HP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

Curious about the engine driving HP's success? Our Business Model Canvas breaks down how they connect with customers, deliver value, and generate revenue. Download the full, detailed canvas to gain a strategic advantage.

Partnerships

HP collaborates with major technology and software providers to embed cutting-edge functionalities into its diverse product range. These partnerships are instrumental in bringing AI-driven advancements to PCs and workstations, aiming to significantly boost user productivity and overall experience.

For instance, HP's work with NVIDIA has been crucial in integrating AI capabilities, as seen in their latest workstation lines, enhancing performance for demanding professional workloads. These strategic alliances are fundamental to HP's strategy of developing forward-looking solutions and broadening its market presence.

HP relies on a massive network of channel partners, such as distributors, national solution providers, and resellers, to get its products to customers worldwide. This extensive network is fundamental to HP's ability to sell its personal systems, printing hardware, and supplies across various markets and to different types of customers.

HP’s Amplify Partner Program is designed to foster deeper collaboration and mutual growth within this vital partner ecosystem. This program is key to ensuring that partners are incentivized and equipped to effectively represent and sell HP's diverse product portfolio.

HP cultivates key partnerships with manufacturing entities and suppliers to streamline its worldwide production and supply chain operations. A notable strategy involves diversifying manufacturing sites beyond China, aiming to bolster resilience and mitigate geopolitical or logistical risks. These collaborations are crucial for achieving cost efficiencies and maintaining robust product availability for consumers.

3D Printing Ecosystem Collaborations

HP actively cultivates key partnerships within the 3D printing ecosystem. These collaborations are vital for driving innovation and expanding market reach in additive manufacturing.

HP collaborates with material developers to enhance the range and performance of printable materials, and with software providers to streamline design and print preparation workflows. For instance, partnerships with companies like Autodesk for software solutions and ArcelorMittal for advanced metal printing materials are crucial. These alliances are instrumental in accelerating the adoption of HP's 3D printing technologies across various industries.

- Material Innovation: Collaborations with companies like ArcelorMittal for advanced metal powders expand the material portfolio for HP's Multi Jet Fusion and Metal Jet technologies.

- Software Integration: Partnerships with software firms such as Autodesk and Siemens enable seamless integration of HP's hardware with leading design and manufacturing software, improving user experience and workflow efficiency.

- Application Development: Working with industrial companies and end-users across sectors like automotive, healthcare, and aerospace helps develop specific applications and validate HP's 3D printing solutions for real-world production.

Service and Solution Integrators

HP collaborates with service and solution integrators to deliver robust IT solutions and managed services to its business clientele. These partnerships are crucial for expanding HP's service reach and offering specialized, integrated solutions that meet complex enterprise needs.

These collaborations are particularly vital for delivering intricate enterprise solutions, thereby boosting customer satisfaction. For instance, in 2024, HP continued to strengthen its ties with major system integrators to bundle its hardware and software with specialized consulting and implementation services, aiming to capture a larger share of the growing managed services market.

- Extended Service Capabilities: Integrators augment HP's offerings with specialized expertise in areas like cloud migration, cybersecurity, and data analytics.

- Comprehensive IT Solutions: Partnerships enable the creation of end-to-end solutions, combining HP's hardware and software with the integrator's implementation and support services.

- Enhanced Customer Satisfaction: By providing integrated, specialized support, these collaborations lead to more seamless customer experiences and higher satisfaction rates.

- Market Penetration: Collaborating with established integrators allows HP to access new markets and customer segments more effectively.

HP's key partnerships are multifaceted, encompassing technology providers for innovation, a vast network of channel partners for global distribution, and manufacturing entities for supply chain efficiency. These collaborations extend to the burgeoning 3D printing sector, where HP partners with material and software developers to drive advancements. Furthermore, strategic alliances with service and solution integrators are crucial for delivering comprehensive IT solutions to enterprise clients.

What is included in the product

A structured framework outlining HP's approach to creating, delivering, and capturing value, detailing customer segments, value propositions, channels, and key resources.

It provides a clear, visual representation of HP's business strategy, encompassing revenue streams, cost structure, and key partnerships.

Simplifies complex business strategies into a clear, actionable framework.

Helps teams quickly align on core value propositions and customer segments.

Activities

HP's commitment to Research and Development is a cornerstone of its business strategy, fueling innovation across its personal systems, printing, and burgeoning 3D printing segments. The company consistently allocates substantial resources to R&D, aiming to stay ahead of technological curves and anticipate customer needs.

A major thrust of HP's R&D in 2024 and beyond is the integration of Artificial Intelligence into its product ecosystem, notably through the development of AI PCs. Simultaneously, significant efforts are directed towards advancing printing technologies, including inkjet and laser printing, and expanding its capabilities in the 3D printing market.

This dedication to R&D is critical for HP to maintain its competitive advantage in rapidly evolving markets. For instance, HP's investments in AI are designed to create more intelligent and personalized computing experiences, while advancements in printing aim to enhance efficiency, sustainability, and new application possibilities.

HP's manufacturing and production activities are central to its business, focusing on the large-scale creation of personal computers, printers, and associated hardware. This requires meticulous management of a sophisticated global supply chain, ensuring components are sourced efficiently and products are assembled effectively. The company's 2024 strategy continues to emphasize optimizing these production processes to maintain cost-effectiveness and meet high demand.

In 2024, HP continued its commitment to streamlining its manufacturing operations. The company's extensive network of manufacturing facilities and partners worldwide plays a crucial role in delivering its diverse product portfolio to customers across the globe. This global footprint allows HP to adapt to regional market needs and maintain a competitive edge in product availability and delivery times.

HP invests heavily in marketing and sales to showcase its broad range of products, from personal computers to enterprise solutions. This involves a multi-channel approach, utilizing digital advertising, a dedicated sales force, and a robust network of channel partners to connect with consumers, small and medium-sized businesses, and major corporations.

In 2024, HP continued to emphasize digital marketing, with a significant portion of its budget allocated to online campaigns, social media engagement, and search engine optimization to enhance brand awareness and drive customer acquisition. The company's direct sales teams focus on larger enterprise accounts, offering tailored solutions and support.

Supply Chain Management and Logistics

HP’s supply chain management and logistics are core to its operations, involving everything from sourcing components to getting finished products into customers' hands. This complex network requires careful planning and execution to ensure efficiency and cost-effectiveness across its global operations.

HP is actively managing its supply chain to navigate geopolitical shifts and bolster resilience. For instance, in 2024, the company continued its efforts to diversify manufacturing locations away from single-country dependence, a strategy that has been ongoing for several years to mitigate potential disruptions.

Effective logistics are paramount for HP to ensure timely delivery and manage costs for its wide range of products. This includes optimizing transportation routes, warehousing, and inventory levels to meet market demand consistently.

- Procurement: Sourcing raw materials and components from a global network of suppliers.

- Inventory Management: Balancing stock levels to meet demand while minimizing carrying costs.

- Global Logistics: Managing the transportation and warehousing of finished goods worldwide.

- Risk Mitigation: Diversifying manufacturing and supply sources to enhance resilience against disruptions.

Service and Support Delivery

HP's service and support delivery is a cornerstone of its business model, encompassing comprehensive after-sales assistance, maintenance, and technical services. This commitment extends to providing robust warranties, specialized managed print services, and initiatives aimed at extending device lifecycles.

A well-executed service delivery framework is crucial for fostering enduring customer loyalty and establishing predictable, recurring revenue streams. For instance, HP's managed print services contracts, often multi-year agreements, ensure consistent income and deeper customer engagement.

- After-Sales Support: Offering comprehensive technical assistance and troubleshooting for all HP products.

- Maintenance & Repair: Providing ongoing maintenance and repair services to ensure optimal device performance.

- Managed Print Services (MPS): Delivering outsourced print management solutions to businesses, optimizing efficiency and cost.

- Device Lifecycle Management: Extending the useful life of devices through upgrades, repairs, and refurbishment programs.

HP's key activities revolve around innovation and production, with a strong emphasis on Research and Development to drive advancements, particularly in AI PCs and 3D printing. Manufacturing and supply chain management are critical for efficiently producing and distributing its vast array of personal systems and printers globally, ensuring cost-effectiveness and product availability.

Full Document Unlocks After Purchase

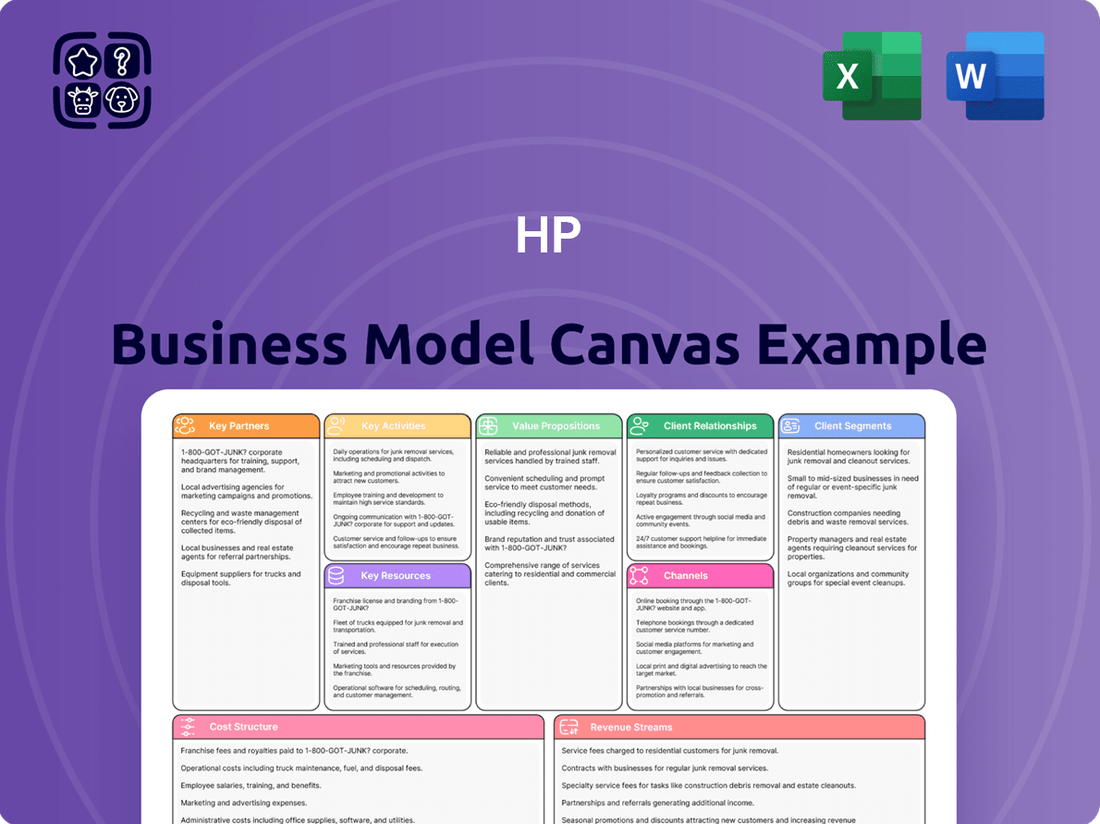

Business Model Canvas

This preview showcases the actual HP Business Model Canvas you will receive upon purchase. What you see here is a direct representation of the final, comprehensive document, ensuring complete transparency. Upon completing your order, you'll gain full access to this identical file, ready for immediate use and customization.

Resources

HP's intellectual property, particularly its extensive patent portfolio, is a cornerstone of its business model. This IP covers innovations in personal computing, printing, and cutting-edge 3D printing solutions, directly fueling its competitive edge.

These patents are not just legal protections; they are fundamental assets that enable HP to develop and market unique technologies. For instance, HP's advancements in inkjet and laser printing technologies, protected by numerous patents, have historically been key differentiators in the market.

In 2024, HP continued to invest heavily in R&D, a significant portion of which is dedicated to securing and expanding its intellectual property. This ongoing commitment ensures that HP's product development remains at the forefront, safeguarding its market position and driving future innovation.

HP's global brand recognition and reputation are cornerstones of its business model. This strong presence, built over decades, translates directly into customer trust and loyalty, making new product adoption easier and reducing customer acquisition costs. In 2024, HP continued to be a household name, consistently ranking among the top technology brands worldwide.

This established brand equity acts as a significant intangible asset, providing a competitive advantage. It allows HP to command premium pricing and weather market fluctuations more effectively than less recognized competitors. The company's long history of delivering reliable products further solidifies this reputation, a critical factor in the fast-paced tech sector.

HP's innovation engine is fueled by a highly skilled workforce, especially in engineering and R&D. This talent pool is crucial for developing advanced technologies in areas like AI and 3D printing, directly impacting their product pipeline.

In 2024, HP continued to invest in employee development, recognizing that deep expertise in hardware, software, and emerging tech like advanced materials science is paramount. This focus ensures they remain competitive in creating sophisticated solutions for their customers.

Extensive Distribution and Service Network

HP’s extensive global distribution and service network is a cornerstone of its business model, enabling broad product availability and robust customer support. This network encompasses a vast array of distributors, resellers, and retail channels, ensuring HP products reach diverse customer segments efficiently across the globe.

This physical infrastructure is critical for HP's market penetration and customer engagement. In 2024, HP continued to rely on this established network to deliver its wide range of personal systems and printers. The company's strategy emphasizes maintaining strong relationships with channel partners to ensure optimal product placement and customer service.

Key components of HP's distribution and service network include:

- Global Reach: HP operates in over 170 countries, leveraging local partners to navigate diverse market conditions.

- Channel Diversity: The network includes large enterprise resellers, small and medium-sized business partners, direct-to-consumer online sales, and major retail outlets.

- Service Infrastructure: A comprehensive network of authorized service centers provides localized technical support and repair services, enhancing customer satisfaction and product lifecycle management.

Financial Capital

HP's financial capital is the bedrock for its extensive operations. Substantial financial resources are crucial for HP to fund its research and development, manufacturing operations, strategic acquisitions, and marketing initiatives. This financial strength allows HP to innovate and maintain its competitive edge in the technology sector.

Healthy cash flow and strong financial performance enable continued investment in growth areas. For HP, this means being able to invest in new product lines, expand into emerging markets, and support its global supply chain effectively. This consistent investment is key to its long-term sustainability and market position.

HP's fiscal 2024 net revenue was $53.6 billion, demonstrating its significant market presence and sales volume. Furthermore, the company generated $3.3 billion in free cash flow during the same period, highlighting its ability to convert revenue into readily available cash. This financial health is vital for funding its various business activities and strategic objectives.

Key aspects of HP's financial capital include:

- Revenue Generation: Fiscal 2024 net revenue of $53.6 billion underscores HP's substantial market reach and sales capabilities.

- Cash Flow: The generation of $3.3 billion in free cash flow in fiscal 2024 indicates strong operational efficiency and financial flexibility.

- Investment Capacity: These financial resources directly support R&D, manufacturing, acquisitions, and marketing efforts, fueling growth and innovation.

- Financial Stability: Robust financial performance ensures HP can weather market fluctuations and continue investing in future opportunities.

HP's intellectual property, including its vast patent portfolio, is a critical resource. This IP protects innovations in personal computing, printing, and 3D printing, giving HP a distinct market advantage.

These patents are vital for developing unique technologies, such as those in inkjet and laser printing, which have historically set HP apart. HP's ongoing investment in R&D in 2024 further strengthens this IP, ensuring continued innovation and market leadership.

Value Propositions

HP's innovative personal systems, encompassing both consumer and commercial laptops and desktops, are at the forefront of computing. This includes a significant push into AI-powered PCs, designed to elevate user experience.

These advanced systems offer substantial benefits like boosted performance, robust security, and intelligent features that streamline productivity and foster better collaboration. HP is actively shaping the future of work through these computing advancements.

For instance, in fiscal year 2023, HP's Personal Systems segment generated $34.4 billion in revenue, highlighting the scale of its PC business. The company has been investing heavily in AI integration, with projections suggesting a significant portion of PCs will feature AI capabilities by 2025, further underscoring this value proposition.

HP offers a broad spectrum of printing hardware, from the user-friendly DeskJet and versatile OfficeJet to the robust LaserJet, serving both individual and business clients. This comprehensive range ensures that customers can find a solution tailored to their specific printing demands.

The value proposition is built on delivering reliable, easy-to-use, and cost-effective printing experiences. HP's commitment to quality and convenience is further enhanced by services like Instant Ink, which proactively supplies ink, ensuring users never run out and often at a lower cost. For instance, in fiscal year 2023, HP reported approximately $53 billion in net revenue, underscoring the significant market presence and demand for its printing solutions.

HP's advanced 3D printing technology provides businesses with cutting-edge solutions for both polymer and metal printing, emphasizing cost-effectiveness, scalability, and environmental responsibility.

These innovative offerings empower companies to revolutionize their manufacturing, leading to reduced production expenses and faster product development cycles. For instance, HP's Multi Jet Fusion technology has been shown to reduce production costs by up to 50% compared to traditional methods for certain applications.

HP is demonstrably committed to advancing its 3D printing capabilities, evidenced by significant investments in research and development and the establishment of numerous adoption centers globally. By 2024, HP had expanded its 3D printing solutions to over 60 countries, supporting a wide range of industries from automotive to healthcare.

Reliability and Security

HP's commitment to reliability and security is a cornerstone of its value proposition, especially for its business clientele. They engineer their hardware, like PCs and printers, with advanced security features designed to safeguard sensitive corporate data and maintain uninterrupted operations. This focus on dependable performance and data protection builds essential trust.

This dedication is reflected in HP's product design and ongoing support. For instance, HP's commercial PCs often include features like HP Sure Start, which automatically recovers from BIOS attacks, and HP Sure View, a privacy screen to prevent shoulder surfing. In 2024, HP continued to invest heavily in cybersecurity research and development, aiming to stay ahead of evolving threats.

The emphasis on security isn't just about individual devices; it extends to HP's integrated solutions and services. Businesses rely on HP to provide a secure ecosystem, from managed print services to cloud-based device management, ensuring that their entire IT infrastructure is protected and functions reliably. This comprehensive approach is vital for organizations handling critical information.

HP's value proposition for reliability and security can be summarized as:

- Robust Hardware and Software Security: HP integrates advanced security protocols directly into its devices and software to protect against cyber threats and data breaches.

- Operational Continuity: By ensuring the dependable performance of its products, HP helps businesses minimize downtime and maintain productivity.

- Data Protection: Features like self-healing BIOS and integrated privacy screens are designed to keep sensitive corporate information secure.

- Trusted Partner: HP aims to be a trusted provider by consistently delivering secure and reliable technology solutions that meet the demanding needs of enterprises.

Sustainable and Responsible Solutions

HP's commitment to sustainability is a core value proposition, offering products and services that actively reduce environmental impact. This focus on eco-friendly solutions appeals strongly to a growing segment of environmentally conscious consumers and businesses.

The company champions circularity through initiatives like utilizing recycled materials in its hardware and offering carbon-neutral computing services. For example, HP reported using over 30% post-consumer recycled plastic in its eligible products in 2023, demonstrating a tangible commitment to reducing waste.

Managed print services are another key element, designed to optimize printing processes and significantly cut down on paper and energy consumption. These services not only benefit the environment but also offer cost savings to customers, creating a dual advantage.

- Environmental Impact Reduction: HP's product design prioritizes lower energy consumption and reduced material usage.

- Circularity Focus: Increased use of recycled plastics and metals in manufacturing, aiming for a closed-loop system.

- Carbon Neutrality: Offering computing services and products that are carbon neutral, aligning with global climate goals.

- Digital Equity: Supporting initiatives that provide access to technology and education, fostering responsible digital citizenship.

HP's value proposition centers on delivering innovative and reliable computing and printing solutions. They offer AI-enhanced personal systems designed for improved performance and security, alongside a comprehensive range of user-friendly printing hardware supported by services like Instant Ink. Furthermore, HP is a leader in 3D printing, providing cost-effective and scalable solutions for businesses looking to revolutionize manufacturing.

HP's commitment to reliability and security is paramount, especially for its business clients. They embed advanced security features into their hardware and software to protect sensitive data and ensure operational continuity. This focus extends to integrated services, creating a secure ecosystem for businesses.

Sustainability is a key pillar, with HP offering eco-friendly products and services that reduce environmental impact. This includes using recycled materials, promoting circularity, and providing carbon-neutral computing options, appealing to environmentally conscious customers.

HP's value proposition can be distilled into these key areas:

| Value Proposition Area | Description | Key Features/Initiatives | Fiscal Year 2023 Data/Impact |

|---|---|---|---|

| Innovative Personal Systems | Cutting-edge laptops and desktops, with a focus on AI integration. | AI-powered PCs, enhanced performance, robust security. | $34.4 billion revenue from Personal Systems segment. |

| Comprehensive Printing Solutions | Wide range of printers for consumers and businesses, with convenient services. | DeskJet, OfficeJet, LaserJet; Instant Ink service. | Approximately $53 billion in net revenue. |

| Advanced 3D Printing | Cutting-edge polymer and metal 3D printing for industrial applications. | Multi Jet Fusion technology, cost-effectiveness, scalability. | Solutions available in over 60 countries by 2024. |

| Reliability and Security | Dependable hardware and software with advanced security features. | HP Sure Start, HP Sure View, secure ecosystem management. | Continued heavy investment in cybersecurity R&D in 2024. |

| Sustainability | Eco-friendly products and services that minimize environmental impact. | Recycled materials, circularity initiatives, carbon-neutral services. | Over 30% post-consumer recycled plastic used in eligible products (2023). |

Customer Relationships

HP offers tiered customer support, from self-service online knowledge bases and community forums to direct phone support and strategically located service centers. This multi-channel approach ensures accessibility for a broad customer base. In 2024, HP continued to invest in digital support tools, aiming to resolve a significant portion of customer inquiries without human intervention.

The company provides robust after-sales services, including extensive warranties and proactive maintenance programs designed to maximize product lifespan and minimize downtime for business clients. HP’s commitment to these services in 2024 underscored its focus on customer retention and satisfaction, fostering loyalty through reliable support infrastructure.

HP’s direct customer engagement strategy is geared towards swift issue resolution and cultivating enduring relationships. By offering personalized support and efficient problem-solving, HP aims to enhance the overall customer experience, which is crucial for repeat business and positive brand perception in the competitive tech market.

HP is actively growing its subscription services, notably with offerings like Instant Ink for printing supplies and broader managed print services. These initiatives are designed to create predictable, recurring revenue and deepen customer loyalty by delivering convenience and value.

By shifting towards subscriptions, HP aims to significantly lower customer churn and enhance the overall lifetime value of its customer base. For instance, HP Instant Ink has seen substantial adoption, with millions of customers enrolled by early 2024, demonstrating the appeal of its convenience and cost-efficiency.

HP cultivates robust relationships with its vast network of channel partners through initiatives like the HP Amplify program. This program offers key benefits such as financial incentives, comprehensive training modules, and collaborative demand generation strategies. For instance, in 2023, HP Amplify saw significant engagement, with partners reporting increased sales and market penetration.

Nurturing these strategic partnerships is fundamental to HP's market expansion and its ability to deliver a unified and positive customer experience across diverse geographical regions. The program aims to foster loyalty and drive mutual growth.

Direct Engagement with Enterprise Clients

For its large enterprise and public sector clients, HP cultivates direct sales and dedicated account management relationships. This approach is crucial for understanding and addressing the intricate IT requirements of these organizations, often leading to highly customized solutions and strategic partnerships.

These direct engagements enable HP to offer tailored services and develop collaborative strategies, which are fundamental to securing and managing substantial, long-term contracts. In 2024, HP reported significant revenue from its enterprise segment, underscoring the importance of these direct client relationships.

- Direct Sales Force: HP maintains a specialized sales team focused on large enterprise accounts.

- Account Management: Dedicated account managers build and nurture relationships, ensuring client satisfaction and identifying new opportunities.

- Customized Solutions: Direct engagement allows for the development of bespoke IT solutions to meet specific enterprise needs.

- Strategic Partnerships: HP collaborates with large clients on strategic IT initiatives, fostering long-term loyalty and revenue.

Community and Digital Equity Initiatives

HP cultivates strong customer relationships by actively engaging in community and digital equity initiatives. A prime example is the HP LIFE program, which offers free online business and tech skills training to entrepreneurs worldwide. This program underscores HP's dedication to empowering individuals and fostering economic development, thereby building trust and loyalty that extends beyond product purchases.

These efforts are more than just philanthropy; they are strategic investments in community well-being and digital inclusion. By providing accessible educational resources, HP positions itself as a partner in its customers' success. This commitment, particularly evident in 2024 with expanded reach in underserved regions, strengthens the HP brand and creates a positive brand perception.

- HP LIFE Program: Offers free business and tech skills training globally, empowering entrepreneurs and small business owners.

- Digital Equity Focus: Initiatives aim to bridge the digital divide, ensuring more people have access to technology and the skills to use it.

- Community Impact: HP's social responsibility programs foster goodwill and build lasting connections with diverse customer segments.

- Brand Loyalty: These community-focused efforts enhance HP's reputation, driving customer loyalty and differentiating it in a competitive market.

HP's customer relationship strategy is multifaceted, focusing on tiered support, subscription models, partner engagement, and direct enterprise relationships. The HP Amplify program, for instance, incentivizes channel partners, with significant engagement reported in 2023, leading to increased sales. For large clients, dedicated account management and customized solutions are key, contributing to substantial enterprise revenue in 2024.

Subscription services like HP Instant Ink are central to deepening loyalty, with millions of customers enrolled by early 2024. Beyond products, HP's community initiatives, such as the HP LIFE program, build brand trust and loyalty by fostering digital equity and skills development. These efforts enhance HP's reputation and customer connection.

| Customer Relationship Strategy | Key Initiatives/Programs | 2023-2024 Impact/Data |

|---|---|---|

| Tiered Support & Digital Tools | Online knowledge bases, community forums, direct phone support | Continued investment in digital tools for efficient issue resolution in 2024. |

| Subscription Services | HP Instant Ink, Managed Print Services | Millions of HP Instant Ink enrollments by early 2024; focus on recurring revenue and customer lifetime value. |

| Channel Partner Engagement | HP Amplify Program | Significant partner engagement in 2023; reported increased sales and market penetration. |

| Direct Enterprise Relationships | Dedicated account management, customized IT solutions | Substantial revenue from enterprise segment in 2024; crucial for long-term contracts. |

| Community & Digital Equity | HP LIFE Program, digital inclusion initiatives | Expanded reach in underserved regions in 2024; builds brand trust and loyalty. |

Channels

HP leverages a vast global network of physical retail stores, encompassing major consumer electronics chains and office supply retailers, to reach its customer base. This direct physical presence is crucial for allowing consumers to interact with products before purchasing, fostering confidence and driving immediate sales, particularly for individual buyers.

In 2024, HP's retail channel remained a cornerstone of its go-to-market strategy, with an estimated 70% of consumer PC sales in North America still influenced by in-store experiences. This highlights the enduring importance of brick-and-mortar locations for product discovery and impulse buys, even in an increasingly digital world.

HP heavily utilizes HP.com and prominent online retailers to reach customers worldwide, offering a seamless digital purchasing experience for both individuals and businesses. This digital strategy provides unparalleled global reach and direct access to HP's extensive product portfolio.

The convenience of e-commerce is a significant driver of sales, with over 80% of HP's transactions occurring through digital channels, underscoring the importance of these platforms in their overall sales strategy.

HP utilizes a dedicated direct sales force to engage with large enterprises, government entities, and complex commercial clients. This approach facilitates in-depth, personalized consultations, enabling the creation of tailored solutions and direct contract negotiations. It's a vital component for securing high-value business-to-business transactions.

In 2024, HP's direct sales efforts are crucial for navigating the intricate needs of major clients. For instance, large enterprise deals often involve multi-year commitments and significant upfront investment, making direct relationship management essential for understanding and addressing specific technical and strategic requirements. This channel directly contributes to a substantial portion of HP's B2B revenue, particularly in areas like enterprise computing and managed services.

Distributors and Wholesalers

HP relies on a robust network of distributors and wholesalers to ensure its diverse product range reaches a wide array of resellers and retail outlets. These partners are crucial for managing the complexities of logistics and inventory, enabling HP to maintain broad market penetration.

The effectiveness of this channel was highlighted when Distribution Management was recognized as HP Inc. Partner of the Year for U.S. Supplies Distributor in 2024, underscoring the critical role these intermediaries play in HP's go-to-market strategy.

- Efficient Market Reach: Distributors and wholesalers extend HP's product availability across numerous geographic regions and customer segments.

- Logistical Backbone: They manage the intricate processes of warehousing, transportation, and order fulfillment, ensuring timely product delivery.

- Inventory Optimization: These partners help balance supply and demand, reducing carrying costs and minimizing stockouts for HP.

- Partner Recognition: Awards like HP Inc. Partner of the Year for U.S. Supplies Distributor in 2024 validate the strategic importance and performance of key distribution partners.

Value-Added Resellers (VARs) and System Integrators

HP collaborates with Value-Added Resellers (VARs) and System Integrators to extend its market reach and deliver comprehensive IT solutions. These partners bundle HP hardware with complementary software and services, tailoring offerings to unique customer requirements, particularly within the enterprise sector.

This channel is vital for HP's strategy, enabling the creation of complex, integrated IT environments that address specific industry challenges. For instance, in 2024, HP's channel partners played a significant role in driving sales of its advanced server and storage solutions to businesses seeking hybrid cloud capabilities.

- Channel Partners: VARs and System Integrators are key to HP's go-to-market strategy.

- Value Proposition: They combine HP products with other technologies to create end-to-end solutions.

- Market Focus: This channel is particularly important for serving business clients with specialized IT needs.

- 2024 Impact: Partners were instrumental in deploying HP's latest solutions for digital transformation initiatives.

HP's channels are diverse, spanning direct sales, retail partnerships, online platforms, and specialized resellers. These multifaceted approaches ensure broad market penetration, catering to individual consumers and large enterprises alike.

In 2024, HP continued to balance its physical retail presence with a strong digital strategy, recognizing that customer purchasing habits remain varied. The company's ability to meet customers where they prefer to shop, whether online or in-store, is a key differentiator.

HP's direct sales force is critical for securing large enterprise contracts, often involving complex solutions and long-term partnerships. This direct engagement allows for tailored offerings and deep understanding of client needs.

HP's extensive network of distributors and Value-Added Resellers (VARs) ensures its products reach a wide array of businesses and consumers, often bundled with additional services and support.

| Channel Type | Primary Customer Segment | Key Function | 2024 Significance |

|---|---|---|---|

| Physical Retail | Consumers, Small Businesses | Product interaction, impulse buys | Influenced ~70% of North American consumer PC sales |

| Online (HP.com, E-tailers) | Consumers, Businesses (all sizes) | Global reach, direct purchase | Accounted for over 80% of transactions |

| Direct Sales Force | Large Enterprises, Government | Complex solutions, contract negotiation | Crucial for high-value B2B deals and managed services |

| Distributors/Wholesalers | Resellers, Retailers | Logistics, inventory management | Enabled broad market penetration; Distribution Management named Partner of the Year |

| VARs/System Integrators | Businesses (specific industries) | Bundled solutions, tailored IT environments | Drove sales of advanced solutions for hybrid cloud |

Customer Segments

Individual consumers represent a core customer segment for HP, encompassing a broad range of users who purchase PCs, printers, and related accessories for personal use, entertainment, and home-based work. These buyers often prioritize a blend of performance, aesthetic appeal, value for money, and user-friendliness when making their choices. HP caters to this diverse group with distinct product lines such as the Pavilion for everyday use, Envy for premium experiences, and Omen for gaming enthusiasts.

Small and medium-sized businesses (SMBs) are a crucial customer segment for HP, seeking dependable, secure, and budget-friendly technology. HP addresses this by offering a diverse portfolio of business laptops, desktops, and commercial printers specifically engineered for the operational demands of these organizations. In 2024, the SMB sector continued to represent a significant portion of IT spending, with many businesses investing in hardware upgrades to boost productivity and data security.

Large enterprises require powerful, scalable, and secure IT solutions. HP addresses this need with high-performance workstations, advanced commercial printing, and managed IT services. Their offerings are designed to support complex operations and evolving workplace demands, including hybrid work models.

HP's commitment to large enterprises is evident in their focus on solutions for AI-powered computing and robust infrastructure. In fiscal year 2023, HP reported significant revenue from its commercial segments, reflecting the substantial demand from this customer base for reliable and advanced technology.

Public Sector Clients (Government, Education, Healthcare)

HP addresses the distinct needs of public sector clients, including government agencies, educational institutions, and healthcare providers. These organizations frequently require specialized hardware, software, and comprehensive service solutions designed to meet stringent procurement processes, robust security protocols, and the complexities of large-scale technology deployments. HP’s commitment to this segment is evident in its tailored offerings that directly address these sector-specific demands.

For instance, in the education sector, HP has been a significant player in providing devices for digital learning initiatives. In 2024, many school districts continued to invest in student laptops and classroom technology to support hybrid learning models and enhance digital literacy. HP's solutions often include robust device management software and security features crucial for educational environments. Similarly, healthcare providers rely on HP for secure and reliable IT infrastructure, including workstations and printers that meet strict HIPAA compliance standards, ensuring patient data privacy and operational efficiency.

- Government Agencies: HP provides secure and scalable IT solutions for federal, state, and local governments, supporting everything from citizen services to national defense infrastructure.

- Educational Institutions: HP offers a range of devices and solutions for K-12 and higher education, facilitating digital learning, administrative efficiency, and research capabilities.

- Healthcare Providers: HP delivers secure printing, computing, and data management solutions designed to meet the rigorous compliance and operational needs of hospitals, clinics, and research facilities.

Specialized Industries and Professional Users (e.g., 3D Printing, Gaming)

HP targets specialized industries and professional users who depend on cutting-edge technology for their operations. This includes sectors like 3D printing, where engineers and designers rely on HP's advanced solutions for rapid prototyping and production. For instance, HP's Metal Jet technology is transforming manufacturing by enabling faster and more cost-effective metal part creation.

Another key area is the gaming industry, where gamers demand high-performance PCs and peripherals that offer superior speed and visual fidelity. HP's Omen gaming line, known for its powerful processors and graphics capabilities, caters directly to this segment. In 2024, the global gaming market was projected to reach over $200 billion, highlighting the significant revenue potential within this user base.

- Niche Market Focus: Serves professionals in sectors like 3D printing and gaming who require specialized, high-performance hardware.

- Product Specialization: Offers tailored solutions such as HP Metal Jet for industrial additive manufacturing and Omen PCs for demanding gamers.

- Market Growth: Leverages the substantial and expanding global gaming market, which saw significant growth in 2024.

- Value Proposition: Provides advanced technology enabling innovation, efficiency, and superior user experiences in these specialized fields.

HP's customer segments are diverse, ranging from individual consumers seeking personal computing devices to large enterprises requiring robust IT infrastructure. The company also serves small and medium-sized businesses (SMBs) with tailored solutions, as well as specialized sectors like government, education, and healthcare, each with unique demands for security and performance.

Furthermore, HP targets niche markets such as 3D printing professionals and the rapidly growing gaming community, offering specialized, high-performance products. This broad customer base allows HP to leverage various market opportunities and maintain a strong presence across different technology adoption curves.

| Customer Segment | Key Needs | HP's Offering Examples |

|---|---|---|

| Individual Consumers | Performance, aesthetics, value, user-friendliness | Pavilion (everyday), Envy (premium), Omen (gaming) |

| Small & Medium Businesses (SMBs) | Dependability, security, budget-friendliness | Business laptops, commercial printers |

| Large Enterprises | Scalability, security, high performance, managed services | Workstations, advanced printing, AI solutions |

| Public Sector (Govt., Education, Healthcare) | Security, compliance, large-scale deployment, specialized solutions | Secure devices, management software, HIPAA-compliant solutions |

| Specialized Industries (3D Printing, Gaming) | Cutting-edge technology, high performance, innovation | Metal Jet (3D printing), Omen PCs (gaming) |

Cost Structure

The cost of goods sold (COGS) represents HP's most significant expense. This category encompasses all the direct costs associated with creating their products, from the raw materials and components used in personal computers and printers to the direct labor involved in their assembly. For fiscal year 2024, HP reported a net revenue of $53.6 billion, and managing COGS effectively is paramount to their profitability.

HP's ability to maintain competitive pricing and healthy profit margins hinges on its mastery of COGS. This involves not only sourcing materials efficiently but also optimizing manufacturing processes and leveraging economies of scale. Their extensive global supply chain and high-volume production are crucial levers for controlling these substantial costs.

HP's commitment to innovation means significant investment in Research and Development (R&D) is a core cost. This is particularly evident as the company pushes advancements in areas like artificial intelligence, cutting-edge 3D printing technologies, and the development of entirely new product categories. These R&D expenditures are vital for HP to maintain its competitive edge in a rapidly evolving tech landscape and to fuel its long-term growth trajectory.

For fiscal year 2023, HP reported R&D expenses of approximately $3.7 billion. This substantial figure underscores the company's strategy to remain at the forefront of technological innovation, ensuring it can introduce next-generation products and solutions to the market.

HP dedicates significant resources to its sales, marketing, and distribution efforts, essential for reaching its broad customer base. These costs encompass advertising, promotional activities, and maintaining its vast global supply chain. For fiscal year 2023, HP reported net revenue of $53.0 billion, with selling, general, and administrative expenses totaling $7.5 billion, a portion of which directly relates to these crucial functions.

Operating Expenses and Administrative Overhead

HP's operating expenses and administrative overhead encompass a broad range of costs crucial for day-to-day business functions. These include salaries for essential non-production personnel, the maintenance and upgrade of IT infrastructure, and various other operational overheads that keep the company running smoothly.

To enhance efficiency and reduce these costs, HP is actively pursuing its Future Ready initiative. This strategic plan is designed to achieve significant structural cost savings and streamline operations across the organization. A key target is to realize $1.9 billion in annualized gross run rate structural cost savings by the close of fiscal year 2025.

- General administrative expenses

- Salaries for non-production staff

- IT infrastructure costs

- Operational overheads

Supply Chain and Tariff-Related Costs

HP navigates a complex global supply chain where costs are significantly influenced by logistics and trade policies. Unexpected tariff increases, particularly in recent years, have presented a direct challenge to maintaining cost-effective operations and pricing strategies. For instance, during the trade tensions of 2018-2019, tariffs on goods imported into the US from China impacted many electronics manufacturers, including those in HP's supply chain.

To counter these volatile costs and mitigate risks, HP has been strategically diversifying its manufacturing and assembly locations. This involves shifting production away from single regions and establishing operations in countries with more favorable trade agreements or lower tariff exposure. This geographical diversification is a key strategy to optimize expenses and maintain competitive pricing for its diverse product portfolio.

- Supply Chain Diversification: HP's ongoing efforts to shift manufacturing away from China to countries like Vietnam and Thailand are aimed at reducing exposure to tariffs and associated logistical costs.

- Tariff Impact Mitigation: The company actively monitors global trade policies and adjusts its sourcing and manufacturing strategies to minimize the financial impact of unexpected tariff increases.

- Cost Optimization: By reconfiguring its supply chain, HP seeks to achieve greater cost efficiencies, which in turn supports its ability to offer competitive pricing in the global market.

HP's cost structure is dominated by the cost of goods sold, which includes raw materials, components, and direct labor for products like PCs and printers. For fiscal year 2024, HP reported net revenue of $53.6 billion, highlighting the critical importance of managing these direct expenses. Significant investments in Research and Development, amounting to approximately $3.7 billion in fiscal year 2023, are also a key component, fueling innovation in areas like AI and 3D printing to maintain a competitive edge.

Operating expenses, including sales, marketing, and general administration, represent another substantial cost. In fiscal year 2023, these expenses totaled $7.5 billion out of $53.0 billion in net revenue. HP's Future Ready initiative aims to achieve $1.9 billion in annualized gross run rate structural cost savings by the end of fiscal year 2025, focusing on streamlining operations and reducing overhead.

| Cost Category | FY 2023 (Approximate) | Notes |

| Cost of Goods Sold (COGS) | Significant portion of revenue | Direct costs of manufacturing PCs, printers, etc. |

| Research & Development (R&D) | $3.7 billion | Investment in future technologies like AI, 3D printing. |

| Selling, General & Administrative (SG&A) | $7.5 billion | Includes sales, marketing, and operational overhead. |

Revenue Streams

HP's Personal Systems segment is a major revenue generator, primarily from selling a wide array of computers like laptops, desktops, and workstations, along with their accessories. This segment is crucial for the company's financial health.

Commercial personal systems have been particularly strong, driving a good chunk of HP's revenue growth. This indicates a healthy demand from businesses for their computing solutions.

Looking at recent performance, in the second quarter of fiscal year 2025, HP's Personal Systems segment brought in $9.0 billion in net revenue, highlighting its substantial contribution to the company's overall financial results.

HP generates significant income from selling its printing hardware. This encompasses a wide range of devices, from the inkjet and LaserJet printers familiar to many households and businesses, to more advanced 3D printers.

These sales cater to both individual consumers and commercial clients, forming a core part of HP's revenue generation strategy. For instance, in the second quarter of fiscal year 2025, HP reported that its Printing segment's net revenue reached $4.2 billion, highlighting the substantial contribution of hardware sales.

HP generates consistent revenue through the sale of printer supplies like ink and toner cartridges, a classic example of the 'razor-and-blades' business model. This strategy ensures a recurring income stream, contributing substantially to the company's overall profitability and financial stability.

In the fourth quarter of fiscal year 2024, HP reported a 2% increase in net revenue from supplies, demonstrating the ongoing demand and importance of this segment to their business.

Services and Solutions

HP's revenue streams are increasingly diversified beyond hardware sales, with a significant push into services. This includes managed print services, where HP handles printing infrastructure for businesses, and Device-as-a-Service (DaaS) models, offering devices on a subscription basis. The company also generates income from IT support and consulting, helping clients manage their technology environments.

HP is strategically focusing on these contractual and subscription-based services to establish more predictable, recurring revenue. This shift is designed to create stronger customer loyalty and a more stable financial outlook.

Evidence of this strategy's success can be seen in HP's financial performance. For instance, in fiscal year 2024, HP reported substantial growth in its services revenue, underscoring the effectiveness of its move towards service-centric business models.

- Managed Print Services: HP manages and optimizes printing environments for businesses.

- Device-as-a-Service (DaaS): Offers hardware, support, and lifecycle management on a subscription basis.

- IT Support and Consulting: Provides expert advice and technical assistance for IT infrastructure.

- Growing Services Revenue: HP's focus on these areas contributed to an increase in services revenue during fiscal year 2024.

3D Printing Solutions and Materials

HP's 3D printing segment generates revenue through the sale of its advanced 3D printers, a range of specialized printing materials, and associated support and maintenance services. This business unit is a key growth driver for HP, with ongoing research and development focused on expanding its market reach and product capabilities.

The company's commitment to innovation in this area is evident in its strategic partnerships and the continuous introduction of new technologies. For instance, HP's Metal Jet technology is designed to accelerate the adoption of metal additive manufacturing across various industries. In 2024, HP reported significant progress in its 3D printing division, highlighting its potential for substantial future revenue growth.

- Printer Sales: Direct revenue from the sale of HP's industrial-grade 3D printers.

- Materials Revenue: Income derived from the sale of proprietary powders, resins, and filaments optimized for HP's printing systems.

- Service Contracts: Revenue from ongoing maintenance, technical support, and software subscriptions for 3D printing solutions.

- Application Development: Potential revenue from co-development projects and specialized solutions tailored for specific customer needs.

HP's revenue streams are robust, built on both hardware sales and a growing services portfolio. The Personal Systems segment, led by commercial PCs, generated $9.0 billion in net revenue in Q2 FY25, demonstrating strong business demand. The Printing segment also remains a significant contributor, with $4.2 billion in net revenue in the same quarter, driven by both hardware and recurring supplies.

Beyond traditional sales, HP is actively expanding its service offerings, including Managed Print Services and Device-as-a-Service (DaaS). This strategic shift towards subscription and contractual models aims to create more predictable, recurring revenue and foster customer loyalty, with notable growth observed in services revenue throughout fiscal year 2024.

The 3D printing division represents a key growth area, with revenue generated from advanced printer sales, specialized materials, and crucial support services. Continued innovation and strategic partnerships in 2024 underscore the substantial future revenue potential of this segment.

| Revenue Stream | Primary Products/Services | Q2 FY25 Net Revenue (Billions USD) | Key Driver |

|---|---|---|---|

| Personal Systems | Laptops, Desktops, Workstations, Accessories | 9.0 | Commercial PC Demand |

| Printing | Inkjet & LaserJet Printers, 3D Printers | 4.2 | Hardware & Supplies Sales |

| Supplies | Ink & Toner Cartridges | N/A (Integrated into Printing) | Recurring Purchases |

| Services | Managed Print, DaaS, IT Support | N/A (Growing Segment) | Subscription & Contractual Models |

| 3D Printing | Industrial 3D Printers, Materials, Support | N/A (Growth Segment) | Advanced Manufacturing Solutions |

Business Model Canvas Data Sources

The HP Business Model Canvas is constructed using a blend of internal financial performance data, extensive market research on customer needs and competitive landscapes, and strategic insights derived from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of HP's business operations and strategic direction.