position.

- Intense Competition: The PC and printer markets feature established global players, leading to constant rivalry.

- Pricing Pressure: Aggressive pricing by competitors can force HP to lower its own prices, impacting profitability.

- Differentiation Strategy: HP focuses on innovation, services, and solutions to stand out beyond price.

- Market Share Defense: Successful differentiation is vital for HP to retain and grow its share against rivals.

Interest Rates and Access to Capital

Changes in interest rates directly affect HP's cost of capital. For instance, if the Federal Reserve raises its benchmark interest rate, borrowing for HP's R&D projects, factory upgrades, or potential acquisitions becomes more expensive. This can lead to a slowdown in strategic investments.

Access to affordable capital is crucial for HP to fund its growth strategies and manage its existing debt obligations effectively. In early 2024, the Federal Reserve maintained its interest rate target range between 5.25% and 5.50%, reflecting a period of elevated borrowing costs compared to previous years.

- Higher interest rates increase the cost of debt financing for HP's capital expenditures.

- Reduced access to cheap capital can temper HP's investment in new technologies and market expansion.

- HP's ability to manage its debt load is directly impacted by prevailing interest rate environments.

- The cost of capital influences the financial viability of long-term projects and acquisitions for HP.

Global economic conditions significantly shape HP's performance, with growth spurts boosting demand for PCs and printers, while slowdowns dampen it. Projections for 2024 and 2025 indicate a gradual global economic recovery, with the IMF forecasting around 3.2% global growth for 2024, offering potential tailwinds for HP.

Inflationary pressures directly impact HP's costs, as seen in Q2 2024 where COGS for Personal Systems saw a slight increase. To mitigate this, HP has strategically raised prices on its hardware to protect profit margins against rising tariffs and other expenses.

Currency fluctuations present a challenge, as a stronger US dollar in 2024 can make HP products more expensive internationally, potentially reducing demand and overseas revenue. This trend was observed in late 2023, with the dollar strengthening against major currencies like the Euro and Yen.

| Economic Factor | Impact on HP | 2024/2025 Data/Projections |

|---|---|---|

| Global GDP Growth | Drives demand for PCs and printing solutions | IMF projects 3.2% global growth in 2024 |

| Inflation | Increases cost of goods sold (COGS) | Q2 2024 saw slight COGS increase in Personal Systems |

| Currency Exchange Rates | Affects international pricing and revenue conversion | US dollar strength against EUR/JPY observed in late 2023, impacting exporters |

Preview Before You Purchase

HP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive HP PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You’ll gain a deep understanding of the external forces shaping HP's strategic landscape, enabling informed decision-making.

Sociological factors

The shift towards hybrid and remote work has reshaped the technology landscape, boosting demand for personal computers and collaboration software. HP is capitalizing on this by developing AI-enhanced PCs designed to improve efficiency and seamless connectivity for employees working from various locations.

In 2024, an estimated 30% of the global workforce is expected to be working in a hybrid model, a significant increase from pre-pandemic levels. This trend directly influences HP's product development, with a reported 15% year-over-year growth in sales for their premium business laptops in Q1 2024, driven by these flexible work arrangements.

Consumer preferences are increasingly leaning towards sustainable products, directly impacting HP's strategic decisions. This shift is driven by heightened awareness of environmental issues, compelling companies like HP to integrate eco-friendly practices throughout their operations. For instance, HP's 2023 annual sustainability report highlighted that 39% of their total print and 53% of their total PC units shipped contained recycled content, a direct response to this growing demand.

HP's proactive stance on sustainability, evident in their use of recycled plastics and commitment to energy-efficient designs, aligns perfectly with these evolving consumer expectations. This strategy not only appeals to environmentally conscious buyers but also enhances brand loyalty and market differentiation. In 2024, HP aims to further increase the use of recycled plastics in its products, targeting 75% in its eligible products by 2030.

The global drive for digital equity means more people, especially in underserved areas, are gaining access to technology. This is a significant social responsibility for companies like HP, but also a huge market opportunity. By helping to bridge the digital divide, HP can reach new customers and build brand loyalty.

HP's Digital Equity Accelerator, for example, is designed to provide technology and training to those who need it most. This not only fosters social good but also expands HP's potential customer base. For instance, in 2024, the company committed to enabling sustainable digital equity for 150 million people by 2030, demonstrating a clear strategy to leverage this societal trend.

Demographic Shifts and Aging Workforce

Demographic shifts, particularly the aging workforce in developed nations, are reshaping technology needs. As more experienced workers remain in the labor force longer, there's a growing demand for user-friendly interfaces and enhanced accessibility features. HP's commitment to intuitive design and efficient solutions directly addresses this trend, making their products more appealing to a broader age range of professionals.

By 2030, it's projected that over 20% of the U.S. population will be 65 years and older, a significant portion of whom will still be in or re-entering the workforce. This demographic reality underscores the importance of technology that supports diverse abilities and learning styles. HP's investment in research and development for accessibility, such as adjustable font sizes and voice command integration, positions them well to capture this evolving market segment.

- Aging Workforce Impact: Increased demand for ergonomic and easy-to-use technology.

- Accessibility Focus: HP's solutions cater to users with varying technical proficiencies and physical needs.

- Market Opportunity: The growing senior demographic represents a substantial user base for accessible computing.

Privacy Concerns and Data Security

Growing societal concerns about data privacy and cybersecurity are increasingly shaping consumer and business purchasing decisions. As digital footprints expand, individuals and organizations are more vigilant about how their personal and sensitive information is handled. This heightened awareness directly impacts technology companies like HP, demanding strong security measures as a core product offering rather than an afterthought.

HP is actively addressing these privacy concerns through its HP Wolf Security suite, which integrates hardware, software, and services to protect devices from emerging threats. Furthermore, their strategic focus on local AI processing, which keeps data on the device rather than sending it to the cloud, directly mitigates risks associated with data breaches and unauthorized access. This approach not only safeguards user information but also builds crucial trust, a vital differentiator in the competitive tech landscape.

The market is responding to these security-focused initiatives. For instance, in fiscal year 2023, HP reported significant growth in its commercial segment, partly driven by the demand for secure computing solutions. According to industry reports from late 2024, over 60% of businesses consider data security a top IT priority, underscoring the importance of HP's investments in this area.

- Growing Demand for Data Protection: Societal awareness of data privacy has surged, making robust security a non-negotiable for tech consumers and businesses alike.

- HP's Strategic Response: HP Wolf Security and a commitment to local AI processing are key initiatives designed to meet these evolving privacy expectations.

- Building User Trust: By prioritizing data security, HP aims to foster greater user confidence and loyalty in its product ecosystem.

- Market Validation: The increasing emphasis on cybersecurity in business IT spending, with over 60% of companies citing it as a top priority in late 2024, validates HP's security-centric strategy.

The increasing global focus on digital inclusion presents a significant opportunity for HP to expand its market reach. By actively working to bridge the digital divide, HP can cultivate new customer relationships and enhance brand loyalty.

HP's commitment to digital equity is exemplified by initiatives like the Digital Equity Accelerator, which provides essential technology and training to underserved communities. This strategic approach not only addresses social needs but also broadens HP's potential customer base, aiming to impact 150 million people by 2030.

Societal expectations regarding sustainability continue to rise, influencing consumer choices and driving demand for eco-friendly products. HP's integration of recycled materials, with 39% of its total print and 53% of its total PC units shipped in 2023 containing recycled content, directly aligns with these growing consumer preferences.

The aging global population is reshaping technology needs, with an increasing demand for user-friendly interfaces and enhanced accessibility features. HP's focus on intuitive design and accessible solutions positions it to effectively serve this expanding demographic, which is projected to see over 20% of the U.S. population aged 65 and older by 2030.

Technological factors

Artificial Intelligence is a major force reshaping the technology landscape, and HP is actively integrating AI into its product development. The company is investing significantly in AI-powered personal computers and comprehensive solutions designed to boost user productivity and create more intuitive experiences.

These AI advancements are set to unlock new functionalities, from sophisticated data analysis and seamless communication to enhanced security features within HP devices. For instance, HP's 2024 strategy includes leveraging AI for smarter device management and personalized user interactions, aiming to differentiate its offerings in a competitive market.

HP is a significant force in the 3D printing arena, consistently introducing new developments in both polymer and metal additive manufacturing. For example, HP's Metal Jet technology, launched in 2018, continues to see advancements, aiming to make metal 3D printing more accessible and cost-effective for industrial production.

These technological leaps are designed to lower manufacturing expenses, enable larger-scale production runs, and speed up the integration of additive manufacturing across diverse sectors like footwear and the automotive industry. By 2024, the global 3D printing market was projected to reach over $27 billion, with HP actively contributing to this growth through its innovative solutions.

The relentless march of personal computing hardware, from faster processors to more efficient graphics units, directly shapes HP's product innovation. For instance, the increasing power density of CPUs and GPUs in 2024 and 2025 allows for sleeker laptop designs and more capable workstations, directly influencing HP's development priorities.

The emerging trend of AI PCs, equipped with dedicated neural processing units (NPUs), presents a significant opportunity for HP. These NPUs are designed to accelerate on-device artificial intelligence tasks, leading to improved performance in applications like image recognition and natural language processing, a key area for HP's future product lines.

Cloud Computing and Software-as-a-Service (SaaS)

The widespread adoption of cloud computing and Software-as-a-Service (SaaS) significantly reshapes the demand for traditional hardware. As more businesses shift to cloud-based solutions, the need for on-premises servers and infrastructure can decrease, impacting hardware manufacturers like HP. For instance, the global cloud computing market was valued at approximately $593 billion in 2023 and is projected to reach over $1.3 trillion by 2028, demonstrating a clear trend away from solely on-premise solutions.

HP is actively navigating this shift by strategically integrating its hardware offerings with cloud-based services. This approach involves developing and enhancing software solutions that complement their hardware, such as the Workforce Experience Platform. This platform aims to provide a seamless experience for users accessing cloud applications and data through HP devices, thereby maintaining relevance in a cloud-centric environment. This strategy is crucial as Gartner predicts that by 2025, over 80% of enterprises will be operating in the cloud.

- Cloud Market Growth: The global cloud computing market is expanding rapidly, with projections indicating a value exceeding $1.3 trillion by 2028.

- SaaS Dominance: SaaS continues to be a primary driver of cloud adoption, influencing hardware purchasing decisions.

- HP's Adaptation: HP is focusing on hybrid solutions, blending hardware with cloud services and software platforms like the Workforce Experience Platform.

- Future Outlook: By 2025, it's anticipated that over 80% of enterprises will be utilizing cloud services, underscoring the necessity of HP's cloud-integration strategy.

Cybersecurity Technologies

The ever-growing complexity of cyber threats demands constant advancements in security technology. HP is actively addressing this by embedding robust security solutions, such as its HP Wolf Security suite, directly into its hardware and software offerings. This proactive approach is a significant differentiator, appealing to both individual consumers and large organizations increasingly concerned about data breaches and ransomware attacks.

The global cybersecurity market is experiencing substantial growth. Projections indicate the market could reach $300 billion by 2025, highlighting the immense demand for advanced security measures. HP's investment in this area is therefore strategically aligned with market needs.

- HP Wolf Security integrates hardware-based security, threat containment, and advanced threat intelligence to offer comprehensive device protection.

- Market Growth: The global cybersecurity market is forecast to grow significantly, reaching an estimated $300 billion by 2025, underscoring the demand for advanced solutions.

- Ransomware Impact: In 2024, ransomware attacks continued to be a major concern, with average recovery costs for businesses escalating, making robust endpoint security a critical investment.

- Enterprise Demand: Businesses are increasingly prioritizing devices with built-in security features to mitigate risks associated with remote work and sophisticated cyber threats.

HP is deeply invested in artificial intelligence, integrating AI into its PCs and solutions to enhance user productivity and create more intuitive experiences. This focus on AI, particularly with the rise of AI PCs featuring dedicated NPUs, aims to improve on-device AI tasks like image recognition and natural language processing, a key strategy for HP in 2024 and 2025.

The company is also a leader in 3D printing, advancing both polymer and metal additive manufacturing with technologies like Metal Jet, making metal 3D printing more accessible for industrial use. This push is crucial as the 3D printing market was projected to exceed $27 billion in 2024, with HP contributing significantly to this expansion.

HP is strategically adapting to the dominance of cloud computing and SaaS by integrating its hardware with cloud services, such as its Workforce Experience Platform. This is vital as over 80% of enterprises are expected to operate in the cloud by 2025, and the global cloud market is projected to surpass $1.3 trillion by 2028.

Furthermore, HP is bolstering its security offerings with solutions like HP Wolf Security, directly embedding robust security into its hardware and software. This is a critical response to escalating cyber threats, with the global cybersecurity market expected to reach $300 billion by 2025, and ransomware attacks continuing to pose significant risks in 2024.

| Technological Factor | HP's Strategy/Investment | Market Trend/Data | Impact on HP |

| Artificial Intelligence (AI) | Integrating AI into PCs and solutions; developing AI PCs with NPUs. | AI PC market growth; AI enhancing productivity and user experience. | Differentiates products, improves performance, drives innovation. |

| 3D Printing (Additive Manufacturing) | Advancing Metal Jet technology; expanding polymer and metal printing capabilities. | Global 3D printing market projected over $27 billion (2024); increasing industrial adoption. | Lowers manufacturing costs, enables new production models, expands market reach. |

| Cloud Computing & SaaS | Developing hybrid solutions; integrating hardware with cloud platforms (e.g., Workforce Experience Platform). | Cloud market projected over $1.3 trillion (2028); over 80% of enterprises in cloud by 2025. | Ensures relevance in cloud-centric environments, expands service offerings. |

| Cybersecurity | Embedding HP Wolf Security into hardware and software; enhancing threat containment. | Cybersecurity market projected $300 billion (2025); rising ransomware threats and costs. | Mitigates risks, builds customer trust, creates a competitive advantage. |

Legal factors

HP operates under significant antitrust and competition law scrutiny, especially concerning its printer consumables market. Regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the European Commission, actively monitor practices that could stifle competition. In 2024, ongoing investigations into printer manufacturers’ market dominance continue to shape industry practices and consumer protection measures.

The company has faced numerous class action lawsuits alleging anti-competitive behavior, notably the practice of requiring HP-branded ink cartridges for optimal printer functionality. These legal challenges underscore the critical need for HP to ensure its business models align with fair competition principles, avoiding actions that could be perceived as monopolistic or restrictive.

Strict data privacy regulations worldwide, such as GDPR in Europe and CCPA in California, directly impact how HP collects, stores, and processes customer data. These laws mandate transparency and consent, requiring significant investment in data security infrastructure and compliance protocols. Failure to adhere can result in substantial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

HP must navigate a complex web of product liability and safety regulations, ensuring its vast array of hardware and software offerings meet stringent consumer safety standards. Failure to comply can result in costly product recalls, expensive litigation, and significant damage to HP's brand reputation.

In 2024, regulatory bodies worldwide continue to emphasize cybersecurity and data privacy within hardware and software, impacting product design and lifecycle management. For instance, the EU's Cyber Resilience Act, which came into effect in 2024, mandates cybersecurity requirements for connected products, directly affecting how HP develops and markets its devices.

Intellectual Property Laws (Patents, Copyrights, Trademarks)

HP's ability to protect its intellectual property through patents, copyrights, and trademarks is fundamental to maintaining its competitive edge in the technology sector. These legal safeguards are essential for preventing competitors from unfairly capitalizing on HP's research and development investments. In 2023, HP continued to actively pursue patent filings, with a significant number of applications related to its printing technology and personal computing innovations, underscoring the ongoing importance of IP protection.

The strength and enforcement of intellectual property laws directly impact HP's capacity to monetize its innovations and deter infringement. Robust legal frameworks allow HP to license its technologies and prevent the unauthorized use of its brand, which is critical for revenue generation and brand integrity. For instance, trademark protection is vital for HP's well-recognized product lines like Spectre and Envy, ensuring consumers associate quality with the HP brand.

- Patent Protection: HP relies on patents to safeguard its novel technologies in areas such as inkjet and laser printing, as well as advancements in laptop design and security features.

- Copyright Safeguards: Software, firmware, and marketing materials are protected by copyright, preventing unauthorized duplication and distribution of HP's digital assets.

- Trademark Enforcement: HP's iconic logos and product names are protected by trademarks, crucial for brand recognition and preventing market confusion.

- Litigation and Defense: HP actively engages in legal proceedings to defend its intellectual property rights against infringement and to resolve disputes.

Labor and Employment Laws

HP's global operations necessitate strict adherence to a complex web of labor and employment laws across numerous jurisdictions. These regulations govern everything from minimum wages and working hours to employee benefits and anti-discrimination policies. For instance, in 2024, many European countries continued to strengthen worker protections, impacting hiring and termination practices.

Restructuring and workforce reduction initiatives, a common strategy for large corporations like HP, are particularly scrutinized under these legal frameworks. Companies must navigate notification periods, severance pay requirements, and potential legal challenges arising from layoffs. In the US, the Worker Adjustment and Retraining Notification (WARN) Act mandates advance notice for mass layoffs, a key consideration for HP's strategic planning.

- Global Compliance: HP must comply with varying labor laws in over 160 countries, affecting employment contracts, benefits, and termination procedures.

- Workforce Adjustments: Layoffs and restructuring are governed by laws like the WARN Act in the US and similar regulations in other regions, requiring careful legal oversight.

- Employee Rights: Laws concerning fair wages, safe working conditions, and non-discrimination are constantly evolving, demanding continuous legal review and policy updates.

- Union Relations: In regions with strong union presence, HP must negotiate and comply with collective bargaining agreements, impacting operational flexibility.

HP navigates stringent antitrust laws, particularly concerning its printer ink and toner markets, facing scrutiny from global regulators like the FTC and European Commission. Ongoing investigations in 2024 into market dominance practices highlight the need for compliance with fair competition principles to avoid legal challenges and protect consumer interests.

Data privacy regulations such as GDPR and CCPA impose strict requirements on how HP handles customer information, necessitating significant investment in cybersecurity and compliance. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover, emphasizing the financial risk associated with data breaches or mishandling.

HP's product development and marketing are heavily influenced by evolving cybersecurity and product safety standards, as exemplified by the EU's Cyber Resilience Act effective in 2024, which mandates cybersecurity for connected products. This regulatory landscape requires continuous adaptation in product design and lifecycle management to ensure compliance and mitigate risks like recalls and litigation.

Environmental factors

HP is actively tackling climate change, aiming for net-zero greenhouse gas emissions across its entire value chain by 2040. This commitment is a significant driver for its operational and strategic decisions.

The company's strategy centers on reducing Scope 1, 2, and 3 emissions. This involves enhancing energy efficiency in its operations, increasing the use of renewable energy sources, and collaborating with suppliers to decarbonize the supply chain. For instance, HP reported a 15% reduction in its overall carbon footprint in fiscal year 2023 compared to 2019, demonstrating tangible progress toward its targets.

HP is making significant strides in adopting a circular economy, focusing on product longevity and reducing waste. By 2025, HP aims for all its product packaging to be made from 100% recycled or renewable materials, a commitment that underscores its dedication to environmental stewardship.

Furthermore, HP is actively increasing the amount of post-consumer recycled content in its products. For instance, in fiscal year 2023, HP reported that 46% of its total product portfolio by weight contained recycled plastic, demonstrating tangible progress towards its sustainability targets.

HP is increasingly focused on sustainable sourcing due to growing global concerns about resource depletion. This commitment is evident in their goal to reduce virgin material usage in production by 50% by 2025, a target that directly addresses the environmental impact of raw material extraction.

The company actively collaborates with its suppliers to enhance their environmental practices, aiming to build a more resilient and responsible supply chain. This proactive approach helps mitigate risks associated with the scarcity and fluctuating costs of virgin materials, ensuring more stable operations.

E-waste Regulations and Product End-of-Life Management

HP faces increasing pressure from stringent e-waste regulations globally, necessitating robust product end-of-life management strategies. These regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, mandate responsible disposal and recycling, directly impacting HP's operational costs and supply chain. For instance, in 2023, the global e-waste generated reached a record 62 million metric tons, highlighting the scale of the challenge and the importance of compliance for major electronics manufacturers like HP.

HP's environmental strategy actively addresses these challenges through expanded recycling programs and a focus on circular economy principles. The company is investing in initiatives to increase the collection and processing of used electronics, aiming to recover valuable materials and minimize landfill waste. HP's commitment to sustainability includes ambitious goals for using recycled content in its products; by 2030, they aim to increase the use of recycled plastic in their portfolio by 30% compared to a 2019 baseline.

- Global E-waste Surge: Over 62 million metric tons of e-waste were generated worldwide in 2023, underscoring the critical need for effective management.

- Regulatory Compliance: Adherence to directives like the WEEE mandates responsible product lifecycle management for companies like HP.

- Circular Economy Focus: HP is enhancing recycling programs and promoting reuse and remanufacturing to reduce environmental impact.

- Recycled Material Goals: The company targets a 30% increase in recycled plastic usage in its products by 2030, demonstrating a commitment to sustainability.

Water Usage and Pollution Control

While not as heavily scrutinized as carbon emissions, HP recognizes the environmental impact of its water usage and potential pollution from manufacturing processes. The company actively tracks and reports its water footprint, aiming to minimize its impact throughout its global operations and supply chain.

HP's commitment to water stewardship is reflected in its sustainability reports. For instance, in its 2023 report, HP detailed efforts to reduce water consumption in its facilities and among its suppliers. These initiatives often involve investing in water-efficient technologies and implementing stricter wastewater treatment protocols to prevent pollution.

- Water Footprint Reporting: HP publicly discloses its water usage data, providing transparency on its consumption across manufacturing and operational sites.

- Pollution Control Measures: The company employs advanced wastewater treatment technologies and adheres to stringent environmental regulations to mitigate water pollution from its operations.

- Value Chain Engagement: HP works with its suppliers to promote responsible water management practices, extending its environmental efforts beyond its direct operations.

- Targeted Reduction Goals: HP has set specific targets for reducing water withdrawal and improving water efficiency in high-stress regions where it operates.

HP is actively addressing environmental concerns, aiming for net-zero emissions by 2040 and increasing recycled content in its products, with 46% of its 2023 portfolio by weight containing recycled plastic.

The company is committed to circular economy principles, targeting 100% recycled or renewable packaging by 2025 and a 30% increase in recycled plastic usage by 2030.

Facing a global surge in e-waste, with 62 million metric tons generated in 2023, HP is enhancing recycling programs and managing product end-of-life to comply with regulations like the WEEE Directive.

HP also focuses on water stewardship, reporting water usage and implementing measures to reduce consumption and prevent pollution, working with suppliers to promote responsible water management.

PESTLE Analysis Data Sources

Our HP PESTLE Analysis is built on a robust foundation of data from leading market research firms, government economic reports, and technology industry publications. We integrate insights from global economic indicators, environmental policy updates, and evolving social trends to provide a comprehensive view.